Bitcoin

Nasdaq Proposes In-Kind Redemptions for BlackRock’s Bitcoin ETF

Published

1 month agoon

By

admin

Nasdaq has submitted a groundbreaking proposal to the U.S. Securities and Exchange Commission (SEC) that could transform the operational framework of Bitcoin exchange-traded funds (ETFs). The proposal, focused on BlackRock’s iShares Bitcoin Trust (IBIT), seeks to introduce “in-kind” bitcoin redemptions, offering a streamlined and cost-effective alternative to the current cash redemption process.

JUST IN: BlackRock files to allow in-kind creations and redemptions for its spot Bitcoin ETF! pic.twitter.com/SSigX4utRG

— Bitcoin Magazine (@BitcoinMagazine) January 24, 2025

What Are In-Kind Redemptions?

Under the proposed system, institutional players known as authorized participants (APs) – responsible for creating and redeeming ETF shares – could opt to exchange ETF shares directly for bitcoin rather than cash. This innovation eliminates the need to sell bitcoin to generate cash for redemptions, simplifying the process while cutting operational costs.

While this option would only be available to institutional participants and not retail investors, experts suggest that the improved efficiency could indirectly benefit everyday investors. By reducing operational hurdles, in-kind redemptions have the potential to make Bitcoin ETFs more streamlined and cost-efficient for all market participants.

Related: BlackRock CEO Larry Fink Forecasts $700K Bitcoin Price Amid Inflation Worries

Why the Change?

The cash redemption model, implemented in January 2024 when spot Bitcoin ETFs were first approved by the SEC, was designed to keep financial institutions and brokers from handling bitcoin directly. This approach prioritized regulatory simplicity during the nascent stages of Bitcoin ETFs.

However, the rapid growth of the Bitcoin ETF market has created new opportunities to improve its infrastructure. With evolving regulations and a more mature digital asset ecosystem, Nasdaq and BlackRock now see a pathway to adopt a more efficient in-kind redemption model.

Benefits of In-Kind Redemptions

- Operational Efficiency:

- Reduces the complexity and number of steps in the redemption process.

- Streamlines ETF operations, saving both time and costs.

- Tax Advantages:

- Avoiding the sale of bitcoin minimizes capital gains distributions, making ETFs more tax-efficient for institutional investors.

- Market Stability:

- Reduces sell pressure on bitcoin during redemptions, potentially stabilizing the asset’s price.

Regulatory and Market Context

Nasdaq’s proposal coincides with significant regulatory developments under the pro-Bitcoin Trump administration. Recent policy shifts, such as the repeal of Staff Accounting Bulletin 121 (SAB 121), have paved the way for broader cryptocurrency adoption. The removal of SAB 121 eliminated barriers that previously discouraged banks from offering cryptocurrency custody services, creating a more favorable environment for innovations like Nasdaq’s in-kind redemption model.

BlackRock’s Bitcoin ETF: A Market Leader

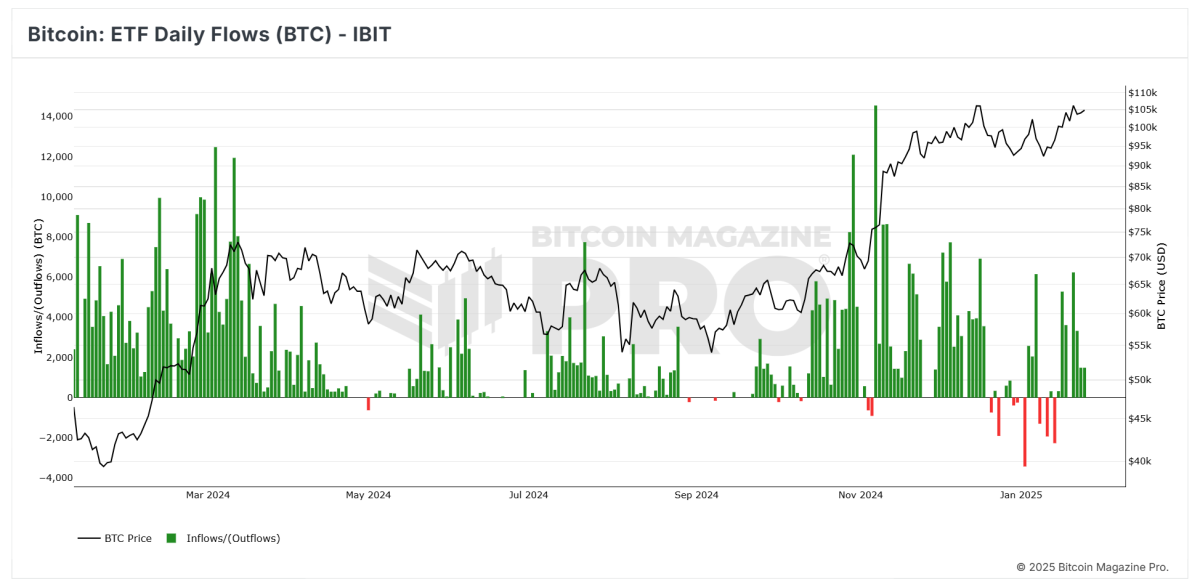

Since its 2024 launch, BlackRock’s iShares Bitcoin ETF has emerged as a market leader, with over $60 billion in inflows. The fund’s consistent growth highlights institutional demand for Bitcoin investment products. Innovations like Nasdaq’s in-kind redemption model could further enhance IBIT’s appeal to institutional investors.

Note the consistent upward trend of green candles, reflecting strong and steady inflows.

Related: What Bitcoin Price History Predicts for February 2025

Conclusion

Nasdaq’s proposal to introduce in-kind redemptions for BlackRock’s Bitcoin ETF represents a pivotal moment for the Bitcoin ETF market. By simplifying redemption processes, offering tax efficiencies, and reducing sell pressure on bitcoin, the model stands to significantly enhance the appeal and performance of Bitcoin ETFs for institutional investors.

As the Bitcoin ETF market matures and regulatory support continues to grow, innovations like this are poised to drive further adoption. If approved, Nasdaq’s proposal could mark a critical step forward, solidifying Bitcoin ETFs as a cornerstone of institutional digital asset investment while indirectly benefiting retail participants.

With a favorable regulatory climate and growing institutional interest, the future of Bitcoin ETFs looks brighter than ever.

Source link

You may like

SUI Drops 5.1% as Index Trades Lower From Thursday

South Korea to block non-compliant crypto exchanges

Pakistan Plans To Legalise Bitcoin And Crypto

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Meteora shares two proposals on MET token allocation

Trump Aides Look To Reform USAID With Blockchain For ‘Transparency’: Report

Pakistan unveils plans to legalise bitcoin and crypto and implement a regulatory framework to attract foreign investment and boost adoption.

Bilal Bin Saqib, CEO of the Pakistan Crypto Council, told Bloomberg on Thursday that Pakistan has unveiled plans to legalise bitcoin and crypto and implement a regulatory framework to attract foreign investment and boost adoption.

The government aims to devise clear regulations and align with international best practices. Pakistan’s Finance Minister formed the PCC last week to steer the country’s crypto strategy.

“Pakistan is done sitting on the sidelines” regarding bitcoin and crypto, Saqib told Bloomberg. “We want to attract international investment because Pakistan is a low-cost, high-growth market with 60% of the population under 30.”

Spoke to Bloomberg this morning

Our message is clear – Pakistan is done sitting on the sidelines! We want Pakistan as the leader in blockchain-powered finance. Pakistan is a low-cost high-growth market with 60% of the population under 30. We have a web3 native workforce ready… pic.twitter.com/VwhGGh7QWg

— Bilal bin Saqib MBE (@Bilalbinsaqib) March 20, 2025

“Trump is making crypto a national priority, and every country, including Pakistan, will have to follow suit,” he said.

This move comes amid a global shift in attitudes towards bitcoin and crypto after the United States pushed for greater mainstream acceptance. The new stance is a stark change for Pakistan, which had previously banned crypto. By embracing bitcoin and crypto early, Pakistan is looking to position itself as a regional leader and attract investors.

Pakistan’s central bank had expressed concerns earlier. However, the government now seeks to mitigate risks through prudent legislation. Clear rules could boost innovation and prevent potential abuse of decentralised networks.

Source link

Bitcoin

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Published

6 hours agoon

March 21, 2025By

admin

A widely followed analyst says Bitcoin (BTC) is showing signs of being on the verge of a massive breakout.

The analyst pseudonymously known as Credible Crypto tells his 462,900 followers on the social media platform X that Bitcoin may reclaim the $100,000 range if BTC can break through resistance around the $88,000 level.

“We’re at a key inflection point around this region, but since we went up to tag it BEFORE going down to range lows this is a good sign. It increases the odds that if we reject here but hold range lows [at around $78,000], the next move up will be expansion and a true breakout through not just this level but the original supply zone above in RED that we first rejected from. All eyes on this key zone for now.”

The analyst says Bitcoin’s dip to the $84,000 range after tagging $87,000 on Thursday keeps the flagship crypto asset on target to reclaim the $100,000 level.

“A perfect rejection so far.”

Bitcoin is trading for $84,427 at time of writing, down 1.5% in the last 24 hours.

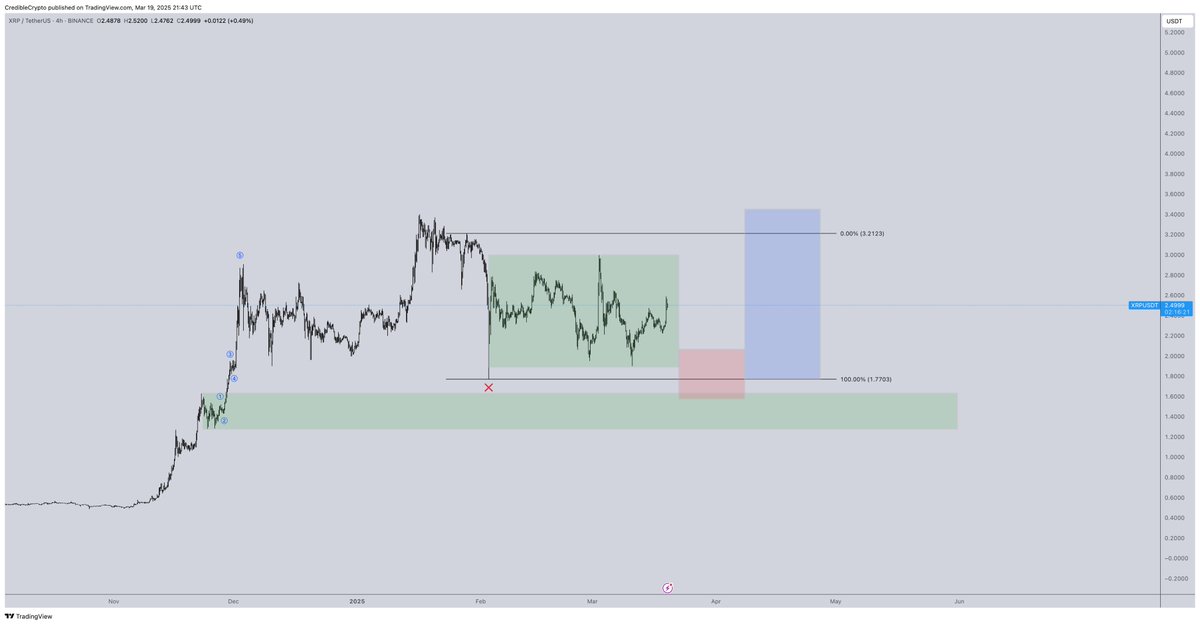

Next up, the analyst suggests payments token XRP may dip below $2.00 before rallying to its all-time high of about $3.40.

“This is still the game plan for XRP by the way. If we don’t get it, we don’t get it, and we ride spot to double digits regardless. But I’m not interested in jumping into fresh longs mid-range. Hoping people choose to fade this push so we get what would be a fantastic opportunity.”

XRP is trading for $2.45 at time of writing, down 1.7% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Top 6 Important Fed Decisions To Know After SEC Drops Ripple Lawsuit Appeal

Published

12 hours agoon

March 21, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The crypto industry received a significant legal victory as Ripple CEO Brad Garlinghouse announced on March 19 that the U.S. Securities and Exchange Commission (SEC) had officially dropped its appeal against the company. The announcement came in a video posted on social media platform X, where Garlinghouse noted the regulatory agency’s decision to end its pursuit of further litigation.

Besides this interesting development, another major financial development has taken center stage in the crypto market in the past 24 hours; the outcome of the Federal Reserve’s latest meeting.

Fed Keeps Interest Rates Steady Amid Uncertainty

The outcome of the latest Fed meeting can be divided into six key decisions. First, the Federal Reserve opted to maintain interest rates at their current level, keeping the borrowing rate in a range between 4.25% and 4.5% for the second consecutive meeting. This decision is part of a continued pause in the Fed’s tightening cycle.

Related Reading

Secondly, the Fed noted that uncertainty surrounding the economy has increased, and third, the Fed’s updated projections were the shift in expectations for rate cuts in 2025. The median forecast suggests 50 basis points of cuts for the year, but a growing number of Fed officials are less convinced that rate reductions will be necessary. In December, only one official anticipated no rate cuts in 2025. However, there’s now a more divided outlook, and that number has now risen to four, as noted in a post on social media platform X by analysts at The Kobeissi Letter.

Beyond interest rates, the Fed revised its economic growth projections downward for 2025, suggesting that policymakers see slower expansion ahead. This adjustment comes alongside an increase in the Fed’s inflation forecast for the same period, reflecting concerns about price pressures persisting longer than previously anticipated. With inflation remaining a key focus, the central bank is treading carefully as it evaluates the right time to pivot toward a looser monetary stance.

Fourthly, the Fed announced that it would slow the pace of its balance sheet runoff beginning in April. This is alongside a sharp reduction in the Fed’s 2025 growth projections and a markup in their 2025 inflation forecast.

Implications For Crypto Markets And Digital Assets

For the crypto industry, the Fed’s decision to hold rates steady and its mixed messaging on future cuts introduce a dynamic situation to Bitcoin and others. The fact that the Fed is still concerned about inflation and economic uncertainty shows that the path to more accommodative policies regarding the crypto industry may not be as smooth.

Related Reading

However, if the Fed stays hesitant to cut rates and economic growth slows as projected, digital assets may face headwinds later in the year, which may slow down the predicted growth by crypto analysts.

Featured image from Unsplash, chart from Tradingview.com

Source link

SUI Drops 5.1% as Index Trades Lower From Thursday

South Korea to block non-compliant crypto exchanges

1.5M Holders, 10M Blocks on Shibarium

Pakistan Plans To Legalise Bitcoin And Crypto

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Meteora shares two proposals on MET token allocation

Trump Aides Look To Reform USAID With Blockchain For ‘Transparency’: Report

Ethereum Price Eyes 50% Drop Amid Heavy ETH Whale Profit Booking

Polymarket is Over 90% Accurate in Predicting World Events: Research

Bad news Bitcoin bulls, the long-hoped-for retail is already here: CryptoQuant

Top 6 Important Fed Decisions To Know After SEC Drops Ripple Lawsuit Appeal

Leaders In Adoption And Innovation

Trader Issues Urgent XRP Alert, Says the Top-Five Altcoin at Risk of Sharp Correction – Here’s His Target

This coin could see a $10b market cap and double-digit price before SHIB gains its 2021 mojo

Can a Meme Coin Fund the Future of Scientific Research?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x