Bitcoin

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Published

1 month agoon

By

admin

Bitcoin continues to trade just below the $84,000 mark, reflecting a broader slowdown in upward momentum. Despite attempts to reclaim higher levels, the cryptocurrency has remained under the $90,000 mark for over two weeks.

This current range-bound activity comes nearly two months after Bitcoin touched its all-time high in January, indicating a period of uncertainty as traders assess macroeconomic conditions and upcoming Federal Reserve policy decisions.

In the midst of the stagnation from BTC’s price, on-chain data is offering contrasting signals on where the market might be headed next. Analysts have pointed to fluctuations in buying and selling pressure on major exchanges, particularly Binance, as key indicators of short-term market sentiment.

Surge in Binance Net Taker Volume

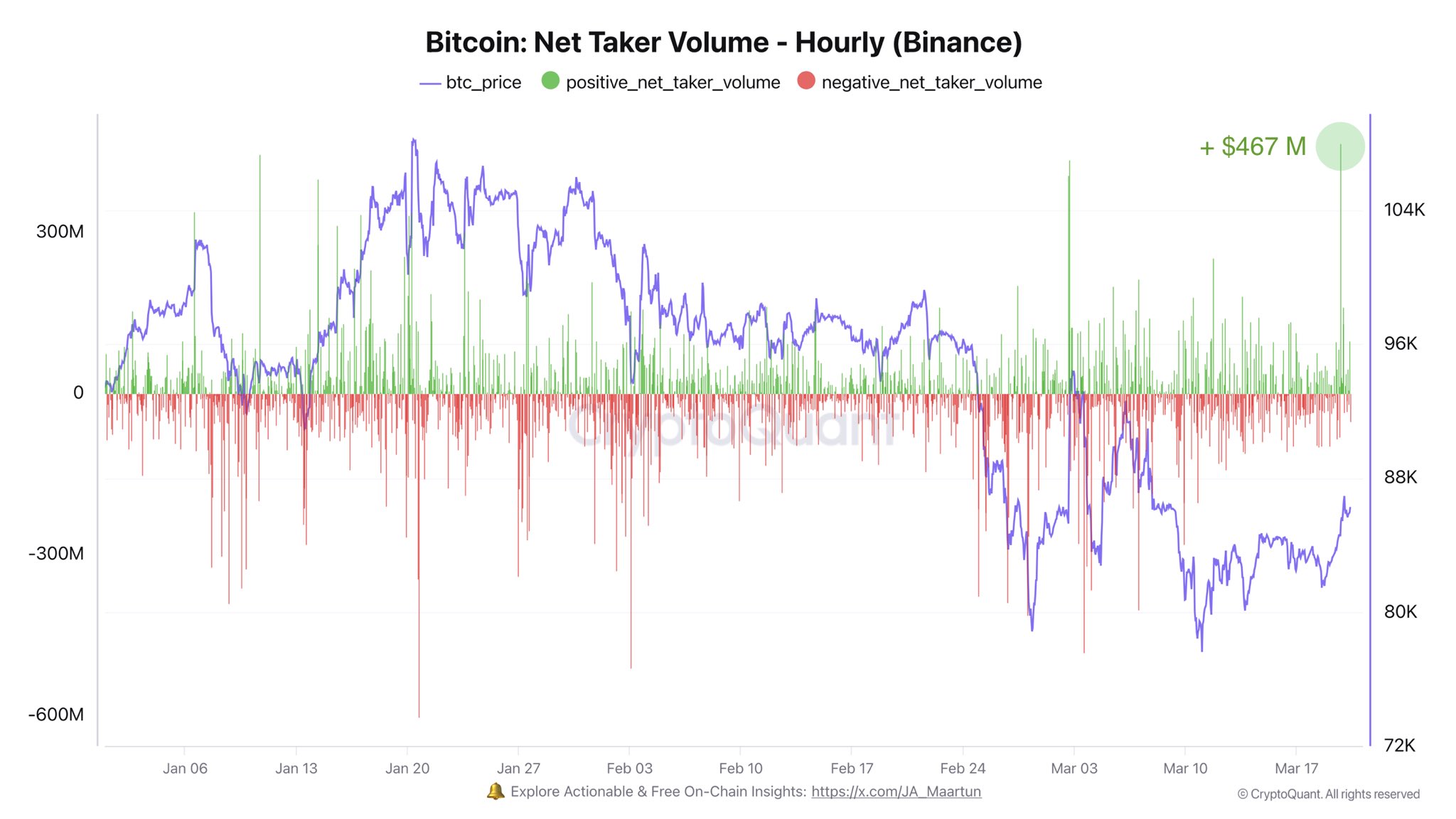

CryptoQuant analyst Darkfost recently highlighted a notable spike in net taker volume on Binance, the world’s largest centralized crypto exchange. According to Darkfost, net taker volume surged by $467 million in a single hour—marking the highest level recorded in 2025 so far.

This metric, which measures the difference between aggressive market buys and sells, is often used to gauge the immediate sentiment of active traders. A positive value indicates stronger buying activity and has historically signaled short-term bullishness.

Darkfost emphasized that this uptick in taker volume occurred just prior to the recent FOMC meeting, suggesting that some traders may be positioning for favorable policy outcomes.

While the data only reflects an hourly time frame and may not imply long-term directional change, the movement could signal a broader shift in sentiment among active participants, especially given Binance’s influential position in global crypto markets.

Buying pressure from Binance traders might be back.

— Binance is the CeX with the highest trading volume, making it particularly relevant for data analysis. —

The net taker volume is a powerful metric for gauging trader sentiment, as it measures the volume of market buys and… pic.twitter.com/enI1VMAixf

— Darkfost (@Darkfost_Coc) March 20, 2025

Bitcoin Whale Activity Returns as Exchange Ratios Spike

Meanwhile, another CryptoQuant analyst, EgyHash, provided a more cautious interpretation of recent activity. According to his analysis, the Bitcoin Exchange Whale Ratio—defined as the share of total exchange inflows coming from the top 10 largest addresses—has surged to its highest point in over a year.

This ratio is closely monitored because spikes often precede increased selling pressure, especially when large holders move funds to exchanges. While not a definitive indicator of immediate liquidation, the rise in whale-driven deposits suggests that some major players may be preparing for reallocation or profit-taking.

Combined with stagnant price action, this metric implies that Bitcoin’s current price level may be approaching a decision point, where the market direction will be determined by the balance between new demand and potential supply from large holders.

Featured image created with DALL-E, Chart from TradingView

Source link

You may like

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Bitcoin

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

Published

4 hours agoon

April 28, 2025By

admin

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

Source link

24/7 Cryptocurrency News

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Published

6 hours agoon

April 28, 2025By

admin

The Ethereum-to-Bitcoin ratio has fallen to its lowest level in five years after a dismal Ethereum price performance. As investors try to wrap their heads around the grim metric, Taproot Wizards co-founder Eric Wall has explained the reason behind the steep drop.

Eric Wall Highlights Reasons For ETH/BTC Ratio Collapse

Taproot Wizards co-founder Eric Wall has identified a raft of reasons behind the decline of the ETH/BTC ratio in 2025. The cryptocurrency expert revealed the factors behind the falling ETH/BTC ratio in an X post, hinging the bulk of the blame on Ethereum’s recent price performance.

The ETH/BTC ratio slumped to a five-year low after Ethereum bucked the trend of following Bitcoin on a rally after the halving event. While Bitcoin price rose to cross the $100K mark, Ethereum price has tumbled below $2,000 to reach lows of $1,400.

For Wall, one factor affecting the ETH/BTC ratio appears to be Ethereum’s position in a competitive landscape. Since its launch, several blockchains have cropped up to snag market share from the largest altcoin, offering cheaper fees and faster processing times.

The cryptocurrency expert argues that the absence of a Saylor-like buyer for ETH is playing its role in the decline of the ETH/BTC ratio. Michael Saylor’s BTC purchases have contributed to the asset’s performance, but Wall argues that Ethereum does not have a consistent buyer.

Wall adds that Bitcoin and gold have evolved into wartime assets in the current macroeconomic climate, while ETH is considered a “peacetime asset.” Gold has surged to new highs, sparking optimism that Bitcoin will follow in the same path for a similar rally, while the Ethereum price continues its unimpressive run.

The Merge Is Not Responsible For The Ratio Decline

Eric Wall notes that Ethereum’s Merge event is not responsible for the ETH/BTC slump, contrary to popular sentiment. Ethereum migrated from Proof-of-Work to Proof-of-Stake in 2022, with the ETH/BTC ratio tanking since the Merge.

“The ETHBTC ratio did not go down because of The Merge,” said Eric Wall.

However, pseudonymous cryptocurrency analyst Beanie argues that the Merge is the primary reason for the price decline. Rebuffing the speculation, Wall opines that Ethereum’s layer 2 tokens triggered network fragmentation after botching the “asset value capture narrative,” affecting the ETH/BTC ratio.

“Ethereum also stagnated into a depressingly small number of defi primitives relative to what past expectations were,” added Wall.

Ethereum is flashing signs of brilliance after ETH trading volume spiked to $17.5 billion in less than a day. ETH prices are exchanging hands at nearly 1,800 after an impressive 12% rally that saw it outperform SOL and XRP

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

Published

20 hours agoon

April 27, 2025By

admin

April has been a month of extreme volatility and tumultuous times for traders.

From conflicting headlines about President Donald Trump’s tariffs against other nations to total confusion about which assets to seek shelter in, it has been one for the record books.

Amid all the confusion, when traditional “haven assets” failed to act as safe places to park money, one bright spot emerged that might have surprised some market participants: bitcoin.

“Historically, cash (the US dollar), bonds (US Treasuries), the Swiss Franc, and gold have fulfilled that role [safe haven], with bitcoin edging in on some of that territory,” said NYDIG Research in a note.

NYDIG’s data showed that while gold and Swiss Franc had been consistent safe-haven winners, since ‘Liberation Day’—when President Trump announced sweeping tariff hikes on April 2, kicking off extreme volatility in the market—bitcoin has been added to the list.

“Bitcoin has acted less like a liquid levered version of levered US equity beta and more like the non-sovereign issued store of value that it is,” NYDIG wrote.

Zooming out, it seems that as the “sell America” trade gains momentum, investors are taking notice of bitcoin and the original promise of the biggest cryptocurrency.

“Though the connection is still tentative, bitcoin appears to be fulfilling its original promise as a non-sovereign store of value, designed to thrive in times like these,” NYDIG added.

Read more: Gold and Bonds’ Safe Haven Allure May be Fading With Bitcoin Emergence

Source link

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

✓ Share: