Adoption

Ohio introduces second Bitcoin reserve bill

Published

4 months agoon

By

admin

The State of Ohio has introduced a second Bitcoin reserve bill as crypto legislation gains momentum across the U.S. ahead of Donald Trump’s inauguration.

Ohio House GOP Majority Whip Steve Demetriou proposed legislation to allow the state to manage a strategic Bitcoin (BTC) reserve, Satoshi Act Fund founder Dennis Porter shared on Dec. 19 during an X Spaces event.

Demetriou’s bill follows a similar proposal from Representative Derek Merrin, which would also position Ohio as a Bitcoin reserve holder. Speaking on X Spaces, Demetriou explained that his legislation would enable Ohio to allocate up to 10% of its state-controlled funds toward a BTC stockpile.

“Bitcoin can help tap into Ohio’s existing energy reserves,” Demetriou added. Ohio is famed for having massive natural gas reserves and a competitive energy grid.

The Ohio GOP Majority Whip provided no specific timeline for the bill’s passage but expressed hope that House bureaucracy would not delay progress.

BREAKING: Ohio introduces a 2nd bill to create a Strategic Bitcoin Reserve. This will be the lawmaker that passes it into law.

— Dennis Porter (@Dennis_Porter_) December 19, 2024

American legislative conversations have increasingly focused on BTC-related proposals following President-elect Donald Trump’s victory in the recent election.

Earlier, Porter said that the Bitcoin renaissance was spotted amassing momentum in over 12 states and counting. Texas, Ohio, and Pennsylvania were a few states that weighed BTC reserve laws.

In Washington, Senator Cynthia Lummis has advocated for federal BTC reserve policies. Responding to Federal Reserve Chair Jerome Powell, Lummis argued that the Senate should authorize the central bank to hold Bitcoin. Powell previously clarified that the Fed cannot own BTC under current laws.

Source link

You may like

From Booze to Barbells: Exercise May Offset Risks of College Partying

Ethereum Foundation shuffles leadership, splits board and management

Bitcoin Price (BTC) Retakes $95K Level After Early U.S. Decline

A New Risk For The Industry?

Justin Sun Bets Big On JUST Token, Sees 100x Potential

Worldcoin price prediction | What’s next for WLD price?

Adoption

Is 8% Of Bitcoin Owned By Institutions A Threat To Its Future?

Published

3 days agoon

April 26, 2025By

admin

Institutional ownership of Bitcoin has surged over the past year, with around 8% of the total supply already in the hands of major entities, and that number is still climbing. ETFs, publicly listed companies, and even nation-states have begun securing substantial positions. This raises important questions for investors. Is this growing institutional presence a good thing for Bitcoin? And as more BTC becomes locked up in cold wallets, treasury holdings, and ETFs, is our on-chain data losing its reliability? In this analysis, we dig into the numbers, trace the capital flows, and explore whether Bitcoin’s decentralized ethos is truly at risk or simply evolving.

The New Whales

Let’s start with the Treasury of Public Listed Companies table. Major companies, including Strategy, MetaPlanet, and others, have collectively accumulated more than 700,000 BTC. Considering that Bitcoin’s total hard-capped supply is 21 million, this represents roughly 3.33% of all BTC that will ever exist. While that supply ceiling won’t be reached in our lifetimes, the implications are clear: the institutions are making long-term bets.

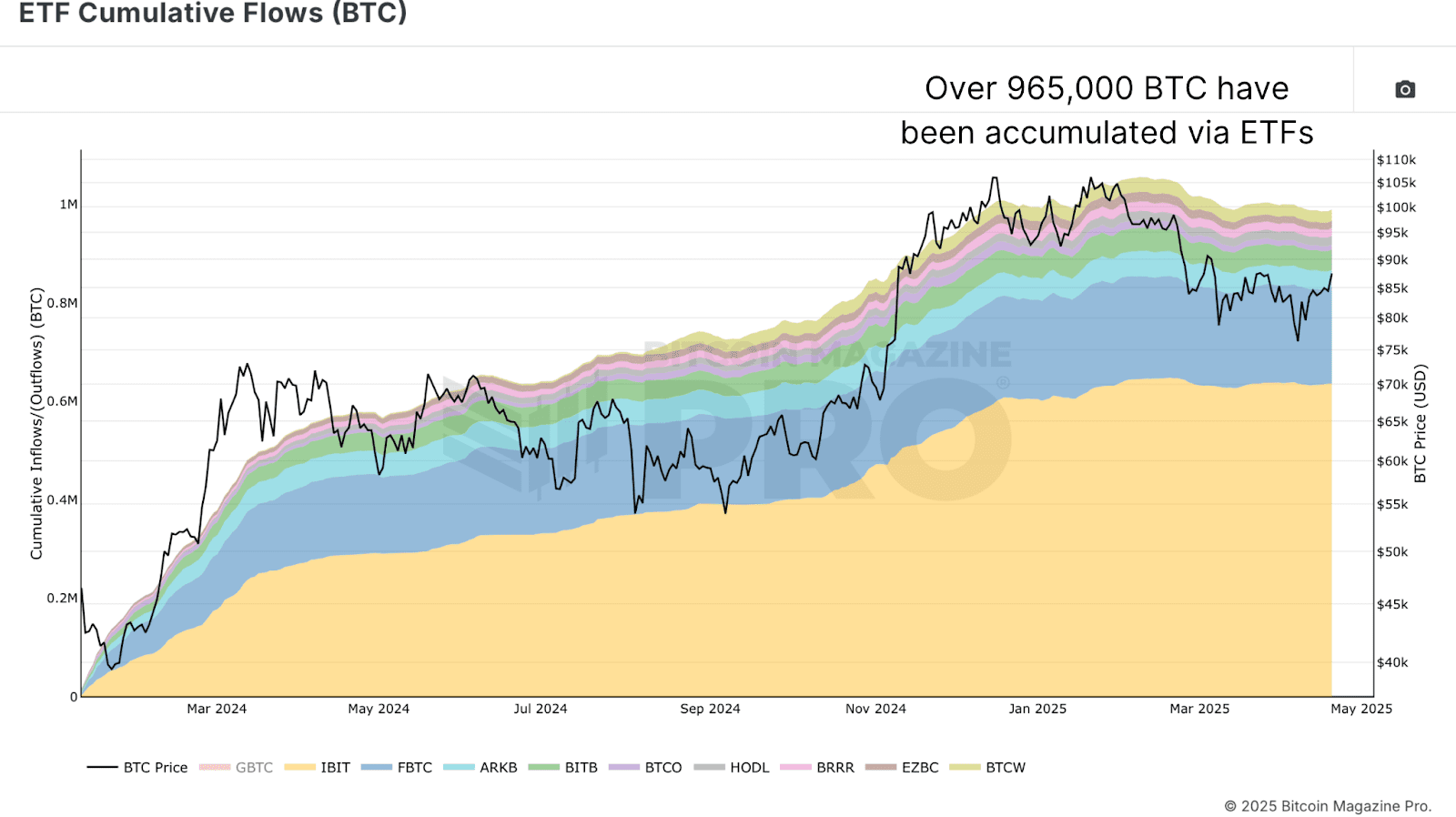

In addition to direct corporate holdings, we can see from the EFT Cumulative Flows (BTC) chart that ETFs now control a significant slice of the market as well. At the time of writing, spot Bitcoin ETFs hold approximately 965,000 BTC, just under 5% of the total supply. That figure fluctuates slightly but remains a major force in daily market dynamics. When we combine corporate treasuries and ETF holdings, the number climbs to over 1.67 million BTC, or roughly 8% of the total theoretical supply. But the story doesn’t stop there.

Beyond Wall Street and Silicon Valley, some governments are now active players in the Bitcoin space. Through sovereign purchases and reserves under initiatives like the Strategic Bitcoin Reserve, nation-states collectively hold approximately 542,000 BTC. Add that to the previous institutional holdings, and we arrive at over 2.2 million BTC in the hands of institutions, ETFs, and governments. On the surface, that’s about 10.14% of the total 21 million BTC supply.

Forgotten Satoshis and Lost Supply

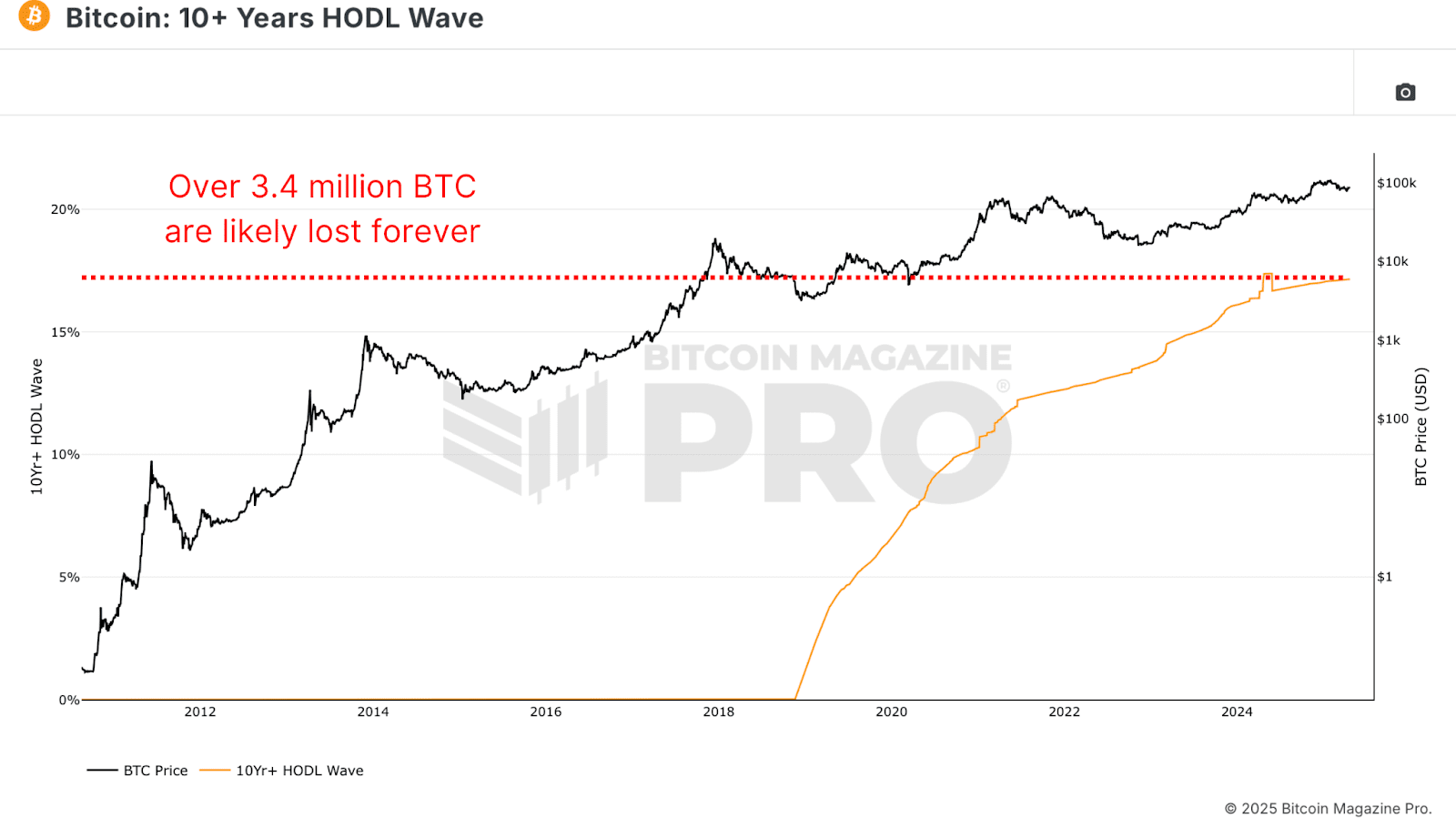

Not all 21 million BTC are actually accessible. Estimates based on 10+ Years HODL Wave data, a measurement of coins that haven’t moved in a decade, suggest that over 3.4 million BTC are likely lost forever. This includes Satoshi’s wallets, early mining-era coins, forgotten phrases, and yes, even USBs in landfills.

With approximately 19.8 million BTC currently in circulation and roughly 17.15% presumed to be lost, the effective supply is closer to 16.45 million BTC. That radically changes the equation. When measured against this more realistic supply, the percentage of BTC held by institutions rises to roughly 13.44%. This means that approximately one in every 7.4 BTC available to the market is already locked up by institutions, ETFs, or sovereigns.

Are Institutions Controlling Bitcoin?

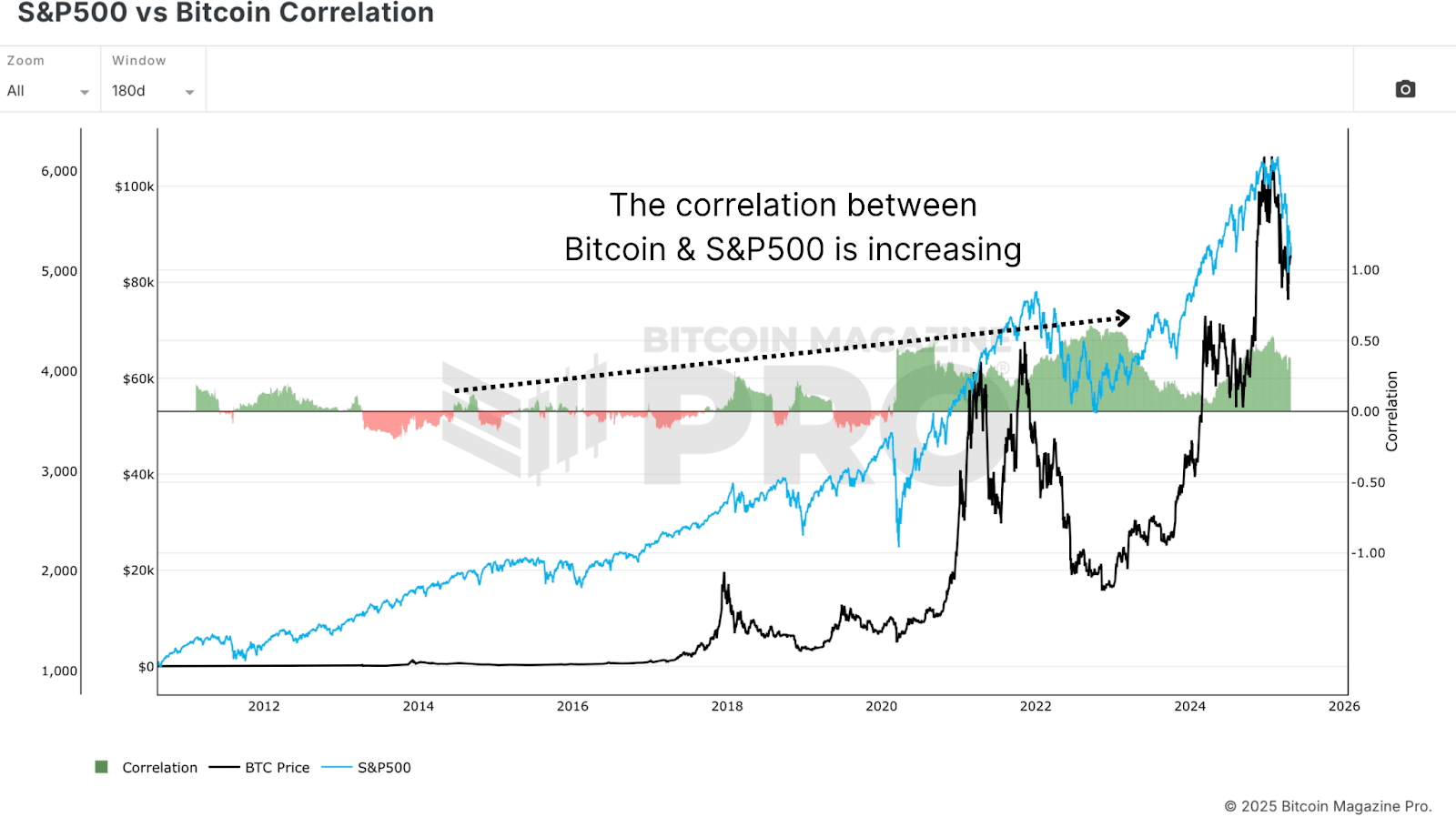

Does this mean Bitcoin is being controlled by corporations? Not yet. But it does signal a growing influence, especially in price behavior. From the S&P 500 vs Bitcoin Correlation chart, it is evident that the correlation between Bitcoin and traditional equity indexes like the S&P 500 or Nasdaq has tightened significantly. As these large entities enter the market, BTC is increasingly viewed as a “risk-on” asset, meaning its price tends to rise and fall with broader investor sentiment in traditional markets.

This can be beneficial in bull markets. When global liquidity expands and risk assets perform well, Bitcoin now stands to attract larger inflows than ever before, especially as pensions, hedge funds, and sovereign wealth funds begin allocating even a small percentage of their portfolios. But there’s a trade-off. As institutional adoption deepens, Bitcoin becomes more sensitive to macroeconomic conditions. Central bank policy, bond yields, and equity volatility all start to matter more than they once did.

Despite these shifts, more than 85% of Bitcoin remains outside institutional hands. Retail investors still hold the overwhelming majority of the supply. And while ETFs and company treasuries may hoard large amounts in cold storage, the market remains broadly decentralized. Critics argue that on-chain data is becoming less useful. After all, if so much BTC is locked up in ETFs or dormant wallets, can we still draw accurate conclusions from wallet activity? This concern is valid, but not new.

Need to Adapt

Historically, much of Bitcoin’s trading activity has occurred off-chain, particularly on centralized exchanges like Coinbase, Binance, and (once upon a time) FTX. These trades rarely appeared on-chain in meaningful ways but still influenced price and market structure. Today, we face a similar situation, only with better tools. ETF flows, corporate filings, and even nation-state purchases are subject to disclosure regulations. Unlike opaque exchanges, these institutional players often must disclose their holdings, providing analysts with a wealth of data to track.

Moreover, on-chain analytics isn’t static. Tools like the MVRV-Z score are evolving. By narrowing the focus, say, to an MVRV Z-Score 2YR Rolling average instead of full historical data, we can better capture current market dynamics without the distortion of long-lost coins or inactive supply.

Conclusion

To wrap it up, institutional interest in Bitcoin has never been higher. Between ETFs, corporate treasuries, and sovereign entities, over 2.2 million BTC are already spoken for, and that number is growing. This flood of capital has undoubtedly had a stabilizing effect on price during periods of market weakness. However, with that stability comes entanglement. Bitcoin is becoming more tied to traditional financial systems, increasing its correlation to equities and broader economic sentiment.

Yet this does not spell doom for Bitcoin’s decentralization or the relevance of on-chain analytics. In fact, as more BTC is held by identifiable institutions, the ability to track flows becomes even more precise. The retail footprint remains dominant, and our tools are becoming smarter and more responsive to market evolution. Bitcoin’s ethos of decentralization isn’t at risk; it’s just maturing. And as long as our analytical frameworks evolve alongside the asset, we’ll be well-equipped to navigate whatever comes next.

For more deep-dive research, technical indicators, real-time market alerts, and access to a growing community of analysts, visit BitcoinMagazinePro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Adoption

Toulouse starts to accept crypto for public transport

Published

4 weeks agoon

March 31, 2025By

admin

In Toulouse, France, residents can pay for their metro, tram, cable car, and bus tickets with Bitcoin and other cryptocurrencies.

In fact, starting on March 17, Toulouse became the first European city where crypto can legally be spent on public transport.

🚋 European Premiere: Crypto for Tram Fares!

With @Lyzi_app and @tisseo_officiel, you can now get around Toulouse using your crypto holdings; marking them as the first European public transport system to test this! ⚡️

Metro, tram, bus, cable car, and park & ride – they’re all… pic.twitter.com/2lKfEUCJYU

— Lyzi 🇫🇷 (@Lyzi_app) March 20, 2025

The move comes as France actively seeks to deploy various crypto-friendly services. It is reported that Cannes is also working on a payment system that will accept crypto from residents.

Tisséo, a Toulouse public transport operator, launched its solution first. The tickets can be bought via an Android-based mobile app for Bitcoin or one of the 70 altcoins. The crypto is instantly converted to euros. Binance Pay is among the supported payment options.

According to the deputy mayor of Toulouse, Sacha Briand, the initiative is experimental as the company wants to check how widespread the use of crypto can become in the long run. The press release emphasizes that the Toulouse administration is interested in the long-term prospects of cryptocurrency integration.

It’s worth noting that Paris-based Lyzi developed the crypto payment infrastructure for Tisséo. This white-label fintech company actively helps other businesses, including pharmacies, coworking spaces, and restaurants, accept crypto payments.

Lyzi also facilitates crypto payments for Printemps fashion stores across France.

They accept binancepay. They don’t accept Bitcoin

— Oliver Koblížek 🍩 (@Stromens) March 24, 2025

Some of the Bitcoin maxis have already expressed discontent over the fact that the service involves an intermediary of Binance, as they disapprove of the use of any middlemen or altcoins.

Advocates of the move by Tisséo argue that having Binance involved was important to ensure the speedy execution of transactions.

A more serious hurdle is the necessity to declare crypto transactions via tax form 3916-bis. Crypto transactions incur a 30% capital gains tax. Time will tell how easy it is. Regulators will likely have to adjust the rules to make crypto payments easier. The stats indicating how many people use the new payment avenue are unavailable as of press time.

Crypto in France

France is one of the countries that adopted general crypto regulations in 2020, making cryptocurrency storage and transactions legal and inspectable as France complies with the AML rules.

The press release dedicated to the crypto implementation in Toulouse mentions that cryptocurrency is becoming more popular among the French. The 2024 report by Gemini indicates that around 18% of French citizens hold crypto. Tisséo’s adoption of crypto payments for city transit was made in anticipation of the further growth in the number of crypto owners.

While the new initiative can attract more people’s interest in owning crypto, it may also create a robust infrastructure where people can use crypto for daily purchases once the share of crypto holders becomes critical.

Bitcoin cities

Although Toulouse became the first European city to let residents use crypto to pay for public transport, several other countries boast various services that can be paid for in crypto:

- Argentina: In 2019, Argentina allowed its citizens to top up the SUBE cards used in around 60 cities to pay for public transport with crypto.

- United Arab Emirates: Dubai is arguably one of the first so-called “Bitcoin cities” that come to mind when considering places to spend Bitcoins. Although Bitcoin is not registered as a legal tender in the United Arab Emirates, it can be spent there in hotels, malls, and restaurants. It is possible to rent a vehicle or book a flight using Bitcoin. Real estate purchases are also possible via crypto in Dubai. Those who don’t feel confident using online crypto exchanges may use one of the city’s crypto ATMs.

- Switzerland: Another notable example is the city of Zug, dubbed “Crypto Valley.” The city hosts the same crypto conference, while Switzerland itself is a well-known cryptocurrency hub. Zug allowed its residents to pay in Bitcoin for services (i.e., taxes) back in 2016.

- China: Hong Kong, considered a special administrative region, is another place where people can pay for dinner with Bitcoin. Immigrants can also use Bitcoin, Ethereum, and other digital assets as proof of wealth when visiting Hong Kong.

Source link

Adoption

HK Asia Holdings Becomes First In China To Adopt Bitcoin Treasury

Published

1 month agoon

March 25, 2025By

admin

HK Asia Holdings (HKEX: 1723), soon to be renamed Moon Inc., has made history as the first publicly traded company in Greater China to adopt a Bitcoin treasury strategy. In a recent discussion hosted by Allen Helm of Bitcoin For Corporations, new CEO John Riggins outlined the company’s pivot, its regulatory alignment with Hong Kong, and the broader momentum building across Asia.

Riggins, a longtime Bitcoin advocate with extensive experience across China and Southeast Asia, explained that the move was driven by both long-term conviction and a favorable shift in regulatory posture in Hong Kong. He said the company had spent months consulting with regulators, public market investors, and local partners before executing the transition.

Originally focused on SIM cards and prepaid tech products, HK Asia Holdings now aims to integrate Bitcoin both as a balance sheet asset and into its business model. This includes plans to roll out Bitcoin-related offerings through its retail footprint, such as ATMs and prepaid Bitcoin products.

The company’s first steps included the acquisition of 8.88 BTC during a post-acquisition period, followed by another 10 BTC purchase once the leadership transition was finalized—bringing its total holdings to 18.88 BTC, valued at over $1.7 million at the time of announcement. Riggins said further accumulation is planned, though it will proceed in accordance with Hong Kong’s measured but transparent regulatory guidance.

“We see it as a way to protect our balance sheet, and we see it as a way to diversify, our treasury with an eye on how the rest of the world is moving,” said Riggins.

The strategic intent goes far beyond speculation. Riggins framed Bitcoin as a hedge against macro uncertainty, a tool for long-term resilience, and a bridge to emerging global financial infrastructure. He also emphasized how corporate boards in the region are beginning to engage more seriously with the idea, pointing to MetaPlanet in Japan and Strategy in the U.S. as compelling precedents.

While Asia’s corporate Bitcoin adoption is still in its early stages, interest is growing fast. Riggins highlighted South Korea, Thailand, Malaysia, and Indonesia as markets with clear potential to follow suit. Much of the movement, he noted, is happening quietly behind the scenes—especially in China, where institutional stakeholders and state-connected investors are actively monitoring U.S. policy shifts and corporate adoption trends.

“I’m flooded with messages more and more from, people in the government, people, you know, institutional investors who are kinda watching this space closely looking for inside information about what’s happening here,” said Riggins.

Although no formal public moves have been announced by Chinese state entities, Riggins believes Bitcoin is already being held indirectly through government-affiliated organizations, including state-connected investment arms. He suggested these holdings may be more significant than publicly known. With the U.S. moving toward a strategic Bitcoin reserve, he sees China closely watching—and potentially following—if global policy momentum continues to shift.

Looking ahead, Moon Inc. plans to expand its Bitcoin holdings within Hong Kong’s regulatory framework and serve as a model for other Asian companies exploring similar strategies. The company will co-host Bitcoin Asia this August in Hong Kong, positioning itself as a regional trailblazer and helping catalyze broader corporate adoption across Asia.

Disclaimer: This content was written on behalf of Bitcoin For Corporations. This article is intended solely for informational purposes and should not be interpreted as an invitation or solicitation to acquire, purchase, or subscribe for securities. For full transparency, please note that BTC Inc., the parent company of UTXO Management, holds a stake in HK Asia Holdings Limited (1723.HK) in partnership with Sora Ventures and other entities.

Source link

From Booze to Barbells: Exercise May Offset Risks of College Partying

Ethereum Foundation shuffles leadership, splits board and management

Bitcoin Price (BTC) Retakes $95K Level After Early U.S. Decline

A New Risk For The Industry?

Justin Sun Bets Big On JUST Token, Sees 100x Potential

Worldcoin price prediction | What’s next for WLD price?

Bitcoin Is About To Begin Outperforming Gold, Says InvestAnswers – Here’s His Timeline

Bloomberg Analyst Confirms No Set Launch Date for ProShares XRP ETFs

What is Base? The Ethereum Layer-2 Network Launched by Coinbase

Loopscale hacker in talks to return stolen crypto

Bitcoin (BTC) Yield Platform Coming From Coinbase (COIN), Aspen Digital

The Emerging Market For State Services Via Citizen X

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines