Bitcoin Magazine Pro

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Published

2 months agoon

By

admin

Bitcoin’s recent price action has been nothing short of exhilarating, but beyond the market buzz lies a wealth of on-chain data offering deeper insights. By analyzing metrics that gauge network activity, investor sentiment, and the BTC market cycles, we can gain a clearer picture of Bitcoin’s current position and potential trajectory.

Plenty Of Upside Remaining

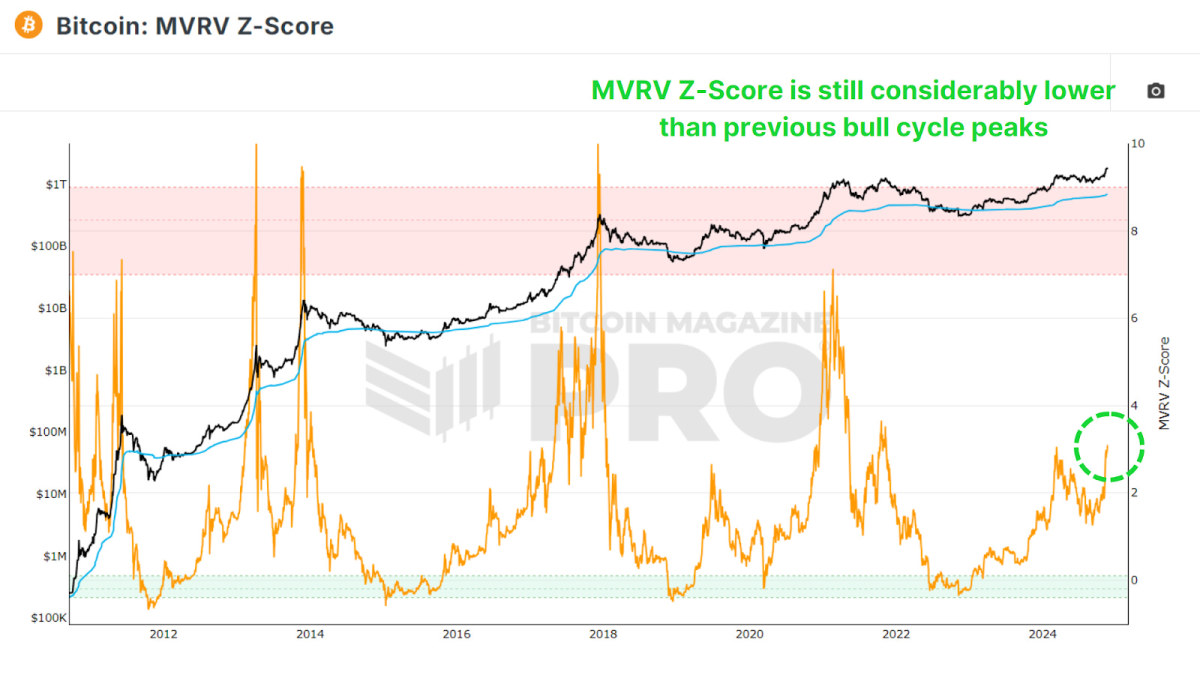

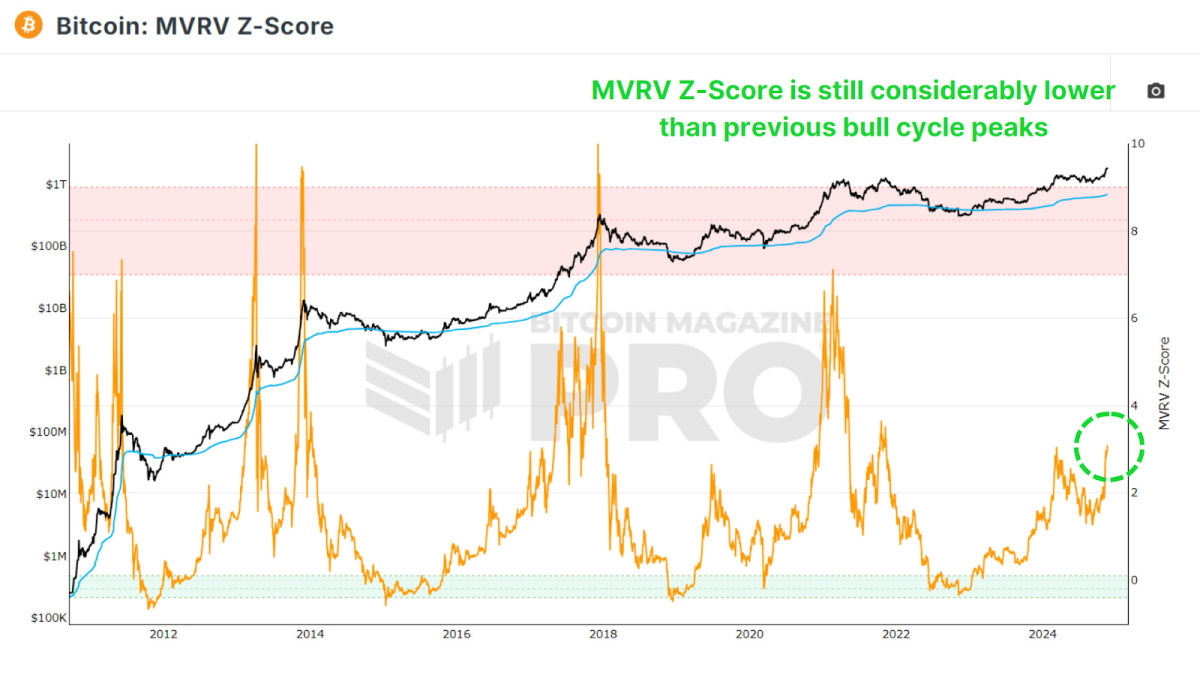

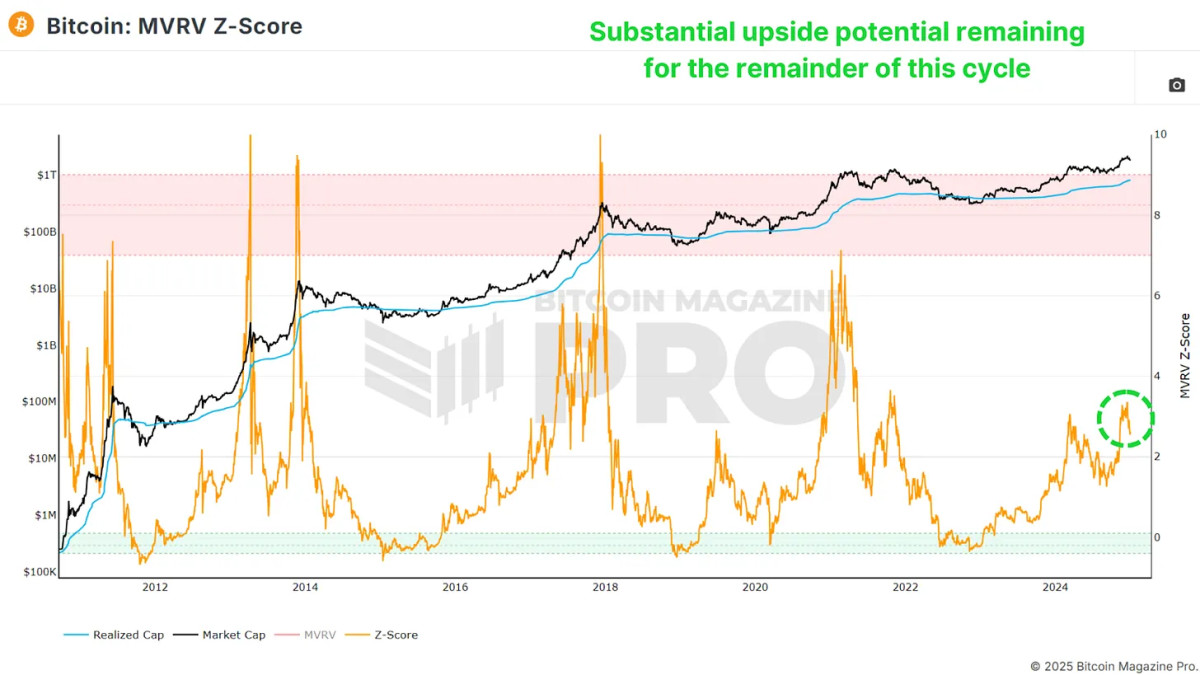

The MVRV Z-Score compares Bitcoin’s market cap, or price multiplied by circulating supply, with its realized cap, which is the average price at which all BTC were last transacted. Historically, this metric signals overheated markets when it enters the red zone, while the green zone suggests widespread losses and potential undervaluation.

Currently, despite Bitcoin’s rise to new all-time highs, the Z-score remains in neutral territory. Previous bull runs saw Z-scores reach highs of 7 to 10, far beyond the current level of around 3. If history repeats, this indicates significant room for further price growth.

Miner Profitability

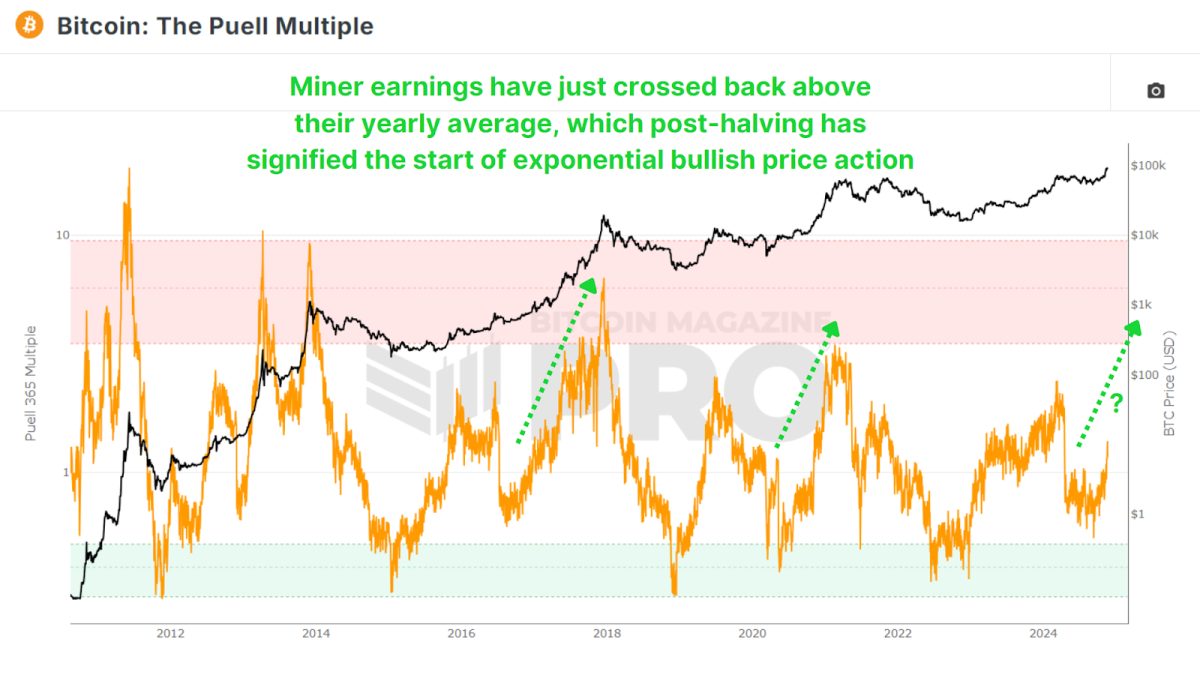

The Puell Multiple evaluates miner profitability by comparing their daily USD-denominated revenue to their previous one-year moving average. Post-halving, miners’ earnings dropped by 50%, which led to a multi-month period of decreased earnings as the BTC price consolidated for most of 2024.

Yet even now, as Bitcoin has skyrocketed to new highs, the multiple indicates only a 30% increase in profitability relative to historical averages. This suggests that we are still in the early to middle stages of the bull market, and when comparing the patterns in the data we look like we have the potential for explosive growth akin to 2016 and 2020. With a post-halving reset, consolidation, and a finally a reclaim of the 1.00 multiple level signifying the exponential phase of price action.

Measuring Market Sentiment

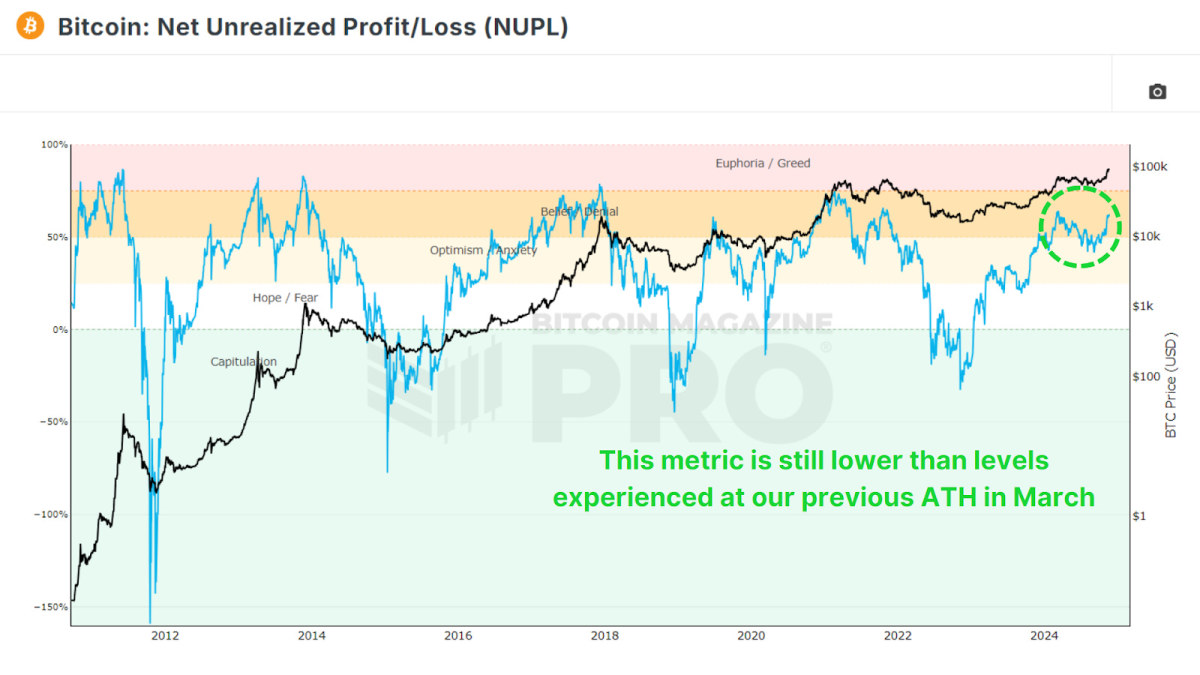

The Net Unrealized Profit and Loss (NUPL) metric quantifies the network’s overall profitability, mapping sentiment across phases like optimism, belief, and euphoria. Similar to the MVRV Z-Score as it is derived from realized value or investor cost-basis, it looks at the current estimated profit or losses for all holders.

Presently, Bitcoin remains in the ‘Belief’ zone, far from ‘Euphoria’ or ‘Greed’. This aligns with other data suggesting there is ample room for price appreciation before reaching market saturation. Especially considering this metric is still at lower levels than this metric reached earlier this year in March when we set out previous all-time high.

Long-Term Holder Trends

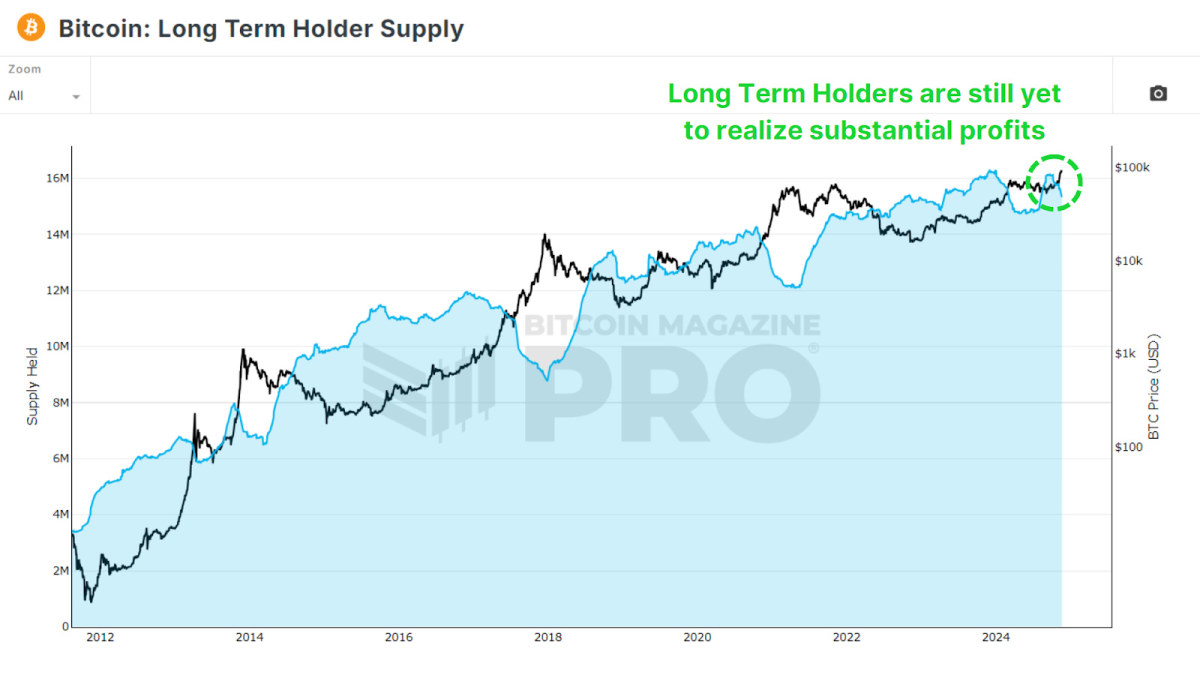

The percentage of Bitcoin held for over a year, represented by the 1+ Year HODL Wave, remains exceptionally high at around 64%, which is still higher than at any other point in Bitcoin history prior to this cycle. Prior price peaks in 2017 and 2021 saw these values fall to 40% and 53%, respectively as long-term holders began to realize profits. If something similar were to occur during this cycle, then we still have millions of bitcoin to be transferred to new market participants.

So far, only around 800,000 BTC has been transferred from the Long Term Holder Supply to newer market participants during this cycle. In past cycles, up to 2–4 million BTC changed hands, highlighting that long-term holders have yet to cash out fully. This indicates a relatively nascent phase of the current bull run.

Tracking “Smart Money”

The Coin Days Destroyed metric weighs transactions by the holding duration of coins, emphasizing whale activity. We can then multiply that value by the BTC price at that point in time to see the Value Days Destroyed (VDD) Multiple. This gives us a clear insight into whether the largest and smartest BTC holders are beginning to realize profits in their positions.

Current levels remain far from the red zones typically seen during market tops. This means whales and “smart money” are not yet offloading significant portions of their holdings and are still awaiting higher prices before beginning to realize substantial profits.

Conclusion

Despite the rally, on-chain metrics overwhelmingly suggest that Bitcoin is far from overheated. Long-term holders remain largely steadfast, and indicators like the MVRV Z-score, NUPL, and Puell Multiple all highlight room for growth. That said, some profit-taking and new market participants signal a transition into the mid to late-cycle phase, which could potentially be sustained for most of 2025.

For investors, the key takeaway is to remain data-driven. Emotional decisions fueled by FOMO and euphoria can be costly. Instead, follow the underlying data fueling Bitcoin and use tools like the metrics discussed above to guide your own investing and analysis.

For a more in-depth look into this topic, check out a recent YouTube video here: What’s Happening On-chain: Bitcoin Update

Source link

You may like

Are Pudgy Penguins pushing back?

Hamster Kombat (HMSTR) Price Prediction January 2025, 2026, 2030, 2040

North Dakota Considers Crypto Reserve as State Bitcoin Treasuries Gain Momentum

XRP aims for $50 in 2025 as this rising crypto steals the show

How 3 Consecutive Wins Made This Crypto Investor $9M in Profits?

Red-Hot DeFi Platform Usual Faces Backlash as Protocol Update Triggers Sell-Off

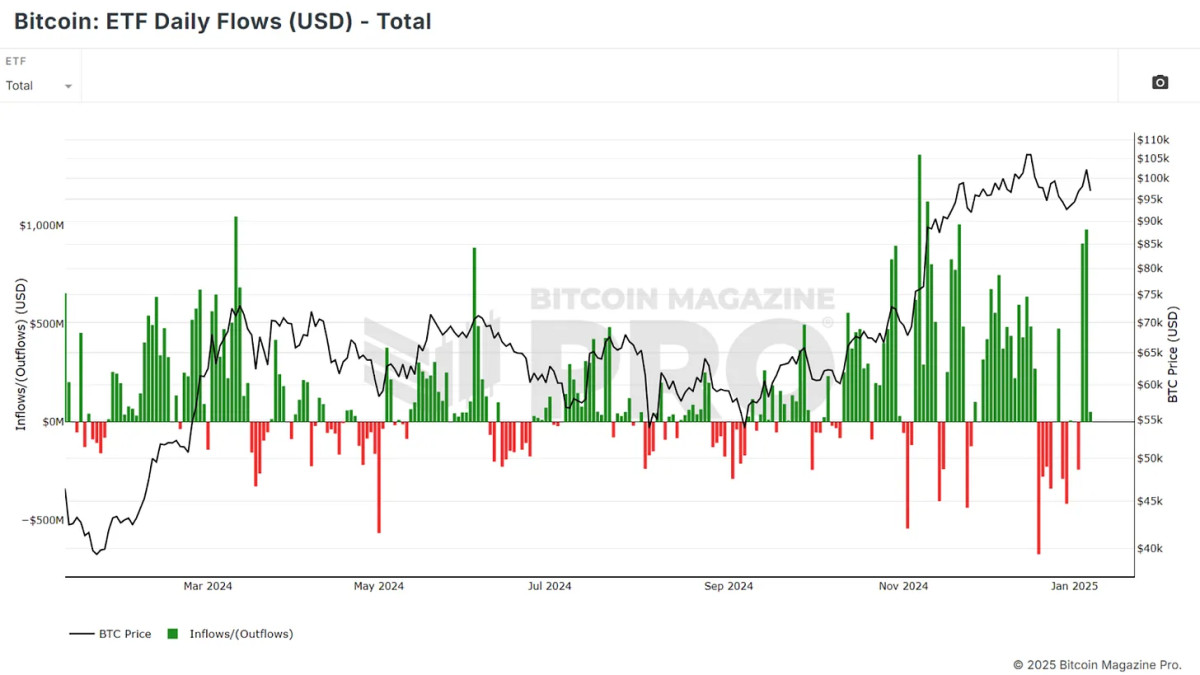

The launch of Bitcoin ETFs in January 2024 was heralded as a groundbreaking moment for the market. Many expected these products to open the floodgates for institutional capital and catapult Bitcoin prices to new heights. But now, a year later, have Bitcoin ETFs delivered on their promise?

For a more in-depth look into this topic, check out a recent YouTube video here: Have Bitcoin ETFs Lived Up to Expectations?

A Strong Start

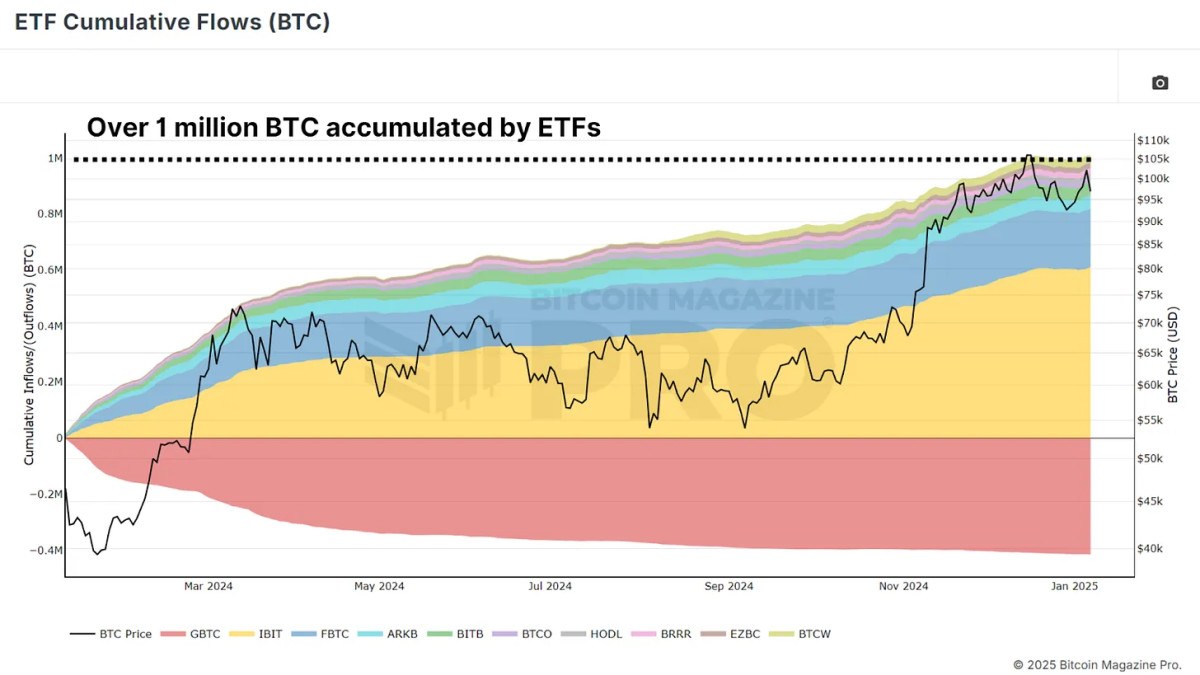

Since their launch, Bitcoin ETFs have accumulated over 1 million BTC, equivalent to approximately $40 billion in assets under management. Even when accounting for outflows from competing products like the Grayscale Bitcoin Trust (GBTC), which saw withdrawals of over 400,000 BTC, the net inflows remain significant at about 540,000 BTC.

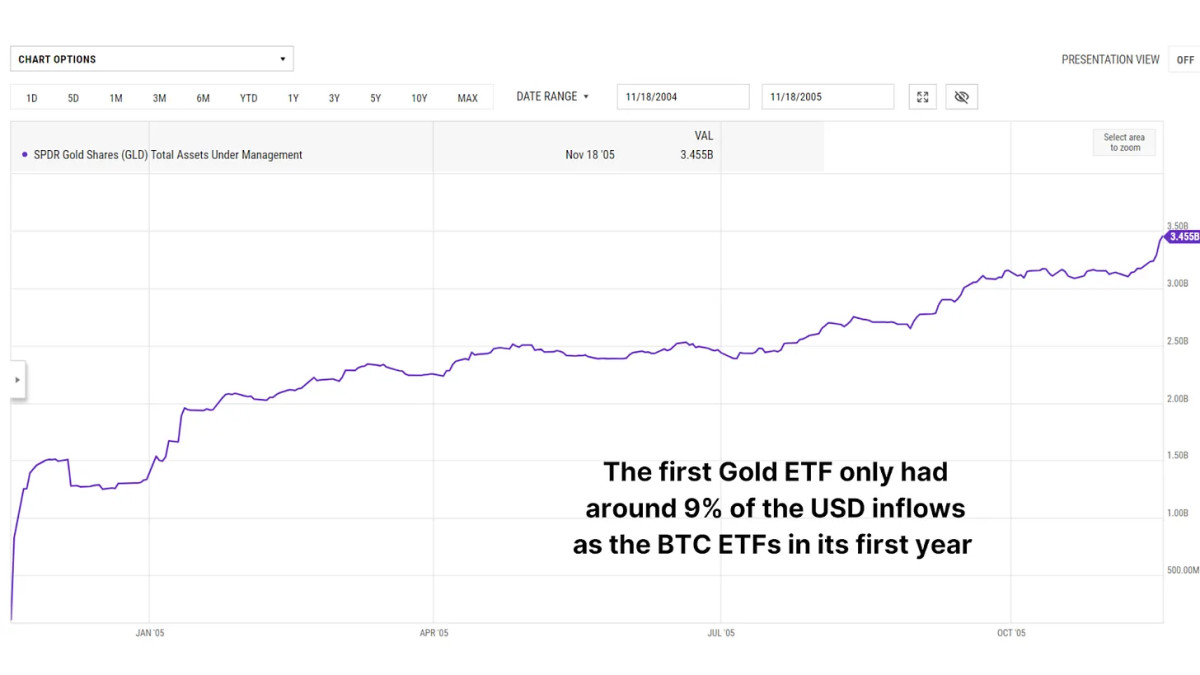

To put this into perspective, the scale of inflows far exceeds what we witnessed during the launch of the first gold ETFs in 2004. Gold ETFs garnered $3.45 billion in their first year, a fraction of Bitcoin ETFs’ $37.5 billion in inflows over the same period. This highlights the intense institutional interest in Bitcoin as a financial asset.

Bitcoin’s Year of Growth

Following the launch of Bitcoin ETFs, initial price movements were underwhelming, with Bitcoin briefly declining by nearly 20% in a “buy the rumor, sell the news” scenario. However, this bearish trend quickly reversed. Over the past year, Bitcoin prices have risen by approximately 120%, reaching new heights. For comparison, the first year following the launch of gold ETFs saw a modest 9% price increase for gold.

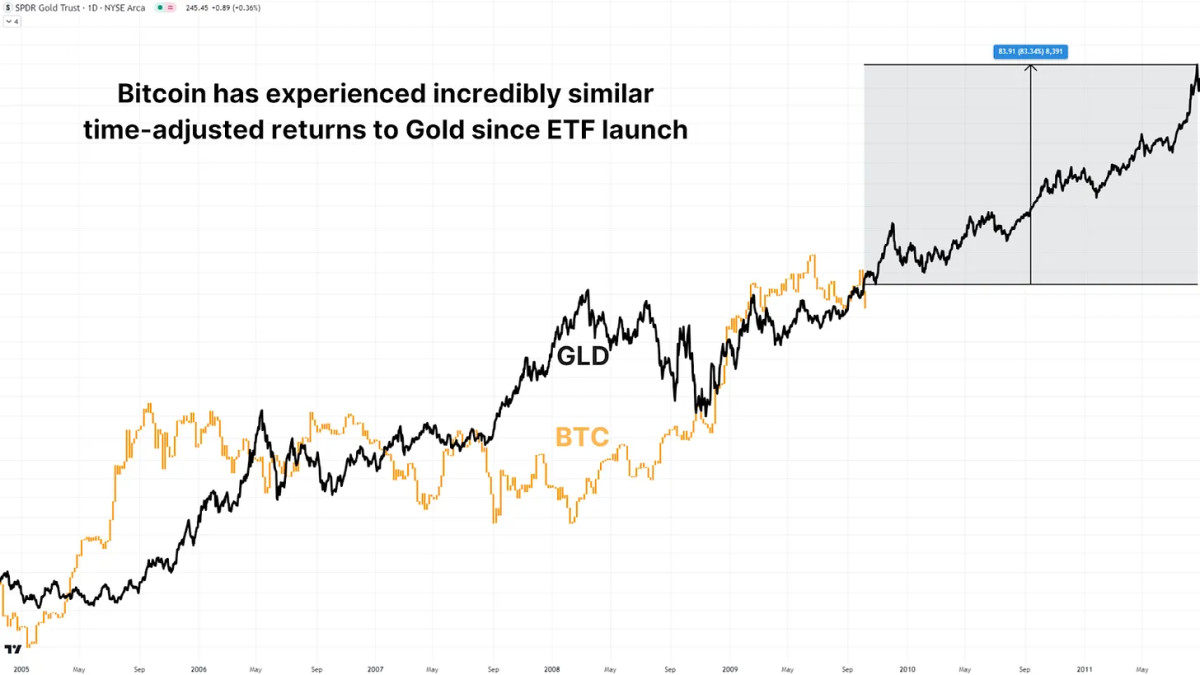

Following the Gold Fractal

When accounting for Bitcoin’s 24/7 trading schedule, which results in roughly 5.3 times more yearly trading hours than gold, a striking similarity emerges. By overlaying Bitcoin’s first year of ETF price action with gold’s historical data (adjusted for trading hours), we can see almost the same % returns. If Bitcoin continues to follow gold’s pattern, we could see an additional 83% price increase by mid-2025, potentially pushing Bitcoin’s price to around $188,000.

Institutional Strategy

One intriguing insight from Bitcoin ETFs has been the relationship between fund inflows and price movements. A simple strategy of buying Bitcoin on days with positive ETF inflows and selling on days with outflows has consistently outperformed a traditional buy-and-hold approach. From January 2024 to today, this strategy has returned 130%, compared to ~100% for a buy-and-hold investor, an outperformance of nearly 10%.

For more information on this institutional inflow strategy, watch the following video:

Using ETF Data to Outperform Bitcoin [Must Watch]

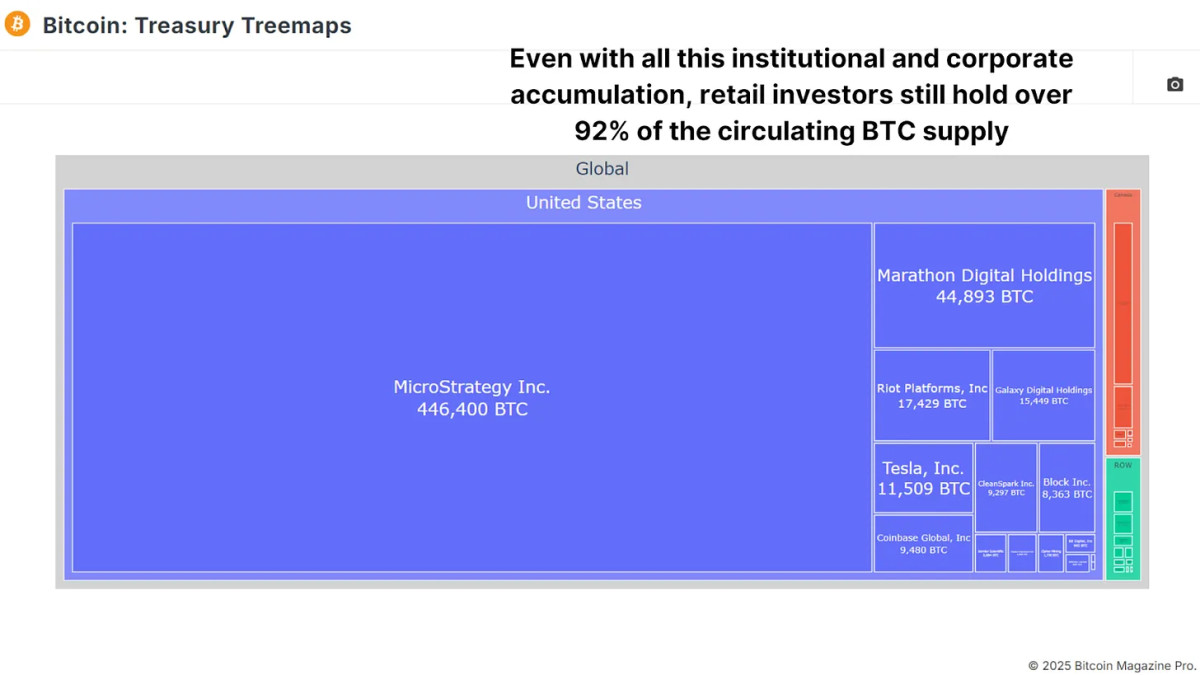

Supply and Demand Dynamics

While Bitcoin ETFs have accumulated over 1 million BTC, this represents only a small fraction of Bitcoin’s total circulating supply of 19.8 million BTC. Corporations like MicroStrategy have also contributed to institutional adoption, collectively holding hundreds of thousands of BTC. Yet, the majority of Bitcoin remains in the hands of individual investors, ensuring that market dynamics are still driven by decentralized supply and demand.

Conclusion

One year in, Bitcoin ETFs have exceeded expectations. With billions in inflows, a significant impact on price appreciation, and increasing institutional adoption, they have solidified their role as a key driver of Bitcoin’s market narrative. While some early skeptics were disappointed by the lack of immediate explosive price action, the long-term outlook remains highly bullish.

The comparisons to gold ETFs provide a compelling roadmap for Bitcoin’s future. If the gold fractal holds true, we could be on the cusp of another major rally. Coupled with favorable macroeconomic conditions and growing institutional interest, Bitcoin’s future looks brighter than ever.

Explore live data, charts, indicators, and in-depth research to stay ahead of Bitcoin’s price action at Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin Magazine Pro

New Pi Cycle Top Prediction Chart Identifies Bitcoin Price Market Peaks with Precision

Published

5 days agoon

January 6, 2025By

admin

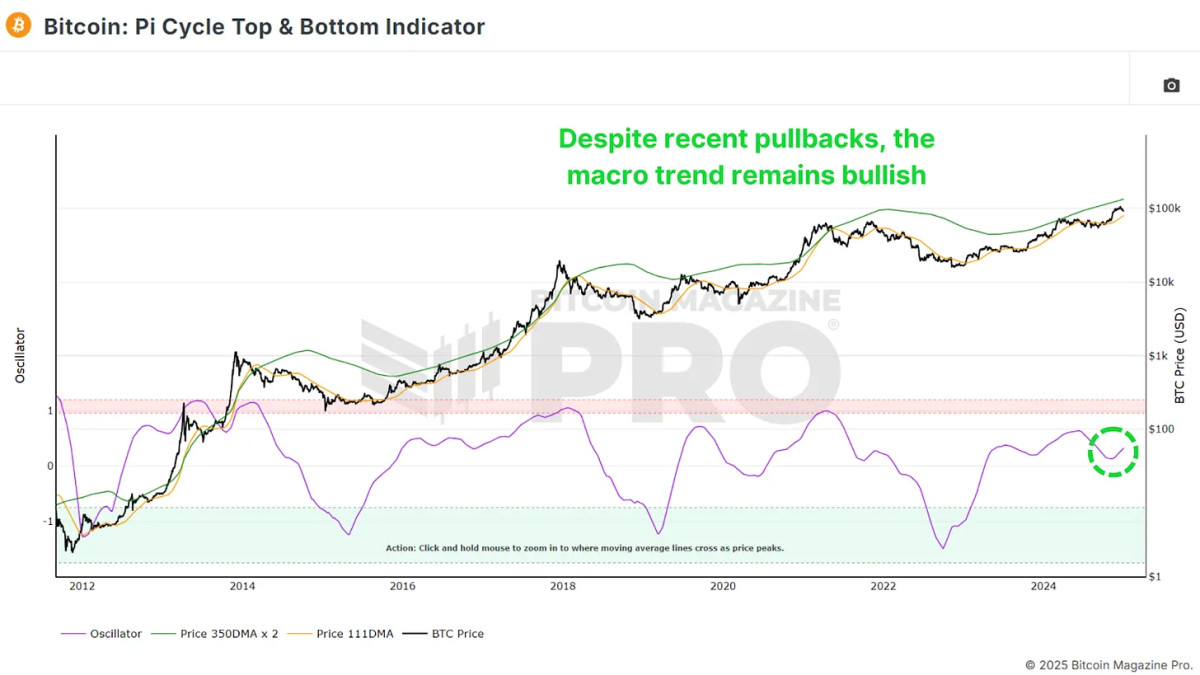

Bitcoin investors and analysts constantly seek innovative tools and indicators to gain a competitive edge in navigating volatile market cycles. A recent addition to this arsenal is the Pi Cycle Top Prediction chart, now available on Bitcoin Magazine Pro. Designed for professional and institutional investors, this chart builds on the widely recognized Pi Cycle Top indicator—a tool that has historically pinpointed Bitcoin’s market cycle peaks with remarkable accuracy.

🚨 NEW FREE CHART ALERT 🚨

Following the amazing feedback we received on our video series:

'Mathematically Predicting the BTC Peak'

We decided to recreate the data we used and provide it in a new and completely FREE indicator:

🔥 Bitcoin Pi Cycle Top Prediction 🔥

This… pic.twitter.com/9DqRWGhhGr

— Bitcoin Magazine Pro (@BitcoinMagPro) January 6, 2025

Understanding the Pi Cycle Top Prediction Indicator

The Pi Cycle Top Prediction chart enhances the concept of its predecessor by projecting future potential crossover points of two key moving averages:

- 111-day Moving Average (111DMA)

- 350-day Moving Average multiplied by two (350DMA x2)

By calculating the rate of change of these two moving averages over the past 14 days, the tool extrapolates their trajectory into the future. This approach provides a predictive estimate of when these two averages will cross, signaling a potential market top.

Historically, the crossover of these moving averages has been closely associated with Bitcoin’s cycle tops. In fact, the original Pi Cycle Top indicator successfully identified Bitcoin’s previous cycle peaks to within three days, both before and after its creation.

Implications for Market Behavior

When the 111DMA approaches the 350DMA x2, it suggests that Bitcoin’s price may be rising unsustainably, often reflecting heightened speculative fervor. A crossover typically signals the end of a bull market, followed by a price correction or bear market.

For professional investors, this tool is invaluable as a risk management mechanism. By identifying periods when market conditions might be overheating, it allows investors to make informed decisions about their exposure to Bitcoin and adjust their strategies accordingly.

Key Prediction: September 17, 2025

The current projection estimates that the moving averages will cross on September 17, 2025. This date represents a potential market top, offering investors a timeline to monitor and reassess their positions as market dynamics evolve. Users can view this projection in detail by hovering over the chart on the Bitcoin Magazine Pro platform.

Origins and Related Tools

The Pi Cycle Top Prediction indicator was conceptualized by Matt Crosby, Lead Analyst at Bitcoin Magazine Pro. It builds on the original Pi Cycle Top indicator, created by Philip Swift, Managing Director of Bitcoin Magazine Pro. Swift’s Pi Cycle Top has become a trusted resource among Bitcoin analysts and investors for its historical accuracy in identifying market peaks.

Investors interested in a deeper exploration of market cycles can also refer to:

- The Original Pi Cycle Top Indicator: View the chart

- The Pi Cycle Top and Bottom Indicator: View the chart

Video Explainer and Educational Resources

For a comprehensive explanation of the Pi Cycle Top Prediction chart, investors can watch a detailed video by Matt Crosby, available here. This video provides an overview of the methodology, practical applications, and historical context for this predictive tool.

Why This Matters for Professional Investors

In a market as dynamic and unpredictable as Bitcoin, professional investors require sophisticated tools to anticipate and respond to significant market shifts. The Pi Cycle Top Prediction chart offers:

- Data-Driven Insights: By leveraging historical data and predictive modeling, the chart delivers actionable insights for portfolio management.

- Timing Precision: The ability to estimate cycle tops with a high degree of accuracy enhances strategic decision-making.

- Risk Mitigation: Early warning signals of market overheating empower investors to protect their portfolios from potential downside risks.

As Bitcoin matures into an asset class increasingly adopted by institutional investors, tools like the Pi Cycle Top Prediction chart become essential for understanding and navigating its unique market cycles. By integrating this chart into their analytical toolkit, investors can deepen their insights and improve their long-term investment outcomes.

To explore live data and stay informed on the latest analysis, visit bitcoinmagazinepro.com.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin 2025

2025 Bitcoin Outlook: Insights Backed by Metrics and Market Data

Published

1 week agoon

January 3, 2025By

admin

As we step into 2025, it’s time to take a measured and analytical approach to what the year might hold for Bitcoin. Taking into account on-chain, market cycle, macroeconomic data, and more for confluence, we can go beyond pure speculation to paint a data-driven picture for the coming months.

MVRV Z-Score: Plenty of Upside Potential

The MVRV Z-Score measures the ratio between Bitcoin’s realized price (the average acquisition price of all BTC on the network) and its market cap. Standardizing this ratio for volatility gives us the Z-Score, which historically provides a clear picture of market cycles.

Currently, the MVRV Z-Score suggests we still have significant upside potential. While previous cycles have seen the Z-Score reach values above 7, I believe anything above 6 indicates overextension, prompting a closer look at other metrics to identify a market peak. Presently, we’re hovering at levels comparable to May 2017—when Bitcoin was valued at only a few thousand dollars. Given the historical context, there’s room for multiple hundreds of percent in potential gains from current levels.

The Pi Cycle Oscillator: Bullish Momentum Resumes

Another essential metric is the Pi Cycle Top and Bottom indicator, which tracks the 111-day and 350-day moving averages (the latter multiplied by 2). Historically, when these averages cross, it often signals a Bitcoin price peak within days.

The distance between these two moving averages has started to trend upward again, suggesting renewed bullish momentum. While 2024 saw periods of sideways consolidation, the breakout we’re seeing now indicates that Bitcoin is entering a stronger growth phase, potentially lasting several months.

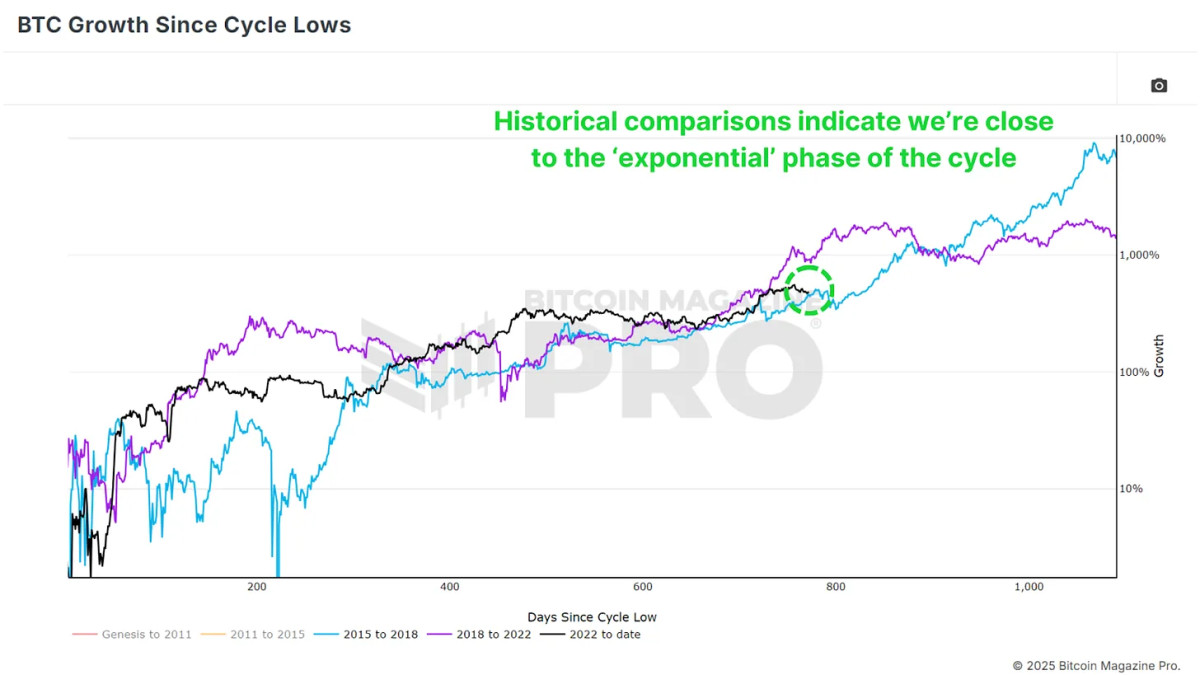

The Exponential Phase of the Cycle

Looking at Bitcoin’s historical price action, cycles often feature a “post-halving cooldown” lasting 6–12 months before entering an exponential growth phase. Based on previous cycles, we’re nearing this breakout point. While diminishing returns are expected compared to earlier cycles, we could still see substantial gains.

For context, breaking the previous all-time high of $20,000 in the 2020 cycle led to a peak near $70,000—a 3.5x increase. If we see even a conservative 2x or 3x from the last peak of $70,000, Bitcoin could realistically reach $140,000–$210,000 in this cycle.

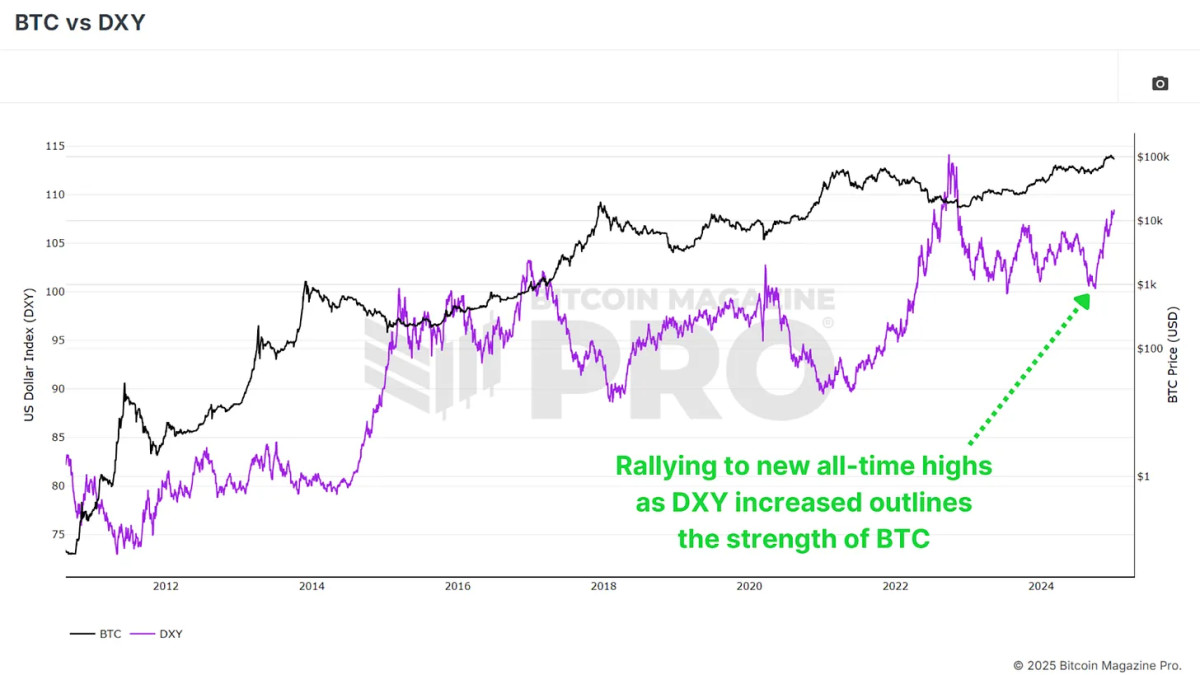

Macro Factors Supporting BTC in 2025

Despite headwinds in 2024, Bitcoin performed strongly, even in the face of a strengthening U.S. Dollar Index (DXY). Historically, Bitcoin and the DXY move inversely, so any reversal in the DXY’s strength could further fuel Bitcoin’s upside.

Other macroeconomic indicators, such as high-yield credit cycles and the global M2 money supply, suggest improving conditions for Bitcoin. The contraction in the money supply seen in 2024 is expected to reverse in 2025, setting the stage for an even more favorable environment.

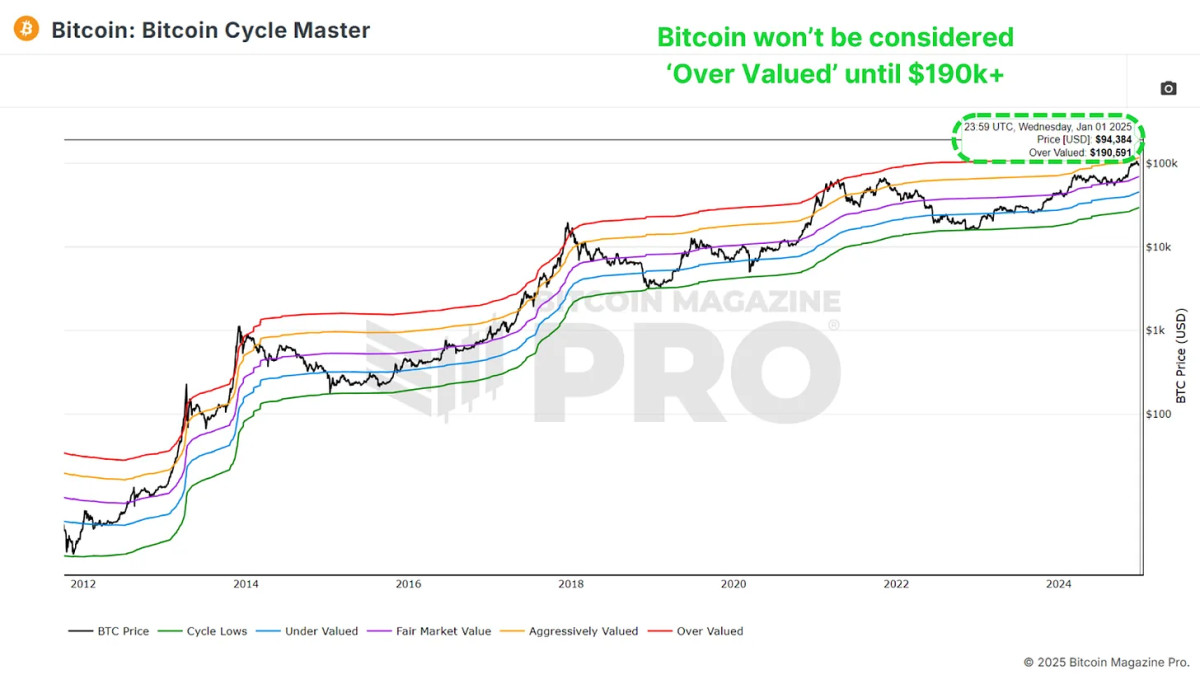

Cycle Master Chart: A Long Way to Go

The Bitcoin Cycle Master Chart, which aggregates multiple on-chain valuation metrics, shows that Bitcoin still has considerable room to grow before reaching overvaluation. The upper boundary, currently around $190,000, continues to rise, reinforcing the outlook for sustained upward momentum.

Conclusion

Currently, almost all data points are aligned for a bullish 2025. As always, past performance doesn’t guarantee future results, however the data strongly suggests that Bitcoin’s best days may still lie ahead, even after an incredibly positive 2024.

For a more in-depth look into this topic, check out a recent YouTube video here: Bitcoin 2025 – A Data Driven Outlook

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Are Pudgy Penguins pushing back?

Hamster Kombat (HMSTR) Price Prediction January 2025, 2026, 2030, 2040

North Dakota Considers Crypto Reserve as State Bitcoin Treasuries Gain Momentum

XRP aims for $50 in 2025 as this rising crypto steals the show

How 3 Consecutive Wins Made This Crypto Investor $9M in Profits?

Red-Hot DeFi Platform Usual Faces Backlash as Protocol Update Triggers Sell-Off

The DTX Exchange hybrid platform shocks the online trading space

US Bitcoin ETF Ends Week With $149.4M Outflow, Will It Impact BTC Rally?

Spot Bitcoin ETF Approval Was The Most Important Moment In 2024

Ethereum Faces Crucial Test As Funding Rates Decline And $3K Level Looms

Best Altcoins to Buy Now

Coinbase CLO Paul Grewal Calls Out FDIC Over Incomplete FOIA Responses

Privacy Shouldn't Be A Product, Stop Treating It Like One

Billionaires Pour ~$1,777,000,000 Into Three Assets in Major Portfolio Overhaul: Report

First Sitting U.S. President to HODL meme coins

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x