News

Over $5 m in token unlocks are set for this New Year’s week

Published

3 months agoon

By

admin

In the upcoming week, a token release of over $5 million will take place, featuring assets such as SUI, OP, ZETA, KAS, DYDX, ENA, and others.

According to Tokenomist, the first in the unlock cycle is SUI, with $263.20 million in tokens scheduled to be unlocked, amounting to 2.19% of its circulating supply. This event is expected to occur approximately one day from now. Likewise, $58.61 million worth of Optimism (OP) tokens, or 2.32% of the total supply, will be unlocked within hours. Then comes Zeta Chain (ZETA), with $31.22 million, or 9.35% of its supply, that will be released in the same timeframe.

Last Weekly Unlocks of the year

From : 30 Dec’24 – 5 Jan’25

Unlocks Over $420m+

Highlight Unlocks this week

$SUI (2.2%) – $267.7m$OP (2.3%) – $58.6m$ZETA (9.4%) – $32.2m$AI (17.9%) – $14.7m$DYDX (1.2%) – $13.0m$ENA (0.4%) – $12.0m

.

.

. ( % of cir. supply) pic.twitter.com/M1U892WVPT— Tokenomist (prev. TokenUnlocks) (@Tokenomist_ai) December 28, 2024

Other key projects include dYdX, which will release $12.75 million in tokens, or 1.17% of its supply, and Ethena (ENA), whose $12.73 million in tokens will account for 0.44% of its supply.

The Kaspa (KAS) token, on the other hand, will unlock $21.39 million worth of tokens within the next six days, making up 0.72% of its circulating supply. These releases crowd circulating supply and can push up prices, trading volumes, and liquidity through the market. Leveraging the GHOSTDAG consensus protocol, KAS enables the parallel creation of blocks, resulting in the formation of a block Directed Acyclic Graph or blockDAG for improved scalability and consensus. Unmatched by the current 1 block/s and the plan to achieve 10 or even 100 block/s, KAS is built for high-throughput financial applications, with speed, scalability, and security as its pillars, and features like directed acyclic graph (DAG) topology querying, data pruning, and SPV proofs and layer 2 subnetworks.

Token unlocks refer to the planned release of locked crypto tokens, typically allotted to early investors, team members, or ecosystem growth. These events raise a token’s circulating supply, which can impact its price in a scenario where market demand cannot absorb the newly issued tokens. Because they affect market dynamics, transparency, and investor sentiment, unlock is essential.

Big unlocks can indicate selling pressure and affect near-term prices, while the others might drive ecosystem growth by funding development or incentivizing participation. Investors usually monitor them — to anticipate price movements and adjust strategies.

Source link

You may like

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Eric Trump Joins Metaplanet’s Board Of Advisers

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Donald Trump

Eric Trump Joins Metaplanet’s Board Of Advisers

Published

34 minutes agoon

March 22, 2025By

admin

Metaplanet, Japan’s largest corporate bitcoin holder, has appointed Eric Trump to its newly formed strategic board of advisers. The move aims to advance Metaplanet’s bitcoin adoption mission as bitcoin gains mainstream traction.

Metaplanet announced the move on Friday, stating that Trump’s expertise and passion for bitcoin will help drive the company’s goals. As the son of U.S. President Donald Trump, Eric Trump has emerged as an influential voice supporting the growth bitcoin and the crypto industry.

JUST IN:

Japanese public company Metaplanet appoints Eric Trump as a strategic advisor to help drive Bitcoin adoption. pic.twitter.com/9UnAFzF5Ty

— Bitcoin Magazine (@BitcoinMagazine) March 21, 2025

The advisory board will also include other high-profile figures yet to be named, according to Metaplanet. The focus will be bringing together leaders in business, politics and technology to further bitcoin’s acceptance globally.

Metaplanet Representative Director Simon Gerovich welcomed Trump’s appointment, emphasizing his business acumen and enthusiasm for the bitcoin community. Gerovich said, “His business expertise and passion for BTC will help drive our mission forward as we continue building one of the world’s leading Bitcoin Treasury Companies.”

The Tokyo-based company has aggressively accumulated bitcoin reserves, now holding over 3,200 BTC worth approximately $267 million. Earlier in March, Metaplanet purchased 150 additional bitcoins at a value of $12.5 million.

Established in 1999, Metaplanet has shifted its focus to bitcoin investment and advocacy. The company trades on the Tokyo Stock Exchange and was previously known as Red Planet Japan.

Eric Trump has increasingly backed bitcoin and cryptos. He is involved with World Liberty Financial, a Trump family’s crypto venture. His father, Donald Trump, recently signed an executive order to launch a strategic bitcoin reserve.

With bitcoin going mainstream, Metaplanet is betting on crypto-friendly advisers like Trump to drive institutional adoption. Major corporations adding bitcoin to reserves could accelerate acceptance and solidify bitcoin as a sound corporate asset.

Source link

Bitcoin

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Published

3 hours agoon

March 22, 2025By

admin

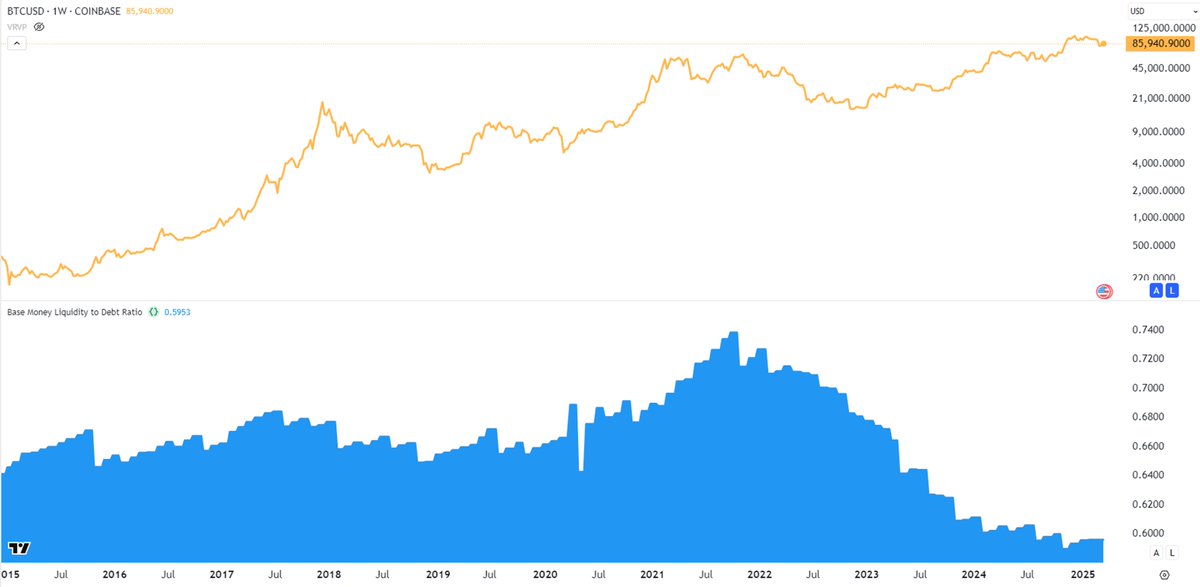

Real Vision’s chief crypto analyst says that Bitcoin (BTC) may soon print a series of rallies as macroeconomic conditions could ease later this year.

In a new thread, crypto strategist Jamie Coutts tells his 37,300 followers on the social media platform X that market liquidity is expected to increase in the second half of 2025, which may pump Bitcoin.

“The bottom line, though, is that if Bitcoin can rally through the worst liquidity withdrawal in decades, it’s primed for more significant moves as conditions ease through the rest of the year. Watch the blue line [Base Money Liquidity to Debt Ratio] begin to tick higher in 2H (second half) of the year.”

In addition to predicting money supply will increase faster than US debt, he also predicts that Bitcoin adoption will increase among US banks and sovereign wealth funds, helping to increase the value of the flagship crypto asset.

“More likely, base money outpaces government debt growth. What happens if base money expands faster than U.S. debt growth? In some reality, that might steady the ship and dampen the fear fueling Bitcoin adoption. But, in my view, that only hits the margins.

Meanwhile, deeper Bitcoin integration at both sovereign and banking levels is inevitable. Ultimately, US structural deficits are not changing. The US government will need to find new and inventive ways to ensure there is a bid for their debt.”

Bitcoin is trading for $84,090 at time of writing, flat on the day.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

legal

US Treasury Removes Tornado Cash From OFAC Sanctions List

Published

9 hours agoon

March 22, 2025By

admin

The Department of Treasury has lifted Sanctions on Tornado Cash, the Ethereum based smart contract mixer, following a series of legal defeats and administrative challenges.

“Based on the Administration’s review of the novel legal and policy issues raised by use of financial sanctions against financial and commercial activity occurring within evolving technology and legal environments, we have exercised our discretion to remove the economic sanctions against Tornado Cash as reflected in Treasury’s Monday filing in Van Loon v. Department of the Treasury,” the Treasury Department stated.

Quick Overview of the Tornado Cash Story

Tornado Cash was launched in 2019 as a decentralized protocol to enhance transaction privacy on Ethereum.

In August 2022, the mixer was added to the Office of Foreign Assets Control (OFAC) list, which includes sanctioned individuals and entities. U.S. law enforcement alleged that Tornado Cash facilitated over $7 billion in money laundering, including funds linked to North Korea’s Lazarus Group.

This led to a ban on U.S. persons using the service and legal action against its co-founders, Roman Storm and Roman Semenov, who were indicted in 2023 for money laundering tied to over $1 billion in transactions.

Six Tornado Cash users, backed by Coinbase, sued the Treasury, challenging the sanctions.

A Texas federal court ruled in January 2025 that the smart contracts couldn’t be sanctioned, a decision upheld by the Fifth Circuit in November 2024.

Today the Treasury officially lifted the sanctions, citing evolving legal and technological considerations, though it expressed concern about ongoing illicit crypto activities and reinforced its intent and authority to continue DPRK sanctions.

Tension Continues

The Treasury nevertheless reinforced its intent to enforce sanctions against Democratic People’s Republic of Korea (DPRK), an ongoing source of geopolitical tension given the recent $1 billion+ hack from Bybit argued to have been executed by Lazarous, a hacking group with DRKP ties.

“We remain deeply concerned about the significant state-sponsored hacking and money laundering campaign aimed at stealing, acquiring, and deploying digital assets for the Democratic People’s Republic of Korea (DPRK) and the Kim regime,” the agency stated.

“Treasury will continue to monitor closely any transactions that may benefit malicious cyber actors or the DPRK, and U.S. persons should exercise caution before engaging in transactions that present such risks.”

Although the lifted sanction appears to be good news for financial privacy software developers, it is too early to tell what this means for the Bitcoin and crypto industry in general, or whether it will have an effect on upcoming court cases like those against the Samurai Wallet developers.

“Digital assets present enormous opportunities for innovation and value creation for the American people,” said Secretary of the Treasury Scott Bessent. “Securing the digital asset industry from abuse by North Korea and other illicit actors is essential to establishing U.S. leadership and ensuring that the American people can benefit from financial innovation and inclusion.”

Source link

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Eric Trump Joins Metaplanet’s Board Of Advisers

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Coinbase Could Be Near Multi-Billion Dollar Deal for Deribit: Bloomberg

Tether eyes Big Four firm for its first full financial audit: Report

Why Current ‘Boredom Phase’ Could Trigger Epic Rally

US Treasury Removes Tornado Cash From OFAC Sanctions List

21,899 Bank Customers Affected As US Lender Suffers Cybersecurity Breach, Hacker Taps Social Security Numbers and Other Sensitive Information

Tether eyeing ‘Big Four’ firm for reserve audit: CEO

Solo Bitcoin Miner Hits the Jackpot, Scoring $266K Reward

Is Bitcoin Price Bottom In? Key Metrics Show rally Is Likely

SEC ‘Earnest’ About Finding Workable Crypto Policy, Commissioners Say at Roundtable

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x