Bitcoin

Over 50% of Americans sell gold or stocks to buy Bitcoin

Published

2 months agoon

By

admin

Most people who read about cryptocurrencies know that Bitcoin, due to its characteristics, is often referred to as ‘digital gold.’ A new study reveals that more and more people in the U.S. prefer Bitcoin to gold.

The GameFi platform ChainPlay conducted a joint survey with Storible. In their study, they asked 1,428 Americans about cryptocurrencies and investments in their lives.

According to the report, over 68% of Americans now own some crypto. 77% consider increasing their crypto investment in 2025. 60% of crypto investors believe the value of their assets will double in 2025.

The survey shows that 50% of crypto owners are boomers, while nearly 30% are millennials, and the rest are Gen Z. The report authors conclude that crypto owners get younger. However, it is not clear what digits were used as a reference point. The total lack of Gen X representatives in this report raises questions. Now that’s the real lost generation!

Unfortunately, the report doesn’t specify what the groups of respondents were and how ChainPlay and Storible chose who to survey.

According to other sources, only 13% of Americans owned crypto as of November 2024. It seems that the number heavily depends on the methodology.

New crypto investment stats

A survey revealed that Trump’s victory made a serious impact on people’s perception of cryptocurrencies, with 38% of respondents deciding to invest in crypto following the election outcome.

A huge amount of these people, 84%, are first-time buyers who decided to try fortunes in crypto after the win of the pro-crypto candidate.

Now, it’s time to talk more closely about the BTC investment insights found in the report. There are three main points. First, 51% of Americans allocate over 30% of their assets in meme coins. That’s an interesting statistic proving that a booming meme token market is no joke.

The second point notes that one-fifth of Americans allocate over 30% of their investment in crypto. And, finally, third–nearly 52% of responders admitted they were selling gold or stocks to invest in Bitcoin.

The latter revelation illustrates the tectonic shift in people’s minds. Over half of all respondents believe now that Bitcoin is here to stay, and it is safer and probably more profitable than gold or stocks.

The preference for Bitcoin over gold or stocks was still a marginal mindset during the 2017 bull run. Nowadays, when various governments across the globe announce they will mine or stock bitcoins or use it for international payments, people look at Bitcoin without prejudice.

On top of that, the stats mean that these people not only decided to buy some BTC, but they have made an additional step of dumping their traditional assets to invest in BTC first. According to the survey, over 51% of such people are in America. It shows the unprecedented bullishness of digital gold.

Bitcoin and gold

The “digital gold” name has its grounds, of course. Bitcoin bears certain similarities with gold. Both assets are scarce and deflationary. There will not be more gold or more Bitcoin in the future. The amount of both assets is finite and isn’t likely to increase. You have probably heard about the preset Bitcoin mining reward shrinks in two once every four years (so-called halving). The gold mining is decreasing too, however, the speed at which the gold mining drops is far behind Bitcoin’s increasing scarcity.

Experts speculate whether humanity reached the “gold peak” point (a moment after which gold mining will be constantly dropping). In the Bitcoin case, the Bitcoin peak was in the first years, and then, production has always gone down, making Bitcoin scarcer than gold. When gold mining drops by a couple of percent, Bitcoin may drop by 50%.

More than that, after every coin is mined, Bitcoin may be going to the moon, and the gold diggers may literally start mining gold on the moon, increasing the total supply available for the Earth’s markets. While gold gets increasingly scarce due to its use in devices, jewelry, and other products, bitcoins get lost or blocked forever. The speed at which bitcoins get stuck has been so high that in 16 years of Bitcoin’s existence, around 20% of all units are considered lost.

⚡️MARK CUBAN: “#Bitcoin – it became a store of value, it’s marketed that way and has been marketed for the last 15 years or whatever it is and it’s gotten to a point of acceptance just like gold.” pic.twitter.com/w3h2fjEnps

— Cointelegraph (@Cointelegraph) January 4, 2025

According to businessman and TV personality Mark Cuban, Bitcoin became a store of value and reached an acceptance level comparable to gold. Both he and MicroStrategy’s frontman Michael Saylor point out that in contrast to gold, Bitcoin is easy to transport and generally control.

Saylor once offered a thought experiment in which we should imagine trying to bring a substantial amount of gold or cash to the plane. The airport officers will treat owners as thieves. The same happens if we try to send a large amount of money abroad via a wire transfer. Saylor notes that, unlike traditional assets, Bitcoin provides owners with autonomy and control over their funds.

In another instance, Saylor noted that the gold era ended in the 16th century when other means of payment became more popular. However, Cuban’s estimation, in which he rather puts Bitcoin in line with gold, seems to be less maximalist as people still invest in gold while it’s obvious that it is Bitcoin, not gold, that is going through the blooming phase. The possible downside of Bitcoin is its higher volatility and shorter market history. However, as of 2025, its ups have always been more prominent than downs.

Source link

You may like

Memecoin Insider Creates Wolf of Wall Street-Inspired Coin Despite Potential Interpol Warrant: Report

Bitfarms stock dips despite $110m acquisition

Police Arrest Four Teens Over Amouranth Home Invasion, Attempted Bitcoin Theft

MUBARAK Coin Price Soars 22% Amid This Binance Announcement, What’s Next?

Michael Saylor’s MSTR Purchases 130 Additional BTC

Michael Saylor’s Strategy makes smallest Bitcoin purchase on record

Bitcoin

Michael Saylor’s MSTR Purchases 130 Additional BTC

Published

4 hours agoon

March 17, 2025By

admin

Strategy (MSTR) marginally added to its massive bitcoin (BTC) holdings, selling a modest amount of its preferred stock (STRK) to fund the acquisition.

The company last week purchased 130 bitcoin for roughly $10.7 million, or an average price of $82,981 each, according to a Monday morning filing. The so-called “BTC yield” is 6.9% year-to-date, according to Strategy.

Company holdings are now 499,226 bitcoin acquired for a total of $33.1 billion, or an average cost of $66,360 per token.

This latest purchase was funded by the sale of 123,000 shares of STRK, which generated about $10.7 million of net proceeds. Strategy last week announced a mammoth $21 billion at-the-market offering of that preferred stock.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Source link

Bitcoin

Bitcoin To $10 Million? Experts Predict Explosive Growth By 2035

Published

6 hours agoon

March 17, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a new publication titled The Mustard Seed, Joe Burnett—Director of Market Research at Unchained—outlines a thesis that envisions Bitcoin reaching $10 million per coin by 2035. This inaugural quarterly letter takes the long view, focusing on “time arbitrage” as it surveys where Bitcoin, technology, and human civilization could stand a decade from now.

Burnett’s argument revolves around two principal transformations that, he contends, are setting the stage for an unprecedented migration of global capital into Bitcoin: (1) the “Great Flow of Capital” into an asset with absolute scarcity, and (2) the “Acceleration of Deflationary Technology” as AI and robotics reshape entire industries.

A Long-Term Perspective On Bitcoin

Most economic commentary zooms in on the next earnings report or the immediate price volatility. In contrast, The Mustard Seed announces its mission clearly: “Unlike most financial commentary that fixates on the next quarter or next year, this letter takes the long view—identifying profound shifts before they become consensus.”

At the core of Burnett’s outlook is the observation that the global financial system—comprising roughly $900 trillion in total assets—faces ongoing risks of “dilution or devaluation.” Bonds, currencies, equities, gold, and real estate each have expansionary or inflationary components that erode their store-of-value function:

- Gold ($20 trillion): Mined at approximately 2% annually, increasing supply and slowly diluting its scarcity.

- Real Estate ($300 trillion): Expands at around 2.4% per year due to new development.

- Equities ($110 trillion): Company profits are constantly eroded by competition and market saturation, contributing to devaluation risk.

- Fixed Income & Fiat ($230 trillion): Structurally subject to inflation, which reduces purchasing power over time.

Burnett describes this phenomenon as capital “searching for a lower potential energy state,” likening the process to water cascading down a waterfall. In his view, all pre-Bitcoin asset classes were effectively “open bounties” for dilution or devaluation. Wealth managers could distribute capital among real estate, bonds, gold, or stocks, but each category carried a mechanism by which its real value could erode.

Related Reading

Enter Bitcoin, with its 21-million-coin hard cap. Burnett sees this digital asset as the first monetary instrument incapable of being diluted or devalued from within. Supply is fixed; demand, if it grows, can directly translate into price appreciation. He cites Michael Saylor’s “waterfall analogy”: “Capital naturally seeks the lowest potential energy state—just as water flows downhill. Before bitcoin, wealth had no true escape from dilution or devaluation. Wealth stored in every asset class acted as a market bounty, incentivizing dilution or devaluation.”

As soon as Bitcoin became widely recognized, says Burnett, the game changed for capital allocation. Much like discovering an untapped reservoir far below existing water basins, the global wealth supply found a new outlet—one that cannot be augmented or diluted.

To illustrate Bitcoin’s unique supply dynamics, The Mustard Seed draws a parallel with the halving cycle. In 2009, miners received 50 BTC per block—akin to Niagara Falls at full force. As of today, the reward dropped to 3.125 BTC, reminiscent of halving the Falls’ flow repeatedly until it is significantly reduced. In 2065, Bitcoin’s newly minted supply will be negligible compared to its total volume, mirroring a waterfall reduced to a trickle.

Though Burnett concedes that attempts to quantify Bitcoin’s global adoption rely on uncertain assumptions, he references two models: the Power Law Model which projects $1.8 million per BTC by 2035 and Michael Saylor’s Bitcoin model which suggests $2.1 million per BTC by 2035.

He counters that these projections might be “too conservative” because they often assume diminishing returns. In a world of accelerating technological adoption—and a growing realization of Bitcoin’s properties—price targets could overshoot these models significantly.

The Acceleration Of Deflationary Technology

A second major catalyst for Bitcoin’s upside potential, per The Mustard Seed, is the deflationary wave brought on by AI, automation, and robotics. These innovations rapidly increase productivity, lower costs, and make goods and services more abundant. By 2035, Burnett believes global costs in several key sectors could undergo dramatic reductions.

Adidas’ “Speedfactories” cut sneaker production from months to days. The scaling of 3D printing and AI-driven assembly lines could slash manufacturing costs by 10x. 3D-printed homes already go up 50x faster at far lower costs. Advanced supply-chain automation, combined with AI logistics, could make quality housing 10x cheaper. Autonomous ride-hailing can potentially reduce fares by 90% by removing labor costs and improving efficiency.

Burnett underscores that, under a fiat system, natural deflation is often “artificially suppressed.” Monetary policies—like persistent inflation and stimulus—inflate prices, masking technology’s real impact on lowering costs.

Bitcoin, on the other hand, would let deflation “run its course,” increasing purchasing power for holders as goods become more affordable. In his words: “A person holding 0.1 BTC today (~$10,000) could see its purchasing power increase 100x or more by 2035 as goods and services become exponentially cheaper.”

To illustrate how supply growth erodes a store of value over time, Burnett revisits gold’s performance since 1970. Gold’s nominal price from $36 per ounce to roughly $2,900 per ounce in 2025 appears substantial, but that price gain was continuously diluted by the annual 2% increase in gold’s overall supply. Over five decades, the global stock of gold almost tripled.

If gold’s supply had been static, its price would have hit $8,618 per ounce by 2025, according to Burnett’s calculations. This supply constraint would have bolstered gold’s scarcity, possibly pushing demand and price even higher than $8,618.

Related Reading

Bitcoin, by contrast, incorporates precisely the fixed supply condition that gold never had. Any new demand will not spur additional coin issuance and thus should drive the price upward more directly.

Burnett’s forecast for a $10 million Bitcoin by 2035 would imply a total market cap of $200 trillion. While that figure sounds colossal, he points out that it represents only about 11% of global wealth—assuming global wealth continues to expand at a ~7% annual rate. From this vantage point, allocating around 11% of the world’s assets into what The Mustard Seed calls “the best long-term store of value asset” might not be far-fetched. “Every past store of value has perpetually expanded in supply to meet demand. Bitcoin is the first that cannot.”

A key piece of the puzzle is the security budget for Bitcoin: miner revenue. By 2035, Bitcoin’s block subsidy will be down to 0.78125 BTC per block. At $10 million per coin, miners could earn $411 billion in aggregate revenue each year. Since miners sell the Bitcoin they earn to cover costs, the market would have to absorb $411 billion of newly mined BTC annually.

Burnett draws a parallel with the global wine market, which was valued at $385 billion in 2023 and is projected to reach $528 billion by 2030. If a “mundane” sector like wine can sustain that level of consumer demand, an industry securing the world’s leading digital store of value reaching similar scale, he argues, is well within reason.

Despite public perception that Bitcoin is becoming mainstream, Burnett highlights an underreported metric: “The number of people worldwide with $100,000 or more in bitcoin is only 400,000… that’s 0.005% of the global population—just 5 in 100,000 people.”

Meanwhile, studies might show around 39% of Americans have some level of “direct or indirect” Bitcoin exposure, but this figure includes any fractional ownership—such as holding shares of Bitcoin-related equities or ETFs through mutual funds and pension plans. Real, substantial adoption remains niche. “If Bitcoin is the best long-term savings technology, we would expect anyone with substantial savings to hold a substantial amount of bitcoin. Yet today, virtually no one does.”

Burnett emphasizes that the road to $10 million does not require Bitcoin to supplant all money worldwide—only to “absorb a meaningful percentage of global wealth.” The strategy for forward-looking investors, he contends, is simple but non-trivial: ignore short-term noise, focus on the multi-year horizon, and act before global awareness of Bitcoin’s properties becomes universal. “Those who can see past the short-term volatility and focus on the bigger picture will recognize bitcoin as the most asymmetric and overlooked bet in global markets.”

In other words, it is about “front-running the capital migration” while Bitcoin’s user base is still comparatively minuscule and the vast majority of traditional wealth remains in legacy assets.

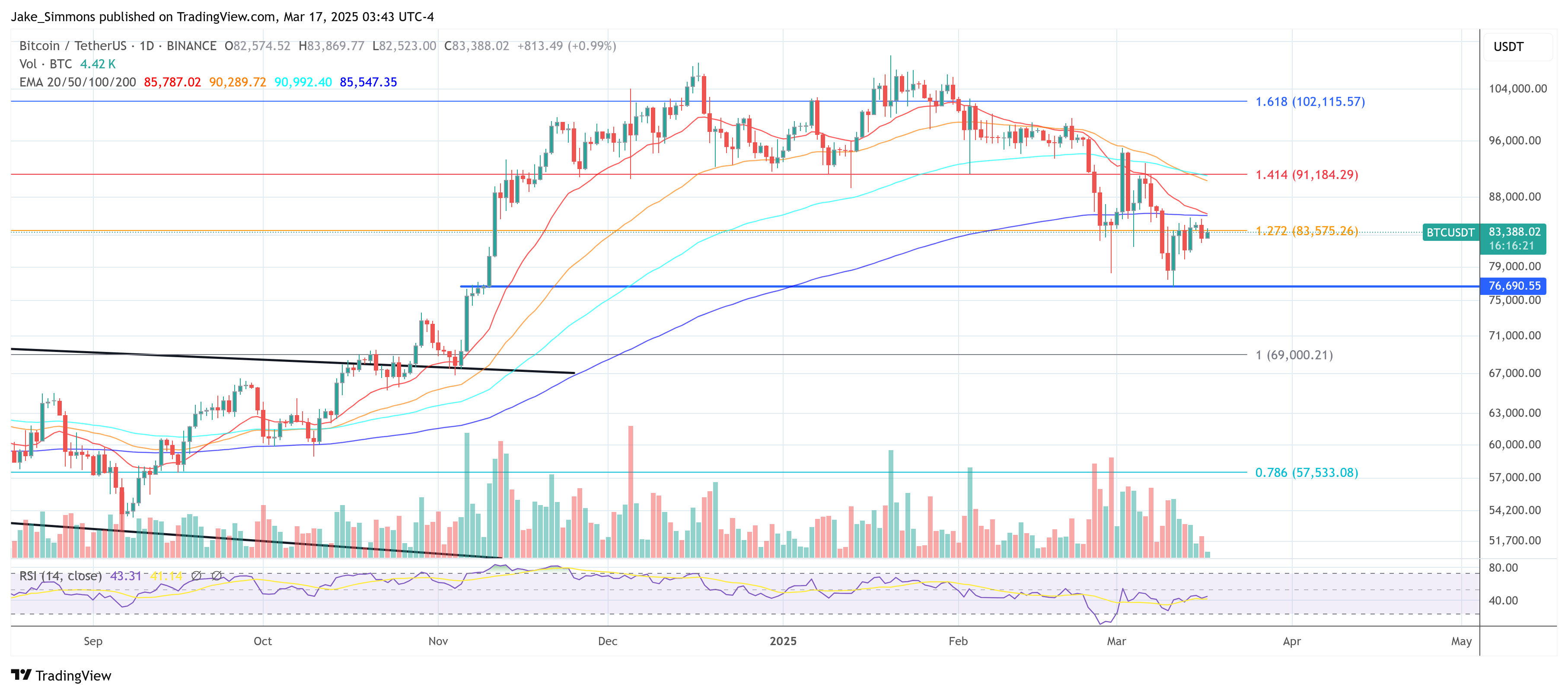

At press time, BTC traded at $83,388.

Featured image created with DALL.E, chart from TradingView.com

Source link

Bitcoin

Dormant whale sends 300 BTC to FalconX as Bitcoin nears $84k CME gap

Published

6 hours agoon

March 17, 2025By

admin

A whale that has been dormant for 1.5 years has deposited 300 BTC to crypto brokerage FalconX alongside 1,050 BTC to two other wallets.

According to data on SpotOnChain, an anonymous whale with $85.7 million in Bitcoin (BTC) holdings just sent 300 BTC through digital asset broker FalconX. At current market prices, the transaction is worth around $25.1 million in BTC.

In addition to FalconX, the whale also sent 1,050 BTC, equal to around $87.2 million, to two fairly new wallets. At press time, the address still holds around $12.55 million worth of Bitcoin, or equal to 150,000 BTC.

The last transaction recorded on-chain from the whale occurred on Aug. 18, 2023 when it received 1,500 BTC from market marker Cumberland at a price of $26,353, worth $39.5 million at the time. This means that the address has been dormant for nearly two years.

According to data from crypto.news, Bitcoin has gone down by 0.44%. BTC is currently trading hands at $83,613. Bitcoin has been on a turbulent path in the past month, going down by more than 14%.

In the past day, Bitcoin reached a peak price of $84,693 before falling further to a $82,061 low and maintaining its value at around $83,000. In fact, BTC’s dive to the $84,000 threshold fills the CME price gap, which sets the stage for another potential price climb.

A CME gap is the disparity between the closing price of Bitcoin on the Chicago Mercantile Exchange or CME and its opening price when trading resumes. It is often used as an indicator for corrections after a sharp drop in the market. The CME gap is often referred as a “magnet” for Bitcoin prices.

Bitcoin’s recent price drop filling the CME gap and the notable BTC whale movements could suggest increased market activity is on the horizon. Traders are already anticipating the next market moves that could very well influence Bitcoin’s price trajectory and overall market sentiment.

Source link

Memecoin Insider Creates Wolf of Wall Street-Inspired Coin Despite Potential Interpol Warrant: Report

Bitfarms stock dips despite $110m acquisition

Police Arrest Four Teens Over Amouranth Home Invasion, Attempted Bitcoin Theft

MUBARAK Coin Price Soars 22% Amid This Binance Announcement, What’s Next?

Michael Saylor’s MSTR Purchases 130 Additional BTC

Michael Saylor’s Strategy makes smallest Bitcoin purchase on record

Bitcoin To $10 Million? Experts Predict Explosive Growth By 2035

Dormant whale sends 300 BTC to FalconX as Bitcoin nears $84k CME gap

Bitcoin Flashing Bullish Reversal Signal Amid Waning Sell-Pressure, According to Crypto Strategist

Bitcoin Price Mirrors Gold’s 1970 Rally – A Six-Figure BTC Target of $250k Next?

OKX Pauses DEX Aggregator to Address Security Concerns

Trump’s second ex-wife calls for end of prosecution against Roger Ver

SEC Commissioner Hester Peirce on the New Crypto Task Force

Solana Hits 400B Transactions, Nearly $1T in 5 Years

640,000 Chainlink (LINK) Withdrawn From Exchanges In 24 Hours – Bullish Accumulation?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x