Bitcoin

Pakistan Plans To Legalise Bitcoin And Crypto

Published

22 hours agoon

By

admin

Pakistan unveils plans to legalise bitcoin and crypto and implement a regulatory framework to attract foreign investment and boost adoption.

Bilal Bin Saqib, CEO of the Pakistan Crypto Council, told Bloomberg on Thursday that Pakistan has unveiled plans to legalise bitcoin and crypto and implement a regulatory framework to attract foreign investment and boost adoption.

The government aims to devise clear regulations and align with international best practices. Pakistan’s Finance Minister formed the PCC last week to steer the country’s crypto strategy.

“Pakistan is done sitting on the sidelines” regarding bitcoin and crypto, Saqib told Bloomberg. “We want to attract international investment because Pakistan is a low-cost, high-growth market with 60% of the population under 30.”

Spoke to Bloomberg this morning

Our message is clear – Pakistan is done sitting on the sidelines! We want Pakistan as the leader in blockchain-powered finance. Pakistan is a low-cost high-growth market with 60% of the population under 30. We have a web3 native workforce ready… pic.twitter.com/VwhGGh7QWg

— Bilal bin Saqib MBE (@Bilalbinsaqib) March 20, 2025

“Trump is making crypto a national priority, and every country, including Pakistan, will have to follow suit,” he said.

This move comes amid a global shift in attitudes towards bitcoin and crypto after the United States pushed for greater mainstream acceptance. The new stance is a stark change for Pakistan, which had previously banned crypto. By embracing bitcoin and crypto early, Pakistan is looking to position itself as a regional leader and attract investors.

Pakistan’s central bank had expressed concerns earlier. However, the government now seeks to mitigate risks through prudent legislation. Clear rules could boost innovation and prevent potential abuse of decentralised networks.

Source link

You may like

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Tether eyes Big Four firm for its first full financial audit: Report

US Treasury Removes Tornado Cash From OFAC Sanctions List

21,899 Bank Customers Affected As US Lender Suffers Cybersecurity Breach, Hacker Taps Social Security Numbers and Other Sensitive Information

Tether eyeing ‘Big Four’ firm for reserve audit: CEO

24/7 Cryptocurrency News

Is Bitcoin Price Bottom In? Key Metrics Show rally Is Likely

Published

10 hours agoon

March 21, 2025By

admin

Bitcoin (BTC) price volatility is slowing down as the coin’s capitulation continues. At the time of writing, Bitcoin’s price was changing hands for $84,278.83 as it pared off the losses accrued in earlier trading. At this pace, the question now hinges on whether BTC can form sustainable support at the $84,000 price mark or whether further drawdown lies ahead.

Core Bitcoin Price Metric to Watch

According to Glassnode data, BTC Short-Term Holders (STH) are under increasing pressure. This group’s unrealized losses have surged, pushing many STH coins into losses. As revealed, their holdings are now nearing the two-standard deviation threshold.

Despite this outlook, the data platform hinted that losses remain within historical bull market bounds. Specifically, it noted that these losses are less severe than the May 2021 sell-off from the all-time high. Glassnode said the rolling 30-day losses for STH have topped $7 billion. It confirmed that “this remains well below prior capitulation events, such as the $19.8B and $20.7B losses in 2021-22.”

BTC price jumped to an ATH above $109,000 in January but has since dropped by 22.79%. While experts predicted a drop of over 35%, the limited loss from holders can form a good rebound basis.

BTC Price Bottom In, Here Are Triggers for Rally

Over the past week, Bitcoin has rallied within very tight price ranges, from a low of $81,300 to a high of $87,320. Some market observers believe the coin has attained its floor price and might be set for a rebound.

While firms like Strategy have kept Bitcoin purchase plans alive with Strife’s perpetual stock offering, the Global Money Supply M2 also lays a positive basis for growth. With the current outlook, the projection that the $83,00 level is the BTC price floor is resounding among analysts.

The shift in regulation and the backing of Bitcoin by President Donald Trump creates a tailwind for the coin’s proponents. At the Digital Asset Summit earlier this week, President Trump reiterated the plan to make the US the crypto capital of the world.

Several government agencies have shifted their policies in this regard, which might attract investors in the long term.

How High Can Bitcoin Valuation Rise?

Despite the slowdown in growth in recent weeks, many market leaders are still confident in the coin’s prospects. As reported earlier by CoinGape, Bitwise CIO Matt Hougan maintained the price target of $1 million by 2029. He cited a longer-term reaction to macroeconomic uncertainties as the basis for his prediction.

While this Bitcoin price prediction appears lofty, others believe Bitcoin may cross $200,000 once the bull rally returns. With spot Bitcoin ETF hype and other growing institutional adoption, BTC price has an arguably bright future.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Published

24 hours agoon

March 21, 2025By

admin

A widely followed analyst says Bitcoin (BTC) is showing signs of being on the verge of a massive breakout.

The analyst pseudonymously known as Credible Crypto tells his 462,900 followers on the social media platform X that Bitcoin may reclaim the $100,000 range if BTC can break through resistance around the $88,000 level.

“We’re at a key inflection point around this region, but since we went up to tag it BEFORE going down to range lows this is a good sign. It increases the odds that if we reject here but hold range lows [at around $78,000], the next move up will be expansion and a true breakout through not just this level but the original supply zone above in RED that we first rejected from. All eyes on this key zone for now.”

The analyst says Bitcoin’s dip to the $84,000 range after tagging $87,000 on Thursday keeps the flagship crypto asset on target to reclaim the $100,000 level.

“A perfect rejection so far.”

Bitcoin is trading for $84,427 at time of writing, down 1.5% in the last 24 hours.

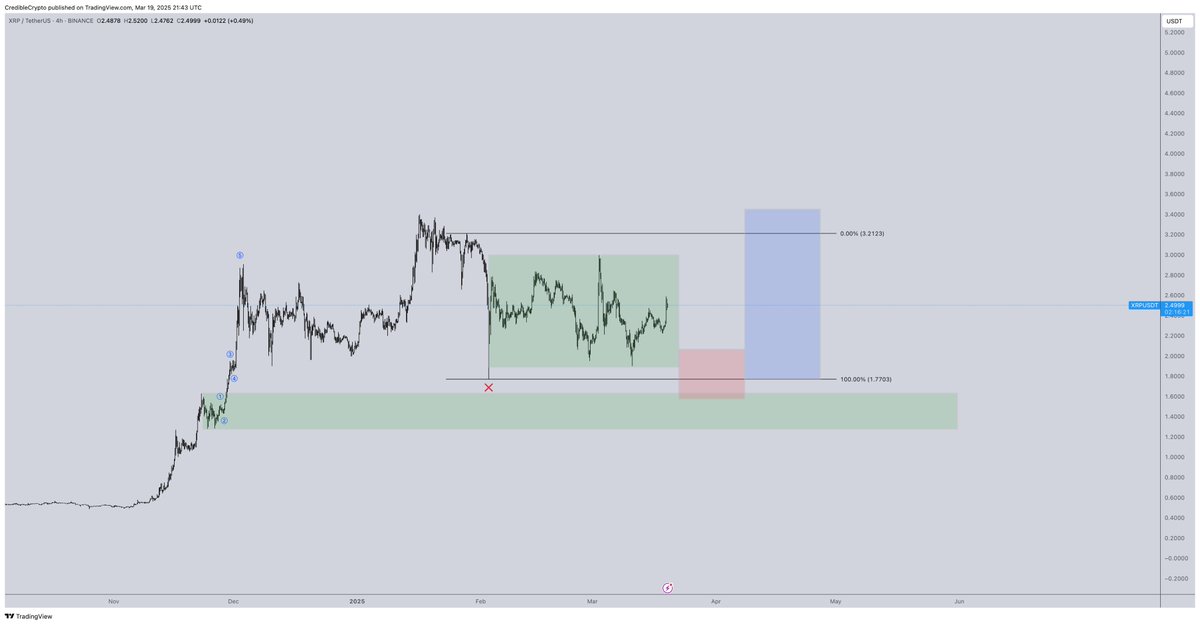

Next up, the analyst suggests payments token XRP may dip below $2.00 before rallying to its all-time high of about $3.40.

“This is still the game plan for XRP by the way. If we don’t get it, we don’t get it, and we ride spot to double digits regardless. But I’m not interested in jumping into fresh longs mid-range. Hoping people choose to fade this push so we get what would be a fantastic opportunity.”

XRP is trading for $2.45 at time of writing, down 1.7% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Top 6 Important Fed Decisions To Know After SEC Drops Ripple Lawsuit Appeal

Published

1 day agoon

March 21, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The crypto industry received a significant legal victory as Ripple CEO Brad Garlinghouse announced on March 19 that the U.S. Securities and Exchange Commission (SEC) had officially dropped its appeal against the company. The announcement came in a video posted on social media platform X, where Garlinghouse noted the regulatory agency’s decision to end its pursuit of further litigation.

Besides this interesting development, another major financial development has taken center stage in the crypto market in the past 24 hours; the outcome of the Federal Reserve’s latest meeting.

Fed Keeps Interest Rates Steady Amid Uncertainty

The outcome of the latest Fed meeting can be divided into six key decisions. First, the Federal Reserve opted to maintain interest rates at their current level, keeping the borrowing rate in a range between 4.25% and 4.5% for the second consecutive meeting. This decision is part of a continued pause in the Fed’s tightening cycle.

Related Reading

Secondly, the Fed noted that uncertainty surrounding the economy has increased, and third, the Fed’s updated projections were the shift in expectations for rate cuts in 2025. The median forecast suggests 50 basis points of cuts for the year, but a growing number of Fed officials are less convinced that rate reductions will be necessary. In December, only one official anticipated no rate cuts in 2025. However, there’s now a more divided outlook, and that number has now risen to four, as noted in a post on social media platform X by analysts at The Kobeissi Letter.

Beyond interest rates, the Fed revised its economic growth projections downward for 2025, suggesting that policymakers see slower expansion ahead. This adjustment comes alongside an increase in the Fed’s inflation forecast for the same period, reflecting concerns about price pressures persisting longer than previously anticipated. With inflation remaining a key focus, the central bank is treading carefully as it evaluates the right time to pivot toward a looser monetary stance.

Fourthly, the Fed announced that it would slow the pace of its balance sheet runoff beginning in April. This is alongside a sharp reduction in the Fed’s 2025 growth projections and a markup in their 2025 inflation forecast.

Implications For Crypto Markets And Digital Assets

For the crypto industry, the Fed’s decision to hold rates steady and its mixed messaging on future cuts introduce a dynamic situation to Bitcoin and others. The fact that the Fed is still concerned about inflation and economic uncertainty shows that the path to more accommodative policies regarding the crypto industry may not be as smooth.

Related Reading

However, if the Fed stays hesitant to cut rates and economic growth slows as projected, digital assets may face headwinds later in the year, which may slow down the predicted growth by crypto analysts.

Featured image from Unsplash, chart from Tradingview.com

Source link

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Coinbase Could Be Near Multi-Billion Dollar Deal for Deribit: Bloomberg

Tether eyes Big Four firm for its first full financial audit: Report

Why Current ‘Boredom Phase’ Could Trigger Epic Rally

US Treasury Removes Tornado Cash From OFAC Sanctions List

21,899 Bank Customers Affected As US Lender Suffers Cybersecurity Breach, Hacker Taps Social Security Numbers and Other Sensitive Information

Tether eyeing ‘Big Four’ firm for reserve audit: CEO

Solo Bitcoin Miner Hits the Jackpot, Scoring $266K Reward

Is Bitcoin Price Bottom In? Key Metrics Show rally Is Likely

SEC ‘Earnest’ About Finding Workable Crypto Policy, Commissioners Say at Roundtable

John Reed Stark opposes regulatory reform at SEC crypto roundtable

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

The FAIR Act Would Protect Bitcoin Holders

Russian National Set To Forfeit Nearly $23,000,000 After Agreeing To Plead Guilty to Crypto Market Manipulation

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: