Crypto exchange

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Published

3 months agoon

By

admin

HyperLiquid, a layer-1 blockchain and decentralized exchange for perpetual futures (perps), has experienced a notable outflow of the USDC stablecoin amid speculation North Korean hackers are interacting with the platform, according to a post on X by pseudonymous observer Tay, known for tracking threats posed by to crypto protocols by the country.

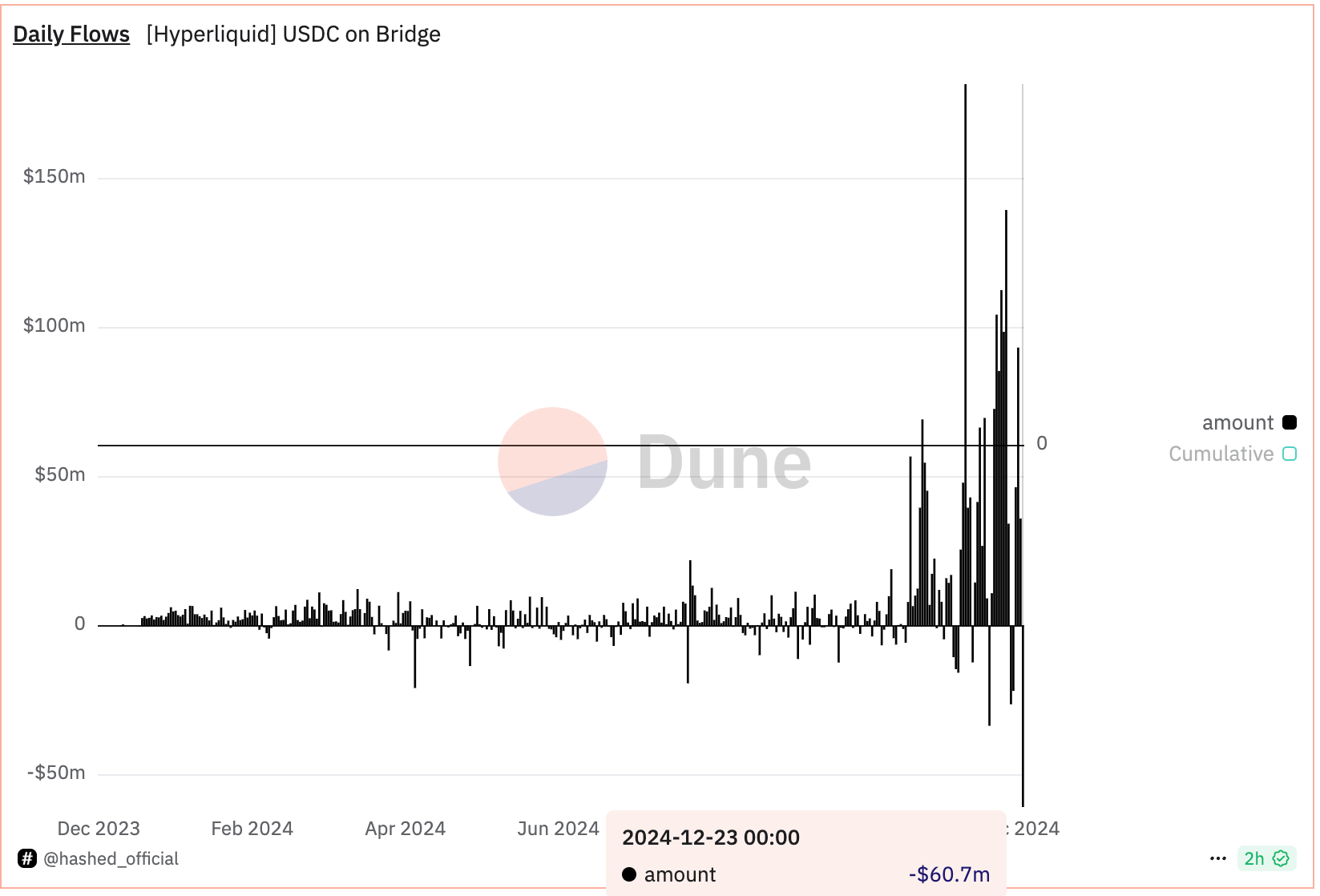

A record $60 million of USDC fled the exchange by 10:00 UTC Monday, according to Hashed Official’s Dune-based tracker. USDC, the world’s second-largest dollar-pegged stablecoin, is used as collateral on HyperLiquid. The deposit bridge still holds $2.2 billion in USDC.

Addresses associated with hackers from the Democratic People’s Republic of Korea (DPRK) have accrued losses exceeding $700,000 while trading on HyperLiquid, Tay said. The transactions indicate the hackers are potentially familiarizing themselves with the platform’s inner workings to launch a malicious attack.

“DPRK doesn’t trade. DPRK tests,” Tay said.

CoinDesk contacted HyperLiquid on X for comments on the USDC outflows and potential threat from North Korea.

Tay said they reached out to the platform two weeks ago, offering help in countering a potential threat.

“I really want to emphasize that these are the most sophisticated and rapidly evolving of all of the DPRK threat groups. They are very creative and persistent. They also get their hands on 0days (such as the one Chrome patched today,” Tay’s message to the platform said.

HyperLiquid is the leading on-chain perpetuals exchange, commanding over 50% of the total on-chain perpetuals trading volume, which tallied $8.6 billion in the past 24 hours.

The platform debuted its token HYPE on Nov. 29. Since then, it has

surged over 600% to $28.6, briefly topping $10 billion in market capitalization. As of writing, HYPE was the 22nd largest digital asset in the world, according to Coingecko.

Source link

You may like

This Week in Bitcoin: Volatility Rises as ETFs Rebound and SEC Gives OK to Mining

Will ETH ETF Net Outflow Exceed $20 Million?

Will new US SEC rules bring crypto companies onshore?

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Eric Trump Joins Metaplanet’s Board Of Advisers

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Binance

Binance Receives $2,000,000,000 Investment From Abu Dhabi Investment Firm MGX

Published

1 week agoon

March 12, 2025By

admin

The world’s largest crypto exchange platform by volume is receiving $2 billion worth of investments from a state-owned Emirate investment firm focused on technology and artificial intelligence (AI).

In a new thread on the social media platform X, Binance announces that it will be taking its first institutional investment on record – a staggering $2 billion worth of stablecoins from the wealth fund MGX, the single largest investment in a crypto firm ever.

“MGX, an Abu Dhabi sovereign wealth fund, invests $2 billion in Binance for a minority stake. The transaction will be 100% in crypto (stablecoins), marking it the largest investment transaction done in crypto to date. This is also the first institutional investment Binance has taken. Onwards… Build!”

In a recent press release, Binance notes that the investment was MGX’s first foray into digital assets and that the firm obtained a minority stake in the exchange “as part of a broader strategy to support blockchain’s transformative impact on society.”

The press release notes that Binance CEO Richard Teng used to be CEO of the Abu Dhabi Financial Services Authority, and “played a key role in initiating one of the world’s first crypto regulatory frameworks.”

In a post on the social media platform X, Binance co-founder Yi He said that Binance welcomes investments from sovereign wealth funds, but not financial investors.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

bybit

Bybit Ethereum (ETH) Reserves Steadily Recovering Following Massive Hack, According to CryptoQuant

Published

4 weeks agoon

February 24, 2025By

admin

Market intelligence platform CryptoQuant says that the Ethereum (ETH) reserves of Bybit are recuperating after the crypto exchange was hacked to the tune of $1.4 billion.

In a new thread on the social media platform X, Julio Moreno – CryptoQuant’s head of research – says that Bybit is seeing inflows worth over $390 million in ETH.

“Bybit’s ETH reserves are slowly recovering. The exchange has experienced positive net flows of 139,000 ETH since the hack.”

Previous reports indicate that the Singapore-based exchange suffered the biggest exploit in the digital assets industry when a bad actor took control of its ETH cold wallet, which stores keys offline.

According to recent data from the blockchain tracker Lookonchain, Bybit’s rapid recovery of ETH is being aided by other digital asset firms as well as crypto whales.

“Since being hacked, Bybit has received 145,879 ETH ($390 million) in loans and deposits. Whales withdrew 47,800 ETH ($127.56 million) from Binance to Bybit as loans.

Bitget transferred 40,000 ETH ($106 million) to Bybit as loans. Whale ‘0x3275’ transferred 20,000 ETH ($53.7 million) to Bybit as loans.

[The crypto exchange] MEXC transferred 12,652 stETH ($33.74 million) to Bybit as loans.

Whale ‘0xd7CF’” bought 15,427 ETH ($42.2 million) from CEXs (centralized exchanges) and DEXs (decentralized exchanges), then deposited it to Bybit.

A wallet suspected to be Fenbushi Capital deposited 10,000 ETH ($27 million) to Bybit.”

Furthermore, Lookonchain finds that Bybit itself purchased $197 million ETH via over-the-counter transactions.

Ethereum is trading for $2,808 at time of writing, a 1.5% increase during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

coinbase

Judge Refuses To Dismiss Coinbase Class Action Lawsuit, Says Exchange Must Face Complaint in New York: Report

Published

1 month agoon

February 9, 2025By

admin

A federal judge is reportedly ruling that top US-based crypto exchange Coinbase must face a class action lawsuit in New York.

According to a new report from Reuters, Paul Engelmayer, a judge for the Southern District of New York, is rejecting Coinbase’s argument that it did not qualify as a “statutory seller” to dismiss a lawsuit that alleges the firm illegally sold securities in the form of digital assets to customers without being registered as a broker-dealer.

Engelmayer says that Coinbase’s claim was invalid because it never passed title to the 79 crypto assets traded by customers, noting that “customers on Coinbase transact solely with Coinbase itself.”

In a statement, Coinbase says,

“Coinbase does not list, offer, or sell securities on its exchange. We look forward to vindicating the remaining claims in the district court.”

Engelmayer further rejected to dismiss claims governed by the laws of California, New Jersey and Florida, noting that the complainants have sufficient grounds to allege that Coinbase was the direct seller of the crypto assets.

In February of 2023, Engelmayer dropped the lawsuit but an appellate court reviewed the case and decided to return some parts of it to the judge.

In June 2023, Coinbase was sued by the U.S. Securities and Exchange Commission (SEC) for allegedly violating securities laws as well as operating as an unlicensed broker-dealer.

However, a year later, Coinbase filed its own lawsuit against the regulatory agency alongside the Federal Deposit Insurance Corporation (FDIC) claiming that they were out to intentionally cripple the digital assets industry.

As stated by Coinbase at the time,

“The SEC has waged a scorched-earth enforcement war on digital-asset firms that, in conjunction with efforts by other financial regulators to de-bank crypto firms, is designed to cripple the digital asset industry.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Yurchanka Siarhei

Source link

This Week in Bitcoin: Volatility Rises as ETFs Rebound and SEC Gives OK to Mining

Will ETH ETF Net Outflow Exceed $20 Million?

The SEC Resets Its Crypto Relationship

Will new US SEC rules bring crypto companies onshore?

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Eric Trump Joins Metaplanet’s Board Of Advisers

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Coinbase Could Be Near Multi-Billion Dollar Deal for Deribit: Bloomberg

Tether eyes Big Four firm for its first full financial audit: Report

Why Current ‘Boredom Phase’ Could Trigger Epic Rally

US Treasury Removes Tornado Cash From OFAC Sanctions List

21,899 Bank Customers Affected As US Lender Suffers Cybersecurity Breach, Hacker Taps Social Security Numbers and Other Sensitive Information

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x