cryptocurrency

PitchBook predicts $18 billion in crypto VC funding for 2025

Published

3 months agoon

By

admin

PitchBook analyst Robert Le expects crypto VC funding to be “much much stronger” in 2025 compared to 2024.

“We’re going to see $18 billion or more in venture capital dollars that’s going to be invested into crypto,” Le told CNBC’s Jordan Smith. That’s a 50% increase from 2024, but still less than the roughly $30 billion “that was invested in 2021 and 2022,” he added.

2023 and 2024 recap

Le described 2023 as a challenging year for crypto funding due to the collapse of FTX, erosion of trust, and higher interest rates.

However, 2024 started strong with positive momentum driven by spot Bitcoin exchange-traded funds, or ETFs getting approved.

Despite a slowdown mid-year, “we’re probably going to end [2024] at somewhere between $11 [billion] and $12 billion of invested capital, which is still 10 to 20% more than 2023,” he said.

2025 Funding Expectations

Le’s projection of $18 billion or more in crypto VC funding is a 50% increase compared to 2024. Several factors bode well for the sector, he says. They include:

- Generalist investors are regaining interest, signaling potential large-scale investments.

- Crypto-native funds have significant dry powder but require generalist participation for substantial growth.

- Financial institutions will play a pivotal role by leveraging their trusted relationships with regulators.

Shifting focus

Le anticipates a shift in focus toward application-layer investments, moving beyond infrastructure projects. Examples include:

- Decentralized applications (dApps) targeting non-crypto users with better risk management.

- Use cases leveraging crypto infrastructure for non-crypto sectors such as mobility and energy data.

The analogy of AWS serving as a base for companies like Uber and Airbnb highlights the need for robust applications atop crypto infrastructure to realize its full potential, Le argues.

The benefit of ‘nothing’

Le emphasized the importance of regulatory clarity for the crypto industry’s growth. He expressed cautious optimism about the U.S. regulatory environment in 2025, noting:

- A shift in SEC leadership under the incoming Trump administration could result in fewer enforcement actions.

- Legislative progress, such as stablecoin bills or crypto-specific rules, would be beneficial but is not guaranteed.

- Even a lack of new regulatory actions could be an improvement over the past two years of uncertainty.

Le concluded that a stable regulatory environment, coupled with growing institutional involvement and application-focused investments, could set the stage for significant advancements in the crypto sector in 2025.

But even if the next presidential administration and incoming lawmakers “do nothing,” Le says, “that is already an improvement.”

For the full interview, see below.

Source link

You may like

SUI Drops 5.1% as Index Trades Lower From Thursday

South Korea to block non-compliant crypto exchanges

Pakistan Plans To Legalise Bitcoin And Crypto

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Meteora shares two proposals on MET token allocation

Trump Aides Look To Reform USAID With Blockchain For ‘Transparency’: Report

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

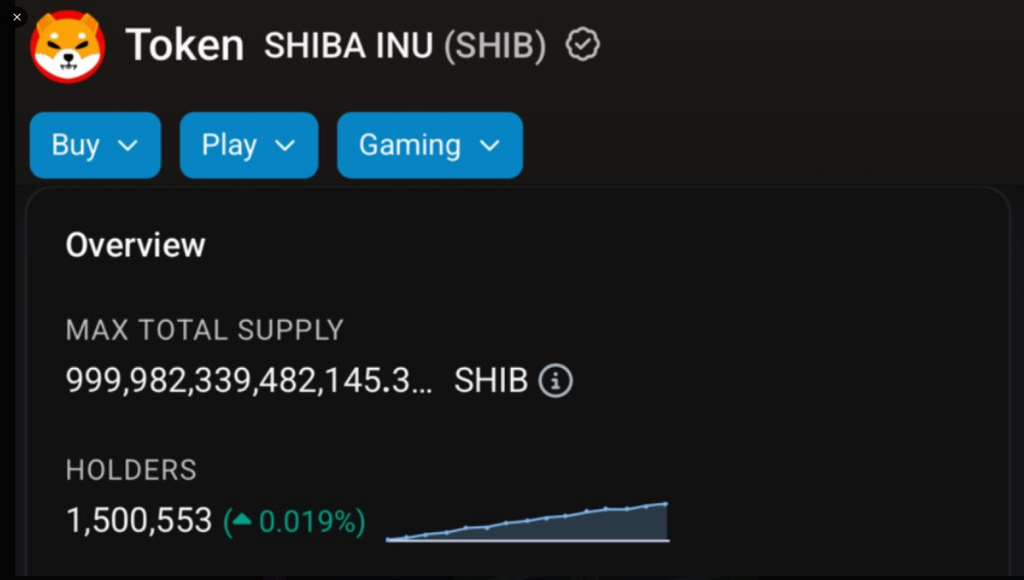

The ecosystem of a popular meme coin has attained two major milestones, showing the continued interest in the token that could lead to a bullish scenario. Analysts reported that Shiba Inu recently reached 1.5 million holders while its Shibarium recorded 10 million blocks, an indicator that the SHIB ecosystem could attract new users.

Related Reading

1.5 Million SHIB Holders

Crypto analysts revealed Shiba Inu successfully achieved a major milestone, offering a bright spot for the broader cryptocurrency market which has faced some challenges recently.

The project’s marketing lead, LUCIE noted that the meme coin hit 1.5 million holders on March 18, reaching such a milestone is an important achievement for any crypto.

As of writing, about 843 new holders have joined the Shiba Inu ecosystem, indicating that the token remained attractive to traders.

SHIB has reached 1.5 million on-chain holders!

pic.twitter.com/sKaAO57R6I

— 𝐋𝐔𝐂𝐈𝐄 (@LucieSHIB) March 18, 2025

Analysts believe that Shiba Inu’s milestone suggests continued interest in the meme coin, fueling the token’s significant growth. It also showed a bullish outlook on the meme coin.

Market observers said that the milestone might signify the unwavering belief of its community in the token.

10 Million Blocks For Shibarium

Meanwhile, Shiba Inu’s Ethereum Layer 2 network, Shibarium also recorded a win after surpassing 10 million blocks with an estimated 10,010,974 blocks as of press time.

Crypto analysts said that this achievement is proof of the network’s longevity and reliability, adding that it could entice more new users.

Market observers noted that the network has experienced exponential growth in total addresses in the last few weeks as it now tallies almost 175 million.

Shibarium’s growth is crucial in burning SHIB tokens and a major price control mechanism. Many investors are optimistic that diminishing supply and solid demand might send the token to surge. Shibarium played an essential role in burning around 713 million SHIB.

Unmoved By The Crypto Downturn

Many analysts say that milestones achieved by Shiba Inu and Shibarium offer a great deal of hope to investors, considering the ongoing downtrend in the cryptocurrency market.

For instance, Shiba Inu tanked by about 68% in the last four months, dipping from a high of $0.00003343 in December 2024 to a low of $0.00001082 in March 2025.

On the other hand, some analysts raised their concern about Shiba Inu underperforming the competition, noting that the token only increased by 98% following the US presidential election, while the Dogecoin skyrocketed by 200%.

Related Reading

Currently, Shiba Inu is traded at $0.00001288 per token, down by 0.2% in the past 24 hours with a total market cap of over $7.5 billion.

Featured image from Getty Images, chart from TradingView

Source link

Bitcoin

1 Million Bitcoin In New Whale Hands—A Mega BTC Rally On The Horizon?

Published

19 hours agoon

March 20, 2025By

admin

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

Source link

crypto wallet

Cardano wallet Lace adds Bitcoin support

Published

21 hours agoon

March 20, 2025By

admin

Lace, a web3 non-custodial wallet developed by Input Output, is now multichain, with initial support including Bitcoin.

Input Output, an infrastructure and web3 research platform founded in 2015 by Charles Hoskinson and Jeremy Wood, announced the development via a press release on Mar. 20. Hoskinson is the founder of Cardano (ADA), one of the top cryptocurrency and blockchain projects.

According to IO, the Lace wallet’s non-custodial solution is now officially multichain. The launch expands the wallet’s support beyond Cardano, with initial support for Bitcoin (BTC).

“The future of blockchain is multichain, and with Lace, we’re making sure users have everything they need in one powerful, easy-to-use wallet. Building on the foundations we have established with Cardano, we identified Bitcoin as the logical next step. And we’re just getting started,” Brandon Wolf, general manager at Lace, said.

Lace now allows its users to store, manage, and transfer BTC.

According to IO, the integration of BTC is a milestone that brings web3 closer to reality.

This is because the support does not only help accelerate adoption for Bitcoin—it also boosts the broader ecosystem. As the top blockchain network sees increased traction across decentralized finance and smart contracts, several layer-2 solutions built on top of it are gaining further adoption.

“Bitcoin was the starting point for many people’s Web3 journey, and now we are witnessing its next evolution with the rise of Bitcoin DeFi. With Bitcoin integration now live, Lace is creating a seamless, intuitive gateway to maximise the best of blockchain innovation” Hoskinson said.

The integration provides an “intuitive gateway” that will help maximize blockchain innovation and add to the growth of DeFi, the Cardano founder added.

Other than DeFi, Lace’s web3 traction includes non-fungible tokens and multi-chain asset management.

Bitcoin continues to attract attention for its potential, with zero-knowledge powered platform BitcoinOS among those to champion its integration with crypto.

The project’s open-sourcing of its BitSNARK v0.2 unlocks unlimited BTC programmability, the protocol’s team posted on X. BitcoinOS’ code allows anyone to verify ZK proofs on Bitcoin.

Source link

SUI Drops 5.1% as Index Trades Lower From Thursday

South Korea to block non-compliant crypto exchanges

1.5M Holders, 10M Blocks on Shibarium

Pakistan Plans To Legalise Bitcoin And Crypto

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Meteora shares two proposals on MET token allocation

Trump Aides Look To Reform USAID With Blockchain For ‘Transparency’: Report

Ethereum Price Eyes 50% Drop Amid Heavy ETH Whale Profit Booking

Polymarket is Over 90% Accurate in Predicting World Events: Research

Bad news Bitcoin bulls, the long-hoped-for retail is already here: CryptoQuant

Top 6 Important Fed Decisions To Know After SEC Drops Ripple Lawsuit Appeal

Leaders In Adoption And Innovation

Trader Issues Urgent XRP Alert, Says the Top-Five Altcoin at Risk of Sharp Correction – Here’s His Target

This coin could see a $10b market cap and double-digit price before SHIB gains its 2021 mojo

Can a Meme Coin Fund the Future of Scientific Research?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x