Canada

Polymarket Traders Bet on Canadian Tariff Cuts After Lutnick Hints at Negotiations

Published

2 months agoon

By

admin

There’s a 70% chance that the trade war between Canada and the U.S. will be over by May, according to odds on a Polymarket contract on the topic, as Commerce Secretary Howard Lutnick told Fox Business that U.S. President Donald Trump was open to negotiation.

On Tuesday morning, Canada and Mexico faced the implementation of 25% tariffs on all products entering the U.S., with President Trump citing their failure to curb fentanyl trafficking and illegal immigration as a national security threat.

But later in the day, Lutnick appeared to offer a potential avenue for negotiation, with odds rising 20% in a few hours on Polymarket.

I think [Trump is] going to work something out with them,” Lutnick said on Fox Business. “It’s not going to be a pause, none of that pause stuff, but I think he’s going to figure out: you do more, and I’ll meet you in the middle someway and we’re going to probably announce that tomorrow.”

Lutnick’s comments also appeared to calm crypto markets on ‘Turnaround Tuesday’ with bitcoin (BTC) up 1.5% and trading comfortably above $87,000, according to CoinDesk Indices data.

The CoinDesk 20 (CD20), a measure of the performance of the world’s largest digital assets, is up 2% on the news.

Source link

You may like

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

AI

Canada’s securities regulator flags rise in crypto scams amid ‘geopolitical unpredictability’

Published

3 days agoon

April 25, 2025By

admin

Crypto-related fraud is booming in Canada as scammers increasingly use AI tools to target investors, the Ontario Securities Commission says.

Canada‘s top securities watchdog is sounding the alarm on a wave of crypto scams, saying fraudsters are now using slick artificial intelligence deepfakes and fake trading platforms to fool investors and steal their money.

During the annual event on Thursday, Grant Vingoe, the chief executive officer of the Ontario Securities Commission, said the country is now in an environment “where there’s more scams, more fraud, more insider trading, more corruption, enabled by an atmosphere in which anything goes and the traditional norms are not being observed as they have in the past,” The Globe and Mail reports.

Vingoe linked the rise in fraud to wider instability as the “unpredictability of the geopolitical environment leads to an environment where people who are interested in doing wrong will find a place.” In 2024 alone, victims reported nearly $640 million in losses, per data from the Canadian Anti-Fraud Centre.

Now, Bonnie Lysyk, the OSC’s executive vice-president of enforcement, says the Commission wants to focus on “high-impact cases,” adding the the Commission wants to “put in place additional strategies to disrupt those who harm investors earlier” as the crypto space “is ripe for fraud.”

Canada began tightening crypto-related regulations in February 2023 when the Canadian Securities Administrators required all crypto trading platforms operating in the country to sign legally binding pre-registration undertakings. This came on top of existing restrictions, including the prohibition on offering margin trading to Canadian users.

Since the CSA considers some stablecoins to be securities or derivatives, exchanges were also prohibited from offering stablecoins or value-referenced crypto through contracts without prior approval, making it challenging for many crypto platforms to comply.

Source link

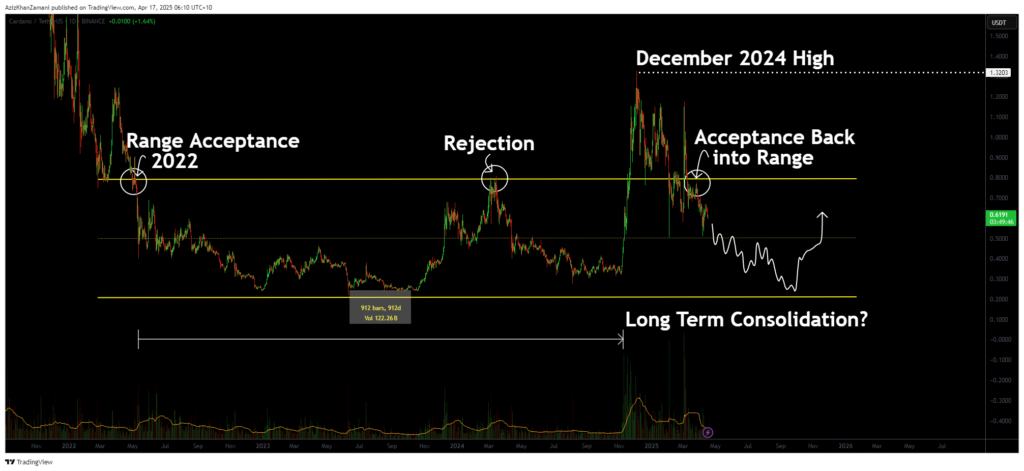

Cardano (ADA) has shown major structural developments as it re-enters a multi-year trading range. The recent price action suggests acceptance back within this long-term structure, with indicators pointing toward a potential move to the lower support region.

Cardano (ADA) has re-entered a significant trading range that has contained its price action for over three years. After a breakout in late 2024 that lacked volume strength, the asset has failed to sustain its highs and is now showing signs of weakness. For traders, this shift back into the range carries major implications for ADA’s medium- to long-term price trajectory.

Key points covered

- ADA has closed multiple candles back within a multi-year trading range, signaling true acceptance

- The 2024 breakout lacked volume confirmation, indicating a potential climactic top

- A move towards the lower support region is increasingly likely as ADA seeks true market value

After more than 912 days of trading within a well-defined range since 2022, ADA finally broke out in December 2024, setting a new high. However, this breakout lacked the critical component of follow-through volume. A sharp drop in volume immediately after the breakout signaled weakening momentum, suggesting a climactic top rather than a sustainable bullish trend.

Price action has since fallen back below the range high and closed multiple candles beneath it, a clear sign of acceptance back within the range. This is significant from a structural standpoint. Rather than consolidating above and building new support, ADA is now signaling a potential return to its value zone, likely toward the lower bound of the long-term range.

The volume profile reinforces this theory. The expansion to the December highs was not matched by sustained buyer interest. Instead, volume sharply tapered off, indicating that the breakout may have been speculative and not backed by conviction. In such cases, price often returns to equilibrium levels to reassess fair market value.

What to expect in the coming price action

With ADA now firmly back inside the long-term range, a slow grind toward the lower support region is increasingly probable. Traders should exercise patience, avoiding premature entries until there is either a confirmed trend reversal or a test of the lower boundary. The real opportunity may lie in ADA’s eventual consolidation and structure near the bottom of this historical range.

Source link

Canada

Kraken Secures Restricted Dealer Status in Canada Amid 'Turning Point' for Crypto in the Country

Published

4 weeks agoon

April 3, 2025By

admin

Crypto exchange Kraken has registered as a restricted dealer in Canada, allowing the exchange to continue offering crypto trading services to Canadian users under the country’s evolving regulatory framework.

The registration, announced on Tuesday, comes after a multi-year process that required exchanges to meet higher standards for investor protection and governance. Kraken said it worked closely with Canadian regulators during this pre-registration phase, upgrading its compliance systems and internal controls to meet expectations set by the Ontario Securities Commission (OSC).

To lead its Canadian expansion, Kraken named Cynthia Del Pozo as general manager for North America. Del Pozo, a fintech and operations veteran, will oversee strategy, regulatory engagement and business development across the region.

“Canada is at a turning point for crypto adoption,” said Del Pozo in a statement, pointing to growing interest from both retail and institutional investors. A recent survey cited by Kraken found that 30% of Canadian investors currently hold crypto assets.

Kraken also announced it will offer free Interac e-Transfer deposits for Canadian users, a move aimed at reducing friction for newcomers to the platform. The exchange claims it doubled its team and user base in Canada over the last two years and now manages over $2 billion CAD in client assets.

Mayur Gupta, Kraken’s chief marketing officer and general manager of growth, will be speaking at CoinDesk’s Consensus 2025 in Toronto on May 14-15.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Source link

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines