Politics

Pro-Bitcoin Donald Trump Becomes the 47th President of the United States

Published

6 months agoon

By

admin

Donald J. Trump has officially emerged victorious, claiming the presidency for a second time as the 47th President of the United States. With a critical victory in Pennsylvania and a decisive win in Wisconsin, Trump clinched the presidency by surpassing the 270 electoral votes needed to secure his return to the White House. These key battleground states, which were closely contested throughout the campaign, proved pivotal in pushing Trump over the threshold, solidifying his victory.

Trump’s final electoral tally reflects significant support across much of the Midwest and South, with additional wins in states such as Ohio and Florida reinforcing his lead. Vice President Kamala Harris, despite strong performances in traditional Democratic strongholds like California and New York, fell short as Pennsylvania and Wisconsin tipped in favor of Trump, marking the turning point in the race. Trump also garnered a majority of the popular vote, with over 51% (66.7 million votes), signaling a renewed mandate from voters who prioritized his economic policies and focus on deregulation.

A Milestone for Bitcoin in the White House

This election victory also marks the historic inauguration of the first openly pro-Bitcoin president in the United States. During his campaign, Trump included a stop at Bitcoin 2024 in Nashville where he embraced several key promises aimed at Bitcoiners and the broader crypto community, which distinguished him from previous candidates and resonated strongly with advocates of decentralized finance. His stance on Bitcoin showcased an alignment with the values of financial freedom and sovereignty that underpin the broader crypto community. By pledging to protect Bitcoin miners, explore the possibility of a Bitcoin Strategic Reserve, and even vow to commute the sentence of Ross Ulbricht, Trump attracted considerable support from the Bitcoin and crypto voter demographic.

Trump’s promises have not only inspired optimism among Bitcoiners but also highlighted a potential shift in the government’s approach to cryptocurrency. During his campaign, Trump criticized CBDCs as an encroachment on personal financial freedom, signaling his wariness of state-controlled digital currencies. This stance, which aligns with concerns in the Bitcoin community about financial privacy and state overreach, has helped position Trump as a potential ally in the fight against excessive financial control.

Promises to Bitcoiners and the Crypto Community

Among Trump’s most notable commitments to Bitcoiners are several promises that represent a radical departure from previous administrations’ approach to cryptocurrency:

- Support for Bitcoin Miners in America: Trump has pledged to protect the burgeoning Bitcoin mining industry within the United States. His commitment to deregulation and support for energy independence aligns with the interests of miners, many of whom rely on stable energy policies and a supportive regulatory environment. This focus could help secure the U.S.’s position as a global leader in Bitcoin mining, fostering economic growth and innovation in blockchain technology.

- Bitcoin Strategic Reserve: In a move that would be unprecedented for a sitting president, Trump’s campaign discussed the idea of establishing a Bitcoin Strategic Reserve. Such a reserve could provide a hedge against inflation and currency devaluation, aligning with Bitcoin’s core appeal as “digital gold.” By backing this initiative, Trump has shown an openness to treating Bitcoin as a legitimate asset within the national financial framework.

- Pardon for Ross Ulbricht: Trump’s promise to pardon Ross Ulbricht, the founder of Silk Road who is serving a double life sentence, struck a chord within the Bitcoin community. Ulbricht’s imprisonment has long been viewed by many Bitcoiners as a case of excessive punishment, and Trump’s willingness to revisit the issue has further cemented his image as a candidate who values justice reform and personal freedom.

- Opposition to Central Bank Digital Currencies (CBDCs): Trump’s campaign included strong opposition to the creation of a Federal Reserve-controlled CBDC, citing concerns about government overreach and loss of individual financial autonomy. Many in the Bitcoin community see CBDCs as antithetical to the principles of decentralized finance. Trump’s alignment with this viewpoint has bolstered his appeal among Bitcoiners who prioritize privacy and freedom from state-controlled monetary systems.

- Simplified Tax Code for Digital Assets: While not explicitly part of his campaign, Trump’s emphasis on simplifying tax codes has led many Bitcoiners to speculate that his administration could enact policies to make digital asset taxation less burdensome. By easing the tax reporting process for cryptocurrency holders, Trump’s administration could foster greater adoption and legal clarity for investors.

As Bitcoin adoption is on the rise, Trump’s presidency could mark a pivotal moment for Bitcoin in America. The growing alliance between Bitcoin’s ideals of decentralization and Trump’s policies on economic freedom suggest a promising road for Bitcoin under the next administration.

Source link

You may like

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

CBDC

Israel’s New Study Shows 51% Of Public Is Interested In Adopting CBDC (Digital Shekel) – Is That So?

Published

2 weeks agoon

April 13, 2025By

admin

On April 1st, at the KPMG offices in Tel Aviv, several dozen people gathered for a meeting of the “CBDC IL Forum” to hear representatives from academia, the Bank of Israel, and KPMG present findings from a study conducted by the Bank of Israel through “Roschink” research institute. The study included around 1,000 participants, and the results were published on the Bank of Israel’s website. In this article, I will review key points from the meeting, comment on the research published by the Bank of Israel, and share what I had said to attendees at the end of the forum meeting.

Study: The Israeli Public’s Willingness to Adopt a Digital Shekel

Dr. Nir Yaacobi from the Digital Shekel team at the Bank of Israel shared that participants in the study were randomly selected and represent all population segments. “The research institute works with these individuals, and they are paid for their participation,” he said. The amount paid was not disclosed. Prof. Ruth Plato-Shinar, one of the study’s authors, mentioned that the questionnaires were in a digital format. She noted that even people with very basic phones could participate, but acknowledged that those without any digital access likely did not participate and probably don’t understand what a digital shekel is.

Analysis of the study document reveals several methodological issues:

- Sampling method: An online panel was used, meaning participants were already enrolled in digital survey platforms—potentially biasing the sample toward tech-savvy individuals and skewing attitudes about a digital currency.

- Sample representation: The random sampling underrepresented certain groups, especially Arab citizens. Reweighting was used to correct this by doubling responses of some participants, potentially compromising authenticity.

- Risks such as loss of privacy, government overreach, and impact on cash economies may be underrepresented due to a bias toward digitally-inclined respondents.

- Participant dropout: 115 participants dropped out between the first and second questionnaires, which may indicate a selection bias—those more interested in the topic stayed on.

Despite efforts to ensure a representative sample, these methodological limitations may affect the study’s validity.

Avoiding Disclosure of Digital Shekel Risks

At the end of the meeting, I spoke critically about the partial and mainly positive information presented to study participants and the CBDC IL Forum attendees. The public wasn’t exposed to potential risks and limitations of such a system, which I’ve elaborated on in many of my keynote speeches, articles and podcasts.

The following video shows that the way the digital shekel was presented to study participants was lacking. The description of the digital shekel and its system focused on the advantages, as read by Prof. Plato-Shinar at the CBDC IL forum meeting:

In addition, the study does not comprehensively address potential risks for end users—such as the possibility of state control over financial behavior, loss of privacy, asset seizure, use of the currency as a surveillance tool, restricted access to funds due to regulatory decisions, and more. The lack of emphasis on these risks is especially problematic for individuals concerned about government overreach and privacy violations, but also for those who are simply unaware of the potential dangers and their implications.

The study does mention:

- Limited privacy claims: It is stated that “the central bank will not have access to identified information about balances and transactions in users’ wallets,” but also that privacy levels will be defined according to user type—which implies that privacy is not absolute.

- Enforcement capabilities and restrictions: “The system will support the implementation and enforcement of restrictions” on wallet balances, which could indicate the potential for usage limitations. The digital shekel is being designed with technical capabilities to impose limits on wallet balances—meaning it will be possible to define how much money a person is allowed to hold in their digital wallet and monitor that in real time. Although the document does not specify who would be authorized to enforce these limitations, the mere existence of enforcement capabilities indicates a control mechanism that could theoretically allow freezes, blocks, or other restrictions on usage—raising questions about financial freedom, privacy, and institutional power.

- Government control: The Bank of Israel will be “the sole authority empowered to issue and redeem the digital shekel,” meaning there will be no decentralized alternatives like cryptocurrencies such as Bitcoin.

Implications for Cash-Based Communities

The study does refer to the level of interest among different population groups and notes that among the ultra-Orthodox community, interest in the digital shekel is among the lowest. However, it does not explicitly discuss the consequences of transitioning to a digital currency for communities that rely heavily on cash. The digital shekel may pose a significant challenge to these groups if cash usage is eventually curtailed.

Possible reasons for low interest among the Haredi (ultra-Orthodox) community:

- Clear preference for cash: Most Haredim use cash due to privacy concerns, a desire to avoid dependence on banks, and some hold traditional opposition to modern financial systems.

- Digital literacy gaps: Financial digital literacy in parts of the ultra-Orthodox community is lower than the general population.

- Fear of regulatory control: Cash offers a degree of economic independence, whereas a digital shekel may increase government control over payments.

Senior Citizens

In 2023, the Israeli Internet Society conducted a survey among Israelis aged 65 and older. It found that approximately 30% do not use the internet at all, and “it can be said that at least some of them have not bridged the access gap.” This population segment (60+) comprises around 25.3% of Israel’s total population (data from 2020). This is another example of a group whose access to technology is limited—and therefore will likely also be limited in their ability to use a digital shekel.

Since the study was conducted digitally, that 30% segment of this population likely was not represented in the sample. That said, only 13% of the study participants were aged 60+ (13% in the first survey and 12% in the second), meaning people aged 60 and over were underrepresented in the sample—at about half their proportion in the general population.

This raises several concerns:

- Digital exclusion: A significant portion of those aged 65+ simply could not participate in the survey.

- Overestimated tech readiness: If only elderly people with digital skills participated, the study may overestimate interest among the elderly.

- Accessibility gaps: People who struggle with technology may also struggle to use the digital shekel—but their perspectives were not captured.

All of these factors may introduce bias that should be taken into account when interpreting the findings. To achieve a more accurate picture, the researchers could have incorporated other research methods (such as phone or in-person interviews) to reach those without digital access.

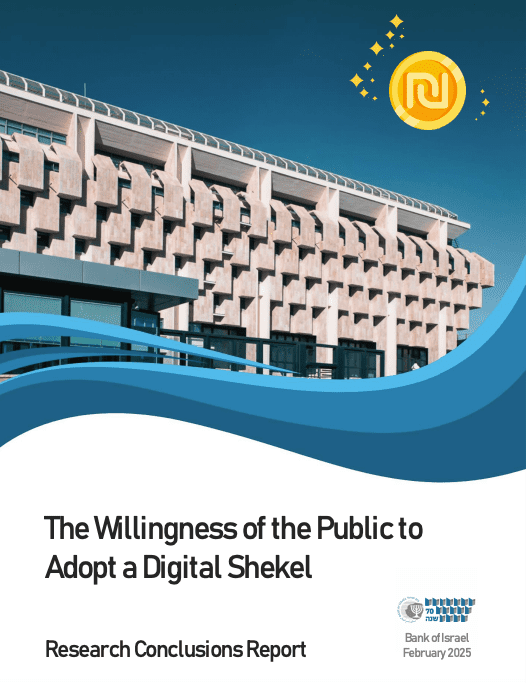

What’s New in the World of CBDCs

At the meeting, Ben Benakot of KPMG Israel presented developments in the CBDC space. He noted that most countries in the world are exploring CBDC solutions at various stages, and that 65 countries are in advanced research stages.

One case study he presented was Brazil, where the central bank launched the PIX retail payment system during the COVID-19 period. It saw rapid adoption. Today, Brazil’s central bank is working on DREX, a wholesale CBDC system, and has completed a collaboration with Meta to enable payments via WhatsApp using PIX.

Ben pointed out that no advanced Western countries have launched CBDC systems yet—likely one reason the Bank of Israel is not rushing to make a decision. The Bank of Israel has previously stated it is monitoring the EU central bank as a model.

Balancing the Narrative on the EU and China

In my closing statements at the CBDC IL forum meeting, I also referred to a study conducted recently in the EU with less than flattering results; This study was clearly not mentioned by any of the forum’s experts. I found it important to balance the overly positive narrative and bring the following to attendees’ attention:

On March 12, the European Central Bank (ECB) published a working paper titled “Consumer Attitudes Toward CBDC,” surveying approximately 19,000 respondents across 11 Eurozone countries. The report highlighted significant communication challenges that are expected to hinder adoption of the digital euro. It found that Europeans show little interest in a digital euro, strongly prefer existing payment methods, and see no real added value in a new payment system given the many alternatives.

Nevertheless, the European Central Bank recently announced that it will begin the rollout of the digital euro in October 2025, pending regulatory approvals.

Read more about the EU’s CBDC plans in my recent article, ECB Prepping the Ground for Digital Euro Launch.

Furthermore (at the CBDC IL meeting), I went on to explain that the high adoption rate of the CBDC in China is not necessarily a result of public enthusiasm, but rather of a top-down market strategy led by the central bank—a “If you can’t beat them, join them” approach. In the early years of the e-CNY (China’s CBDC), the project was considered a failure due to low adoption. Eventually, the central bank instructed major retail and tech companies to integrate e-CNY into their most popular apps (DiDi, Meituan, Ctrip, WeChat Pay, and Alipay)—a move that enabled wide adoption. Today, the e-CNY has about 180 million digital wallet users and a cumulative transaction volume of $1 trillion.

The Trust Factor

70% of Israel’s study participants expressed trust in the Bank of Israel. At the meeting, Ben Benakot of KPMG commented on the trust issue: “If we don’t trust the government, this becomes a problematic issue, because theoretically, CBDCs give the state more data.” Benakot noted that although the Bank of Israel is designing the system so that it won’t have direct access to user information—only authorized payment providers will—there’s no guarantee that a future government won’t change the system and gain direct access to accounts and personal data.

He also mentioned that today, for example, the Israeli tax authority already has the ability to monitor financial data on citizens (albeit not immediately or directly due to oversight). In theory, the digital shekel is not very different.

Public Awareness and Messaging

Another point I raised at the meeting was the Bank of Israel’s responsibility to inform the public in a fair, honest, and balanced way. I asked: if the Bank truly seeks to understand the public’s willingness to adopt the digital shekel—why hasn’t it launched a nationwide campaign like it did during Covid-19, when the government mobilized all its resources to educate the public through experts, influencers, media, social platforms, billboards, and more?

Why, unlike during Covid, isn’t the Bank of Israel making an effort to present the full picture—including the risks and downsides—not just the flattering, positive aspects?

As someone with about 20 years of experience in marketing, I also pointed out the haste with which the Bank moved from releasing the study and press announcement, to publishing a post the very next day (!) on social media (Instagram, Facebook) stating: “51% of the public wants a digital shekel.”

Every beginner marketer knows that when you highlight the yes, you obscure the no. Yes, there’s interest—but what about the other 49%?

The post read: “Most of the public sees the benefits: easy to use, convenient, and protected from fraud.” Most of the public? Based on a 1,000-person study where 51% expressed interest?

It also states: “No final decision has been made, but it seems the future is already here.” That sounds like the decision’s already been made—only the launch date is missing.

Conclusion

Dr. Nir Yaacobi from the Bank of Israel’s Digital Shekel team said at the meeting: “We’re entering uncharted territory, and we don’t currently have a strategy”—referring to which digital financial solution will be chosen in Israel.

“We’re working on three fronts: a digital shekel (CBDC), stablecoins, and tokenized commercial bank deposits.” He added: “Maybe we’ll go with one solution—like the digital shekel—or maybe all three. If we launch a wholesale CBDC, legislation likely won’t be needed. If it’s retail—yes.”

After I finished my remarks, Assaf David-Margalit from the Digital Shekel team responded and said that some of what I said was accurate—but most of it was not. When I asked what wasn’t accurate, I received no response. My invitation to Mr. David-Margalit to respond with specific clarifications remains open.

To conclude: I believe it is vital to raise public awareness around the digital shekel, because clearly “the future is already here.” For that reason, it is essential to openly present both the risks and benefits of a digital shekel system so that an informed public can participate meaningfully in the conversation and make relevant choices about their lives.

This is a guest post by Efrat Fenigson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

CFTC

Former CFTC Chairman Timothy Massad On Bitcoin And Digital Asset Privacy

Published

2 weeks agoon

April 11, 2025By

admin

While attending the MIT Bitcoin Expo this past weekend, I was afforded the opportunity to sit down with Timothy Massad, Research Fellow at the Kennedy School of Government at Harvard University and former Chairman of the U.S. Commodities and Futures Trading Commission (CFTC).

Massad served as the head of the CFTC from 2014 to 2017, and it was under his leadership that bitcoin was classified as a commodity.

In recent years, Massad has shared his thoughts on what regulation around bitcoin and digital assets should look like. He’s appeared on Bloomberg to discuss the matter, and he recently testified at the first Senate Banking Subcommittee hearing on Digital Assets.

Massad considers the need to balance user privacy when using public blockchains with the need for the U.S. government to monitor the networks for illicit activities as one the biggest challenges that regulators currently face — and he doesn’t claim to have the answer as to how this is best accomplished.

He explained that it’s important that people cannot see the balance of our funds or the entirety of our transaction history when we do something as trivial as paying for a cup of coffee with a digital asset.

In our conversation, he stated that the innovator who develops the technology that finds this balance will have found the “holy grail.”

You can watch the interview here:

Source link

Featured

Bitcoin Magazine, Bitcoin Policy Institute Launch “The Bitcoin Policy Hour” To Explore Global Finance, Policy And Monetary Trends

Published

3 weeks agoon

April 10, 2025By

admin

New Show Release – “The Bitcoin Policy Hour”

April 9, 2025 – Nashville, TN – Bitcoin Magazine, in collaboration with the Bitcoin Policy Institute (BPI), has officially launched a new weekly show titled The Bitcoin Policy Hour, a timely and incisive series focused on political economy, macroeconomic policy, and the evolving global financial order.

The weekly show features BPI Executive Director Matthew Pines, Head of Policy Zack Shapiro, and Growth Associate Zack Cohen. With decades of combined experience in national security, regulatory affairs, and economic research, this trio brings a fresh and rigorous perspective to Bitcoin’s role in shaping the future of finance.

“The Bitcoin Policy Hour” aims to provide viewers with context-rich, forward-looking discussions that cut through the noise. Each episode dives deep into major developments in geopolitics, economic policy, trade, inflation, and sovereign debt—analyzing how these forces are reshaping the monetary landscape and what that means for Bitcoin.

The premiere episode, titled “Wargaming the Mar-a-Lago Accord: Tariffs, Bitcoin and Stablecoins”, explores the strategic implications of U.S.–China trade tensions, the emerging risks (and tailwinds) to the dollar system, and the potential realignment of global capital flows. Viewers are taken inside a scenario planning framework that considers how tariffs, national debt, and monetary experimentation are accelerating interest in non-sovereign monetary alternatives.

This new collaboration underscores the shared mission of Bitcoin Magazine and BPI to elevate public understanding of monetary policy and foster informed debate about the future of money.

Episodes of The Bitcoin Policy Hour will air weekly across Bitcoin Magazine’s media platforms, including YouTube, X, Rumble and BitcoinMagazine.com, providing an essential briefing for investors, policymakers, and anyone tracking the shifting tides of the global economy.

Source link

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje