meme coin

Pump.fun dismisses token launch rumors on heels of lawsuit

Published

1 month agoon

By

admin

The co-founder of Pump.fun has denied circulating rumors about an upcoming token launch, urging users to disregard information not directly shared by the platform.

Co-founder Alon Cohen, who helped launch Pump.fun in January 2024, posted on X that his team remains focused on product improvements. They also remain committed to “rewarding users properly,” he said.

Cohen’s message emphasized the importance of patience, stating “good things take time,” while warning against unauthorized claims about the platform’s plans. This comes as the platform goes through increased attention from both traders and regulators.

seeing rumors about a potential pump fun token – these are wrong

would advise not to listen to anything that didn’t directly come from @pumpdotfun

while the pump fun team has mainly been focused on improving the product in its 1-year history, the team has always been committed…

— alon (@a1lon9) February 9, 2025

The statement contradicts earlier reports from crypto analyst Wu Blockchain, who reported Pump.fun was preparing to release a token through a Dutch auction model in collaboration with centralized exchanges.

Speculation about the token’s features included revenue sharing and exclusive platform access for holders.

Pump.fun has established itself as a prominent meme coin launchpad on the Solana (SOL) blockchain, allowing users to create and trade tokens quickly. However, the platform faces several legal challenges now.

On Jan. 16, Burwick Law and Wolf Popper LLP filed the first major lawsuit against the platform. The lawsuit alleged violations of U.S. securities laws through the facilitation of unregistered securities sales disguised as meme tokens.

The complaint specifically highlighted the case of the Peanut the Squirrel token, which allegedly experienced artificial price inflation through influencer promotions before a collapse.

The legal pressure intensified on Jan. 30, with a second lawsuit expanding allegations against Baton Corporation Ltd., Pump.fun’s operator, and key platform executives. These legal actions target what plaintiffs mentioned as coordinated price manipulation schemes harming retail investors.

The co-founder’s warning against unauthorized claims comes as the platform goes through this increased regulatory scrutiny.

Source link

You may like

Insider at Major US Bank Quietly Drains $180,000 From Two Customers’ Accounts, Alleges Department of Justice

Bitcoin ‘in position’ for first key RSI breakout in 6 months at $85K

Beyond Strategy: 11 More Publicly Traded Companies That Are Stockpiling Bitcoin

Crypto stocks mirror market-wide slump in Bitcoin, altcoins

Fidelity Files for OnChain U.S. Treasury Fund, Joining the Asset Tokenization Race

Analyst Predict XRP Price Could Hit $77 in This Bull Cycle

meme coin

Solana’s 5th birthday highlights explosive growth and trading activity: Mercuryo

Published

6 days agoon

March 18, 2025By

admin

As Solana celebrates its fifth anniversary, new data from global payments infrastructure platform Mercuryo reveals extreme levels of volatility in Tether trading on the Solana transport layer this year.

The sharp price movements reflect growing interest from crypto traders in Solana (SOL), which has become one of the most active blockchain networks by transaction volume.

Solana’s genesis block was created on March 16, 2020. Over the past five years, the network has processed more than 408 billion transactions and nearly $1 trillion in trading volume on decentralized exchanges, establishing itself as a dominant player in the layer-1 blockchain space.

Since its launch five years ago, Solana has become one of the top-performing layer-1 blockchains given its combination of high-speed with low-cost transactions. Solana’s ability to handle massive transaction volumes with minimal fees has made it a preferred network for traders seeking quick execution and high liquidity.

Extreme USDT volatility reflects market interest

According to data from Mercuryo, Tether USDT trading on Solana has seen increased volatility in early 2025 as traders respoisition their approach and strategy to capitalize on changing market trends. Mercuryo’s data highlights the following dramatic price swings:

- 100% surge (week of Jan 13)

- 63% drop (Jan 20)

- 129% recovery (Jan 27)

- 61% plunge (Feb 10)

- 137% spike (Feb 24)

“Solana captivates the interest of crypto traders across the globe,” said Greg Waisman, Co-founder and COO at Mercuryo. “As Solana celebrates its fifth birthday, our transaction data on Tether tokens on the Solana transport layer suggests an unparalleled level of trading activity amid an explosion of interest in trading opportunities on Solana that we’ve seen over the past 12 months.”

Memecoin frenzy fuels trading activity

A major driver behind the surge in Solana’s trading volume is the growing popularity of meme coins. Holders of Solana have been using the token to buy meme coins like dogwifhat (WIF) and Bonk (BONK).

Meanwhile, Pump.fun has generated over $540 million in revenue over the past year. Notably, Pump.fun’s trading volume has surpassed Ethereum over 24-hour periods on many occasions over the past year. This can be seen as a clear sign of Solana’s role in the meme coin space.

Source link

Bitcoin

Dogecoin’s Fate Hinges On $0.16—Breakout Or Breakdown Ahead?

Published

2 weeks agoon

March 10, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Dogecoin is at a critical point, with its price hovering around $0.16. Traders are watching closely, as this support level could be the deciding factor in whether the meme coin takes off or tumbles further. If history is any guide, maintaining this level could spark a rally, while losing it may bring more pain.

Related Reading

Dogecoin: Key Level To Watch

The $0.16 support level is not just a random number—it has been a crucial zone for Dogecoin. If it stays above this mark, there’s a strong chance of a rebound. Past price movements suggest that Dogecoin tends to climb after testing key supports.

Some analysts believe that holding this level could lead to a breakout toward the $0.20–$0.30 range in the near term.

Crypto analyst Ali Martinez has weighed in, stating that Dogecoin’s price is following an ascending parallel channel. He believes that if the $0.16 support holds, the meme coin could surge toward $2.74 or even as high as $6.24 in a strong bullish scenario.

However, a breakdown below this level could invalidate this outlook and send the price lower.

#Dogecoin $DOGE is nearing a crucial support level at the lower boundary of this channel. Holding above $0.16 could fuel a strong rebound! pic.twitter.com/foCUdbnTFZ

— Ali (@ali_charts) March 9, 2025

Traders Adjust Price Targets

The market mood is shifting. Some traders are setting their profit targets between $0.70 and $0.80, looking for another big move. Even with recent setbacks, many people still believe that Dogecoin will reach $1.

Even if this seems far-fetched, anyone who recalls Dogecoin’s meteoric climb in 2021 knows that when momentum builds, it may surprise.

Short-term traders, meanwhile, are exercising caution and holding off on making significant trades until they receive clear signs.

The course of the next few days may determine if Dogecoin continues to trend upward or remains in its present range.

History Hints At A Possible Rally

Dogecoin’s past performance shows a pattern of major price swings after testing strong support zones. After going up from key marks in 2017 and 2021, the coin made a lot of money.

If things keep going the way they are, some experts think Dogecoin could go over $1.75 in its next bull run.

Still, it’s never easy to tell how crypto will move. External factors, such as how the market feels, Bitcoin’s price movement, and broader economic trends, will also affect the meme coin’s price route.

Related Reading

Current Price Action

Currently selling at around $0.174, Dogecoin has dropped about 7% over the previous day. The low dropped to $0.16; the intraday high hit $0.1878. The meme crypto’s market capitalization now is almost $26.23 billion. Technical indicators suggest a possible rebound, but that depends on whether buyers step in at this critical level.

Featured image from Gemini Imagen, chart from TradingView

Source link

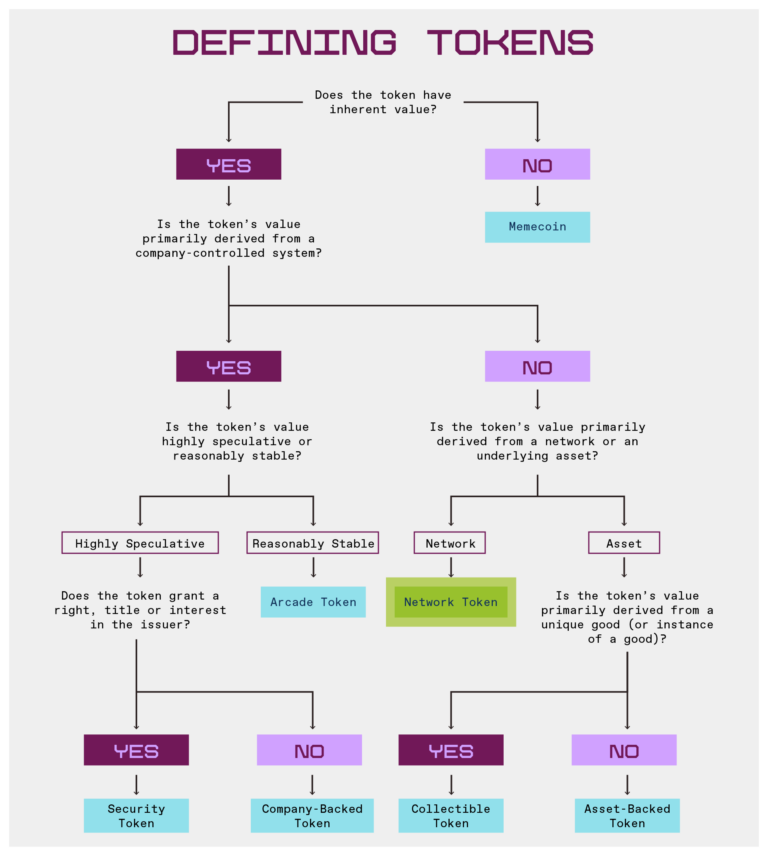

From network tokens to meme coins, a16z crypto has laid out a framework to help businesses navigate the evolving crypto landscape.

What is a cryptocurrency? According to Wikipedia’s definition, it is a digital currency designed to work through a computer network that is “not reliant on any central authority, such as a government or bank, to uphold or maintain it.”

And while at the very beginning in 2009 there was one and only cryptocurrency out there, called Bitcoin (BTC), things have changed significantly since then. Now, there over 12 million different tokens, per data from crypto price aggregator platforms. But how to differ them? There are memecoins, utility tokens, security tokens, and many more. No wonder crypto has become so complex.

“So, whether you’re building a blockchain-based project, investing in tokens, or simply using them as a consumer, it’s essential to know what to look for. It’s important not to confuse, for instance, memecoins with network tokens.”

a16z crypto

To help sort the crypto things out, Miles Jennings, Scott Duke Kominers, and Eddy Lazzarin from a16z crypto created a framework for understanding the seven categories of tokens they see entrepreneurs building with most often. Below is a breakdown of these categories.

Network tokens

Network tokens are used to keep a blockchain or smart contract protocol running. Basically, their value comes from how the network works. They usually have a clear purpose, like helping with network operations, forming consensus, upgrading the protocol, or rewarding certain actions within the network.

As a16z crypto explains, these networks, where the tokens live, usually have features like “programmatic buybacks, dividends, and other changes to the total token supply via token creation or burning to introduce inflationary and deflationary pressures in service of the network.”

Network tokens depend on trust. And in this aspect a16z crypto says these tokens “are similar to both commodities and securities.”

“Recognizing this, both the SEC’s 2019 Framework and FIT21 provided for network tokens to be excluded from U.S. securities laws when those trust dependencies are mitigated through decentralization of the underlying network.”

a16z crypto

These tokens are used to launch new networks, distribute ownership or control, and keep the network secure. The brightest examples are Bitcoin, Ethereum (ETH), Solana (SOL), Uniswap (UNI), and Dogecoin (DOGE).

Security tokens

While network tokens might seem like securities, security tokens are actually digital versions of traditional securities, like company shares or corporate bonds. They can also have special features, like giving profits interest in an LLC or rights to future settlement payments from lawsuits.

While securities give holders specific rights, titles, or interests, and the issuer often controls the asset’s risk, these tokens will still be under U.S. securities laws, as a16z crypto points out. Even though these tokens aren’t as common as network tokens or memecoins, they’ve still been used to raise money for business ventures.

For example, Etherfuse Stablebonds and Aspen Coin gave people fractional ownership in the St. Regis Aspen Resort.

Company-backed tokens

Company-backed tokens are tied to an off-chain application, product, or service run by a company or centralized organization.

Like network tokens, company-backed tokens may use blockchain and smart contracts (e.g., to facilitate payments). However, they primarily serve off-chain operations rather than network ownership. As a result, a company has more control over the issuance, utility, and value of the token.

Although these tokens don’t provide a defined right or title like traditional securities, they still have trust dependencies akin to securities.

“Their value is inherently dependent upon a system that is controlled by a person, company or management team.”

a16z crypto

For this exact reason, company-backed tokens could be subject to U.S. securities laws when they attract investment, the analysts warn. Historically, company-backed tokens have been used to circumvent securities laws in the U.S., acting as proxies for equity or profits interests in companies.

For instance, examples include (FTT), which was a profit interest in the notorious FTX exchange. Binance Coin (BNB) is another example of a company-backed token that transitioned into a network token after the launch of BNB Chain.

Arcade tokens

Arcade tokens are primarily used within a system and are not meant for investment, a16z crypto explains. These tokens often serve as currencies within virtual economies, like digital gold in a game, loyalty points for a membership program, or credits for digital products.

What makes arcade tokens unique is that they are designed to discourage speculation. They may have an uncapped supply — meaning an unlimited number can be minted — and/or limited transferability.

As a16z crypto points out, these tokens may even “expire or lose value if unused, or they may only have monetary value and utility within the system in which they are issued.” As a rule, arcade tokens don’t promise financial returns, which makes them relatively safe from U.S. securities laws.

Examples include FLY, the loyalty token for the Blackbird restaurant network, and Pocketful of Quarters, an in-game asset that received relief from the U.S. Securities and Exchange Commission in 2019.

Collectible tokens

One of the most well-known types of tokens are collectible ones. They can represent things like a work of art, a music piece, or even a concert ticket stub. But for the public, they’re more commonly known by a different name — NFTs, or non-fungible tokens. And while NFTs might seem like another speculative bubble, these tokens may actually have utility within specific contexts.

“A collectible token may function as a license or ticket to an event; could be used in a video game (like that sword); or could provide ownership rights with respect to intellectual property.”

a16z crypto

Because collectable tokens generally relate to finished goods and don’t rely on third-party efforts, they are usually excluded from U.S. securities laws, a16z crypto notes. The well-known NFTs are probably Bored Ape Yacht Club and CryptoPunks.

Asset-backed tokens

Asset-backed tokens get their value from a claim on underlying assets. For example, commodities, fiat currency, or even digital assets such as cryptocurrencies.

These tokens may be fully or partially collateralized, and they serve various purposes, such as acting as stores of value or hedging instruments. However, unlike collectable tokens, which derive value from the ownership of unique goods, asset-backed tokens function more like financial instruments. Per a16z crypto, the “regulatory treatment of asset-backed tokens, however, depends on their structure and use.”

Examples include fiat-backed stablecoins like Circle’s USD Coin (USDC), liquidity provider tokens like Compound’s C-tokens, or derivative tokens like OPYN’s Squeeth.

Memecoins

And then, we’ve got memecoins – probably the most well-known ones. These are like the peak of internet chaos. They don’t really do anything useful and are mostly all about memes or whatever community hype is going on. Their fundamentals? Forget it. It’s all about speculation and whatever the market feels like, which means they’re super easy to manipulate or get rug-pulled.

Because of how wild they are, memecoins are “generally excluded from U.S. securities laws,” as a16z crypto says, noting though that they’re still “subject to anti-fraud and market manipulation laws.” What makes them stand out? They’ve got zero purpose or real use, and their prices can swing like crazy, which makes them pretty much a no-go for investment. Some famous ones include Pepe (PEPE), Shiba Inu (SHIB), and the new Official Trump (TRUMP) memecoin linked to U.S. President Donald Trump.

Source link

Insider at Major US Bank Quietly Drains $180,000 From Two Customers’ Accounts, Alleges Department of Justice

Bitcoin ‘in position’ for first key RSI breakout in 6 months at $85K

Beyond Strategy: 11 More Publicly Traded Companies That Are Stockpiling Bitcoin

Crypto stocks mirror market-wide slump in Bitcoin, altcoins

Fidelity Files for OnChain U.S. Treasury Fund, Joining the Asset Tokenization Race

Analyst Predict XRP Price Could Hit $77 in This Bull Cycle

Jupiter Price Action Signals Breakdown—$0.41 Target In Play

Sonic unveils high-yield algorithmic stablecoin, reigniting Terra-Luna ‘PTSD’

Ethereum Altcoin Explodes 68% After Korea’s Second-Biggest Crypto Exchange Announces Trading Support

Time for XRP to hit new highs after SEC case over? IntelMarkets could rattle the market

Swedish Film ‘Watch the Skies’ Set for US Release With AI ‘Visual Dubbing’

US FOMC, XRP Lawsuit, & Pi Network In Spotlight

Now Is the Time to Rally to Web3 Gaming

Misleading crypto narratives continue, driven by ‘sensationalist’ sentiment

Analyst Predicts XRP To Surge To $9-$10 – Here’s Why

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x