Coins

Quarter of All Bitcoin Investors Underwater as BTC Price Lags: CrypoQuant

Published

3 weeks agoon

By

admin

Amid recent Bitcoin losses and volatility, more than a quarter—26%—of the Bitcoin supply is now “underwater,” meaning it is worth less than what it was purchased for.

This marks a stark reversal of fortunes for investors in recent months, according to data collected by market analysis tool CryptoQuant. On December 15, only 0.015% of the BTC supply was “underwater,” meaning only a very slim percentage of BTC held was without an unrealized gain for investors. As recently as January 18, the percentage of Bitcoin being held at a loss sat at just 1.46%.

But according to CryptoQuant’s data, this percentage has been slowly rising since Jan. 18, as macroeconomic concerns have impacted the prices of crypto assets. The Bitcoin price is currently sitting at $76,880.56 after having fallen 3.7% in the past 24 hours, while Ethereum is down 8.1% over the last 24 hours according to CoinGecko data, as U.S. President Donald Trump’s tariffs on Chinese goods came into play on Tuesday at midnight.

The last time such a significant proportion of the Bitcoin supply was in the red was September 6 last year, when the number hit just shy of 30%. Though at the time of writing Bitcoin is trading significantly higher than it was on September 6, when it traded at roughly $56,000, the number of “underwater” Bitcoin remains roughly comparable.

This could reflect the near-record level of inflows into BTC in late 2024 and early 2025, amid the crypto bull run accompanying the election of President Donald Trump, at historically high prices.

Though the number of Bitcoin “underwater” has appeared to broadly correlate with the BTC price over the past few years, it also reflects when speculators or investors choose to enter the market, and the price which they paid.

Institutional investors aren’t exactly piling in at current prices; $326.3 flowed out of Bitcoin ETFs yesterday, and flows have been negative for seven out of the past eight days, as per data from Farside Investors.

Investors have had it worse before

Though a big chunk of BTC investors are now in the red compared to just a few months ago, they are still faring comparatively well relative to some of the crypto world’s darkest hours.

In November 2022, around the time of the collapse of crypto exchange FTX , more than 56% of BTC investors were in the red.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Coins

Cathie Wood’s Ark Invest Makes Boldly Bullish Bitcoin Price Prediction

Published

2 days agoon

April 26, 2025By

admin

In brief

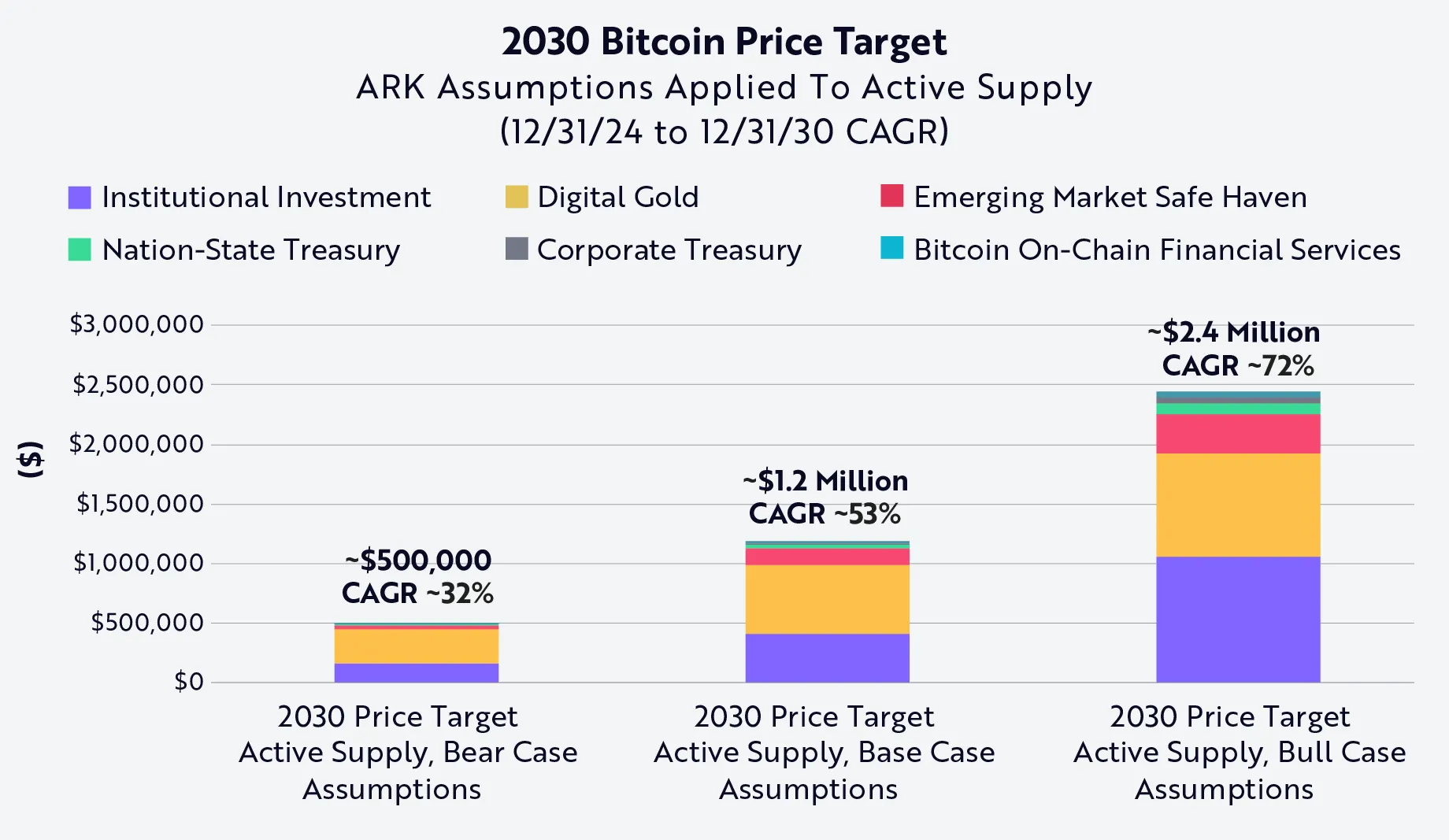

- Ark Invest predicts that Bitcoin could hit a price of as much as $2.4 million per coin by 2030.

- At worst, the firm predicts a bear case of around $500,000 in the next five years.

Prominent technology investor Cathie Wood’s Ark Invest released an updated Bitcoin price target, outlining a path for the top cryptocurrency to reach a price of as much as $2.4 million per coin by 2030.

Released on Thursday, the latest report levels up Ark’s previous price predictions from its annual Big Ideas report, which used total addressable markets (TAM) and penetration rate assumptions to determine a price prediction for Bitcoin.

Now, the firm combined its previous predictions with experimental modeling that considers Bitcoin’s “active” supply—which discounts lost or long-held coins.

“Bitcoin’s network liveliness has remained near ~60% since early 2018. In our view, that magnitude of liveliness suggests that ~40% of supply is ‘vaulted,’” the report reads. “On that basis, we arrive at the following price targets, which are roughly 40% higher than our base model, which does not account for Bitcoin active supply and network liveliness”

When accounting for active supply, Ark Invest predicts a bear case—or the most negative view—of around $500,000 per BTC. The bull case? A Bitcoin price of $2.4 million per coin.

Contributing to its potential growth, the report highlights the major inputs for its TAM and penetration rate data, which include its standing as a “digital gold,” institutional investment in spot ETFs, emerging market investors seeking a safe haven asset, and corporate treasuries continuing to diversify with Bitcoin.

Ark is not the only Bitcoin proponent to suggest a price appreciation above $1 million per coin. In September Strategy Chairman and co-founder Michael Saylor predicted the leading crypto asset would reach $13 million per coin over the next 21 years. In January, Coinbase CEO Brian Armstrong said he thinks it will reach the “multiple millions price range” as well.

Bitcoin topped $95,000 for the first time in two months earlier Friday, but still remains down from its all-time peak price of nearly $109,000 set in January.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Coins

ZKsync Hacker Accepts Bounty, Returns Nearly $5M in Stolen Crypto

Published

4 days agoon

April 24, 2025By

admin

In brief

- A Hacker has returned nearly $5 million to ZKsync after accepting a 10% bounty under a safe harbor deal.

- The funds were originally stolen by exploiting a compromised airdrop contract.

- The incident adds to $1.67B in crypto losses in Q1 2025, with Ethereum hit hardest.

A hacker who drained nearly $5 million from Ethereum scaling protocol ZKsync’s airdrop contract has returned the stolen funds within the project’s 72-hour deadline, closing the chapter on the recent exploit.

“We’re pleased to share that the hacker has cooperated and returned the funds within the safe harbor deadline,” ZKsync posted on X, formerly Twitter. “The case is now considered resolved.”

The recovered assets, consisting of over 44.6 million ZK tokens and nearly 1,800 ETH, are now under the custody of the ZKsync Security Council, which will determine the next steps via governance.

The deal follows an exploit that took place earlier this week, targeting a “compromised key” behind the ZK token airdrop contract, which allowed the attacker to mint new tokens and reroute unclaimed funds.

The attacker then transferred the funds across both Ethereum and ZKsync’s own Layer 2 network.

“All user funds are safe and have never been at risk,” ZKsync said in a Tuesday post. “The ZKsync protocol and ZK token contract remained secure.”

The protocol responded later by issuing an on-chain message offering the attacker a 10% bounty if 90% of the funds were returned within 72 hours.

If the offer was ignored, ZKsync warned the hacker that the case would be escalated to law enforcement to pursue a “full criminal investigation.”

The ZK token’s price briefly plunged to $0.04 after the exploit but has since stabilized near $0.05, down 2.6% over the last 24 hours, according to CoinGecko data.

Following the return of the stolen funds, ZKsync said that a final investigation report is in the works and will be published once complete.

Hackers abound

The incident is the latest in a string of attacks plaguing the crypto sector this year. According to blockchain security firm Immunefi, nearly $1.6 billion in crypto has already been stolen in the first two months of the year.

A separate report from blockchain security firm CertiK paints an equally concerning picture, noting that the first quarter of the year saw a loss of $1.67 billion due to hacks, scams, and exploits, already accounting for over two-thirds of all stolen funds in 2024.

Much of this total was driven by the catastrophic Bybit exploit, which alone resulted in $1.45 billion in losses and has raised industry-wide concerns about centralized exchange security practices.

Private key compromises continued to dominate as a critical threat vector, responsible for $142.3 million in losses across just 15 incidents.

Alarmingly, only 0.38% of stolen funds were recovered this quarter, down from over 42% in the previous quarter. In February alone, not a single dollar was returned, the report said.

Meanwhile, Ethereum remained the most targeted, suffering nearly $1.54 billion in theft across 98 incidents.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Coins

Trump Meme Coin Goes Parabolic as President Touts Dinner for Top Holders

Published

5 days agoon

April 23, 2025By

admin

President Trump’s official Solana meme coin, TRUMP, skyrocketed in value Wednesday after the project offered an exclusive dinner as a reward for top token holders.

TRUMP is up nearly 66% on the day, according to data from CoinGecko, rising from $9.30 to the current mark of $14.72 in less than an hour. It’s the highest price seen for Trump’s meme coin since early March.

Editor’s note: This story is breaking and will be updated with additional details.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines