AI

ReadyGamer announced as Virtual Protocol rides wave of investor confidence

Published

5 months agoon

By

admin

Virtual Protocol’s price surge highlights growing interest in decentralized gaming, as ReadyGamer promises to merge AI, blockchain, and autonomous worlds into the gaming landscape.

Having experienced a major pump in the last few days, Virtual Protocol (VIRTUAL) continues to garner attention, reflecting increased investor confidence in the token and its ecosystem. The introduction of ReadyGamer, a joint venture with Sovrun that intends to incorporate AI, blockchain, and autonomous worlds into Web3 gaming, further underscores the growing market interest in VIRTUAL.

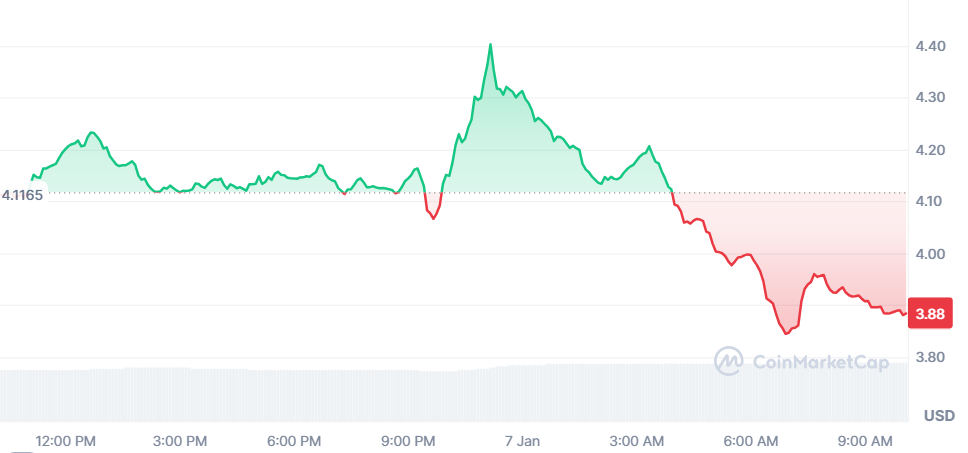

VIRTUAL has increased by 5.55% over the last day, and it is now trading at $3.88. Its 24-hour trading volume has reached $408.28 million, and its market capitalization has increased to almost $3.88 billion. This upward trend predates the ReadyGamer announcement, driven by rising expectations of Virtual Protocol’s ability to transform digital interactions and gaming ecosystems.

The ReadyGamer project seeks to provide a cutting-edge gaming platform by leveraging Virtual Protocol’s GAME architecture. The initiative combines dynamic AI systems, blockchain-secured transactions, and autonomous virtual environments to empower gamers with greater control and participation. Sovrun, with its expertise in decentralized systems, complements Virtual Protocol’s technology, positioning the two companies to tap into the growing demand for player-driven and immersive ecosystems.

Sovrun, formerly BreederDAO, brings deep expertise in blockchain gaming and on-chain ecosystems. The company specializes in fostering virtual economies and enabling players and creators to build autonomous worlds. Its collaboration with Virtual Protocol strengthens the foundation for innovation in decentralized gaming.

While VIRTUAL‘s price spike has captured attention, industry experts suggest ReadyGamer’s long-term potential could overshadow the current market momentum which is yet to be seen.

Source link

You may like

Ethereum Price Headed For Crash To $2,000 With Current Price Action

Tokenized funds hit $5.7B, scaling fast — Moody’s

Authorities Warn of Phony Text Messages Phishing for Sensitive Information, Telling Victims Their Bank Account Is at Risk

Tether invests in Chilean crypto exchange Orionx

MARA Hits Record-High Bitcoin Production in May

Retail investors no longer FOMO into BTC, altcoins

Worldcoin and Hyperliquid rank among the top two cryptocurrencies by weekly gains. CoinGecko data shows that WLD and HYPE gained nearly 35% in the past week. The two tokens could extend their price rally next week.

Worldcoin (WLD) has rallied for seven consecutive weeks, seen in the WLD/USDT weekly price chart. In the last 24 hours, WLD gained nearly 2% and nearly 35% in the last seven days. Worldcoin’s rally is likely driven by a series of announcements from the Sam Altman-led AI firm regarding the project’s expansion plans.

Hyperliquid (HYPE) added 7% to its value on the day, up nearly 35% in the last seven days. The project’s recent gains are attributed to HYPE accumulation and demand from crypto elites like Arthur Hayes, former BitMEX CEO and co-founder of Maelstrom.

Worldcoin and Hyperliquid price forecast

Worldcoin posted seven consecutive weeks of gains, and the rally continued this week. WLD price could extend its rally according to technical indicators on the weekly timeframe. A 32% increase could push WLD to test psychologically important resistance at $2.

RSI reads 51, crossing above the neutral level at 50 and MACD flashes consecutively green histogram bars, signaling a positive underlying momentum in WLD price trend.

In the event of a flashcrash or market-wide correction, WLD could slip to support at $0.914.

The daily price chart supports a similar thesis with WLD targeting resistance at $1.641, the lower boundary of an FVG. This marks nearly 8% climb for WLD from the current price level of $1.538.

The $0.835 support is key to WLD as the AI token continues its upward trend. RSI has crossed above 70, into the “overbought” zone and MACD signals positive underlying momentum in WLD price trend.

WLD faces resistance at $2, marked as R2 on the WLD/USDT daily price chart.

HYPE is 13% away from its closest resistance, at R1, marked by $40 on the daily timeframe. HYPE started its upward trend on April 7, 2025. The token could find support at $32 in the event of a correction.

Momentum indicators on the daily timeframe support further gains in HYPE, RSI climbed towards 83 and is sloping upwards. MACD is flashing green histogram bars above the neutral line, signaling the underlying positive momentum in HYPE price trend.

The 2024 peak of $42.252 is a key target for HYPE, it comes into play once the token flips resistance at $40 into support.

WLD and HYPE on-chain analysis

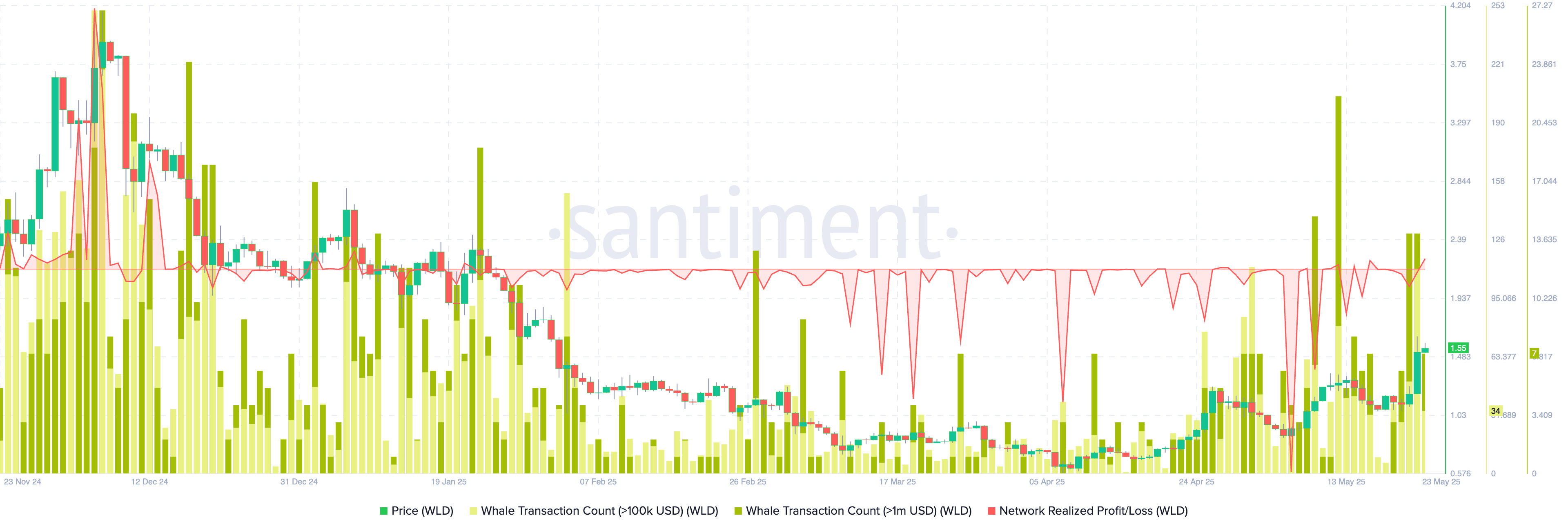

Worldcoin’s on-chain indicators support a bullish thesis for WLD in the coming weeks. Network realized profit and loss, a metric that identifies the net profit/loss of all tokens moved on a given day shows consistent loss realization from traders throughout the first part of 2025.

NPL shows likely capitulation in WLD, typically followed by an increase in a token’s price. The whale transaction count in two segments, valued at $100,000 and $1 million and higher shows spikes this week.

Large wallet investors moved their WLD tokens realizing gains on their holdings, in a relatively small volume compared to the count of traders taking losses in the past few weeks. This shows selling pressure on WLD is relatively low and there is scope for price gain next week.

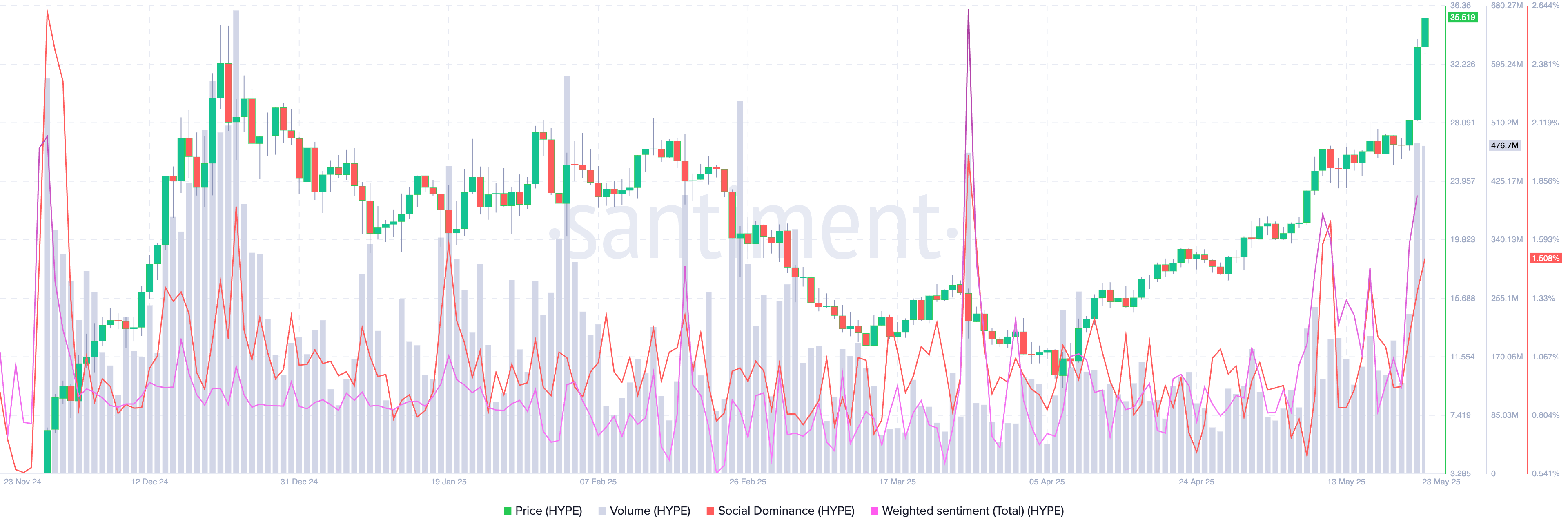

Hyperliquid’s on-chain metrics show a spike in trade volume, weighted sentiment and social dominance alongside the rally. HYPE price rallied this week, driving up the share of HYPE’s mentions across social media platforms and weighted sentiment turned increasingly positive.

While a spike is noted in social dominance and weighted sentiment, it remains relatively low when compared to the large positive spike observed in March 2025. This was followed by a correction in HYPE and the token started its upward trend in the second week of April 2025.

Derivatives traders bullish on HYPE rally, WLD hype fades

Derivatives data from Coinglass shows that long/short ratio exceeds 1 for HYPE. This implies traders are bullish on gain in HYPE price, and short positions dominate liquidations in the 24 hour timeframe.

The total liquidations for the last 24 hours are $940,000, a majority of short positions paid for longs, according to Coinglass data.

The futures open interest chart for HYPE shows that OI is at its highest level since December 2024. OI has climbed to $1.16 billion, during the ongoing price rally and this marks the total value of open derivatives contracts in HYPE.

Worldcoin derivatives data analysis shows nearly 50% increase in OI in the last 24 hours. Similar to HYPE, short liquidations exceed long and the total volume of liquidations stands above $7 million.

The long/short ratio is under 1 and shows derivatives traders may not be as bullish on WLD price gain and sidelined buyers should exercise caution when opening a trade in the AI token.

Catalysts driving gains in WLD and HYPE

For WLD, one of the largest catalysts is the announcement of Worldcoin’s expansion and the direct token sale to a16z and Bain Capital Crypto. News of a direct purchase of $135 million in WLD has fueled a bullish sentiment among traders.

Through its official account, the Worldcoin team said that the investment was a direct purchase of non-discounted tokens, by two of the “earliest backers” of the project.

The funding comes from two of World’s earliest backers and long-term holders — a16z and Bain Capital Crypto.

This wasn’t a venture round. It was a direct purchase of non-discounted liquid tokens.The circulating supply of WLD has thus increased correspondingly.…

— World (@worldcoin) May 21, 2025

Hyperliquid has made several announcements about bridges built to transfer tokens to the HYPE ecosystem, new listings and partnerships. However, a recent tweet from Maelstrom co-founder Arthur Hayes has supported the social media mentions of HYPE.

Early on Friday, Messari Crypto reported that a Hyperliquid short-seller got liquidated for $23 million as the token posted nearly 90% gains.

Tether and its partner Plasma Foundation power zero-fee stablecoin transfers and the initiative was extended to the Hyperliquid exchange, adding to the list of catalysts.

The on-chain perpetual exchange’s new listings, partnerships and the arrival of zero-fee stablecoin transfers in its ecosystem are currently the largest catalysts driving gains in HYPE token.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Trading in the financial markets has evolved and come a long way. And now with AI into the picture, quicker judgments, smarter trading actions, and a better handle on market turbulence, are being promised by many providers offering AI for crypto predictions.

It sounds like the future. Algorithms monitor emotion, examine charts, and respond instantly. It is claimed that machine learning can identify trends before they become popular. Crypto, however, is not a script. No matter how sophisticated the model is, it cannot predict everything, particularly when human complexity is involved.

In an effort to address the crucial question of whether AI can accurately forecast market movements ahead of time, this article discusses into the core question of whether one can use AI for crypto forecasts, and also use AI for crypto market trends in advance. Let’s dive right into it.

Can AI predict crypto prices?

Algorithms and machine learning can be used by AI to automate cryptocurrency trading buy and sell decisions. Without human assistance, these computers are able to apply predictive models, examine historical data, and track current market patterns. The objective is to conduct trades using statistical probabilities and eliminate human emotion.

Large datasets from a variety of sources, including sentiment analysis, social media, blockchain activity, and historical price charts, can be analyzed by AI algorithms. These models learn to identify trends and modify their tactics to forecast future price movements through supervised or reinforcement learning.

Here’s how they work:

- Before searching online, AI models are frequently tested on historical data to see how well they perform in various scenarios.

- AI systems can manage strategy and execute trades without human input, responding to changes in a matter of seconds.

- To decipher headlines or tweets that could influence market activity, some people employ natural language processing, or NLP.

- Handles risk quickly: AI is faster and more accurate than humans at estimating possible losses and evaluating volatility.

- Depending on the objectives and architecture of the model, it supports a variety of tactics, including mean reversion, momentum trading, arbitrage, and high-frequency trading.

While there’s no ‘best’ AI to predict cryptocurrency movements in advance, there are some tools that hit the mark more often than miss. We will discuss the most popular ones among the common crypto investors and specifically free AI for crypto predictions.

ChatGPT

OpenAI’s ChatGPT AI model is utilized for market analysis, sentiment monitoring, and research in cryptocurrency trading. It is used by traders to create trading strategies, forecast trends, assess news, and automate technical analysis bots.

ChatGPT and other AI algorithms are able to identify data trends that frequently result in price adjustments. Crypto is still uncertain, though, because it depends on a lot of human elements.

ChatGPT crypto predictions can be right and wrong at the same time as crypto trading is subjective, and the AI algorithm might not be able to predict global events that can significantly affect the price of cryptocurrencies.

DeepSeek

Originating in China, DeepSeek is a rising star in the field of AI research and language models, gaining popularity due to its sophisticated reasoning capabilities. Traders are beginning to utilize DeepSeek for a variety of purposes, from technical chart analysis to pattern detection in historical price data, even though it was not created specifically for bitcoin prediction.

The power of DeepSeek resides in its capacity to combine enormous amounts of intricate data. In the context of the cryptocurrency market, it can help with:

- Finding nuances in the relationships between crypto fluctuations and macroeconomic data.

- Producing comprehensive sentiment analysis from news stories, financial reports, and social media sites.

- Enabling trading strategy backtesting with past market data.

DeepSeek can recognize possibilities but not certainties, hence it lacks future vision like any other AI model. Additionally, the quality of the data it receives and the specificity of the prompts it uses have a significant impact on how effective it is.

Grok 3

Grok 3, created by Elon Musk’s AI business xAI, interfaces with the X platform (previously Twitter) and is notable for its real-time social sentiment access, which is a key factor in the movement of cryptocurrency prices.

Due to its personality-driven design and superior conversational comprehension, Grok 3 is useful for:

- Tracking changes in sentiment in real time from X developers, traders, and influencers.

- Interpreting abrupt narrative shifts, like token listings, project updates, or regulatory news.

- Helping traders improve their strategies in light of viral debates or current events.

It has an edge in identifying early social cues because of its intrinsic integration with X. For instance, a new Layer 2 solution that is trending may attract more attention and pricing activity; Grok is able to identify this more quickly than traditional techniques.

That being said, not all traders, particularly those who favor dashboards with a lot of data, will find Grok’s conversational interface and casual tone perfect. It performs best when used as a sentiment companion to more reliable trading strategies or in conjunction with technical instruments.

Can ChatGPT predict crypto prices?

ChatGPT can help traders make quicker and better-informed decisions by analyzing cryptocurrency news headlines and producing actionable trade signals. Well-written directions are crucial since ChatGPT will respond more accurately and helpfully if you provide more detailed instructions.

However, it must be noted that the predictions provided by ChatGPT can be completely wrong as well and the AI tool is bound to make mistakes as well.

How to use ChatGPT to predict crypto market trends?

You can use the following prompts in ChatGPT and ask it to predict crypto market trends:

Prompt 1: Bitcoin has reached its all-time high. Is there a chance it can retrace 10% or more?

Prompt 2: Ethereum’s price has stayed stagnant for a long time. When will it break out of its accumulation phase?

Now the answers of ChatGPT will base on the information that is present online at the time you ask the question.

However, if in the very next minute something new emerges the prediction can be totally wrong as well. Hence it is advisable to only use ChatGPT as a confluence and not rely on it completely.

Is ChatGPT good for predicting crypto?

The answer to this is yes and no. Flawed training data, short market history, volatility and black swan events, lack of human instinct, are just some of the reasons that ChatGPT might not be able to predict the markets correctly every time. However, this doesn’t mean you can’t train the AI model into thinking like a human and bring it closer to human instinct, but this requires expertise of AI developers.

Can AI predict Bitcoin price?

It depends on what you ask about the AI tool you’re using and how efficient that tool is. For example, you ask ChatGPT about Bitcoin (BTC) price prediction without going into specifics and it will give you a general overview.

However, if you ask about BTC’s price based on moving averages, or RSI, or volume, the answer will be different. So it depends on your trading capability and learning of the market, and only then ChatGPT can help you enhance your target for BTC or any other crypto asset for that matter.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

AI

Synthetic Court System Coming to Crypto with GenLayer

Published

1 month agoon

April 30, 2025By

admin

What if there were a crypto protocol that specialized in arbitrating on-chain disputes?

Imagine if, whenever prediction markets like Polymarket settled in a controversial manner, users had a formal way to appeal through a sort of neutral on-chain court system. Or if decentralized autonomous organizations (DAOs) could rely on an efficient, knowledgeable third party to help them make decisions. Or if insurance contracts could automatically execute payouts when specific real-world events occurred.

That’s essentially what Albert Castellana Lluís and his team are building with GenLayer, a crypto project that markets itself as a decision-making system, or trust infrastructure.

“We’re using a blockchain that has multiple AIs coordinate and reach agreement on subjective decisions, as if they were a judge,” Castellana, co-founder and CEO of YeagerAI told CoinDesk in an interview. “We’re basically building a global synthetic jurisdiction that has an embedded court system that doesn’t sleep, that’s super cheap, and that’s super fast.”

The demand for such an arbitration project may spike in the coming years with the development of AI agents — sophisticated programs powered by artificial intelligence that are capable of carrying out complex tasks in an autonomous manner.

When it comes to crypto markets, AI agents can be used in all kinds of ways: for trading memecoins, arbitraging bitcoin on exchanges, monitoring the security of DeFi protocols, or providing market insights through in-depth analysis, to cite only a few use-cases. AI agents will also be able to hire other AI agents in order to complete even more complex assignments.

Such agents may proliferate at an unexpected rate, Castellana said. In his view, most crypto market participants could be managing a handful of them by the end of 2025.

“These agents, they work super fast, they don’t sleep, they don’t go to jail. You don’t know where they are. Are they going to pass anti-money laundering rules? Are they going to have a bank account? Can they even use a Visa card?” Castellana said. “How can we enable fast transactions between them? And how can trust happen in a world like this?”

Thanks to its unique architecture, GenLayer could provide a solution by allowing entities — human or AI — to get a reliable, neutral opinion to weigh in on any decision in record time. “Anywhere where you normally would have a third party made of a bunch of humans… We replace them with a global network that provides a consensus between different AIs, a network that can make decisions in a way that is as correct and as unbiased as possible,” Castellana said.

Synthetic court system

GenLayer doesn’t seek to compete with other blockchains like Bitcoin, Ethereum or Solana — or even DeFi protocols such as Uniswap or Compound. Rather, the idea is for any existing crypto protocol to be able to connect to GenLayer and make use of its infrastructure.

GenLayer’s chain is powered by ZKsync, an Ethereum layer 2 solution. Its network counts 1,000 validators, each one connected to a large language model (LLM) such as OpenAI’s ChatGPT, Google’s Bert or Meta’s Llama.

Let’s say a market on Polymarket settles in a controversial manner. If Polymarket is connected to GenLayer, users of the prediction market have the ability to raise the issue (or, as Castellana put it, to create a “transaction”) with its synthetic court system.

As soon as the transaction comes in, GenLayer picks five validators at random to rule on it. These five validators query an LLM of their choice in order to find information on the topic at hand, and then vote on a solution. That produces a ruling.

But the Polymarket users, in our example, don’t necessarily need to be satisfied with the ruling: they can decide to appeal the decision. In which case, GenLayer picks another set of validators — except this time, their number jumps to 11. Just like before, the validators issue a ruling based on the information they gather from LLMs. That decision can also be appealed, which makes GenLayer pick 23 validators for another ruling, then 47 validators, then 95, and so on and so forth.

The idea is to rely on Condorcetʼs Jury Theorem, which according to GenLayer’s pitch deck states that “when each participant is more likely than not to make a correct decision, the probability of a correct majority outcome increases significantly as the group grows larger.” In other words, GenLayer finds wisdom in the crowd. The more validators are involved, the more likely they are to zero in on an accurate answer.

“What this means is that we can start small and very efficiently, but also we can escalate to a point where something very, very tricky, they can still get right,” Castellana said.

The average transaction takes roughly 100 seconds to process, Castellana said, and the court’s decision becomes final after 30 minutes — a timeframe that can be elongated if multiple appeals occur. But that means the protocol can reach a decision on major issues in a very short period of time, day or night, instead of going through arduous real-world litigation processes which may take months or even years.

Looking at incentives

GenLayer’s mission naturally raises a question: is it possible to game the system? For example, what if all of the validators select the same AI (say, ChatGPT) to solve a given proposal? Wouldn’t that mean that ChatGPT will have essentially issued the ruling?

Every time you query an LLM, you generate a new seed, Castellana said, so you obtain a different answer. On top of that, validators have the freedom of choosing which LLM to use based on the topic at hand. If it’s a relatively easy question, perhaps there’s no need to use an expensive LLM; on the other hand, if the question is particularly complex, the validator may opt for a higher-quality AI model.

Validators may even end up in a situation where they feel like they’ve seen a certain type of question so many times that they can pre-train a small model for a specific purpose. “We think that, over time, there’s just going to be endless new models,” Castellana said.

There’s a strong incentive for validators to be on the winning side of the decision-making process, because they’re financially rewarded for it — while the losing side ends up incurring costs associated with using computation, without collecting any rewards.

In other words, the question is not whether one’s validator is providing a correct answer, but whether it manages to side with the majority.

Since validators have no idea what other validators are voting, the goal is for them to use the necessary resources to provide accurate information with the expectation that other validators will converge on that information as well — because arriving at the same incorrect answer would probably require rigorous coordination.

And if that gambit doesn’t work out, the appeal system is ready to kick in.

“If I know that I’m reusing a good LLM, and I think that other people are using a bad LLMs and that’s why I lost, then I have quite a big incentive to appeal, because I know that with more people, there’s going to be an incentive for them to be using better LLMs as well” since other validators will want to earn the rewards from a successful appeal, Castellana said.

The system makes it hard for validators to collude, because they only have 100 seconds to reach a decision, and they don’t know whether they will be picked to settle specific questions. An entity would need to control between 33% and 50% of the network to be able to attack it, Castellana said.

Like Ethereum, GenLayer will be using a native token for its financial incentives. With a testnet already launched, the project should go live by the end of the year, according to Castellana. “There’s going to be a very big incentive for people to come and build things on top,” he said.

Source link

Ethereum Price Headed For Crash To $2,000 With Current Price Action

Tokenized funds hit $5.7B, scaling fast — Moody’s

Authorities Warn of Phony Text Messages Phishing for Sensitive Information, Telling Victims Their Bank Account Is at Risk

Tether invests in Chilean crypto exchange Orionx

MARA Hits Record-High Bitcoin Production in May

Retail investors no longer FOMO into BTC, altcoins

AVAX Rises 3.8% on Strong Volume, Breaking Key Resistance Levels

K33 begins Bitcoin buying with 10 BTC purchase for treasury strategy

Why $107,500 And $103,500 Are The Levels To Watch

Pakistan Proposes New Crypto Regulations

Japanese Bitcoin Hoarder Metplanet Adds $115,600,000 Worth of BTC As Stock Surpasses 263% Gains on the Year

Bitcoin traders anticipate decline, watch $100K

Ethereum Foundation Restructures R&D Division, Plans ‘Rethink’ on Design and Development

Here’s why Sophon crypto rallied over 40% today

BCB Strikes Deal with SocGen–FORGE to Distribute Euro-Pegged Stablecoin EURCV

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Pi Network coin to $10? 4 catalysts that may make it possible

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Blockchain groups challenge new broker reporting rule

Xmas Altcoin Rally Insights by BNM Agent I

Trending

24/7 Cryptocurrency News7 months ago

24/7 Cryptocurrency News7 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Markets3 months ago

Markets3 months agoPi Network coin to $10? 4 catalysts that may make it possible

Ripple Price3 months ago

Ripple Price3 months ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin5 months ago

Bitcoin5 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin7 months ago

Bitcoin7 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion7 months ago

Opinion7 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin4 months ago

Bitcoin4 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines