IPO

Ripple CEO Confident of XRP Being Included in U.S. Strategic Reserve, Says IPO is 'Possible'

Published

3 days agoon

By

admin

Ripple CEO Brad Garlinghouse sees closely related XRP as part of the White House’s proposed digital asset stockpile and anticipates the launch of an XRP exchange-traded fund (ETF) before the end of 2025, per a Bloomberg Markets interview.

Garlinghouse’s optimism came after the resolution of Ripple’s long-standing legal battle with the U.S. Securities and Exchange Commission (SEC), which concluded with the agency dropping its case against the company on Wednesday.

“XRP was named by the President of Truth Social. (He said) there’s gonna be a bitcoin strategic reserve and a crypto stockpile that will include things like XRP,” Garlinghouse told Bloomberg’s Sonali Basak, referring to the initiative formalized by President Donald Trump’s executive order in early March.

The Ripple CEO also foresaw a “wave of XRP ETF approvals” in the second half of 2025, noting a growing list of over ten applications pending with the SEC from firms like Bitwise and Franklin Templeton.

“I have immense confidence in the ETFs,” he said, pointing to the success of XRP exchange-traded products (ETPs) outside the U.S. Meanwhile, a Ripple Labs IPO isn’t out of question either. “Something is possible; it isn’t a huge priority,” he said.

XRP has climbed 11% to over $2.51 in the past 24 hours, leading gains in the broader market. It has flipped USDT to become the third-largest token by market capitalization behind bitcoin (BTC) and ether (ETH) as of Asian morning hours Thursday.

Source link

You may like

South Korea Plans Sanctions Against BitMEX, KuCoin, Others: Report

Gold-backed stablecoins will outcompete USD stablecoins — Max Keiser

Bitcoin Exchange Whale Ratio Hits New 2025 High — BTC Price At Risk?

Having The Bitcoin Privacy Discussion With Politicians Will Be Difficult — Please Help

$4,750,000 Guaranteed Income Program To Distribute Cash to Citizens Across One US State

Key factors why Ripple could soon skyrocket like it did in 2024

Citigroup

Crypto Exchange Gemini Quietly Files for IPO With Goldman Sachs and Citigroup: Report

Published

2 weeks agoon

March 9, 2025By

admin

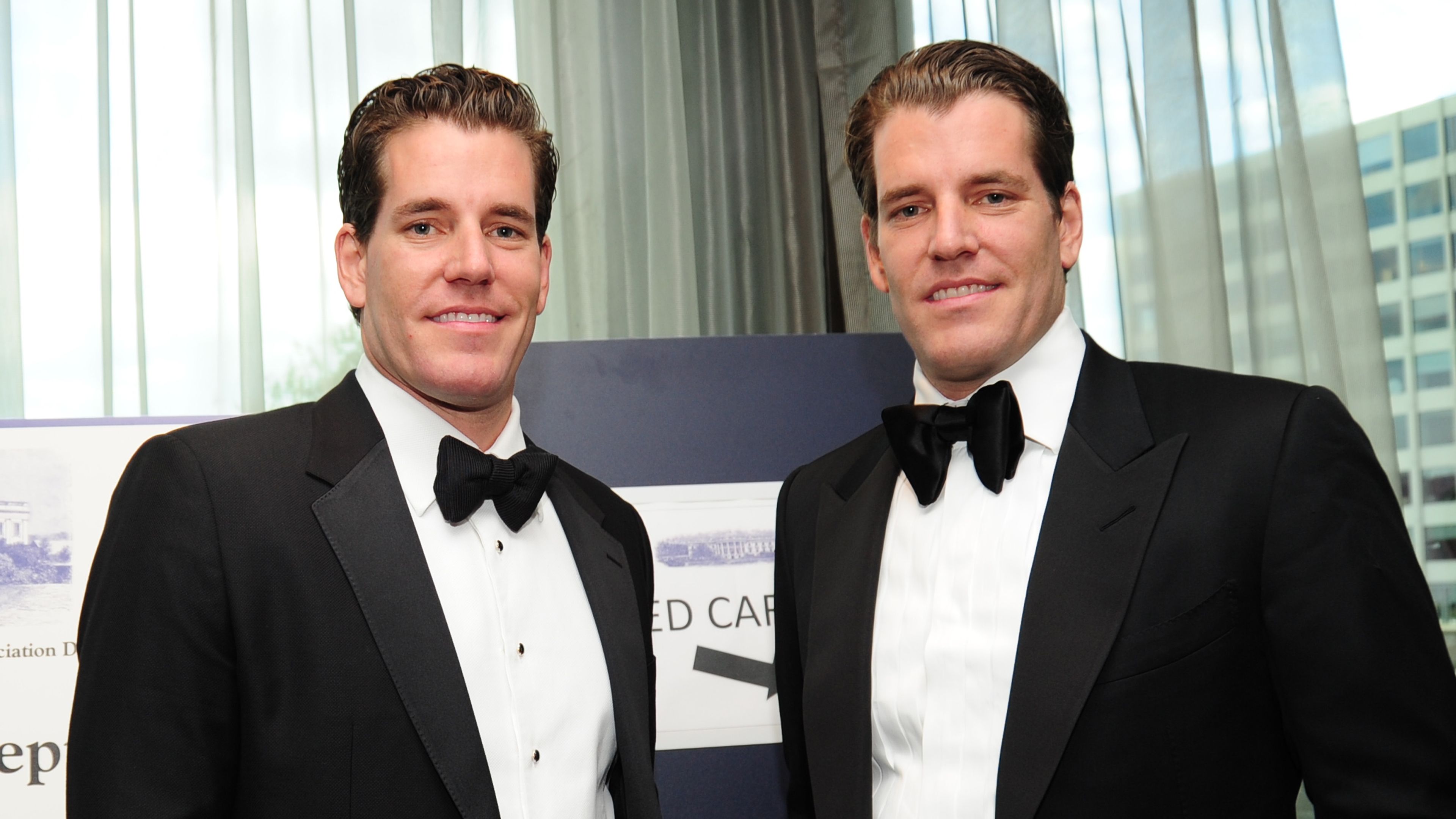

The crypto exchange founded by billionaire twins Tyler and Cameron Winklevoss has reportedly filed for an initial public offering (IPO).

Citing people familiar with the matter, Bloomberg reports that Gemini is working with the investment banking titans Goldman Sachs and Citigroup in its efforts to quietly go public.

The anonymous sources also say that discussions are still ongoing and no final decision has been made concerning an IPO.

An IPO is typically underwritten by investment banks, which also arrange for the shares to be listed on stock exchanges.

Last month, the U.S. Securities and Exchange Commission (SEC) also ended its probe into the exchange. In a letter addressed to Gemini lawyer Jack Baughman, the securities regulator said that it has closed its investigation and will not be pursuing any further enforcement actions against the platform.

Cameron Winklevoss says the regulator’s withdrawal is a milestone that signifies the end of the SEC’s “war on crypto,” but the Gemini co-founder says this hardly makes up for the damage caused by the agency.

“The SEC cost us tens of millions of dollars in legal bills alone and hundreds of millions in lost productivity, creativity and innovation.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Finance

Billionaire Winklevoss Twins-Backed Gemini Confidentially Filed for a U.S IPO: Bloomberg

Published

2 weeks agoon

March 8, 2025By

admin

Crypto exchange and custodian Gemini has confidentially filed for an initial public offering (IPO), Bloomberg reported, citing people familiar with the matter.

The firm, founded by billionaire Cameron and Tyler Winklevoss, is working with Goldman Sachs and Citigroup, the report said, noting that no final decision has been made on the listing.

The potential IPO comes after the U.S. Securities and Exchange Commission (SEC) ended its investigation into Gemini without taking action, according to a February post by Cameron Winklevoss. The company also settled a separate Commodity Futures Trading Commission lawsuit in January for $5 million.

Gemini is among several crypto firms lining up to list their companies in the U.S. public market after the SEC has been in a full-scale litigation retreat in the first months of the Trump administration.

Just today, Bloomberg reported that Crypto exchange Kraken is considering an IPO by the first quarter of 2026, adding to the reports that firms such as Circle, Bullish (parent company of CoinDesk) and Blockchain.com are also queueing up for a U.S. listing.

Source link

Core Scientific

CORZ Shares Drop 15% Pre-Market as MSFT Cuts CoreWeave Commitments

Published

2 weeks agoon

March 6, 2025By

admin

Shares of bitcoin (BTC) miner Core Scientific (CORZ) were down 15% in pre-market on Thursday after reports that Microsoft (MSFT) has pulled back from some agreements with soon to listed cloud computing firm CoreWeave.

Last month, Core Scientific said it was planning a $1.2 billion data center expansion with CoreWeave. This week, CoreWeave filed for an intital public offering, hoping to raise $4 billion at a $35 billion valuation.

According to an FT article, CoreWeave, which supplies artificial intelligence (AI) computing power to Microsoft, was facing delivery issues and missed deadlines, causing the tech giant to reduce its commitments, though it remains a major partner.

Microsoft represents 62% of CoreWeave’s revenue and has pledged over $10 billion in spending on its services by 2030. CoreWeave has rapidly grown, generating $1.9 billion in revenue in 2024 but posting significant losses.

It relies heavily on Nvidia’s (NVDA) AI chips and has raised $14.5 billion in debt and equity. Microsoft’s decision aligns with its shifting AI infrastructure strategy, though it remains committed to major investments in the sector.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Source link

South Korea Plans Sanctions Against BitMEX, KuCoin, Others: Report

Gold-backed stablecoins will outcompete USD stablecoins — Max Keiser

Bitcoin Exchange Whale Ratio Hits New 2025 High — BTC Price At Risk?

Having The Bitcoin Privacy Discussion With Politicians Will Be Difficult — Please Help

$4,750,000 Guaranteed Income Program To Distribute Cash to Citizens Across One US State

Key factors why Ripple could soon skyrocket like it did in 2024

This Week in Bitcoin: Volatility Rises as ETFs Rebound and SEC Gives OK to Mining

Will ETH ETF Net Outflow Exceed $20 Million?

The SEC Resets Its Crypto Relationship

Will new US SEC rules bring crypto companies onshore?

Net Taker Volume on Binance Hits Yearly High Amid Bitcoin Price Consolidation

Eric Trump Joins Metaplanet’s Board Of Advisers

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x