Markets

Roaring Kitty Returns: GameStop Stock, GME Meme Coin Spike on Cryptic Post

Published

4 months agoon

By

admin

Keith Gill, the meme stock influencer better known online as Roaring Kitty, is back at it again—swapping memes from an animated movie for one based on a famed magazine cover.

On Thursday, Gill’s first social media post in three months moved markets instantaneously, sending GameStop’s stock price higher as meme coins modeled on the video game retailer with a cult-like following took flight too.

Gill, whose cryptic social media activity sparked a rally in GameStop shares earlier this year, posted an altered version of a photo-illustration created by Arthur Hochstein for Time Magazine on X (formerly known as Twitter).

In 2006, the publication selected “You” as its Person of the Year, paying homage to YouTube’s aesthetic with its cover, while discussing the revolutionary aspects of the internet’s growing popularity and cultural impact in its whimsically worded article.

“It’s a story about community and collaboration on a scale never seen before,” an excerpt of the article read regarding 2006. “It’s about the cosmic compendium of knowledge Wikipedia and the million-channel people’s network YouTube and the online metropolis MySpace.”

However, the image posted by Gill was not a carbon copy of the magazine’s original cover: “You” and other text had been removed, while the time duration shown on the photo-illustration’s mirror-like monitor showed “01:09/04:20” in the version that Gill posted (aka the meme numbers 69 and 420).

As of this writing, GameStop shares are trading hands at $28.93, rising 7% over the past day. While the stock’s price was down 5% over the past week, it has jumped 26% over the past month. Amid an initial lurch and spike to a daily peak of nearly $31, the stock’s trading was temporarily halted, according to Nasdaq Trader.

Within the crypto world, a Solana-based meme coin borrowing GameStop’s ticker name jumped 72% in price to $0.0089 over the course of three minutes, according to DEX Screener. As of this writing, GME had drifted down to $0.0067, showing gains of 30% over the past day.

When Gill’s X account posted an altered picture from Pixar’s “Toy Story 2” in September, the stock price of pet supplies retailer Chewy took a momentary hit. Showing the character Andy tossing down a dog-faced version of his toy cowboy Woody, Chewy’s 3.7% drop in price was short lived. Gill had bought millions of shares in Chewy back in July.

Gill, also known as DeepFuckingValue on Reddit, rose to prominence amid GameStop’s famed short squeeze in 2021. Emerging as the de facto mascot of a movement to bet big on Wall Street short sellers through GameStop’s stock, he’s been dubbed a “nihilist’s Warren Buffet.”

In June, Gill returned to streaming on YouTube after a three-year absence from social media, discussing GameStop’s financials carefully, amid reports that the Securities and Exchange Commission (SEC) and Massachusetts’ securities regulator were investigating the meme stock influencer for his recent online behavior.

In Gill’s latest Reddit post, made six months ago, a “YOLO update” showed holdings of GameStop shares and cash worth $268 million. At one point in June, his purported holdings, which included options at the time, were worth $586 million.

When Gill’s return to social media sparked renewed interest in GameStop in April, the company’s share price rose as high as $48.75. During Gill’s short-lived streaming stint, shares climbed again to $46.55, but have crept down to current levels since.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Markets

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

Published

14 hours agoon

April 16, 2025By

admin

Payments-focused XRP’s immediate prospects look bleak, with its price chart flashing a “rising wedge” breakdown.

A rising wedge comprises two converging trendlines that connect higher lows and higher highs. This convergence suggests that upward momentum is weakening. When the price moves below the lower trendline, it signals a shift to a bearish trend.

XRP dived out of its rising wedge pattern during Wednesday’s early Asian hours, suggesting that the attempted recovery from the April 7 lows near $1.60 has likely lost momentum, allowing sellers to regain control.

According to technical analysis theory, analysts should identify the starting point of the rising wedge as the initial support level following the breakdown, which means XRP can now fall back to $1.60. The cryptocurrency has also fallen below the Ichimoku Cloud, a momentum indicator, on the hourly chart, reinforcing the bearish outlook indicated by the rising wedge breakdown.

Tuesday’s high of $2.18 is the level for bulls to beat to invalidate the bearish outlook.

Source link

The U.S. dollar index remains under pressure as Donald Trump’s tariffs push investors to other currencies.

The DXY index was trading at $99.95 on Tuesday, down by 9.20% from its highest level this year. It has also been hovering at its lowest point since July 2023, and a death cross it formed points to more downside in the coming months.

The US dollar index could crash further

More technical signals show that the U.S. dollar index has further downside potential. It has formed an inverse cup and shoulders pattern whose depth is about 9%. Measuring the same distance from the lower side of the cup points to further downside to $91.

Further, a key survey of institutional investors shows that most of them are bearish on the currency as the trade war continues. Sixty-one percent of respondents in Bank of America’s Global Fund Manager Survey see the greenback falling in the next 12 months. This is the most bearish these fund managers have been since 2006.

These investors are concerned about Trump’s policies and their economic impact. The most urgent fear is tariffs, which analysts expect will affect the economy. Many fund managers believe the U.S. will sink into a recession this year.

While Trump has walked back some tariffs, those on China remain at uncomfortable levels. Most Chinese goods flowing to the United States will receive a 145% tariff, affecting goods worth hundreds of billions of dollars. On Tuesday, Beijing announced that it would block Boeing purchases by its airlines.

Further, the U.S. dollar index has dropped as Congress negotiates Trump’s funding bill, which includes $4.5 trillion in tax cuts.

A falling US dollar could benefit Bitcoin and most altcoins

A deteriorating US dollar index could benefit Bitcoin (BTC) and altcoins for three reasons. First, most of these coins are traded in Tether, a stablecoin backed by the U.S. dollar. As such, a weakening greenback makes Bitcoin and these altcoins more affordable.

Second, the ongoing dollar weakness is likely due to concerns about the American economy and the impact of tariffs. As such, there is a likelihood that the Federal Reserve will intervene and slash interest rates. Some Fed officials, like Christopher Waller and Susan Collins, have confirmed that the bank is ready to act in the event of a recession.

Third, Bitcoin and altcoins could benefit as the U.S. dollar index falls because they are often considered safe havens. While Bitcoin’s price has dropped this year, it has performed better than the stock market.

Source link

With all the current bearish sentiment and macroeconomic uncertainty swirling around both Bitcoin and the broader global economy, it might come as a surprise to see miners as bullish as ever. In this article, we’ll unpack the data that suggests Bitcoin miners are not just staying the course, they’re accelerating, doubling down at a time when many are pulling back. What exactly do they know that the broader market might be missing?

For a more in-depth look into this topic, check out a recent YouTube video here:

Why Bitcoin Miners Are Doubling Down Right Now

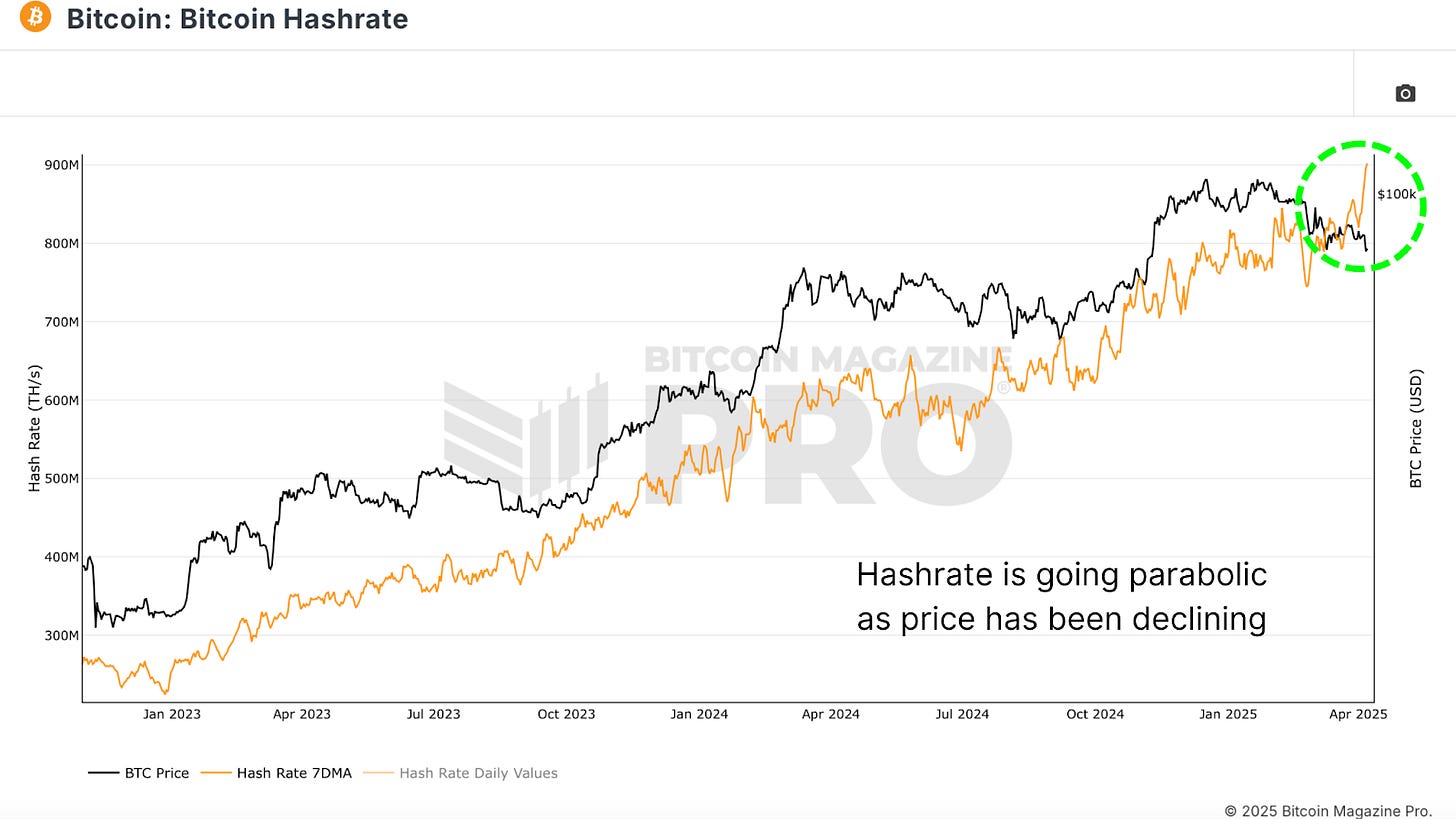

Bitcoin Hash Rate Going Parabolic

Despite Bitcoin’s recent price underperformance, the Bitcoin Hashrate has been going absolutely vertical, breaking all-time highs with seemingly no regard for macro headwinds or sluggish price action. Typically, hash rate is tightly correlated with BTC price; when price drops sharply or remains stagnant, hash rate tends to plateau or decline due to economic pressure on miners.

Yet now, in the face of heightened global tariffs, economic slowdown, and a consolidating BTC price, hash rate is accelerating. Historically, this level of divergence between hash rate and price has been rare and often significant.

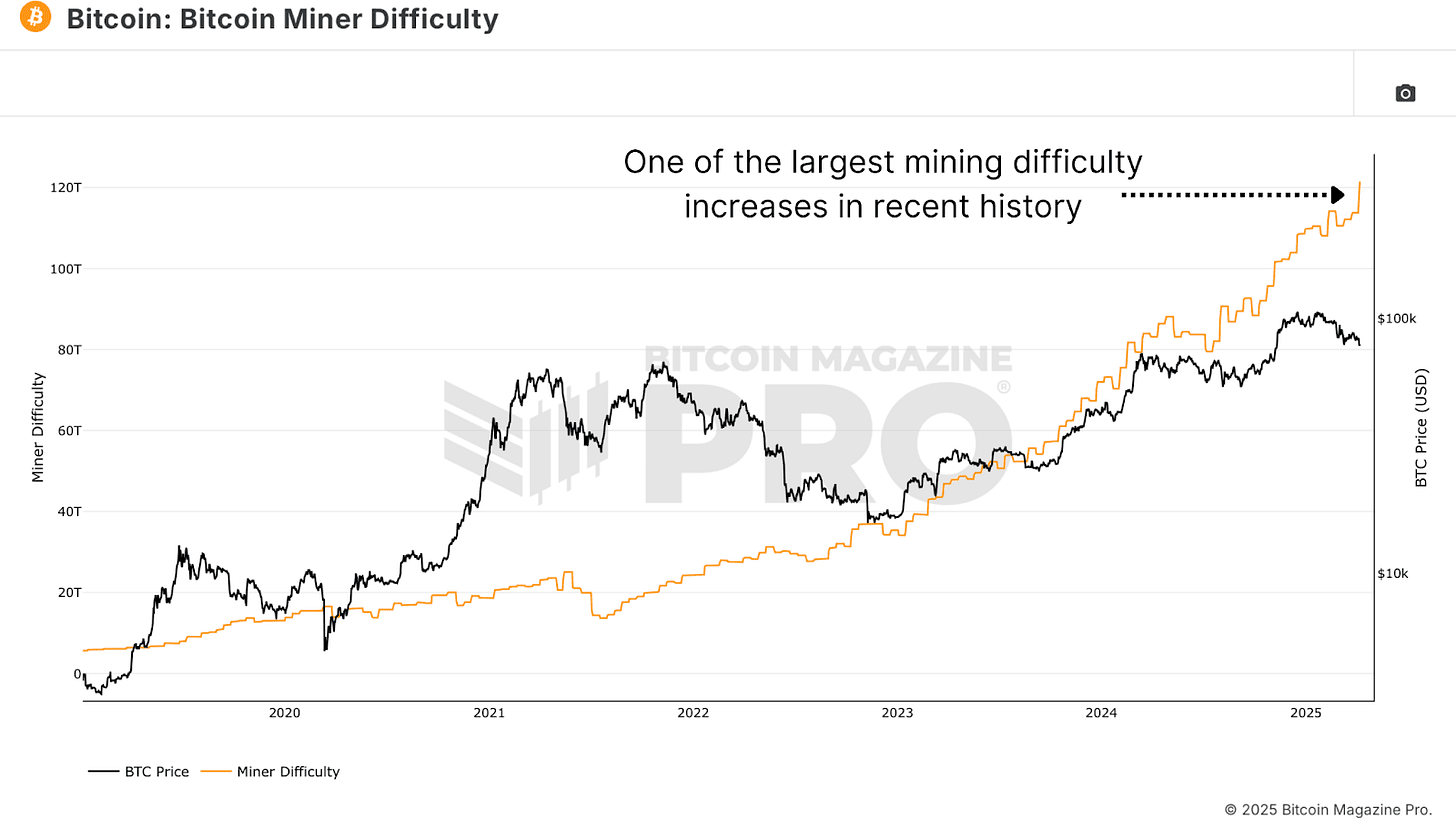

Bitcoin Miner Difficulty, a close cousin to hash rate, just saw one of its largest single adjustments upward in history. This metric, which auto-adjusts to keep Bitcoin’s block timing consistent, only increases when more computational power floods the network. A difficulty spike of this magnitude, especially when paired with poor price performance, is nearly unprecedented.

Again, this suggests that miners are investing heavily in infrastructure and resources, even when BTC price does not appear to support the decision in the short term.

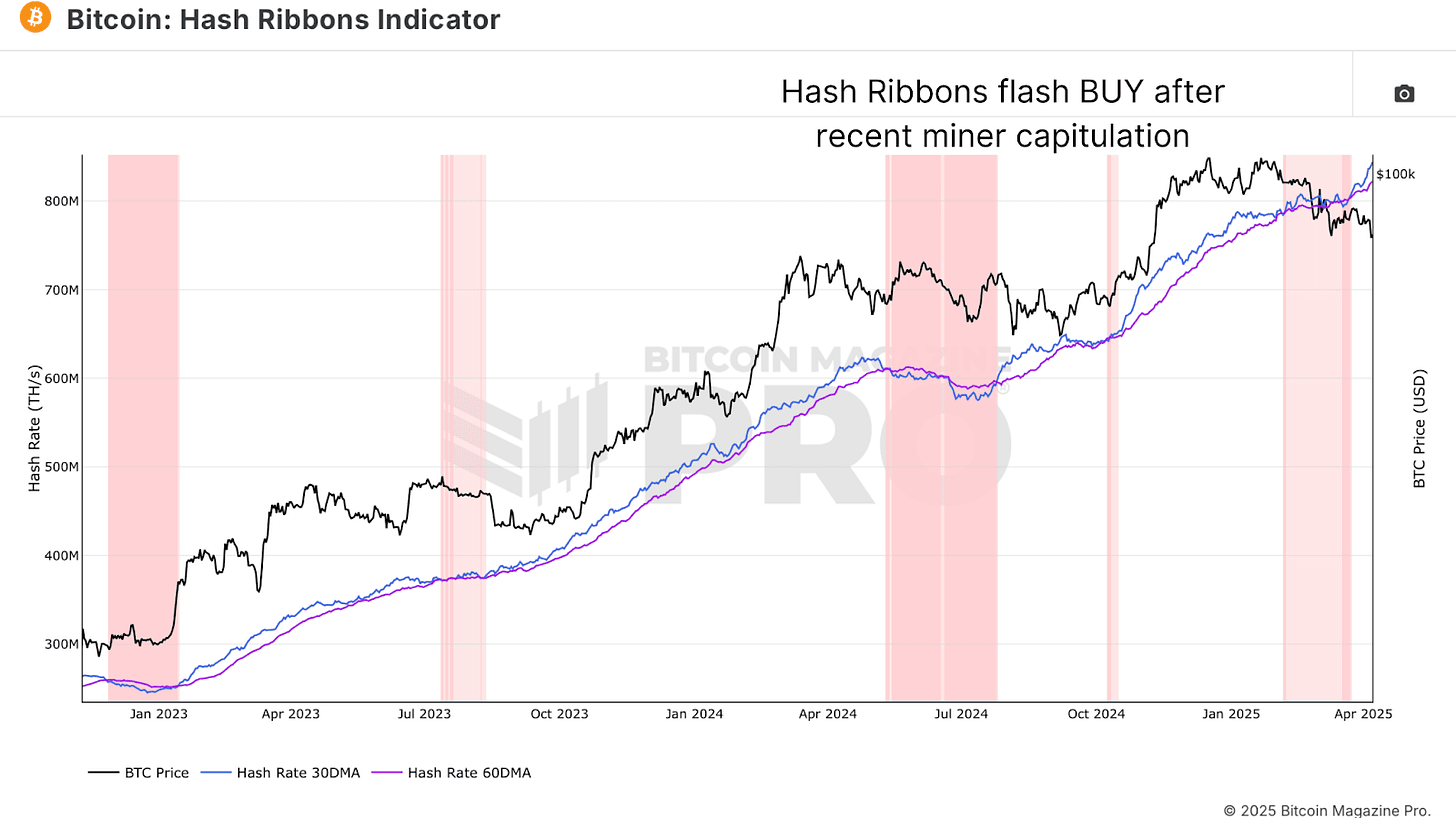

Adding further intrigue, the Hash Ribbons Indicator, a blend of short and long-term hash rate moving averages, recently flashed a classic Bitcoin buy signal.

When the 30-day moving average (blue line) crosses back above the 60-day (purple line), it signals the end of miner capitulation and the beginning of renewed miner strength. Visually, the background of the chart shifts from red to white when this crossover occurs. This has often marked powerful inflection points for BTC price.

What’s striking this time around is how aggressively the 30-day moving average is surging away from the 60-day. This is not just a modest recovery, it’s a statement from miners that they are betting heavily on the future.

The Tariff Factor

So, what’s fueling this miner frenzy? One plausible explanation is that miners, especially U.S.-based ones, are trying to front-run the impact of looming tariffs. Bitmain, the dominant producer of mining equipment, is now in the crosshairs of trade policies that could see equipment prices surge by 30–50%, potentially to even over 100%!

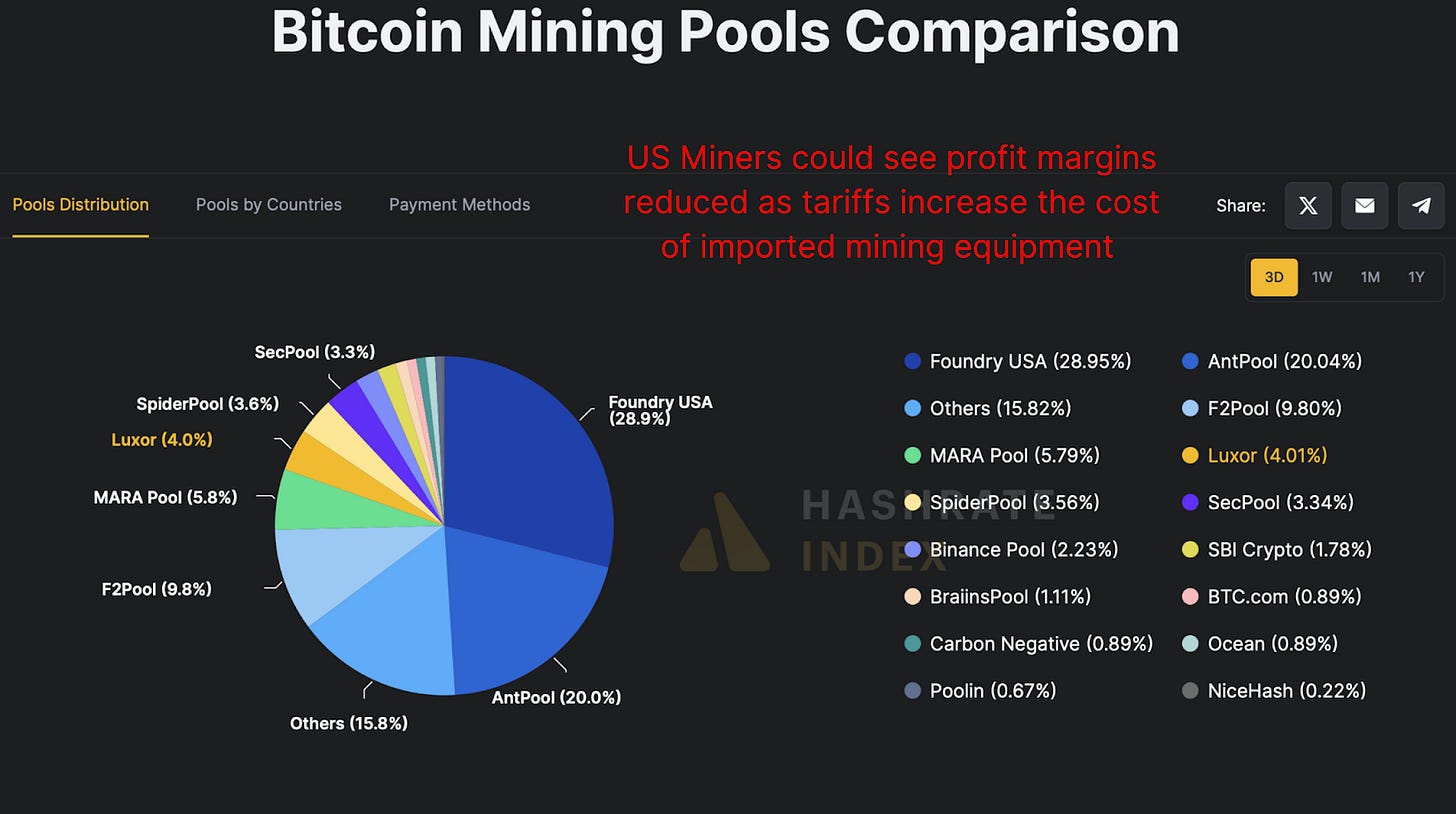

Given that over 40% of Bitcoin’s hash rate is controlled by U.S.-based pools like Foundry USA, Mara Pool, and Luxor, any cost increase would drastically reduce profit margins. Miners may be aggressively scaling now while hardware is still (relatively) cheap and available.

Bitcoin Miners Keep Mining

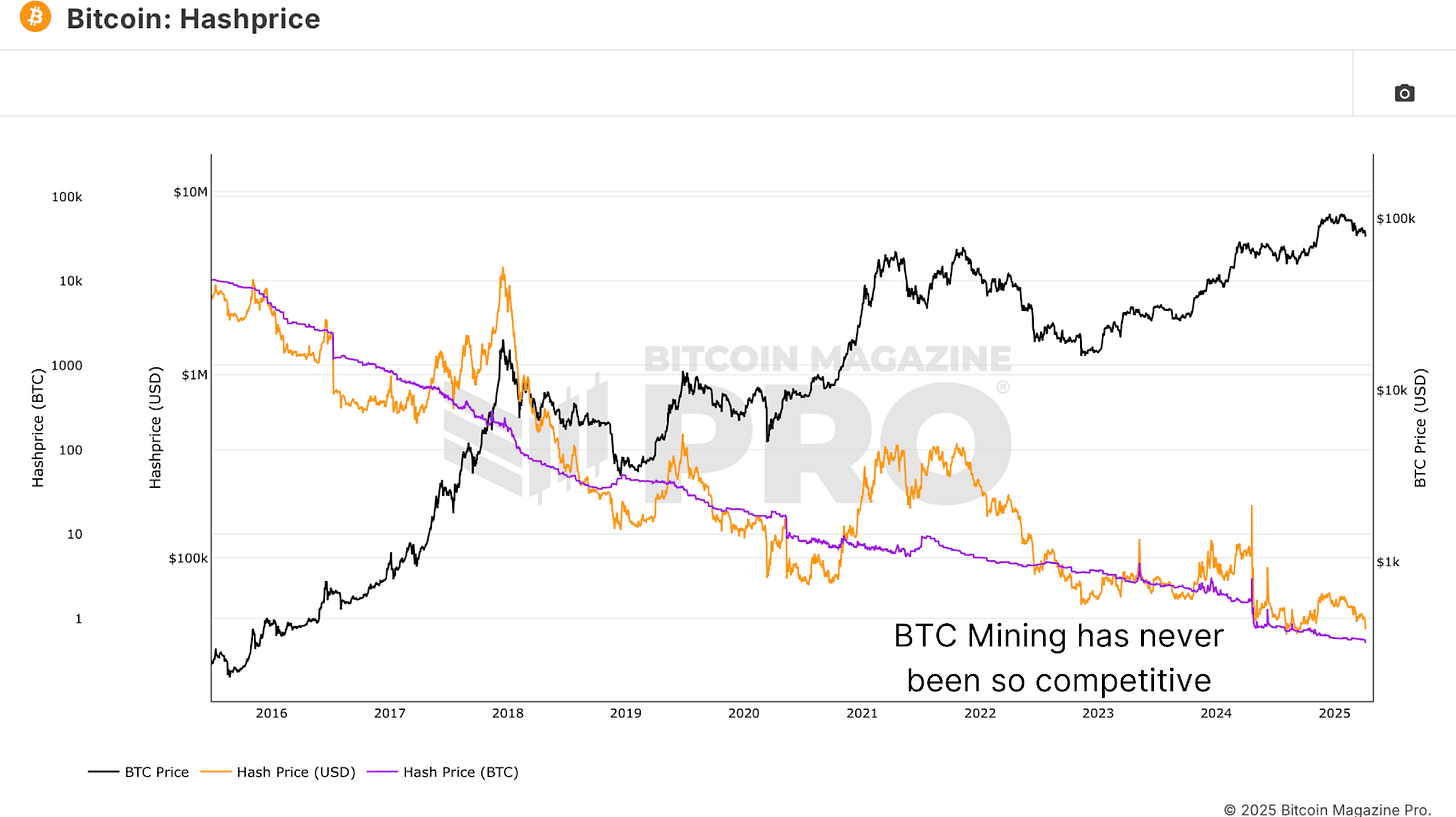

Hashprice, the BTC-denominated revenue per terahash of computational power, is at historical lows. In other words, it’s never been less profitable in BTC terms to operate a Bitcoin miner on a per-terahash basis. Typically, we see hash price increase toward the tail-end of bear markets, as competition fades and weaker players exit the space.

But that’s not happening here. Despite terrible profitability, miners are not only staying online, they’re deploying more hash power. This could imply one of two things; either miners are racing against deteriorating margins to front-load BTC accumulation, or, more optimistically, they have strong conviction in Bitcoin’s future profitability and are buying the dip aggressively.

Bitcoin Miners Conclusion

So, what’s really happening? Either miners are desperately front-running hardware costs, or, more likely, they’re signaling one of the strongest collective votes of confidence in the future of Bitcoin we’ve seen in recent memory. We’ll continue tracking these metrics in future updates to see whether this miner conviction is proven right.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

China selling seized crypto to top up coffers as economy slows: Report

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x