Law and Order

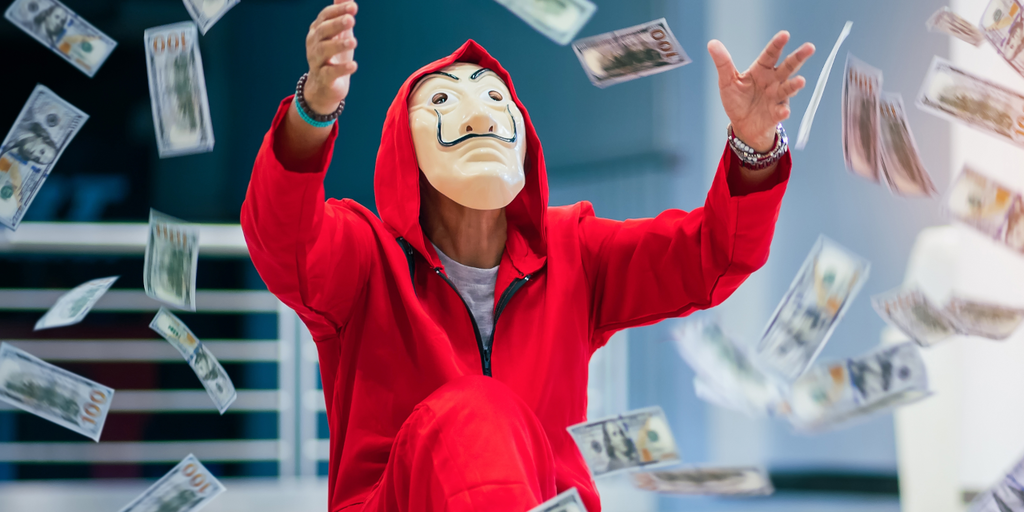

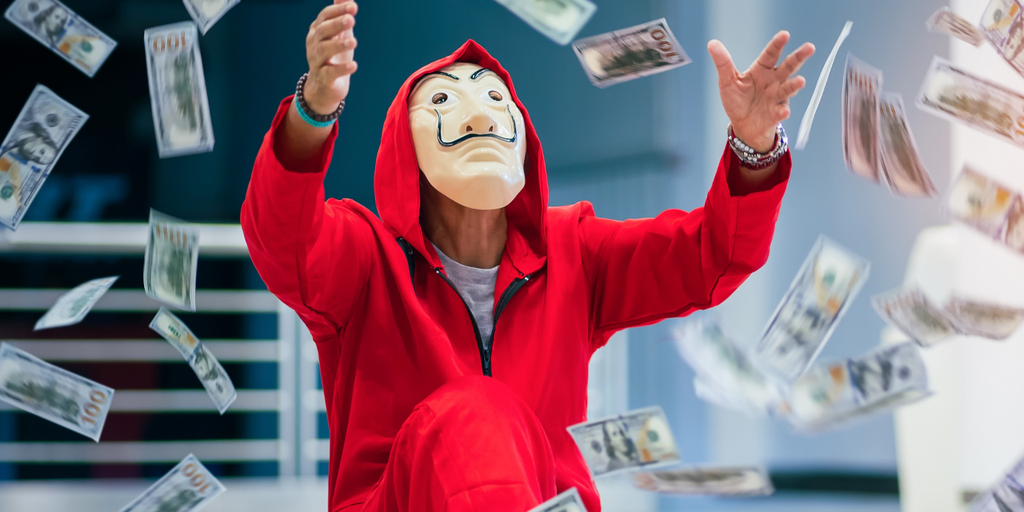

Scammer Tried to Hijack Kraken Crypto Account Wearing Rubber Mask of Victim

Published

5 months agoon

By

admin

When trying to regain access to your Kraken account, you may be asked to jump on a video call with a support agent to prove you are actually who you say you are.

Last month, the centralized exchange said it caught someone wearing a Halloween-style rubber mask attempting to fool the worker on the other side of the call—but it didn’t work.

The attacker had raised a number of red flags during the first round of checks, such as failing to name the assets that the account held. These flags caused the agent working the case to require a video call to grant access to the account. During the call, the Kraken worker asked some more questions and checked the person’s ID.

The attacker failed this stage—in dramatic fashion.

“Our agent was like: This is absolutely ridiculous. This is a rubber mask the guy’s wearing,” Kraken Chief Security Officer Nick Percoco told Decrypt.

The mask didn’t even look like the person the attacker was claiming to be, Percoco said. The victim was a Caucasian male in his early 50s, so it appeared to Percoco that the attacker simply grabbed a mask that vaguely fit the description.

And this isn’t the first time someone has worn a disguise in an attempt to fool Kraken.

“[We] see things, from time to time, where people put on a fake mustache,” he told Decrypt. “They show [ID] and it looks close because they wear the same style glasses, have a mustache, and have blonde hair. We see that from time to time. They never pass.”

“But this is the first time,” he added, “that someone has gone out to the costume store to get a mask.”

To make matters worse, the attacker didn’t even have a believable ID. It was “clearly” Photoshopped and printed onto card stock, Percoco explained, albeit with the correct information on it.

While this wasn’t a sophisticated attack, it highlights that even sloppy scammers can potentially gain access to the private information of everyday people. Even with such an unpolished attempt, Percoco believes, attackers could see success.

“I think it must [work],” he told Decrypt. “I think people wearing disguises, people who breach another place and get a copy of your government ID, and then print it out on glossy paper, holding that up… for some exchanges, that probably works.”

He claimed that some exchanges do not have the same level of attention to detail that Kraken demands from its team. Percoco specifically points to companies that outsource their support, claiming that this is more likely to lead to mistakes.

If he’s correct, then this means that those using centralized exchanges shouldn’t always rely on the company to fend off bad actors. To protect themselves, Percoco says, users should deploy two-factor authentication “everywhere”—from your email to well beyond—to prevent bad actors getting any personal information at all costs.

Even with such protection methods employed, a user can still fall for phishing scams. For the top level of security, he recommends using FIDO2 and passkeys, which are hardware keys that can turn your phone or laptop into your password for an account.

“Passkeys are cryptographically bound to the sites and the applications you’re using them with,” he said, “so you can’t be duped into thinking you’re logging into Kraken.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

Law and Order

Coinbase Urges Australia to Vote for Crypto Progress in May

Published

13 hours agoon

April 16, 2025By

admin

Australia’s federal election next month could decide the future of crypto in the country, according to a call to action from Coinbase urging voters to back progress on digital asset reform.

John O’Loghlen, Coinbase’s Managing Director for APAC, warned that despite soaring interest in digital assets, “Australia’s policy environment for crypto remains frustratingly vague and underdeveloped,” in a blog post on Monday.

“It’s now 2025, and we still don’t have clear rules to support innovation, protect consumers, and attract long-term investment,” O’Loghlen said.

Coinbase outlined five urgent steps for the next government, including launching a crypto taskforce in its first 100 days, tackling the country’s worsening debanking problem, enabling stablecoin use, and providing tax clarity and startup support for Web3 builders.

While up to 31% of Australians have held crypto, placing the country among global leaders in adoption, regulatory paralysis is driving talent and capital abroad, the post said.

“Talented Web3 builders are heading offshore,” O’Loghlen wrote. “Every day, we’re seeing local capital and talent flow to friendlier jurisdictions like Singapore and Dubai.”

O’Loghlen cautioned that Australia risks losing its edge in Web3 innovation, noting it’s “unlikely the world’s next Coinbase or Circle will be founded in Australia,” not due to a lack of talent, but because the country “lacks the ambition and urgency to support them.”

The platform’s plea comes as Prime Minister Anthony Albanese’s government attempts to roll out a regulatory framework.

Australia’s plan

In March, Treasury outlined plans requiring major exchanges to obtain Australian Financial Services Licences and issued guidance on stablecoin oversight and custody services.

The agency also pledged to tackle debanking by working with banks to promote transparency and fairness, a practice Coinbase slammed as “treating everyday Australians like criminals.”

Meanwhile, new data from the Australia-based educational platform Digital Wealth Group offered insight into Australian crypto behavior.

A poll of 696 members found only 9.9% held more than $195,000 (A$300,000) in crypto, despite 55% reporting household incomes over $97,500 (A$150,000).

“This suggests that even wealthy Australians aren’t going all in on crypto—yet—they’re still just dabbling,” the group said. Only 3% reported portfolios above $650,000 (A$1 million).

The crypto exchange’s statement comes just weeks after it was confirmed Australians will vote on May 3 in a tightly contested election.

With Labor defending a slim majority, polls suggest either party could be forced to work with independents or minor parties to form government.

While cost-of-living, housing, and healthcare dominate the campaign, Coinbase is calling for crypto to take a key place in the debate.

The exchange says the next government must move “beyond consultation and into legislation” as Australia “can’t risk falling further behind” in regards to crypto innovation.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Law and Order

Tariffs May Help Fund US Bitcoin Reserve Buildup Says White House Advisor Bo Hines

Published

2 days agoon

April 15, 2025By

admin

The Trump administration’s sweeping tariffs, which have roiled global markets over the past few weeks, may just become instrumental to funding the U.S. Strategic Bitcoin Reserve without using taxpayer money.

While the extensive tariffs threatened and implemented over the past month have escalated and jolted crypto markets as the Trump administration pursues an “America First” trade policy, a key White House advisor thinks the revenues from it could be used to add to the country’s Bitcoin stash.

Bo Hines, executive director of the Presidential Council of Advisers on Digital Assets, said in a White House interview with Professional Capital Management’s Anthony Pompliano that the Trump administration is exploring several “budget-neutral” methods to get more Bitcoin.

“We’re looking at many creative ways, whether it be from tariffs or something else,” Hines said.

Hines’ ideas come after President Donald Trump signed an executive order that established the country’s creation of the Strategic Bitcoin Reserve last month. Data from Arkham tracking the U.S. stash shows it’s currently at 192,012 BTC.

Following Trump’s executive order, a separate document circulated from the Federal Register detailing a presidential directive requiring federal agencies to disclose all Bitcoin and digital asset holdings to the Treasury Secretary. That order’s deadline was last Saturday.

Hines adds that there is a “180-day landmark that’s on the horizon” as the federal agencies go through recommendations for acquiring more Bitcoin. “We’ll comb through all the reports and then we’ll produce a comprehensive piece of work,” Hines said.

Aside from the “creative” strategy of using tariff revenues for buying Bitcoin, Hines cites Senator Cynthia Lummis’s Bitcoin Act of 2025, which would revalue Treasury gold certificates from their outdated valuation of approximately $43 per ounce to reflect current market prices exceeding $3,000 per ounce.

Such an adjustment could free billions in value for Bitcoin acquisition without requiring congressional appropriations.

Treasury Secretary Besson and Commerce Secretary Lutnick join “many great actors” working through an inter-agency digital assets working group to develop acquisition strategies aligned with the administration’s goal of making the U.S. “the Bitcoin superpower of the globe,” Hines said.

“We’ll come together and flesh out some of these ideas and really get to the best solution,” he added.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Law and Order

From the Crypto Trenches to the Hill: Why Solana Is Making a Big Push in Washington

Published

3 days agoon

April 13, 2025By

admin

When Solana debuted in 2020, it set out to dominate decentralized finance. Now, five years and more than eight billion transactions later, supporters of the so-called Ethereum killer have assumed a far more ambitious undertaking: conquering the halls of Congress.

However, advocating for Solana on Capitol Hill—where DeFi still suffers from its association with money launderers and hackers, despite a growing embrace of crypto—won’t be easy.

Enter the Solana Policy Institute.

Founded in March, the policy arm of the second-largest layer-1 network by total-value locked aims to represent the many pseudonymous coders and founders building on Solana and other blockchains within the sprawling DeFi sector. DeFi is a catchall term that represents a wide array of crypto-driven, autonomous financial services that do not require centralized intermediaries like banks.

The nonprofit will be helmed by President Kristin Smith—the outgoing Blockchain Association CEO—and CEO Miller Whitehouse-Levine, the one-time DeFi Education Fund Director. They’re two star lobbyists equally fluent in D.C. discourse and the slang of the crypto trenches.

Together, they are setting out to reform the DeFi sector’s shadowy reputation and to ensure the space remains top of mind among policymakers.

“A lot happens in the world, and Congress ought to be responsive to what is happening,” Whitehouse-Levine told Decrypt.

“We want to make sure that those in D.C. policy-making circles and everyone advocating for their interests here are aware of all the cool stuff happening on Solana and the possibilities of development on-chain,” he added.

The SPI is planning to organize a spate of “fly-ins,” springing its developers, founders and other builders from the trenches and sending them to Capitol Hill to educate lawmakers, according to Whitehouse-Levine.

The fly-ins represent a major ramping up of the layer-1’s presence on Capitol Hill. For years, advocates for Solana and other leading blockchains have convened for monthly phone calls on DeFi policy, Whitehouse-Levine said. But, those efforts haven’t always translated to invitations to mingle with lawmakers.

“There is no substitute for the folks actually building these things coming to Washington, explaining what they’re trying to accomplish to policymakers and showing policymakers what they’re building,” Whitehouse-Levine said.

It remains unclear how SPI intends to fund its education push, however. Whitehouse-Levine did not disclose the amount of money the Solana Policy Institute has in its coffers, and he declined to identify the source of those funds.

A source familiar with the matter told Decrypt the institute intends to make a major funding announcement soon, however.

Meanwhile, three sources in the Solana ecosystem told the publication Unchained on Friday they understood the organization to be supported with funding from the Solana Foundation.

The Solana Policy Institute is not officially associated with the Switzerland-based Solana Foundation, which supports the adoption and growth of the Solana network. However, their mandates are largely aligned.

The Solana Foundation did not respond to Decrypt’s repeated requests for comment on the matter.

DC’s growing crypto embrace

SPI’s founding comes just months after crypto lobbyists helped elect the most pro-crypto Congress and administration yet, accelerating the industry’s efforts to soften stigmas around digital assets stateside.

But even as lawmakers largely embrace Web3 firms under pro-crypto U.S. President Donald Trump, some have kept decentralized finance players at arm’s length. The sector’s pseudonymous founders, meme coin creators, and “shadowy super coders” are largely untrained in the kind of politicking that their corporate-coded centralized exchange counterparts have mastered to advance their interests on Capitol Hill.

They also have splashed less cash on courting regulators and lawmakers. In 2024, corporate crypto titans such as Coinbase, Ripple Labs and investment firm Andreessen Horowitz ranked as the top three donors to pro-crypto super PAC Fairshake, allocating more than $150 million combined to the group, according to OpenSecrets data.

Meanwhile, donors linked to Solana, which ranked as the PAC’s 20th-largest donor and one of its biggest DeFi contributors, gave just $25,000 to the group last year, the same data shows.

Those factors may have kept DeFi leaders out of some important decision-making rooms. In March, the Trump administration hosted more than a dozen crypto company leaders at its inaugural Crypto Summit in Washington D.C. Just a few of the roughly two dozen invitees represented DeFi projects.

Still, SPI founder Whitehouse-Levine is confident that the Solana Policy Institute, led by experts like Smith—a Fortune 40 Under 40 in Government and Politics alumna and top lobbyist, according to the U.S. politics-focused newsroom The Hill—will help DeFi enter more conversations on the Hill.

“She is an icon in crypto policy, and…as far as I’m concerned, the foundation of the industry’s efforts as they have been built over the last eight years,” he said.

‘Meme coin casino’ makeover

But Solana’s reputation is not necessarily as polished as that of Smith’s.

Founded in 2020, the network has in part attracted a growing user base over the last year-plus through its so-called meme coin casino, where it’s among the cheapest and easiest places to launch a token that could just as rapidly skyrocket and then plunge in value.

It’s also an anything-goes playground where people set themselves on fire or fake their own deaths to pump tokens with no intrinsic utility, while heads of state can rug-pull unsuspecting traders via social media.

That spate of antics poses a major risk to the platform’s ability to connect with regulators and legislators, but Whitehouse-Levine believes good policy can curb the impact of those incidents and help the ecosystem reform its image.

“First things first, we can’t have people setting themselves on fire,” he told Decrypt. “Like, I can’t believe we’re actually saying that out loud.”

“There’s been multiple speculative frenzies in the history of crypto, and to the extent that [a]clear regulatory framework can help bring that in, that’s in everyone’s interests,” Whitehouse-Levine added.

However, to get that kind of legislation passed, it’s important that developers and legislators take the time to understand one another with the help of go-betweens like Whitehouse-Levine, Smith, and other policy experts, DeFi Education Fund Executive Director Amanda Tuminelli—who will be working closely with SPI on DeFi-focused policy initiatives—told Decrypt.

“We’re all trying to reach out directly to developers and serve as a bridge between DeFi developers and the Hill,” Tuminelli said.

“It’s very important that we get clear law on the books while we can, [and] while Congress seems like they’re in a place where that could happen,” she said, adding that she’s seen in recent months an increase in securities regulators and lawmakers holding meetings on issues that impact DeFi developers.

“I think people are recognizing that opportunity and putting resources behind it,” Tuminelli added.

Edited by James Rubin

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x