Bitcoin

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Published

3 months agoon

By

admin

Bitcoin financial services company Fold app has submitted an S-4 SEC filing to the US Securities and Exchange Commission in preparation to go public with its IPO.

The Fold app submitted its S-4 SEC filing on Oct. 7. An S-4 filing is a statement created with the SEC by a publicly traded company undergoing a merger or acquisition. In the case of Fold, it announced last July that it plans to go public by merging with FTAC Emerald Acquisition.

According to the document, if the merger is approved and recognized by stakeholders and regulators, then Fold will remain listed on the Nasdaq with FLD as the new ticker symbol. The registration statement lists the firm Emerald as the registrant and Fold as the co-registrant.

“Merger Sub will be merged with and into Fold, with Fold surviving the Merger as a wholly-owned subsidiary of Emerald,” said the statement.

In July 2024, Fold agreed to merge with the special purpose acquisition company FTAC Emerald Acquisition at a pre-money equity valuation of $365 million.

According to the press release, Fold currently holds more than 1,000 Bitcoin(BTC) in its balance sheets. The funds acquired from the merger were allocated for the purpose of bolstering Fold’s growth in regards to its operations and treasury

The fintech company was founded in 2019 Founded in 2019 by William Reeves, Matthew Luongo, and Corbin Pon, Fold raised $20.2 million from 28 investors, according to PitchBook. Fold allows users to earn bitcoin rewards through its debit card, similar to credit card cashback. The company currently has 574,000 accounts.

In 2020, Fold partnered with Visa to introduce a new card that enables users to receive 1 to 2 percent of payment made back in the form of Bitcoin. In 2023, the Visa-Fold rewards program expanded to accommodate card users living in Latin America, Europe, and Asia Pacific regions.

Source link

You may like

Bitcoin

Top 5 Crypto Gainers of 2024 & Should You Hold Them?

Published

7 hours agoon

January 1, 2025By

admin

Meme coins had a great performance in 2024, with most of them beating popular names like Bitcoin, Ethereum, and Cardano. The market cap of all meme coins jumped to over $107 billion. Dogecoin was the best performer among the top ten coins. So, let’s explore whether the top 5 crypto gainers of 2024 will be good investments in 2025.

Best 5 Crypto Gainers In 2024

Dogecoin price soared by 252% in 2024, making it the best-performing major crypto. It was followed by XRP (238%), Tron (136%), Binance Coin (125%), and Bitcoin (121%).

Dogecoin Price Analysis

DOGE price jumped in 2024 and reached a high of $0.4836 in December. Recently, however, the coin has pulled back and stalled at $0.30, slightly above the 61.8% Fibonacci Retracement level on the weekly chart.

There are signs that the coin is forming a bearish flag pattern, which often leads to more downside. That is a sign that it will have a bearish breakout and possibly retest the key support at $0.2276, a popular continuation sign.

If this happens, as Dogecoin price may rebound and retest last year’s high of $0.4835. A move above that level will signal more gains in 2025, which may see it retest the all-time high of $0.7597. More gains may be triggered by the Dogecoin reserves rumors spurred by Elon Musk.

XRP Price Prediction

XRP was one of the top crypto gainers in 2024, with most of these gains happening in the fourth quarter. The weekly chart shows that the coin is slowly forming a bullish pennant chart pattern, a popular bullish sign. It has remained above the 38.2% retracement level and all MAs.

The bullish pennant is nearing its confluence level, pointing to more gains in 2025. Some of the potential catalysts for Ripple are Gary Gensler’s resignation, RLUSD stablecoin growth, and a potential XRP ETF approval.

Tron Price Forecast

The TRX price soared and reached a record high of $0.4486. This surge happened as its ecosystem boomed because of its meme coins and stablecoin transactions. Tron has pulled back and moved to the key resistance at $0.2500. It remains above the key support at $0.1794, the upper side of the cup and handle pattern.

Therefore, there is a likelihood that the Tron price will bounce back, and possibly retest last year’s high. Such a move would imply a 77% surge from the current level, making it a good crypto to buy and hold.

BNB Price Analysis

Binance Coin has one of the best technicals in the crypto industry. It has held steady above the 50 EMA and formed a cup and handle pattern. The ongoing consolidation is part of the handle section. Therefore, the BNB coin price may have a strong bullish breakout, and possibly reach a high of $1,000 later this year.

Bitcoin Price Forecast

Bitcoin was one of the top crypto gainers in 2024 as it jumped by 121%, beating American stock indices. On the weekly chart, it has remained above the key point at $73,700, the highest level in March last year, and the upper side of the handle section of the C&H pattern.

Bitcoin is in a bullish trend after bottoming in 2023, helped by MicroStrategy purchases and BTC ETF inflows. Therefore, Bitcoin price will soar in 2025, and possubly hit the psychological point at $200,000.

Frequently Asked Questions (FAQs)

Some of the top crypto gainers in the crypto industry in 2024 were the likes of VIRTUAL, Popcat, XRP, and ai16z.

The outlook for the crypto industry is bullish in 2025, helped by ETF inflows and approvals, friendly regulations, and low interest rates.

A highly conservative view is where Bitcoin rises to $200,000 in 2025.

crispus

Crispus is a seasoned Financial Analyst at CoinGape with over 12 years of experience. He focuses on Bitcoin and other altcoins, covering the intersection of news and analysis. His insights have been featured on renowned platforms such as BanklessTimes, CoinJournal, HypeIndex, SeekingAlpha, Forbes, InvestingCube, Investing.com, and MoneyTransfers.com.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

ADA

Analyst Says ‘Up Only’ Price Action on the Horizon for Bitcoin and Altcoins, Predicts New Leg Up for Cardano

Published

8 hours agoon

January 1, 2025By

admin

Widely followed analyst Michaël van de Poppe believes it’s only a matter of time before Bitcoin (BTC) and altcoins regain their bullish momentum.

The trader tells his 759,000 followers on the social media platform X that he thinks Bitcoin and altcoins are close to carving a local bottom.

According to Van de Poppe, crypto will witness renewed rallies once the market pullback is over.

“The correction is almost over and the time for up only is on the horizon for altcoins and Bitcoin.

Expecting a lot to come.

The optimal entries for longs on Bitcoin are around $90,000 and we’re getting those.”

Looking at Bitcoin itself, the crypto strategist thinks BTC will continue to see lackluster performance until US President-elect Donald Trump takes office.

“The scenario on Bitcoin remains the same.

I’m still expecting that we’ll see some more downward momentum pre-Trump and return upwards from there.

The ideal area is around $90,000.”

At time of writing, Bitcoin is trading for $93,855.

As for the native asset of the popular layer-1 platform Cardano, Van de Poppe thinks ADA is in the process of bottoming out. He also predicts that ADA will print a new all-time high late this year or in 2026.

“The scenario remains the same.

Pretty heavy run upwards and a 40% correction.

I think we’re getting towards the end of this correction, through which I’m expecting a new leg up for things like ADA.”

At time of writing, ADA is worth $0.85.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoin

Ethereum To Outperform Bitcoin In 2025? Report Predicts $8,000 ETH Price

Published

20 hours agoon

January 1, 2025By

admin

According to a recent report by Steno Research, Ethereum (ETH) is poised to outperform Bitcoin (BTC) in 2025. This outlook is attributed to historical trends and the anticipated impact of favorable cryptocurrency regulations following Republican presidential candidate Donald Trump’s victory in the November election.

Will 2025 Be The Year Of Ethereum?

While the overall cryptocurrency market surged to unprecedented heights this year – reaching an all-time high (ATH) total market cap of $3.9 trillion – Ethereum, the second-largest cryptocurrency, has lagged behind in terms of price performance.

Related Reading

However, Steno Research’s report suggests Ethereum could finally achieve a new ATH in 2025, driven by increased institutional investment and supportive regulatory developments. The report predicts that ETH could climb to at least $8,000 in the upcoming year.

Bitcoin is also expected to hit a new ATH of $150,000 in 2025, but Ethereum may more than double from its current price of $3,400. Additionally, the ETH/BTC trading pair is forecasted to rise from 0.035 to 0.06 within the next 12 months.

The weekly chart below illustrates ETH’s declining performance against BTC since September 2022. However, the pair is now hovering near a crucial support level at 0.035, with expectations of a rebound to the 0.06 level, which was last seen in February 2024.

Steno Research’s optimistic forecast for Ethereum underscores a potential bullish momentum for altcoins in 2025. Mads Eberhardt, an analyst at Steno Research, stated:

This expectation is partly based on the argument that Donald Trump’s U.S. presidential victory is more favorable for altcoins than for Bitcoin.

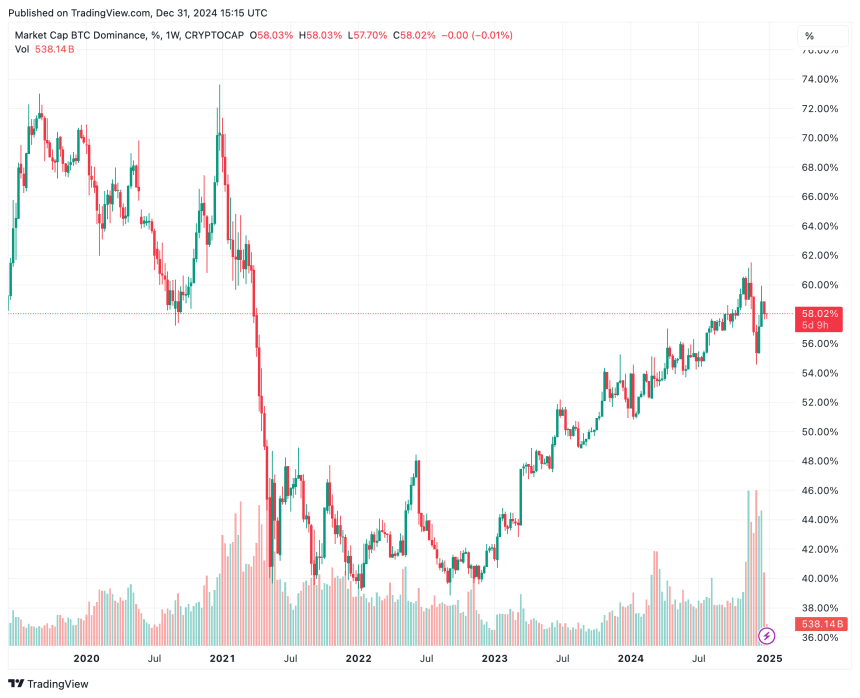

The report adds that Bitcoin dominance (BTC.D) – a metric used to gauge the proportion of the total crypto market cap commanded by BTC – is expected to tumble to as low as 45% from its current level.

The following weekly chart demonstrates BTC.D’s sustained uptrend since September 2022, rising from a low of around 39% to a peak of 61%. However, recent price action suggests a lower high has been formed, signaling a potential sharp decline to around 45%.

DeFi Activity To Rebound In 2025

The report further predicts a resurgence in decentralized finance (DeFi) activity within Ethereum’s ecosystem in 2025. Specifically, the total value locked (TVL) in decentralized applications is expected to hit a new high of $300 billion next year.

Related Reading

Renewed interest in DeFi could further drive higher altcoin prices in 2025. Notably, ETH jumped 10% following Trump’s November election victory, as improved sentiment surrounding DeFi regulations boosted market confidence.

In addition, strong inflows attracted by spot Ethereum exchange-traded funds (ETF) further strengthen the bullish case for ETH heading into 2025. At press time, ETH trades at $3,417, up 3% in the past 24 hours.

Featured image from Unsplash, charts from Tradingview.com

Source link

Pump Fun Moves 120,000 SOL To Kraken, Selloff Incoming?

Recounting Ethiopia’s Bitcoin Developments In 2024

These leading 6 cryptos are poised to explode

A Look At Historical Price Alignments

5 Important Crypto Events To Watch in January 2025

3 key reasons BNB price may surge to $1,155 in 2025

Top 5 Crypto Gainers of 2024 & Should You Hold Them?

Analyst Says ‘Up Only’ Price Action on the Horizon for Bitcoin and Altcoins, Predicts New Leg Up for Cardano

Saudi billionaire bets $1.8m on viral Solana alternative before Coinbase listing

AI Agent Confirms Ethereum Price Will Bounce To $4,200 Next

Crypto Crystal Ball 2025: Will VCs Go Crypto Crazy Again?

USUAL fee switch activation could reshape DeFi ecosystem in 2025

What’s Stopping Shiba Inu From Reaching $0.0001?

Ethereum holders flock to this presale gem for unmatched gains in 2025

Charles Hoskinson Delivers Bullish Cardano Price Forecast For 2025

Telegram users can send gifts to friends, TON fails to pump

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

A16z-backed Espresso announces mainnet launch of core product

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

What is World Chain? Human-First New Blockchain Goes Live

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trump’s Coin Is About As Revolutionary As OneCoin

Trending

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion2 months ago

Opinion2 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Sponsored3 months ago

Sponsored3 months agoCardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

News2 months ago

News2 months agoTether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

✓ Share: