24/7 Cryptocurrency News

Semler Scientific Achieves 99.3% BTC Yield Boosting Holdings To Over 2,300 BTC

Published

2 months agoon

By

admin

Semler Scientific, Inc., a medical technology company focused on combating chronic diseases, has expanded its Bitcoin holdings significantly. The company recently acquired 237 BTC, bringing its total reserves to 2,321 Bitcoin. This move reflects Semler’s ongoing strategy of increasing its cryptocurrency treasury to enhance shareholder value.

Semler Scientific Boosts Bitcoin Holdings to 2,321 BTC with 99.3% BTC Yield

In a recent statement, Semler Scientific confirmed acquiring 237 Bitcoin between December 16, 2024, and January 10, 2025. The acquisition was made at an average price of $98,267 per Bitcoin, including fees. These purchases added $23.3 million worth of Bitcoin to its reserves, which now total 2,321 BTC.

The company stated its total Bitcoin investment amounts to $191.9 million. Semler’s strategy focuses on using Bitcoin as a treasury asset to drive long-term growth and shareholder value.

Additionally, Semler Scientific funded its Bitcoin acquisitions through an at-the-market (ATM) offering and operational cash flow. As of January 10, 2025, the company had generated $121.8 million in gross proceeds under its ATM sales agreement with Cantor Fitzgerald.

The ATM program, which was expanded by $50 million in December 2024, enables the company to issue additional shares for strategic investments. This financing model underpins Semler Scientific’s continued ability to grow its Bitcoin holdings.

Interestingly, institutional Bitcoin adoption has risen with Michael Saylor’s MicroStrategy announcing another massive purchase of 2,530 BTC today, worth $243 million. This brings its total holdings to 450,000 BTC, acquired for $28.2 billion. Despite the move, MSTR stock declined after Bitcoin’s price dropped below key support levels.

Bitcoin Adoption and Key Performance Indicators

Since adopting its Bitcoin treasury strategy in July 2024, Semler Scientific has monitored its performance through a key performance indicator (KPI) known as BTC Yield. From July 2024 to January 2025, the company achieved a 99.3% BTC Yield, reflecting the effectiveness of its treasury management.

Bitcoin adoption remains integral to Semler Scientific’s financial strategy. The company has consistently emphasized its focus on increasing Bitcoin reserves.

Semler Scientific remains committed to its Bitcoin strategy, with plans to continue acquiring Bitcoin through proceeds from its ATM program and cash flow.

BTC Price Action

Meanwhile, Bitcoin’s 24-hour price action shows a 3.34% drop, falling from $94,820 to $91,700. Trading volume surged by 193.09%, reaching $58.6 billion, as the market cap stands at $1.81 trillion. BTC struggles to hold key support amid market volatility.

A recent report by CoinGape highlighted the reasons behind today’s drop in Bitcoin price. The decline is attributed to a strong jobs market diminishing hopes for rate cuts, technical exhaustion following Bitcoin’s rally to $100K, and profit-taking ahead of President-elect Donald Trump’s inauguration. Key support remains at $90,804.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

New SEC Chair Paul Atkins Holds $6,000,000 in Crypto-Related Investments – Here’s His Portfolio: Report

We’ve Turned A Generation Of Bitcoiners Into Digital Goldbugs

Solana DEX Raydium’s Pump.fun Alternative Is Going Live ‘Within a Week’

Google Cloud joins Injective as validator, expands Web3 tools

U.S. House Stablecoin Bill Poised to Go Public, Lawmaker Atop Crypto Panel Says

South Korea Urges Google To Block 17 Unregistered Crypto Exchanges

24/7 Cryptocurrency News

South Korea Urges Google To Block 17 Unregistered Crypto Exchanges

Published

6 hours agoon

March 26, 2025By

admin

As South Korea continues to strengthen its crypto regulations, the Financial Intelligence Unit (FIU) has requested Google to block access to 17 unlicensed crypto exchanges. These unregistered virtual asset service providers (VASPs) include KuCoin, MEXC, Phemex, XT, CoinEx, BitMart, and Poloniex, among many others.

Reportedly, Google has responded positively to the FIU’s request. As a result, South Korean users will no longer be able to access these listed platforms, effective yesterday.

South Korea Tightens Regulations: Google Blocks 17 Crypto Exchanges

In a recent development, South Korea’s FIU has requested Google to block users from accessing 17 unlicensed crypto exchanges, including KuCoin, MEXC, Phemex, XT, CoinEx, BitMart, and Poloniex. As part of the move, Google blacklisted these platforms since yesterday.

Notably, South Korea’s decision to block access to these crypto exchanges comes amid growing concerns over crypto theft and money laundering activities. Recently, South Korea announced its potential regulatory revamp in a move to strengthen the country’s anti-money laundering rules.

Google Restricts Downloads and Updates

The Financial Services Commission (FSC) enlisted 22 unregistered platforms on March 26. In response to the South Korean financial regulator’s request, Google has blocked users’ access to the crypto exchanges that are deemed unregistered. In addition, the Google Play Store will not allow users to download or update the applications of these crypto exchanges.

Meanwhile, the FIU asserted that the financial watchdog is collaborating with Apple Korea and the Korea Communications Standards Commission (KCSC) to block both internet and App Store access to these exchange platforms.

Interestingly, the FSC believes that this strategic measure could help prevent money laundering activities involving crypto assets and potential future harm to local users. This move comes just a few days after the FIU launched a crackdown on these exchanges. It is alarming that KuCoin, one of the top crypto exchanges, is also facing intense scrutiny from FIU.

South Korea’s Crypto Regulations: What To Expect More?

Significantly, South Korean regulators mandate crypto exchanges to adhere to the country’s licensing rules before offering services. The restrictions apply to foreign platforms that cater to Korean users by offering Korean-language interfaces, conducting targeted marketing campaigns, or facilitating transactions in Korean won.

According to FIU’s official statement, the platforms that violate these laws could face up to five years in prison or fines of up to 50 million won (approximately $34,150).

South Korea vs United States: Crypto Regulatory Views

South Korea’s rigid crypto regulations come amidst the United States’ loosened norms under President Donald Trump. While South Korea is restricting access to crypto exchanges and tightening regulations, the US is dismissing prevailing crypto lawsuits.

This distinct regulatory trend highlights the two countries’ differing approaches to balancing innovation and investor protection in the rapidly evolving crypto market. The wider implications of these approaches remain differing with South Korea’s caution likely to influence Asian markets and the US’s permissiveness potentially shaping Western regulatory norms.

Nynu V Jamal

Nynu V Jamal is a passionate crypto journalist with three years of experience in blockchain, web3, and fintech spheres. She has established herself as a knowledgeable and engaging voice in the cryptocurrency and blockchain space. Her experience as an Assistant Professor in English Language and Literature has further added to her quest for crafting informative, well-researched, and accessible content.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Why Is Pi Coin Price Down Another 12% Today?

Published

14 hours agoon

March 26, 2025By

admin

Pi Network continues to remain under strong selling pressure as native cryptocurrency Pi Coin has corrected another 12% today, with its price dropping to $0.81 support levels. With this, it has extended its weekly losses to 28% amid delays in mainnet launch, Binance listing, etc. and initial investor sentiment waning significantly. Investors are turning anxious about whether the Pi Coin price could stage an upside above $1 anytime soon or not.

Pi Network Core Team Needs to Step Up

With delays in plans of a mainnet launch, listing on Binance, or the Pi Domain auction, the Pi community members are seeking answers from the Core team, asking them to step up the game, as the Pi Coin price faces a steep fall from $3 to $0.82. Community members believe that the recent turbulence comes as the Core Team (CT) remains silent on critical updates.

Furthermore, there have been allegations that the Pi core team has been drifting away from its promise of full decentralization, to now attracting big institutions. Large corporations handling billions of dollars in daily transactions naturally prioritize security and transaction speed over complete decentralization.

With these opposing interests, the Pi Network core team seems to have made some compromises while trying to strike a balance between inclusivity and global adoption. Popular community member, Dr. Altcoin noted:

“We should embrace this collaboration between everyday users and big institutions. High-volume trading driven by businesses is what is required to drive our utilities, and that will ultimately push the price upward. The Core Team should also remain committed to rewarding the Pi community. Without the Pi community, the Pi Network would have been just another typical memecoin story”.

What Happens to Pi Coin Price Next?

Despite the strong community back, the Pi Coin price has been seeing a one-directional downside all the way to $0.82. Crypto analyst Moon Jeff has issued a bold prediction regarding Pi Network’s price trajectory. According to Jeff, the token is poised to decline to $0.60, which he identifies as its last significant support level.

Despite this, the analyst remains optimistic of the Pi Coin price recovery, suggesting that a rebound from this point could spark a rally toward the $5 mark. Dr. Altcoin also shared a similar outlook noting: “Let’s HODL and buy both Patience and Pi together while they’re still available. Let’s also not be surprised if Pi shoots up to $3.14 in the coming weeks or even to $10 in the coming months”. Recent reports also suggest a projected PI listing on the crypto exchange Upbit.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Cardano Price Eyes $0.85 as Whales Scoop Up 240 Million ADA

Published

22 hours agoon

March 25, 2025By

admin

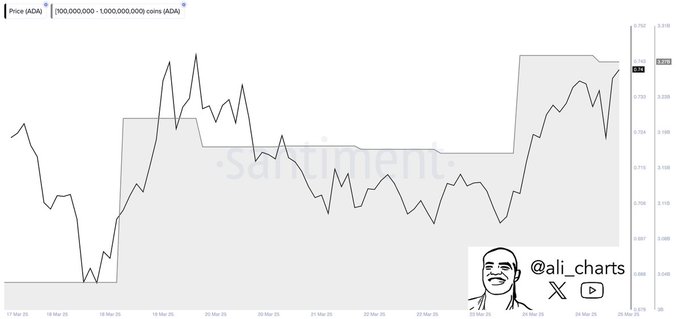

Cardano (ADA) continues to show signs of recovery, with whales significantly accumulating the token. Recently, whale addresses holding between 100 million and 1 billion ADA have purchased over 240 million ADA, worth approximately $175 million. This surge in whale activity suggests confidence in Cardano’s next performance, and the next key price target for ADA could be $0.85.

Whale Activity Supports ADA Price Recovery

Whales have been playing a significant role in the recent price movement of Cardano. In the last one week, the number of whale addresses is on a rise, and they have been accumulating ADA by buying it at higher volumes at a cheaper price. Such a move by the large investors means they have confidence in the asset in the long-run and an expectation of a change in trend, in this case a positive one.

The 240 million ADA purchased by whales serves as a strong indicator that large investors are positioning themselves for a future price increase.

Concurrently, based on the Mean Coin Age, long-term holders have not been selling the ADA tokens therefore they do not consider it a dump asset but rather a token with a massive rally potential. This could help contain the price support for ADA at higher levels and avoid sharp declines in the near term.

Cardano Price Struggles to Break Resistance

Nevertheless, the bullish indications from whale accumulation have been met with a pushback at $0.77 in price. In the previous weeks, ADA price has not managed to trade beyond this level, therefore, it cannot be considered a full recovery. Therefore, the $0.77 area represents the key level that will determine the formation of an uptrend since crossing a price higher than this level will unlock further buy signals.

There is a lack of consistent buying pressure in Cardano’s recent price action that hasn’t allowed ADA to break past significant resistance levels. However, the support from whales and long-term holders may help ADA price to avoid this situation. At press time, Cardano price was trading at $0.7476, a 1.20% rally from the intraday support of $0.7222.

If ADA price can cross above $0.77 then the next level of significant resistance may be $0.85 in order to pump for another round of higher price action.

Will ADA Price Soar To $5? Analyst Weighs In

Crypto analyst Javon Marks suggests that in accordance with the prior cycles it is possible to see the next move of ADA price towards the first level of the 1.272 Fibonacci extension, which in this case is $5.36. This target would signify over 6.8 times increase from the current position and more than 585% increase in the price rally.

In the shorter term, the 1.272 Fibonacci extension of the current base suggests a target of approximately $3.95. This target is in line with other past bullish runs that Cardano has exhibited where most of the movements occur after the formation of consolidation patterns.

Moreover, according to crypto analyst LLuciano_BTC, the Cardano price is showing signs of a bullish flag breakout after a period of consolidation. If the ADA price breaks above the descending resistance with strong volume, it could trigger a significant upside move, potentially toward $1.80.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

New SEC Chair Paul Atkins Holds $6,000,000 in Crypto-Related Investments – Here’s His Portfolio: Report

We’ve Turned A Generation Of Bitcoiners Into Digital Goldbugs

Solana DEX Raydium’s Pump.fun Alternative Is Going Live ‘Within a Week’

Google Cloud joins Injective as validator, expands Web3 tools

U.S. House Stablecoin Bill Poised to Go Public, Lawmaker Atop Crypto Panel Says

South Korea Urges Google To Block 17 Unregistered Crypto Exchanges

Bitcoin Rally To $95K? Market Greed Suggests It’s Possible

Polymarket faces scrutiny over $7M Ukraine mineral deal bet

Morgan Stanley Warns of Short-Lived Stock Market Rally, Says Equities To Print ‘Durable’ Low Later in the Year

Stablecoins Are The CBDCs

Ethereum Volatility Set to Surge in April as Derive Flags Bearish Sentiment Shift

Crusoe Energy sells Bitcoin mining arm to NYDIG, turns focus to AI

What Next For XRP, DOGE as Bitcoin Price Action Shows Bearish Double Top Formation

Why Is Pi Coin Price Down Another 12% Today?

XRP Price Struggles at Key Resistance—Can Bulls Force a Breakout?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: