News

Shiba Inu dev proposes crypto strategic hub in the US, SHIB pumps 40%

Published

5 months agoon

By

admin

Shiba Inu has surged following lead developer Shytoshi Kusama’s proposal for a strategic blockchain innovation hub in the U.S.

The announcement coincided with a major price pump for Shiba Inu (SHIB).

Shiba Inu developer shares vision

Kusama unveiled an ambitious proposal to establish a “Silicon Valley for crypto” just days before the U.S. presidential election.

The proposed strategic hub is estimated to cost several billion dollars. This plan aims to position the U.S. as a global leader in blockchain innovation.

Kusama stated:

“Not just for Shib, but as a way to have a Silicon Valley for crypto, I proposed this in hopes that the United States would move forward with embracing innovation and, in doing so, catch up to the rest of the world.”

Shiba Inu pumps 40%

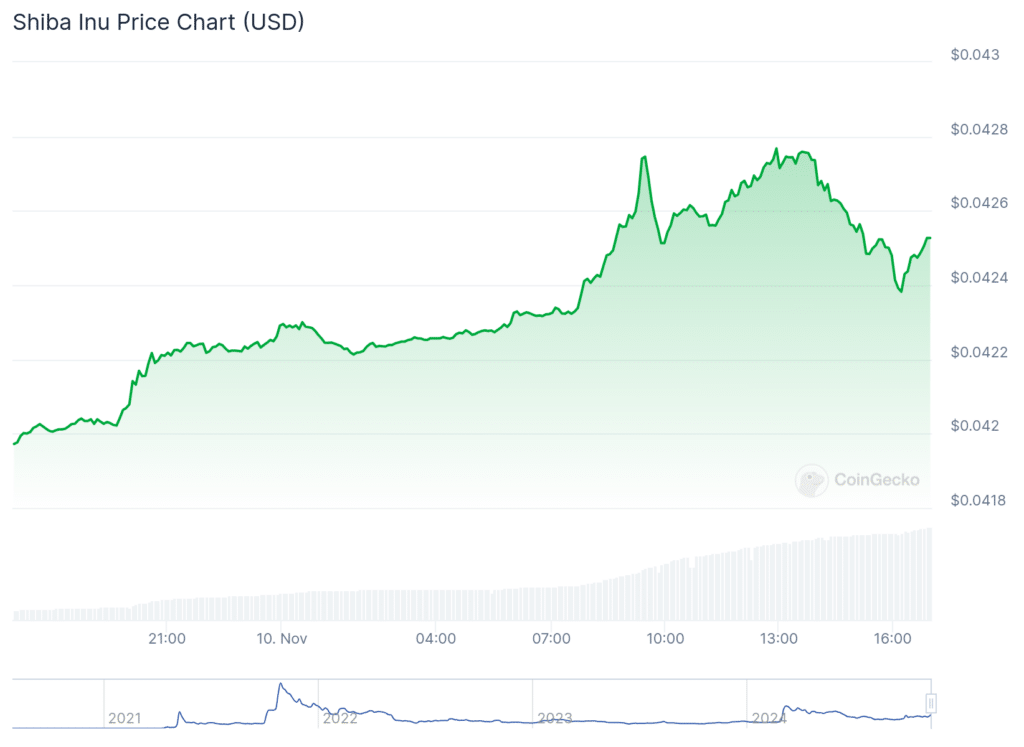

The market responded enthusiastically to the proposal. SHIB’s price reached $0.00002727 — a 40% increase in 24 hours.

The token’s trading range pumped from $0.00001925 to $0.00002768, while weekly gains exceeded 65%.

Despite the impressive surge, SHIB remains 68% below its all-time high of $0.00008616 from October 2021.

The recent surge cannot be directly attributed to Kusama’s proposal. One of the major reasons could be the overall crypto-bullish market conditions.

The Shiba Inu foundation plans to officially present the proposal to the incoming administration, suggesting that funds gathered through their D.O.G.E. initiative could support these innovations.

“This is a chance to let the world know we are still here, our technologies to be adopted, and proof that our innovations will benefit the globe,” Kusama emphasized.

Source link

You may like

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Apple

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Published

2 minutes agoon

April 16, 2025By

admin

Apple has delisted 14 crypto apps in South Korea at the request of one of the country’s regulators.

South Korea’s Financial Intelligence Unit (FIU), an anti-money laundering agency, issued the requests.

The regulator claims the banned apps involved foreign virtual asset operators conducting “unreported business activities.”

Apple’s list of blocked apps includes the crypto exchange giants KuCoin and MEXC. Last month, Google Play delisted both of those exchanges and 15 other crypto operators at the FIU’s request.

The regulatory crackdown materializes as crypto adoption swells across South Korea. The Seoul-based news agency Yonhap, citing data released by the South Korean government, reported that as of late February of this year, 16.29 million people have opened accounts on Upbit, Bithumb, Coinone, Korbit and Gopax, the country’s top five domestic crypto exchanges. The country currently has an overall population of nearly 52 million.

Banks in South Korea have also reportedly been rushing to partner with crypto firms as the country’s digital asset regulations become less restrictive.

In February, South Korea’s Financial Services Commission announced that the country would launch a pilot program in the second half of 2025 that allows 3,500 corporate entities to buy crypto for investment and financial purposes. Corporate crypto transactions have been banned in the country since 2017.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Blockchain

Athens Exchange Group eyes first onchain order book via Sui

Published

3 minutes agoon

April 16, 2025By

admin

Greek exchange Athens Exchange Group has moved closer to adopting a Sui-based order book following its collaboration with Mysten Labs.

On April 16, the Sui (SUI) team announced that Athens Exchange Group, or ATHEX, had finalized the technical design for an onchain fundraising platform that will leverage zero-knowledge proofs on the Sui blockchain.

ATHEX’s ZK-powered fundraising platform will help the stock exchange enhance its offering with privacy and speed, bolstering its growth in traditional capital markets.

This nod to blockchain innovation and integration follows Sui contributor Mysten Labs’ partnership with the Athens Exchange Group in March 2024.

The collaboration between the two platforms aims to leverage their respective ecosystems to deliver the technical design for ATHEX’s Electronic Book Building (EBB), the exchange’s fundraising feature. By tapping into Sui’s technology and tooling, the company will be able to integrate zero-knowledge proofs into EBB’s bidding process.

Currently, Athens Exchange Group and Mysten Labs are eyeing a proof of concept, with this a key milestone towards building the first onchain order book for a stock exchange.

“The focus on privacy-preserving mechanisms, combined with Sui’s unparalleled speed and security, will enable us to build a state-of-the-art PoC that can evolve into a full-fledged onchain order book, setting a new benchmark for the industry,” said Dr. Kostas Kryptos Chalkios, Chief Cryptographer and Co-Founder of Mysten Labs

ATHEX will benefit from a platform that combines privacy-preserving mechanisms, speed and security.

Sui’s capacity to scale and handle transactions in parallel, with industry-leading throughput will be crucial to the stock exchange.

“By integrating zero-knowledge proofs, we aim to uphold the highest standards of compliance and data integrity while boosting operational efficiency for all market participants,” said Nikos Porfyris, chief operating officer at Athens Exchange Group.

Sui is the 10th largest blockchain by total value locked per DeFiLlama with over $1.18 billion in TVL.

Source link

cryptocurrency

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Published

8 hours agoon

April 16, 2025By

admin

AI-focused crypto tokens are seeing a dip as Nvidia, the top AI chipmaker fueling the space, could soon take a major financial hit due to new U.S. export restrictions.

In a filing on April 14, Nvidia said it expects around $5.5 billion in charges for the first quarter of fiscal year 2026 because of U.S. government rules limiting its AI chip sales to China.

On April 9, officials told Nvidia it now needs special export licenses for its popular H20 chips and others with similar capabilities. The new restrictions target China, Hong Kong, and Macau, with the government warning that the chips could end up powering Chinese supercomputers.

The H20 chip is the most advanced AI chip Nvidia is currently allowed to sell in China under the earlier rules. It’s reportedly been used by Chinese AI startup DeepSeek to train models, something that has raised concerns among U.S. lawmakers.

Even though Nvidia said it plans to spend hundreds of millions over the next four years making some AI chips in the U.S., that hasn’t stopped the stock from sliding after its latest filing and the expected hit to future revenues. NVDA dropped 6.3% in after-hours trading on April 15 to $105.10, and it’s down about 16.45% so far this year.

Nvidia’s decline mirrors a wider pullback in tech as Trump’s tariff escalation rattles investor confidence across the sector. Other prominent tech stocks were also in the red, with Apple down 0.20% from the previous close to $202.14, Microsoft off 0.56% at $385.73, Alphabet sliding 1.71% to $156.31, and Amazon dropping 1.33% to $179.59.

Adding to Nvidia’s troubles, a “death cross” has formed on the 1-day NVDA/USD chart, a bearish technical signal where its 50-day moving average drops below the 200-day one. The last time this happened was in April 2022, and Nvidia’s stock plunged nearly 50% in the following six months.

That’s got investors in AI crypto tokens on edge, as these tokens have often reacted to Nvidia-related news mostly due to the fact that Nvidia’s hardware plays a central role in powering the AI infrastructure that many of these projects rely on.

For instance, in December, reports of China launching an antitrust probe into Nvidia caused the AI crypto token market cap to drop by over 14% in a single day. In the past, a surge in the Nvidia stock price has also resulted in bullish rallies for AI tokens.

Following Nvidia’s latest filing, the total market cap of AI-related tokens has fallen 3.7% in the past 24 hours, now sitting at around $20.1 billion. Trading volume also declined, signaling weaker demand.

Near Protocol (NEAR), the biggest AI crypto by market cap, slid 5.3% over the past day. Other major tokens like Internet Computer (ICP), Render (RENDER), Sei (SEI), Virtuals Protocol (VIRTUAL), and Akash Network (AKT) also lost between 5% and 12%.

Source link

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

China selling seized crypto to top up coffers as economy slows: Report

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x