Markets

Solana comeback? Moving averages keep bullish hopes alive

Published

3 months agoon

By

admin

Solana price has retreated by 16.8% from the year-to-date high as the recent crypto momentum faded.

Solana (SOL) was trading at $220 on Sunday, bringing its market cap to $105 billion, and making it the fifth-biggest cryptocurrency.

SOL has numerous catalysts that could propel the price higher in the longer term. It has become the biggest competitor to Ethereum (ETH), the biggest blockchain in the world.

According to DeFi Llama, its total value locked has jumped by 18% in the last 30 days, bringing its total assets to over $9.12 billion. It has about $30 billion worth of stablecoins in its ecosystem.

Solana has also become the biggest player in the Decentralized Exchange industry. Its seven-day volume stood at over $29.7 billion, higher than Ethereum’s $21 billion. The biggest Solana DEX networks are Raydium, Orca, and Meteora.

Solana has a big share in the Decentralized Public Infrastructure and meme coin industry. Its DePIN networks like HiveMapper and Helium are doing well, while all Solana meme coins have a market cap of over $19 billion, led by Dogwifhat, Bonk, Peanut the Squirrel, and Popcat.

HiveMapper is aiming to be a better mapping solution than Google Maps. According to its website, it has already mapped about 17 million kilometers of roads and has a global coverage of 29%. Helium is disrupting the wireless industry by building a decentralized network.

Meanwhile, expectations are high that the incoming Trump administration will loosen crypto regulations, and potentially approve a spot SOL ETF. There are chances that such a fund will attract institutional capital, as we have seen with Ethereum, which has attracted over $2.26 billion in inflows in the past few months.

Solana price analysis: bullish patterns forms

The daily chart shows that the SOL price peaked at $264.40 on Nov. 22. It pulled back to $220, but dropped and retested the crucial support level at $205 — the highest swing in March this year, and the upper side of the cup and handle pattern.

A C&H pattern is made up of a horizontal line and a rounded bottom, and is a popular bullish continuation sign. Solana has also remained above the 50-day moving average — a sign that the bull market is still there.

It has formed a falling wedge pattern, a popular bullish sign. Therefore, the coin will likely have a strong bullish breakout in the coming weeks. The first target will be the year-to-date high of $264, followed by $400.

Source link

You may like

Analyst Sets Dogecoin Next Target As Ascending Triangle Forms

Crypto exchange Kraken exploring $1B raise ahead of IPO: Report

Bitcoin and Stock Market Rally Hard as White House Narrows Scope of Tariffs

Tabit Insurance Raises $40 Million Bitcoin-Funded Insurance Facility

Strategy’s Bitcoin Holdings Cross 500,000 BTC After Stock Sales

PwC Italy, SKChain to launch self-sovereign EU digital ID

Markets

White House to Scale Back Tariffs, Bitcoin Gains on Eased Economic Jitters

Published

13 hours agoon

March 24, 2025By

admin

Bitcoin regained momentum Sunday and nudged up by as much as 2.7% following reports that the White House has signaled a more targeted approach to its April 2 tariffs, confirming it would likely omit sector-specific duties while still implementing “reciprocal tariffs” on major trading partners.

The crypto market saw higher gains amid reports on Sunday afternoon from Bloomberg and the Wall Street Journal that Trump’s administration is narrowing its tariff strategy.

Bitcoin traded above $86,700 by Sunday midnight, roughly twelve hours after the aforementioned reports emerged, showing resilience after volatile swings over the past week, which saw lows of $81,200.

The alpha crypto is up 3.3% on the day, while the rest of the market has tracked up by 0.7% in total market cap, data from CoinGecko shows.

This shift from a broader tariff implementation to a more targeted approach has eased concerns about immediate economic disruption.

Previous market fears had centered on Trump’s declaration of April 2 as “Liberation Day,” when he planned to impose sweeping tariffs across multiple sectors.

Citing Treasury Secretary Scott Bessent’s pronouncements last week, the WSJ reported that the administration is looking to have tariffs applied to “about 15% of nations with persistent trade imbalances with the U.S.”

It follows the Federal Reserve’s projections last week that it would hold interest rates steady. Meanwhile, two weeks before, the Consumer Price Index saw cooling numbers, marking 2.8% from February, which some investors are interpreting as signs of easing financial conditions.

While tariffs do not directly impact Bitcoin and broader crypto prices short-term, Zach Pandl, head of research Grayscale, previously told Decrypt Trump’s trade policies are part of a larger trend, with Bitcoin being “swept up in broader macro uncertainty.”

This suggests that “higher policy uncertainty has caused investors to reduce portfolio risk across the board,” Pandl explained.

A study from Bloomberg shows that President Trump’s implemented or threatened tariffs have affected at least $1.8 trillion in global trade, imposing 25% duties on worldwide steel and aluminum, 25% on non-compliant USMCA goods, and an additional 10% on Chinese imports.

An additional 25% tariffs on E.U. goods was also proposed. Responding to these threats and singling out Trump’s crypto initiatives, an ECB official said Sunday last week that financial crises “often originate in the United States and spread to the rest of the world.”

Meanwhile, the same study cites Bloomberg Economics forecasting a reduction in U.S. GDP by up to 0.7% while increasing inflation by 0.4%, despite Trump’s claims that the tariffs, as economic measures, are designed to curb illegal immigration and address trade imbalances.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Blockchain

Trump-Linked WLFI Snaps Up 3.54M MNT After Last Week’s Hard Fork

Published

15 hours agoon

March 24, 2025By

admin

World Liberty Financial (WLFI), a DeFi project backed by President Donald Trump’s family, has acquired substantial amounts of Mantle’s MNT token following last week’s major technological upgrade of the network.

WLFI purchased about 3.54 million MNT for nearly $3 million USDC for an average purchase price of 84 cents, according to data sources Lookonchain and Arkham Intelligence.

The recent purchase has increased WLFI’s coin holdings, which include tokens like ETH, WBTC, TRX, LINK, AAVE, ENA, and others, to over $340 million. However, the Trump family-backed outlet still faced a paper loss of $111 million as of writing.

MNT is the native cryptocurrency of the Mantle Network, serving as a utility token for gas fees and a governance token for the layer 2 ecosystem focused on scaling Ethereum.

The Mantle Mainnet hard fork, or backwards-incompatible upgrade, took effect on March 19, activating EigenDA on the network. EigenDA is a secure, high-throughput, decentralized data availability service on Ethereum.

The EigenDA integration is said to boost Mantle Network’s scalability without hitting data rate limits, reportedly resulting in a 15 MB/s throughput. In other words, the network can process more transactions per block. Additionally, the upgrade has made the Mantle Network better compatible with Ethereum’s impending Pectra upgrade.

MNT traded at 6% higher on the day at 83 cents at press time, according to data sources CoinDesk and TradingView.

Source link

Bitcoin

Crypto stocks mirror market-wide slump in Bitcoin, altcoins

Published

1 day agoon

March 23, 2025By

admin

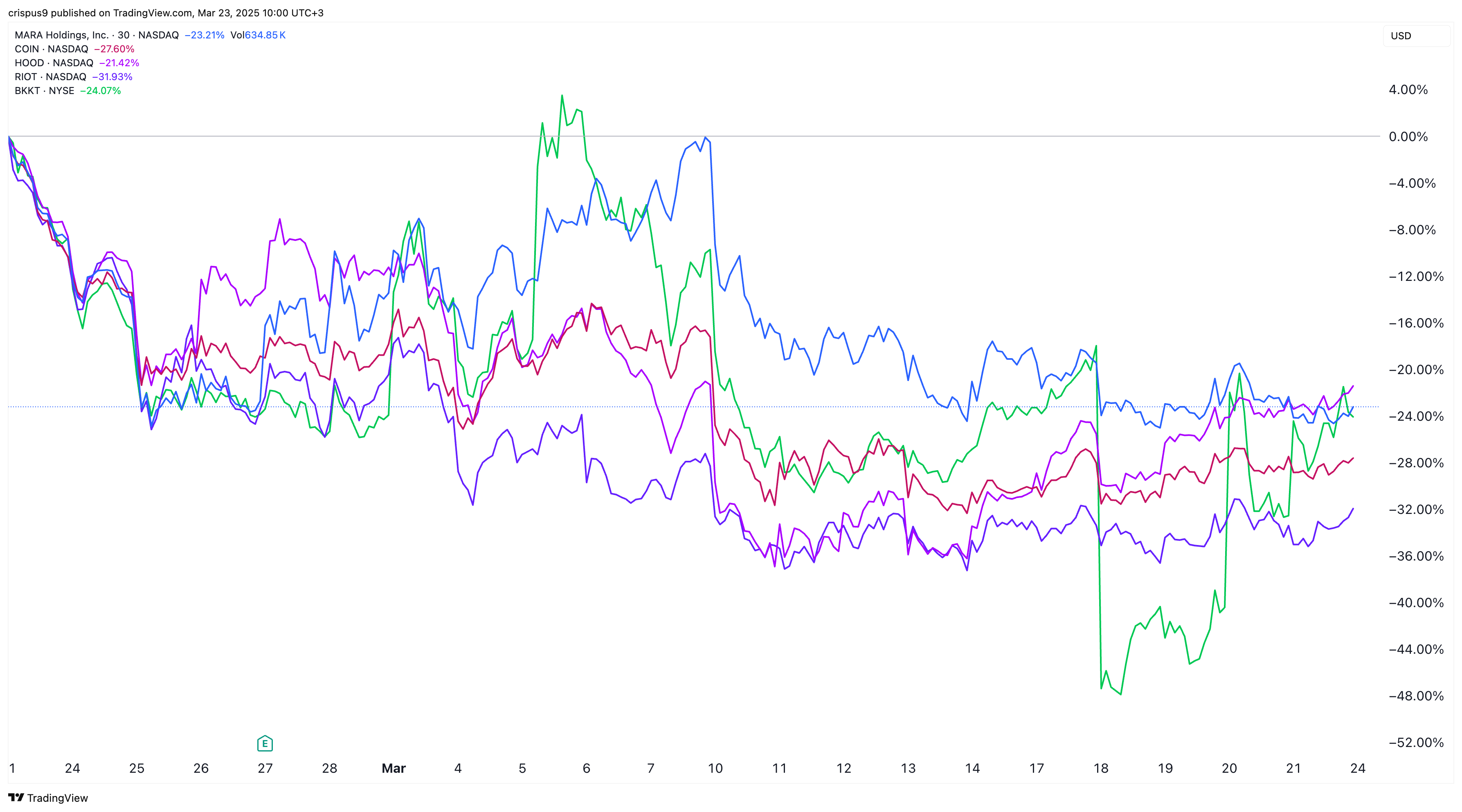

Crypto stocks are caught in a brutal free fall, mirroring the market-wide slump in Bitcoin and altcoins.

Coinbase, the biggest crypto exchange in the U.S., has crashed from nearly $350 per share in November to $190. This decline has brought its market cap from $86 billion to $48 billion—a $38 billion wipe out.

Michael Saylor’s Strategy, has also shed billions of dollars in value. Its market cap dipped from a high of $106 billion last year to $79 billion today. The company, formerly known as MicroStrategy, has continued to accumulate Bitcoin and now holds 499,226 Bitcoins in its balance sheet.

Robinhood stock crashed from $66.85 earlier this year to $45, erasing $18 billion in value. While Robinhood is known for providing retail trading, it has become a major player in the crypto market. It hopes to play a bigger role in the sector when it completes its BitStamp acquisition later this year.

Bitcoin (BTC) mining stocks have also plunged as the struggling BTC price hurts margins. Mara Holdings, formerly known as Marathon Digital, has lost over $4.6 billion in valuation. Other similar companies like Riot Blockchain, Core Scientific, CleanSpark, Hut 8 Mining, and TeraWulf have also shed billions in valuation.

Bitcoin, altcoin prices plummet

These crypto stocks have dropped because of the ongoing decline of Bitcoin and other altcoins. According to CoinMarketCap, the market cap of all cryptocurrencies has dropped from over $3.7 trillion in 2024 to $2.7 trillion today.

Bitcoin has dropped from $109,300 in January to $85,000 at last check. Most altcoins have done worse. For example, Solana meme coins have shed over $18 billion in value as their combined market cap sank.

Crypto prices and crypto stocks have dropped despite the Trump administration’s pledge to be highly supportive of the sector via initiatives like a Strategic Bitcoin Reserve.

The Securities and Exchange Commission has also enacted some friendly policies and ended most of the lawsuits in the industry. It has ended lawsuits brought on companies like Coinbase, Ripple Labs, and Kraken.

Whether these crypto stocks bounce back remains to be seen. Crypto analysts have a mixed outlook on the industry. Some observers expect Bitcoin’s price to recover, with Standard Chartered predicting it will hit $500,000 over time.

Ki Young Ju, CryptoQuant’s founder, estimates that the crypto bull run has ended, noting that all indicators were bearish.

Source link

Analyst Sets Dogecoin Next Target As Ascending Triangle Forms

Crypto exchange Kraken exploring $1B raise ahead of IPO: Report

Bitcoin and Stock Market Rally Hard as White House Narrows Scope of Tariffs

Tabit Insurance Raises $40 Million Bitcoin-Funded Insurance Facility

Strategy’s Bitcoin Holdings Cross 500,000 BTC After Stock Sales

PwC Italy, SKChain to launch self-sovereign EU digital ID

PwC Italy, SKChain Advisors to Build Blockchain-Based EU Digital Identity Product

Bitcoin Price Set To Explode as Global Liquidity Z Score Flashes Buy Signal

Crypto Braces For April 2 — The Most Crucial Day Of The Year

DYDX shoots up 10% as buybacks get a quarter of protocol revenue

$7,000,000 Up for Grabs As Feds Tell Crypto Fraud Victims To Come Recover Their Money

Berachain rolls out next phase of proof-of-liquidity system

White House to Scale Back Tariffs, Bitcoin Gains on Eased Economic Jitters

More is Less: Feature Fatigue is Driving Web3 Users Away

Trump-Linked WLFI Snaps Up 3.54M MNT After Last Week’s Hard Fork

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x