Blockchain

Solana gains top spot in daily net inflows with $12M, beating all other blockchains

Published

4 months agoon

By

admin

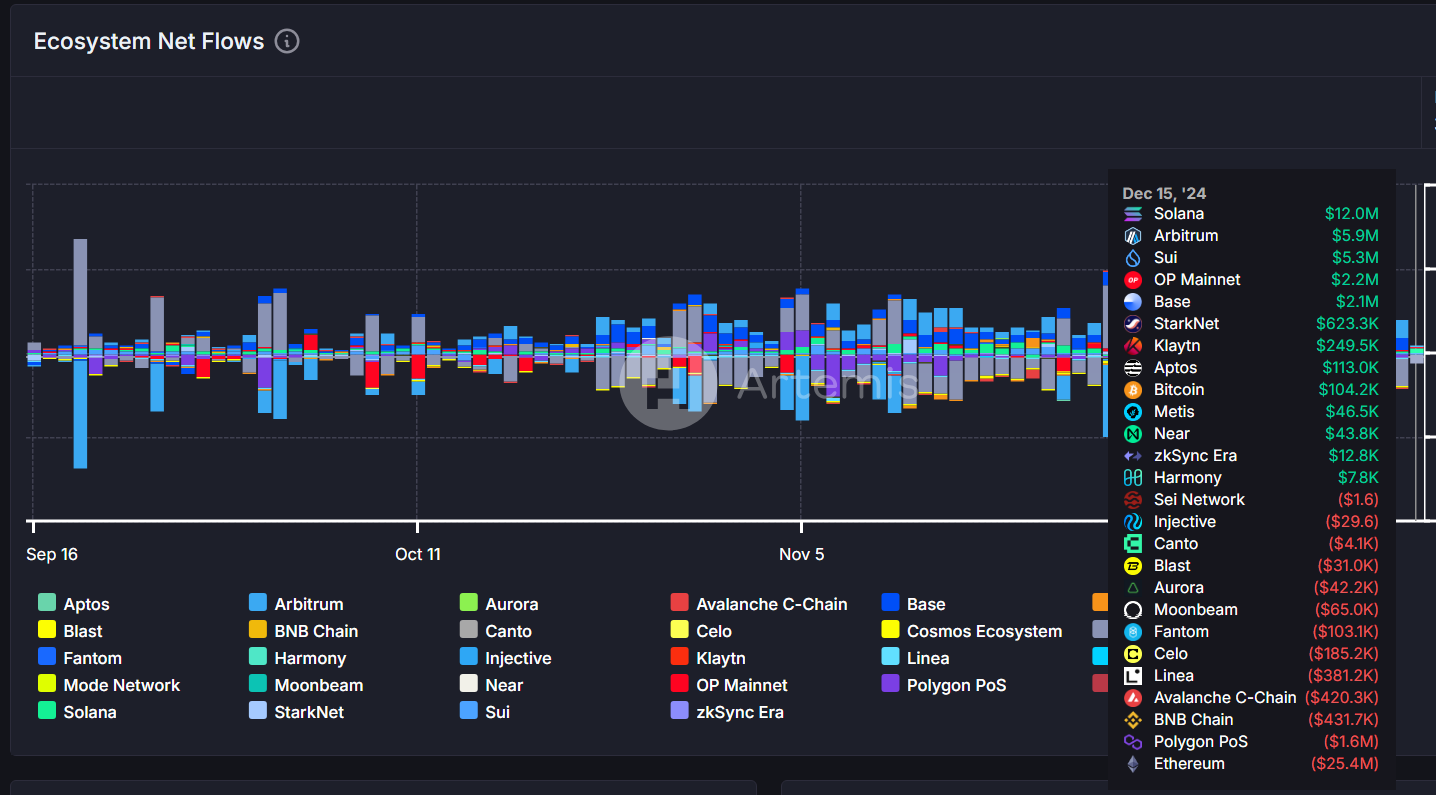

Solana’s daily net inflows have surpassed all other major blockchains, including Sui, Base, Arbitrum and Ethereum. On Dec. 15, the Solana network accumulated net inflows of $12 million.

According to data from Artemix.XYZ, Solana (SOL) recorded the highest number of daily net inflows among the top 20 major blockchains on Dec. 15. Solana’s net inflow of $12 million was larger than the other two blockchains in the top 3, Arbitrum (ARB) and Sui (SUI), combined.

Solana regained the top spot a month after the blockchain last held it on Nov. 17 with $17.6 million. On Dec. 15, Solana dethroned Arbitrum, yesterday’s reigning champion, which held the number two spot with a daily net inflow of $5.9 million.

In third place, Sui accumulated a daily net inflow of $5.3 million, followed by OP Mainnet with $2.2 million and Base with $2.1 million. At the very bottom of the list is the Ethereum (ETH) blockchain with a net outflow of $25.4 million.

A recent surge in Solana revenue is often linked with a similar surge in the meme coin sector, specifically from pump.fun, a launchpad site for Solana-based meme coins. But that is not the case this time around.

According to data from Dune analytics, pump.fun saw its daily revenue dip slightly by 6% from $2.67 million on Dec. 14 to $2.51 million on Dec. 15. Pump.fun’s revenue peaked on Nov. 23 with $14.3 million, but has failed to pass the $5 million mark ever since.

Solana’s end-of-year sprint

In the past few months, Solana has achieved quite a few milestones as the year is nearing its end. As previously reported by crypto.news on Dec. 13, Solana was deemed the fastest-growing blockchain, with an annual growth of up to 83%. Solana even surpassed the largest blockchain in the world, Ethereum.

In November, Solana’s monthly decentralized exchange trading volume reached $109.73 billion, surpassing the $100 billion threshold for the first time in crypto history. The leap in Solana’s trading volume came a few days after Solana’s price went beyond $200 for the first time in seven months of trading after a 8.69% rise. The token later reached an all-time high of $263.21 on Nov. 23.

At the time of writing, Solana is currently trading hands at $220.76, having gone up by nearly 2% in the past 24 hours of trading, according to data on crypto.news. Solana has a market cap of around $105 billion and a fully diluted valuation which stands at more than $130 billion.

Source link

You may like

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

AI

AI flattens creativity. Blockchain is how we save it

Published

1 week agoon

April 19, 2025By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Our timelines were just filled with a bunch of pastel Miyazaki’s ghosts. Studio Ghibli-style AI generations have become the internet’s new favorite aesthetic. PFPs and marketing campaigns were reborn overnight in the watercolor warmth of Spirited Away. Selfies rendered as soot sprites.

The results are charming yet deeply unsettling. Why? Because Hayao Miyazaki didn’t draw them––and no one asked permission. This isn’t just a copyright problem. It’s an authenticity problem where there is a growing inability to see, trace, or understand the origins of the content that shapes our culture.

In the chaos of AI-generated images and memecoins, we’re watching creativity get flattened, authorship obscured, and ownership erased. If that feels like a plague, it’s because it is.

The unfettered mess unleashed by generative AI has caused a powerful use case for blockchain to emerge: proof of provenance and onchain verifiability for agentic creation. By anchoring content to public, immutable ledgers, blockchain enables creators to prove authorship, timestamp originality, license works programmatically, and track derivatives across the network—without relying on centralized gatekeepers.

With the tools of blockchain, creators can participate in fairer, more transparent ecosystems that reward origin and empower open-source and composable content systems.

The collapse of creative clarity

Studio Ghibli has not been the only target. In late 2024, Philip Banks created Chill Guy, a laid-back dog meme that exploded into a half-billion-dollar meme token on Solana. But Banks never gave permission. His accounts were hacked. A false licensing deal was forged. When the truth surfaced, the token crashed 45% in 30 minutes.

Now imagine that story playing out across every medium, on a global scale. That’s exactly what’s happening with OpenAI’s recent co-option of Studio Ghibli’s IP. Now, AI’s tools can mimic any voice, style, or aesthetic—trained on unlicensed data scraped from the internet and any medium it can consume.

Amazon is replacing voice actors with AI. Manga localization is being outsourced to machines. Lawsuits from The New York Times, Getty, and independent artists are piling up. A major problem is that enforcement can’t keep pace with reproduction. The systems we rely on to manage content—from cloud drives to social platforms—cannot tell you where something came from.

They fail at proving provenance and, in turn, fail the creators whose livelihoods depend on IP rights. We’re building the next generation of digital culture on a foundation of guesses, not guarantees.

Creative authenticity requires new blockchain infrastructure

We don’t need more IP lawsuits. We need new rails. Authenticity, or even lucidity—the ability to see clearly and act truthfully—is not just a philosophical idea. In a generative world, it’s a technical requirement. If we want to preserve creative integrity in the age of AI, we need infrastructure that makes origin, attribution, and authorship cryptographically native to every digital asset.

Using content-addressable storage and Merkle tree structures, creators can hash their work and register it to a public chain. This hash becomes a permanent fingerprint of the original content. Smart contracts can define licensing conditions, automate royalties, and even govern remix rights.

Each derivative, usage event, or ownership change is logged immutably—creating a verifiable timeline of creation, modification, and transaction. This doesn’t just protect artists. It improves the machines, too. With blockchain, creators can cryptographically register their work at the moment of creation. Every change, license, or remix becomes part of a transparent, tamper-proof timeline. Smart contracts can automate royalties. Attribution becomes verifiable. And usage becomes traceable—whether that’s a social post, a dataset, or an AI-generated derivative.

This isn’t just hype. It’s a structural shift from guesswork to guarantees, from hearsay to hashes.

Without it, artists will keep getting erased. Investors will keep getting rugged. And trust in the creative economy will continue to corrode.

Building a truthful internet

Freedom of communication and property rights are foundational principles in the canon of Western philosophy. We know that open communication channels and the rule of law to protect private property are the frameworks for building a free society.

However, today, our creative systems are plagued with black-box models, closed-source platforms, and training systems on data without audit trails. We have mistaken this flood of content for an abundance of creativity when, in fact, it’s a hollow kind of plenty—one that undermines the creative people it imitates.

If we want a future where new Miyazakis, Picassos, and myriad creators are possible––where artists can take risks without getting scraped into the next proprietary model––we must build systems that protect them by design.

Blockchain is how we embed authorship into content, how we stop laundering aesthetics, and how we let creativity thrive without erasure. This is not just about bad actors. It’s bad architecture. And the cure isn’t outrage—it’s about provenance. Authenticity isn’t a luxury anymore. It’s a blockchain.

Nirav Murthy

Nirav Murthy is a co-founder at Camp Network and has previous experience as an Investment Banking & Growth Equity Associate at The Raine Group. Prior to that, Nirav worked as a Brand Ambassador at CRV. Nirav holds a Bachelor of Science in Business Administration from the University of California, Berkeley, Haas School of Business, and a Bachelor of Arts in Economics from the University of California, Berkeley.

Source link

Blockchain

Athens Exchange Group eyes first onchain order book via Sui

Published

2 weeks agoon

April 16, 2025By

admin

Greek exchange Athens Exchange Group has moved closer to adopting a Sui-based order book following its collaboration with Mysten Labs.

On April 16, the Sui (SUI) team announced that Athens Exchange Group, or ATHEX, had finalized the technical design for an onchain fundraising platform that will leverage zero-knowledge proofs on the Sui blockchain.

ATHEX’s ZK-powered fundraising platform will help the stock exchange enhance its offering with privacy and speed, bolstering its growth in traditional capital markets.

This nod to blockchain innovation and integration follows Sui contributor Mysten Labs’ partnership with the Athens Exchange Group in March 2024.

The collaboration between the two platforms aims to leverage their respective ecosystems to deliver the technical design for ATHEX’s Electronic Book Building (EBB), the exchange’s fundraising feature. By tapping into Sui’s technology and tooling, the company will be able to integrate zero-knowledge proofs into EBB’s bidding process.

Currently, Athens Exchange Group and Mysten Labs are eyeing a proof of concept, with this a key milestone towards building the first onchain order book for a stock exchange.

“The focus on privacy-preserving mechanisms, combined with Sui’s unparalleled speed and security, will enable us to build a state-of-the-art PoC that can evolve into a full-fledged onchain order book, setting a new benchmark for the industry,” said Dr. Kostas Kryptos Chalkios, Chief Cryptographer and Co-Founder of Mysten Labs

ATHEX will benefit from a platform that combines privacy-preserving mechanisms, speed and security.

Sui’s capacity to scale and handle transactions in parallel, with industry-leading throughput will be crucial to the stock exchange.

“By integrating zero-knowledge proofs, we aim to uphold the highest standards of compliance and data integrity while boosting operational efficiency for all market participants,” said Nikos Porfyris, chief operating officer at Athens Exchange Group.

Sui is the 10th largest blockchain by total value locked per DeFiLlama with over $1.18 billion in TVL.

Source link

Altcoin

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Published

2 weeks agoon

April 13, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

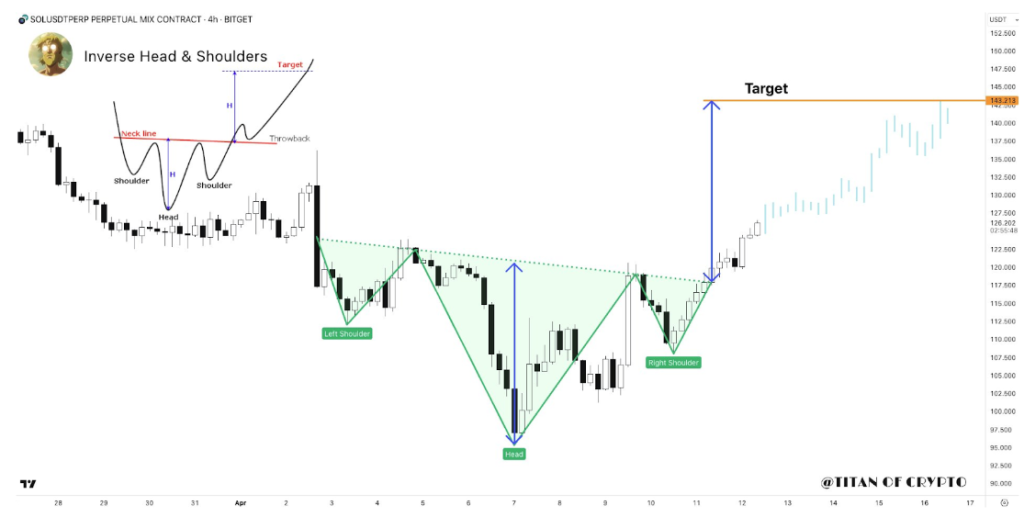

Solana appears to be gearing up for a major technical breakout, with recent price action building up an interesting chart formation. A familiar bullish pattern has formed, and if validated, it could drive the price to a level not seen in recent weeks. This new development was highlighted by popular analyst Titan of Crypto on social media platform X.

Pattern Breakout Sets $143 In Sight

Like every other large market-cap cryptocurrency, Solana has experienced an extended period of price crashes since late February. In the case of Solana, this price crash has been drawing out since January, when it reached an all-time high of $293 during the euphoria surrounding the Official Trump meme coin. Since then, Solana has corrected massively, even reaching a low of $97 on April 7.

Related Reading

The price action before and after this $97 low has created an interesting formation on the 4-hour candlestick timeframe chart. As crypto analyst Titan of Crypto noted, this formation is enough to send Solana back up to $143.

At the heart of the latest bullish outlook is a clearly defined inverse head and shoulders structure, which is known for its reliability in signaling a reversal from a downtrend to a bullish breakout. The left shoulder of the pattern began forming in early April as Solana attempted to rebound from sub-$110 levels. The subsequent drop to the $96 bottom on April 7 formed the head of the structure. From there, a recovery started as buyers cautiously stepped back in, giving rise to the right shoulder.

The breakout of the neckline resistance has taken place in the past 24 hours. With this in mind, Titan of Crypto predicted that $143 becomes the next logical destination based on the measured move from the head to the neckline.

Image From X: Titan of Crypto

Momentum Strengthens With Structure Confirmation

Looking at the chart shared by the analyst, the momentum behind Solana’s price movement appears to be gaining strength. Trading volume is an important metric in evaluating the strength of a breakout, and the volume accompanying the recent breakout above the neckline seemingly confirms it.

Particularly, Solana has seen a 5.3% increase in its price during the past 24 hours, with trading volume surging by 3.76% within this timeframe to $4.21 billion.

Although it is common to see a throwback or minor consolidation just above the neckline, the projected path suggests continued upside as long as price action holds above that key breakout zone.

Related Reading

At the time of writing, Solana is trading at $129, 10% away from reaching this inverse head-and-shoulder target. A move to $143 would not only represent a meaningful recovery from April’s lows but could also improve the confidence in Solana’s price trajectory moving into Q2. The next outlook is what happens after it reaches this target of $143, which will depend on the general market sentiment.

Featured image from The Information, chart from TradingView

Source link

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines