SOL

Solana ‘God Candle Is Close’ As It Breaks From Crucial Resistance – Top Analyst

Published

5 months agoon

By

admin

Solana recently broke its yearly high at $210, sparking a surge in trading activity as the altcoin now attempts to consolidate above this key level. This period of volatile price action highlights Solana’s strong position within the market, as investors watch for signs of a further breakout.

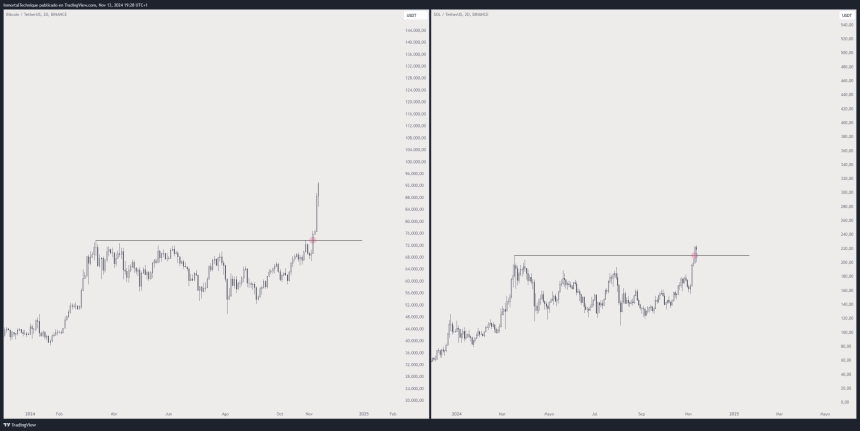

Top analyst and investor Immortal recently shared an insightful technical analysis comparing Solana’s chart to Bitcoin’s historical price movements, suggesting that Solana’s next breakout may be imminent.

Related Reading

As the market reaches new highs, Solana’s ability to hold above $210 could indicate strength, drawing in additional interest from retail and institutional investors. In the coming days, Solana’s price action will likely clarify whether this consolidation phase is merely a pause before a more substantial move.

With the broader crypto market reaching unprecedented levels, Solana is positioned at a critical juncture, and traders will closely monitor its performance for signs of a continuation of its upward trajectory.

Solana Preparing For A Rally

Solana appears poised for a significant rally, having broken out of an 8-month accumulation phase that began in March. This critical development has caught the attention of top analyst and trader Inmortal, who shared an analysis on X, comparing Solana’s recent chart patterns to those of Bitcoin. His technical perspective suggests that Solana mirrors Bitcoin’s past price movement and could be on the cusp of a substantial surge.

Following its break above the yearly high of $210, Solana’s next target is likely to be its all-time high of $258. This level is viewed by many as a critical resistance, and a successful test could pave the way for even greater price gains. The breakout from such an extended accumulation phase has bolstered confidence in Solana’s bullish structure, and the market is closely watching for signs of sustained momentum.

The timing of this potential move is also strategic. As Bitcoin consolidates just below its all-time high, a period of stability could provide the perfect window for altcoins, particularly Solana, to gain traction. This pause in Bitcoin’s rally allows liquidity to shift toward other strong projects, positioning Solana well for a possible continuation of its upward trend.

Related Reading

The next few days will be pivotal for Solana as traders look to see if it can sustain support above $210. If Solana holds this level and momentum remains, a push toward the $258 all-time high could unfold rapidly, further solidifying its role as a leading altcoin in the market’s current bull phase.

SOL Testing Last Supply Levels Before ATH

Solana is currently trading at $220, having broken its yearly highs, yet it’s now encountering some volatility as traders assess the next move. With SOL just 17% away from its all-time high of $258, many are watching closely to see if it can sustain this momentum without giving traders any lower entry points.

The $210 support level is particularly crucial in the coming days. If SOL fails to hold above this mark, a short-term correction could drive prices lower, potentially offering some breathing room for buyers looking to enter before the next rally. However, should SOL remain steady above $210, the likelihood of a rapid push to new highs becomes even stronger, as it signals ongoing bullish strength in a market eager for upward movement.

Related Reading

As Solana continues to consolidate at these elevated levels, a decisive break could ignite a swift rally, drawing in both retail and institutional interest. Traders are preparing for either outcome: a brief correction as a buying opportunity, or a breakout that takes Solana into uncharted territory, setting new highs and reaffirming its place among top-performing altcoins this cycle.

Featured image from Dall-E, chart from TradingView

Source link

You may like

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

SOL

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

Published

31 minutes agoon

April 16, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana is trading above the $125 level after bulls stepped in and reclaimed key levels, sparking optimism across the market. After enduring weeks of massive selling pressure, this recovery marks the first sign of strength from buyers since early March. Still, not all analysts are convinced this marks the beginning of a sustainable rally. While momentum appears to be shifting in Solana’s favor, some see this move as a possible bearish setup rather than a reversal.

Related Reading

Top crypto analyst Ali Martinez shared a cautionary view on X, suggesting that Solana might be retesting the breakout zone from a right-angled ascending broadening pattern — a structure that often precedes sharp declines. According to his analysis, if Solana fails to hold current support levels, prices below $80 could come back into play. This aligns with broader macro concerns, as global trade tensions and volatile risk markets continue to pressure crypto valuations.

With both bullish enthusiasm and bearish warnings in the air, Solana’s price action in the coming days could determine whether this is a genuine recovery — or a setup for a deeper correction. Eyes are now on how SOL behaves around $125 in the short term.

Solana Faces a Pivotal Test as Global Risks Rise

Solana is at a crucial juncture as bulls attempt to hold the $125 level and regain momentum after weeks of aggressive selling pressure. While the recent bounce has offered short-term relief, the broader market environment remains highly unstable, making this recovery fragile.

Macroeconomic uncertainty, paired with growing trade war fears, continues to weigh heavily on risk assets like Solana. The erratic tone set by US President Donald Trump, including unpredictable tariff policies targeting China and other global partners, has introduced renewed volatility across financial markets.

These macro headwinds are colliding with technical pressure in Solana’s chart. Martinez shared a bearish scenario, noting that Solana could be retesting the breakout zone from a right-angled ascending broadening pattern. Historically, this pattern often signals the potential for sharp reversals. According to Martinez, if Solana fails to hold above key support, the price could plunge toward $65 — a level not seen since late 2023.

The $125 zone now acts as a make-or-break level for bulls. Reclaiming higher resistance at $135–$145 would be necessary to shift sentiment and spark a full recovery rally. However, failure to hold current levels could result in a steep decline as panic returns to the market.

Related Reading

SOL Price Faces Key Resistance After $136 Rejection

Solana (SOL) is currently trading at $125 after facing a clean rejection at the $136 resistance level earlier this week. The failure to break through this short-term ceiling has paused the bullish momentum, placing bulls in a vulnerable position as they try to defend recent gains. To regain control and signal a clear reversal, SOL must reclaim the $136 level with conviction and continue climbing toward the $150 mark — a zone that aligns with key daily resistance and short-term liquidity.

Reclaiming both levels would signal strong market confidence and could set the stage for a sustained rally, possibly retesting April highs. However, without that upside push, the risk of deeper downside grows. Market volatility remains high, fueled by global macroeconomic tensions and uncertainty around US-China trade developments. These factors are still weighing heavily on sentiment, particularly among altcoins like Solana.

Related Reading

If SOL continues to struggle below $136 and fails to attract enough buying pressure, a breakdown toward the $100 mark becomes increasingly likely. That level has previously served as a psychological support zone and could attract renewed interest — but only if broader market conditions stabilize. For now, SOL remains in a delicate, high-stakes trading zone.

Featured image from Dall-E, chart from TradingView

Source link

Altcoins

Analyst Says Solana Flashing Biggest Bear Trap, Predicts New All-Time High for SOL by End of 2025

Published

2 days agoon

April 15, 2025By

admin

A closely followed trader believes that the layer-1 protocol Solana (SOL) may have just flashed a strong bullish reversal signal.

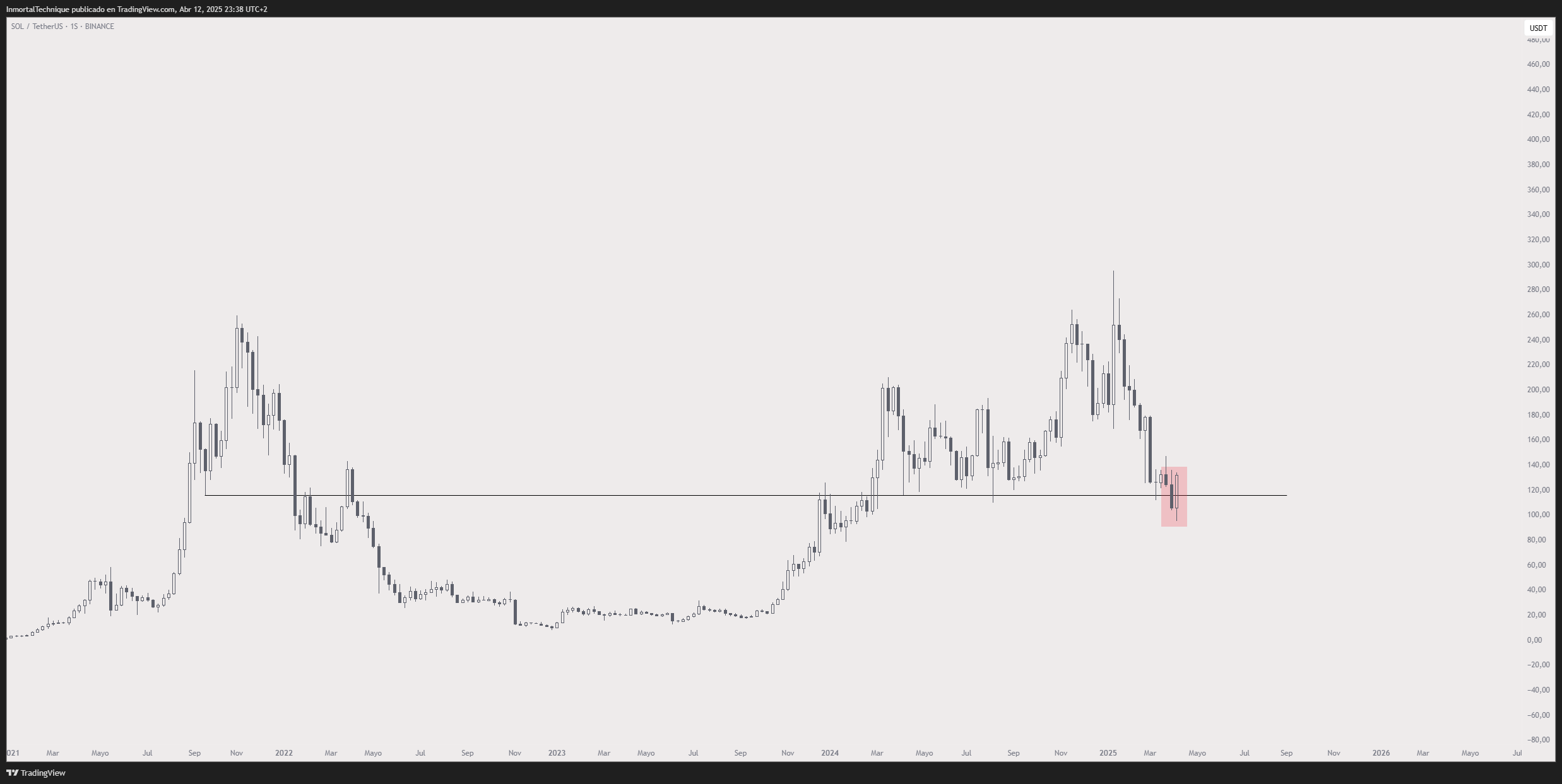

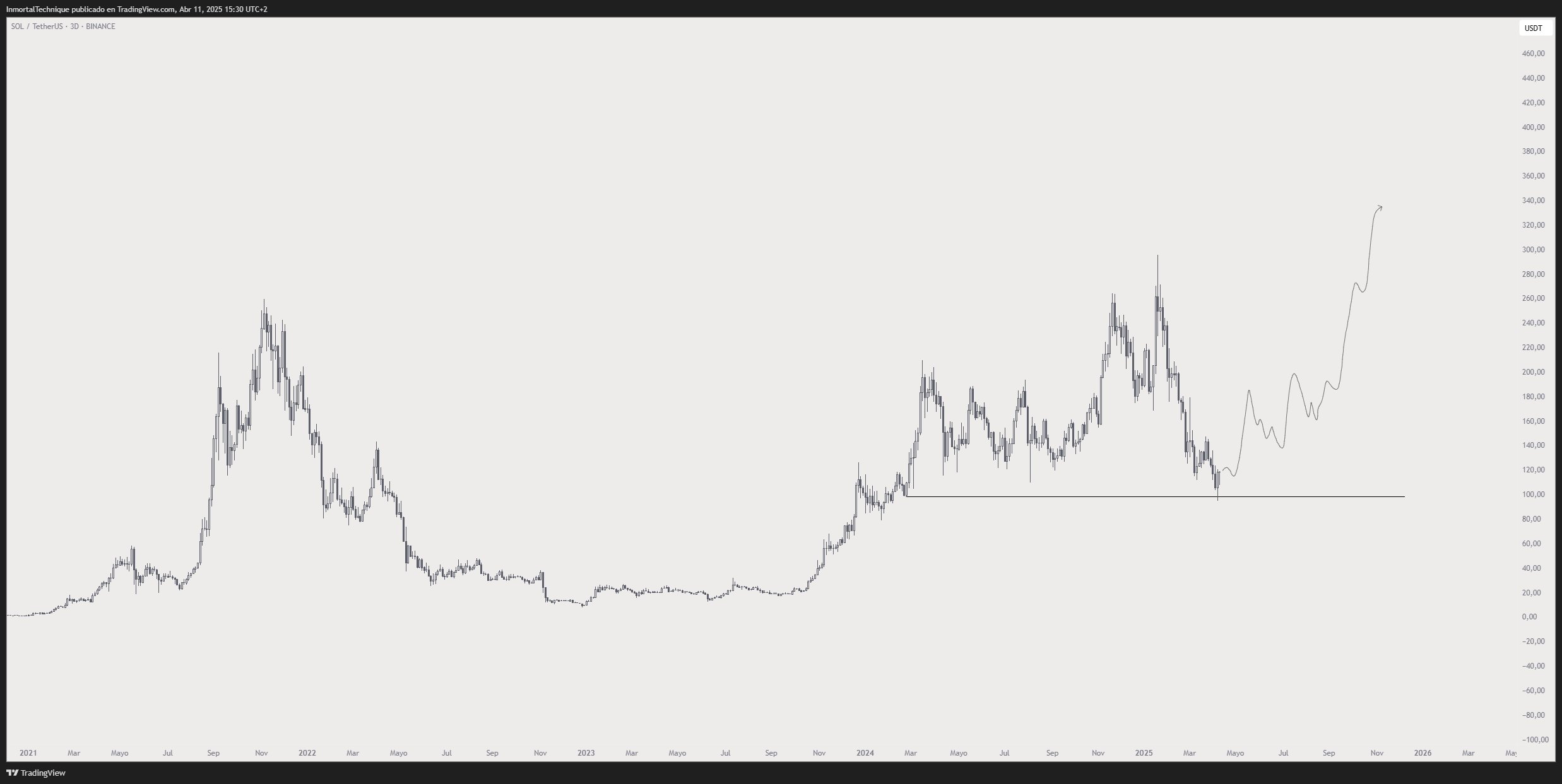

Pseudonymous trader Inmortal tells his 231,500 followers on the social media platform X that Solana appears to have set a massive bear trap earlier this month when the price of SOL briefly dropped below $100.

A bear trap is a false signal that makes it appear that the price of an asset is heading to much lower levels, but instead, the price abruptly reverses and rallies, leaving short-sellers trapped.

Says Inmortal,

“That weekly candle is maybe the biggest bear trap I’ve ever seen, SOL.”

The analyst now believes that SOL is setting the stage for strong rallies en route to a new all-time high of $340 by December 2025.

“In retrospect, it will be so obvious, SOL.”

At time of writing, Solana is trading for $128.19, down over 3% on the day.

Looking at Bitcoin, Inmortal thinks that BTC will trade between $74,000 and $95,000 in the coming months before sparking a breakout rally toward the end of the year.

“Expecting something like this:

> Bounce to $90,000

> More chop/ranging ($67,000 maybe)

> Uptrend in the second half of this year

Maybe not in this exact order.

BTC.”

Based on the trader’s chart, he appears to suggest that Bitcoin will soar close to $130,000 by the end of 2025. At time of writing, Bitcoin is worth $84,943.

Turning to the memecoin Floki (FLOKI), Inmortal thinks the altcoin is at a price level where it can potentially carve a major cycle bottom.

“Accumulating more FLOKI at these levels.

RSI (relative strength index) is at the same levels it was 700 days ago, and price at pre-bullrun levels.”

The RSI is a momentum indicator that can help traders spot levels where an asset is oversold or overbought. At time of writing, FLOKI is worth $0.000057.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoin

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Published

3 days agoon

April 13, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

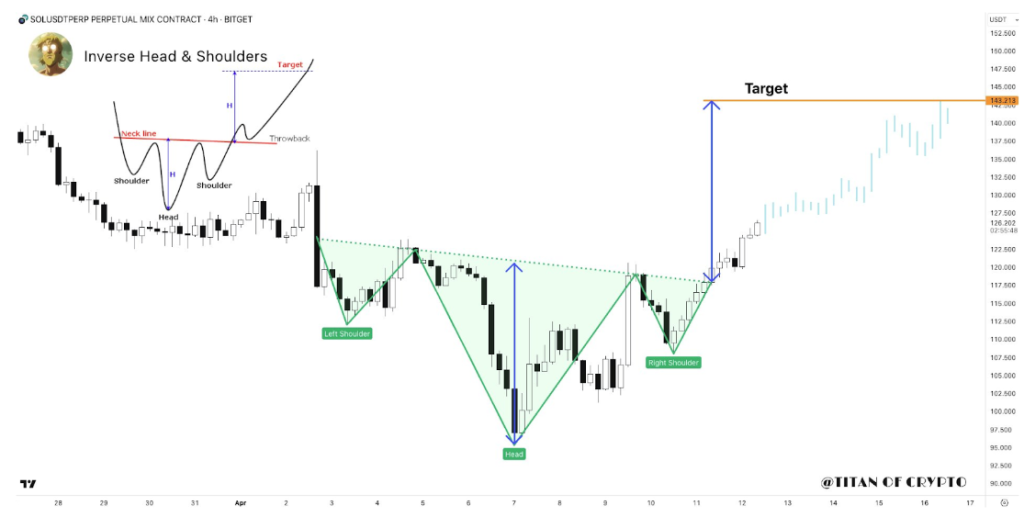

Solana appears to be gearing up for a major technical breakout, with recent price action building up an interesting chart formation. A familiar bullish pattern has formed, and if validated, it could drive the price to a level not seen in recent weeks. This new development was highlighted by popular analyst Titan of Crypto on social media platform X.

Pattern Breakout Sets $143 In Sight

Like every other large market-cap cryptocurrency, Solana has experienced an extended period of price crashes since late February. In the case of Solana, this price crash has been drawing out since January, when it reached an all-time high of $293 during the euphoria surrounding the Official Trump meme coin. Since then, Solana has corrected massively, even reaching a low of $97 on April 7.

Related Reading

The price action before and after this $97 low has created an interesting formation on the 4-hour candlestick timeframe chart. As crypto analyst Titan of Crypto noted, this formation is enough to send Solana back up to $143.

At the heart of the latest bullish outlook is a clearly defined inverse head and shoulders structure, which is known for its reliability in signaling a reversal from a downtrend to a bullish breakout. The left shoulder of the pattern began forming in early April as Solana attempted to rebound from sub-$110 levels. The subsequent drop to the $96 bottom on April 7 formed the head of the structure. From there, a recovery started as buyers cautiously stepped back in, giving rise to the right shoulder.

The breakout of the neckline resistance has taken place in the past 24 hours. With this in mind, Titan of Crypto predicted that $143 becomes the next logical destination based on the measured move from the head to the neckline.

Image From X: Titan of Crypto

Momentum Strengthens With Structure Confirmation

Looking at the chart shared by the analyst, the momentum behind Solana’s price movement appears to be gaining strength. Trading volume is an important metric in evaluating the strength of a breakout, and the volume accompanying the recent breakout above the neckline seemingly confirms it.

Particularly, Solana has seen a 5.3% increase in its price during the past 24 hours, with trading volume surging by 3.76% within this timeframe to $4.21 billion.

Although it is common to see a throwback or minor consolidation just above the neckline, the projected path suggests continued upside as long as price action holds above that key breakout zone.

Related Reading

At the time of writing, Solana is trading at $129, 10% away from reaching this inverse head-and-shoulder target. A move to $143 would not only represent a meaningful recovery from April’s lows but could also improve the confidence in Solana’s price trajectory moving into Q2. The next outlook is what happens after it reaches this target of $143, which will depend on the general market sentiment.

Featured image from The Information, chart from TradingView

Source link

Solana Retests Bearish Breakout Zone – $65 Target Still In Play?

How Expanding Global Liquidity Could Drive Bitcoin Price To New All-Time Highs

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x