Markets

Solana Hits $275 as Donald Trump’s Token Jumps to $8 Billion, Bu

Published

2 months agoon

By

admin

Donald Trump’s official memecoin has jumpstarted fresh speculative activity in the Solana ecosystem nearly overnight.

Multiple large-cap tokens based on Solana surged higher Saturday, and the blockchain’s native SOL token set fresh highs above $275 as the incoming U.S. president backed a new Solana-based TRUMP token Friday night, calling it his “official” memecoin.

The choice of Solana as an issuance network bumped demand and sentiment for SOL tokens, as CoinDesk reported Saturday.

SOL trading volumes have rocketed from Thursday’s $3 billion to over $26 billion in the past 24 hours, with Saturday’s moves bringing weekly gains to over 46%.

That’s a nearly 3,000% surge since three-year lows of $9 in December 2022 following the implosion of crypto exchange FTX and prominent backer Sam Bankman-Fried, which dented sentiment for Solana at the time.

Trump’s official memecoin was issued in late U.S. hours Friday on the Solana blockchain by a team including ecosystem giants Jupiter and Meteora. Prices of Jupiter’s JUP tokens are up 30% in the past 24 hours.

The token launch was co-ordinated by CIC Digital LLC – an affiliate of the Trump Organization, and the newly-formed company Fight Fight Fight LLC, per BBC. The duo holds 80% of the tokens, subject to a vesting period of over three years, and it is unclear how much money Trump might make from the venture.

TRUMP prices rocketed from a few cents to $14 in less than six hours amid widespread confusion on whether the token was actually backed by Trump or if someone had hacked Trump’s account and issued a fake token.

It trades above $44 in Asian afternoon hours Sunday, grabbing listings on prominent exchanges Coinbase and Binance, as well as several futures products. It has become the third-largest memecoin by market capitalization behind dogecoin (DOGE) and shiba inu (SHIB), flipping pepecoin (PEPE).

Source link

You may like

Memecoin Insider Creates Wolf of Wall Street-Inspired Coin Despite Potential Interpol Warrant: Report

Bitfarms stock dips despite $110m acquisition

Police Arrest Four Teens Over Amouranth Home Invasion, Attempted Bitcoin Theft

MUBARAK Coin Price Soars 22% Amid This Binance Announcement, What’s Next?

Michael Saylor’s MSTR Purchases 130 Additional BTC

Michael Saylor’s Strategy makes smallest Bitcoin purchase on record

Bitcoin

Michael Saylor’s MSTR Purchases 130 Additional BTC

Published

4 hours agoon

March 17, 2025By

admin

Strategy (MSTR) marginally added to its massive bitcoin (BTC) holdings, selling a modest amount of its preferred stock (STRK) to fund the acquisition.

The company last week purchased 130 bitcoin for roughly $10.7 million, or an average price of $82,981 each, according to a Monday morning filing. The so-called “BTC yield” is 6.9% year-to-date, according to Strategy.

Company holdings are now 499,226 bitcoin acquired for a total of $33.1 billion, or an average cost of $66,360 per token.

This latest purchase was funded by the sale of 123,000 shares of STRK, which generated about $10.7 million of net proceeds. Strategy last week announced a mammoth $21 billion at-the-market offering of that preferred stock.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.

Source link

Markets

TON Token Surges 20% as Telegram Founder Recovers Passport From French Authorities

Published

20 hours agoon

March 16, 2025By

admin

The price of TON has surged more than 20% over the last 24 hours to now trade above $3.45 and have a $8.14 billion market capitalization after French authorities returned Telegram founder Pavel Durov’s passport.

The move restores Durov’s ability to travel freely and marks the end of a situation that had drawn concerns from privacy and free speech advocates. Durov, who co-founded Telegram, a messaging platform with nearly a billion users, has long been an outspoken advocate for privacy and secure communication.

Read more: TON Down 14% as Telegram CEO Pavel Durov Arrested in France

The TON Foundation, which supports the Telegram Open Network (TON), celebrated the moment on social media. “As part of the decentralized TON community, we have stood in solidarity with Pavel, supporting his unwavering dedication to defending the right to free speech and privacy online.“

TON has also benefited from new features introduced to the Wallet app on Telegram, which include multiple assets, a yield program, an updated user interface, and more.

Read more: Telegram’s Pivot to TON Payments for Ads Boosts Toncoin

Source link

layer 1

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

Published

1 day agoon

March 16, 2025By

admin

Cryptocurrency prices rose modestly during the weekend as investors embraced a risk-on sentiment following Friday’s surge in the US stock market.

Bitcoin (BTC) held steady above $84,000, while the market cap of all coins rose to over $2.8 trillion.

The crypto market will have two main catalysts this week: President Donald Trump’s tariffs and the Federal Reserve’s interest rate decisions. A sign of Trump easing his stand on tariffs and a more dovish Fed will be bullish for cryptocurrencies and other risky assets.

The top cryptocurrencies to watch this week will be Binance Coin (BNB), Cronos (CRO), and ZetaChain (ZETA).

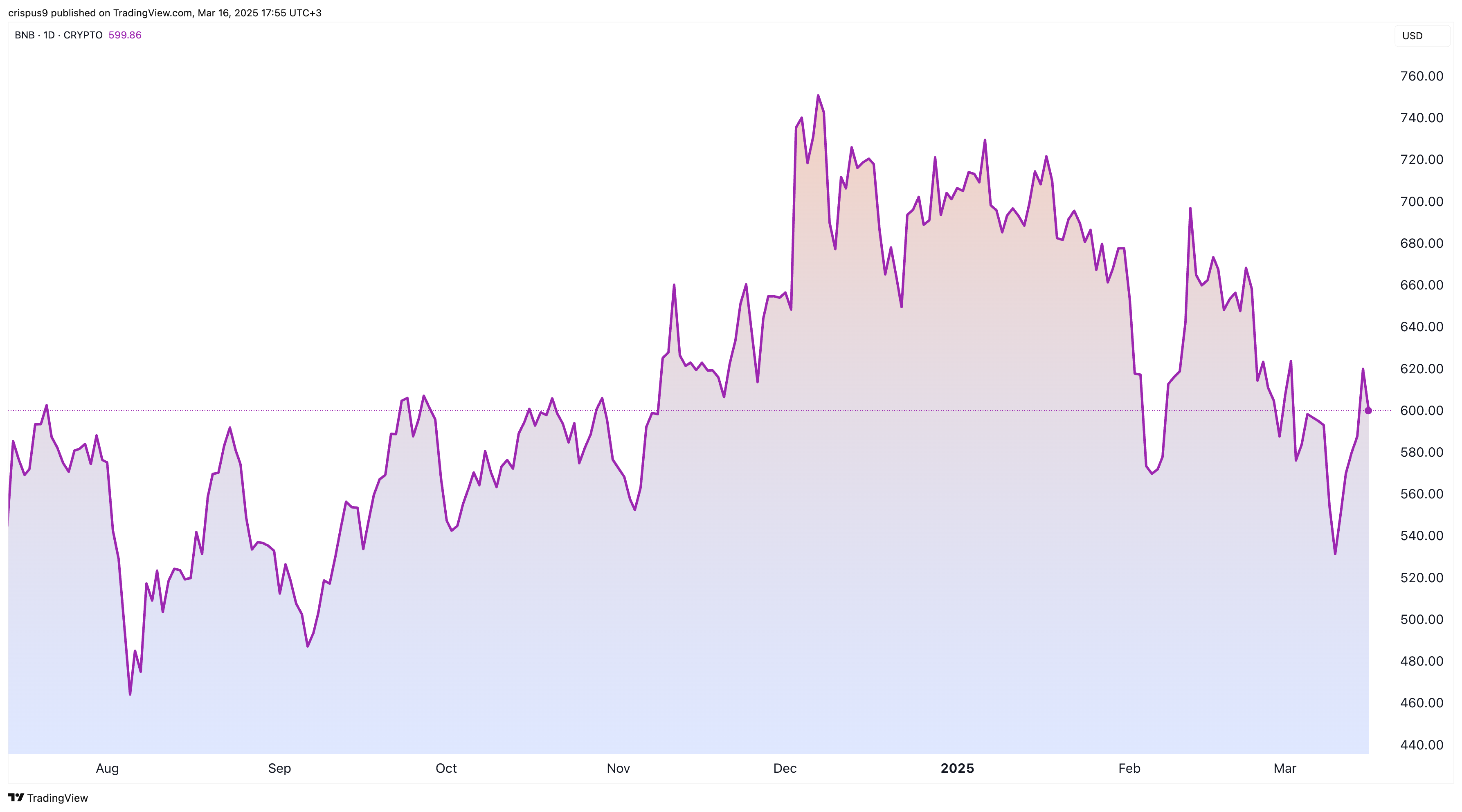

BNB

BNB price will be in the spotlight this week as the developers activate the Pascal hard fork on March 20. This is one of the three upgrades scheduled for the year’s first half. It is set to introduce newer features, including more Ethereum compatibility, native smart contract wallets, and more security.

The other two upgrades will improve BNB Chain’s speed and security. This is happening as the BSC Chain becomes one of the best alternatives to Ethereum (ETH) and Solana (SOL). Ethereum has higher fees and is slow, while the Solana network is highly associated with meme coins.

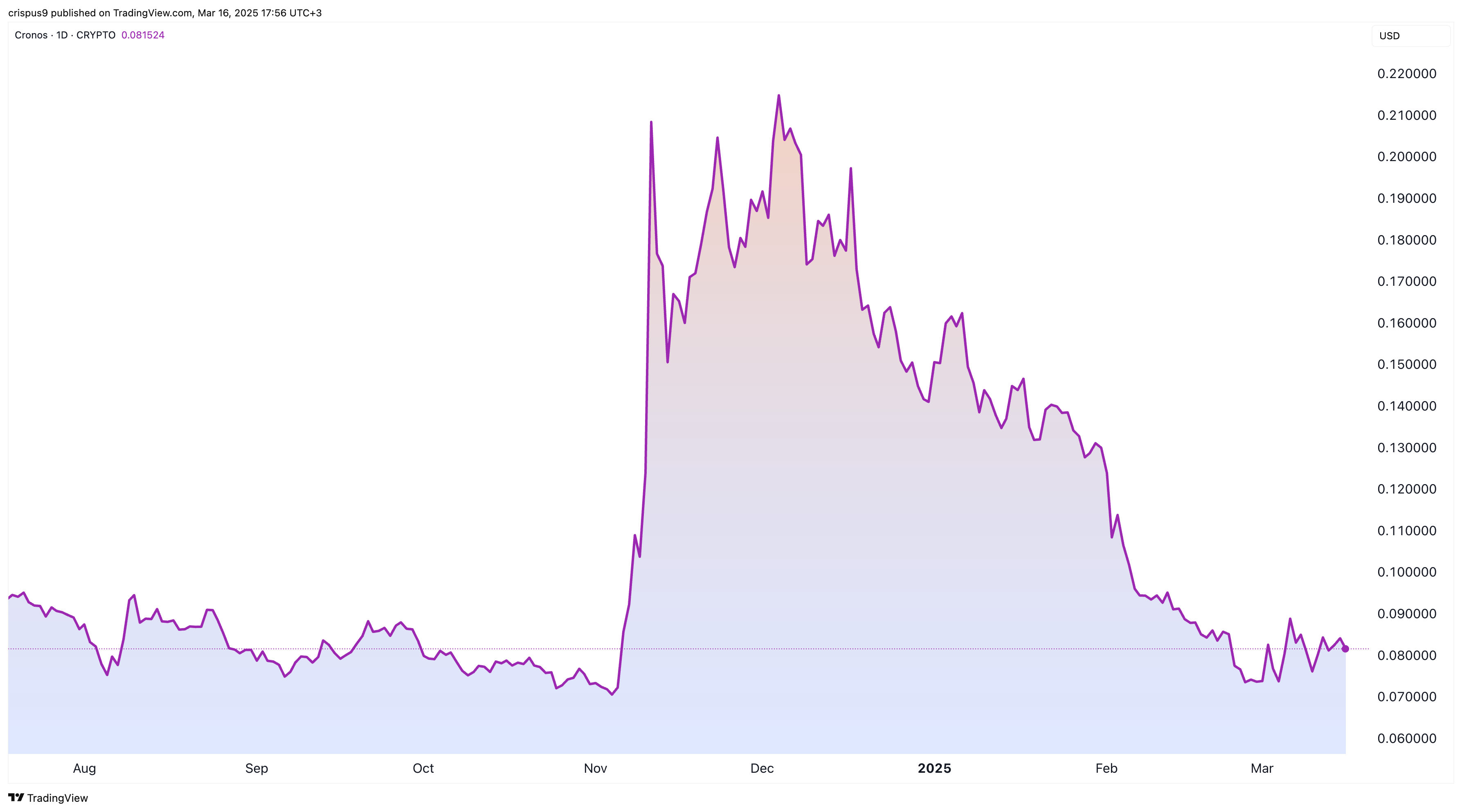

Cronos

A key Cronos vote will conclude on March 17. This crucial vote seeks to determine the creation of the Cronos Strategic Reserve. It aims to do that by undoing a 70 billion token burn that happened in 2021.

If the vote passes, Cronos will create 70 billion tokens and use them to create a reserve that will be used to support the ecosystem. Critics argue that creating these new tokens will dilute existing investors by adding to the supply.

Voting data shows that 45.8% of users have voted in support of the proposal, while 44.4% have rejected it. 9.27% have abstained. If the vote ends like this, the proposal will be rejected as the turnout is less than the quorum.

ZetaChain

ZetaChain is another top cryptocurrency to watch after its price crashed to a record low of $0.2070. It has dropped by over 92% from its all-time high, bringing its market cap to $151 million.

One reason for the ZETA price crash is that the total value locked in its ecosystem has crashed to $13 million from its all-time high of near $20 million.

The other reason is that Zetachain is highly dilutive as it has a circulating supply of 731 million against a total supply of 2.1 billion.

The network will unlock tokens worth over $6.6 million, representing 4.29% of the float this week. Cryptocurrencies are often highly volatile when there is a major unlock.

Source link

Memecoin Insider Creates Wolf of Wall Street-Inspired Coin Despite Potential Interpol Warrant: Report

Bitfarms stock dips despite $110m acquisition

Police Arrest Four Teens Over Amouranth Home Invasion, Attempted Bitcoin Theft

MUBARAK Coin Price Soars 22% Amid This Binance Announcement, What’s Next?

Michael Saylor’s MSTR Purchases 130 Additional BTC

Michael Saylor’s Strategy makes smallest Bitcoin purchase on record

Bitcoin To $10 Million? Experts Predict Explosive Growth By 2035

Dormant whale sends 300 BTC to FalconX as Bitcoin nears $84k CME gap

Bitcoin Flashing Bullish Reversal Signal Amid Waning Sell-Pressure, According to Crypto Strategist

Bitcoin Price Mirrors Gold’s 1970 Rally – A Six-Figure BTC Target of $250k Next?

OKX Pauses DEX Aggregator to Address Security Concerns

Trump’s second ex-wife calls for end of prosecution against Roger Ver

SEC Commissioner Hester Peirce on the New Crypto Task Force

Solana Hits 400B Transactions, Nearly $1T in 5 Years

640,000 Chainlink (LINK) Withdrawn From Exchanges In 24 Hours – Bullish Accumulation?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x