cryptocurrency

Solana liquidity grab below $90 coming first or a reclaim of point of control resistance?

Published

2 weeks agoon

By

admin

Solana is currently struggling to reclaim a key point of control within its trading range, leading to a weak rejection and signs of bearish compression. As the price remains below this critical volume zone, it opens up the possibility of a move below $90, a region primed for a potential liquidity sweep and swing failure pattern that could set the stage for a significant reversal.

Solana’s (SOL) recent price action suggests an effort to build a base, but bullish momentum is being capped by its inability to reclaim the range’s point of control—where the majority of recent trading activity has occurred. This failure has turned that zone into short-term resistance, compressing price action and leaving Solana vulnerable to further downside unless reclaimed decisively.

Key points covered in this article:

- Rejection at the point of control puts pressure on Solana’s short-term trend

- $89 support remains critical for a possible SFP and reversal trigger

- Liquidity beneath current levels could fuel a bullish rotation back to $178–$252

Solana’s rejection at the volume point of control has created a precarious technical setup. This level, once acting as support, has flipped into resistance, tightening price action and amplifying the likelihood of a liquidity-driven dip. Unless Solana reclaims this volume node with conviction, the short-term outlook remains defensive for bulls.

The $89 support, just under the psychological $90 threshold, is now a key area to watch. It marks a swing low that remains untouched and sits in a high-liquidity zone. A sweep of this level followed by a clear swing failure pattern could trigger a strong reversal, with upside targets in the weekly structure zone between $178 and $252.

It’s essential to understand that markets hunt liquidity, and the region below $90 is likely loaded with stop orders from traders holding positions between $130 and $100. A move into this liquidity pocket would be consistent with typical market structure, especially in a consolidating asset. However, if Solana manages to reclaim the point of control before that happens, this bearish scenario becomes invalidated, and a more bullish outlook resumes, favoring continuation toward higher resistance levels.

How to trade this setup:

Wait for a sweep of the $89 low, and look for signs of a swing failure pattern as a trigger for long entries. If confirmed, position for a potential rally targeting $178–$252. If price reclaims the point of control, consider adjusting the bias to favor bullish continuation. It is important to use price action upon discretion and management according to your trading system

Source link

You may like

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Altcoin

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Published

17 hours agoon

April 27, 2025By

adminReason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

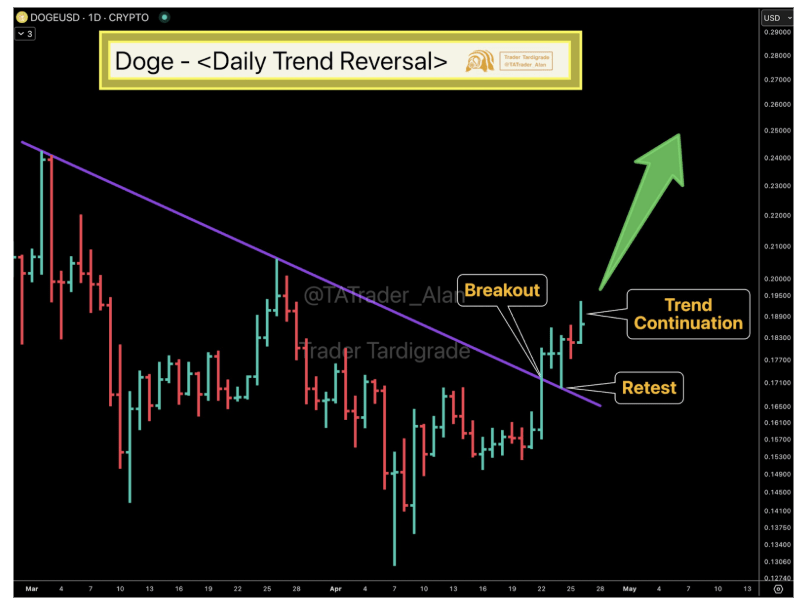

Dogecoin’s price is entering a new bullish phase after months of decline. Technical analysis of the daily candlestick timeframe chart shows that the popular meme cryptocurrency is flashing a trend reversal, hinting at a significant shift from bearish to bullish momentum.

Analyst Flags Daily Trend Reversal On Dogecoin Chart

A prominent crypto analyst known as Trader Tardigrade has highlighted a confirmed trend reversal for Dogecoin. In a post on X (formerly Twitter) this week, he pointed out that DOGE’s daily chart has flipped from a downtrend to an uptrend. This claim is reinforced by a technical analysis of Dogecoin’s price action.

Related Reading

Dogecoin’s price recently broke above a descending trendline that had defined its downtrend for several weeks. This breakout occurred on April 22, when Dogecoin closed above $0.165 on the daily candlestick timeframe. This breakout was the first step indicating the coin was escaping its bearish trajectory.

Shortly after breaching the downward sloping resistance line, Dogecoin’s price pulled back between April 23 and April 24 to retest the same trendline, but this time from above. Importantly, the former resistance trendline held strong as a new support level during the retest. Following that successful test, Dogecoin resumed its upward climb, marking the continuation of the new uptrend.

This pattern of breakout, retest, continuation is a classic technical confirmation of a trend reversal. The successful retest of this trendline gives more confidence that the bullish shift is real and not a false signal.

Image From X: Trader Tardigrade

Bullish Target: $0.25 By Early May

With the daily trend now pointing upward, the focus is now on how far this new uptrend could carry Dogecoin. According to Trader Tardigrade’s analysis, Dogecoin could continue climbing in the coming days, potentially crossing the quarter-dollar mark very soon. As indicated on the chart he shared by Trader Tardigrade, the next Dogecoin price target is around $0.25 by the first week of May.

If achieved, a rise to $0.25 would be a significant milestone, considering Dogecoin has been stuck in a downtrend for over 10 weeks. As such, a break to $0.25 would mark Dogecoin’s highest price since late February and a robust recovery from its recent lows around the $0.14 to $0.15 range. Such a move would also represent roughly a 51% gain from the breakout level of $0.165.

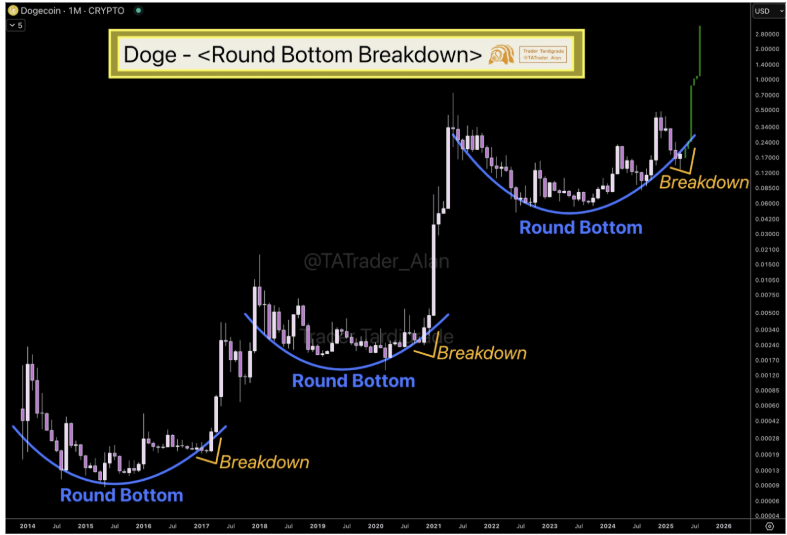

However, $0.25 is only the target in the short term. In a separate analysis, Trader Tardigrade pointed to Dogecoin’s long-term chart, highlighting a round bottom formation. The accompanying chart shows that in previous cycles, Dogecoin’s price formed a rounded bottom before entering explosive upward trends. This repeated pattern, now visible again on the monthly timeframe, signals that Dogecoin may be on the verge of another significant breakout. The long-term price target in this case is $2.8.

Image From X: Trader Tardigrade

Related Reading

At the time of writing, Dogecoin is trading at $0.18.

Featured image from Unsplash, chart from TradingView

Source link

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Although some believe that crypto PR and communications efforts should slow down when the markets are cooling off, it couldn’t be further from the truth. Sure, during crypto winters, product development teams huddle together to work on building their solutions—and that’s great—but these are also the ideal times for brand building.

Indeed, when the market is going through a crypto slowdown, the strategic brands are seizing the opportunity to strengthen credibility while everyone else is hibernating. And when the market inevitably heats up, this strategy will position such players ahead of the competition.

Now, not all might agree with this point of view, arguing that pushing PR during a downturn is tone-deaf. Others might see slow market communications as unnecessary noise when product development should be the only priority. But visibility isn’t vanity—it’s strategy, and it’s easier to get noticed in calmer markets.

Slower news, hungrier journalists

As the movements in the crypto market slow down, so does everything else that relates to it, including newsrooms. In other words, journalists have more space (and patience) for stories that go beyond mere price action. There are no big stories of exploding digital assets. Bitcoin (BTC) is nowhere near reaching a new all-time high, and altcoins are taking the cue from the industry’s number one, sleeping it off themselves.

Thus, when the hype and the noise in the crypto sphere die down, media outlets are on the lookout for stories worth telling. In such moments, true innovation and strong projects get their chance to shine and get real editorial interest, instead of getting lost among drama-driven headlines.

Small news can be perceived as newsworthy in a bear market

Here’s a secret—during a bull run, not even a $10 million funding round might turn heads. It’s just too common when there’s money flowing everywhere across the board. To illustrate, an insider source at a crypto media powerhouse once said that their “funding news coverage threshold is a minimum of $10 million, with exceptions.”

This might sound counterintuitive at first, but in a more bearish market sentiment, that same outlet might just be interested in a mere $5 million, or even a $1.4 million seed round, like the one recently raised by crypto payment hub Lyzi to expand its Tezos-based service.

In other words, Lyzi has just told the world that it’s there and constantly working on building its product. Arguably, in a period of market pessimism, it would be one hell of a smart and well-timed PR move, and the best part—the likes of CoinDesk might pick it up.

Pick up the mic when no one else is talking

Providing expert commentary when the industry goes silent becomes even more valuable. Journalists still seek third-party sources and insights, and this is your chance to establish yourself as an authoritative figure in the sector, to whom journalists will come back when the bull market returns.

This means that when it’s all quiet on the crypto front and a journalist comes knocking at your door, be ready. Hiring a good PR firm that will lead you, shape your story, and provide the stage is certainly the right move, but it’s up to you to step up with confidence and claim the spotlight.

Execution still matters

With this in mind, don’t mindlessly drop news just for the sake of it. Be strategic about timing, like holidays, conferences, and other major events that might overshadow your news, as well as the tone—this isn’t the time to brag but display resilience and value.

Also, use the time of market bearishness to build your reputation and flesh out your digital footprint through earned media placements in trusted crypto outlets. Potential users, partners, and investors will look you up online, so make sure they have good things to read about you—that’s your PR working in the background.

The real bottom line

All things considered, crypto PR in times of market stagnation and bearish sentiment is not so much about creating hype as it is about demonstrating real substance. It’s about crafting a narrative that portrays you as the crypto player who can weather the blizzard, better positioning your brand.

So, the next time you’re considering staying silent during a crypto downturn, think again. You might miss out on the best PR opportunities of the cycle, as at this time, you could get more attention than usual.

Don’t wait for the bull to charge—make your mark when the field is clear.

Afik Rechler

Afik Rechler is the co-founder and co-CEO of Chainstory, a results-driven crypto PR agency. He specializes in crypto communications and search-driven content marketing. Afik has been in the crypto industry since late 2016, helping blockchain businesses meet their marketing and communications goals.

Source link

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin (BTC) edges closer to the psychologically significant $100,000 milestone, several technical and on-chain indicators suggest that a major breakout could be on the horizon. One such metric – Bitcoin’s Apparent Demand – has shown a strong rebound, signalling renewed interest and sustained accumulation in the market.

Bitcoin Sees Sharp Rebound In Apparent Demand

According to a recent CryptoQuant Quicktake post, contributor IT Tech pointed to a significant rise in BTC’s Apparent Demand. Most notably, this key indicator has returned to positive territory after spending several consecutive weeks in the red.

Related Reading

For the uninitiated, Bitcoin’s Apparent Demand (30-day sum) measures the cumulative net demand for BTC over the past 30 days by tracking wallet accumulation and exchange outflows. A sharp increase in this metric suggests strong, sustained buying pressure, which can indicate bullish sentiment and potential for a price rally.

The following chart illustrates this rebound in BTC’s Apparent Demand, which essentially reflects net changes in one-year inactive supply adjusted by daily block rewards – a metric designed to better represent organic demand growth.

Previously, this metric had fallen deeply into negative territory – dipping below -200,000 (highlighted in red) – suggesting waning demand. However, its recent reversal into positive territory signals that long-dormant capital is flowing back into the market. As noted in the post:

The demand pivot is closely aligned with the recent price rebound above $87K, implying this recovery is underpinned by real on-chain behavior rather than purely speculative flows.

This marks the first positive Apparent Demand reading since February and aligns with rising inflows into spot Bitcoin exchange-traded funds (ETFs), as well as growing accumulation by long-term holders.

Data from SoSoValue shows that US-based spot BTC ETFs have recorded five consecutive days of net positive inflows, totalling more than $2.5 billion. The cumulative net inflow into spot BTC ETFs now stands at an impressive $38.05 billion.

Is A BTC Rally In Sight?

IT Tech noted that past reversals in Apparent Demand have historically preceded either significant rallies or periods of strong price support. If the current trend continues, BTC may have the momentum needed to challenge the $90,000 level in the near term.

Related Reading

However, analysts caution that Bitcoin must hold its current support around $91,500 to maintain upward momentum. This level is particularly important because it is close to the realized price of short-term BTC holders, according to CryptoQuant contributor Crazzyblockk.

Further adding to this outlook, prominent crypto analyst Rekt Capital emphasized that Bitcoin needs to secure a weekly close above $93,500 and reclaim it as support in order to establish a clear path to $100,000. At press time, BTC trades at $94,492, up 2% in the last 24 hours.

Featured image from Unsplash, charts from CryptoQuant and Tradingview.com

Source link

XRP Price Shoots For 20% Surge To $2.51 Amid Pullback To Breakout Zone

Stocks edge higher ahead of big earnings week

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines