crypto analyst

Solana Needs 15% Bounce After Multi-Year Support Retest

Published

3 weeks agoon

By

admin

Rubmar is a writer and translator who has been a crypto enthusiast for the past four years. Her goal as a writer is to create informative, complete, and easily understandable pieces accessible to those entering the crypto space. After learning about cryptocurrencies in 2019, Rubmar became curious about the world of possibilities the industry offered, quickly learning that financial freedom was at the palm of her hand with the developing technology.

From a young age, Rubmar was curious about how languages work, finding special interest in wordplay and the peculiarities of dialects. Her curiosity grew as she became an avid reader in her teenage years. She explored freedom and new words through her favorite books, which shaped her view of the world. Rubmar acquired the necessary skills for in-depth research and analytical thinking at university, where she studied Literature and Linguistics. Her studies have given her a sharp perspective on several topics and allowed her to turn every stone in her investigations.

In 2019, she first dipped her toes in the crypto industry when a friend introduced her to Bitcoin and cryptocurrencies, but it wasn’t until 2020 that she started to dive into the depth of the industry. As Rubmar began to understand the mechanics of the crypto sphere, she saw a new world yet to be explored.

At the beginning of her crypto voyage, she discovered a new system that allowed her to have control over her finances. As a young adult of the 21st century, Rubmar has faced the challenges of the traditional banking system and the restrictions of fiat money.

After the failure of her home country’s economy, the limitations of traditional finances became clear. The bureaucratic, outdated structure made her feel hopeless and powerless amid an aggressive and distorted system created by hyperinflation. However, learning about decentralization and self-custody opened a realm of opportunities. Cryptocurrencies allowed her to experience financial control for the first time and expand her financial education.

Moreover, the peculiar nature of the crypto community sparked Rubmar’s curiosity about the other layers of the industry. As a result, she found a particular interest in discovering the diverse perspectives of investors, market watchers, experts, and developers. Her attempts to better understand the crypto space made her realize the strong links of the community with other industries, enriching her perspective of the sector. As someone who spends most of her day online, Rubmar enjoys finding the points where the crypto world meets with her other passions and hobbies –or her favorite memes.

In her free time, she usually finds joy in different art forms. As a child, she enlisted in every extra-curricular activity in her hometown, including music classes, dancing, jewelry making, and the local chorus. Despite her many attempts to learn different instruments, Rubmar only knows how to play the xylophone, which she played for 7 years in her school’s marching band.

She also has a passion for learning new languages and cultures, having set the goal to learn another six languages – currently attempting to learn Italian and Korean. Scrapbooking, paper crafting, and bookbinding are her biggest interests outside of work, constantly taking classes and attending workshops to learn new techniques. The rest of her free time is spent stressing over football matches and transfer market news or feeding cats –hers or stray.

In summary, Rubmar seeks to present entertaining and educational pieces to be enjoyed by everybody, aiming to report on the latest news and offer a unique perspective while adding a meme or a pun whenever possible.

Source link

You may like

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

ADA

Cardano Breakout Eyes $0.80 – ADA Repeating Its ATH Playbook?

Published

4 days agoon

April 23, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Amid the market recovery, Cardano (ADA) has seen a 5% daily surge to retest the $0.66 level. Its recent price action has led the cryptocurrency to break out of a bullish formation, which could propel ADA to a key resistance zone.

Related Reading

Cardano Breakout Eyes 27% Move

On Tuesday, Cardano followed Bitcoin’s price jump and climbed to the $0.66 resistance, attempting to break above the key level for the third time this month. ADA has been in a downtrend since hitting its 3-year high of $1.32 in December 2024, retracing over 50% in the past four months.

In March, the cryptocurrency surged 80% toward the $1.17 mark, driven by US President Donald Trump’s initial announcement of a “Crypto Strategic Reserve” comprised of ADA, XRP, and Solana (SOL).

However, after the White House’s Crypto Czar, David Sacks, explained that the listed cryptocurrencies were used as an example of leading tokens, ADA’s price retraced to the $0.70-$0.80 range.

Amid the late March retraces, Cardano lost the $0.70 mark, falling to the $0.50-$0-55 zone in early April. This month, the cryptocurrency has retested the $0.66 level but has been rejected twice.

Today, it attempted to break this level again but was rejected a third time. Nonetheless, analyst Ali Martinez pointed out that ADA has broken out of a symmetrical triangle pattern amid its current performance.

Cardano has been consolidating within a symmetrical triangle formation throughout April, setting the stage for a 27% price move. After surging above the $0.63 mark, ADA broke out of the pattern, eyeing a surge toward the $0.77 resistance next.

ADA Preparing For Key Retests

Analyst Sebastian noted that the cryptocurrency “is brewing,” as it’s moving within a four-month descending channel. ADA has bounced toward the upper boundary, which has served as resistance, each time it has retested the lower trendline as support.

After the recent drop to $0.50, Cardano could retest the upper boundary soon, at around the $0.80 price range. Moreover, the analyst pointed out that the token is currently breaking out of an Inverse Head & Shoulders pattern within the descending channel, which could see the cryptocurrency surge toward the key resistance level.

Another market watcher suggested that the cryptocurrency could be following its 2020-2021 pattern. According to the chart, once ADA broke out of its bear market rally levels, it reached a new cycle high, followed by a retest of the bear market rally as support.

Related Reading

After breaking out of the downtrend, it rallied toward its all-time high (ATH) of $3.09 in the coming months. “If ADA broke out this week and followed the same pattern as last cycle, it would be on track to hit a new ATH in the middle of August,” the analyst asserted.

Meanwhile, Dan Gambardello affirmed that Cardano’s biggest resistance is at the $3 mark, “where a lot of people have regret for not selling last cycle.” The analyst forecasted that once ADA hits ATH levels, its pump “will probably pause in that general area with a lot of volatility, and then continue to $5. It’ll be like a crypto bus stop.”

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

Bitcoin

Top Analyst Predicts Ethereum Could Ignite Bull Rally If Price Surpasses $2,330

Published

5 days agoon

April 22, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

As Bitcoin (BTC) approaches the $90,000 mark, Ethereum (ETH) remains in a consolidation phase, trading just above $1,500. This divergence in price movements has sparked discussions among crypto analysts regarding the potential future trajectory of Ethereum, particularly in light of Bitcoin’s bullish momentum.

Ethereum Bull Run Potential

Crypto analyst Ali Martinez recently shared insights on social media platform X (formerly Twitter), suggesting that Ethereum could ignite a new bull run if it manages to breach the critical resistance level at $2,330.

Martinez emphasized that a breakout above this supply wall could signal renewed investor interest and push ETH towards significantly higher prices. However, Ethereum has been trapped in a narrow range between $1,500 and $1,650 for the past week, lacking any substantial catalysts to spur an upward movement.

Related Reading

The immediate focus for Ethereum bulls is the $1,600 level, which has emerged as a near-term resistance point. Market expert TedPillows highlighted that Ethereum has recently broken out of a downtrend for the first time since February 2025, indicating a potential shift in market sentiment. If ETH can hold above the $1,600 threshold, analysts speculate it could rally towards the $2,000 mark by April.

Conversely, some analysts, including Crypto Fella, warn of the risks associated with Ethereum’s current stagnation. The importance of a swift upward movement; a failure to break through the nearest resistance could result in a drop towards $1,200, highlighting the precarious nature of the altcoin’s current position.

Bitcoin Surges Past $87,000

In stark contrast, Bitcoin’s market performance paints a different picture. The cryptocurrency’s recent surge above $87,000 is interpreted by Nicholas Roberts-Huntley, CEO of Concrete and Glow Finance, as a clear indication that investors are seeking refuge in decentralized assets amidst rising tariffs, inflation concerns, and global economic uncertainty.

This sentiment is echoed as the crypto market reacts to political tensions, particularly surrounding President Trump’s threats to remove Federal Reserve Chair Jerome Powell for not expediting interest rate cuts.

Related Reading

Youwei Yang, chief economist at Bitcoin mining company BIT Mining, provided further context on Bitcoin’s behavior in the current economic climate.

Yang noted that while Bitcoin may initially respond like a risk asset—similar to tech stocks—during times of crisis, it tends to stabilize and exhibit characteristics of a safe haven asset akin to gold as market conditions improve.

At the time of writing, ETH is trading at $1,584, posting losses of over 3% in the weekly time frame. Even more concerning, the altcoin is still down nearly 70% from its all-time high reached in the last bullish cycle.

Featured image from DALL-E, chart from TradingView.com

Source link

APT

Aptos To Continue Moving In ‘No Man’s Land’ – Can It Reclaim $5?

Published

1 week agoon

April 17, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

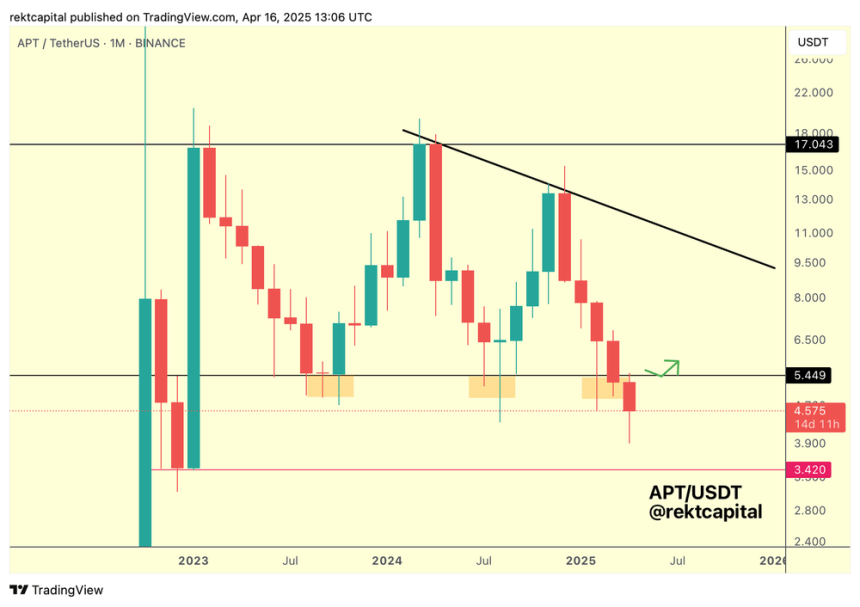

After falling from its Macro Range, Aptos (APT) has faced rejection from key levels. Amid its 15% monthly decline, some analysts suggest that APT’s party won’t continue until the $5 resistance is reclaimed.

Related Reading

Aptos Trades In ‘No Man’s Land’

Over the past two weeks, Aptos has seen its price drop to its lowest levels in two years, falling below the $4 mark for the first time. The cryptocurrency has been trading within the $5.45-$17 price range since 2023, maintaining the Macro Range lows until the March corrections.

Notably, APT had tested this key level twice before, but closed below its Macro Range for the first time last month. Analyst Rekt Capital noted that the cryptocurrency has historically developed bases around these levels “in the form of downside wicks for three-month periods,” seemingly forming one for the third time with its current downtrend.

Amid the early April recovery, the analyst noted that Aptos was forming a lower timeframe bullish divergence as its Relative Strength Index (RSI) was forming Higher Lows despite the downside deviation. Nonetheless, he warned about “the dangers of a higher timeframe bearish retest for APT.”

Since then, Aptos has “followed through on that bearish retest and rejected from the previous Macro Range Low, treating it as resistance.” After the rejection, APT’s price retraced 26% to the $3.9 support, where it “found some liquidity” and bounced to the $4.2-$4.5 range.

“However, still, the confirmation for a trend reversal isn’t there just yet,” he explained, adding that Aptos must reclaim the Macro Range Lows or it would risk further bleeding.

APT needs to reclaim the $5.44 Range Low level as support to confirm that it is ready to resynchronise with its prior range and try to position itself to challenge for higher prices. Without that confirmation, the risk is a little bit too steep because APT is in the middle of no man’s land.

Until then, “it will be important to watch out for signs of mounting strength in the meantime,” the analyst added.

APT Party Halted?

Similarly, analyst Sjuul from AltCryptoGems considers that there will be “no party on APT” until it reclaims the $5 resistance, which it has been unable to recover for the past two weeks.

“As long as we stay below the $5 level, unfortunately, it’s just a bearish retest,” he asserted. Meanwhile, another market watcher pointed out that APT has been moving within a falling wedge pattern for the past five months, with a breakout “imminent.”

However, the analyst affirmed that this week’s performance could determine whether the pattern will break out, as it needs to reclaim the $5 resistance and surge above $5.4.

Related Reading

Rekt Capital noted that Aptos has revisited the 35 Relative Strength Index (RSI) during its recent performance, “which has historically been a key region in facilitating basing periods from which price would reverse to the upside over time.”

With APT at this level, the RSI would need to break its multi-week RSI Downtrend to “confirm a sign of emerging strength in price, building out a bottoming-out area here. Until then, it is a waiting game for the most part.”

As of this writing, APT trades at $4.5, a 1% decline in the daily timeframe.

Featured Image from Unsplash.com, Chart from TradingView.com

Source link

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

BlackRock’s Bitcoin ETF Sees $643 Million Inflows

DePIN Altcoin Outpaces Crypto Market and Skyrockets by Nearly 44% Following High-Profile Exchange Listing

Solaxy, BTC bull token, and Pepeto gaining momentum as leading 2025 presale tokens

Australian Radio Station Used AI DJ For Months Before Being Discovered

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals