Layer 2

Solana price is falling, but shorting it is risky, crypto analyst says

Published

5 months agoon

By

admin

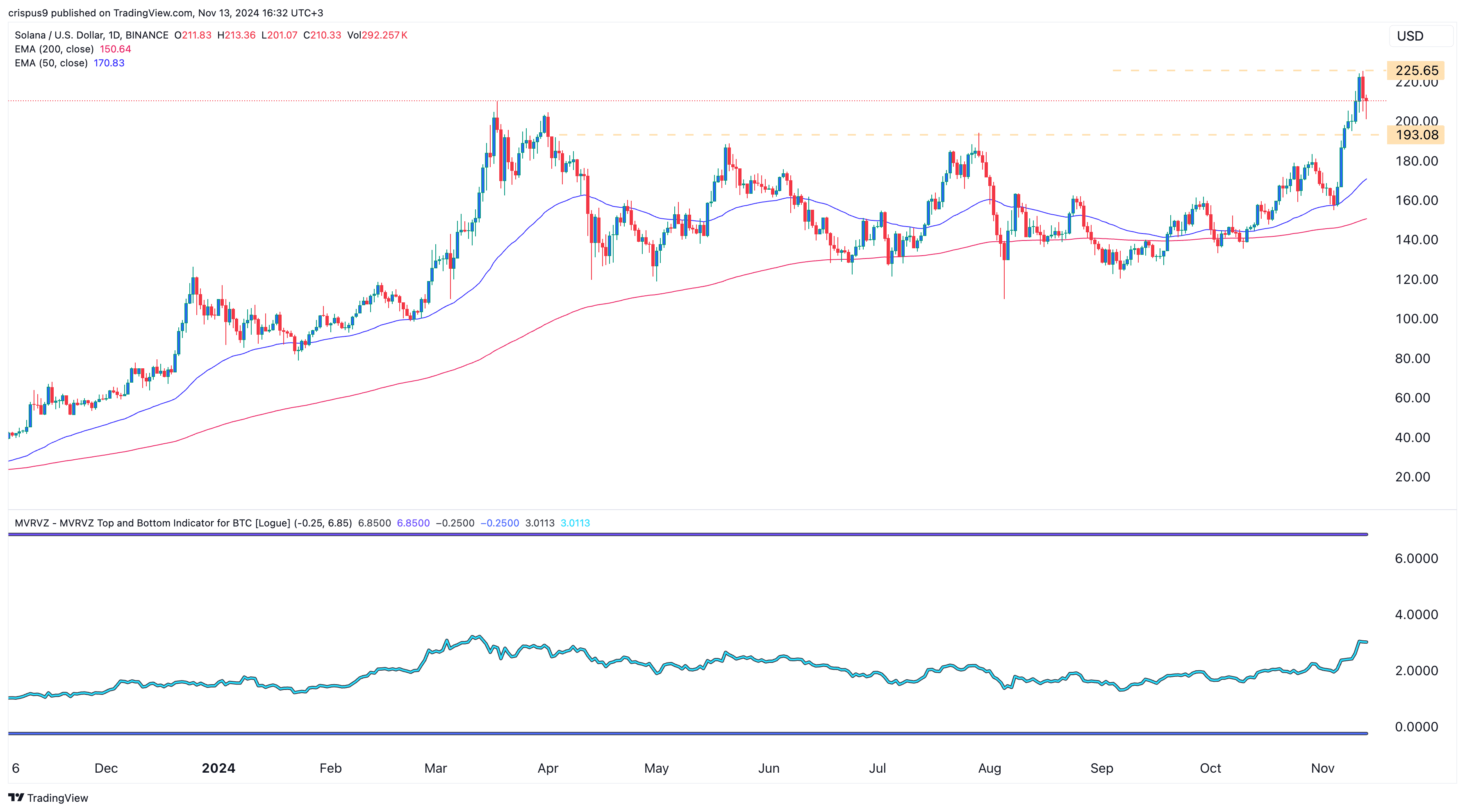

Solana price has fallen for two consecutive days, dropping 7.8% from its highest level this week.

Solana (SOL), the fourth-largest cryptocurrency, fell to $207 on Nov. 13, down from this week’s high of $225.

Its retreat mirrored that of Bitcoin (BTC) and other cryptocurrencies like Ethereum (ETH) and Cardano (ADA).

Despite the sell-off, one analyst believes it is too risky for traders to short SOL at the current prices. In an X post, Kingpin Crypto, an analyst with over 27,000 followers, warned that shorting the coin could be risky. He cited the fact that Solana was breaking out of an eight-month trading range.

Additionally, Solana maintains solid fundamentals as it has become a major player in the crypto industry. For example, it has become the blockchain of choice for developers who are building meme coins.

According to CoinGecko, the total market cap of all Solana meme coins has jumped to over $17.8 billion. Dogwifhat has a market cap of $3 billion, while Bonk, Peanut the Squirrel, and Popcat each have valuations of over $1 billion.

Solana has also overtaken Justin Sun’s Tron to become the second-largest chain in the decentralized finance industry. Its total value locked has jumped to over $7.58 billion, with the biggest players in the network being Jito, Kamino, Jupiter, and Raydium.

After dominating Ethereum in DEX volume in October, Solana is repeating the same trend this month. Its volume has risen by 91% in the last seven days to $24.55 billion, mostly due to several trending Solana meme coins like Department of Government Efficiency and Happy Coin.

Solana price to form break and retest before roaring back

The daily chart shows that the SOL price has pulled back after soaring to $225 on Tuesday. It has remained above the 50-day and 200-day moving averages, which is a bullish sign. Also, the MVRVZ indicator has moved sideways after rising to its highest level since March.

Most importantly, there are signs that Solana is about to form a break and retest pattern by moving to the key support at $193, its highest level on June 29. A break and retest happens when an asset rallies above a key level, retests it, and then resumes the bullish trend. If this is correct, there are high chances that Solana will rebound and retest $250 in the near term.

Source link

You may like

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Ethereum

Ethereum instant finality? Buterin aims to silence critics

Published

1 week agoon

April 6, 2025By

admin

Ether had the worst first quarter in seven years regarding price action. Nevertheless, the Ethereum platform continues to develop as founder Vitalik Buterin introduces a new roadmap to increase the ecosystem’s security and finality.

Ethereum killers

Platforms copying Ethereum’s functionality while trying to tackle its downsides are usually dubbed “Ethereum killers.”

Talks about Ethereum’s death have been so persistent that a special website called Ethereum Obituaries was created. It tracks all the Ethereum “deaths,” ticking at the 133 mark as of press time.

Ethereum is criticized for ignoring the community’s demands and opinions during the current cycle.

In general, Ethereum’s market underperformance, especially compared to Solana’s success, may signal a serious crisis.

Even though Ethereum’s journey has been rough lately, and, at times, users and developers showed preference for its competitors, Ether is still the second-largest crypto after Bitcoin in terms of market capitalization.

In March, Ethereum outpaced its main competitor, Solana, in trading volume by 22%, becoming the leading platform in the DeFi space for the first time since September 2024. In terms of TVL, Ethereum is by far larger than Solana.

Furthermore, 53% of the stablecoin market is built on Ethereum. So, despite the ongoing price decline, Ethereum is still the second-biggest crypto brand after Bitcoin.

the only thing wrong with ethereum

is price and your bagsno alternative has significant enough improvements to make everyone switch over.

the network effects make that incredibly hard. it has 50% of all TVL & L2s add another 10%.

ethereum is built the right way to scale to…

— rip.eth (@ripdoteth) March 19, 2025

The platform still has many supporters among crypto enthusiasts, investors, and professionals from the crypto sector. Buterin is still a prominent voice in the crypto space, and what matters most is that the platform keeps on moving forward.

The new roadmap introduced in March confirms this.

Scalability issues

The new roadmap, published on March 28, reveals the planned steps to tackle one of Ethereum’s most notorious problems–its poor scalability. Throughout the time, the network experienced several major congestions that resulted in performance lags.

The most prominent example is the network slowing down caused by the Cryptokitties game in December 2017. The game involved in-game ETH transactions, and in December 2017, their volume reached 10% of all Ethereum transactions, causing substantial lags in the network.

Because ETH doesn’t scale, and those examples aren’t even firsts.

It’s really easy to build things on top of SQL databases that look interesting and useful. Indeed, if you’re ok with centralization they can be.

But that’s just not comparable to Bitcoin’s goals. pic.twitter.com/fCErmUzuAH

— Peter Todd (@peterktodd) December 21, 2019

The scalability concerns were discussed in 2017, and by 2025, Ethereum is still struggling to address this issue, which is very critical, given that Ethereum serves as the backbone for the majority of the NFT and stablecoin markets and various other decentralized platforms and tokens built on top of it.

The Ethereum team has been working on a solution ever since, and the 2022 transition from the proof-of-work consensus mechanism to proof-of-stake was one of the crucial steps in this direction.

In addition to addressing the scalability issues, the new roadmap aims to increase the network’s security.

Digesting the new roadmap

Buterin outlined three directions in the future development of Ethereum:

- Increasing the number of blobs up to 72 by 2026

- Reaching instant secure finality via 2-of-3 hybrid-proof architecture

- Improving aggregation levels

This list may seem difficult to understand for people unfamiliar with Ethereum’s architecture, so we’ll break it down.

The improvements will involve the increase of active roll-ups and blobs. Roll-ups are smart contracts that settle transactions off-chain and relay the data back to the mainnet, thus elevating the network’s speed and decreasing transaction costs.

There are three different layers of roll-ups: optimism (OP), zero-knowledge (ZK), and trusted execution environments (TEE).

Ethereum aims to scale through sharding, a split of the network into smaller manageable sections. Blobs are the Proto-Danksharding objects used to structure data. Increasing the number of blobs improves the work of rollups.

According to Buterin, by the end of the year, the network upgraded to the Pectra version (an upgrade is scheduled for May 2025) will use six blobs, while the Fusaka version of the network may use up to 72 blobs.

The base direction of the new roadmap is deploying a hybrid-proof architecture that will increase the speed and soundness of the Ethereum network.

To avoid dependency on a single type of proof, Ethereum will use a hybrid model in which transactions may be finalized immediately if their state roots are approved both via ZK and TEE rollups.

If ZK or TEE doesn’t approve a transaction, it gets approved with the help of the OP rollups, but it will take much longer.

According to Buterin’s description, such cases won’t be normal. Most of the transactions will be finalized instantly while being approved by two independent roll-ups, one of which (ZK) is fully trustless.

Buterin concludes:

This gets us to a pragmatic higher level of fast finality and security while getting us to the key stage 2 milestone of full trustlessness in the case where proof systems (OP and ZK) work correctly. It will reduce round-trip times for market makers to 1 hour or even much lower, allowing fees for intent-based cross-L2 bridging to be very low.

In the final part of the roadmap, Buterin stressed that the dev team should work harder on standardized proof aggregation layers scaled to the entire Ethereum ecosystem.

ZK-based proof systems should use single aggregate proofs to reduce gas expenses. Vitalk named Layer2 applications and zkemail-like wallet recoveries “the most natural initial use cases” for that.

The roadmap received mixed feedback, as some in the Ethereum community didn’t like its focus on Layer2. Will the proposed changes save Ethereum from tumbling down? Time will tell.

Source link

Ethereum

Ethereum ‘commoditized itself’ by shifting value to layer-2s, Standard Chartered says

Published

3 weeks agoon

March 25, 2025By

admin

Standard Chartered analysts say Ethereum is going through a “midlife crisis,” with ETH struggling to hold around $2,000.

Ethereum (ETH) has seemingly stuck in limbo as it’s giving away its value for free to layer-2 networks while struggling to keep investors interested. The world’s second-largest cryptocurrency by market capitalization has dropped 40% in the past three months, with Standard Chartered analysts now saying the network if facing “midlife crisis.”

In an interview with the Financial Times, Standard Chartered’s head of digital assets research Geoff Kendrick said the network “gave away value for free” as with layer-2 networks Ethereum has “essentially commoditized itself.”

Now, Ethereum is struggling with keeping its price from falling even further. As of press time, ETH is trading at around $2,054, after plunging to $1,813 earlier in March. Kaiko’s research analyst Adam McCarthy says the decline might be tied due to the fact that Ethereum “is just not interesting to most people.”

“It’s hard to get too excited about amazing feats of engineering when there [are] so many competing things now in the attention economy.”

Adam McCarthy

At the same time, Ethereum’s developers are struggling with internal disagreements, and user activity on the network hasn’t picked up, noted Carol Alexander, a finance professor at the University of Sussex. She added that the decentralized finance vision now feels “much further away now than a year ago” and that decision-making in the Ethereum community has become “a bit of a shambles.”

Ethereum’s direction has been under scrutiny lately as even former Ethereum Foundation engineer Harikrishnan Mulackal criticized the network’s governance, saying it suffers from a “lack of a clear and cohesive vision.”

Per Mulackal, without stronger leadership, Ethereum could stagnate, suggesting that the network should push for faster updates and ship “one hard fork each quarter.” Otherwise, he said, Ethereum risks reproducing “exactly the same result” as the past five years.

Source link

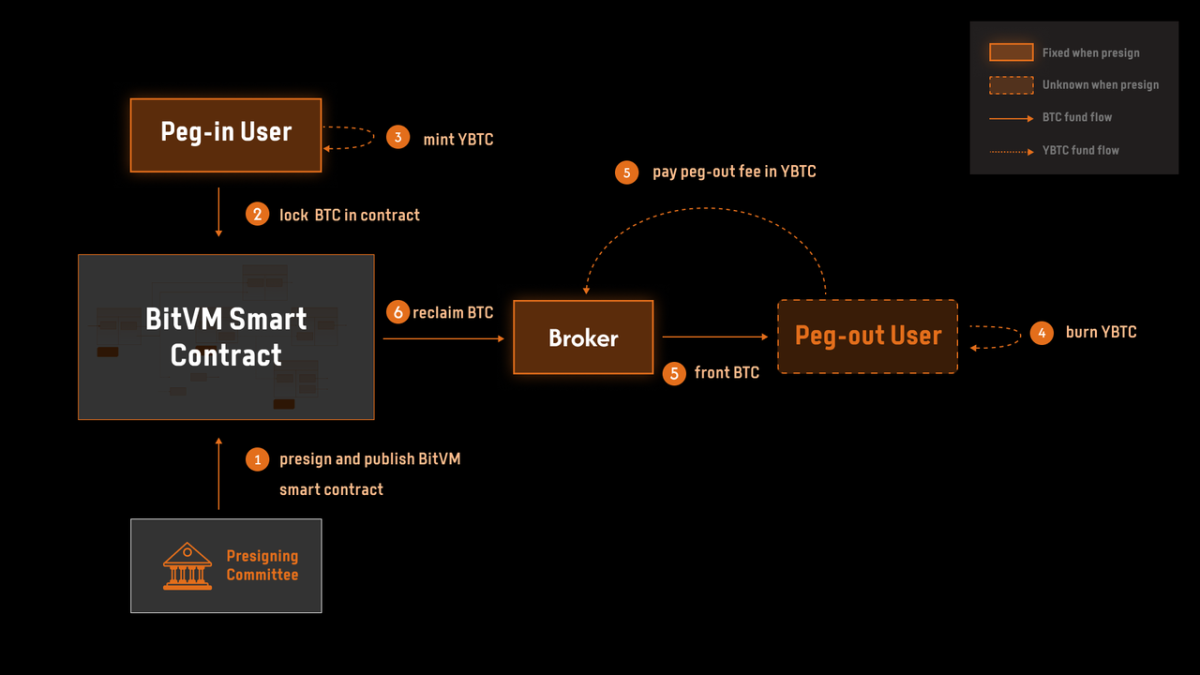

The introduction of BitVM smart contracts has marked a significant milestone in the path for scalability and programmability of Bitcoin. Rooted in the original BitVM protocol, Bitlayer’s Finality Bridge introduces the first version of the protocol live on testnet, which is a good starting point for realizing the promises of the Bitcoin Renaissance or “Season 2”.

Unlike earlier BTC bridges that often required reliance on centralized entities or questionable trust assumptions, the Finality Bridge leverages a blend of BitVM smart contracts, fraud proofs, and zero-knowledge proofs. This combination not only enhances security but also significantly reduces the need for trust in third parties. We’re not at the trustless level that Lightning provides, but this is a million times better than current sidechains designs claiming to be Bitcoin Layers 2s (in addition to significantly increasing the design space for Bitcoin applications).

The system operates on a principle where funds are securely locked in addresses governed by a BitVM smart contract, functioning under the premise that at least one participant in the system will act honestly. This setup inherently reduces the trust requirements but has to introduce additional complexities that Bitlayer aims to manage with this version of the bridge.

The Mechanics of Trust

In practical terms, when Bitcoin is locked into the BitVM smart contract through the Finality Bridge, users are issued YBTC – a token that maintains a strict 1:1 peg with Bitcoin. This peg is not just a promise but is enforced by the underlying smart contract logic, ensuring that each YBTC represents a real, locked Bitcoin on the main chain (no fake “restacked” BTC metrics). This mechanism allows users to participate in DeFi activities like lending, borrowing, and yield farming within the Bitlayer ecosystem without compromising on the security and settlement assurances that Bitcoin provides.

While some in the community might find these activities objectionable, this type of architecture allows users to get some guarantees that they previously could not hope to get with traditional sidechain designs, with the added bonus that we do not need to “change” Bitcoin to make it happen (although covenants would make this bridge design completely “trust-minimized, which would effectively make it a “True” Bitcoin Layer 2). For more details about the different levels of risks associated with sidechains designs, take a look at Bitcoin Layers assessment of Bitlayer here.

However, until such advancements come to fruition, the Bitlayer Finality Bridge serves as the best realization of the BitVM 2 paradigm. It’s a testament to what’s possible after the dev “brain drain” from centralized chains back to Bitcoin. Despite all the challenges that BitVM chains will face, I remain exceptionally excited at the prospect of Bitcoin fulfilling its destiny as the Ultimate Settlement Chain for all economic activity.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Guillaume’s articles in particular may discuss topics or companies that are part of his firm’s investment portfolio (UTXO Management). The views expressed are solely his own and do not represent the opinions of his employer or its affiliates. He’s receiving no financial compensation for these Takes. Readers should not consider this content as financial advice or an endorsement of any particular company or investment. Always do your own research before making financial decisions.

Source link

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

China selling seized crypto to top up coffers as economy slows: Report

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x