SOL

Solana Reclaims Monthly And Weekly Support Levels – Expert Sets $330 Target

Published

3 months agoon

By

admin

Solana (SOL) has made a remarkable recovery following Monday’s unexpected flash crash, surging by more than 28% in less than five days. This impressive rebound has sparked renewed optimism among investors, who are now eyeing the potential for a bullish continuation in the weeks ahead. The rapid price increase has positioned Solana as one of the top-performing assets in the crypto market, signaling a potential shift in momentum.

Related Reading

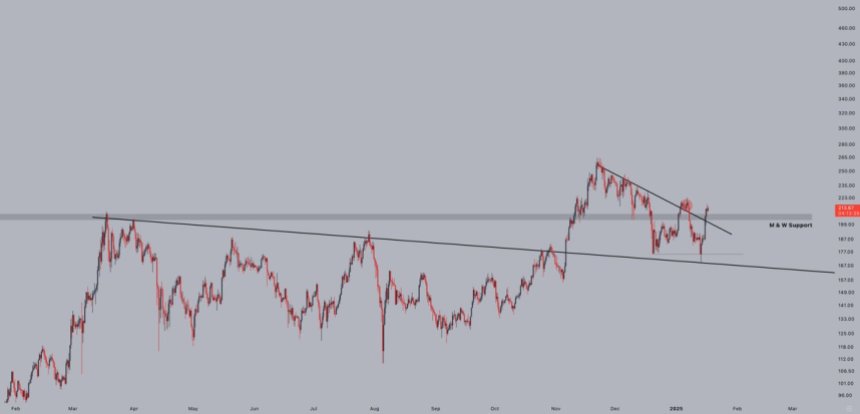

Renowned analyst Jelle recently shared a detailed technical analysis, highlighting that Solana has broken out of its prolonged downtrend. According to Jelle, SOL has successfully reclaimed crucial monthly and weekly support levels, indicating a significant move could be on the horizon. These levels, often considered key benchmarks for long-term stability, suggest that Solana’s recent gains may be more than just a temporary bounce.

If Solana can sustain this momentum, it may not only recover from recent losses but also pave the way for further gains, potentially outperforming other major altcoins. As technical indicators align with market enthusiasm, Solana could be gearing up for a breakout rally that captures the spotlight.

Solana Set To Enter Price Discovery Phase

Solana (SOL) emerged as one of the top market performers in 2024, posting an impressive surge of over 170%. This stellar performance cemented its position as a market leader and highlighted its resilience and growth potential within the crypto space. As 2025 unfolds, optimism surrounding Solana remains high, with many investors anticipating significant gains in the coming months.

The momentum appears to be building already, as Solana begins the year with a potential breakout. Renowned analyst Jelle recently shared insights on X, pointing out that SOL has successfully broken out of the downtrend that had restrained it since late November.

Moreover, Solana has reclaimed both monthly and weekly support levels—crucial milestones indicating that the asset has regained its bullish footing. According to Jelle, the price action for Solana is “super clean,” suggesting that the cryptocurrency is well-positioned for higher valuations.

Jelle’s initial target for SOL is set at $330, a level that would not only mark a significant recovery but could also push Solana into a price discovery phase. This phase typically sees heightened market interest and volatility as traders and investors recalibrate expectations for the asset’s long-term value. With technical indicators and market sentiment aligning, Solana appears poised to capitalize on its upward trajectory.

Related Reading

If Solana sustains this bullish momentum, it could continue to dominate headlines as a top-performing asset in 2025. As anticipation builds for further upside, traders and investors are closely monitoring key levels, knowing that the cryptocurrency’s next big move could redefine its role in the broader crypto ecosystem.

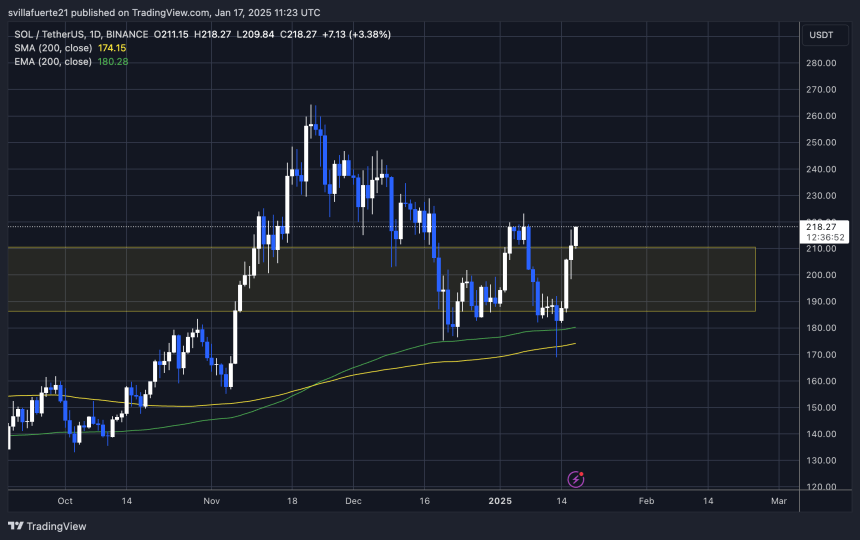

SOL Testing Crucial Supply Around $220

Solana (SOL) is currently trading at $218, approaching a critical level that could determine its next major move. The price is on the verge of setting a new local high above $222, a significant resistance point. Breaking through this level would signal a strong bullish continuation, setting the stage for massive price appreciation and the potential to reclaim its all-time high (ATH).

Analysts believe that if SOL clears the $222 mark and maintains its momentum, the next key level to watch is $250. Reclaiming and holding $250 as support would pave the way for Solana to enter uncharted territory, pushing its price into a new all-time high and potentially beginning a price discovery phase. This development would further solidify Solana’s position as a market leader and attract increased investor attention.

Related Reading

However, failing to surpass the $222 resistance or reclaim the $250 level could lead to a consolidation phase. Such a pause in price action might delay Solana’s rally but could also provide a foundation for renewed momentum in the future. With market participants closely monitoring these levels, Solana’s price movements in the coming days will be pivotal in determining whether the cryptocurrency embarks on its next major leg up or enters a temporary holding pattern.

Featured image from Dall-E, chart from TradingView

Source link

You may like

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Altcoins

Analyst Says Solana Flashing Biggest Bear Trap, Predicts New All-Time High for SOL by End of 2025

Published

2 days agoon

April 15, 2025By

admin

A closely followed trader believes that the layer-1 protocol Solana (SOL) may have just flashed a strong bullish reversal signal.

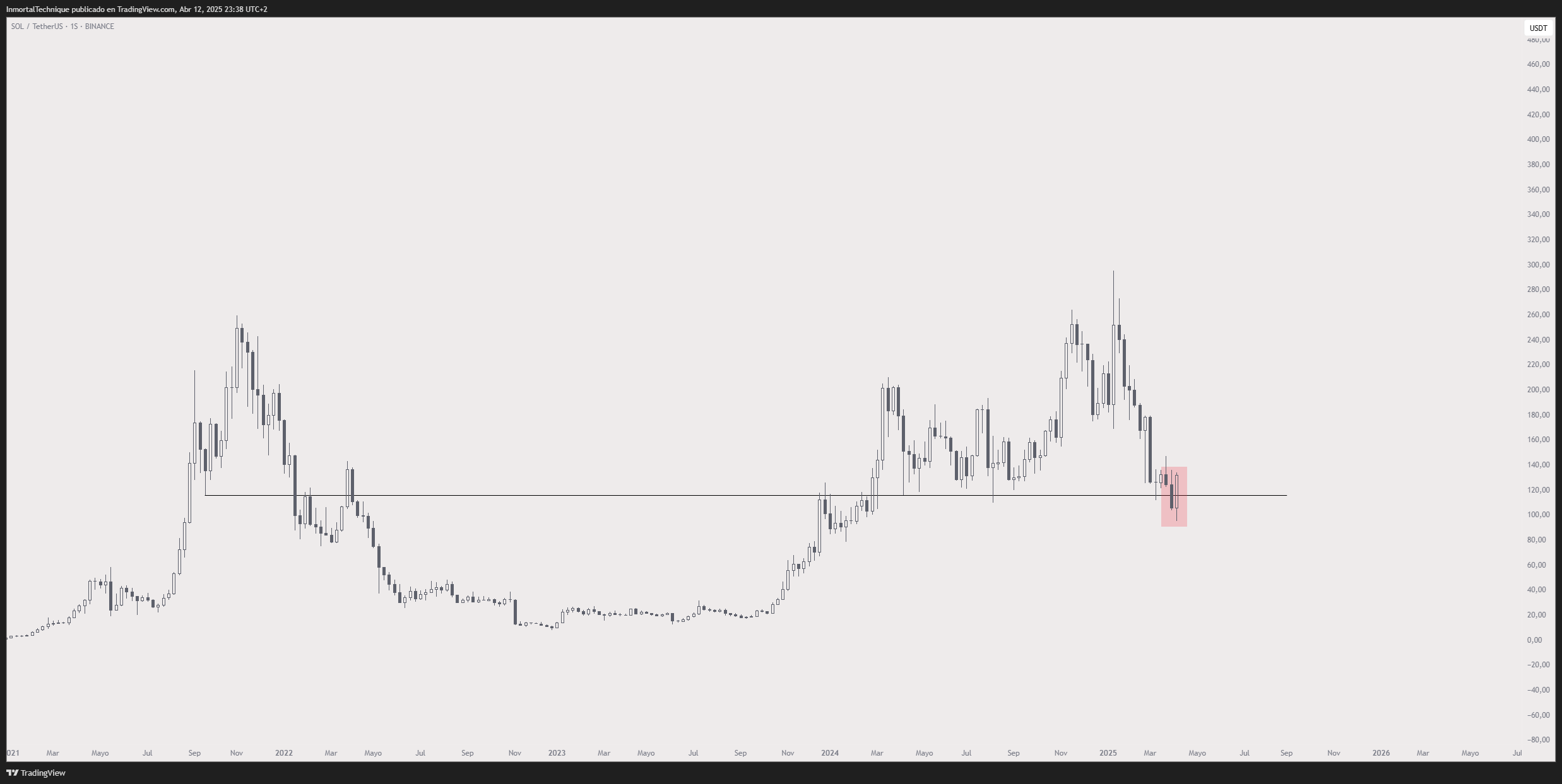

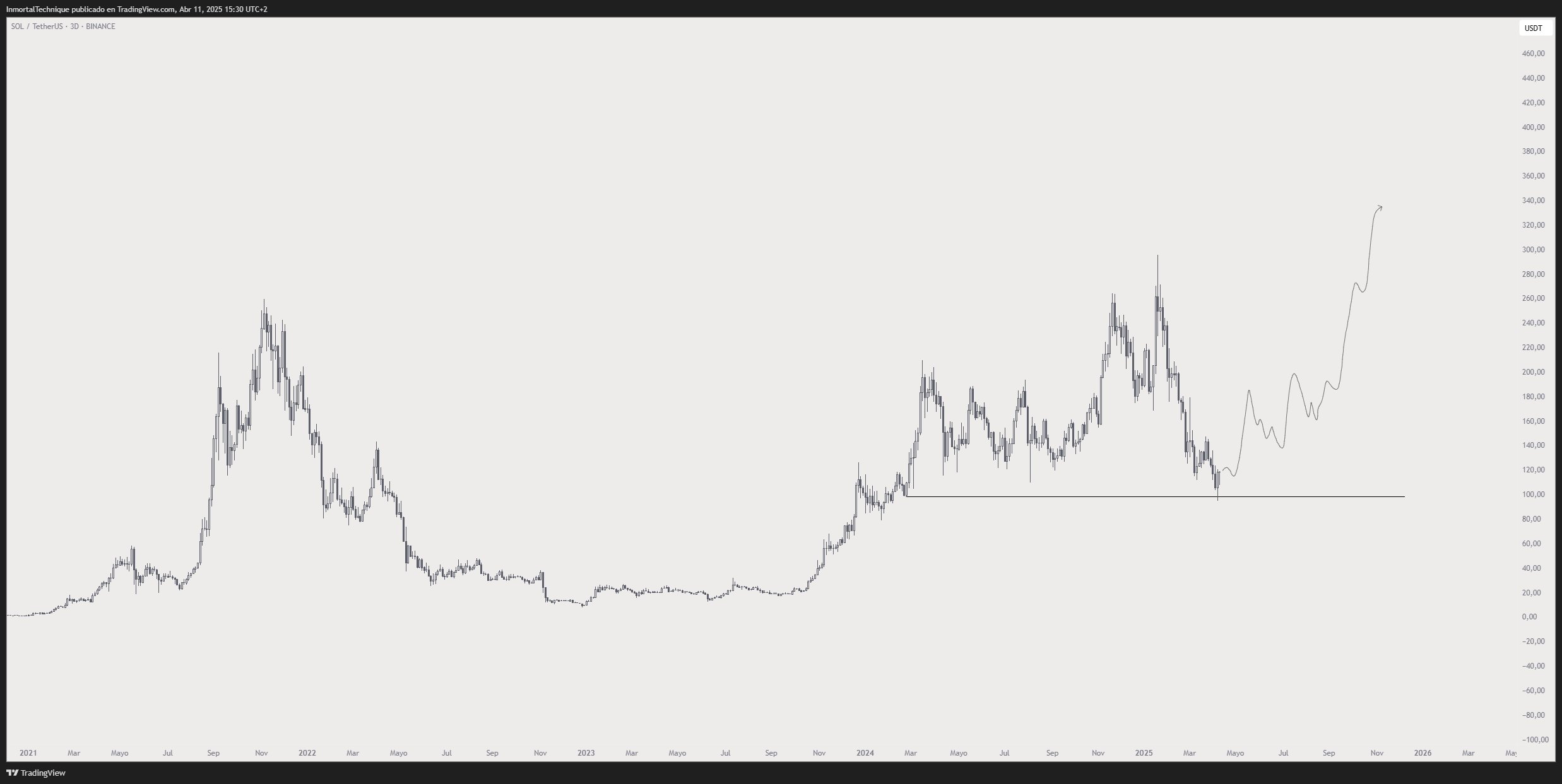

Pseudonymous trader Inmortal tells his 231,500 followers on the social media platform X that Solana appears to have set a massive bear trap earlier this month when the price of SOL briefly dropped below $100.

A bear trap is a false signal that makes it appear that the price of an asset is heading to much lower levels, but instead, the price abruptly reverses and rallies, leaving short-sellers trapped.

Says Inmortal,

“That weekly candle is maybe the biggest bear trap I’ve ever seen, SOL.”

The analyst now believes that SOL is setting the stage for strong rallies en route to a new all-time high of $340 by December 2025.

“In retrospect, it will be so obvious, SOL.”

At time of writing, Solana is trading for $128.19, down over 3% on the day.

Looking at Bitcoin, Inmortal thinks that BTC will trade between $74,000 and $95,000 in the coming months before sparking a breakout rally toward the end of the year.

“Expecting something like this:

> Bounce to $90,000

> More chop/ranging ($67,000 maybe)

> Uptrend in the second half of this year

Maybe not in this exact order.

BTC.”

Based on the trader’s chart, he appears to suggest that Bitcoin will soar close to $130,000 by the end of 2025. At time of writing, Bitcoin is worth $84,943.

Turning to the memecoin Floki (FLOKI), Inmortal thinks the altcoin is at a price level where it can potentially carve a major cycle bottom.

“Accumulating more FLOKI at these levels.

RSI (relative strength index) is at the same levels it was 700 days ago, and price at pre-bullrun levels.”

The RSI is a momentum indicator that can help traders spot levels where an asset is oversold or overbought. At time of writing, FLOKI is worth $0.000057.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Altcoin

Solana Price Eyes Breakout Toward $143 As Inverse Head & Shoulders Pattern Takes Shape On 4-hour Chart

Published

3 days agoon

April 13, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

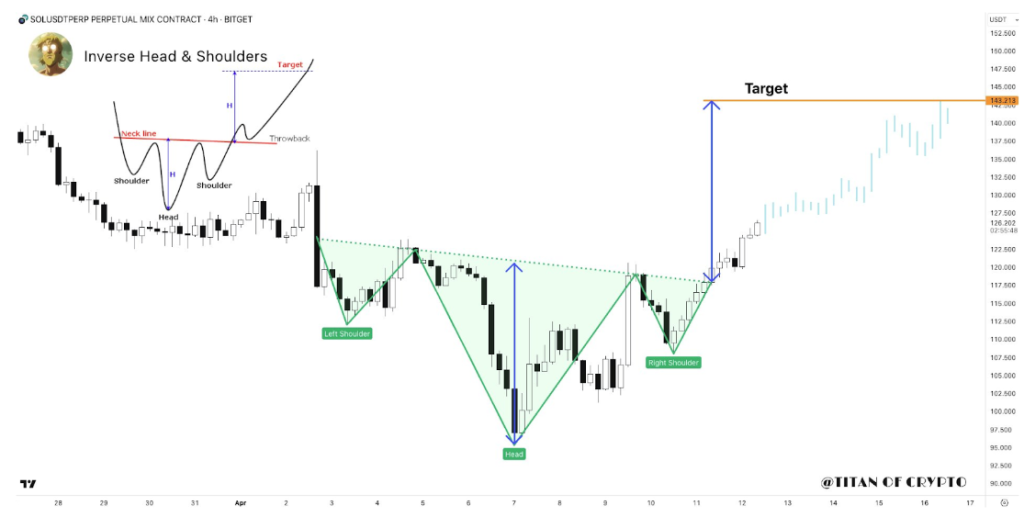

Solana appears to be gearing up for a major technical breakout, with recent price action building up an interesting chart formation. A familiar bullish pattern has formed, and if validated, it could drive the price to a level not seen in recent weeks. This new development was highlighted by popular analyst Titan of Crypto on social media platform X.

Pattern Breakout Sets $143 In Sight

Like every other large market-cap cryptocurrency, Solana has experienced an extended period of price crashes since late February. In the case of Solana, this price crash has been drawing out since January, when it reached an all-time high of $293 during the euphoria surrounding the Official Trump meme coin. Since then, Solana has corrected massively, even reaching a low of $97 on April 7.

Related Reading

The price action before and after this $97 low has created an interesting formation on the 4-hour candlestick timeframe chart. As crypto analyst Titan of Crypto noted, this formation is enough to send Solana back up to $143.

At the heart of the latest bullish outlook is a clearly defined inverse head and shoulders structure, which is known for its reliability in signaling a reversal from a downtrend to a bullish breakout. The left shoulder of the pattern began forming in early April as Solana attempted to rebound from sub-$110 levels. The subsequent drop to the $96 bottom on April 7 formed the head of the structure. From there, a recovery started as buyers cautiously stepped back in, giving rise to the right shoulder.

The breakout of the neckline resistance has taken place in the past 24 hours. With this in mind, Titan of Crypto predicted that $143 becomes the next logical destination based on the measured move from the head to the neckline.

Image From X: Titan of Crypto

Momentum Strengthens With Structure Confirmation

Looking at the chart shared by the analyst, the momentum behind Solana’s price movement appears to be gaining strength. Trading volume is an important metric in evaluating the strength of a breakout, and the volume accompanying the recent breakout above the neckline seemingly confirms it.

Particularly, Solana has seen a 5.3% increase in its price during the past 24 hours, with trading volume surging by 3.76% within this timeframe to $4.21 billion.

Although it is common to see a throwback or minor consolidation just above the neckline, the projected path suggests continued upside as long as price action holds above that key breakout zone.

Related Reading

At the time of writing, Solana is trading at $129, 10% away from reaching this inverse head-and-shoulder target. A move to $143 would not only represent a meaningful recovery from April’s lows but could also improve the confidence in Solana’s price trajectory moving into Q2. The next outlook is what happens after it reaches this target of $143, which will depend on the general market sentiment.

Featured image from The Information, chart from TradingView

Source link

SOL

Solana Triggers Long Thesis After Pushing Above $125 – Start Of A Bigger Rally?

Published

3 days agoon

April 13, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Solana is trading above the $125 mark after bulls stepped in with force, reclaiming critical technical levels and bringing some relief to a market that had been dominated by selling pressure. After weeks of steep declines and heightened volatility, Solana is finally showing signs of strength as buyers return and confidence starts to rebuild.

Related Reading

The bounce came at a crucial moment, as SOL was on the verge of breaking into lower demand zones following a sharp 47% drop since early March. The shift in momentum has caught the attention of market participants, especially as broader market sentiment begins to stabilize.

Top analyst Big Cheds shared a technical analysis on X, suggesting that Solana has “triggered a long thesis overnight” after reclaiming several key levels on the chart. His comments are fueling speculation that this move could mark the beginning of a broader recovery phase for SOL—provided bulls can hold current levels and build momentum from here.

As traders monitor upcoming resistance and key indicators, the next few days will be crucial in determining whether Solana’s rally has legs—or if it’s just another short-lived bounce in a volatile macro environment.

Solana Surges 40% As Long Thesis Takes Shape

Solana has gained over 40% since last Monday, sparking renewed bullish sentiment and opening a debate among analysts and traders: is this the start of a sustained move higher, or will SOL consolidate around current prices? After weeks of persistent selling pressure, Solana has finally seen a wave of buying interest, bouncing strongly from a $95 low. This bounce marks one of the most aggressive reversals among major altcoins during the recent market correction.

The surge came shortly after US President Donald Trump announced a 90-day pause on reciprocal tariffs for all countries except China, which now faces a 145% tariff. The announcement sparked relief rallies across risk assets, with Solana among the top beneficiaries.

Big Ched’s analysis reveals that Solana triggered a long thesis after successfully reclaiming the $125 resistance level. This move is seen as a breakout confirmation, suggesting that a bullish structure may now be forming.

However, global tensions and trade war fears continue to inject uncertainty into financial markets. For Solana, holding above the $120–$125 support zone will be key in determining whether the recent bounce has staying power—or if further consolidation is in store.

Related Reading

Price Holds Above Key Moving Averages: Crucial Resistance Awaits

Solana (SOL) is trading at $131 after finally breaking above the 4-hour 200 Moving Average (MA) and Exponential Moving Average (EMA), which sat around $125 and $128, respectively. This move signals a potential short-term trend shift in favor of the bulls, who are now holding some advantage after reclaiming these critical technical levels. The breakout came on strong volume, reinforcing the bullish momentum that emerged from last week’s bounce off the $95 low.

However, for the rally to continue and higher highs to form, SOL must maintain its position above the $125 level and push toward the next major resistance around $146. Reclaiming this level would strengthen bullish conviction and confirm a recovery rally in the broader trend.

Related Reading

Despite the recent strength, risks remain. If Solana fails to hold above $125, the bullish setup could unravel quickly, and the price may revisit the $100 demand zone. With global market volatility still elevated due to ongoing macroeconomic tensions, traders are watching this support-resistance range closely to determine whether SOL can sustain upward momentum or return to consolidation.

Featured image from Dall-E, chart from TradingView

Source link

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

China selling seized crypto to top up coffers as economy slows: Report

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x