Solana

Solana Surpasses PayPal In Market Cap As Price Soars 6%; Analyst Predicts ‘Big Breakout’ Ahead

Published

2 months agoon

By

admin

Solana (SOL), the fifth largest cryptocurrency by market cap, has recently outperformed several of the top ten cryptocurrencies with a notable 6% price increase over the past week. This rise puts Solana just behind Dogecoin (DOGE), which gained 7.8% over the same period, as the two best performers among the top ten cryptocurrencies by market capitalization.

As a result, Solana has surpassed the payment platform PayPal in market capitalization, marking a significant milestone for the cryptocurrency.

Solana Market Cap Hits $83.56 Billion

As of now, Solana’s market capitalization stands at approximately $83.56 billion, reflecting a 2% growth. In contrast, PayPal’s market cap is slightly lower at $83.52 billion, underscoring the growing interest and investment in SOL as it continues to attract attention from investors.

Related Reading

In terms of trading volume, Solana has seen a remarkable increase of nearly 28% in the last 24 hours, amounting to around $2.76 billion. This contrasts sharply with PayPal, which has averaged $11.66 million in trading volume over the past three months.

Despite its recent gains, Solana has faced challenges in breaking through its most important resistance level in the short term at $180, experiencing four unsuccessful attempts within the past week.

This struggle has led to a slight retracement of 1% in the last 24 hours, bringing the current trading price to $175.60 per SOL.

Potential Upside Breakout From Triangle Pattern

Despite any short-term obstacle, crypto analyst CryptoBullet has recently shared a bullish outlook for the Solana price, suggesting that the SOL/BTC trading pair is on the verge of a “big breakout.” According to the analyst, this potential movement could represent the final leg up in Solana’s current market cycle.

Previous predictions from CryptoBulltet indicated that Wave 4 of Solana’s price action on the weekly chart has concluded, setting the stage for a breakout from a “massive” triangle pattern, which could lead to new all-time highs.

However, while Solana is currently trading between $175 and $179, it remains down nearly 33% from its all-time high of $259, achieved during the 2021 bull market in November.

Related Reading

Looking at the key support levels, with the current consolidation mode experienced over the past week, the token has found strong support at $170, preventing it from retesting even lower levels, which if breached in the current retracement could take SOL to the $164 area, where its next support level is located.

However, given the number of bullish predictions for Solana and the broader market in the final months of the year, especially with the upcoming US elections, if the token manages to break above $180 and consolidate, the next target would be the $200 level, which has not been tested since the start of the last bearish trend at the end of July.

Featured image from DALL-E, chart from TradingView.com

Source link

You may like

Why You May Want To Redeem Your Bitcoin From THORChain's Lending Service

Zuckerberg Knowingly Used Pirated Data to Train Meta AI, Authors Allege

Meme Index raises $2M in 2 weeks

XRP Price Eyes Breakout: Bullish Pennant Points Upward

Pieter Wuille and Gregory Maxwell Receive The Finney Freedom Prize

Kenya Prepares to Legalize Cryptocurrencies in Policy Shift: Report

Ali Martinez

$4,000 Solana? Trader Ali Martinez Says SOL Forming Potentially Massive Cup and Handle Set Up

Published

5 days agoon

January 5, 2025By

admin

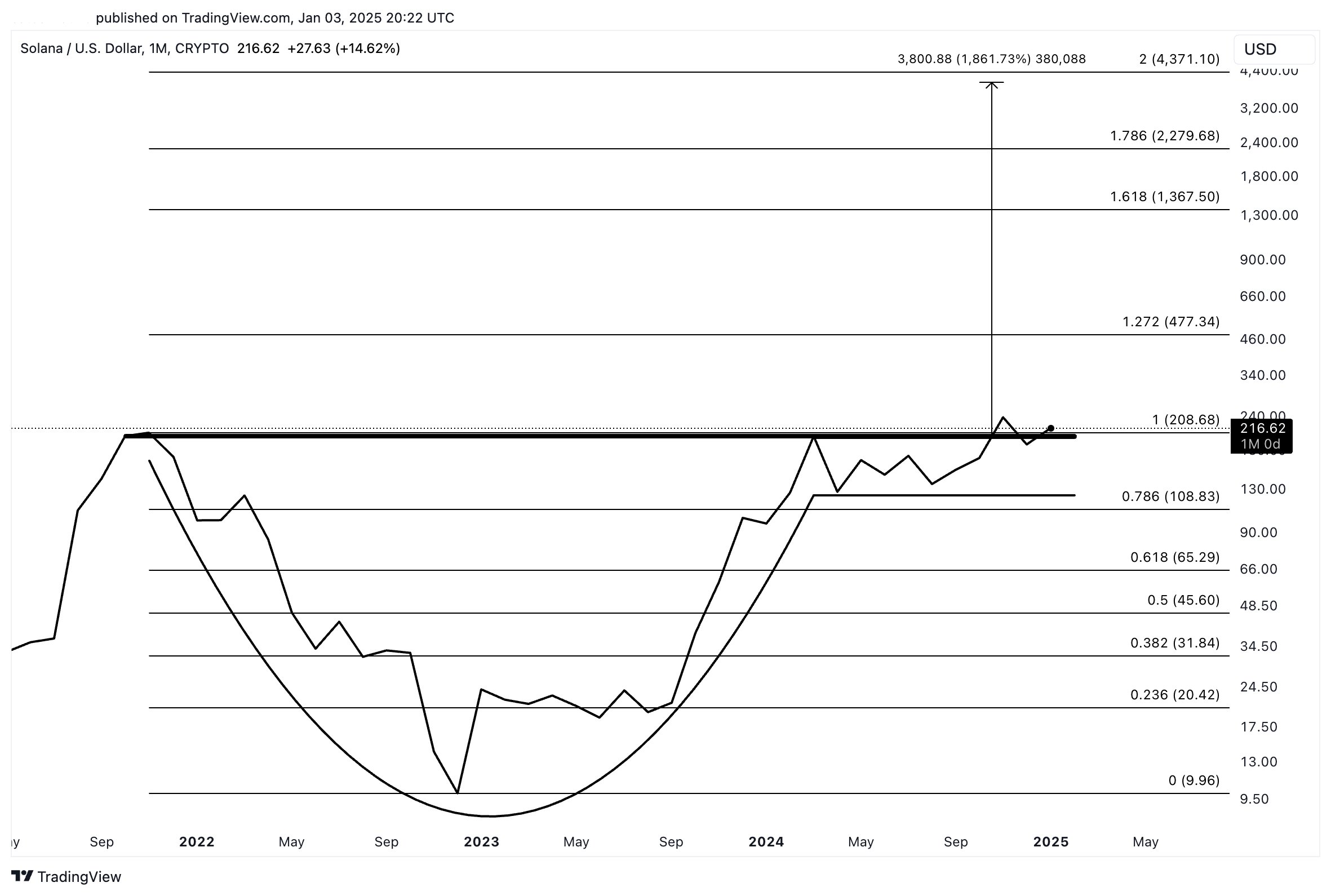

A closely followed crypto analyst says that smart contract platform Solana (SOL) is potentially forming a bullish technical pattern that could see it surge by over 1,700%.

In a new strategy session, crypto trader Ali Martinez tells his 108,000 followers on the social media platform X that it’s possible the Ethereum (ETH) rival is forming a cup-and-handle pattern that could push it to astronomical levels.

“There’s a chance SOL is forming a cup-and-handle pattern, and it will reach $4,000!”

A cup and handle is typically observed when the price movement of an asset forms a “cup” pattern before printing a smaller “handle” structure which suggests consolidation prior to a potential breakout.

Solana is trading for $215 at time of writing, a 1.3% decrease during the last 24 hours. If Solana were to reach Martinez’s target price, it would represent a staggering 1,760% increase.

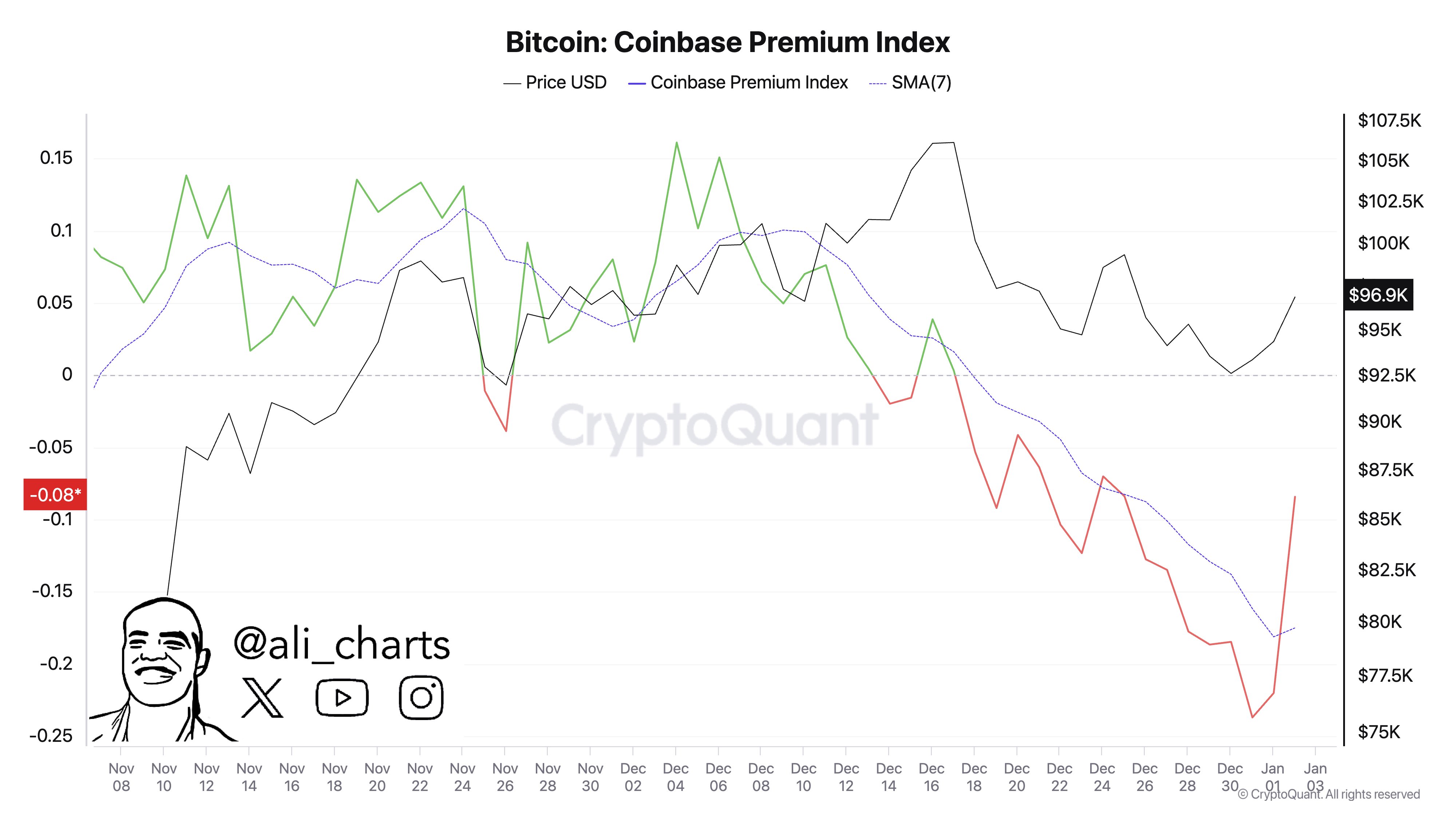

Moving on to the flagship digital asset Bitcoin (BTC), Martinez notes that Coinbase’s Premium Index – which tracks the price premium for BTC on Coinbase and therefore its demand in the US by proxy – suggests that institutional demand for the top crypto asset by market cap is ramping up in America.

“The Coinbase Premium Index recently hit -0.23%, a two-year low, but it’s now rebounding quickly. This signals growing institutional demand for BTC from US-based investors!”

Bitcoin is trading for $98,137 at time of writing, a marginal decrease on the day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Bitcoin

Bitwise Unveils Crypto Predictions for 2025, Says One Top-10 Altcoin Set To Explode 250% This Year

Published

6 days agoon

January 4, 2025By

admin

Digital asset investment manager Bitwise is unveiling its predictions for cryptocurrencies and the industry in 2025.

Starting with Solana (SOL), Bitwise’s head of research Ryan Rasmussen says the asset manager is predicting that the Ethereum (ETH) rival will skyrocket by 250% and hit a price of $750 this year.

Solana is trading at $214 at time of writing, around 18% below the all-time high price of $263 reached in November of 2024.

On Bitcoin (BTC), Bitwise predicts that the crypto king will surge by 106% from the current level to reach a price of $200,000 in 2025. Ethereum, according to Bitwise, will rally by around 99% from the current level to hit a price of $7,000 this year.

Bitcoin is trading at $96,940 at time of writing while Ethereum is worth $3,521.

Turning to US spot Bitcoin exchange-traded funds (ETFs), Rasmussen says Bitwise expects the inflows in 2025 to surpass last year’s figures. The cumulative total net inflows into the US spot Bitcoin ETFs as of January 3rd amounted to approximately $35.66 billion.

Rasmussen also says that Bitwise is predicting that the number of countries holding Bitcoin in their reserves will double in 2025. Some of the countries that currently hold Bitcoin reserves include El Salvador. The Central American country holds over $588.95 million in Bitcoin as of January 3rd.

The Bitwise head of research also cites the crypto asset manager’s bonus prediction that is projected to materialize further into the future.

“In 2029, Bitcoin will overtake the $18 trillion gold market and trade above $1 million.”

Bitcoin has a market cap of approximately $1.917 trillion at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

China

Edith Yeung Sees Big Things to Come for Crypto in Hong Kong

Published

6 days agoon

January 4, 2025By

admin

As the co-founder and general partner at early stage venture capital fund Race Capital, Edith Yeung has had a front-row seat on the development of the crypto sector, particularly in Hong Kong, where she was born and raised. Most notably, she was a seed investor in Solana, investing $250,000 when SOL was valued at just $0.04, and also was an early investor in Lightning Network. Since 2017, Yeung has also authored the China Internet report, an influential annual survey of technology trends in China.

Here, Yeung, who will be a speaker at Consensus Hong Kong, discusses Hong Kong’s ongoing development as a crypto hub, her take on China’s stance towards crypto, what she foresees for Solana and one big crypto prediction for 2025.

This series is brought to you by Consensus Hong Kong. Come and experience the most influential event in Web3 and Digital Assets, Feb.18-20. Register today and save 15% with the code CoinDesk15.

Interview has been condensed and lightly edited for clarity.

How do you see crypto regulations developing in HK in 2025? Do you think more crypto companies will become licensed by the SFC in 2025?

It’s exciting to see that Hong Kong now has seven SFC-licensed virtual asset trading platforms. From an investor’s perspective, having a clear licensing regime is a major step forward. Regulatory clarity and predictability are like well-lit roads — they give investors the confidence to drive forward without worrying about unexpected detours.

That said, licensing alone isn’t enough. Liquidity is the other critical piece of the puzzle. Think of a trading platform like a brand-new highway: you can have the smoothest pavement and clearest signs, but if no cars are on it, drivers won’t bother. Similarly, no matter how many licenses you have, if there’s no active trading and liquidity, investors will hesitate to come aboard.

The key for Hong Kong now is to build not just the infrastructure but the traffic flow — because a great platform without liquidity is like an empty highway going nowhere.

What kind of role do you see Hong Kong developing in terms of the crypto sector, especially in relation to the US? What about Asia more broadly?

Hong Kong is the New York of Asia. Exchange Square is basically Wall Street — a 24/7 financial powerhouse with soaring skyscrapers and streets full of traders, investors and bankers with energy that never quits. If you are a crypto builder or investor, you will find many TradFi talents (traders, market makers, etc.) in Hong Kong.

To build a successful TradFi or DeFi company, you need to recruit specific types of talent that are hard to find even in Silicon Valley. Hong Kong boasts a rich financial history, with its stock market origins dating back to 1866 — over 150 years — means there is a deep pool of experienced professionals who can drive innovation and growth in your venture.

What would you say is distinctive about HK/Southeast Asia for crypto compared to the US and Europe?

The U.S. is home to the largest crypto addressable market in terms of institutional investors, regulators and builders. But Asia is home to the highest growth potential for the crypto market. In 2024, half of the top 10 countries in the world ranked by crypto adoption were located in Asia.

With the new Trump administration, the U.S. will continue to set the tone for crypto regulation and institutional adoption (e.g., BlackRock ETF). Asia will follow their lead with its massive usage base that is young and crypto-native.

Do you view China as generally pro or anti-crypto? There’s been a lot of crypto activity there, but at the same time, the government is officially against mining and speculation.

Hong Kong is part of China. Seeing pro-crypto regulation slowly forming in Hong Kong is a great sign and indicator for China. That said, China literally has an army of 220 million retail investors sitting on almost $21 trillion worth of savings. With a lingering property crisis and a meek economy, however, it is very difficult to say when China will open up for crypto business again, as the government focuses on these larger issues.

You were a seed investor in Solana; do you still have your initial investment there? Do you think Solana will continue to attract as much memecoin activity as it did in 2024?

Yes. It was an honor that I got to meet Solana co-founders Anatoly Yakovenko and Raj Gokal and become their seed investor back in March 2018. I am a long-term Solana holder and supporter. What I love about them is their dedication to building and their support for the developer community. The developer energy at the 2024 Breakpoint conference was high not only because of memecoins.

The Firedancer team made huge technical advances last year, and I just love that Anatoly is still head-down geeking out with people like Jump Trading chief science officer Kevin Bowers and his team every day. Even more exciting to me is seeing traditional finance players like Fidelity, Citi and PayPal speaking at Breakpoint about what they are building on Solana. This influx of established players not only validates Solana’s future but also signals that blockchain technology is ready for the masses.

What kinds of companies are you currently looking to invest in and why?

I am a seed investor in Huma Finance — a leader in PayFi building on Solana and a leader in stablecoin infrastructure. In 2024, they did over $2 billion in stablecoin transactions. At Race Capital, we will continue to focus on investing in internet infrastructure. Builders who want to be around long-term do not mind whether it’s an up or down cycle.

What’s something you think will happen in 2025 that will surprise crypto folks?

The establishment of a U.S. Bitcoin Reserve by the end of 2025. The United States is currently the largest holder of Bitcoin, with approximately 207,189 bitcoins. This effort will be bolstered by this massive stockpile, which is now valued at over $20 billion at current prices. This decision is expected to drive up bitcoin prices, prompting other governments around the world to follow suit.

What are you most excited to discuss onstage in Hong Kong?

Hong Kong’s role in building the crypto industry in 2025, China’s love/hate relationship with crypto and perhaps more insights on Solana.

Source link

Why You May Want To Redeem Your Bitcoin From THORChain's Lending Service

Zuckerberg Knowingly Used Pirated Data to Train Meta AI, Authors Allege

Meme Index raises $2M in 2 weeks

XRP Price Eyes Breakout: Bullish Pennant Points Upward

Pieter Wuille and Gregory Maxwell Receive The Finney Freedom Prize

Kenya Prepares to Legalize Cryptocurrencies in Policy Shift: Report

Genius Group buys $5m more in Bitcoin, totaling treasury to $35m

Why This AI Agent Crypto AIXBT is Up 55% Today?

Have Bitcoin ETFs Lived Up to the Hype?

Apostas basquete Brasil

SAFE rallies 20% on Bithumb listing

Solana, XRP, Litecoin, HBAR in 2025 With New SEC Chair?

Bitcoin Supercycle Incoming Amid Changing Market Conditions, According to Alex Krüger – But There’s a Catch

K-pop giant Cube Entertainment’s CEO under fire for misleading crypto investment guarantees

How a Crypto Trader Turned a 90% Loss Into a $2.5M Win?

Ethereum’s lowered yield might signal a paradigmatic shift in the ecosystem

Telegram users can send gifts to friends, TON fails to pump

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

A Kamala Presidency Could Be Just as Bullish for Bitcoin

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Cardano and the XRP price action lock in bulls vs bears battle as RCO Finance prepares for 3,000% surge

A16z-backed Espresso announces mainnet launch of core product

Tether CEO Paolo Ardoino Denies Rumors That Stablecoin Issuer Is Under Federal Investigation

Crypto Exchange OKX Moves To Support USDC Ecosystem by Adding Six New Trading Pairs

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

DeFi3 months ago

DeFi3 months agoEthereum’s lowered yield might signal a paradigmatic shift in the ecosystem

News3 months ago

News3 months agoTelegram users can send gifts to friends, TON fails to pump

Bitcoin2 months ago

Bitcoin2 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin2 months ago

Bitcoin2 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Opinion2 months ago

Opinion2 months agoCrypto’s Big Trump Gamble Is Risky

Opinion3 months ago

Opinion3 months agoA Kamala Presidency Could Be Just as Bullish for Bitcoin

Price analysis2 months ago

Price analysis2 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x