SOL

Solana To New ATH Before Christmas – Analyst Expects $300 Soon

Published

5 months agoon

By

admin

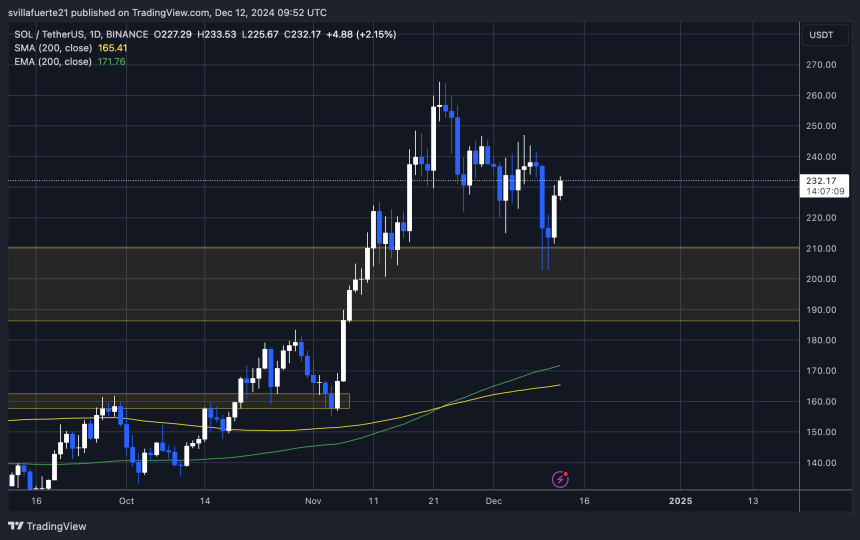

Solana (SOL) has faced a 23% retrace after hitting new all-time highs at $264, testing the resilience of bullish momentum. Despite this pullback, SOL’s price structure remains strong, with the token holding firmly above a critical demand zone. This consolidation phase indicates the market is gearing up for another potential breakout as bullish sentiment persists.

Related Reading

Renowned crypto analyst and investor Jelle recently shared a technical analysis on X, expressing optimism about Solana’s future price trajectory. According to Jelle, the retrace is a healthy correction that allows SOL to build the strength needed for another significant rally. He predicts that Solana will reach new all-time highs before Christmas, setting the stage for an exciting close to the year.

With Solana maintaining its position above key levels and investor interest remaining robust, all eyes are on the $264 mark as bulls prepare to push the token into price discovery once again. The coming weeks will be pivotal, with the potential for SOL to reclaim its momentum and deliver significant gains. If the bullish predictions hold true, Solana could solidify its position as one of the standout performers in the crypto market this cycle.

Solana Price Action Signals Strength

Solana (SOL) continues to show bullish momentum, holding strong above $210, a critical support level that previously acted as resistance. This price behavior signals a healthy retrace, allowing the market to reset before another potential move higher. Solana’s ability to maintain this level reinforces the bullish narrative, suggesting that it’s preparing for another upward push.

Top crypto analyst Jelle recently shared his insights on X, expressing confidence in Solana’s price trajectory. Jelle’s technical analysis predicts that SOL will reach new heights before Christmas, highlighting a price target of $300 in the near term. He emphasizes that the current consolidation phase is a positive sign, as it allows for accumulation and builds the momentum necessary for a breakout.

However, despite the optimism, the possibility of a prolonged consolidation phase looms if SOL fails to break its all-time high (ATH). This scenario could lead to a temporary stagnation in price action, with SOL ranging sideways as traders await a clearer market direction. Such a consolidation phase would not necessarily be bearish but could delay the anticipated rally.

Related Reading

For Solana to meet Jelle’s $300 target, bulls must reclaim and hold levels above the ATH, signaling strength and renewed buyer interest. If successful, Solana is poised to enter price discovery once again, securing its position as a top-performing crypto asset in the current market cycle.

SOL Testing Liquidity Levels

Solana (SOL) is currently trading at $232, showing resilience after successfully holding key demand levels at $210. This critical support has proven vital in maintaining bullish momentum, allowing the price to recover and consolidate above $222. The ability to stay above this mark has strengthened investor confidence, with the focus now shifting to higher targets.

The next key resistance for SOL is $246. Breaking above this level would not only signify a bullish breakout but also position SOL to challenge and surpass its all-time high (ATH) of $264. A confirmed breakout above $246 would signal renewed momentum, potentially driving Solana into uncharted territory and reigniting market excitement.

Related Reading

However, the bullish scenario depends on SOL’s ability to maintain its upward trajectory. If the price struggles to break above the $246 level in the coming weeks, it risks losing momentum. This could lead to a broader correction, with traders eyeing the $210 demand zone once again as a critical area to watch.

Featured image from Dall-E, chart from TradingView

Source link

You may like

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

SOL

Solana (SOL) Holding Strong Above $150 — Breakout Zone In Play

Published

3 days agoon

April 25, 2025By

admin

Solana started a fresh increase from the $132 support zone. SOL price is now consolidating and might climb further above the $155 resistance zone.

- SOL price started a fresh increase above the $135 and $150 levels against the US Dollar.

- The price is now trading above $150 and the 100-hourly simple moving average.

- There is a connecting bullish trend line forming with support at $150 on the hourly chart of the SOL/USD pair (data source from Kraken).

- The pair could start a fresh increase if it clears the $155 resistance zone.

Solana Price Gains Over 10%

Solana price formed a base above the $132 support and started a fresh increase, like Bitcoin and Ethereum. SOL gained pace for a move above the $135 and $145 resistance levels.

The pair even spiked toward the $150 resistance zone. A high was formed at $154.55 and the price is now consolidating gains. There was a minor move below the 23.6% Fib retracement level of the upward move from the $145 swing low to the $155 high.

Solana is now trading above $150 and the 100-hourly simple moving average. There is also a connecting bullish trend line forming with support at $150 on the hourly chart of the SOL/USD pair. The trend line is close to the 50% Fib retracement level of the upward move from the $145 swing low to the $155 high.

On the upside, the price is facing resistance near the $154 level. The next major resistance is near the $155 level. The main resistance could be $162. A successful close above the $162 resistance zone could set the pace for another steady increase. The next key resistance is $175. Any more gains might send the price toward the $180 level.

Pullback in SOL?

If SOL fails to rise above the $155 resistance, it could start another decline. Initial support on the downside is near the $150 zone. The first major support is near the $145 level.

A break below the $145 level might send the price toward the $138 zone. If there is a close below the $138 support, the price could decline toward the $132 support in the near term.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

Hourly Hours RSI (Relative Strength Index) – The RSI for SOL/USD is above the 50 level.

Major Support Levels – $150 and $145.

Major Resistance Levels – $155 and $162.

Source link

Altcoins

XRP, Solana, DOGE and Others Among 72 Different ETF Applications Waiting for SEC Approval: Report

Published

4 days agoon

April 24, 2025By

admin

Crypto firms are now waiting to hear back on 72 active applications for new crypto-related exchange-traded funds (ETFs).

James Seyffart, an ETF analyst at Bloomberg Intelligence, compiled the list of submissions to the U.S. Securities and Exchange Commission (SEC).

ETFs awaiting approval include funds tied to Solana (SOL), XRP (XRP), Sui (SUI), Litecoin (LTC), Axelar (AXL) Hedera (HBAR), BNB, Cardano (ADA), Avalanche (AVAX), Dogecoin (DOGE), Polkadot (DOT), Aptos (APT), Chainlink (LINK), Pudgy Penguins (PENGU), Official Trump (TRUMP), Melania (MELANIA) and Bonk (BONK).

Other potential new ETFs are tied to a basket of currencies, and a few are based on Bitcoin (BTC) and/or Ethereum (ETH), assets that have already been approved for inclusion in other spot ETFs.

Eric Balchunas, a senior ETF analyst at Bloomberg Intelligence, predicts that BTC ETFs will remain dominant regardless of the number of altcoin funds that are approved.

“No Second Best? Bitcoin ETFs command 90% of all the crypto fund assets globally. While a TON of alt/meme coin ETFs are likely going to hit market this year, they will only make a minor dent, Bitcoin likely to retain at least 80-85% share long-term.”

The SEC greenlit the first spot market Bitcoin ETFs in January 2024, bringing in billions of dollars worth of inflows to the top digital asset by market cap, and the regulator subsequently approved Ethereum ETFs for trading last July.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Don White – Art Dreamer/Vladimir Sazonov

Source link

24/7 Cryptocurrency News

Solana Price Targets $250 as SOL Strategies Unveils $500M Convertible Note to Buy SOL

Published

4 days agoon

April 23, 2025By

admin

Solana price is on the rise, and analysts observe trends that may propel it to the $250 mark. This is an optimistic prediction following SOL Strategies, a listed Canadian company that deals in the Solana ecosystem, announcing that it has secured a $500 million convertible note deal with ATW Partners to boost its SOL holdings and staking activities.

$500 Million Convertible Note Structure To Buy SOL

SOL Strategies has secured what it describes as a “first-of-its-kind” convertible note facility with ATW Partners. According to the announcement, the $500 million facility will be implemented in multiple tranches. This starts with a $20 million closing expected to occur around May 1, 2025. This is subject to customary closing conditions.

BREAKING: SOL Strategies secures landmark USD $500M convertible note facility with ATW Partners to expand SOL holdings.

This first-of-its-kind structure is exclusively for SOL purchases and staking on our validators, with interest paid in SOL.

This represents the largest… pic.twitter.com/p9SB4dRm6o

— SOL Strategies (CSE: HODL | OTCQX: CYFRF) (@solstrategies_) April 23, 2025

The facility is designed basically for the Solana ecosystem. Also, all capital will be exclusively allocated to purchasing SOL tokens. These tokens will then be staked on validators operated directly by SOL Strategies.

The announcement comes at a time when the Solana price has reclaimed the $150 level. SOL has pumped close to 18% in the last seven days.

In a notable element of the agreement, interest on the notes will be paid in SOL tokens rather than fiat currency. This interest will be calculated as up to 85% of the staking yield generated by the SOL acquired through the facility.

Technical Analysis Points To $250 Solana Price Target

Technical analysts are observing bullish patterns on Solana price charts that are indicative of a possible run-up to the $250 level. The SOL/USDT chart shows a definitive breakout from a falling wedge pattern. This is identified as a bullish indication of a price increase in technical analysis.

Analyst Luciano_BTC has shared some important changes on the chart. They are a “Falling Wedge” pattern that has shifted higher with a clean “Trendline Breakout.” The chart from the analyst also displays a potential target of +50% Uptrend.

Called it – pumped it.

$SOL is the easiest trade of the century.

In my opinion, more green candles are coming.

NFA. https://t.co/MRjTpSy9ij pic.twitter.com/HXYbgwBR58

— Lucky (@LLuciano_BTC) April 23, 2025

Technical analyst Christiaan concurs with this technical outlook. He just tweeted that the Solana price is heading to $250. Another analyst, Lucky, expressed strong conviction about Solana’s prospects. He called it the easiest trade of the century and predicting more green candles are coming.

The technical configuration shows SOL finding support at a point known as a Demand Zone, which Luciano_BTC identified, prior to starting its current rally. The chart shows a number of possible points of resistance to $250, with targets towards $180 and $220 before reaching the final destination. CoinGape has also analyzed and shared their price prediction for Solana, which shows that SOL is 49% bullish.

Vignesh Karunanidhi

Vignesh Karunanidhi is a seasoned crypto journalist with nearly 7 years of experience in the cryptocurrency industry. He has contributed to numerous publications, including WatcherGuru, BeInCrypto, Milkroad, and authored over 10,000 articles

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Bitcoin trades at ‘40% discount’ as spot BTC ETF buying soars to $3B in one week

Bitcoin Continues To Flow Out Of Major Exchanges — Supply Squeeze Soon?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

✓ Share: