Donald Trump

Solana TVL Crosses $10B, for First Time Since FTX Collapse, After $TRUMP Memecoin

Published

2 months agoon

By

admin

The “official” memecoin of incoming U.S. President Donald Trump has boosted interest in Solana (SOL), leading to a surge in both its price and trading volume, which in turn helped the total dollar value locked (TVL) on the network top $10 billion for the first time since the collapse of FTX.

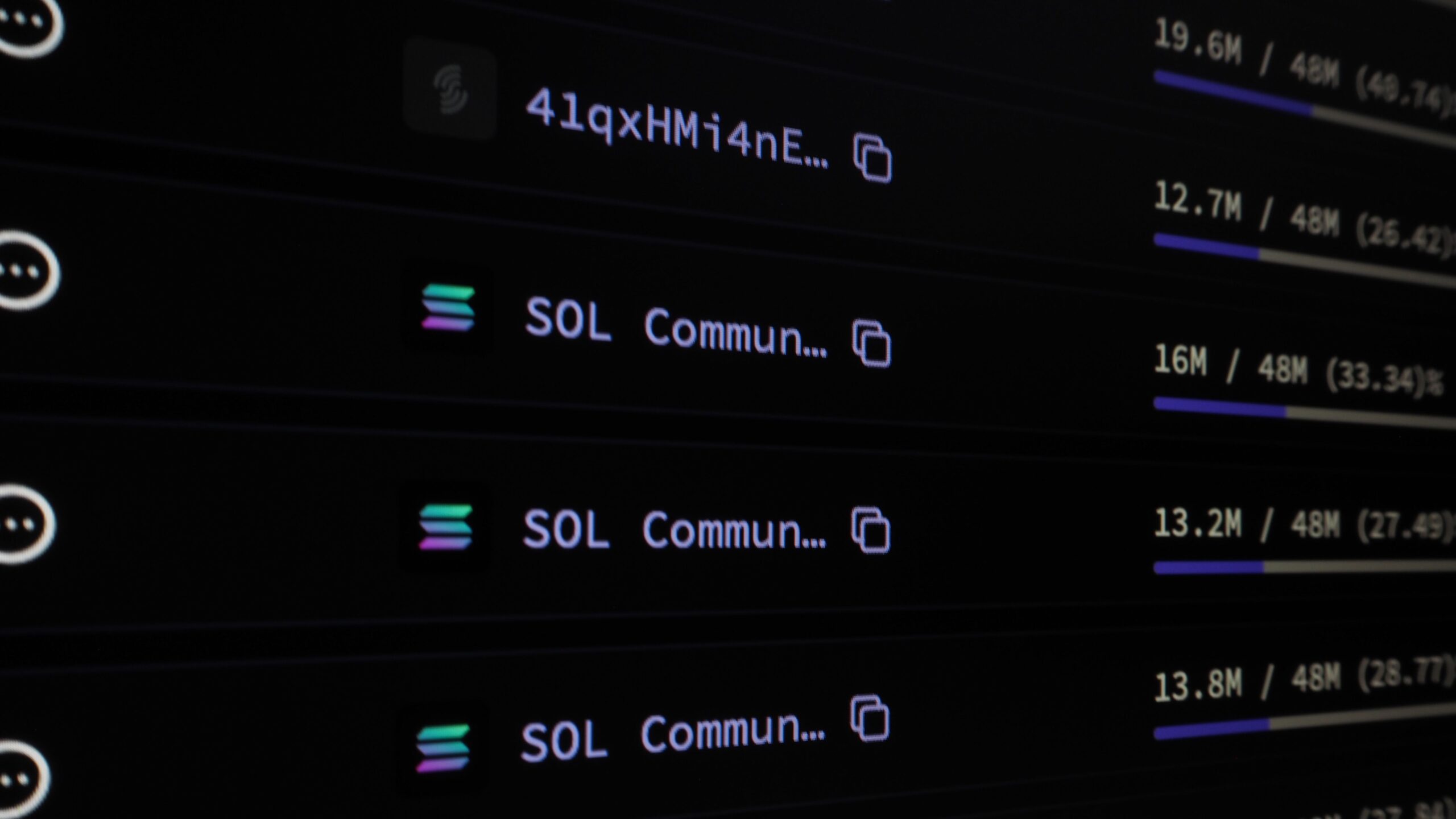

Donald Trump’s choice of issuing the memecoin on Solana helped SOL rise more than 23% since its announcement, moving the cryptocurrency’s price to a new all-time high and boosting the dollar value locked on its smart contracts. Data from DeFiLlama shows TVL on Solana is now at $12 billion, a new all-time high.

Measured in SOL, the value locked on the network has been steadily growing since the beginning of last year and recently topped 45 million SOL. This level hasn’t been seen since August 2022, ahead of the collapse of FTX, whose co-founder Sam Bankman-Fried was a major Solana proponent.

The launch of Donald Trump’s official memecoin, $TRUMP, was co-ordinated by CIC Digital LLC, a Trump-affiliated organization, the BBC reported. Together with Fight Fight Fight LLC, they own 80% of the memecoin’s supply set to be released over the next three years.

The memecoin, which has been dominating headlines in the space and is set to be listed on major cryptocurrency exchanges including Binance and Coinbase, is currently the third-largest across all blockchains behind Shiba Inu and Dogecoin in terms of market capitalization.

The token was launched by a team including Solana ecosystem protocols Jupiter and Meteora and led to a trading frenzy on the network’s decentralized exchanges, with DeFiLlama showing Raydium surpassed Tether in 24-hour fee generation.

Moonshot, the memecoin trading platform featured on the memecoin’s website posted on social media by President-elect Donald Trump, reported a 12-hour trading volume of nearly $400 million after the memecoin launched, adding it onboarded over 200,000 users onto the network in the process.

https://x.com/moonshot/status/1880659326395666759

The network choice also helped boost the perceived odds of a spot Solana exchange-traded fund (ETF) being launched in the first half of the year. Polymarket traders went from weighing a 43% chance such a product would be launched by July 31, to 61%.

The trading frenzy came during the weekend, when trading volumes are typically muted as many institutional investors and professional traders are less active. This means that speculative activity on the network could well continue during the week.

Beyond that, the memecoin’s launch is bringing Solana an influx of new users and presents the network, which has suffered multiple major outages, with an opportunity to showcase its robustness. If it withstands the test, the Solana ecosystem could keep on seeing significant inflows.

The introduction of Trump’s token also signals the U.S. government’s change in stance toward the cryptocurrency sector and offers it increased legitimacy, as the President of the world’s largest economy has quite literally launched a Solana-based memecoin.

The memecoin’s rollout signals a “change in US fintech policy towards much more permissive innovation,” crypto OG and Shapeshifter founder Erik Voorhees commented.

Source link

You may like

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Solana Protected Gender Identity Before Panning It in Anti-Queer Ad

Musk says he found ‘magic money computers’ printing money ‘out of thin air’

Donald Trump

Mr. Wonderful says the crypto cowboy era is over. Really?

Published

1 day agoon

March 16, 2025By

admin

As President Donald Trump stakes his claim on the future of cryptocurrency in America, investors and industry insiders are divided on whether his administration truly marks a turning point for digital assets.

Kevin O’Leary, chairman of O’Leary Ventures and a longtime cryptocurrency advocate, recently lauded Trump’s stance on digital assets, arguing that this administration is ushering in a “new phase” for the industry.

Speaking on “My View with Lara Trump,” O’Leary asserted that the so-called “cowboy era of crypto” — marked by high-profile fraud cases and regulatory uncertainty — was over.

Recall that O’Leary was indeed affected by perhaps the biggest crypto fraud case of all — FTX. As an investor and spokesperson for the exchange, O’Leary lost a significant amount of money when Sam Bankman-Fried’s startup went bankrupt in late 2022.

“All the crypto cowboys are in jail or out of business. So now we’re in a new phase. There’s a new tone with the government. Trump has put it forward,” O’Leary said.

But rug pulls and devastating hacks are still commonplace.

Meanwhile, crypto “whales” and influencers are making a killing by pumping up coins with fake “insider knowledge,” inflating prices before cashing out, and leaving everyday investors holding the bag. It’s the Wild West out there, and the scammers are riding high.

O’Leary’s optimism comes as Trump embarks on one new crypto initiative after another.

After speaking at the Bitcoin 2024 Conference in Nashville, the then-GOP nominee launched World Liberty Financial. Two days before his inauguration, he unveiled the Official Trump (TRUMP) meme coin. And all of those SEC-led investigations into cryptocurrency-related companies (i.e., Binance and Coinbase)? They’re disappearing.

Earlier this month, Trump signed an executive order establishing a Strategic Bitcoin Reserve. The move, which designated certain digital assets like XRP, SOL, and ADA as part of a government-backed strategic reserve, has been touted by Trump and his allies as a major step toward integrating crypto into traditional finance.

While O’Leary hails these developments as proof of a regulatory turning point, not everyone in the crypto world is convinced.

‘This ain’t it’

Critics argue that Trump’s newfound embrace of digital assets hurts the industry’s credibility and paves the way for crony capitalism.

“Crypto is at an existential moment,” Zack Guzmán, a crypto journalist and founder of the Web3 media company Trustless Media, warned on Jan. 18. “I understand the desire to make quick money; I understand the excitement of thinking short-term; I understand stand [sic] why Trump, a man who has grifted in every way to make money for himself would so easily win the industry. But this ain’t it.”

Only politically favored crypto firms will thrive under government protection, Guzmán said.

The same day Trump decided to launch a memecoin, which skyrocketed 10,000% in value, crypto elitists dressed up in tuxedos and gowns, ready to hobnob at a gala in Washington, D.C. They were completely unaware that Official Trump would soon become a digital dumpster fire (it’s currently down over 84% from its peak).

“I’m not saying Trump just used everyone in crypto by throwing a black tie event in DC while simultaneously launching a memecoin without them, but that’s exactly what he did,” Guzmán wrote on Jan. 18. “This industry is his industry now, whether they are aware of it or not. Frankly, that’s extremely sad.”

‘Stupid and embarrassing’

After Trump launched Official Trump, Balaji Srinivasan, a cryptocurrency investor, called meme coins a “zero sum game.”

“There is no wealth creation,” he tweeted the day before Trump’s inauguration. “Every buy order is simply matched by a sell order. And after an initial spike, the price eventually crashes and the last buyers lose everything.”

Crypto entrepreneur Erik Voorhees wrote on X:

Trumpcoin is stupid and embarrassing. Trumpcoin is a signal of sea change in US fintech policy towards much more permissive innovation. Both are true.

SkyBridge founder and former White House Communications Director Anthony Scaramucci called it “Idi Amin-level corruption”, referring to the military officer whose Ugandan rule in the 1970s was defined by corruption.

And that Bitcoin reserve — the one David Sacks, Trump’s crypto czar, says will be filled with seized digital assets — seems far-fetched, too. Crypto analyst Dessislava Aubert told the Agence France-Presse that the U.S. government must return seized Bitcoin to all victims identified as suffering from a hack.

Despite the skepticism, O’Leary remains steadfast in his belief that Trump’s policies will legitimize crypto in ways no previous administration has.

“The big news is that this will be the first administration that’s going to say this sector belongs in America. The development should be here. The technology should be mastered here. We should lead the world in it,” O’Leary added.

Whether Trump’s promises translate into lasting regulatory clarity—or are merely political grandstanding—remains an open question. For now, the crypto world watches closely, caught between hope and deep-seated doubt.

Source link

Donald Trump

Sacks purges crypto, but Trump? His digital empire continues

Published

3 days agoon

March 15, 2025By

admin

David Sacks, President Donald Trump’s go-to “czar” for AI and crypto, and his venture-capital firm, Craft Ventures, recently parted ways with a whopping $200 million worth of digital asset holdings.

According to Bloomberg, citing a memo from the White House, Sacks and Craft liquidated their entire crypto portfolio—Bitcoin (BTC), Ethereum (ETH), Solana (SOL)—before Trump’s inauguration on Jan. 20.

This revelation came on March 5 by White House counsel David Warrington.

Among the divestitures: Sacks ditched his stakes in Coinbase and Robinhood, as well as his limited-partner shares in crypto funds Multicoin Capital and Blockchain Capital.

Craft Ventures followed suit, selling off its own interests in Multicoin Capital and Bitwise Asset Management.

Sacks has repeatedly insisted he’s not into crypto anymore—at least not since becoming the White House’s crypto czar. He even made a point of addressing it directly on March 3, responding to a tweet by VC reporter George Hammond.

“Correct. I sold all my cryptocurrency (including BTC, ETH, and SOL) prior to the start of the administration,” he clarified on X (formerly Twitter).

Democratic Sen. Elizabeth Warren had also been pressing for Sacks to release his financial disclosures to the public. By divesting his crypto holdings before taking on the role of crypto adviser, Sacks is clearly distancing himself from any potential bias.

But Trump’s track record on the matter? That’s a different story.

Potential conflicts of interest

On the eve of his inauguration, Trump launched his very own memecoin, Official Trump (TRUMP) — a token that has no utility. But that didn’t stop it from gaining a cult following and peaking at a value of $15 billion.

Those followers? They lost billions. Official Trump is currently down about 83.5% of its value from its all-time high. See below.

A recent Financial Times investigation shows the project raising at least $350 million in the first three weeks post-launch. Despite claims that it’s “not distributed or sold by Donald Trump or his affiliates,” the memecoin’s real backers seem to be Trump’s subsidiary, CIC Digital, and Fight Fight Fight LLC, which own a whopping 80% of the token.

Trump’s crypto ventures didn’t stop there. Last September, he launched World Liberty Financial, a decentralized finance platform that peddles the WLFI token. His sons—Eric, Don Jr., and Barron—are all reportedly involved in the project.

This week, World Liberty Financial raised $550 million in a token sale, pushing its total funding close to $600 million so far. So far, it has secured $550 million by selling its WLFI tokens, data from ICO Drops shows.

Last month, crypto.news reported that World Liberty Financial sold over 24 billion tokens, leaving around 950 million tokens available for purchase.

It’s worth noting that, on March 6, Trump signed a second Executive Order to establish a U.S. Bitcoin reserve and a Digital Asset Stockpile. At the time, Sacks downplayed the decision to include altcoins in the stockpile.

Buddying up to Binance?

Binance is reportedly in talks with Trump and/or World Liberty Financial to sell a financial stake in its U.S. arm. The discussions reportedly began after Binance, the world’s largest cryptocurrency exchange, rbeagan looking to reestablish a presence in the U.S. market.

It remains unclear whether the stake would be contingent on a pardon for Binance founder and former CEO Changpeng Zhao.

Recall how Binance’s recent brush with the law. The company, which has no official headquarters, ran into significant legal trouble over allegations of money laundering and regulatory violations.

But under the Trump administration, cryptocurrency companies like Binance stand to benefit from loose regulations. So far, the Trump-appointed leadership of the U.S. Securities and Exchange Commission has halted numerous investigations into crypto-related companies that started under President Joe Biden’s watch — including Binance.

Source link

Bitcoin

Crypto Faces Uncertainty As Trump’s ‘Short-Term Pain’ Unfolds

Published

4 days agoon

March 14, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

US President Trump’s outspoken acceptance of near-term economic hardship has placed risk assets—including Bitcoin (BTC) and the broader crypto market—under mounting pressure. According to a thread by The Kobeissi Letter on X, President Trump’s strategy revolves around tolerating significant “short term pain” in order to drive down inflation and facilitate the refinancing of over $9 trillion in US debt.

Will Crypto Survive Trump’s ‘Short-Term Pain’ Strategy?

The impact on cryptocurrencies has been immediate and pronounced. While US equities have shed an estimated $5 trillion in market value this year, digital assets have also suffered steep losses. Since President Trump’s inauguration on January 21, Bitcoin (BTC) has declined by approximately -23%, Ethereum (ETH) has tumbled by roughly -43% and the broader crypto market has experienced even more dramatic price drops.

Related Reading

Although high volatility is nothing new in crypto, the synchronized downturn suggests that crypto assets are not immune to macroeconomic forces. The Kobeissi Letter adds, “Based on our research, President Trump made this conclusion BEFORE inauguration. However, he began formally articulating it on March 6th. Below is the headline that destroyed investor confidence in 2025. President Trump is no longer the ‘stock market’s President’ (for now).”

The Kobeissi Letter points to March 9 as the date President Trump further confirmed his stance by noting that America is in a “period of transition” and that it will “take a little time,” implying a willingness to tolerate near-term market turbulence. During this period, Commerce Secretary Lutnick’s statement on March 6—“Stock market not driving outcomes for this admin”—was followed by Treasury Secretary Bessent’s remark, “Not concerned about a little volatility.”

Although The Kobeissi Letter’s analysis notes that the administration’s viewpoint solidified before inauguration, it cites President Trump’s urgent focus on the year 2025, when $9.2 trillion in US debt will either mature or need to be refinanced. The thread states, “First, as we have previously noted, the US is facing a massive refinancing task. In 2025, $9.2 TRILLION of US debt will either mature or need to be refinanced. The quickest way to LOWER rates ahead of this colossal refinancing would be a recession.”

Related Reading

Beyond debt concerns, The Kobeissi Letter also highlights the administration’s drive to reduce oil prices and the US trade deficit as part of the same economic calculation. Since President Trump took office, oil has fallen by over 20%. “Furthermore, a clearly defined part of President Trump’s strategy has been to LOWER oil prices. Oil prices are down 20%+ since Trump took office. This morning, Citigroup said oil prices falling to $53 would lower inflation to 2%. What would lower oil prices? A recession.”

Meanwhile, the administration’s extensive use of tariffs, which The Kobeissi Letter describes as “levying tariffs on almost ALL US trade partners,” is chipping away at GDP growth estimates, further hinting that a deliberate slowdown is in motion.

The Kobeissi Letter also notes, “On top of this, DOGE and Trump are attempting to cut TONS of government jobs. These are the same jobs that have accounted for much of the recent job ‘growth’ in the US. Government jobs have risen by 2 million over the last 4.5 years. Cutting these jobs will spur a recession.” DOGE leader Elon Musk appears resigned to short-term declines. Even after Tesla (TSLA) recorded its seventh-largest historical drop on March 10, Musk posted that “It will be fine long-term.”

For crypto traders and investors, the “short term pain” scenario by Trump is currently dictating the price action. The question, the analysts from The Kobeissi Letter posit, is whether this will lead to a more favorable economic landscape in the long run. “Is the ‘short term pain’ worth the ‘long term gain’ in President Trump’s economic strategy?”.

At press time, the BTC price remained under heavy downward pressure and traded at $82,000.

Featured image from Shutterstock, chart from TradingView.com

Source link

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Solana Protected Gender Identity Before Panning It in Anti-Queer Ad

Musk says he found ‘magic money computers’ printing money ‘out of thin air’

XRP To Triple Digits? Analyst Confident In $100 Price Goal

What Are They And What Do They Do?

Trader Predicts Crypto Rallies Amid Expectations of Fed Monetary Policy Shift – But There’s a Catch

Solana’s 5th birthday highlights explosive growth and trading activity: Mercuryo

Trump, Associates Net $390 Million Payday From World Liberty Token Sale

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Ethena Labs, Securitize launch blockchain for DeFi and tokenized assets

Shiba Inu Gains Momentum: SHIB Price Breaks Above 100-Day Moving Average, What’s Next?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x