Ethereum

Sony’s Layer-2 Blockchain “Soneium” Goes Live

Published

2 months agoon

By

admin

Sony, the 78-year-old Japanese electronics giant, is the latest legacy megacorp to explore blockchain technology. On Tuesday, the company announced that it is officially launching “Soneum,” a general-purpose blockchain platform.

The team behind Sony Block Solutions Labs (SBSL), a joint project between Sony Group and Singapore-based Startale Labs, describes Soneuim — technically a layer-2 network atop Ethereum — as “a versatile general-purpose blockchain platform” built to support a diverse ecosystem of gaming, finance and entertainment apps. According to SBSL, the launch comes after a four month-long test period that involved participation from 14 million wallets.

Sony’s network is yet more evidence that traditional technology companies might again be keen on blockchain’s ability to connect and commercialize the future of media. The chain is aimed towards “bridging the gap between web2 and web3 audiences, especially for the creators, fans and community,” SBSL said in a statement shared with CoinDesk. “The platform prioritizes user-centric design, simplifying blockchain interactions and evolving web3 from a niche hobby into an everyday experience.”

The team tapped Optimism’s OP Stack to build out their network — a customizable framework that lets developers use optimistic rollup technology to transact on Ethereum quickly and at a low cost.

Other companies using the OP Stack include the U.S. crypto exchanges Coinbase and Kraken, which use the tech to power their popular Base and Ink networks. Uniswap, the leading decentralized exchange, and Worldcoin, the Sam Altman-founded digital passport, also use OP Stack to power their layer-2 blockchain networks.

In many cases, the Optimism Foundation, which stewards the development of the OP Stack, has awarded grants to companies that agreed to use its tech. SBSL declined to comment on how many OP tokens they would receive as part of this deal, though previous reporting indicates that Optimism’s grants can be substantial.

In August 2023, Coinbase received up to 118 million OP tokens — worth $182 million at the time, or $192 million at today’s prices — to use OP Stack for Base chain. CoinDesk also reported that Kraken received up to 25 million OP tokens, worth roughly $100 million, when it agreed to use the OP Stack in January 2024 (now worth $42 million).

Similar grants are doled out by Optimism competitors like Polygon and Arbitrum, each of whom is dueling to build its own interconnected web of blockchains.

Read more: Sony, Electronics Pioneer Behind Walkman, Starts Own Blockchain ‘Soneium’

Source link

You may like

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Solana Protected Gender Identity Before Panning It in Anti-Queer Ad

Musk says he found ‘magic money computers’ printing money ‘out of thin air’

Ethereum

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

Published

2 hours agoon

March 18, 2025By

admin

Ethereum Foundation now appears to be shifting focus toward founder-driven growth and capital formation after facing criticism from investors and builders.

Ethereum‘s leadership seems to be reconsidering its growth strategy as criticism mounts, with signs of a shift toward a more founder-driven and ecosystem-focused approach, according to Dragonfly Capital’s managing partner Haseeb Qureshi.

After meeting with several EF people at ETH SF, I’m more optimistic about Ethereum.

There’s a real urgency and an understanding that things need to change. It’s not 2020 anymore, and they get it—they want Ethereum to matter. They’re taking input from investors, from builders,…

— Haseeb >|< (@hosseeb) March 17, 2025

In an X post on March 17, Qureshi revealed that after meeting with several Ethereum Foundation representatives he’s now “more optimistic about Ethereum.” He noted a “real urgency” among Ethereum Foundation members, adding that they understand concerns about Ethereum’s lack of momentum and “want Ethereum to matter.”

Now, Qureshi says the team appears to be considering how to “replicate the success” of Solana‘s Superteam, a community of operators, developers & grantees working on Solana projects, within the Ethereum ecosystem, with less emphasis on research and more on “capital formation and founder journeys.”

“Ethereum leadership have been getting a lot of criticism, and it’s important that you all know this — it’s working. They’re listening. They’re thinking hard about how to adapt. It’s a teachable moment for them.”

Haseeb Qureshi

Qureshi’s comments come as Ethereum’s direction has been under scrutiny lately as even former Ethereum Foundation engineer Harikrishnan Mulackal criticized the network’s governance, saying it suffers from a “lack of a clear and cohesive vision.”

Per Mulackal, without stronger leadership, Ethereum could stagnate, suggesting that the network should push for faster updates and ship “one hard fork each quarter.” Otherwise, he said, Ethereum risks reproducing “exactly the same result” as the past five years.

Source link

ADA

Analyst Says Crypto Whales Loading Up on Ethereum, Accumulating $815,514,345 in ETH in Just Five Days

Published

1 day agoon

March 17, 2025By

admin

A crypto analyst says deep-pocketed investors are snapping up the top layer-1 platform Ethereum (ETH) amid the marketwide digital asset correction.

Trader Ali Martinez tells his 132,900 followers on the social media platform X that whales gobbled up more than $815.514 million worth of ETH in less than a week.

“Whales have bought more than 420,000 Ethereum ETH in [five days]!”

Martinez is also keeping a close watch on Ethereum’s In/Out of the Money Around Price (IOMAP) metric – which classifies crypto addresses as either profiting, breaking even, or losing money – to determine support and resistance levels for ETH.

According to Martinez, ETH is currently trading in a narrow range between stiff support and resistance zones.

“Ethereum ETH key levels to watch! On-chain data reveals $1,870 as the strongest support and $2,050 as its toughest resistance!”

At time of writing, ETH is trading for $1,941.

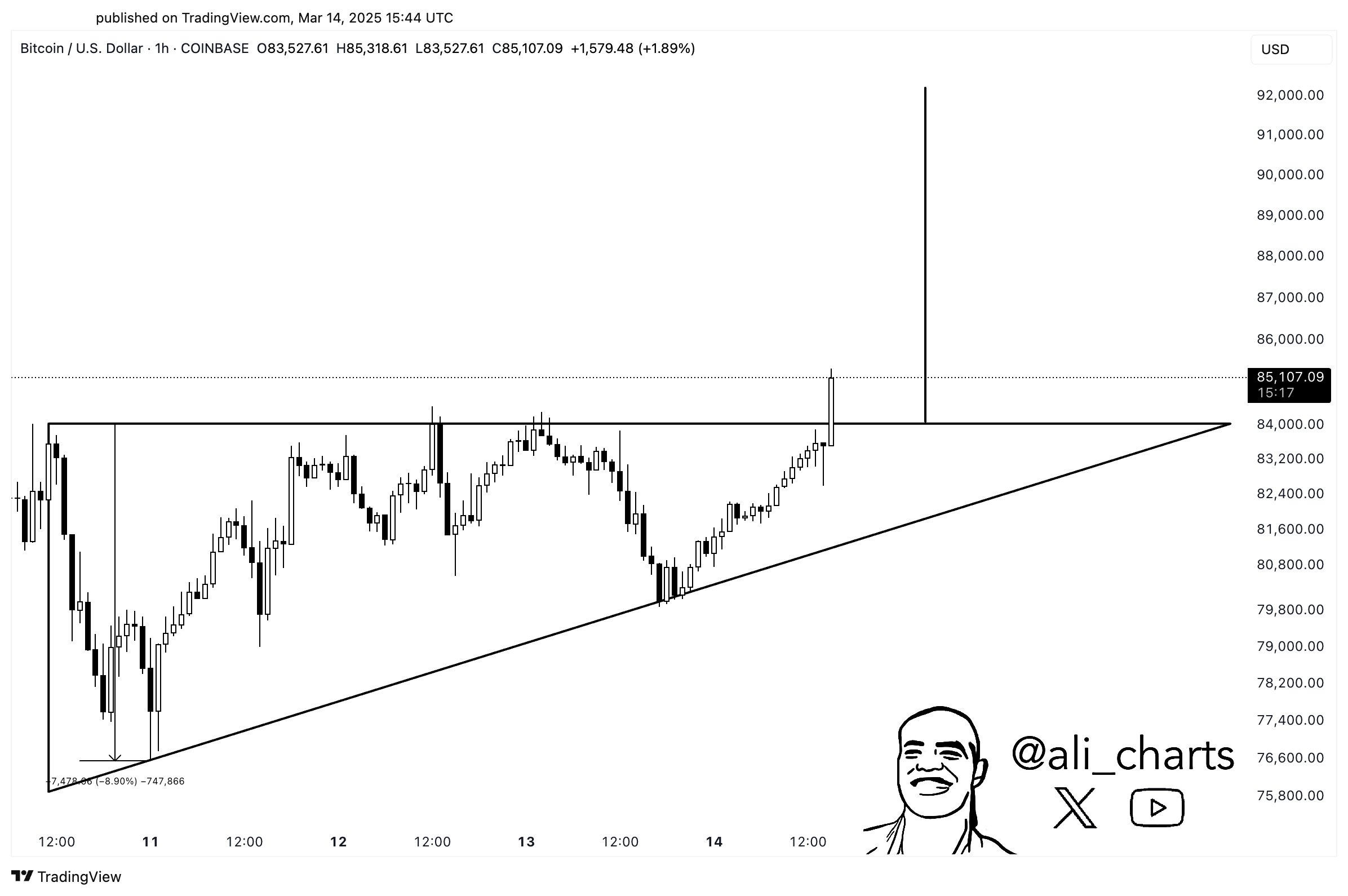

Turning to Bitcoin (BTC), the trader believes that the crypto king is poised to witness tactical rallies after breaching the horizontal resistance of an ascending triangle pattern.

“Bitcoin BTC is breaking out! The target is $90,000 as long as the $84,000 support holds.”

An ascending triangle pattern may be considered a bullish reversal structure if the asset soars above its horizontal resistance.

At time of writing, Bitcoin is trading for $84,288.

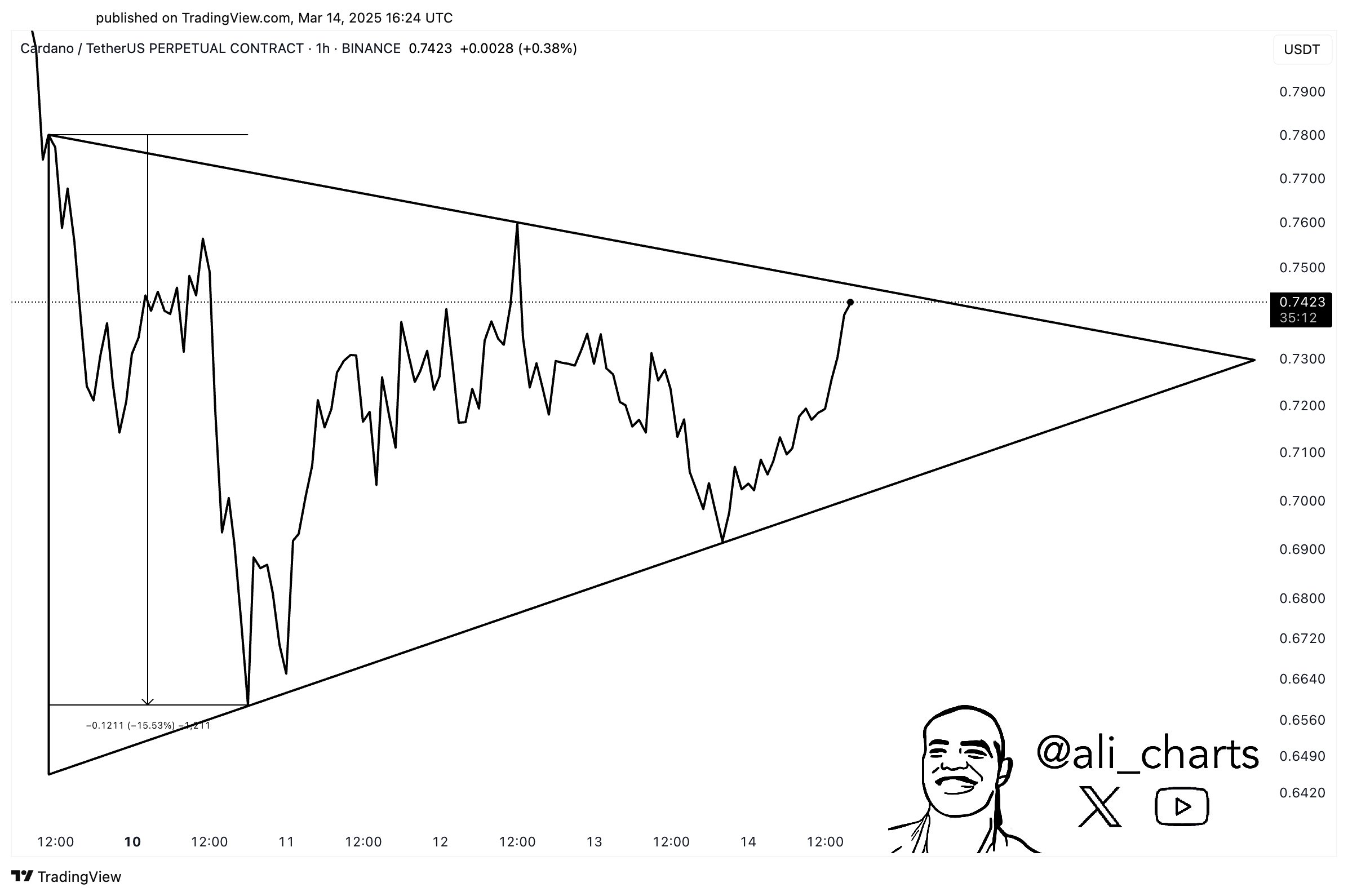

Turning to Ethereum rival Cardano, the analyst predicts rallies for ADA if the altcoin takes out the diagonal resistance of a triangle pattern at around $0.75.

“Cardano ADA is about to break free! Busting out of this triangle will trigger a 15% price move.”

A triangle is typically viewed as a consolidation pattern as it signals a potential breakout in either direction. The asset is considered bullish if the price moves above the diagonal resistance and bearish if it tumbles below the diagonal trend line.

At time of writing, ADA is worth $0.744.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Ethereum

Ethereum Cost Basis Data Signals Strong Support At $1,886

Published

2 days agoon

March 16, 2025By

admin

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency.

Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems.

In two years of active crypto writing, Semilore has covered multiple aspects of the digital asset space including blockchains, decentralized finance (DeFi), staking, non-fungible tokens (NFT), regulations and network upgrades among others.

In his early years, Semilore honed his skills as a content writer, curating educational articles that catered to a wide audience. His pieces were particularly valuable for individuals new to the crypto space, offering insightful explanations that demystified the world of digital currencies.

Semilore also curated pieces for veteran crypto users ensuring they were up to date with the latest blockchains, decentralized applications and network updates. This foundation in educational writing has continued to inform his work, ensuring that his current work remains accessible, accurate and informative.

Currently at NewsBTC, Semilore is dedicated to reporting the latest news on cryptocurrency price action, on-chain developments and whale activity. He also covers the latest token analysis and price predictions by top market experts thus providing readers with potentially insightful and actionable information.

Through his meticulous research and engaging writing style, Semilore strives to establish himself as a trusted source in the crypto journalism field to inform and educate his audience on the latest trends and developments in the rapidly evolving world of digital assets.

Outside his work, Semilore possesses other passions like all individuals. He is a big music fan with an interest in almost every genre. He can be described as a “music nomad” always ready to listen to new artists and explore new trends.

Semilore Faleti is also a strong advocate for social justice, preaching fairness, inclusivity, and equity. He actively promotes the engagement of issues centred around systemic inequalities and all forms of discrimination.

He also promotes political participation by all persons at all levels. He believes active contribution to governmental systems and policies is the fastest and most effective way to bring about permanent positive change in any society.

In conclusion, Semilore Faleti exemplifies the convergence of expertise, passion, and advocacy in the world of crypto journalism. He is a rare individual whose work in documenting the evolution of cryptocurrency will remain relevant for years to come.

His dedication to demystifying digital assets and advocating for their adoption, combined with his commitment to social justice and political engagement, positions him as a dynamic and influential voice in the industry.

Whether through his meticulous reporting at NewsBTC or his fervent promotion of fairness and equity, Semilore continues to inform, educate, and inspire his audience, striving for a more transparent and inclusive financial future.

Source link

TokenPicks Launches Reward System to Incentivize Crypto Education

Ethereum leadership now eyes Solana-style growth, Dragonfly’s Qureshi says

SEC’s Uyeda Signals Possible Revisions to Crypto Custody Rule

Mubarak Meme Coin Trader Turns $232 Into $1.1 Million, Here’s How

Solana Protected Gender Identity Before Panning It in Anti-Queer Ad

Musk says he found ‘magic money computers’ printing money ‘out of thin air’

XRP To Triple Digits? Analyst Confident In $100 Price Goal

What Are They And What Do They Do?

Trader Predicts Crypto Rallies Amid Expectations of Fed Monetary Policy Shift – But There’s a Catch

Solana’s 5th birthday highlights explosive growth and trading activity: Mercuryo

Trump, Associates Net $390 Million Payday From World Liberty Token Sale

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Ethena Labs, Securitize launch blockchain for DeFi and tokenized assets

Shiba Inu Gains Momentum: SHIB Price Breaks Above 100-Day Moving Average, What’s Next?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x