Bitcoin

Spot ETFs Fail To Ignite Bitcoin Growth – Analyst

Published

5 months agoon

By

admin

The Spot Bitcoin ETFs have become a major headliner recently due to heightened levels of market inflows. According to data from SoSoValue, these ETFs have attracted over $5 billion in investments over the past three weeks coinciding with an impressive Bitcoin price rally of over 23%. However, amidst this euphoria, macro investment researcher Jim Bianco says these Spot ETFs have contributed no significant growth to the Bitcoin market.

Spot Bitcoin ETFs Bring In No New Money, Only Recycled Investments

In a series of X posts on November 2, Bianco claimed the Spot Bitcoin ETFs despite their impressive inflow record do not attract any new investments to the underlying asset. Firstly, The analyst applauds the performance of these institutional funds some of which rank as the best-performing ETFs of 2024 following their launch in January.

However, Bianco highlights BTC has failed to surpass its all-time high value of 73,750 set eight months ago despite the Spot Bitcoin ETFs accruing over $12 billion in inflows since BTC within the same period.

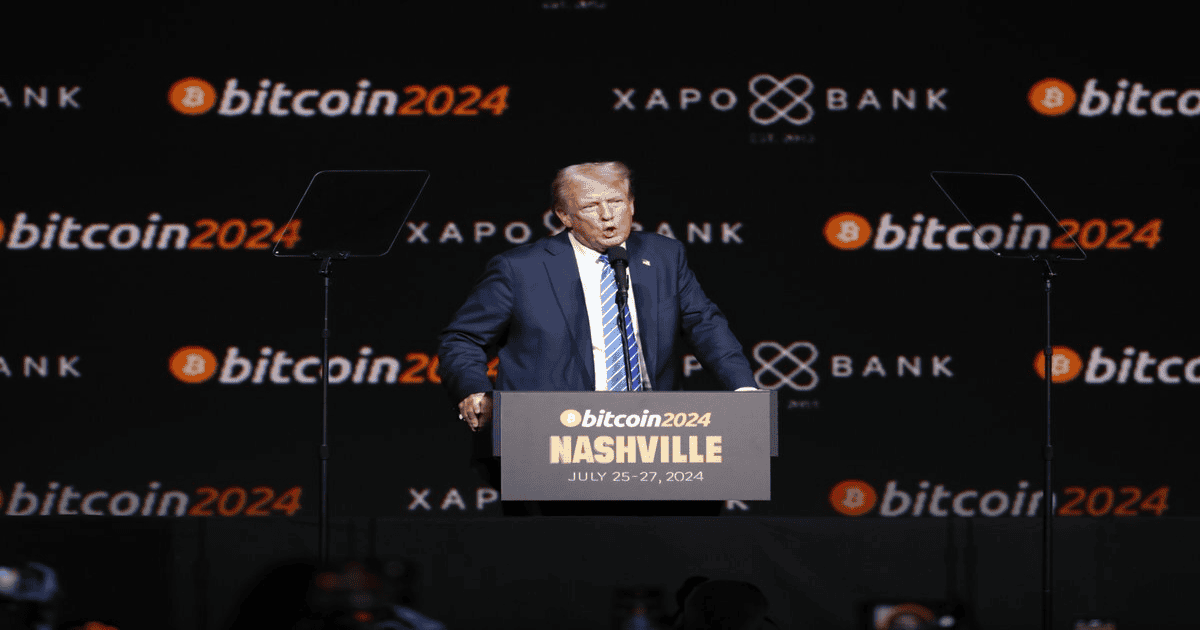

Rather than being less than 4% down from its ATH, the analyst explained that such high inflows should have since pushed premier cryptocurrency beyond the $100,000 mark especially considering other positive indicators such as Fed rate cuts, the halving, and public endorsement by Republican Presidential candidate Donald Trump.

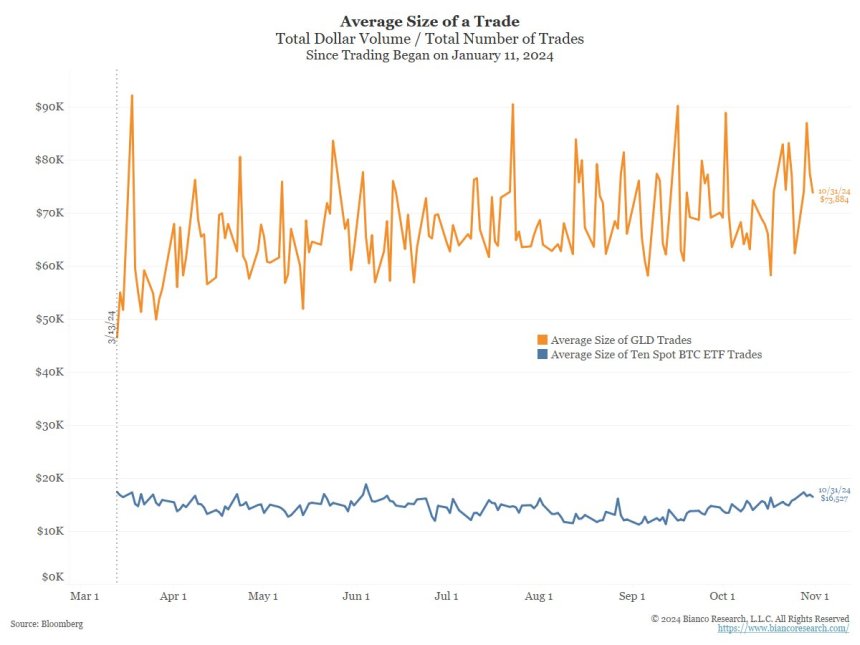

For context, Bianco references the Gold ETFs with a record of over $6 billion in inflows since March 13, resulting in a 25% increase in gold’s market price during that period. The market analyst postulates that this price growth can be attributed to the “new money” flowing into the Gold ETFs. However, recycled funds shifted from on-chain wallets or centralized exchanges account for the majority of the investments in Spot Bitcoin ETFs.

Jim Bianco backs this theory with a report from Coinbase CFO Alesia Haas which highlighted a decline in the exchange’s bitcoin retail traders over the last few months. Furthermore, he also points to the average Spot BTC ETF trade of $16,000 compared to the average gold ETF trade of $72,000 which is consistent with investments from wealth managers and institutions.

In conclusion, Jim Bianco states the Spot Bitcoin ETFs are not attracting any “new money” but merely circulating existing investments in Bitcoin, which he describes as a concerning trend that may grant traditional financial institutions (TradFi) more influence in the crypto market as against the ethos of decentralization.

Bloomberg Analyst Fires Back At BTC ETF Criticism

Popular Bloomberg ETF analyst Eric Balchunas has issued a strong rebuttal to Bianco’s take on the Spot Bitcoin ETFs which he describes as merely “mental gymnastics”. Balchunas has lauded the performances of these ETFs which he believed have played a crucial role in driving Bitcoin’s price from $35,000 in January to the present market price of almost $70,000. The Bloomberg analyst describes the Spot Bitcoin ETFs as “powerful” due to their low cost, high liquidity, and association with an established brand name and advises against betting against them.

At the time of writing, BTC. continues to trade at $68,100 reflecting a 2.55% decline in the past 24 hours.

Featured image from Blockzeit, chart from Tradingview

Source link

You may like

Can a Meme Coin Fund the Future of Scientific Research?

Analyst Confirms XRP Price Is Still On Path To $130

Proof-of-Work Crypto Mining Doesn’t Trigger Securities Laws, SEC Says

Crypto campaign donations are democracy at work — former Kraken exec

1 Million Bitcoin In New Whale Hands—A Mega BTC Rally On The Horizon?

Argentina’s Senate Hosts First-Ever Conference On Bitcoin Regulation

Bitcoin

1 Million Bitcoin In New Whale Hands—A Mega BTC Rally On The Horizon?

Published

6 hours agoon

March 20, 2025By

admin

They say journalists never truly clock out. But for Christian, that’s not just a metaphor, it’s a lifestyle. By day, he navigates the ever-shifting tides of the cryptocurrency market, wielding words like a seasoned editor and crafting articles that decipher the jargon for the masses. When the PC goes on hibernate mode, however, his pursuits take a more mechanical (and sometimes philosophical) turn.

Christian’s journey with the written word began long before the age of Bitcoin. In the hallowed halls of academia, he honed his craft as a feature writer for his college paper. This early love for storytelling paved the way for a successful stint as an editor at a data engineering firm, where his first-month essay win funded a months-long supply of doggie and kitty treats – a testament to his dedication to his furry companions (more on that later).

Christian then roamed the world of journalism, working at newspapers in Canada and even South Korea. He finally settled down at a local news giant in his hometown in the Philippines for a decade, becoming a total news junkie. But then, something new caught his eye: cryptocurrency. It was like a treasure hunt mixed with storytelling – right up his alley!

So, he landed a killer gig at NewsBTC, where he’s one of the go-to guys for all things crypto. He breaks down this confusing stuff into bite-sized pieces, making it easy for anyone to understand (he salutes his management team for teaching him this skill).

Think Christian’s all work and no play? Not a chance! When he’s not at his computer, you’ll find him indulging his passion for motorbikes. A true gearhead, Christian loves tinkering with his bike and savoring the joy of the open road on his 320-cc Yamaha R3. Once a speed demon who hit 120mph (a feat he vowed never to repeat), he now prefers leisurely rides along the coast, enjoying the wind in his thinning hair.

Speaking of chill, Christian’s got a crew of furry friends waiting for him at home. Two cats and a dog. He swears cats are way smarter than dogs (sorry, Grizzly), but he adores them all anyway. Apparently, watching his pets just chillin’ helps him analyze and write meticulously formatted articles even better.

Here’s the thing about this guy: He works a lot, but he keeps himself fueled by enough coffee to make it through the day – and some seriously delicious (Filipino) food. He says a delectable meal is the secret ingredient to a killer article. And after a long day of crypto crusading, he unwinds with some rum (mixed with milk) while watching slapstick movies.

Looking ahead, Christian sees a bright future with NewsBTC. He says he sees himself privileged to be part of an awesome organization, sharing his expertise and passion with a community he values, and fellow editors – and bosses – he deeply respects.

So, the next time you tread into the world of cryptocurrency, remember the man behind the words – the crypto crusader, the grease monkey, and the feline philosopher, all rolled into one.

Source link

Argentina

Argentina’s Senate Hosts First-Ever Conference On Bitcoin Regulation

Published

6 hours agoon

March 20, 2025By

admin

For the first time in history, the Argentine Senate has opened its doors to discuss Bitcoin, thanks to the efforts of NGO Bitcoin Argentina. The conference, titled “Bitcoin and its Regulatory Framework,” was held this week in the Arturo Illia Hall of the Legislative Palace.

“El Senado de la Nación recibió por primera vez a la ONG Bitcoin Argentina para una conferencia sobre Bitcoin y su marco regulatorio” | Lee la nota acá: https://t.co/ahulRHxhdp

“Con este hito, la ONG Bitcoin Argentina continúa consolidándose como un referente en la materia,… pic.twitter.com/Zpmq4WIc5k

— ONG Bitcoin Argentina (@BitcoinAR) March 20, 2025

Organized by NGO Bitcoin Argentina, the event brought together key political advisors and department heads from various political blocs to explore Bitcoin’s potential impact on Argentina’s economy and regulatory landscape. Gabriela Battiato, lawyer and Legal Coordinator of NGO Bitcoin Argentina, led an in-depth discussion on Bitcoin’s philosophy, evolution, and the ongoing global regulatory debates surrounding its adoption.

“This is a key step toward legislative recognition of the crypto ecosystem. Blockchain technology and cryptocurrencies are already part of the economic reality, and it is essential that strategic decision-makers have clear and accurate information,” said Ricardo Mihura, President of NGO Bitcoin Argentina.

The conference was spearheaded by Senator Antonio José Rodas, with the participation of Senator Mariana Juri of Mendoza, and showcased growing bipartisan interest in understanding and integrating Bitcoin within Argentina’s legal framework. Their discussion on Bitcoin focused on the transformative potential of it and its increasing role in global finance.

“This event sets a precedent and reinforces our goal of bringing knowledge about Bitcoin and blockchain to all sectors of society. We will continue promoting these spaces because we believe that only through dialogue and education can we build appropriate regulations and foster the development of the sector,” said Jimena Vallone, Executive Director of NGO Bitcoin Argentina.

For those interested in viewing the full conference, it is available on YouTube below:

Source link

Bitcoin

President Trump To Address The Digital Assets Summit Tomorrow

Published

14 hours agoon

March 20, 2025By

admin

President Donald Trump is expected to deliver a speech tomorrow via a recording at Blockworks’ Digital Asset Summit (DAS) in New York City. This will be the first time a sitting U.S. president has addressed a Bitcoin and crypto conference, highlighting the growing influence of digital assets in mainstream financial policy.

Trump has previously engaged with the Bitcoin community, having spoken in person at the world’s largest Bitcoin conference in Nashville last summer while on the campaign trail. His return to the stage now as president further highlights the continued support from the U.S. government on Bitcoin.

Trump’s upcoming address at DAS comes only a couple weeks after moving forward with officially integrating Bitcoin into his national strategy, when he signed an executive order establishing the U.S. Strategic Bitcoin Reserve, positioning BTC as a key asset for the country’s financial future.

Joining the lineup tomorrow at DAS is Strategy’s Michael Saylor, who will deliver a keynote speech and engage in a fireside chat with Bitcoin historian Pete Rizzo. Additionally, Bloomberg ETF analyst James Seyffart will host a panel discussion with BlackRock’s Head of Digital Assets Robbie Mitchnick and Nasdaq’s Head of U.S. Equities & Exchange-Traded Products Giang Bui, where they will delve into the evolving landscape of Bitcoin ETFs and institutional adoption.

The announcement of Trump’s participation follows remarks from Bo Hines, Executive Director on Digital Assets for President Trump, who spoke earlier this week at DAS. Hines reaffirmed the administration’s commitment to accumulating Bitcoin for the Strategic Bitcoin Reserve, stating:

“I think it’s high time that our President started accumulating assets for the American people, which is what President Trump is doing rather than taking it away.”

He also emphasized the administration’s approach to acquiring Bitcoin in budget-neutral ways, likening BTC accumulation to gold reserves:

“You know, I’ve been asked all the time, it’s like how much do you want? Well, that’s like asking a country how much gold do you want – as much as we can get.”

JUST IN –

President Trump’s Executive Director on digital assets: “We talked about ways of acquiring more Bitcoin in budget neutral ways.”

We want “as much as we can get.”

pic.twitter.com/zK8PyQK1Rw

— Bitcoin Magazine (@BitcoinMagazine) March 18, 2025

Trump’s executive order has already sparked legislative action aiming to build on this momentum. Senator Cynthia Lummis and Congressman Nick Begich have each proposed plans for the U.S. to acquire 1 million BTC over the next five years, ensuring a long-term reserve of the scarce asset. Earlier today at DAS, House Majority Whip and Congressman Tom Emmer stated that he believes this legislation will be enacted “before this congress is done.”

JUST IN:

Congressmen Tom Emmer said he believes Strategic Bitcoin Reserve bill to buy 1 million BTC will be enacted. pic.twitter.com/DlfuArq1rr

— Bitcoin Magazine (@BitcoinMagazine) March 19, 2025

Source link

Can a Meme Coin Fund the Future of Scientific Research?

Analyst Confirms XRP Price Is Still On Path To $130

Proof-of-Work Crypto Mining Doesn’t Trigger Securities Laws, SEC Says

Crypto campaign donations are democracy at work — former Kraken exec

1 Million Bitcoin In New Whale Hands—A Mega BTC Rally On The Horizon?

Argentina’s Senate Hosts First-Ever Conference On Bitcoin Regulation

Justin Sun Stakes $100,000,000 Worth of Ethereum Amid Calls for ‘Tron Meme Season’

Cardano wallet Lace adds Bitcoin support

Donald Trump Vows to Make America the ‘Undisputed Bitcoin Superpower’

Will Trump Announce Zero Tax Gains in Today’s Crypto Summit Talk?

Avalanche (AVAX) Drops 4.5%, Leading Index Lower

Tether’s US treasury holdings surpass Canada, Taiwan, ranks 7th globally

Here’s Where Support & Resistance Lies For Solana, Based On On-Chain Data

President Trump To Address The Digital Assets Summit Tomorrow

Analyst Says Bitcoin Primed for ‘Party Time’ if BTC Breaks Above Critical Level, Updates Outlook on Chainlink

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x