Cynthia Lummis

Stablecoins Take Center Stage at Senate’s First Digital Assets Subcommittee Hearing

Published

2 months agoon

By

admin

Stablecoins and the role of Congress in addressing future digital assets legislation took center stage during one of the Senate Banking Committee’s first hearings to focus on what a regulatory framework for crypto may look like.

The Wednesday hearing, framed as the jumping-off point for further Congressional action on digital asset regulations, was the first hosted by the banking committee’s new digital assets subcommittee and chaired by Wyoming Republican Cynthia Lummis, a longtime crypto proponent.

“We’re on the precipice of finally creating a bipartisan legislative framework for both stablecoins and market structure,” Lummis said in her opening statement, referring to draft legislation she introduced with New York Democrat Kirsten Gillibrand as a natural counterpart to the House’s Financial Innovation and Technology for the 21st Century Act.

Stablecoins will be first on the committee’s agenda though, she said, echoing statements made by White House Crypto and AI Czar David Sacks and South Carolina Republican Tim Scott, who chairs the overall Senate Banking Committee.

Former CFTC Chair Timothy Massad, one of the hearing’s four witnesses, told the lawmakers to focus on stablecoin legislation for the moment and defer any market structure efforts “for several years.”

“For four years, the crypto industry has called on the SEC and CFTC to develop rules and guidance and to stop regulating by enforcement; that is now happening,” he said. “The SEC has dropped enforcement cases and launched a crypto task force to tackle these issues. We should let these regulatory issue initiatives make progress before rushing to rewrite the securities law.”

Existing proposals to update market structure regulations to address crypto have the potential to “create more confusion than clarity,” he added, particularly around defining how a digital asset might be a security, commodity or something else.

These proposals could potentially undermine existing securities laws, especially if they address decentralized finance.

“That term is used to describe a lot of things that aren’t decentralized,” Massad continued. “There are almost always some vectors of control. And even if a process is decentralized or automated, that does not mean it should be exempt from regulation.”

Virginia Democrat Mark Warner asked the panelists to discuss the possibility of stablecoin users conducting know-your-customer processes, noting that an issuer may conduct KYC but that a stablecoin may be transferred between wallets without those intermediate transfers going through a KYC process.

“I want to get to a regulatory framework that works, but I have seen — echoing what others have said from the classified side — oh my gosh, a whole bunch of bad stuff,” Warner said. “So help me figure out, and I recognize [for] some people, the anonymity and and the disintermediation role the blockchain plays, but how do we put some minimum protections from issuer all the way back to conversion to fiat?”

Lightspark co-founder and Chief Legal Officer Jai Massari noted that even though self-custodied wallets don’t conduct KYC, “there is an immutable on-chain record of those transactions that can be monitored, not only by the issuer, but [by] third parties, including law enforcement.”

While mixers and other tools can obfuscate transactions, custodial wallets still conduct KYC at the end of a chain of transfers, she noted.

“I agree that we need to continue, as the industry has done, to develop new tools to address these issues,” said Massari.

Source link

You may like

24/7 Cryptocurrency News

US Senator Cynthia Lummis Calls Out Fed Crypto Policy Withdrawal, Here’s Why

Published

3 days agoon

April 25, 2025By

admin

US Senator Cynthia Lummis has sharply criticized the Federal Reserve’s recent move to withdraw guidance on cryptocurrency activities. She argued that the decision does not represent genuine progress for the digital asset industry and raised concerns about the ongoing regulatory challenges facing crypto companies.

Lummis, a staunch advocate for cryptocurrency, believes that the Federal Reserve’s actions will continue to stifle innovation and create unnecessary hurdles for businesses in the space.

Cynthia Lummis Concerns Over the Fed’s Crypto Guidance Withdrawal

Senator Cynthia Lummis took to X (formerly Twitter) to express her dissatisfaction with the Federal Reserve’s decision to rescind certain supervisory guidance regarding cryptocurrency activities. She emphasized that despite the Fed’s actions, the core issues facing the crypto industry remain unresolved.

“The Fed withdrawing crypto guidance is just noise, not real progress,” Lummis said. “We are NOT fooled.” According to Lummis, the Fed’s withdrawal of guidance is not a real step forward and fails to address the underlying problems. In a further statement, Lummis said,

“I will continue to hold the Fed accountable until the digital asset industry gets more than a life jacket, Chair Powell—they need a fair shake.”

Cynthia Lummis also criticized the Federal Reserve for undermining the digital asset industry with previous regulatory actions. She pointed out that the Fed’s stance had led to the closure of crypto businesses and hampered innovation. In her view, the Fed’s policies have done significant harm to American interests by preventing the crypto industry from reaching its full potential.

Fed’s Regulatory Approach to Crypto Assets

The decision by the Federal Reserve to withdraw certain supervisory letters represents a new direction in handling of the cryptocurrency industry. These letters had earlier requested banks to obtain prior permission when they intended to undertake activities concerning stablecoins and other cryptocurrencies.

By withdrawing this guidance the Fed follows similar tendencies of other regulators, including the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) who have also shifted to more lenient approach to banking services related to crypto.

Despite these changes, Caitlin Long, founder of Custodia Bank, like Cynthia Lummis, has raised concerns about the Federal Reserve’s continued stance on digital assets. According to Long, the Fed had not withdrawn its guidelines published back in January 2023 that stated that Bitcoin and other cryptocurrencies remained “unsafe and unsound.”

Cynthia Lummis Criticism of the Fed’s Master Account Policy

Senator Cynthia Lummis also pointed out the negligence of the Federal Reserve in not addressing the concerns of master accounts, allegedly used illegally to limit banking services for crypto enterprises.

The Fed’s noncompliance with the law of master accounts has not been well received by Lummis and other members of the crypto community. In her opinion, this still keeps the crypto companies from being on the same level as normal traditional firms. Master accounts are necessary for banks to receive specific services from the Fed, and Lummis says that this constitutes unequal treatment of crypto.

She appealed to the Federal Reserve to cease employing reputation risk as the guiding principle for crypto activities, and its detrimental effect on innovation. According to Lummis, despite the swearing in of a new US SEC Chair, the Fed is stifling the growth of the crypto industry by not allowing broad access to these accounts.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Bitcoin race intensifies as leaders address reserve urgency

Published

1 month agoon

March 23, 2025By

admin

On March 20, investor and entrepreneur Anthony Pompliano stated on Fox News, “There’s a global race going on–Russia, Abu Dhabi, El Salvador, Bhutan–all these other countries are trying to buy Bitcoin… the same way that there was a space race there’s now a Bitcoin race.”

The idea of a Bitcoin “race” is now a reality as world leaders actively discuss the urgency of either establishing digital asset reserves or embracing cryptocurrency as legal tender.

El Salvador, in 2021, became the first country to make Bitcoin legal tender, purchasing over 2,000 Bitcoin as part of a national reserve to foster financial inclusion and economic growth. The move has been both celebrated and criticized due to Bitcoin’s volatility. Similarly, in 2022, the Central African Republic became the second country to adopt Bitcoin, viewing the cryptocurrency as a tool to improve economic development and financial inclusion in one of the world’s least developed nations.

Both countries’ actions reflect growing interest in Bitcoin as an alternative financial strategy. It’s hard-capped at 21 million, and in 10 years, most of it will be mined.

The theory is that the countries considering Bitcoin a valuable reserve asset will strive to establish as much ownership of the total BTC supply as possible.

Proponents believe scarcity and growing demand will drive Bitcoin’s value, making large BTC holders influential.

What Saylor says…

One of the most prominent Bitcoin evangelists, Michael Saylor, said that 78% of the U.S. was bought for $40 million at some point. The former CEO of MicroStrategy referred to various land acquisitions, such as the Louisiana Purchase of 1803 to illustrate why the U.S. government should buy Bitcoin now when it’s “cheap.”

In a recent speech, Saylor called the next decade “a digital gold rush” and compared Bitcoin to the Manhattan Project, dubbing it “digital energy.”

“Today, Bitcoin represents the digital capital network, controlling 99% of power within the cryptocurrency ecosystem,” he said. “The U.S. government recognizes only Bitcoin as legitimate digital capital. To secure the future of cyberspace and maintain global financial dominance, America must adopt Bitcoin strategically. Only Bitcoin—and U.S. Treasuries—have the liquidity and global trust required to serve as reliable reserve assets worldwide.”

No wonder Saylor has been vocally supportive of government officials pushing to increase the U.S.’s BTC stockpile.

President Donald Trump, Republican Sen. Cynthia Lummis, and Bo Hines, the Executive Director of the President’s Council of Advisors on Digital Assets, have all expressed a desire to increase the U.S.’s Bitcoin reserve.

Like Saylor, Pompliano (among the most vocal crypto advocates in the U.S.) considers the Trump administration’s focus on Bitcoin dominance important.

Speaking about the future price of Bitcoin, Pompliano said during a Fox News appearance that he doesn’t know when BTC will hit one million. However, he is seemingly confident that, like gold, its value will increase from where it currently is today.

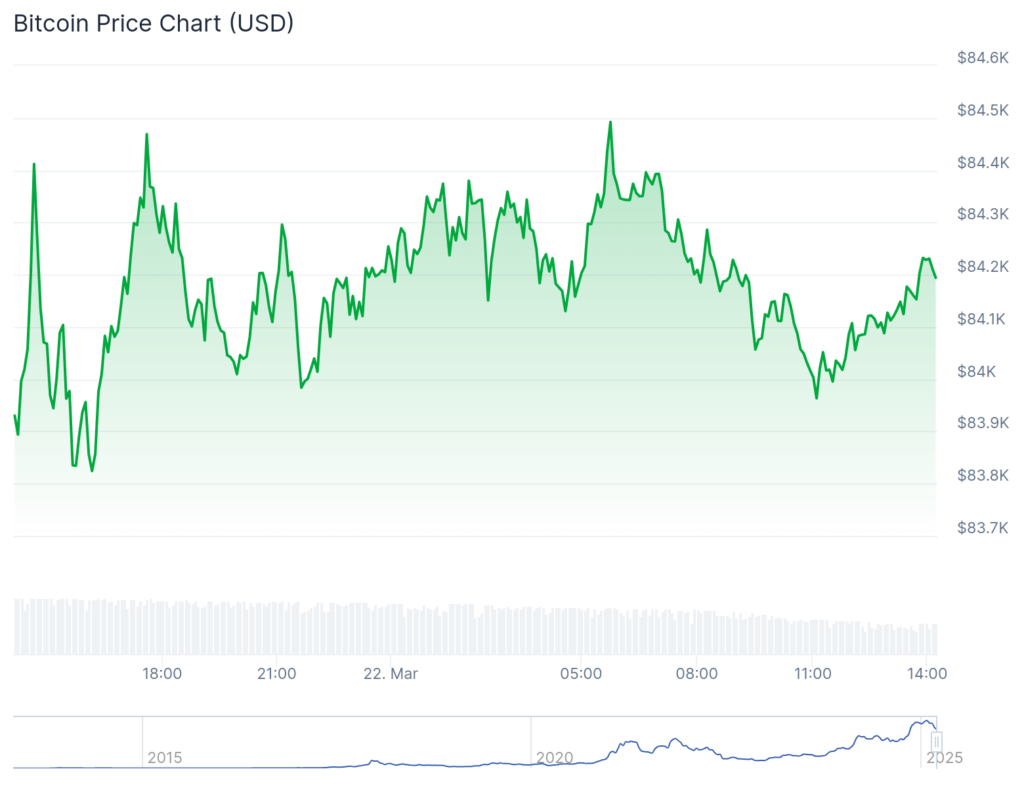

At last check, Bitcoin is trading at just above $84,000.

“I think people are drastically underestimating how maniacal they are going to be about buying Bitcoin,” Pompliano said. “Everyone thinks it’s cute that they put 200,000 Bitcoin over here and now we have this reserve — they are going to continue to buy Bitcoin.”

Who participates in the Bitcoin race?

Apart from the U.S., Pompliano named Russia, El Salvador, Bhutan, and the United Arab Emirates. Indeed, all of these countries reportedly have Bitcoin holdings, but not necessarily all of them explicitly expressed their desire to buy more.

It is not quite clear how much crypto Russia holds. However, it is known that Russia has large-scale mining operations while local companies use crypto for international trade and dodging Western sanctions.

Pompliano neglected to mention several leading Bitcoin holders, including China, which is the second biggest BTC owner after the U.S.

The United Kingdom and Ukraine currently follow China, according to BitBo’s Bitcoin Treasuries page.

All these countries have different strategies:

- North Korea’s hackers steal hundreds of millions of dollars worth of crypto from crypto exchanges.

- The UK holds crypto, seized while dismantling a high-scale money-laundering operation.

- Ukraine became a notable Bitcoin holder through donations made after the intensification of the Russian-Ukrainian conflict in 2022.

- The U.S. intends to confiscate Bitcoin and crypto assets from criminal cases. It’s worth noting that many individual states are exploring the creation of local-level reserves.

More than that, some corporations, most notably Strategy (previously MicroStrategy) and asset manager BlackRock, are among the world’s biggest Bitcoin holders, capable of competing with leading nations in terms of Bitcoin dominance. Both firms own or manage around 500,000 Bitcoins (over 2% of the total supply). As of March 2025, no country holds even half that amount.

Many countries are opting out

European countries have been cautious and innovative in their interactions with blockchain solutions. For instance, Estonia is one of the world’s pioneers in adopting blockchain for elections and healthcare data management. However, the EU countries take a conservative stance when it comes to crypto reserves. High volatility and low liquidity are the main reasons for rejecting Bitcoin’s reserve establishment.

Similar reasons are cited by Switzerland, South Korea, Japan, and other countries that seem unbothered by America’s passion for winning in the Bitcoin musical chairs game. Germany went so far to sell thousands of Bitcoin.

Germany sold all their #Bitcoin at $54,000.

If they had waited, they could have made an extra $990 million.

Losers

pic.twitter.com/2G8iRFhzn9

— Crypto Rover (@rovercrc) November 6, 2024

Crypto.news asked Genius Group, a company using Bitcoin as a corporate reserve, how they time the market.

“As fundamental believers in the long-term potential of Bitcoin, we don’t try to time the market, but rather buy and hold with the intention of never selling,” a spokesperson responded.

Let’s assume the so-called Bitcoin race exists, as Pompliano described it. If we compare it to space or the Manhattan Project, we must ask ourselves: Were the countries that didn’t have spacecraft or atomic weapons in the 20th century left with nothing?

Source link

Bitcoin Policy Institute

US Senator And Congressman Introduce Strategic Bitcoin Reserve Bills To Buy One Million BTC

Published

2 months agoon

March 12, 2025By

admin

Today at the Bitcoin Policy Institute’s “Bitcoin for America” summit in Washington DC, U.S. Senator from Wyoming Cynthia Lummis announced that she is going to reintroduce her strategic Bitcoin reserve legislation in the Senate today.

“I am so pleased to announce that today I will be reintroducing The Bitcoin Act,” Senator Lummis stated. “And I’ll be joined here shortly by Senator Justice of West Virginia, who is one of the cosponsors. And we have several other additional cosponsors. And a lot of it is a result of the excitement that’s been building.”

“So far cosponsors are [Tommy] Tubberville, [Marsha] Blackburn, [Roger] Marshall, [Bernie] Moreno, and [Jim] Justice,” Lummis continued. “We have a couple more feelers out for original cosponsors today but, the House as well through Nick Begich, has six original consponsors.”

Complimentary to Senator Lummis’ Bitcoin act in the Senate, U.S. Congressman Nick Begich announced he will also be introducing the Bitcoin reserve legislation in the House today.

“Today, I will be introducing the Bitcoin Act of 2025 in the United States House,” Congressman Begich said. “This is a bold and forward looking legislative initiative designed to ensure the United States secures its financial independence and maintains its leadership in the global digital economy.”

JUST IN:

US Congressman Nick Begich to introduce Strategic Bitcoin Reserve legislation in the House today to buy 1 million BTC.

The bill already has six co-sponsors

pic.twitter.com/5xJuJ25835

— Bitcoin Magazine (@BitcoinMagazine) March 11, 2025

“The momentum is in our hands and we need to make this happen. Thankfully, President Trump is with us and the opportunities are boundless,” Lummis concluded.

Just last week, President Donald Trump signed an executive order to create a federal strategic Bitcoin reserve. The reserve is to be made up of confiscated bitcoin by the federal government from hacks and seizures, creating an estimated reserve of about 200,000 BTC, pending an official audit. However, this reserve, as it stands, has the potential to be overturned by future presidential administrations. Legislation like the Bitcoin Act of 2025 would solve this potential issue as it would see the United States purchase 200,000 bitcoin per year until it has bought a total of 1,000,000 BTC — to be held for a minimum of 20 years.

$115 billion asset manager VanEck claims that this strategic bitcoin reserve “could help offset national debt”, stating that “if the U.S. government follows the BITCOIN Act’s proposed path – accumulating 1 million BTC by 2029 – our analysis suggests this reserve could offset around $21 trillion of national debt by 2049.”

Source link

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

✓ Share: