Law and Order

Strike While the Crypto Iron is Hot Under Trump, Says Andreessen Horowitz

Published

7 months agoon

By

admin

Andreessen Horowitz’s (a16z) crypto arm sees former President Donald Trump’s re-election as a catalyst for a new era in crypto regulation, urging projects to embrace decentralized solutions and build confidently in the U.S.

The venture capital firm, which has invested heavily in crypto and web3 startups, sees Trump’s pro-crypto stance as a way forward, according to a blog post on Monday.

The firm’s crypto legal and policy experts—Miles Jennings, Michele Korver, and Brian Quintenz—outlined how the new political climate could pave the way for regulatory clarity.

With the election now decided, “we believe this is an incredible opportunity to build on the bipartisan progress from the last Congress,” they wrote.

The experts’ core message to crypto founders is to leverage the new administration’s openness towards digital assets. “Where there is trust, there is regulation,” the experts reminded builders, urging them to eliminate centralized dependencies to stay compliant.

The trio notes now is the time for projects that have held back on using tokens due to regulatory concerns. With Trump’s pro-crypto approach, founders should feel confident in using tokens as “legitimate and lawful tools,” according to experts.

“Today’s all-time high, driven by a Trump election win, signals that we are in the midst of a potential paradigm shift into the next phase of growth for crypto,” OKX chief legal officer Mauricio Beugelmans told Decrypt.

Much of the optimism stems from Trump’s campaign promises to ease restrictions on crypto and replace Securities and Exchange Commission Chair Gary Gensler, whose strict enforcement approach has been a thorn in crypto’s side.

“We hope forward-looking regulation that protects the industry and users and cultivates crypto innovation in America will become a bipartisan topic in the future,” Beugelmans added.

Trump’s re-election has sparked enthusiasm in the markets, with Bitcoin reaching new all-time highs well above $80,000.

“The confirmation of Republicans winning the House could provide an additional boost to the risk rally, but we may see some profit-taking in the coming weeks or months as actual policies are tested,” Aurelie Barthere, Nansen’s principal research analyst, told Decrypt.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Ethereum Price Headed For Crash To $2,000 With Current Price Action

Tokenized funds hit $5.7B, scaling fast — Moody’s

Authorities Warn of Phony Text Messages Phishing for Sensitive Information, Telling Victims Their Bank Account Is at Risk

Tether invests in Chilean crypto exchange Orionx

MARA Hits Record-High Bitcoin Production in May

Retail investors no longer FOMO into BTC, altcoins

Law and Order

SEC Flags Compliance Concerns Over Proposed Ethereum and Solana ETFs

Published

2 days agoon

June 2, 2025By

admin

In brief

- The SEC raised concerns about whether the REX-Osprey ETH and SOL ETFs qualify under the Investment Company Act of 1940.

- Despite ongoing discussions, the ETFs’ registration became effective on May 30 without resolving the issues.

- The letter came a day after SEC staff issued guidance exempting certain staking practices from securities rules.

The U.S. Securities and Exchange Commission on Friday warned that two proposed exchange-traded funds tied to Ethereum and Solana may not meet the legal definition of an investment company, raising concerns over their registration and potential eligibility for exchange listing.

In a letter to counsel for ETF Opportunities Trust, the SEC said staff had unresolved questions about whether the REX-Osprey ETH and SOL ETFs, which include staking components, are structured to primarily invest in securities as required under the Investment Company Act of 1940.

ETF Opportunities Trust is a Delaware-based open-end investment company that serves as a legal vehicle, or issuer, for launching multiple exchange-traded funds, including those managed by REX.

Sponsors REX Shares and Osprey Funds filed a registration statement for their proposed Ethereum and Solana ETFs on January 21.

The filing also included several other crypto-linked products, including the first proposed ETFs for the TRUMP meme coin, BONK, and Dogecoin, as well as additional funds tracking Bitcoin and XRP.

While the registration statement for the REX-Osprey Ethereum and Solana ETFs became effective on May 30, the funds have not launched and are not listed on any exchange.

“As we have communicated to you on several occasions, Commission staff continues to have unresolved questions whether the Funds, if structured and operated as proposed, would be able to meet the definition of ‘investment company’ under the Investment Company Act,” SEC staff wrote.

A fund qualifies as an investment company under U.S. law if it is primarily engaged in investing or trading securities, or if investment securities make up more than 40% of its total assets.

The agency also said the ETFs may have improperly filed under Form N-1A, which is reserved for funds that qualify as investment companies under federal law, and may also fall short of the conditions of Rule 6c-11, which allows ETFs to operate and list without seeking individual exemptive relief.

“To the extent that these concerns remain unresolved, the Commission staff will consider the appropriate next steps to ensure compliance with the federal securities laws,” SEC staff wrote.

The letter follows staff guidance issued Thursday clarifying that certain types of crypto staking, such as self-staking and custodial staking, do not involve the offer or sale of securities under federal law.

The guidance, which is not legally binding, marked a shift from earlier enforcement stances and drew a dissent from Commissioner Caroline Crenshaw, who said the move “continues to sow uncertainty around what the law is.”

The SEC did not immediately respond to a request for comment.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Law and Order

Here’s What’s at Stake for Crypto in South Korea’s Upcoming Election

Published

3 days agoon

May 31, 2025By

admin

In brief

- Nearly one-third of South Koreans own crypto, making digital assets a pivotal campaign topic.

- Both parties support crypto ETFs, but diverge on stablecoin strategy and banking reforms.

- New regulations from June will allow exchanges and non-profits to sell digital assets, signaling a potential policy shift.

South Korea is gearing up to elect a new president on June 3. And while the election may be more dominated by other issues in Korean politics, such as the recent impeachment of the previous president, candidates have positioned digital assets as a key campaign issue in a nation where nearly one-third of citizens own crypto.

Dr. Sangmin Seo, a South Korean technologist who leads the Kaia DLT Foundation, views crypto as becoming increasingly politically instrumental.

“This election, Korean politics sees crypto as a narrative to gain voters’ favors, positioning it as another national growth engine besides AI and semiconductors,” Seo told Decrypt.

“There is widespread support for the idea that the Korean crypto industry cannot lose its competitiveness on the global stage. Both sides of politics feel the urgency to catch up with regulatory advancements in other countries.”

Democratic Party candidate Lee Jae-myung and People Power Party nominee Kim Moon-soo have found rare common ground supporting crypto ETFs.

Yet the two candidates diverge sharply on stablecoin policy.

Lee supports won-backed stablecoins to curb capital flight, or money leaving its shores, citing roughly $40.8 billion in outflows from Korean exchanges in Q1.

The country needs “to prevent national wealth from leaking overseas,” he said during policy discussions earlier this month.

As the front-runner, Lee plans to create a monitoring system and reduce transaction costs, providing investors with regulated access to crypto.

Kim, meanwhile, seeks to dismantle the one-exchange-one-bank rule to ease banking restrictions on crypto firms. He plans to slash taxes for the country’s growing middle class, enabling a transparent crypto market, and allowing crypto-linked funds to operate.

But for those crypto ETFs to come in, regulators would need to work with the parties and their positions on digital assets.

Last week, the country’s Financial Services Commission (FSC) released details of a May 1 discussion that would allow non-profit organizations and crypto exchanges to sell digital assets starting in June.

In the same week, South Korea’s Democratic Party launched a Digital Asset Committee to establish comprehensive regulations.

Decrypt reached out to both parties for comments on their respective crypto policy positions.

Learning from the past

The consensus between the two major parties suggests that crypto and digital asset regulation in the country could soon relax, even with concerns of repeating what happened with Do Kwon and the collapse of Terra, an algorithmic stablecoin.

In addition to the impact on consumers, the collapse of Terra has led to South Korea’s crypto industry being “reviled as one of the darkest markets, with some calling it gambling,” according to Seo.

Coupled with several other high-profile scandals, including one involving a politician’s trading activities, reigning in the industry is a priority.

“Now, lawmakers are communicating with industry experts who have studied the first movers, such as the EU, Singapore, the US, and the UAE, to create the most applicable regulatory framework for the Korean market, and this includes the consumer protection measures,” Seo added.

ETFs

Candidates are also showing interest in launching crypto ETFs in Korea, although the topic has been floated multiple times by politicians since the U.S. launched its spot Bitcoin ETFs and little concrete progress on their introduction has been made.

“[The] first step should start from judging which party can operate spot ETF, including custody,” Ryan Yoon, senior analyst at Tiger Research, a Web3 market analytics firm with expertise in Asian markets, told Decrypt.

“Investor classification depends on their risk tolerance, but I think an ETF will open to all,” Yoon noted.

KP Jang, chief strategy officer at Seoul-based data intelligence platform Xangle, told Decrypt this is likely to happen, but with certain conditions.

“Won-backed stablecoins are likely to circulate primarily within Korea,” Jang said.

Those would be “relatively less prone to triggering global market shocks like the Terra-Luna incident,” given how the Korean won (KRW) isn’t used “as a settlement currency” elsewhere.

The proposed won-backed stablecoin would also be issued as a “fully-collateralized model,” Jang noted, adding that “actual Korean won reserves” would be “held in full against the issued amount.”

Such clarity in collaterals would greatly enhance stability and reduce “the likelihood of a collapse like that of past crypto-algorithmic models,” he said.

Tiger Research’s Yoon echoed this, saying that a repeat of that kind of failure is unlikely.

Still, South Korea lacks “official discussions or regulations to protect stablecoin users,” Yoon said, citing the U.S.’s GENIUS Act could serve as a “potential reference.”

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Law and Order

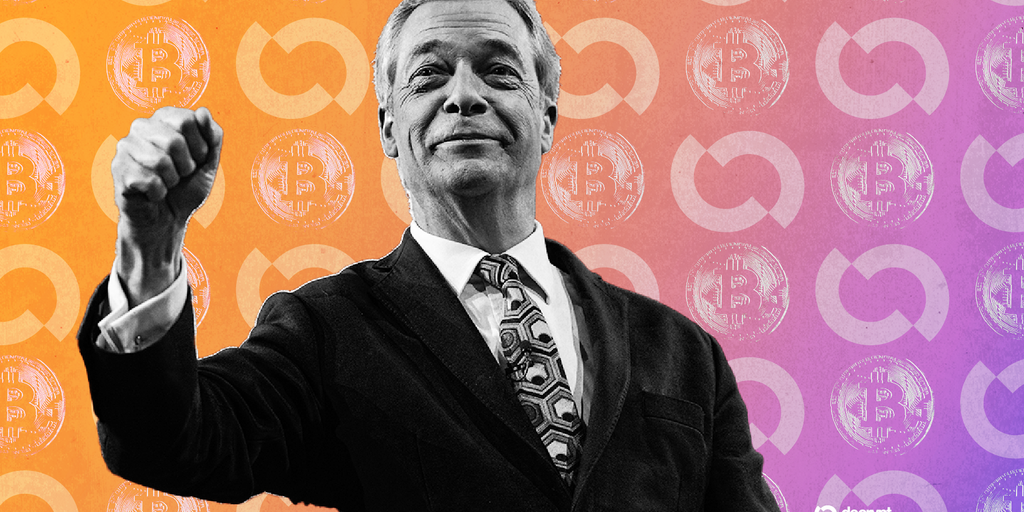

Nigel Farage Pledges to Slash Crypto Capital Gains, Force UK Bitcoin Reserve

Published

4 days agoon

May 31, 2025By

admin

In brief

- UK politician Nigel Farage pledged this week to pass a pro-crypto bill if made prime minister.

- Farage said he would slash crypto capital gains taxes and force the Bank of England to establish a Bitcoin reserve if elected.

- He also promised to end crypto-related debanking in Britain, which he argued remains a massive threat.

Nigel Farage, the leader of Britain’s right-wing Reform Party, is going all-in on crypto—and used an appearance at Bitcoin 2025 this week to showcase his coalition’s new emphasis.

Onstage Thursday at the annual Bitcoin conference, which this year took place in Las Vegas, Farage pledged to prioritize crypto should he become prime minister after the UK’s next general election in 2029.

During the appearance, the British politician waved a printed copy of a new piece of legislation, dubbed the Crypto Assets and Digital Finance Bill, that he pledged to pass if voted into power.

“We will campaign for this and we will put it in place when we win the next general election,” Farage said to a cheering crowd of Bitcoiners. “And what we’re saying is: Bring crypto and digital assets in from the cold.”

The bill, per Farage, would slash capital gains taxes on crypto to 10% (down from the current maximum of 24%); obligate the Bank of England to establish a Bitcoin reserve; and outlaw British banks from denying services to customers based on their involvement with crypto and the crypto industry.

Such alleged practices, dubbed “debanking,” have become a point of mutual sympathy between crypto users and right-wing political figures in recent months. Crypto industry leaders have long argued they have been denied banking services based on their affiliation with the sector, a claim that has been validated by government disclosures.

Similarly, figures including Eric Trump in the United States and Farage in Britain have said they were previously denied banking services based on their political views.

On Thursday, Farage recounted his debanking experience, and attempted to use it as a means to connect with the conference’s crypto-focused attendees.

“I went to 10 banks, all of whom refused me an account,” he said. “No wonder so many people are going for Bitcoin, and going for crypto—because they can’t close you down, and that is the ultimate freedom.”

Farage has been a contentious figure in British politics for decades. He previously led the country’s UK Independence Party (UKIP), which played an instrumental role in passing Brexit—the UK’s 2016 withdrawal from the European Union. UKIP attracted controversy at the time, even among other conservatives, for employing allegedly racially charged anti-immigration rhetoric during the campaign.

Farage shortly thereafter left UKIP to found the Brexit Party, which evolved into the Reform Party, and has since faced similar charges of racism, which the party has denied.

During Thursday’s appearance at Bitcoin 2025, Farage also revealed the Reform Party is now accepting donations in crypto via its website. The site currently accepts BTC, Ethereum (ETH), Solana (SOL), and USDC.

The Reform Party’s embrace of crypto mirrors similar moves in recent months by other right-wing parties and governments around the world, in nations including the United States, El Salvador, and Argentina.

On Thursday, Farage tried to sell Bitcoin conference attendees on the Reform Party’s platform by framing it as similar to crypto’s ethos.

“We are anti-enstablishment,” he said. “We are disruptors.”

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Ethereum Price Headed For Crash To $2,000 With Current Price Action

Tokenized funds hit $5.7B, scaling fast — Moody’s

Authorities Warn of Phony Text Messages Phishing for Sensitive Information, Telling Victims Their Bank Account Is at Risk

Tether invests in Chilean crypto exchange Orionx

MARA Hits Record-High Bitcoin Production in May

Retail investors no longer FOMO into BTC, altcoins

AVAX Rises 3.8% on Strong Volume, Breaking Key Resistance Levels

K33 begins Bitcoin buying with 10 BTC purchase for treasury strategy

Why $107,500 And $103,500 Are The Levels To Watch

Pakistan Proposes New Crypto Regulations

Japanese Bitcoin Hoarder Metplanet Adds $115,600,000 Worth of BTC As Stock Surpasses 263% Gains on the Year

Bitcoin traders anticipate decline, watch $100K

Ethereum Foundation Restructures R&D Division, Plans ‘Rethink’ on Design and Development

Here’s why Sophon crypto rallied over 40% today

BCB Strikes Deal with SocGen–FORGE to Distribute Euro-Pegged Stablecoin EURCV

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Pi Network coin to $10? 4 catalysts that may make it possible

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Blockchain groups challenge new broker reporting rule

Xmas Altcoin Rally Insights by BNM Agent I

Trending

24/7 Cryptocurrency News7 months ago

24/7 Cryptocurrency News7 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Markets3 months ago

Markets3 months agoPi Network coin to $10? 4 catalysts that may make it possible

Ripple Price3 months ago

Ripple Price3 months ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Bitcoin5 months ago

Bitcoin5 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin7 months ago

Bitcoin7 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion7 months ago

Opinion7 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin4 months ago

Bitcoin4 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines