Airdrop

SynFutures announces F token airdrop

Published

5 months agoon

By

admin

SynFutures, a decentralized exchange for perpetual derivatives trading on Base, has introduced SynFutures Foundation and announced an airdrop of its native token, F.

The SynFutures Foundation will collaborate with the community to oversee the DEX platform’s development and secure key partnerships. As a community-led governance initiative, the foundation aims to ensure the success of grants, project collaborations, and funding programs.

The F token is an Ethereum (ETH)-based mainnet asset, will grant holders governance rights, staking rewards, and fee discounts. The airdrop will distribute 10 billion F tokens to the community, with additional airdrops planned in the future.

SynFutures noted in a press release that the airdrop will benefit the community, the DEX’s backers and advisors, the foundation treasury, and core contributors. F is also reserved for liquidity and protocol development.

The community will receive 28.5% of the total F token supply, with 7.5% available for distribution during the Season 1 Airdrop on December 6, 2024. Eligible participants include users who have interacted consistently with SynFutures from v1 to v3.

Several crypto exchanges, including Bybit, Gate.io, Bitget, and KuCoin, have expressed support for the F token airdrop. Bybit will host a launchpool initiative between Dec. 2 and Dec. 5, allowing participants to earn F ahead of its listing. Gate.io is offering a similar program with 75,000 F tokens available.

SynFutures is backed by prominent venture capital platforms such as Pantera, Dragonfly, Polychain, Standard Crypto, and SIG.

The platform recently unveiled a Perp Launchpad, offering a $1 million grant to support tokens deemed under the radar. In September, SynFutures rolled out two perpertual contracts with 10x leverage that allowed traders to bet on the U.S. election.

Source link

You may like

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Airdrop

Meteora shares two proposals on MET token allocation

Published

4 weeks agoon

March 21, 2025By

admin

Meteora, the popular decentralized exchange on Solana, has put forward two proposals for adjusting MET token allocation.

According to Meteora’s Mar. 20 post on X, these changes aim to make liquidity provider rewards fairer, support new token launches, and secure long-term incentives for the team. The first proposal suggests revising the LP Stimulus Plan.

Originally, 10% of the MET supply was set aside to reward liquidity providers, but since the program has been running longer than its expected December 2024 end date, Meteora wants to increase this to 15%. This adjustment ensures that early and new LPs receive rewards without devaluing tokens.

The first two proposals are live on https://t.co/OeTKWfH27W.

These proposals address key community concerns about the LP Stimulus Plan, M3M3 and more.

Watch the community call to see @0xSoju & @0xmiir go through these proposals live.

— Meteora (@MeteoraAG) March 20, 2025

Early contributors will receive 2% of MET under the updated plan, while all LPs will receive 8% equally. The original points multiplier system has been replaced by this. An extra 3% of MET will go to Launch Pools and Launch Pads in order to avoid reward dilution for retail LPs.

The second proposal focuses on the team. Meteora plans to allocate 20% of the MET supply to its team, with a six-year vesting period to maintain long-term commitment. Within this, 2% will go to M3M3 token holders. M3M3 is Meteora’s stake-to-earn platform, which lets users earn fee rewards from permanently locked liquidity pools.

This move follows the mismanagement of M3M3 by its original creators, which led to investor losses. To maintain fairness, the distribution will be based on two snapshots and wallets connected to questionable activity will be blocked.

Meteora has experienced rapid growth in the past few months. According to DeFiLlama data, the platform’s trading volume surged 33 times, from $990 million in December 2024 to $33 billion in January 2025.

Due to its rapid growth, Meteora now holds a 9% market share and is ranked fourth among DEXs by trading volume. While the broader DEX market was on a downturn, Meteora raked in $195 million in monthly fees in February.

Despite its achievements, Meteora is currently facing legal issues that may impact its future. Burwick Law, a New York law firm, filed a class-action lawsuit against Meteora, KIP Protocol, and Kelsier Ventures on Mar. 13. According to the lawsuit, they defrauded retail traders and misled investors by manipulating liquidity during the LIBRA token launch.

Source link

Airdrop

NFT Marketplace OpenSea Confirms Upcoming SEA Token Airdrop, Expands to Crypto Trading

Published

2 months agoon

February 13, 2025By

admin

Popular non-fungible token (NFT) marketplace OpenSea said Thursday that it is expanding its platform to crypto trading and confirmed it is planning to distribute SEA tokens to users.

The trading platform called OS2 has launched today, and aggregates marketplaces, allows cross-chain purchasing and offers lower fees in the beginning, according to the protocol’s press release.

“This represents an expansion of OpenSea from an NFT marketplace to a much broader platform for trading all types of digital assets,” said Devin Finzer, Co-founder and CEO of OpenSea. “We think tokens and NFTs belong together in a single, powerful, delightful experience.”

OpenSea Foundation, the Cayman Islands-based development organization behind the protocol, will also distribute SEA tokens offering utility on the OS2 platform.

While details and date of the airdrop remain undisclosed, OpenSea has confirmed that SEA will recognize both active users and those who have been part of the platform since its early days. US users will be included in the airdrop.

OpenSea has said that SEA’s utility will be focused on long-term engagement rather than short-term speculation.

The platform’s monthly trading volume is down significantly from a $5 billion peak in early 2021, having facilitated trading of $190 million worth of NFTs last month. The platform’s annualized revenue stands at $33 million, according to Dune Analytics data.

Source link

Airdrop

Story Protocol announces launch of public mainnet

Published

2 months agoon

February 13, 2025By

admin

Story Protocol has officially launched its public mainnet following a six month long testnet.

Story Protocol, a layer-1 blockchain, has announced the launched its public mainnet, marking the first-ever global, programmable market for IP. The platform aims to transform the $61 trillion IP asset class by giving IP holders and AI-driven products the tools to manage, trade, and monetize creative assets.

Story Protocol’s launch follows a six-month testnet phase that began with the “Iliad” testnet on August 27, 2024. Now live, its mainnet provides a decentralized platform where IP owners can set up licensing rules and transact without any middlemen.

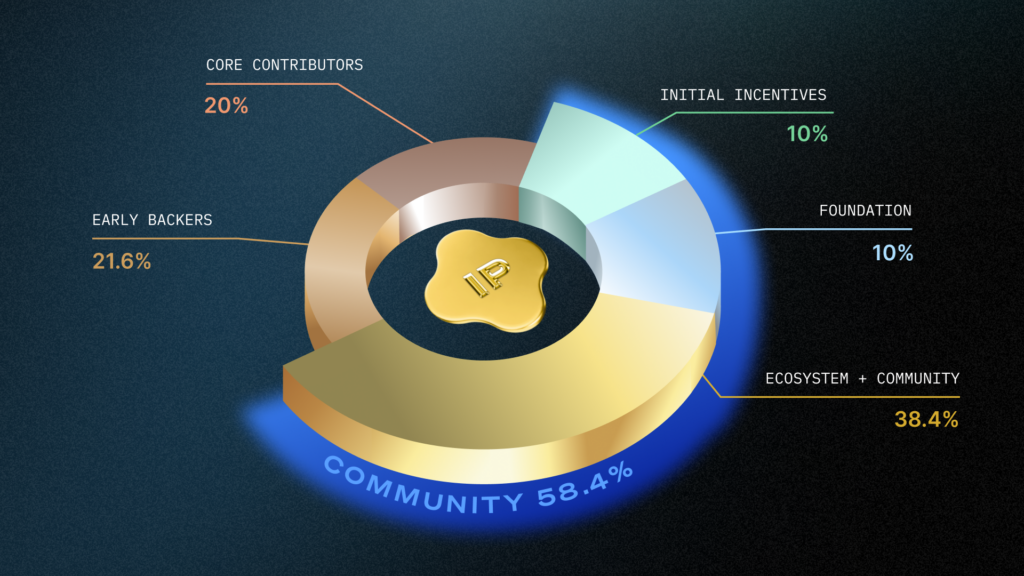

The network will be secured by the IP token. IP is used for transactions, governance, and creator rewards. IP owners can register and tokenize their work on the blockchain, setting rules for how it can be used, modified, or monetized. Developers can build apps on the network, creating new AI tools, licensing platforms, and IP marketplaces.

IP has debuted with an initial supply of 1 billion tokens. A 30-day rewards portal has been set up to allow testnet participants to claim IP tokens. Staking IP is an option for those who wish to promote network security. The staking phase for the IP, called “Singularity,” kicked off on Feb.1, but rewards will be distributed starting March 2.

Notably, tokens allocated to early backers and core contributors will be locked for one year. Major exchanges like Coinbase, OKX, KuCoin, Bybit, Bitget, and Bithumb have already announced the listing of IP.

Story Protocol raised $140 million from investors such as Samsung Next and a16z. Several IP-focused projects are already building on the network. Aria, one such project, raised $7 million to purchase the rights to Justin Bieber’s song “Peaches” and divide the proceeds among the IP asset’s fractional owners.

Source link

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Will Shiba Inu Price 3x?

Bitcoin Cash (BCH) Gains 4.2%, Leading Index Higher

Bybit shuts down four more Web3 services after axing NFT marketplace

Aptos To Continue Moving In ‘No Man’s Land’ – Can It Reclaim $5?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals