lightning

Tando Was All The Rage At This Year’s Africa Bitcoin Conference

Published

5 months agoon

By

admin

Before I even arrived at this year’s Africa Bitcoin Conference, I saw attendees posting about Tando, a new Kenya-based payments app that allows users to spend their sats with merchants who don’t accept bitcoin.

Just arrived in Nairobi

& the 1st thing I see as I exit is the @tando_me sign

LET’S GO @AfroBitcoinOrg

pic.twitter.com/zhPSP2dTH8

— OKIN | Nikolai Tjongarero (@OKIN_17) December 8, 2024

“How is this possible?”, you might ask. Well, let me explain.

To use Tando, you simply download the app and prepare to pay any merchant who accepts payments via M-PESA, Kenya’s mobile money service. (Notice I didn’t say you had to go through a set up or KYC process, as neither are necessary — Tando doesn’t collect any identifying information from its users.)

When the merchant presents you with your bill, you simply click on the “Send Money” square on the app’s home screen. From there, you enter the mobile number tied to the M-PESA account to which you’re sending money and then input the amount of Kenyan shillings you want to send.

The app automatically calculates the amount of sats it will take to cover the shilling amount you’ve input. You then click on the green “Create Invoice” button to obtain a Lightning invoice. After that, you copy the invoice and pay it via your preferred Lightning wallet. Tando receives the sats and then settles the bill in shillings with the merchant within seconds.

I can barely count how many times I’ve watched Bitcoiners use Tando to pay restaurant bills or taxi fares since I’ve been here. (I’ve been to a lot of restaurants and have ridden in a lot of taxis since I’ve arrived.)

Now, I know what some of you are thinking: Tando interfaces with a fiat payment system, which means it should be excommunicated from the Church of Bitcoin.

But before you allow yourself to entertain that kind of thinking, please consider the following notions:

- You’re a loser.

- Here in Kenya, much like in other parts of Africa, people actually use bitcoin for payments.

- When you show someone how to use Tando, it provides you with an opportunity to show the merchant what Bitcoin is as you show them how the app works. (I watched Gorilla Sats’ Brindon Mwiine masterfully do this for a waitress at a conference after party.)

- M-PESA requires that its users KYC and some Kenyan citizens don’t have the proper documentation to do so, which means they’re excluded from the system. Using Tando, they can be included in Kenya’s broader monetary system.

The excitement around Tando at the conference was part of the broader enthusiasm around apps that make bitcoin easier to use across the African continent — apps like Bitsacco, Machankura, Fedi and Bitnob.

Massive shout out to the devs making #Bitcoin wallets easier to use.@bitsacco @Machankura8333 @fedibtc @tando_me @Loicbtc pic.twitter.com/UhVw5bnBxO

— Frank Corva (@frankcorva) December 11, 2024

African Bitcoiners are far ahead of their counterparts in the United States when it comes to using bitcoin as it is intended to be used — as peer-to-peer electronic cash.

And while many Africans are working tirelessly to onboard as many merchants as they can to Bitcoin, Tando is an excellent intermediary step that allows Bitcoiners to spend their sats even if the merchants with whom they’re spending don’t yet accept bitcoin payments.

Source link

You may like

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

Exchange

India’s Leading Bitcoin And Crypto Exchange Unocoin Integrates Lightning

Published

2 weeks agoon

April 13, 2025By

admin

Unocoin, one of India’s longest-standing bitcoin and crypto exchanges, has announced the successful integration of the Lightning Network, a second-layer protocol designed to enable fast and low-cost bitcoin transactions. The integration is powered by Voltage, a U.S.-based infrastructure provider known for its enterprise-grade Lightning solutions.

This development marks a significant step forward for bitcoin utility in India, especially in the context of rising demand for scalable and cost-effective transactions. By adopting the Lightning Network, Unocoin aims to offer its users instant bitcoin settlements and, in the near future, Tether (USDT) transfers via the same network.

“We continuously seek ways to improve transaction efficiency and cost-effectiveness for our users. With the Lightning Network, powered by Voltage, Unocoin is enabling the fastest, lowest-cost bitcoin and Tether transfers,” said Sathvik Vishwanath, CEO of Unocoin.

Unocoin’s move comes at a time when the Indian crypto landscape continues to face regulatory headwinds. While several exchanges have scaled down or exited the market, Unocoin has remained resilient, maintaining operations and user trust. The exchange’s adoption of Lightning technology reinforces its position as a leader in innovation within the country’s bitcoin and crypto sector.

“The Lightning Network represents a revolutionary leap in bitcoin scalability, enabling fast, secure, and cost-effective transactions,” said Graham Krizek, CEO and Founder of Voltage. “By partnering with Unocoin, we aim to bring these benefits to millions of users in India, fostering greater adoption and utility of bitcoin in daily transactions.”

Source link

business

Voltage Aims To Bring Bitcoin’s Lightning Network To Every Business In The World

Published

2 months agoon

February 25, 2025By

admin

Founder: Graham Krizek

Date Founded: October 2020

Location of Headquarters: Wichita, Kansas

Number of Employees: 17

Website: https://www.voltage.cloud/

Public or Private? Private

In 2012, soon after Graham Krizek discovered Bitcoin and subsequently began contributing to Bitcoin Core and building his own applications on Bitcoin, he noticed an issue that was hindering Bitcoin builders.

“The problem that I saw was that everyone was building everything from scratch — over and over and over again,” Krizek told Bitcoin Magazine. “There was no cloud environment where you could just spin up Bitcoin infrastructure and be able to start developing against it.”

At the time, Krizek didn’t feel compelled to act on this issue, though. He was still primarily focused on his career as a software engineer outside of the Bitcoin space, working for various startups as well as companies as large as Salesforce, while contributing to Bitcoin in his free time.

But something shifted within him when he learned about the Lightning Network.

He saw its potential and knew that it would have to be made easier to use if it were to be widely adopted.

“When I found Lightning, I said to myself ‘Okay, this is the next phase of Bitcoin adoption, the thing that’s going to really drive it to the next level,” said Krizek.

“Then, I saw the same pattern happening as I did with Bitcoin. Everyone kept starting from scratch while building, but the problems were more intense because Lightning is that much more complicated,” he added.

“I was like ‘We need a cloud provider where you can just click a button and have a Lightning node running and maintained for you.’ It can just be there so we can develop applications and build the projects we want to build much easier, much faster.”

And so Krizek got to work in creating such a product.

He shared the initial iteration of it with friends and acquaintances, many of whom began using it so much that the project demanded more of his attention.

“The usage grew to a point where I was like, ‘Man, I either need to shut this down because I can’t maintain it anymore or I need to turn this into a business and do it for real,’” said Krizek.

He decided on the latter, and by late 2020, he’d founded Voltage.

How Voltage Works

Voltage abstracts away the complexities of using Lightning by allowing users to deploy a Lightning node and spin up a channel in just a few clicks.

While Voltage hosts your node in its cloud, its public key, peers, channels, balance and transactions all remain private, as all of the traffic routed through the node is transferred via Tor.

While your node is running in the Voltage cloud, which is supported by the Google Cloud and several other cloud service providers, Voltage also helps users manage liquidity and offers other forms of customer support.

Essentially, Voltage abstracts away the difficulties of engaging with Lightning, while supporting its users in the process. And it does this in efforts to help institutions more readily adopt Lightning. Krizek also mentioned they have new products and capabilities to help even traditional finance companies with the integration.

“The mission of Voltage is to make Bitcoin and the Lightning Network accessible to every business on the planet,” said Krizek.

“Lightning is fantastic. It’s got a lot of really amazing capabilities, but it can be really hard to wrap your head around it and especially to incorporate it for business operations — especially for businesses that maybe aren’t in the Bitcoin or crypto space,” he added.

“We make it easy to use and plug in.”

What Types Of Companies Are Using Lightning?

In the past year, notable companies such as major crypto exchange Coinbase and Latin America’s largest fintech bank Nubank have incorporated Lightning into their operations.

Krizek sees this trend of crypto exchanges, neobanks and other financial service platforms onboarding to Lightning continuing in the year ahead.

“Finance companies are definitely going to be the biggest movers because if you can take the value of sub-second settlement with zero fees and apply that to a big payment processor that does global payments, it’s an incredible value add for their business,” said Krizek.

What is more, Krizek sees companies outside of the Bitcoin, crypto and finance space also beginning to utilize Lightning in 2025, in part, because companies like Voltage are making it easier to do so.

“2025 will be a big year for starting to branch out of our niche market,” said Krizek.

“The technology has still been a little rough around the edges for a big company like Walmart to be like, ‘Hey, we’re going to plug this in now.’ Even with Voltage, we haven’t been perfect the entire time with making Lightning super easy to use,” he added.

“I think we’ve made huge strides in the last like year, though, and we have a lot more coming out.”

Another major hurdle for companies looking to adopt Lightning is the risk that comes with managing bitcoin’s volatility.

But that risk doesn’t exist if companies send Tether (USDT) over Lightning instead of bitcoin, which they will be able to do soon.

Tether (USDT) On Lightning

Krizek is optimistic about USDT coming to Lightning, as he believes it will spur growth on the network.

“I think that we’re going to have a lot of products and solutions around it,” said Krizek.

“It’s not even just me being personally excited about it. A lot of our customer base is very excited about it. They’re asking for it directly from us because stablecoins are pretty much the biggest use case in crypto today,” he added.

“When you couple stablecoins with sub-second settlement fees and very low fees, that’s a huge unlock. With fees on Tron getting more expensive. People are looking for an alternative.”

(Tron has been the leading blockchain for stablecoin transactions because of how low fees on the network have been historically.)

As far as USDT running over Lightning potentially presenting a security risk to Bitcoin (as I think it does), Krizek doesn’t seem concerned.

“It doesn’t worry me at all,” said Krizek.

“I think that we’ve advanced since the Blocksize War in terms of takeovers, as I don’t think it’s as easy for a large institution to coerce the Bitcoin ecosystem like some did during the Blocksize Wars,” he added, referring to Tether potentially gaining outsized influence over Bitcoin.

“And it’s even better to integrate something like Tether (USDT) on Lightning because it’s a peer-to-peer network — it’s not public consensus. So, you have much more ability to say ‘Hey, if you don’t want to participate in the USDT transfers, just don’t do it.’”

Moving Forward In A Pro-Bitcoin Regulatory Environment

U.S. Crypto Czar David Sacks is an investor in Voltage (via his venture capital firm, Craft Ventures). This would indicate that he has some understanding of the Lightning Network and the role of bitcoin as a medium of exchange.

So, does this mean that the U.S. is on the verge of embracing bitcoin as such?

According to Krizek, not exactly.

“Everyone is screaming at the government right now for a Strategic Bitcoin Reserve, which treats bitcoin as a store of value,” explained Krizek.

“Over time, we will definitely hear more and more about bitcoin as a means of payment. We just need to get through this Strategic Reserve conversation first and then say, ‘Okay, what else can we do with this?’” he added.

The fact that the government is painting Bitcoin in any sort of positive light at all, though, is exciting to Krizek. Since 2012, when he first entered the Bitcoin space, the government has either dismissed Bitcoin or been antagonistic towards it.

“When I started in Bitcoin, it was completely ignored, and the last four years were very bad for companies like us,” said Krizek.

“With this new administration, we’ve definitely seen the tone shift. We’re still working through certain things, but we’re definitely turning a corner and heading in the right direction,” he added.

“I’m really excited to see where that can go over the coming year. I think it will be a positive one.”

Source link

Ark Labs

My Top 3 Takeaways From Fidelity And Voltage’s Recent Lightning Report

Published

2 months agoon

February 21, 2025By

admin

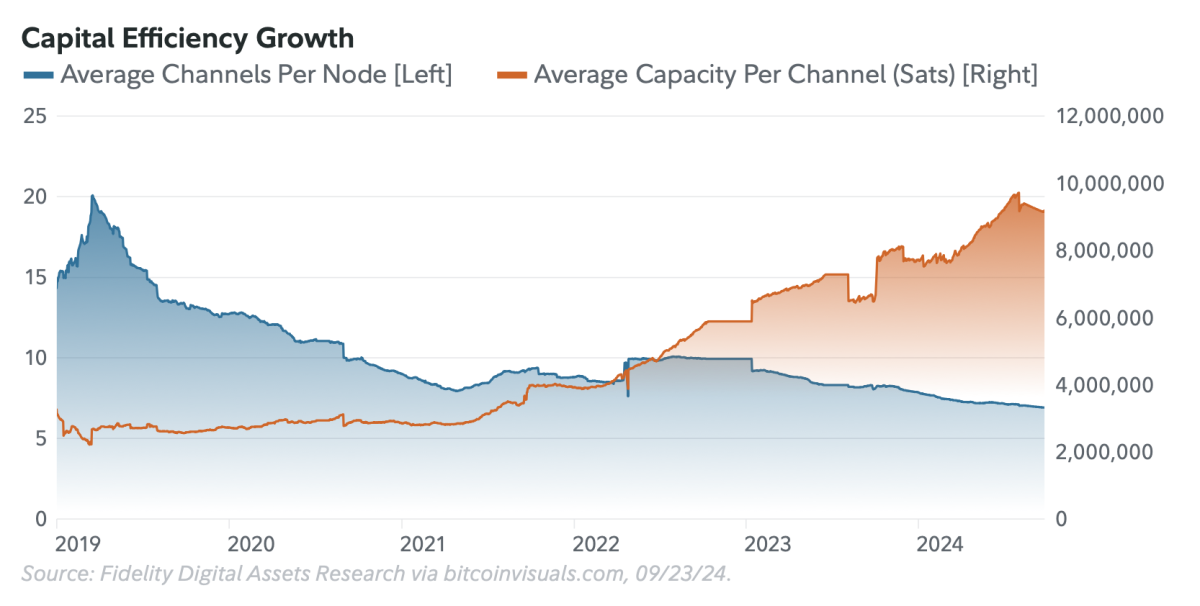

In a report released this Wednesday, Fidelity Digital Assets in collaboration with Lightning payment provider Voltage released a report on the state of the Lightning Network.

The report details the many ways in which the Lightning Network has grown since its launch in 2018.

It also illustrates how more businesses have begun incorporating Lightning in 2024 than any year prior, that larger channels are forming on the network and that more Lightning nodes are coming online.

Some key stats from the piece include the following:

- Total Lightning capacity denominated in U.S. dollars has increased by 2,767% since 2020

- Its bitcoin-denominated capacity has grown by 384% in the same period

- Currently, almost all payments over Lightning below 1,000,000 sats processed in less than 1.1 seconds

While these stats made me optimistic, it was other information in the report that really resonated with me and made me rethink how I view Bitcoin and Lightning.

Below were top three takeaways from the report:

- Lightning payments are gaining traction on Nostr (the world’s largest bitcoin circular economy), as Nostr users have sent over 3.6 million individual zaps in the last six months

- Projects like ARK, another Bitcoin Layer 2 protocol, illustrate that Lightning has use cases beyond just peer-to-peer channels (ARK allows users to share virtual UTXOs (vUTXOs) with a larger group instead of on a one-to-one basis) can can be built upon in ways many didn’t initially anticipate

- The “HODL” mentality is one the things still slowing Lightning adoption; in other words, if Bitcoin enthusiasts don’t spend their bitcoin, Lightning growth may stagnate, which could hurt Bitcoin’s value proposition

So, as we’re here at the beginning of 2025, a year that many think will be big for Lightning, I can’t help but be optimistic to see what sort of traction Lightning gains in the next 10 months.

It’s high time bitcoin is used more as a medium of exchange — the way Satoshi intended for it to be.

Source link

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Ethereum community members propose new fee structure for the app layer

Crypto Investors Sue Nike, Accuse Apparel Giant of Rug Pull After Abrupt Closure of Metaverse Business: Report

Top cryptocurrencies to watch: Pi Network, XRP, Sui

This Week in Crypto Games: Ubisoft’s ‘Might & Magic’, ‘Peaky Blinders’ in Development

Why Arbitrum-Nvidia Partnership Collapsed – And What It Means for Web3

Tariff Carnage Starting to Fulfill BTC’s ‘Store of Value’ Promise

The cost of innovation — Regulations are Web3’s greatest asset

Best Crypto to Buy as Derivatives Exchange CME Set to Launch XRP Futures

Metaplanet Buys Additional ¥1.92 Billion Worth Of Bitcoin

Here Are Four Signs the Stock Market Has Bottomed, According to Fundstrat’s Tom Lee

Bitcoin dips below $94,000 as ETFs record $3b weekly inflow

Bitcoin Post-Halving Price Performance Is the Worst on Record. Why?

Expert Predicts Start Date For Pi Network Price Pump

GameFi Tokens Show Signs of Life After Gala Games, White House Tie-Up

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje