France

Telegram founder Pavel Durov leaves France, Toncoin surges

Published

16 hours agoon

By

admin

Telegram founder Pavel Durov, detained in France since last August, was granted temporary permission to leave the country for Dubai.

Agence France Presse (AFP) first reported the news on Saturday. Shortly afterward, the cryptocurrency market reacted.

Toncoin (TON), the digital token linked to Telegram’s Telegram Open Network (TON), saw a dramatic surge in its trading volume, increasing by more than 15% following the announcement.

The TON token, currently valued at $3.34, has been a key development of Telegram’s blockchain initiatives.

In addition, Notcoin (NOT), a token for a popular tap-to-earn mini-app on the platform, also experienced a rally, rising by over 12.7% at the time of publication.

Durov, a billionaire Russian exile who founded the popular messaging app Telegram in 2013, faces multiple charges linked to allegedly enabling organized crime.

Authorities allowed Durov to depart for Dubai, AFP reported citing an unnamed source. The move follows a ruling by an investigating judge who accepted Durov’s request to modify the conditions of his supervision several days ago.

Durov, 40, has been under investigation for several infractions, including accusations related to terrorism, drug trafficking, fraud, money laundering, and child abuse content on the Telegram platform.

He was initially arrested in August following his indictment, which led to a ban on his departure from the country.

Durov addressed the legal challenges in a statement posted to his official Telegram channel in September. Expressing his surprise at the charges, Durov criticized French authorities for bypassing official communication channels with Telegram’s EU representative and instead questioning him directly. He argued that holding a CEO accountable for crimes allegedly committed by others on a platform—especially one operating under pre-smartphone laws—was a “misguided approach.”

In his statement, Durov also defended Telegram’s moderation practices, highlighting the platform’s daily efforts to remove harmful content and its established connections with NGOs for urgent requests. Despite the legal troubles, he reaffirmed his commitment to ensuring the safety and security of Telegram’s vast user base, which now totals nearly one billion people.

As the investigation continues, Durov’s legal battles are likely to remain a topic of significant attention, especially as Telegram’s cryptocurrency initiatives continue to expand.

Whether the latest legal developments will have any long-term effects on Telegram’s operations or the value of its associated tokens remains to be seen.

Source link

You may like

XRP Must Close Above This Level For Bullish Breakout: Analyst

Bitcoin reclaims $80K zone as BNB, TON, GT, ATOM hint at altcoin season

Stock Market To Witness Rallies in Next One to Two Weeks, Predicts Wall Street’s Cantor Fitzgerald – Here’s Why

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

What is Milady? The Edgy Ethereum NFT Community With Vitalik Buterin’s Support

Can Pi Network Price Triple if Binance Listing is Approved Before March 2025 Ends?

France

Here’s why the Toncoin price surge may be short-lived

Published

10 hours agoon

March 16, 2025By

admin

Toncoin price has risen by 45% from its lowest level this month after Pavel Durov was allowed to leave France after months.

Toncoin (TON) rose to a high of $3.6240 on Saturday, its highest level since Feb. 24, bringing its market cap to over $8.4 billion.

Pavel Durov leaves France

The surge happened in part because of the ongoing crypto prices rebound and after French authorities gave Durov his passport, allowing him the freedom to leave the country.

https://twitter.com/ton_blockchain/status/1900923518281543959?s=46

Durov was arrested in 2024 in France and was accused of several crimes, including complicity in managing an online platform that enabled illegal transactions. Allegations include refusal to cooperate with authorities, drug trafficking and money laundering.

Following Durov’s arrest, many in the crypto community rallied in his defense.

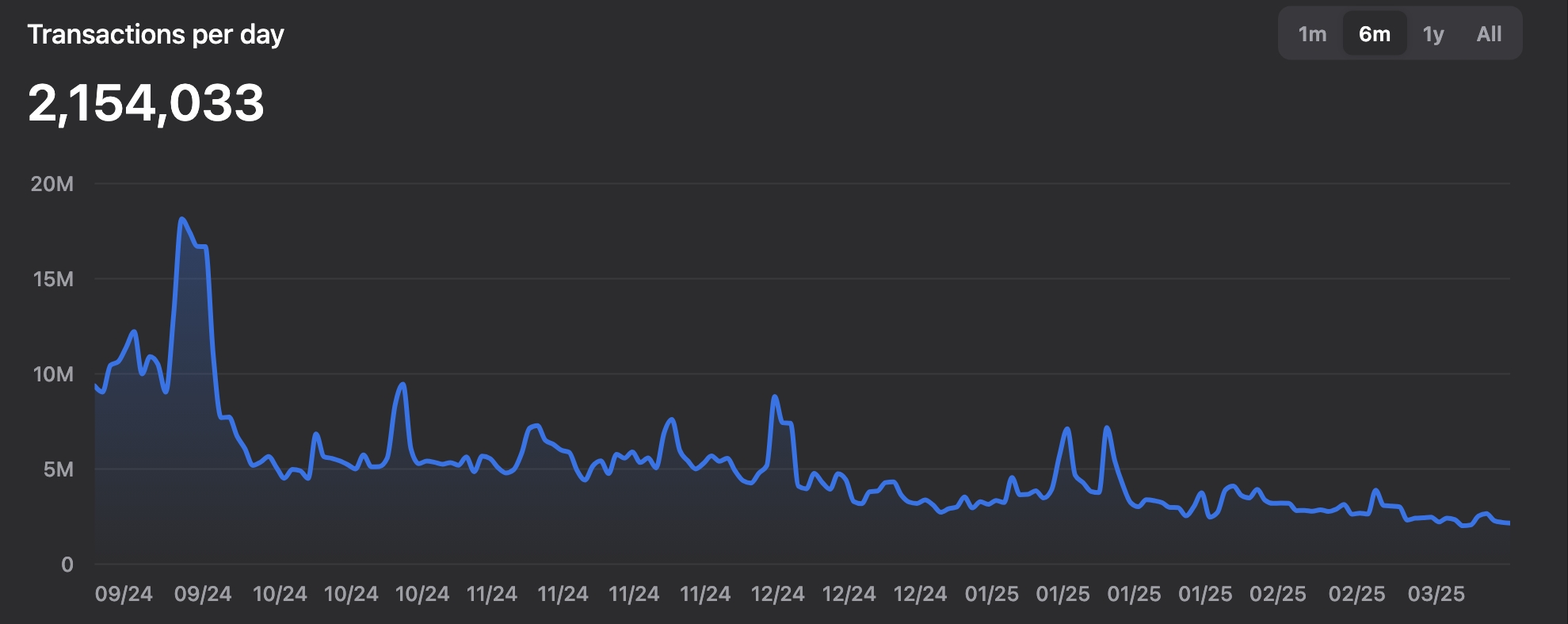

Still, there are risks that the Toncoin price surge may be short-lived because of its fairly weak on-chain metrics. Data compiled by TonStat shows that the TON inflation has continued rising and currently stands at 0.40%, up from 0.33% in October. This inflation has jumped as the total supply has surged to over 5.124 billion.

More data shows that the number of transactions per day crashed to 2.15 million from almost 20 million in September last year.

The number of active wallets in the TON Blockchain has continued to drop. Also, the total value locked in its DeFi ecosystem has dropped to $180 million from almost $800 million a few months ago.

STON.fi, its biggest DEX network, has a small market share, handling $7.1 million in the last 24 hours.

One reason for this performance is that most tokens in the TON Blockchain, like Hamster Kombat (HMSTR), Catizen (CATI) and Tapswap, have crashed — erasing billions of dollars in value.

The Toncoin price may also drop as investors sell the Durov release news. Historically, traders initially overreact to major news and then sell after a while. Recall when Cardano’s price rose after being named one of the tokens included in President Trump’s stockpile (the coin tumbled by double digits a few days later).

Toncoin price analysis

The daily chart shows that the TON price has bounced back after bottoming at $2.3650 this month. It rose to a high of $3.50, which coincided with the 50-day moving average, a sign that it has found substantial resistance.

Toncoin price also found resistance at the weak, stop and reverse point of the Murrey Math Lines. Therefore, the token will likely resume the downtrend and move below $3 as the Durov news starts to fade.

Source link

crime

French Authorities Rescue Ledger Co-Founder and His Wife After Both Were Kidnapped for Crypto Ransom: Report

Published

2 months agoon

January 25, 2025By

admin

French authorities have reportedly rescued the co-founder of hardware wallet firm Ledger and his wife after they were kidnapped and held for ransom.

According to a new article by The New York Times, Dave Balland and his wife were abducted from their home in France earlier this week by bad actors who then contacted another founder of the company and demanded a large amount of crypto for their release.

The report says that Balland was found and released by police on Wednesday about 30 miles away from his home while his wife was found 80 miles away tied up in a car a day later.

His wife was unharmed but Balland had to be hospitalized due to his hand being mutilated by the kidnappers – a photo of which was used to pressure Ledger into paying the ransom.

In the report, Paris prosecutor Laure Beccuau said that during the negotiations, some of the ransom was paid but that the assets were tracked, frozen and seized.

As stated by Ledger CEO Pascal Gauthier on the social media platform X,

“We are deeply relieved that David and his wife have been released, and are now safe. I have reached out to David, and our thoughts continue to be with him, his family, and the members of our team that worked with David while he was at Ledger. We’re grateful to law enforcement for their swift action. Our top priority was always to allow law enforcement to do their jobs and protect the integrity of the investigation.”

Nine men and one woman, aged between 20 and 40, were arrested and questioned about the kidnapping, though no other details about the suspects were released. In the report, Beccaua says that the crimes of kidnapping, torture and armed extortion carry potential life sentences.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

24/7 Cryptocurrency News

Polymarket Faces French Ban After Massive Bets On US Election Results

Published

4 months agoon

November 7, 2024By

admin

Polymarket, a crypto-based prediction market, is likely to be prohibited by France’s gambling regulator, the ANJ, after a huge amount of bets were placed on the 2024 U.S. presidential election. Since the global audience engaged in prediction platforms, Polymarket experienced a record jump, with $450 million expected to be distributed to users following the victory of Donald Trump.

This increase of betting volume and large stakes has become a matter of concern for the French regulator because the platform offers unlicensed gambling services.

$450 Million in Payouts Expected After U.S. Election Bets

Prediction markets, which are expected to increase their payout to election bettors to around $450m following Donald Trump’s projected win, are attracting increasing attention.

Although conventional polls pointed to a closer contest, prediction markets such as Polymarket and Kalshi recorded a steep rise in Trump’s chances in the last few days, indicating a strong divergence with poll-based expectations.

Among the active users of Polymarket, a French trader called “Theo” made a $26 million bet on Trump’s win and won $49 million. This big bet made Polymarket popular, as the French authorities paid attention to the platform and its popularity among French residents, which led to concerns about the compliance of the platform with French gambling legislation.

France’s ANJ Considers Blocking Access to Polymarket

The ANJ has claimed that Polymarket is involved in gambling which is only allowed in France by licensed operators. According to local media, the regulator has the power to ban access to unlicensed gambling sites and is expected to restrict access to Polymarket soon.

An ANJ insider said: “Polymarket is just betting on something that is completely uncertain, which is exactly what gambling is.”

If put in place, the ban would prevent the usage of the application in France, despite the fact that users can still try to avoid the restriction by connecting to VPN. The ANJ could also try to influence media outlets and directories to stop advertising or linking to Polymarket and, thus, limit its audiences even more.

Regulatory Concerns Over Market Manipulation

The high level of activity on Polymarket has led to speculations that the platform may be used for market manipulation. Two blockchain analysis firms, Chaos Labs and Inca Digital, recently revealed that there was potential wash trading within Polymarket’s U.S. presidential betting market where the same assets are bought and sold to simply create a fake market. This type of trading is rather manipulative and can lead to the distortion of signals on the market and mislead other participants.

The US Commodity Futures Trading Commission also has concerns about prediction markets and put forward a rule in May aiming at stricter regulation of such markets due to the potential for manipulation.

Although no final decision has been reached, regulatory actions could impact Polymarket’s ability to operate freely in other markets, including the U.S.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

XRP Must Close Above This Level For Bullish Breakout: Analyst

Bitcoin reclaims $80K zone as BNB, TON, GT, ATOM hint at altcoin season

Stock Market To Witness Rallies in Next One to Two Weeks, Predicts Wall Street’s Cantor Fitzgerald – Here’s Why

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

What is Milady? The Edgy Ethereum NFT Community With Vitalik Buterin’s Support

Can Pi Network Price Triple if Binance Listing is Approved Before March 2025 Ends?

Gold ETFs Inflow Takes Over BTC ETFs Amid Historic Rally

Toncoin in ‘great entry zone’ as Pavel Durov’s France exit fuels TON price rally

XRP $15 Breakout? Not A Far-Fetched Idea—Analysis

Here’s why the Toncoin price surge may be short-lived

Wells Fargo Sues JPMorgan Chase Over Soured $481,000,000 Loan, Says US Bank Aware Seller Had Inflated Income: Report

BTC Rebounds Ahead of FOMC, Macro Heat Over?

Solana Meme Coin Sent New JellyJelly App Off to a Sweet Start, Founder Says

Toncoin open interest soars 67% after Pavel Durov departs France

Coinbase (COIN) Stock Decline Can’t Stop Highly Leveraged Long ETF Rollouts

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: