AI

Tema plunges over 20%, AI Companies is up more than 66%

Published

3 months agoon

By

admin

Tema may garner attention on social media with over 2.7 million TikTok fans tuning in to watch the beloved raccoon, but as a meme coin, it’s trending for the wrong reasons.

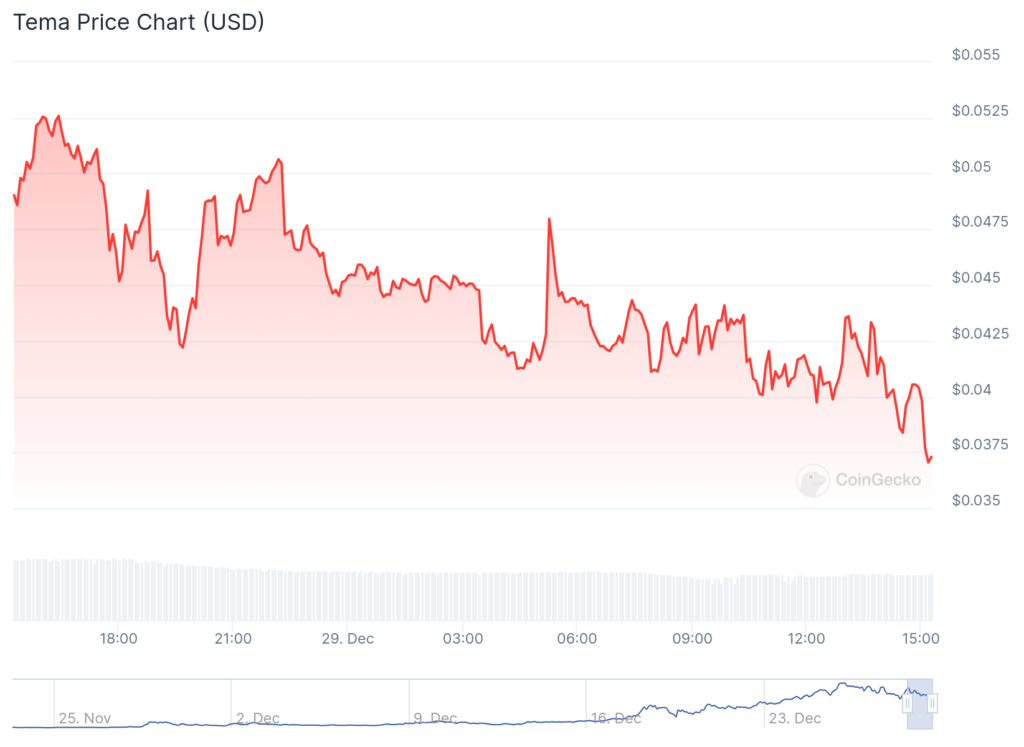

Tema (TEMA), at last check Sunday, was down about 24% and trading at $0.04046. It currently has a market cap of $40.5 million, a circulating supply of more than 999.9 million and a 24-hour trading volume of around $7.87 million.

The meme coin — launched on the Solana blockchain — is inspired by a raccoon named Tema, which has over 2.7 million followers on TikTok.

AI Companions rallies

AI Companions (AIC) is a cryptocurrency token that powers a platform offering customizable, interactive virtual partners.

These companions utilize AI, virtual reality, augmented reality, and blockchain technologies to provide immersive digital companionship experiences.

Its current price is approximately $0.1139 per AIC with a market capitalization of around $84 million.

- Circulating Supply: 750 million AIC tokens, with a maximum supply of 1 billion tokens.

- Recent Performance: The token has experienced significant price fluctuations, with a notable increase of over 52% in the last 24 hours.

- Monetization Strategies: AI Companions employs various monetization methods, including free access with limited features, staking AIC tokens, and subscription models.

AIC tokens are available for trading on several centralized exchanges, including Gate.io, MEXC, and BingX, with the AIC/USDT pair being the most active.

Source link

You may like

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Tether eyes Big Four firm for its first full financial audit: Report

US Treasury Removes Tornado Cash From OFAC Sanctions List

AI

Bittensor spikes 20% after Coinbase announces TAO listing

Published

1 month agoon

February 19, 2025By

admin

Bittensor price rose sharply on Feb. 19 after crypto exchange Coinbase announced the listing of the native token of the decentralized artificial intelligence network.

As most altcoins registered notable gains in the past 24 hour period, Bittensor (TAO) spiked 20% to hit intraday highs of $420. These gains were modest compared to outperformers in the top 100 coins by market cap such as Story, Sonic, Aptos and Floki. However, with double digit gains, Bittensor ranked among the top performers.

The performance saw TAO recoup losses it suffered in the past few days as alts mirrored Bitcoin’s struggles. With 20% upside, bulls wiped most of the accrued losses in the month-to-date period, returning to levels seen when Bittensor price reacted positively to AI news around DeepSeek.

Coinbase to list TAO

A dose of volatility saw Bitcoin rebound above $96,000 and XRP rise 6% amid news of Hashdex’s spot XRP exchange-traded fund approval in Brazil. Cryptocurrencies traded slightly higher as investors awaited the Federal Open Market Committee meeting minutes.

This, along with Coinbase’s upcoming listing of Bittensor on Feb. 20, helped push TAO higher.

In an announcement, the U.S.-based crypto exchange confirmed it would add trading support for TAO on the Bittensor network. The phased launch will offer trading with the TAO/USD pair.

“Trading will begin on or after 9AM PT on February 20 2025 if liquidity conditions are met. Once sufficient supply of this asset is established trading on our TAO-USD trading pair will launch in phases,” Coinbase wrote on X.

Bittensor’s price also soared earlier this month after the project released its Dynamic TAO whitepaper, outlining a major upgrade.

Does TAO listing on Coinbase matter?

Bittensor is a top AI token by market cap, currently the second-largest behind NEAR. Notably, the native token is already listed on Binance, Kraken and other top exchanges. Coinbase listing is nonetheless key as it could give Bittensor further traction.

Besides, the project that launched in 2019 has received investment backing from some of the top venture capital players in the market, including Pantera Capital, Digital Currency Group and Lyrik Ventures.

Grayscale recently noted Bittensor is a crucial project in the AI space as its decentralized model can help increase transparency and democratize access.

According to Grayscale, this is key in the wake of projects such as DeepSeek. While these initiatives highlight the power and potential of open-source AI, the fact that they are centralized companies means there could be risks such as data security and embedded biases. A lack of transparency is another major concern.

Source link

AI

IP crypto surges over 80% following multiple CEX listings, What is IP?

Published

1 month agoon

February 14, 2025By

admin

IP crypto surged by as much as 81.4% in the past 24 hours of trading after the project secured listings on multiple exchanges following its Layer-1 mainnet launch.

According to data from CoinGecko, Story’s token rose to an intraday high of $2.16 on Feb. 14, with its market cap standing at $456 million. The rally was accompanied by a massive surge in demand and activity, with its daily trading volume soaring by over 400,000% to hover around $347 million.

IP was one of the best-performing assets in the crypto market on the day and was trending on Coingecko when writing.

Most of the gains seen over the past day came after the project officially launched its public mainnet after a nearly six-month testnet phase.

The event coincided with the Token Generation Event for its native token, Story tickered IP, which saw over 1 billion tokens enter circulation as part of its initial distribution. Reports indicate that 25% of the initial 1 billion IP supply has been unlocked, with 58.4% allocated to ecosystem development, the community, the foundation, and initial incentive programs.

Following the mainnet launch, IP secured listings on multiple top-tier centralized exchanges, including Coinbase, OKX, KuCoin, Bybit, Bitget, and Bithumb. Most recently, Binance announced the listing of the IP/USDT perpetual contract with up to 25x leverage.

The open interest in the IP futures market has also surged from $92.2k to over $90 million in the past 24 hours, per CoinGlass data.

What is Story Protocol?

Story Protocol is a Layer-1 blockchain designed to revolutionize the $61 trillion intellectual property market by providing a programmable and decentralized framework for managing, trading, and monetizing creative assets.

At its core, the network allows IP holders—including creators, brands, and AI-driven products—to register, tokenize, and govern their digital content on-chain. Users can set custom rules for licensing, modification, and monetization.

The protocol is powered by the IP token, which will serve as the ecosystem’s currency for transactions, governance, and creator rewards. Developers can build on the network, enabling applications such as AI tools, licensing platforms, and decentralized IP marketplaces.

Story Protocol has raised $140 million from investors like a16z and Samsung Next.

Source link

AI

Decentralized AI Opportunity Is ‘Bigger than Bitcoin,’ Says DCG’s Barry Silbert

Published

1 month agoon

February 8, 2025By

admin

Crypto investment magnate Barry Silbert is betting big on decentralized AI, calling it “the next big era of crypto” that could be bigger than even bitcoin.

In a letter to shareholders of his crypto conglomerate Digital Currency Group, Silbert went long on deAI: the crypto industry’s effort to fuse AI innovations with blockchain tech. He believes the tech mashup may pay better dividends for humanity than the closed-off systems being developed by OpenAI and other giants.

“We’re moving from the digital ownership of assets to the decentralized ownership of intelligence and the availability of vast decentralized compute resources,” Siblert wrote in the Q4 letter reviewed by CoinDesk.

The setup reminded Silbert of bitcoin, the best-known and by far biggest cryptocurrency, and the one where he first made his crypto fortune. But instead of a money revolution, deAI could herald a power revolution with crypto as the mechanism to distribute ownership of and governance over powerful AI models.

DCG certainly thinks so. The company has already invested $105 million into over a dozen deAI projects, “and we’re excited to ramp this up in 2025,” Silbert wrote.

He highlighted DCG’s investment in Bittensor – a crypto network that specializes in machine learning and AI applications – as the portfolio company closest to “escape velocity.” Bittensor’s TAO token has many similarities to bitcoin, he wrote.

Notably, TAO’s market cap is $2.7 billion, a rounding error against bitcoin’s nearly $2 trillion valuation.

DCG plans to invest mightily in supporting the Bittensor ecosystem. Silbert pointed out that in November, it spun up a company called Yuma that incubates Bittensor infrastructure projects. And Grayscale, another DCG company, now offers investment products that give exposure to TAO.

Silbert’s Q4 letter capped a year of “rebuilding” at DCG after a long period of tumult spawned by the FTX implosion, which felled its lending business, Genesis. DCG is also a former owner of CoinDesk, having sold to Bullish in late 2023. All five of DCG’s wings had a “successful 2024,” he said.

“The discipline required over the last couple of years has resulted in enhanced infrastructure and more mature processes, improved governance, and a stronger organization focused on executing on our growth initiatives,” Silbert wrote.

Source link

Bitcoin Primed for Major Moves As Macroeconomic Conditions Ease, Says Analyst Jamie Coutts – Here’s His Outlook

Themes ETFs exec on new 2X Coinbase fund: ‘We believe as the Bitcoin tide rises, it will lift all crypto boats’

Ethena’s USDe Stablecoin Sales Blocked by German Regulator Over ‘Serious Deficiencies’

Is Ethena Price At Risk? Market Maker Offloads $10M ENA Raising Concerns

Coinbase Could Be Near Multi-Billion Dollar Deal for Deribit: Bloomberg

Tether eyes Big Four firm for its first full financial audit: Report

Why Current ‘Boredom Phase’ Could Trigger Epic Rally

US Treasury Removes Tornado Cash From OFAC Sanctions List

21,899 Bank Customers Affected As US Lender Suffers Cybersecurity Breach, Hacker Taps Social Security Numbers and Other Sensitive Information

Tether eyeing ‘Big Four’ firm for reserve audit: CEO

Solo Bitcoin Miner Hits the Jackpot, Scoring $266K Reward

Is Bitcoin Price Bottom In? Key Metrics Show rally Is Likely

SEC ‘Earnest’ About Finding Workable Crypto Policy, Commissioners Say at Roundtable

John Reed Stark opposes regulatory reform at SEC crypto roundtable

Investors Withdraw 360,000 Ethereum From Exchanges In Just 48 Hours – Accumulation Trend?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x