Blockchain

Tether freezes $28m in USDT linked to Cambodian fraud

Published

2 months agoon

By

admin

Tether has reportedly frozen a Tron (TRX) wallet containing more than 28 million USDT tokens suspected to be proceeds of criminal activities, including money laundering and fraud.

An account dedicated to the real-time observation of Tron and Ethereum (ETH) stablecoins, USDT/USDC Ban List, reported on July 13 that an address, identified as TNVaKW, had been blacklisted by Tether with $28.25 million in USDT.

TNVaKWQzau7xL9bcnvLmF9KSEQkWEs4Ug8

Timestamp: 12.07.2024, 23:21:36 UTC

Event: AddedBlackList

Balance: 28,257,162.94 USDT (TRC20)https://t.co/Whl97I1K7m— USDT/USDC Ban List (@USDTBanList) July 12, 2024

The wallet is suspected of being tied to the Cambodian company Huione Group. Blockchain security firm Bitrace revealed in a July 14 post on X that the frozen wallet, activated on July 9, is linked to Huione Group’s Guarantee business.

The analysis by Bitrace further indicated that Huione was attempting to bypass the freeze by activating a new address, TQuFSv, and transferring $114,800 in USDC from the frozen TNVaKW wallet.

Furthermore, according to Bitrace, despite Tether’s action, Huione’s other business addresses, including its old business address TL8TBp, remain operational.

Huione Guarantee linked to crypto scams

On July 10, Elliptic — another prominent crypto-tracing firm — reported on Huione Guarantee’s involvement in fraudulent activities, particularly pig-butchering scams.

A new investigation from the Elliptic research team sheds light on online marketplace Huione Guarantee. The platform is widely used by scam operators in South East Asia, including those involved in #pigbutchering scams. Read the full analysis ➡️ https://t.co/p9tqquGhJ6

— Elliptic (@elliptic) July 10, 2024

According to Elliptic, the online marketplace has emerged as a major hub for scam operations in Southeast Asia and has been linked to criminal transactions totaling at least $11 billion.

Elliptic claimed that the Cambodia-based company operates as a deposit and escrow service for peer-to-peer transactions on Telegram, primarily using Tether’s USDT stablecoin. This apparently made it a favored platform for scammers and money launderers.

Furthermore, the blockchain analysis firm alleged that Huione Guarantee was connected to Cambodia’s ruling family, including Prime Minister Hun Manet.

In response to the report, law enforcement and blockchain analysts have started working to disrupt Huone’s operations by tracking crypto transactions and identifying wallets linked to the platform.

The Tether freeze highlights these ongoing efforts to clamp down on crypto-related fraud and the intricate web of financial crimes facilitated by seemingly legitimate crypto platforms.

Source link

You may like

U.S. Spot Bitcoin ETFs See Record $287 Million in Outflows, Except BlackRock

Near Protocol’s X page hacked, again

Chainlink, DexSceener, Metamask Support ADA, Cardano Price Eyes 28% Gains

Robinhood’s Former Ban on Crypto Withdrawals Draws $3.9M Settlement in California

Choose Privacy

Best crypto staking platforms

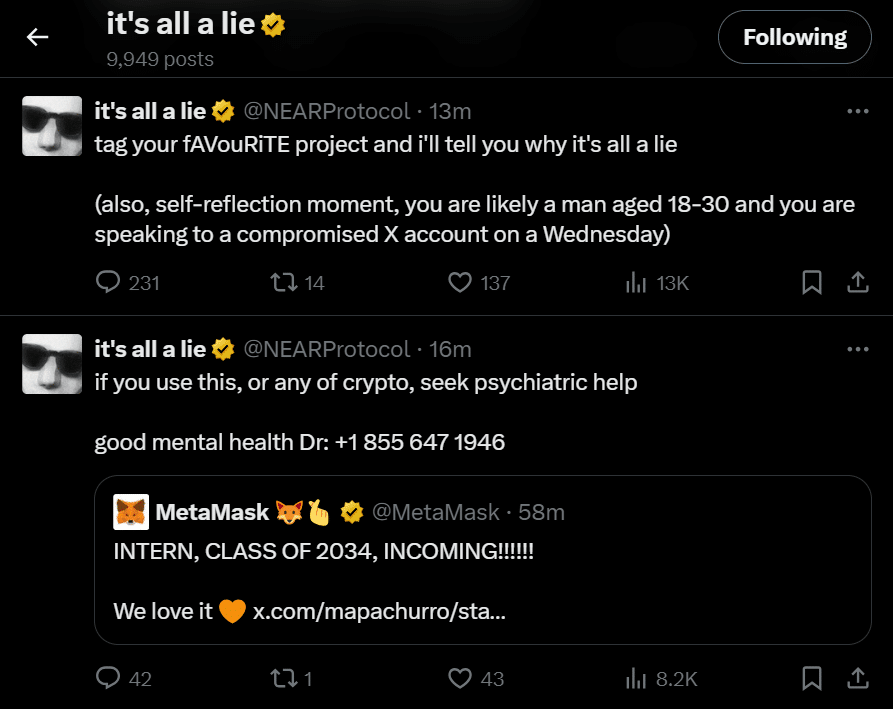

Near Protocol’s X page was apparently breached by hackers who seemed uninterested in promoting sham airdrops or rug pulls.

On Sept. 4, bizarre posts were seen published from the X account of layer-1 proof-of-stake blockchain, Near protocol (NEAR).

Account hijacks like this are common in cryptocurrency, with bad actors often targeting decentralized finance protocols. Typically, hackers leverage compromised access to launch phishing campaigns and steal funds.

However, the Near Protocol hacker deviated from this pattern, instead posting a series of anti-crypto messages aimed at crypto users and the heart of web3.

Delete your X account, go outside, and pick a normal life, you manlets. There is 0 good to come of this. Trust me.

Unknown Near Protocol hacker

At the time of writing, unknown individuals still controlled Near’s X page and continued to criticize the $2 trillion cryptocurrency ecosystem and its underlying blockchain industry. This marks the second time the L1’s X account has been hacked this year, following a previous incident in May.

While seemingly different from other breaches, Near Protocol ranked among a growing list of DeFi and crypto-related projects that have suffered hacks.

According to crypto.news, X accounts belonging to members of the Trump family were recently used in a scam promoting a Solana-based (SOL) memecoin. In late August, football star Kylian Mbappe’s likeness was used to steal over $1 million from crypto traders.

Hackers have also hijacked accounts owned by heavy metal band Metallica, Frax Finance founder Sam Kazemian, and pseudonymous crypto trader GCR.

Source link

Blockchain

Avalanche announces largest network upgrade since mainnet

Published

2 days agoon

September 3, 2024By

admin

Avalanche has announced a major network upgrade as the high-performance blockchain platform eyes further growth within the crypto ecosystem.

The Avalanche (AVAX) team revealed the upcoming launch of Avalanche9000, which they describe as the “largest network upgrade” since the blockchain platform’s mainnet debut in September 2020. According to a blog post, Avalanche9000 will soon be available in testnet.

Avalanche9000 testnet coming soon

Avalanche provides a highly scalable and flexible blockchain that allows developers to build and deploy decentralized applications on a fast and low-cost network.

Avalanche9000 🔺

The catalyst that unlocks an expansive world of purpose-built blockchains that all feel like one, giving builders a suite of out-of-the-box tools with complete customization controls.

Build with no compromises.

Let’s dig in 👇 pic.twitter.com/g7P05y9R7P

— Avalanche 🔺 (@avax) September 3, 2024

The platform aims to create a multi-chain network that benefits from connected layer 1 chains, or subnets, to facilitate the scaling of the entire network.

Avalanche9000 is set to accelerate the deployment of Avalanche subnets by making it economically feasible for developers to launch these L1s. The upgrade will also introduce customizable chains, which will speed up projects’ time-to-market.

In addition to the Avalanche9000 testnet, Avalanche plans to release the necessary tools and documentation for users to launch their own L1s on the network. The upgrade will also include key network changes as outlined in various proposals, as well as developer incentives and partner launches.

What is an Avalanche subnet?

An Avalanche subnet is a chain or network with its own rules on membership, tokenomics, and execution layer. The subset of validators on the network work together to achieve consensus on one or more purpose-built chains. This structure allows Avalanche to offer a unified experience for users.

Some of the major Avalanche L1 launches include those by Deloitte, DeFi Kingdoms, Gunzilla Games, MapleStory, Shrapnel, and SK Planet.

Source link

Blockchain

RCO Finance starts a new revolution in crypto by merging blockchain and artificial intelligence to create wealth.

Published

2 days agoon

September 3, 2024By

admin

RCO Finance (RCOF) is revolutionizing crypto trading by integrating artificial intelligence with blockchain technology. By merging these advanced tools, the Ethereum-based project seeks to create a new paradigm for wealth generation.

This innovative move places RCO Finance at the forefront of decentralized finance’s evolution. Let’s discover how RCOF will use these cutting-edge technologies to transform crypto trading.

RCO Finance Merges Blockchain And AI, New Era In Crypto Trading

The decentralized finance sector is on the cusp of a dramatic shift as RCO Finance emerges with an innovative style to enhance wealth generation. By bridging artificial intelligence into blockchain technology, RCO Finance has developed a modern method to trade crypto assets or other financial instruments profitably and passively.

The platform leverages Ethereum’s blockchain resources and an AI-powered robo-advisor to achieve this goal.

The robo-advisor is an automated investment manager designed to offer cost-effective management services to users. First, it administers a survey to collect information regarding each user’s financial goals, preferences, and risk tolerance. Then, it curates strategies tailored to the information provided to ensure their satisfaction.

Given its ability to analyze market data, it can provide trading insights that investors can use to make well-informed decisions. It can also conduct market research, spot opportunities, and execute trades in the interests of traders. In other cases, the robo-advisor will direct an investor or trader to buy or sell an asset to increase trading accuracy.

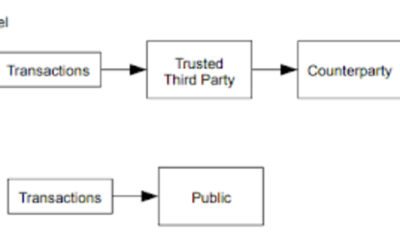

RCO Finance Uses Blockchain Technology To Ensure Transparency

While the robo-advisor is meant to enhance trading results, blockchain provides the bedrock for RCO Finance’s existence. This advanced technology facilitates seamless cross-border transactions registered in a secure and decentralized ledger to ensure transparency.

Whenever a trader accesses any of the 120,000 digital assets on the platform, the transactions are executed via RCO Finance’s smart contract and recorded on the blockchain.

Among the 12,500 digital asset classes available on RCO Finance are stocks, shares, derivatives, real-world assets, and exchange-traded funds. Although exchange-traded funds are typically for institutional investors with more liquidity, RCO Finance has made them accessible to regular crypto traders by breaking them into affordable units.

Crypto traders may swap their cryptocurrencies for any other assets listed on the platform, regardless of the class to which they belong.

RCO Finance is a KYC-free platform, reflecting its commitment to protecting users’ privacy and identities. Whether beginners or expert traders, the platform is suitable for either end of the spectrum due to its user-friendly interface. Users can store their assets on the platform, given that SolidProof has audited its smart contract.

RCO Finance’s Presale Approaches A New Presale Milestone

RCO Finance is closing in on a significant presale milestone. Nearing the $2 million mark, RCOF, its native token, is poised to break a new record in terms of revenue generated. This feat can be attributed to the growing adoption of RCOF among crypto enthusiasts looking to maximize gains.

RCOF is in Stage 2 of its presale, primed for a rally to $0.4, its final presale target. This projection suggests that the token is set for a 1,000% increase in its current price, which could multiply investors’ returns tenfold. Moreover, experts believe RCOF will moon after its exchange listing, given the level of visibility that will follow.

Besides the gains, RCOF investors will enjoy exclusive benefits such as a 50% discount on purchases made at its current presale stage. Later, quarterly dividends and tier-based rewards, calculated based on how many tokens a user holds, will be paid directly into holders’ wallets. RCOF holders will also get to vote in ecosystem governance elections.

Given that this opportunity is limited to a short period, the best time to seize it is now.

For more information about the RCO Finance Presale:

Join The RCO Finance Community

The post RCO Finance starts a new revolution in crypto by merging blockchain and artificial intelligence to create wealth. first appeared on BTC Wires.

Source link

U.S. Spot Bitcoin ETFs See Record $287 Million in Outflows, Except BlackRock

Near Protocol’s X page hacked, again

Chainlink, DexSceener, Metamask Support ADA, Cardano Price Eyes 28% Gains

Robinhood’s Former Ban on Crypto Withdrawals Draws $3.9M Settlement in California

Choose Privacy

Best crypto staking platforms

Investors Lose Sight Of MATIC As It Drops 16% Ahead Of Upgrade

Is SEC Planning More Crypto Crackdowns In September? Legal Officer Warns

Coinbase CFO Says Kamala Harris Campaign Accepts Crypto Donations: Fortune

Trump’s lead over Harris is growing

Crypto Exchange Hacker Moves $6,500,000 in Ethereum (ETH) to Digital Asset Mixer Tornado Cash: PeckShield

Pepe Coin Whale Bags 9 Tln Coins, PEPE Price Breakout Ahead?

UTXO Research Report: State Of The Bridges

New GambleFi token set to 1000x, Ethereum and Solana whales shift attention

‘Nyan Heroes’ Returns to Epic Games Store With New Playtest, Solana Token Rewards

How Web3 can prevent Hollywood strikes

XRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

German Government Sill Holds 39,826 BTC, Blockchain Data Show

House to revisit crypto regulation bill vetoed by Biden

'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

NEAR Foundation And Eigen Labs Team Up To Improve Web3 Transactions On Ethereum Rollups

Record-Breaking GBTC Outflows Send Bitcoin Down 14% To $62,000

LeveX Unleashes Next-Gen Social Trading Features, Pioneering a Cohesive Crypto Trading Ecosystem – Blockchain News, Opinion, TV and Jobs

Worldwide Digital Asset-Based ETP AUM Remains 53% Ahead YTD Despite Quarterly Drop – Blockchain News, Opinion, TV and Jobs

Live Launch Episode 1- Coming Soon

Bitcoin's Role In Defending Democracy In Nicaragua With Félix Maradiaga

Crypto Whale Withdraws $75.8 Million in USDC From Coinbase To Invest In Ethereum’s Biggest Presale – Blockchain News, Opinion, TV and Jobs

Avalanche Foundation Commits $50 Million To Tokenized Asset Purchases

SEC vs Service Provider Developments Keeps Market Volatility Up – Blockchain News, Opinion, TV and Jobs

Republican National Committee pledges to ‘defend the right to mine Bitcoin’

Trending

Blockchain1 year ago

Blockchain1 year agoHow Web3 can prevent Hollywood strikes

crypto1 year ago

crypto1 year agoXRP Explodes With 1,300% Surge In Trading Volume As crypto Exchanges Jump On Board

Markets2 months ago

Markets2 months agoGerman Government Sill Holds 39,826 BTC, Blockchain Data Show

cryptocurrency2 months ago

cryptocurrency2 months agoHouse to revisit crypto regulation bill vetoed by Biden

business2 months ago

business2 months ago'Asia's MicroStrategy' Metaplanet Buys Another ¥400 Million Worth of Bitcoin

crypto10 months ago

crypto10 months agoNEAR Foundation And Eigen Labs Team Up To Improve Web3 Transactions On Ethereum Rollups

Bitcoin6 months ago

Bitcoin6 months agoRecord-Breaking GBTC Outflows Send Bitcoin Down 14% To $62,000

Blockchain12 months ago

Blockchain12 months agoLeveX Unleashes Next-Gen Social Trading Features, Pioneering a Cohesive Crypto Trading Ecosystem – Blockchain News, Opinion, TV and Jobs