News

Tether, top crypto exchange to swap $1b USDT to Tron network

Published

2 months agoon

By

admin

Tether and a top third-party cryptocurrency exchange have announced a chain swap that will move $1 billion USDT from other blockchains to the Tron network.

On Jan. 6, stablecoin issuer Tether posted on X that it plans to coordinate with a major exchange to facilitate the chain swap.

According to the announcement, the coordination will see Tether and the exchange convert a portion of the third party provider’s Tether (USDT) held in cold wallets to the Tron (TRX) network. The USDT will be swapped from different blockchains.

Tether’s USDT is available on multiple blockchains, including Ethereum, Tron, and Solana. The stablecoin issuer clarified that the chain swap will not impact the total supply of USDT.

Chain swaps involve the movement of crypto from one blockchain to another.

This is key to the trading market as it helps traders to use their digital assets on any of the supported blockchains. Tether’s flagship stablecoin is a major player in the crypto industry, with billions of dollars traded daily as users tap into it for payments, trading and cross-border transactions.

USDT holders can transact without the inherent volatility that largely characterizes the crypto market.

The stablecoin is pegged 1:1 to the U.S. dollar and currently dominates the sector across the ecosystem with over $137 billion in market cap. Circle’s USDC (USDC) is the second largest stablecoin with a market cap of $45.8 billion.

Data shows Tether’s 24-hour trading volume is around $102.5 billion, with this representing a 61% increase in the past 24 hours. USDC’s stands around $7.1 billion, up 80% in the past 24 hours.

While Tether contiues to lead the stablecoin space by market share, its market cap has recently suffered as European Union’s Markets in Crypto-Assets regulation came into full effect last December.

Source link

You may like

SUI Drops 5.1% as Index Trades Lower From Thursday

South Korea to block non-compliant crypto exchanges

Pakistan Plans To Legalise Bitcoin And Crypto

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Meteora shares two proposals on MET token allocation

Trump Aides Look To Reform USAID With Blockchain For ‘Transparency’: Report

Pakistan unveils plans to legalise bitcoin and crypto and implement a regulatory framework to attract foreign investment and boost adoption.

Bilal Bin Saqib, CEO of the Pakistan Crypto Council, told Bloomberg on Thursday that Pakistan has unveiled plans to legalise bitcoin and crypto and implement a regulatory framework to attract foreign investment and boost adoption.

The government aims to devise clear regulations and align with international best practices. Pakistan’s Finance Minister formed the PCC last week to steer the country’s crypto strategy.

“Pakistan is done sitting on the sidelines” regarding bitcoin and crypto, Saqib told Bloomberg. “We want to attract international investment because Pakistan is a low-cost, high-growth market with 60% of the population under 30.”

Spoke to Bloomberg this morning

Our message is clear – Pakistan is done sitting on the sidelines! We want Pakistan as the leader in blockchain-powered finance. Pakistan is a low-cost high-growth market with 60% of the population under 30. We have a web3 native workforce ready… pic.twitter.com/VwhGGh7QWg

— Bilal bin Saqib MBE (@Bilalbinsaqib) March 20, 2025

“Trump is making crypto a national priority, and every country, including Pakistan, will have to follow suit,” he said.

This move comes amid a global shift in attitudes towards bitcoin and crypto after the United States pushed for greater mainstream acceptance. The new stance is a stark change for Pakistan, which had previously banned crypto. By embracing bitcoin and crypto early, Pakistan is looking to position itself as a regional leader and attract investors.

Pakistan’s central bank had expressed concerns earlier. However, the government now seeks to mitigate risks through prudent legislation. Clear rules could boost innovation and prevent potential abuse of decentralised networks.

Source link

Bitcoin

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Published

5 hours agoon

March 21, 2025By

admin

A widely followed analyst says Bitcoin (BTC) is showing signs of being on the verge of a massive breakout.

The analyst pseudonymously known as Credible Crypto tells his 462,900 followers on the social media platform X that Bitcoin may reclaim the $100,000 range if BTC can break through resistance around the $88,000 level.

“We’re at a key inflection point around this region, but since we went up to tag it BEFORE going down to range lows this is a good sign. It increases the odds that if we reject here but hold range lows [at around $78,000], the next move up will be expansion and a true breakout through not just this level but the original supply zone above in RED that we first rejected from. All eyes on this key zone for now.”

The analyst says Bitcoin’s dip to the $84,000 range after tagging $87,000 on Thursday keeps the flagship crypto asset on target to reclaim the $100,000 level.

“A perfect rejection so far.”

Bitcoin is trading for $84,427 at time of writing, down 1.5% in the last 24 hours.

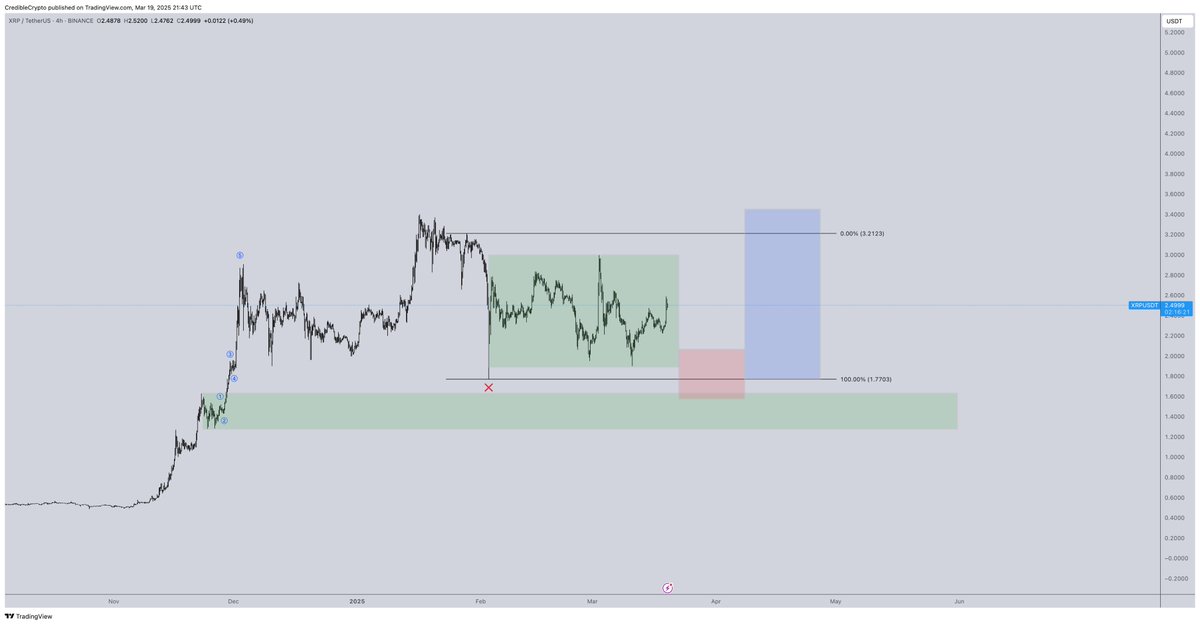

Next up, the analyst suggests payments token XRP may dip below $2.00 before rallying to its all-time high of about $3.40.

“This is still the game plan for XRP by the way. If we don’t get it, we don’t get it, and we ride spot to double digits regardless. But I’m not interested in jumping into fresh longs mid-range. Hoping people choose to fade this push so we get what would be a fantastic opportunity.”

XRP is trading for $2.45 at time of writing, down 1.7% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Airdrop

Meteora shares two proposals on MET token allocation

Published

5 hours agoon

March 21, 2025By

admin

Meteora, the popular decentralized exchange on Solana, has put forward two proposals for adjusting MET token allocation.

According to Meteora’s Mar. 20 post on X, these changes aim to make liquidity provider rewards fairer, support new token launches, and secure long-term incentives for the team. The first proposal suggests revising the LP Stimulus Plan.

Originally, 10% of the MET supply was set aside to reward liquidity providers, but since the program has been running longer than its expected December 2024 end date, Meteora wants to increase this to 15%. This adjustment ensures that early and new LPs receive rewards without devaluing tokens.

The first two proposals are live on https://t.co/OeTKWfH27W.

These proposals address key community concerns about the LP Stimulus Plan, M3M3 and more.

Watch the community call to see @0xSoju & @0xmiir go through these proposals live.

— Meteora (@MeteoraAG) March 20, 2025

Early contributors will receive 2% of MET under the updated plan, while all LPs will receive 8% equally. The original points multiplier system has been replaced by this. An extra 3% of MET will go to Launch Pools and Launch Pads in order to avoid reward dilution for retail LPs.

The second proposal focuses on the team. Meteora plans to allocate 20% of the MET supply to its team, with a six-year vesting period to maintain long-term commitment. Within this, 2% will go to M3M3 token holders. M3M3 is Meteora’s stake-to-earn platform, which lets users earn fee rewards from permanently locked liquidity pools.

This move follows the mismanagement of M3M3 by its original creators, which led to investor losses. To maintain fairness, the distribution will be based on two snapshots and wallets connected to questionable activity will be blocked.

Meteora has experienced rapid growth in the past few months. According to DeFiLlama data, the platform’s trading volume surged 33 times, from $990 million in December 2024 to $33 billion in January 2025.

Due to its rapid growth, Meteora now holds a 9% market share and is ranked fourth among DEXs by trading volume. While the broader DEX market was on a downturn, Meteora raked in $195 million in monthly fees in February.

Despite its achievements, Meteora is currently facing legal issues that may impact its future. Burwick Law, a New York law firm, filed a class-action lawsuit against Meteora, KIP Protocol, and Kelsier Ventures on Mar. 13. According to the lawsuit, they defrauded retail traders and misled investors by manipulating liquidity during the LIBRA token launch.

Source link

SUI Drops 5.1% as Index Trades Lower From Thursday

South Korea to block non-compliant crypto exchanges

1.5M Holders, 10M Blocks on Shibarium

Pakistan Plans To Legalise Bitcoin And Crypto

‘This Is a Good Sign’: Crypto Analyst Says Bitcoin at a Key Inflection Point, Unveils Breakout Targets for BTC

Meteora shares two proposals on MET token allocation

Trump Aides Look To Reform USAID With Blockchain For ‘Transparency’: Report

Ethereum Price Eyes 50% Drop Amid Heavy ETH Whale Profit Booking

Polymarket is Over 90% Accurate in Predicting World Events: Research

Bad news Bitcoin bulls, the long-hoped-for retail is already here: CryptoQuant

Top 6 Important Fed Decisions To Know After SEC Drops Ripple Lawsuit Appeal

Leaders In Adoption And Innovation

Trader Issues Urgent XRP Alert, Says the Top-Five Altcoin at Risk of Sharp Correction – Here’s His Target

This coin could see a $10b market cap and double-digit price before SHIB gains its 2021 mojo

Can a Meme Coin Fund the Future of Scientific Research?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x