Africa

The Bitcoin And Cypherpunk Spirit Is Alive And Well In Africa

Published

3 weeks agoon

By

admin

In the past two months, I’ve attended the Adopting Bitcoin Cape Town conference in South Africa and the African Bitcoin Conference in Kenya. I’ve also visited Bitcoin circular economies in both of these countries including Bitcoin Ekasi, Afribit Kibera and Bitcoin Witsand.

These experiences have opened my eyes to the fact that developers, community leaders and everyday plebs across Africa are harnessing the power of Bitcoin to catalyze change in their lives, and they’re doing so while carrying on the spirit of the early cypherpunks.

An African Bitcoiner’s Manifesto

In “A Cypherpunk’s Manifesto,” Eric Hughes wrote:

“Cypherpunks write code. We know that someone has to write software to defend privacy, and since we can’t get privacy unless we all do, we’re going to write it. We publish our code so that our fellow Cypherpunks may practice and play with it. Our code is free for all to use, worldwide. We don’t much care if you don’t approve of the software we write. We know that software can’t be destroyed and that a widely dispersed system can’t be shut down.”

It’s with this attitude that the builders in Africa are building. And while not all of the builders on the continent are writing code, they’re all doing as much of their work as possible without asking permission.

So, based on what I saw in Africa during my recent two trips to the continent as well as to my trip to Ghana in late 2023, during which I attended the African Bitcoin Conference and visited Bitcoin Dua, I’d image an African Bitcoiner’s version of Hughes’ manifesto might read something like this:

“African Bitcoiners just build things with Bitcoin. We know that somebody has to step up to enact change, because all of the promises from the NGOs and governments have fallen short. We publish our proof of work online so that fellow African Bitcoiners can use it as a model and adapt it to their own unique context. Our proof of work and/or code is free to replicate across Africa, and beyond its borders. We aren’t looking for approval from authorities; however, we aren’t opposed to working with them if they see the value in our projects and visions. We know that our work harnesses the immutable and uncensorable nature of Bitcoin as well as the indefatigable nature of the human spirit and, therefore, can’t be stopped or shut down.”

The following are some examples of projects that embody such a spirit:

Bitcoin Ekasi

Bitcoin Ekasi is one of the most shining manifestations of the cypherpunk and Bitcoin ethos in Africa. The project, initiated in 2021 and based in Mossel Bay, South Africa, has become a model for Bitcoin circular economies across Africa.

The project, founded by Hermann Vivier (also one of the organizers for Adopting Bitcoin Cape Town) aimed to do two things: raise funds in bitcoin for The Surfer Kids non-profit, which Vivier also founded, and onboard shops in the community to Bitcoin. (Project Community Leader Luthando Ndabambi has done the latter masterfully over the years.)

The purpose of the second dimension of the mission was to enable community members to spend their bitcoin within the community, ideally raising the economic status of the community as a whole in the process.

The project now works with the local public primary school, which recently began accepting bitcoin for school fees, and has revamped the community centers for both Bitcoin Ekasi and The Surfer Kids (in part thanks to generous donations from Jack Dorsey and fundraising efforts by Aubrey Strobel.)

Unveiling the new sign at the main entrance of the local township primary school!https://t.co/ttBcG7X2nE pic.twitter.com/f6R2ryGC0P

— Bitcoin Ekasi (@BitcoinEkasi) January 17, 2025

Some politicians in the country, several of whom spoke at Adopting Bitcoin Cape Town this year, have taken notice of the project and are as a result starting to see the value of Bitcoin.

Tando

Tando is an app built by a team based in Kenya that lets Bitcoin Lightning wallets interface with Kenya’s mobile money system M-PESA.

The app, which doesn’t require KYC and is highly intuitive, is one of the greatest tools for financial inclusion in the country, as those who lack the proper ID-papers are excluded from making payments via M-PESA. Using Tando, they can make the payment via their Lightning wallet and transact digitally with their fellow Kenyans.

Tando is also a great option for Bitcoiners who visit Kenya. I used it multiple times during my stay in Kenya to pay Kenyan shilling-denominated tabs digitally.

Learn more about the app here.

Bitcoin Dua

Founded in 2023, Bitcoin Dua is located in Agbozume, Ghana, which is near the country’s border with Togo. It’s quickly established itself as one of the fastest-growing Bitcoin circular economies in Africa.

Not only does the project help to educate Ghanaians about Bitcoin, but it also provides coding and robotics classes to help its community members develop skills that can help them find employment that pays in bitcoin.

Lego Robot for preparation towards the 2025 #robotics competition in Ghana. We are able to improve on our equipment acquisition through the #AfricaBitcoinCircularEconomyGrant. Thanks to @Bitcoinbeach and @BitcoinEkasi pic.twitter.com/S6NIQmYqdL

— Bitcoin Dua (@bitcoin_dua) December 29, 2024

The project’s founder, Mawufemor Kofi Folivi and his team were awarded the Social Impact award at this year’s African Bitcoin Conference, and Jack Dorsey has committed funding to help build a sports complex in the community.

The team at Bitcoin Dua can’t stop and won’t stop.

Machankura

Founded in May 2022 by Kgothatso Ngako (KG) (also one of the organizers for Adopting Bitcoin Cape Town), Machankura enables Africans to use bitcoin over Lightning with feature phones (i.e., cell phones before smart phones).

The technology allows users to send bitcoin over USSD, the equivalent of SMS in Africa, giving some of the two-thirds of the population of Africa that doesn’t have access to the internet access to bitcoin.

KG is also currently working on technology that will store the private keys to bitcoin on chips embedded in feature phones, essentially enabling these phones in the six African countries in which the service is available to double as bitcoin hardware wallets.

CYPHERPUNK AF.

Afribit Kibera

Afribit Kibera, located in Kenya, is a Bitcoin circular economy located in the largest informal settlement in Africa.

The project’s co-founder, Ronnie Mdawida, is a long-time human rights advocate and community organizer, and he’s now using Bitcoin as a tool to help further bring the unbanked and the underbanked into the economy.

Mdawida and his team have onboarded 40 merchants to Bitcoin thus far and have set up a recycling program that rewards participants with sats for their work.

Meet our first-ever merchant in 2025—the journey continues! Soon, the entire Kibera will turn orange!@BitcoinEkasi @FBCEglobal @Bitcoinbeach @blinkbtc @geyserfund @thecore21m pic.twitter.com/rWhEzONN4v

— AFRIBIT KIBERA (@AfribitKibera) January 15, 2025

While many of the merchants and community members of Afribit Kibera were introduced to bitcoin primarily as a medium of exchange, many have started saving in it, feeling more hopeful about their future as a result.

Proceeding Together Apace

While each of the projects mentioned above are incredible in their own right, what makes the Bitcoin story in Africa really special is that the members of all these projects continue to learn from and build with one another.

This is the beauty of not only open-source software but also conferences like Adopting Bitcoin Cape Town and the African Bitcoin Conference where builders across the continent share their successes and challenges as well as offer support for each other.

If you’ve yet to attend one of these conferences, I highly recommend you do so, especially if you’d like to feel firsthand the spirit of the cypherpunks or those who embody the Bitcoin ethos.

African Bitcoiners aren’t waiting for permission to change both their lives and the lives of those around them. Bitcoin gives them the opportunity to build a brighter future — together.

Source link

You may like

Bitcoin Price Set For Big Move As Volatility Drops

The United States Government Should Acquire 20% of the Bitcoin (BTC) Network, Says Michael Saylor – Here’s Why

SEC waves white flag on OpenSea probe, CEO says ‘this is a win’

How to Prepare for Monad: The High-Speed EVM Layer-1 Blockchain

US SEC Faces Backlash as Bybit Hack Highlights Lack of Oversight

Ether Price Spikes Further on Reports of Bybit Starting to Buy ETH

Africa

Conference Bitcoin Afrique: A Bitcoin-Only Revolution in French-Speaking Africa

Published

17 hours agoon

February 22, 2025By

admin

In April 2025, Bitcoiners from across the world will converge in Douala, Cameroon, for the Conference Bitcoin Afrique (CBA), a groundbreaking event dedicated to Bitcoin adoption in French-speaking African countries.

This is not just another crypto or Bitcoin event — it will be a focused, high-impact gathering that aims to educate, empower, and connect the French-speaking Bitcoin community like never before.

With over 400 in-person attendees expected and a digital reach exceeding 50,000 people via social media platforms such as Facebook, X, Youtube, and TikTok, this conference represents a crucial milestone in Bitcoin adoption across French-speaking Africa.

But why is this event French-only and Bitcoin-only? And why is hosting it in Douala, Cameroon, so significant? Let’s explore.

The Franc CFA: A Legacy of Economic Dependence

To understand why Bitcoin adoption is gaining traction in French-speaking Africa, one must first understand the controversial Franc CFA — a colonial-era currency used by 14 African nations and controlled by the French Treasury.

For decades, this system has hindered economic sovereignty, imposed high inflation rates, and restricted monetary policy independence for millions of people.

Unlike Africans living in English-speaking Africa countries, who often enjoy greater monetary autonomy, Africans in French-speaking African nations remain tethered to a financial system that prioritizes stability for France over the economic growth of Africa.

This is where Bitcoin comes in.

Bitcoin offers an alternative: an open, decentralized, and inflation- and censorship-resistant financial system. It empowers individuals to take control of their wealth without having to rely on centralized institutions or foreign influence.

Conference Bitcoin Afrique is dedicated to showcasing how Bitcoin can help break these economic chains.

Why a French-only Bitcoin Conference?

Despite the growing Bitcoin adoption worldwide, French-speaking Africa remains underserved when it comes to Bitcoin conferences.

Most major Bitcoin conferences, educational resources, and businesses are heavily English-centric, leaving millions of French-speaking Africans behind in the global Bitcoin movement.

By making Conference Bitcoin Afrique a French-only conference, we are dismantling the language barrier that has long prevented access to Bitcoin education and networking opportunities. This is not just a regional event—it is a movement to establish French-speaking Africa as a major force in the global Bitcoin economy.

For international businesses and Bitcoin advocates, this is a unique opportunity to engage with an untapped market, create localized solutions, and build relationships with grassroots Bitcoiners driving adoption on the ground.

Why Bitcoin-Only?

Unlike many crypto conferences that mix Bitcoin with thousands of altcoins and blockchain projects, Conference Bitcoin Afrique is Bitcoin-only. Here’s why:

- Bitcoin is the only truly decentralized and censorship-resistant digital asset.

- It has the strongest network security and adoption globally.

- It is the best tool for financial sovereignty in Africa.

- It aligns with long-term wealth preservation, not speculation.

The “crypto” narrative in Africa has often been tainted by scams, Ponzi schemes, and unreliable tokens. Many people have lost money chasing hype, and we believe it’s time to refocus on Bitcoin’s core mission: financial freedom and economic empowerment.

At Conference Bitcoin Afrique, attendees won’t be bombarded with questionable “investment opportunities” or flashy tech gimmicks. Instead, they will gain real insights, practical tools, and networking opportunities that support the real-world adoption of Bitcoin.

It’s worth noting that this is not the first Bitcoin-only conference in the region. In fact, we draw inspiration from several pioneering events:

- Dakar Bitcoin Days in Senegal was the very first Bitcoin conference held in French on the continent, setting a precedent for accessible, localized Bitcoin education.

- Bitcoin Mastermind in Benin, organized by Loic Kassamotto and Alphons Mehoume, and the efforts of Nourou with two editions of Dakar Bitcoin Days have all laid the groundwork for what we aim to build.

- The African Bitcoin Conference also deserves to be mentioned for its significant contributions as an inspiration and benchmark.

With CBA, we are attempting to create a larger Bitcoin educational platform for the region so that we can make our collective voice louder.

Our long-term vision is to bring Conference Bitcoin Afrique to different French-speaking countries in subsequent editions, further expanding the reach and impact of Bitcoin education across Africa.

Why Douala, Cameroon?

Douala is the economic capital of Cameroon, a major trade hub, and one of the most Bitcoin-active cities in the region.

Hosting Conference Bitcoin Afrique in Akwa, the city’s central business district, is strategic for several reasons:

- Accessibility: Douala is well-connected to other African cities and international locations.

- Growing Bitcoin Community: The city has a thriving Bitcoin scene with active P2P trading, businesses accepting Bitcoin, and grassroots education initiatives.

- Strategic Location: Cameroon is at the heart of French-speaking Africa, making it an ideal meeting point for attendees from West and Central Africa.

For global Bitcoin advocates, this is a unique chance to experience firsthand how Bitcoin is transforming everyday life in French-speaking Africa.

Get Involved

Bitcoiners, businesses, and global stakeholders can support this initiative by purchasing tickets or sponsoring the event.

Information about both is available via the conference’s website.

Conclusion: A Call to Action

Conference Bitcoin Afrique is more than just an event — it is a movement. And it aims to liberate French-speaking Africa from financial colonialism, to educate communities on the power of Bitcoin, and to connect international Bitcoiners with a rapidly growing market.

The time to act is now. Join us in Douala from April 25th to 27th, 2025, and be part of history.

This is a guest post by Nzonda Fotsing. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Adoption

Coinbase Rolled Out the Newest State of Crypto Report

Published

4 weeks agoon

January 24, 2025By

admin

Coinbase rolled out the newest State of Crypto report. The study was conducted by Ipsos. It observes how crypto and blockchain technology are viewed in Argentina, Kenya, the Philippines, and Switzerland and how it impacts the lives of people in these countries.

For most of the part, the study is based on surveys with 4,000 adults (not specifying the age rates) in Argentina, Kenya, the Philippines, and Switzerland conducted on behalf of Coinbase. The choice of countries aims to give an outlook of societies living in markedly different socioeconomic conditions in different parts of the world (none of these countries belong to the same continent, with the Philippines being an archipelago-based country).

The similarities between these countries are the mostly Christian populations and the government systems revolving around the republic model. Nevertheless, the countries have strikingly different areas, positions on the map, historical experiences, cultures, languages, climates, economic states, etc.

Coinbase, however, outlines another similarity between Argentina, Kenya, the Philippines, and Switzerland: according to the exchange team, the residents of these countries feel that the local financial systems need to be improved. More than that, generally, the polled residents see cryptocurrencies and blockchain as tools that may enhance their lives in terms of financial wealth and overall give more freedom and independence.

The state of economy in these countries

The report starts with the statistics demonstrating that in each country, less than a half of all respondents believe that the current financial direction in their country will make them live better than the previous generation. However, even fewer people believe that they will live worse than their parents in Argentina and the Philippines.

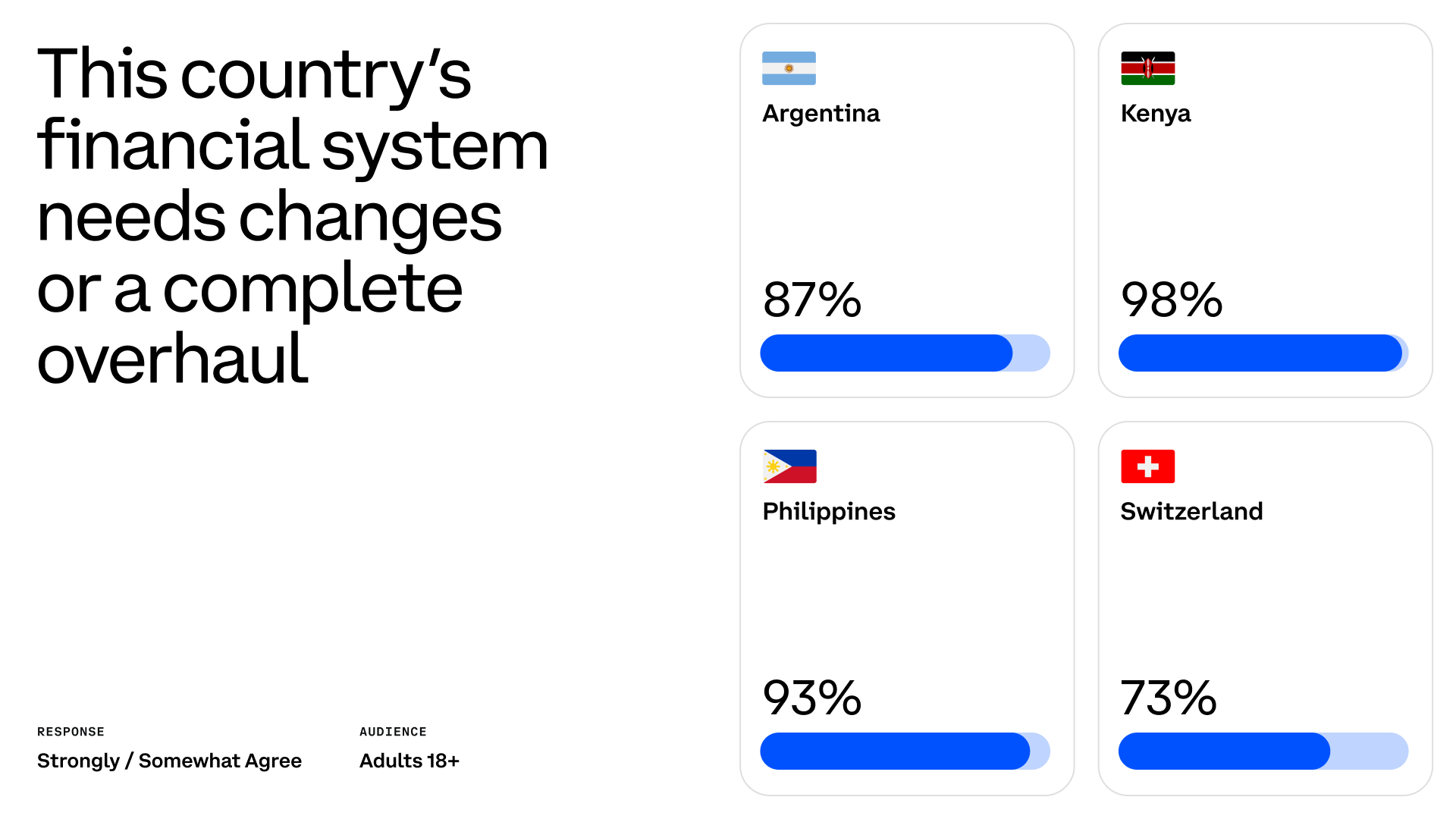

So it’s fair to say that in Kenya and Switzerland, people don’t approve of the current financial politics in contrast to the past years, while Argentina and the Philippines rather dislike both the current and the previous efforts, believing that nowadays things are a bit better than before. Respondents in all these countries agree that the local financial system should be changed or overhauled completely. They refer to the financial systems of their countries as “slow,” “expensive,” and “unstable.” They also cited a lack of innovation as one of the problems.

The study reveals four main concerns of the respondents named in the surveys: lack of fairness (discrimination), centralization, decreasing value of the national currency, and too much hard work to earn enough or save money.

The distribution of concerns varies from country to country, with Kenya and the Philippines being most critical towards centralization, discrimination, and wage slavery. Switzerland is least concerned about many of these issues while being cautious towards the government’s dependency on banks. Argentinians have the biggest trust issues with their financial institutions and a problem with saving money.

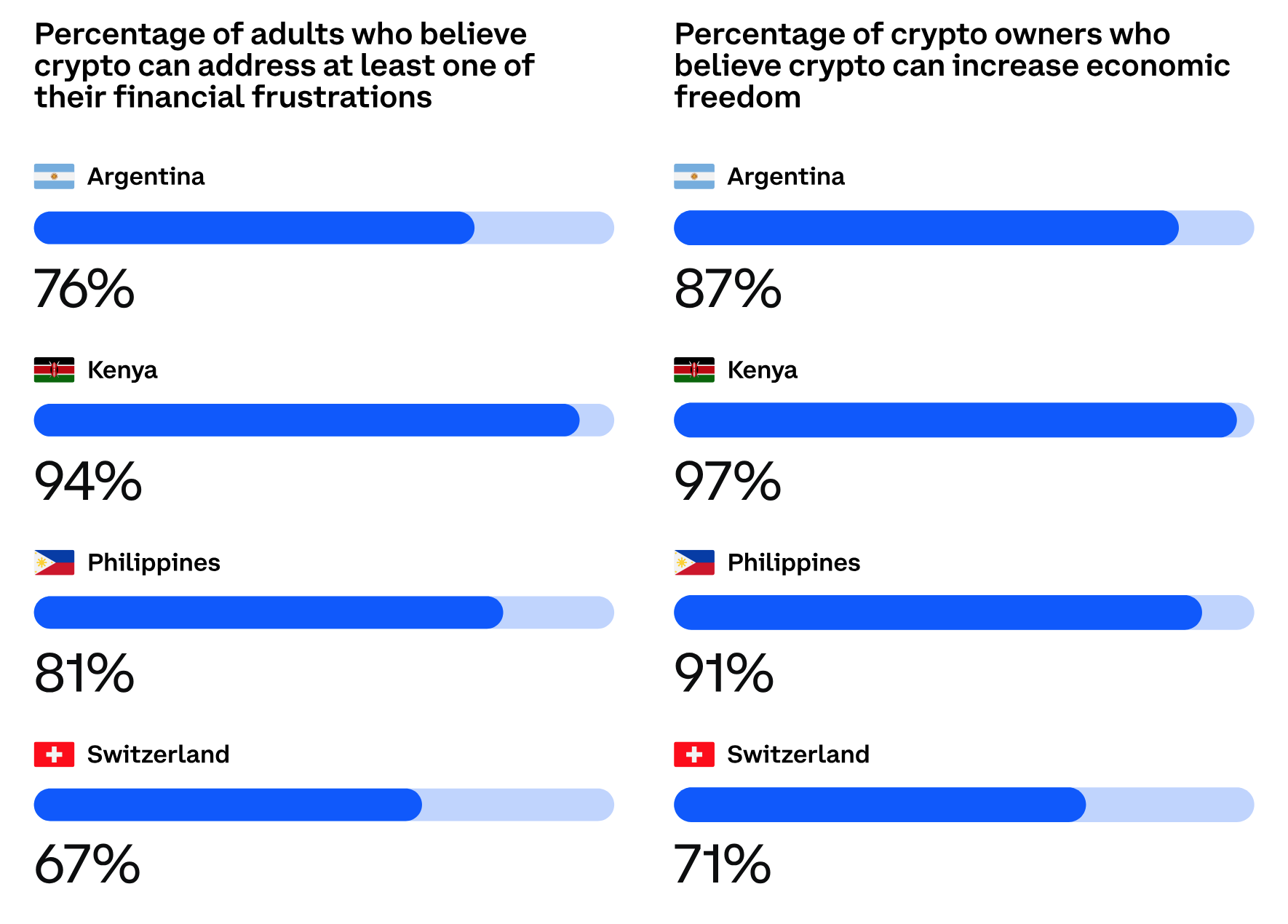

Crypto as a remedy

Most people polled by Ipsos for the study want to be in charge of their financial state and gain more freedom and control over their money. 7 in 10 respondents see cryptocurrency and blockchain as the way to achieve these goals. More than that, both crypto owners and those who don’t have crypto agree that digital currencies can help them gain more freedom and control over their wealth.

Switzerlanders are markedly less interested in crypto than respondents from other countries. However, over 70% of crypto owners in Switzerland believe that crypto offers them more control and freedom. Less than half of the surveyed Switzerlanders with no crypto believe that they need it.

Wider blockchain adoption is also viewed as a favorable factor that may improve the local financial systems and individual wealth. Most respondents believe that blockchain promotes innovation and facilitates control over individual finances. Respondents hope that blockchain will make the system faster and more accessible.

In all polls, Switzerland is presented with lower numbers. It reflects the lower expectations associated with Bitcoin and blockchain and the lower level of dissatisfaction with the financial status quo.

Looking into this study, you may notice a strong connection between the level of satisfaction with the country’s financial direction and the level of support for cryptocurrencies and blockchain. The residents of Switzerland and Argentina are less concerned with the current financial state of their countries, and they are less into crypto than Kenya and the Philippines. Probably, that’s one of the reasons why not only Kenya but Africa in general, where the population has little to no access to banking services but has smartphones, are usually seen as the driver of the mass adoption of cryptocurrency and blockchain-based solutions as the substitute of traditional banks.

Source link

Africa

Mining Bitcoin In The Congo And Beyond: The Journey Of BigBlock Datacenter’s Sébastien Gouspillou

Published

1 month agoon

January 19, 2025By

admin

Listening to Sébastien Gouspillou share stories from the past eight years of his international life as a Bitcoin miner, it’s difficult to believe he’s telling the truth.

Each of his tales come across as works of fiction in which he, often compelled by little more than blind faith and a desire to utilize cheap energy for Bitcoin mining, comes out on top after struggling through soul-shaking trials and tribulations.

And what’s perhaps most mystifying is that he tells many of these stories while smiling from ear to ear, beaming with a certain radiance that comes from having an indefatigable spirit (except for when he tells parts of the stories where others are hurt, wronged or killed; at those points he grows somber).

To quickly provide an overview of his journey, since 2017, the 55-year-old citizen of France and co-founder of BigBlock Datacenter, a Bitcoin mining company, has traversed the planet. From former Soviet states to Africa to The Middle East to South America, he’s been in search of stranded energy for this company’s operations, witnessing both the best and worst of what humanity has to offer in the process.

Gouspillou has become most well known for helping to establish a Bitcoin mining facilities in Virunga National Park in the Democratic Republic of the Congo (DRC), where some of the operation’s proceeds have gone back to both the park for its conservation efforts as well as to bettering the the lives of those in communities that surround the facilities.

Gouspillou has also seen how Bitcoin mining is furthering efforts to electrify rural Africa. After what he’s seen on this front, he believes that we cannot live in a world without Bitcoin mining at this point because “it’s just too useful,” as he puts it.

But Gouspillou hasn’t always been a Bitcoin believer, nor a successful entrepreneur. Before finding Bitcoin, his professional life was more run-of-the-mill, as he held a number of salaried positions in a handful of fields that seemed notably less exciting than running Bitcoin mining operations in some of the most off-the-beaten-path regions of the world.

Gouspillou’s Life Before Bitcoin

Before falling down the proverbial Bitcoin rabbit hole in 2015, Gouspillou had a number of different jobs ranging from working for a real estate developer to working for a forestry company in Asia to importing dry cleaning machines for companies as big as Euro Disney.

“I’m not a scientist or an engineer,” Gouspillou told Bitcoin Magazine.

“I’m a businessman, and my training is in marketing and sales. It was hard for me to understand Bitcoin at first,” he added.

He first heard about Bitcoin in 2010 when his childhood friend and now co-founder of BigBlock Datacenter, Jean-François Augusti, began mining it.

Gouspillou dismissed his friend’s efforts back then; he felt Augusti was wasting his time mining bitcoin.

Five years later, though, Bitcoin piqued Gouspillou’s interest, and he spent most of 2015 researching it. Toward the latter part of that year, he approached Augusti with a new perspective on Bitcoin and proposed that they start mining together.

Shortly thereafter, the two set up amateur operations in a small industrial space they rented. And by June 2017, they had moved their operations to a former Alcatel (a former French telecommunications equipment company) factory Orvault, a small town outside of Gouspillou’s home town of Nantes.

The Early Days Of BigBlock Datacenter

At this point, Gouspillou and Augusti had formally incorporated BigBlock Datacenter and began receiving funding from outside investors.

The facility in Orvault was their first operation, while the second one was in Odessa, Ukraine. What the two locations had in common was access to cheap power.

In Odessa, Gouspillou and Augusti had a container with 200 S9 ASIC miners that they maintained on their own.

“The operation was very small compared to what we have now, but, at that moment, it was very big to us because we were alone to do the work,” recalled Gouspillou.

Aside from the technical challenges that came with learning how to operate a bitcoin mining farm, Gouspillou and his partner ran into other hurdles, as well.

“It was very difficult to work in Ukraine at that time, because people in Europe and in the banks used to say, ‘Are you crazy? It’s a terrorist state — there’s only mafia in this country,’” recalled Gouspillou.

As it turned out, the bad guys in the country didn’t just include members of the mafia but corrupt government officials, as well.

“We had big issues with the government, particularly the Secret Service, the SBU,” said Gouspillou.

“They came one day to seize our farm, and we got shut down for three months. We negotiated and gave them eight bitcoin. That was the price to let us work,” he added.

“Soon after we reconnected the ASICs, though, it was too late. The price of electricity had doubled. So, we left to go to Kazakhstan by 2018.”

Gouspillou and Augusti were two of the first foreigners to begin mining in Kazakhstan. They set up shop on the same lake as Valery Vavilov, founder and CEO of Bitfury, and his team and mined there before falling victim to another shakedown.

“We lost a lot of machines in Kazakhstan,” said Gouspillou.

“The mafia took the machines, and then they sequestered me overnight after a meeting and asked me to buy the machines back from them,” he added.

“Between this and the price of bitcoin crashing in 2018, I lost 20 kilograms in one year.”

Gouspillou and his partner left Kazakhstan soon after to set up a small operation in Siberia, Russia (which has become even smaller in recent years).

Gouspillou remembers well the toll that all of this took not only on him but on his family, as well.

“My wife said, ‘Why don’t you change your work? Why don’t you return to a normal job? Your fucking bitcoin is destroying us,’” he recalled.

“I was in my late 40s, not very young, and maybe it was not the right moment to be taking so many risks,” he added.

“But I didn’t want to stop. Jean-François and I continued to be very confident about the price of Bitcoin rising again one day.”

Opportunity In The Congo

By 2019, rise again it did, alleviating some of Gouspillou’s financial pain in the process.

“The price saved us because we had the capacity to pay back our investors for some ASICs we lost because of the mafia,” said Gouspillou.

Gouspillou and Augusti were able to buy a new fleet of ASICs while the price of the machines was very low, which helped to make their operations very profitable moving forward, especially as the 2020 bitcoin bull run accelerated.

And the winds of fate really shifted when Gouspillou first met Prince Emmanuel de Merode of Belgium, a conservationist and anthropologist who works to protect Virunga and establish peace in the DRC.

“In 2020, he asked me to create a mining farm in Virunga,” said Gouspillou.

“It was the best moment of the life of the company, because we became profitable on our facilities around the globe and well-known when we took this opportunity in Virunga,” he added.

“Before Virunga, we were mining. With Virunga, we implemented mining that was socially useful.” (More on how mining in Virunga is “socially useful” later in the piece.)

This isn’t to say that starting the farm in the Congo was easy, though.

Gouspillou described how there’s been fighting in this region long before he and Augusti brought their first container of ASICs there, and the fighting has only intensified since.

“I am supposed to go to Virunga next week, but I have to wait because there is a deep war in this region at the moment,” explained Gouspillou.

Despite the conflict, Gouspillou, Augusti and the two other team members that founded the Virunga farm have had notable success in the region. They started with two containers filled with 700 ASIC S9s. These machines have been powered by hydroelectric energy from a plant on the Luviro River, close to Ivingu, since that time.

Mining bitcoin with a low cost of electricity in the region quickly made the operation profitable, which not only made Gouspillou’s investors happy but Prince de Merode, as well.

Prince de Merode had invited Gouspillou and his team to Virunga to aid his work in preserving the park. The arrangement looked like this: Initially, Gouspillou and his team brought in two containers — one owned by BigBlock Datacenter and one owned by the park. BigBlock Datacenter paid the electricity costs for their container but managed both. (Now, there are 10 containers in the park, seven owned by BigBlock Datacenter and 3 owned by the park.)

The profits from the bitcoin mined by the park went/go to the park to help preserve it. The mining farm also began employing locals who would otherwise have to resort to burning trees in efforts to produce coal that they could sell.

The benefits of establishing this plant in the region are illustrated in a short documentary Gouspillou showed at Adopting Bitcoin El Salvador 2023 (1:29-7:05 in the following video):

More recently, Gouspillou and his team realized that they could use the heat produced from the mining to dry fruits as well as cocoa beans, which are used to make chocolate.

While the mining farm currently employs 15 people full time, the fruit and cocoa drying efforts have created another 50-60 part-time jobs for those living around the farm. Gouspillou sees the potential for these operations to scale up in the near future.

“With the fruits, we can imagine creating 100 to 300 jobs for people,” he said.

But in the breath after Gouspillou discussed the potential in the region, he also touched on the hardships, some of which have both been heartbreaking and have made scaling difficult.

Hardships

Since the onset of operations in the DRC, Gouspillou has lost a number of team members to both violence and acts of God.

One young man named Moise was killed and washed away in what Gouspillou described as “a rush of water that came down from the mountains.”

(Gouspillou and his team also had to repair the many ASICs that were damaged during this event, many of which were new S19s.)

Then, in another tragic event just six weeks later, members of his team were ambushed, resulting in five deaths.

He described the situation mournfully:

“When the team members leave the farm to go back home, one of their options is to take a plane from the park,” he began.

“But sometimes they don’t have enough gas or kerosene, so we have to take a car 30 kilometers to get to a small airport in the jungle, and the road we have to take is dangerous,” he added.

“One of our technicians, the wife of the cook at the farm and the three others in the car were killed by the Mai-Mai (a rebel group in the region).”

Gouspillou and his team took these deaths hard. The technician, a young man named Jones who was also a manager at the farm, had been with the team for four years.

“He started at the lowest level and in three years became the boss of the farm,” said Gouspillou.

“We were very close to him. I knew him very well since the beginning; I hired him,” he added.

What is more, Prince de Merode has lost upwards of 30 rangers from his team that protect the farm due to violence over the course of the four years the farm has been up and running (and 200 since Prince de Merode has been the head of the park).

The violence is something that never gets easy to deal with, according to Gouspillou.

“You have something like 300 different gangs in the region,” he said.

“When we started in 2020, Emmanuel told us it had gotten calmer as compared to previous years. However, since then, it’s gotten worse every year,” he added.

How Bitcoin Mining Transforms Regions In Africa

Despite the challenging circumstances, Gouspillou remains optimistic. He’s seen the positive effects Bitcoin mining has had not just in the DRC, but next door in the Republic of the Congo, where Gouspillou and his team now operate, as well.

BigBlock Datacenter has built one of their newest facilities in Liouesso, a town in the north of the country. In this region, there’s hardly any industry, in part due to a lack of electrification, but that’s changing due to the mining operations.

“When you give money to the producer of electricity, you change the life of a region,” Gouspillou explained.

“In the town, they have a 20 megawatt power plant, but they only use two to three megawatts to feed the town. So, we built a 12 megawatt farm there,” he added.

“For the electricity provider, this is very important. We are a big client for him. He can now pull the lines to bring electricity to some small village because he has some money.”

The effect that Gouspillou described is the same as what’s happening in Kenya, Botswana and Malawi, the countries in which Gridless, another Bitcoin mining company, operates. Like BigBlock Datacenter, Gridless purchases excess power from hydroelectric power plants in rural Africa, giving energy providers a new stream of revenue, allowing them to expand their operations further into the countryside. This process gives some African communities access to electricity for the first time.

Gouspillou described how it’s virtually a no-brainer to take advantage of this excess power, as many hydroelectric plants in Africa are built to produce more power than they’re capable of dispensing.

“You have so many big hydro power plants, and they don’t have the lines to distribute this electricity,” said Gouspillou.

“In Cameroon right now, a big dam built by EDF (Électricité de France, France’s national power company) produces 80% more electricity than it distributes,” he added.

“When you create a big power plant, it’s normally too big — wherever you build it — because there’s no benefit to building too small. Building a 200 megawatt plant costs doesn’t cost double what building a 100 megawatt plant costs.”

Gouspillou went on to describe how he advised Nemo Semret, the first Bitcoin miner in Ethiopia, who now helps oversee the country’s large-scale, state-sponsored mining operations.

“I gave him some advice on how to make mining containers four years ago, and now the country is mining with 600 megawatts,” Gouspillou said. “There’s huge potential for expansion there, too.”

Beyond furthering the electrification of rural Africa, Gouspillou’s mining efforts are having other notably positive impacts on their surrounding communities, as well.

Community Impact

BigBlock Datacenter’s new farm in Liouesso currently employs 15 full-time technicians and 10 service staff including cooks, assistants, laundry staff, cleaning and grounds maintenance staff and drivers. And it plans to launch operations for fruit drying in the second half of 2025.

“There we have enormous drying capacity: enough to employ over 100 people,” Gouspillou noted.

More than providing community members with jobs, though, Gouspillou and his team have made other investments in the community.

A number of employees for the main farm in the DRC have children who attend a school in the region, which is five kilometers from the farm’s camp. BigBlock Datacenter has provided a Toyota bus to ensure school bus service since the first set up operations there.

The children and teachers once walked this distance every day.

To help lessen this burden, Gouspillou first lent the community members his car so that they could drive the distance instead of walking it. And, more recently, he’s brought in a bus to help transport the community’s residents to and from the school in larger numbers.

Furthermore, BigBlock Datacenter has also made improvements to the school itself.

“They did not have electricity in the classrooms, so we installed it,” said Gouspillou, who added that they’ve also financed the repainting of the school.

“These are very cheap investments and they make a big difference for the teachers and students,” he added.

Aujourd’hui, visite de l’école primaire.

y’a d’la joie. https://t.co/CIxiZw7BAJ pic.twitter.com/arUeBc5nji— Seb Gouspillou (@SebGouspillou) January 15, 2025

Translation: “Today, a visit to the primary school. There is joy.”

Gouspillou contextualized his contribution by sharing that other companies that have come to the region have made similar investments for selfish purposes, seemingly trying to downplay his contribution.

“Oil companies do it, too, because they have to compensate for the pollution they create by doing good deeds,” he explained.

The difference with BigBlock Datacenter is that it doesn’t burn gas or pollute the environment. It mines bitcoin using renewable energy. So, as I understand it, Gouspillou and his team are giving back because they think it’s the right thing to do.

It became clear to me that he’s developed deep bonds with the team members originally from the region as he shared a story about two of them who’ve done extraordinary work. Gouspillou refers to these two team members, Patrick Tsongo and Ernest Kyeya, as two of “the real heroes from Virunga.”

“Ernest has been the manager of the Virunga farm, and Patrick his second in command,” said Gouspillou.

“We employed them four years ago when they were 23 years old. Now they have the capacity to create a farm. They have the capacity to repair ASICs, which is valuable because even if our machines are under warranty, we can’t send them back because the chances they will get stolen in transit are high,” he added.

“They have the capacity to repair all kinds of issues. I think they are the best technicians in the mining world now.”

Ernest and Patrick are now launching the new farm in the Republic of the Congo, and they recently left the DRC for the first time in their lives to do so.

“Three months ago, we went to Pointe-Noire, a port by the sea in the Republic of the Congo, and it was the first time they saw the sea,” said Gouspillou. “They’re so grateful.”

Gouspillou also mentioned that they’ve become tried and true Bitcoiners, as BigBlock Datacenter has given them a bitcoin bonus each year, some of which they’ve held onto and used as it’s appreciated.

“At the beginning, they used to sell it,” said Gouspillou.

“However, they recently bought land with the bitcoin they’ve saved. So, now they’re crazy about Bitcoin. They love it,” he added.

The Future Of BigBlock Datacenter

Moving forward, Gouspillou and his team plan to continue to expand their operations globally.

They currently have mining projects in five African countries as well as others in Paraguay (where Gouspillou says it’s difficult to work because of the mafia presence in the country), Finland, Oman and the small one in Siberia they started years ago.

“We were the first miner in Oman, and I was the guy who convinced the government to start mining,” explained Gouspillou. “We started with two containers, and now the country has big miners with facilities that can mine with up to 300 megawatts.”

They also moved their headquarters to El Salvador six months ago, where they are incorporated as BigBlock El Salvador.

While Gouspillou and his team can likely expand anywhere from here, he shared that he prefers to focus on growing their operations in Africa, as he is most excited about what his team is working on in the Republic of the Congo right now.

Toward the end of my interview with Gouspillou, when I asked him how it feels to see his company grow to the point it has after starting the process in his late-40s, he chuckled before responding with the following:

“Maybe I was a little bit too old, but we had time to build something solid. Now, it’s only pleasure with this business.”

Source link

Bitcoin Price Set For Big Move As Volatility Drops

The United States Government Should Acquire 20% of the Bitcoin (BTC) Network, Says Michael Saylor – Here’s Why

SEC waves white flag on OpenSea probe, CEO says ‘this is a win’

How to Prepare for Monad: The High-Speed EVM Layer-1 Blockchain

US SEC Faces Backlash as Bybit Hack Highlights Lack of Oversight

Ether Price Spikes Further on Reports of Bybit Starting to Buy ETH

Bitcoin Faces Serious Price Compression – What Happened Last Time

FPPS Is Not A Free Lunch For Bitcoin Miners

One of the Most Reliable Indicators for Bitcoin Flashing Bullish Signal, Says Trader – Here Are His Targets

Expert reveals a shocking 10x contender

Franklin Templeton Joins Growing Pile of Solana ETF Applicants

Impact of Bybit’s $1.5B ETH Hack on ETH

Rollback Ethereum to Negate $1.4B Bybit Hack, Arthur Hayes Tells Vitalik Buterin

Altcoins Ready For Round 2? Expert Says Altseason ‘Has Begun’

Conference Bitcoin Afrique: A Bitcoin-Only Revolution in French-Speaking Africa

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

SAFE rallies 20% on Bithumb listing

Will Ethereum Price Fail $3,000 Breakout as Whale Selling Prolongs?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin1 month ago

Bitcoin1 month agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News1 month ago

24/7 Cryptocurrency News1 month agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin3 months ago

Bitcoin3 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Altcoins3 weeks ago

Altcoins3 weeks agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje