Bitcoin Scaling

The Clock Is Ticking While You Do Nothing

Published

1 month agoon

By

admin

Bitcoin does not exist in a vacuum. It does not exist outside the flow of time. We cannot just sit on our hands and do nothing while chasing the perfect, flawless, no downside improvements to this network and protocol.

The real world does not stop.

Yesterday the most powerful nation state on the planet officially instituted a Strategic Reserve of Bitcoin. We are past the point of no return on a path now. Governments are here, they are paying attention, they are actively participating now. The level of that participation will not shrink, it will not be reduced, it will only grow from here.

We do not have time to keep fucking around treating this project as a toy, an academic curiosity, or an intellectual puzzle. It needs to scale, now. The counter narratives to neuter Bitcoin due to its lack of scalability are not just already here, they are massive. They have support from huge swaths of this ecosystem.

“Bitcoin isn’t for spending, it’s for saving.”

“If you need to transact, just use stablecoins (that are centralized, censorable, and seizable).”

“Bitcoin is collateral.”

We are sleep walking into a future where Bitcoin is a neutered useless toy. Where it provides no privacy to anyone. It provides no censorship resistance or sovereignty to anyone. Where it is a useless hunk of lead to anyone outside of a white listed and surveilled system.

Governments aren’t going to just sit on their thumbs while we bicker and waste time until we find the perfect solution to scalability, and then go “Sure things folks, we’ll get right on activating that.” They will fight it tooth and nail. They do not care about you, your freedom, or your prosperity. They care about their own power. They will not support things that degrade their power and influence over you.

“Sorry, we have to have our guys look at this first, we’ll get back to you.”

“This seems risky, we can’t allow some internet nerds who want to tinker to put at risk the value of a strategic national asset.”

“Nope, this seems like it will enable things the last few years of regulation decided were illegal.”

The world doesn’t give a shit that you don’t have the perfect move or course of action available, it will not sit on its ass and wait for that option to become available to you. It will keep moving forward, it will keep removing and limiting the options available to you. There is no pause button.

It’s time to stop fucking around and acting like Bitcoin is some intellectual exercise, it is a real thing in the real world. And it happens to be the only thing that will give us any chance of the future not being a dystopic nightmarish hellhole.

This isn’t a game, and it’s time to stop pretending like it is.

Source link

You may like

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

The witness discount refers to the reduction in data “weight” given to the witness portion of a Bitcoin transaction — the part that contains the signatures used to prove ownership. Implemented as part of the 2017 segregated witness (SegWit) upgrade, this discount effectively lowered the fees for SegWit transactions by making the witness data count for less when calculating the total size of a transaction.

In simpler terms, the witness data gets a 75% discount, meaning that it only counts as one-quarter of its actual size when determining how much space it takes up in a Bitcoin block. This allows for more transactions per block and reduces costs for users who adopt SegWit-enabled wallets.

But why does the Witness Discount exist in the first place? What’s the point of giving the witness data this special treatment? The answer ties back to Bitcoin’s long-standing scalability challenges, and the need to increase transaction capacity without overhauling the network with a risky hard fork. In this article, we explore the purpose behind the witness discount, how it works, and why it continues to matter today.

Key Takeaways

- Witness Discount: A discount applied to the size of the “witness” (or signature) portion of a Bitcoin transaction, reducing fees.

- Part of SegWit: Witness discount is part of segregated witness (SegWit), which solved the long-standing transaction malleability issue and effectively increased Bitcoin’s block size.

- Scalability: It helps make Bitcoin transactions more efficient, allowing for more transactions per block.

Purpose of the Witness Discount

The witness discount was introduced as part of SegWit, a major upgrade to the Bitcoin protocol that separated the transaction data into two parts: the core transaction data and the witness data (mostly digital signatures). In essence, the witness data was given a “discount” in terms of how much it counts toward the overall block size.

Prior to SegWit, Bitcoin’s block size was capped at 1MB. SegWit brought an indirect block size increase by applying a lower “weight” to the witness data — thus enabling more transactions per block without exceeding the 1MB limit for non-SegWit nodes.

The witness discount accomplishes a crucial goal: It allows for more transactions to fit into a block while maintaining compatibility with older nodes that haven’t upgraded to SegWit.

How It Works

When a Bitcoin transaction occurs, the core elements of that transaction — such as the amount of bitcoin being sent and the addresses involved — are recorded. However, there’s another component called the “witness,” which stores the signatures that prove ownership of the transferred bitcoin.

- Pre-SegWit: Before SegWit, all parts of a transaction were treated equally in terms of how much space they consumed in a block.

- Post-SegWit: After SegWit, the witness data (signatures) was stored separately from the rest of the transaction data. This separation allows for more transactions to fit into a block, as the witness data is assigned a lower weight, effectively giving it a 75% discount. A full transaction under SegWit, which could previously take up, say, 300 bytes, now only contributes a smaller amount of that size to the block’s total weight.

This reduces fees for users who opt for SegWit-enabled wallets since fees are calculated based on the virtual size of the transaction, which now discounts the witness data.

History and Rationale

The story behind the witness discount dates back to the block size wars in 2015-2017. At that time, the Bitcoin community was embroiled in heated debates about how to scale the network. Larger block sizes would allow for more transactions per block, but increasing the block size directly (via a hard fork) was controversial. It risked centralizing the network, as bigger blocks are harder to propagate and store for nodes with less bandwidth and storage.

SegWit, proposed by Pieter Wuille, was introduced as a compromise. It addressed the scaling issue by creating more “effective” block space without requiring a hard fork. This is where the witness discount became important. By discounting the witness data, SegWit effectively expanded the number of transactions that could fit into a block while maintaining backward compatibility.

In simpler terms, SegWit allowed Bitcoin to have its cake and eat it too: more transactions per block without the risk of destabilizing the network.

Pros and Cons

Pros:

- Increased Block Efficiency: The witness discount allows for more transactions per block, indirectly increasing Bitcoin’s block size while keeping it backward-compatible with non-upgraded nodes.

- Lower Fees for SegWit Users: Since witness data is given less weight, SegWit transactions tend to be smaller in size, meaning lower transaction fees for users.

- Enhanced Security: SegWit solved the transaction malleability problem, making Bitcoin transactions more secure, which is especially important for second-layer solutions like the Lightning Network.

- Improved Scalability: By reducing the data burden on each transaction, the witness discount improves the scalability of the Bitcoin network.

Cons:

- Complexity: The SegWit implementation, including the witness discount, adds layers of complexity to the protocol, which some purists in the community view as unnecessary.

- Not Fully Adopted: While the witness discount encouraged the use of SegWit, many wallets and exchanges have been slow to adopt it, meaning its benefits aren’t universally experienced.

Witness Discount vs. Block Size Increase

One of the major debates in the Bitcoin scaling saga was whether to increase the block size directly or to implement a solution like SegWit, which indirectly increased the block size. So, how does the witness discount compare to simply raising the block size?

Block Size Increase:

- Direct increase in the number of transactions a block can hold.

- Increases the burden on nodes, requiring more storage and bandwidth to keep up with the network.

- Requires a hard fork, which can split the network (as seen in the case of Bitcoin Cash).

Witness Discount (SegWit):

- Achieves a similar result (increased transaction capacity) without a hard fork.

- Reduces transaction costs for users taking advantage of SegWit.

- Doesn’t impose additional burdens on nodes, making it more sustainable long-term.

Essentially, the witness discount achieves the goal of more transactions per block without compromising Bitcoin’s decentralization, a key tenet of the network’s design philosophy.

Frequently Asked Questions (FAQs)

Why is the witness discount 75%?

The 75% witness discount exists because witness data—which includes digital signatures—does not contribute to the long-term size of the UTXO set that nodes must store permanently. Since this data is only needed for transaction validation and can be discarded afterward, it has a lower impact on node resources compared to non-witness data.

With the SegWit upgrade, transaction size is measured in weight units (WU) rather than bytes. Non-witness data is assigned a weight of 4 WU per byte, while witness data is assigned 1 WU per byte—a 1:4 ratio. This means witness data is effectively counted as 25% of its original size, resulting in a 75% discount.

The choice of 1:4 weighting was a deliberate balance between incentivizing SegWit adoption, preserving network efficiency, and maintaining security. It allows more transactions per block while ensuring compatibility with pre-SegWit rules, enhancing Bitcoin’s scalability without sacrificing decentralization.

Does the witness discount mean SegWit blocks are bigger?

Yes, in practice, SegWit blocks can be larger than the pre-SegWit 1MB block limit. However, the way the block weight is calculated means that SegWit blocks are more efficient in storing data, so more transactions — that don’t count for as much weight as before — can fit into a block.

What happens if I don’t use SegWit?

Non-SegWit transactions don’t benefit from the witness discount, meaning they take up more space in a block and typically incur higher fees. However, they are still fully valid and can be processed by the network.

Is the witness discount here to stay?

As of now, there are no plans to remove the witness discount. It remains a critical part of Bitcoin’s scalability strategy and is widely considered a success in improving the network’s efficiency without compromising decentralization or security.

Source link

Bitcoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Published

2 months agoon

February 12, 2025By

admin

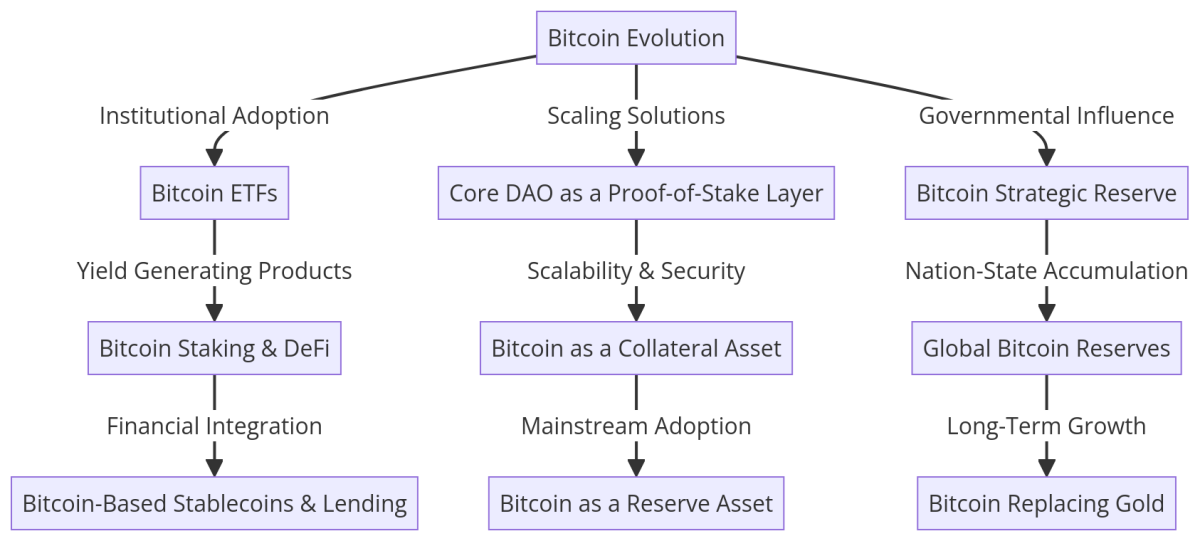

Bitcoin’s evolution from an obscure digital currency to a global financial force has been nothing short of extraordinary. As Bitcoin enters a new era, institutions, governments, and developers are working to unlock its full potential. Matt Crosby, Bitcoin Magazine Pro’s lead market analyst, sat down with Rich Rines, contributor at Core DAO, to discuss Bitcoin’s next phase of growth, the rise of Bitcoin DeFi, and its potential as a global reserve asset. Watch the full interview here: The Future Of Bitcoin – Featuring Rich Rines

Bitcoin’s Evolution & Institutional Adoption

Rich Rines has been in the Bitcoin space since 2013, having witnessed firsthand its transformation from an experimental technology to a globally recognized financial instrument.

“By the 2017 cycle, I was pretty determined that this is what I was going to spend the rest of my career on.”

The conversation delves into Bitcoin’s growing role in institutional portfolios, with spot Bitcoin ETFs already surpassing $41 billion in inflows. Rines believes the institutionalization of Bitcoin will continue to reshape global finance, particularly with the rise of yield-generating products that appeal to Wall Street investors.

“Every asset manager in the world can now buy Bitcoin with ETFs, and that fundamentally changes the market.”

What is Core DAO?

Core DAO is an innovative blockchain ecosystem designed to enhance Bitcoin’s functionality through a proof-of-stake (PoS) mechanism. Unlike traditional Bitcoin scaling solutions, Core DAO leverages a decentralized PoS structure to improve scalability, programmability, and interoperability while maintaining Bitcoin’s security and decentralization.

At its core, Core DAO acts as a Bitcoin-aligned Layer-1 blockchain, meaning it extends Bitcoin’s capabilities without altering its base layer. This enables a range of DeFi applications, smart contracts, and staking opportunities for Bitcoin holders.

“Core is the leading Bitcoin scaling solution, and the way to think about it is really the proof-of-stake layer for Bitcoin.”

By securing 75% of the Bitcoin hash rate, Core DAO ensures that Bitcoin’s security principles remain intact while offering greater functionality for developers and users. With a growing ecosystem of over 150+ projects, Core DAO is paving the way for the next phase of Bitcoin’s financial expansion.

Core: Bitcoin’s Proof-of-Stake Layer & DeFi Expansion

One of the biggest challenges facing Bitcoin is scalability. The Bitcoin network’s high fees and slow transaction speeds make it a powerful settlement layer but limit its utility for day-to-day transactions. This is where Core DAO comes in.

“Bitcoin lacks scalability, programmability. It’s too expensive. All these things that make it a great settlement layer is exactly the reason that we need a solution like Core to extend those capabilities.”

Core DAO functions as a proof-of-stake layer for Bitcoin, allowing users to generate yield without third-party risk. It provides an ecosystem where Bitcoin holders can participate in DeFi applications without compromising on security.

“We’re going to see Bitcoin DeFi dwarf Ethereum DeFi within the next three years because Bitcoin is a superior collateral asset.”

Bitcoin as a Strategic Reserve Asset

Governments and sovereign wealth funds are beginning to view Bitcoin not as a currency but as a strategic reserve asset. The potential for a U.S. Bitcoin strategic reserve, as well as broader global adoption at the nation-state level, could create a new financial paradigm.

“People are talking about building strategic Bitcoin reserves for the first time.”

The idea of Bitcoin replacing gold as a primary store of value is becoming more tangible. Rines asserts that Bitcoin’s scarcity and decentralization make it a superior alternative to gold.

“I think within the next decade, Bitcoin will become the global reserve asset, replacing gold.”

Bitcoin Privacy: The Final Frontier

While Bitcoin is often hailed as a decentralized and censorship-resistant asset, privacy remains a significant challenge. Unlike cash transactions, Bitcoin’s public ledger exposes all transactions to anyone with access to the blockchain.

Rines believes that improving Bitcoin privacy will be a critical step in its evolution.

“I’ve wanted private Bitcoin transactions for a really long time. I’m pretty bearish on it ever happening on the base layer, but there’s potential in scaling solutions.”

While solutions like CoinJoin and the Lightning Network offer some privacy improvements, full-scale anonymity remains elusive. Core is exploring innovations that could enable confidential transactions without sacrificing Bitcoin’s security and transparency.

“On Core, we’re working with teams on potentially having confidential transactions—where you can tell that a transaction is happening, but not the amount or counterparties involved.”

As governments continue to increase scrutiny over digital financial activity, the need for enhanced Bitcoin privacy features will only grow. Whether through native protocol upgrades or second-layer solutions, the future of Bitcoin privacy remains a crucial area of development.

The Future of Bitcoin: A Trillion-Dollar Market in the Making

As the interview progresses, Rines outlines how Bitcoin’s economic framework is expanding beyond speculation and into productive financial instruments. He predicts that within a decade, Bitcoin will command a $10 trillion market cap, with DeFi applications becoming a significant portion of its economic ecosystem.

“The Bitcoin DeFi market is a trillion-dollar opportunity, and we’re just getting started.”

His perspective aligns with a broader industry trend where Bitcoin is not only used as a store of value but also as an active financial asset within decentralized networks.

Rich Rines Roadmap for Bitcoin’s Future

Final Thoughts

The conversation between Matt Crosby and Rich Rines provides a compelling glimpse into the future of Bitcoin. With institutional adoption accelerating, Bitcoin DeFi expanding, and the growing recognition of Bitcoin as a strategic reserve, it is clear that Bitcoin’s best years are ahead.

As Rines puts it:

“Building on Bitcoin is one of the most exciting opportunities in the world. There’s a trillion-dollar market waiting to be unlocked.”

For investors, developers, and policymakers, the key takeaway is clear: Bitcoin is no longer just a speculative asset—it is the foundation of a new financial system.

For more detailed Bitcoin analysis and to access advanced features like live charts, personalized indicator alerts, and in-depth industry reports, check out Bitcoin Magazine Pro.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin Scaling

Why Bother Trying To Scale Bitcoin?

Published

5 months agoon

December 4, 2024By

admin

The public discussion around scaling in the last few years has become poisoned and captured by an incredibly toxic and defeatist attitude: “Why bother?”

“Why bother trying to scale? Basic napkin math shows it’s impossible no matter what we do for everyone to self custody.”

“Why bother trying to scale? People are stupid and lazy anyway, even if we did people would just use a custodian anyways.”

“Why bother trying to scale? I’ve got mine, I’ll be rich enough for self custody, who cares about the stupid and lazy plebs anyways?”

This attitude is permeating the entire space more and more as time goes on, with a plethora of different rationalizations and reasons for it depending on who you talk to. It is a completely defeatist, dystopian, and pessimistic view of the future. I say that as someone who is incredibly pessimistic about a large number of issues that I see in this ecosystem.

Talking yourself into losing is one of the fastest ways to wind up losing. Bitcoin as a distributed system depends on being dispersed enough, and having enough independent system participants, that it can resist the coercive or malicious influence of larger participants. This is critical to it continuing to function as a decentralized and censorship resistant system. If it cannot remain dispersed enough in its distribution then natural tendencies in networks will likely gravitate towards larger and more dense participants until they effectively have an outsized control over the whole network.

That will ultimately very likely spell the end for Bitcoin’s most important property: censorship resistance.

What is mind boggling to me is, even though we aren’t in a perfect place, we have made massive progress in the last decade. Ten years ago we had people screaming about raising the blocksize. Now we have the Lightning Network, Statechains, and now Ark. We have people experimenting with wildly improved federated custodial models using BitVM. We even have a vague inkling of ways to implement covenants without a softfork if some new cryptographic assumptions pan out and prove practical to implement in a usable way.

Even if we do bump into a ceiling eventually we can’t get around, every bit of ground we gain means room for more people to self custody. It means more room for more custodians, allowing more numerous small scale ones to enable people to custody with people they trust more than disconnected corporations, for that more numerous herd to impose greater competitive pressure for custodians in general. To maintain that wide dispersion of entities directly interacting with the network that it needs to maintain its decentralization.

Why are so many Bitcoiners willing to throw up their hands and give in to defeatist sentiment? Yes, we have more problems to solve than we did ten years ago, but we have also covered a massive amount of ground in expanding scalability in that ten years. This isn’t a binary situation, this isn’t a game where you win or lose with no middle ground. Every improvement to scalability we can make gives Bitcoin a higher chance of success. It entrenches and defends Bitcoin’s censorship resistance that much more.

I’m not saying that people should naively buy into every promised solution or hyped thing, there are definitely problems and limitations we should remain cognizant of. But that doesn’t mean throw in the towel and give up this early. There is so much potential here to actually reshape the world in a meaningful way, but that won’t happen overnight. It won’t happen at all if everyone just gives up and kicks back expecting to get rich and apathetically stops caring about it.

Blind pessimism and blind optimism are both poison, it’s time to start looking for a balance between the two rather than picking your drug of choice and sinking into delusion.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Ethereum Price Fights for Momentum—Traders Watch Key Resistance

Corporate Bitcoin Holdings Hit Record High In Q1 2025 As Public Companies Accelerate Accumulation

‘Big Short’ Investor Steve Eisman Derisks, Says Stock Market Volatility Will Be Here for a While

Dow drops over 500 points as UnitedHealth tanks, Fed tensions weigh on markets

Gold Is Still the Safe-Haven King, While Bitcoin Loses Out: JP Morgan

Dogecoin Price Breakout in view as Analyst Predicts $5.6 high

Bitcoin (BTC) Price in Standstill at $85K as Trump Increases Pressure on Fed’s Powell

Ripple acquisition Hidden Road secures FINRA registration

Ethereum Whales Offload 143,000 ETH In One Week – More Selling Ahead?

How Do We Protect Bitcoin From Quantum Computers? Not With A Joke

OKX Goes Live In The US After Setting Up New Headquarters in San Jose, California

Stanford’s AI research lab to use Theta EdgeCloud for LLM model studies

Central African Republic Solana Meme Coin Jumps as President Fuels Rumors of Revival

Will Shiba Inu Price 3x?

Bitcoin Cash (BCH) Gains 4.2%, Leading Index Higher

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Ripple Price4 weeks ago

Ripple Price4 weeks ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals