Featured

The Good, The Bad, And The Unknown

Published

3 weeks agoon

By

admin

Everyone has heard the Chinese proverb British misquote: “May you live in interesting times,” and how it’s supposed to be a curse. It sounds deep, like a quote for edgelords over 80.

But have you ever considered the alternative? According to the Anglo-Saxon Chronicle, there were nearly two centuries where nothing much happened. Vivian Mercier famously called Waiting for Godot “a play in which nothing happens, twice.” But nothing happening 191 times? I’ll take interesting times any day.

And that’s exactly what we have now. Tether, with their stablecoin USDT, are coming to Lightning. We’ve been talking a lot recently about how Lightning is the common language of the bitcoin economy and how bitcoin is a medium of exchange (and it really is; read our report).

These two arguments now seem to be converging. Thanks to Lightning working as a common language, it makes bitcoin interoperable with a wide range of adjacent technologies, like USDT. And USDT is going to turbocharge bitcoin into new use cases, new markets, and new challenges on a scale that the Lightning ecosystem has yet to experience.

Given the choice, I’d rather dive head first into the unknown than spend the afternoon on the couch. All the cool stuff is in the unknown. (Image: pxhere)

Given the choice, I’d rather dive head first into the unknown than spend the afternoon on the couch. All the cool stuff is in the unknown. (Image: pxhere)

USDT on Lightning is terra incognita. Interesting times indeed. So let’s think about what it means for USDT to join Lightning and for Lightning to move USDT — the opportunities, the risks, and the wide open questions.

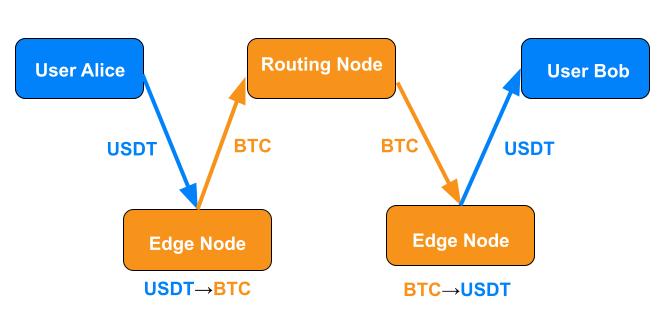

Lightning was originally intended to increase the throughput of the bitcoin blockchain, so bitcoin was to be its only cargo. Taproot Assets is a new protocol that allows fungible assets (e.g. stablecoins) to be transmitted over Lightning as hashed metadata piggybacking on the same infrastructure used to process bitcoin payments.

The way it works is pretty simple for anyone who understands Lightning. The recipient generates an invoice that pings edge nodes (i.e. the nodes connecting users to the broader network) for exchange rates between bitcoin and the asset in question — USDT in the current case. Once the user accepts an edge node’s exchange rate, they generate an invoice for the payment and send it to the payer. The payer sends the asset to the edge node on their own side, the edge node converts everything into a normal-looking bitcoin payment, the payment proceeds through routing nodes along the network as usual, the edge node on the recipient’s end converts the payment back into the original asset (USDT) and forwards it to the recipient.

Taproot Assets leverages the versatility of Lightning and bitcoin to let users transfer new kinds of assets over the network, using bitcoin as the universal medium of exchange. One corollary of all the nodes speaking Lightning is that any routing nodes between the edge nodes see only BTC in transit. Lightning tells them how to move BTC, and that’s all they’re doing as far as they know. Awesome.

But there’s more to it than just technical specs. USDT is, after all, a massive medium of exchange. Tens of billions of USDT value change hands every day spread across millions of payments. Its daily trading volumes are in the same ballpark as the Brazilian real and the Indian rupee. This is a big deal. So what does Lightning mean for USDT, and what does the addition of USDT mean for Lightning?

… for Bitcoin

So far, much of the strategy to bitcoinizing commerce has focused on orange pilling as many people as possible and growing the circular economy one user at a time. This strategy has perhaps reached the limits of its scale. The circle has grown massively in the last decade and a half, but it’s still limited, and we need to think in terms of millions at a time.

Now that USDT and BTC are natively interoperable on Lightning, the circle has gained tangents. With USDT on Lightning, each party to a payment — the payer and the recipient — can choose whether to use BTC or USDT on their own end, and neither depends on the other’s decision. A customer can pay in BTC, and the merchant can receive USDT. Or the customer can pay in USDT, and the merchant can receive BTC. Or they can both use the same asset. It doesn’t matter. Once both assets are native to Lightning, they become automatically, frictionlessly interchangeable. Everyone is free to opt for bitcoin’s advantages as a medium of exchange grown from the bottom up by the users or for USDT’s advantages as an asset whose price is as stable as US monetary policy and Tether’s liquid reserves.

Lightning and, by extension, bitcoin stand to gain millions of users and billions of dollars worth of spending power. It’s a qualitative extension of bitcoin’s utility. The new use cases will do more good for bitcoin than a boatload of orange pills. It’s also potentially a quantitative explosion for Lightning. Many of those new users might not even know that they’re using Lightning thanks to its efficacy as the common language of the bitcoin economy. But we ol’ school Lightning vets know. This is what we’ve been building towards.

And since we just mentioned how Lightning would make USDT easier for American users to access, USDT will also make it easier for them to use Lightning. American tax regulation treats BTC like an equity, making each payment a potentially complex concatenation of tax events. But if US users can access Lightning with an asset that never incurs capital gains, then they’ll have access to many of Lightning’s advantages without one of its particular regulatory drawbacks.

…for Tether

Tether typically issues USDT on proven blockchains that have achieved significant market traction, and they have no interest in launching their own. USDT is currently available on Algorand, Celo, Cosmos, Ethereum, EOS, Liquid Network, Solana, Tezos, Ton, and Tron. Note that these are all proof-of-stake (PoS) blockchains (except Liquid, which uses a federation), so they’re necessarily more centralized than bitcoin.

These blockchains also face different tradeoffs. Ethereum is relatively decentralized for a PoS blockchain, but its transaction fees are notoriously high. Tron is cheaper. Perhaps that’s why, according to one estimate, nearly 7x more monthly active retail USDT users opt for Tron over Ethereum and send 8x more retail volume over Tron. But Tron is notoriously centralized, making it a choke point for USDT. If Tron were to fail, Tether would lose something like half of its total capacity across all blockchains. Ouch. By allowing USDT to be transacted over Lightning, which is inherently decentralized, Tether mitigates their dependency on cheap, centralized blockchains.

Further, Lightning could make USDT much more convenient to use in the US market. US exchanges sometimes limit USDT transactions to certain blockchains. For example, Coinbase says “Coinbase only supports USDT on the Ethereum blockchain (ERC-20). Do not send USDT on any other blockchain to Coinbase.” Lightning gives big exchanges like Binance, Coinbase, and Kraken (which already support Lightning today) a decentralized alternative for USDT payments to offer their users.

The new American administration has mooted onshoring the entire stablecoin industry and suggested that regulating it is their “first priority.” In other words, they’ll be paying very close attention to every development. As long as stablecoins like USDT are pegged to the dollar, those who control the dollar and profit from it will want to control the stablecoins too.

Regulators think they can even improve on freedom by regulating it. They can’t help it. It’s in their nature. But it follows that, as USDT gains utility on Lightning and Lightning gains utility as a means to move USDT, we’re all going to be attracting greater scrutiny from regulators. It’s hard to say how much they’ll actually be able to do or what they’re going to try, but it won’t be any fun. Regulation is always friction.

One area that’s likely to attract regulatory scrutiny is the edge nodes. Conventional centralized exchanges tend to be subject to KYC/AML rules in many jurisdictions. If the edge nodes will be automatically exchanging USDT and BTC and forwarding payments, they might also look a lot like conventional exchanges to regulators, who tend not to like decentralization.

What’s It Cost? What’s It Worth?

While Lightning does offer users and USDT some significant benefits, it’s not obviously the best all-around solution for every payment involving USDT. Lightning users expect low fees. So do USDT users who use centralized blockchains and custodial exchanges. But adding a second asset to Lightning adds some financial considerations that everyone — routing nodes, users, and especially edge nodes — will have to reckon with.

First, the edge nodes are providing the typical tasks of LSPs — keeping users connected to the network with enough channels and enough liquidity to keep those payments moving — in addition to converting between assets. That conversion is a valuable service that deserves compensation, and it can also be risky (see below).

Second, USDT is likely to increase transaction volume considerably, which means that LSPs and routing nodes will have to keep more liquidity on the network to forward those payments. They don’t take the same shortcut as custodial exchanges, which just have to update their internal ledgers. The economics of liquidity allocation still apply, only more so.

Will Lightning be able to compete with centralized blockchains like Tron for USDT payments? The answer will probably resemble the answer to most questions about matching technologies with use cases: each technology will have certain strengths and weaknesses that recommend it for certain use cases and not others. As usual, the market will figure it out. However, since the technology wasn’t tailored to this particular use case, price discovery will be a process of trial and error, which takes time.

Free Call Options? Uh oh.

Edge nodes face the risk of the “free-call-option problem,” which is interesting enough to merit its own discussion here. This is a new risk, and it’s inherent to any situation involving two assets in a single Lightning payment.

Lightning payments need to be completed within a certain time in order to be settled, or the invoice cancels automatically. That time is the “T” in HTLCs — hashed, time-locked contracts.

When the edge nodes bid with their exchange rates for a USDT↔BTC payment, they calculate their bids based on parameters like their current liquidity situation and the spot price. But the users have a window between accepting the edge node’s bid and the expiration of the HTLC in which to settle the payment. Prices can move in that window. If I initiate a USDT payment at one rate, then I can wait until the rate moves in my favor before I release the preimage to settle it. If the rate moves against me, I simply don’t release the preimage. In that case, the edge node might initiate a channel closure to redeem their funds, but that’s a slow (and therefore costly) process. If it moves in my favor, the edge node is on the hook for the difference. Heads, I lose nothing. Tails, I fleece the edge node.

Payments involving any combination of assets on Lightning give the user a call option. Traditional financial institutions manage their downside risk in selling call options by adding the risk to the price. These options can get very expensive for unprepared edge nodes. Just ask Kilian and Michael at Boltz, who originally brought this whole issue to my attention and had the class to describe it for all of us in the ecosystem. The alternative is for the edge nodes to price the call option into their quotes, just like traditional financial institutions. Intertemporal arbitrage is great work if you can get it.

Users aren’t the only source of concern for edge nodes either. If a routing node fails to forward the preimage — whether through intent or malfunction — the edge node could still be on the hook. At least with routing nodes, it might be possible to implement some form of reputation system to help choose the route. However, a reputation system for end users might not be feasible as new users will be constantly joining the network.

The free call options have never been a problem for Lightning until now because the network has only dealt with a single asset: bitcoin. If the free-option problem became serious enough, one could imagine multiple parallel, single-currency Lightning Networks emerging. One for bitcoin. One for USDT. Another for … If bitcoin gets cut out of the loop, we will lose the benefit of bitcoin interoperability. We might even wind up regretting bringing USDT onto Lightning in the first place.

Bitcoin was always meant to be revolutionary. Disrupting broken fiat is the whole point and always has been. We’re in it for the revolution. We know that change and disruption was never going to be a smooth process.

But change is a good thing. Progress is just a kind of change that people welcome. We welcome USDT on Lightning because we see the opportunity. It can represent progress for USDT users, for Lightning, and for bitcoin.

Like any change, though, it’s going to require careful thought, preparation, sharp instincts, and quick reactions. You don’t go into uncharted territory without the right gear and a few skills. Anyone in the Lightning liquidity business is going to face some new challenges, but also stands to make some big gains.

Tether stands to gain an economical, decentralized distribution network and better access to the vital US market. Lightning stands to gain a massive infusion of liquidity and users. Bitcoin will be natively interoperable with USDT. That’s why there’s so much excitement.

But regulators are watching. And edge nodes will only offer the indispensable conversion services if doing so is profitable, not ruinous. So let’s approach this change as we do all new developments in Lightning: by thinking hard, designing carefully, hardening our code, preparing the market, and never losing sight of our ultimate goal, which is to realize the universal bitcoin economy.

This is a guest post by Roy Sheinfeld. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Ethena Labs, Securitize launch blockchain for DeFi and tokenized assets

Shiba Inu Gains Momentum: SHIB Price Breaks Above 100-Day Moving Average, What’s Next?

A Saint Patrick’s Day Price History

Memecoin Insider Creates Wolf of Wall Street-Inspired Coin Despite Potential Interpol Warrant: Report

People tend to celebrate periods of low feerates. It’s time to clean house, consolidate any UTXOs you need to, open or close any Lightning channels you’ve been waiting on, and inscribe some stupid 8-bit jpeg into the blockchain. They’re perceived as a positive time.

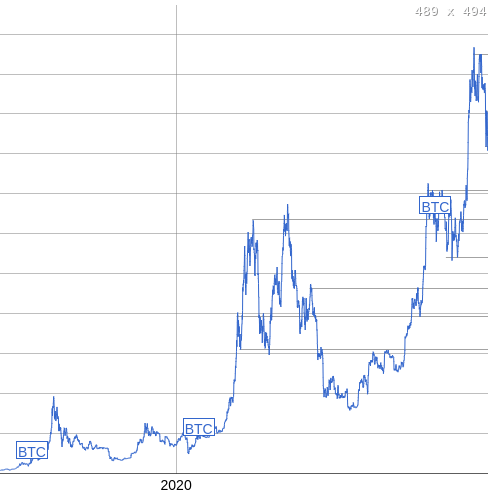

They are not. We have seen explosive price appreciation the last few months, finally hitting the 100k USD benchmark that everyone took for granted as preordained during the last market cycle. That’s not normal.

The picture on the left is the average feerate each day since 2017, the picture on the right is the average price each day since 2017. When the price was pumping, when it was highly volatile, historically we have seen feerates spike accordingly. Generally matching the growth and peaking when the price did. The people actually buying and selling transacted on-chain, people took custody of their own coins when they bought them.

This last leg up to over 100k does not seem at all to have had the same proportional affect on feerates that even moves earlier in this cycle have. Now, if you actually did look at both of those charts, I’m sure many people are going “What if this cycle is at the end?” It’s possible, but let’s say it’s not for a second.

What else could this be indicating? That the participants that are driving the market are changing. A group of people who used to be dominated by individuals who self custodied, who managed their counterparty risk by removing gains from exchanges, who generated time-sensitive on-chain activity, are transforming into a group of people simply passing around ETF shares that have no need of settling anything on-chain.

That is not a good thing. Bitcoin’s very nature is defined by the users who interact with the protocol directly. Those who have private keys to authorize transactions generating revenue for miners. Those who are sent funds, and verify transactions against consensus rules with software.

Both of those things being removed from the hands of users and placed behind the veil of custodians puts the very stability of Bitcoin’s nature at risk.

This is a serious existential issue that has to be solved. The entire stability of consensus around a specific set of rules is premised on the assumption that there are enough independent actors with separate interests that diverge, but align on a value gained from using that set of rules. The smaller the group of independent actors (and the larger the group of people “using” Bitcoin through those actors as intermediaries) the more practical it is for them to coordinate to fundamentally change them, and the more likely it is that their interests as a group will diverge in sync from the interests of the larger group of secondary users.

If things continue trending in that direction, Bitcoin very well could end up embodying nothing that those of us here today hope it can. This problem is both a technical one, in terms of scaling Bitcoin in a way that allows users to independently have control of their funds on-chain, even if only through worst-case recourse, but it is also a problem of incentive and risk management.

The system must not only scale, but it has to be able to provide ways to mitigate the risks of self custody to the degree that people are used to from the traditional financial world. Many of them actually need it.

This isn’t just a situation of “do the same thing I do because it’s the only correct way,” this is something that has implications for the foundational properties of Bitcoin itself in the long term.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Earlier today, the Bitcoin Policy Institute (BPI), a Washington, D.C.-based think tank, hosted the “Bitcoin For America” summit.

The event occurred in the wake of President Trump’s signing an executive order (EO) to establish a Strategic Bitcoin Reserve (SBR) and the White House’s hosting its first-ever Crypto Summit.

One might have expected jingoistic overtones from an event with such a title. However, many of the speakers acknowledged that Bitcoin is something that will benefit the whole world, and that, partially because of this, the U.S. should lead the way in adoption.

David Zell, Director of BPI, set the tone for the event in his opening remarks.

“Our goal for today is to continue this process, to help people understand how Bitcoin benefits America — and the world writ large,” he declared.

Zell was followed by Senator Cynthia Lummis (R-WY), a long-time Bitcoin advocate, who made the case that it’s only natural for America to set the pace when it comes to Bitcoin adoption.

“This really is freedom money,” said Senator Lummis. “And America should lead when it comes to freedom money.”

Michael Saylor: Bitcoin And American Digital Supremacy

Strategy Executive Chairman Michael Saylor agreed with the Senator, making the case for why the U.S. should lead in this arena.

“I’m here today to show you how the Strategic Bitcoin Reserve represents a strategy for United States digital supremacy in the 21st century,” he began.

He went on to argue in favor of bitcoin as digital property, asserting that the United States should acquire as much of it as possible so that it can “rent and finance” on top of that property.

He also posited that trillions of dollars in commerce will flow over the Bitcoin network, which is another reason why the U.S. should prioritize acquiring its share of the network.

Moreover, he asserted that Bitcoin embodies American values and that owning it is the next best thing to living in the U.S.

“Everybody who is living in Asia, in Africa would move to the U.S. if they could,” said Saylor.

“They’d move their money to the U.S. if they could. They want the currency of the U.S. They want the security of the U.S. They want the values of the U.S., but they can’t have it,” he added.

“So, the second best thing they can have is to move their money into the Bitcoin network, which has all of the values, protection, and security of the U.S.”

Vivek Ramaswamy: Bitcoin’s Long-Term Return Is The New High-Risk Hurdle Rate

Ohio gubernatorial candidate and American entrepreneur Vivek Ramaswamy followed Saylor, putting forward the motion that the rate of return on holding bitcoin for a decade or more is now the new high-risk hurdle rate.

He set the stage for this claim by making the case that we’re moving back into an “era of scarce capital.” He shared that this will be the inverse of the past 15 years, during which the Fed printed money en masse, in a manner similar to a cocaine dealer doling out cocaine to hungry users, as he put it.

He explained that institutions are going to once again have to consider the question “What is my opportunity cost of capital?” and, in doing so, they’ll have to define a hurdle rate for both low- and high-risk investments.

Ramaswamy argued that the hurdle rate for low-risk investments is the 10-year U.S. Treasury, while the hurdle rate for a high-risk investment will be the rate of return on bitcoin over a 10-to-15-year period.

He then closed out his talk by pointing out how the American ethos and the Bitcoin ethos overlap, and that, like the American flag, Bitcoin is a symbol of hope.

“I think Bitcoin and what it represents, more than as a financial asset, also helps to fill that hunger for a symbol, a reminder of what American greatness was all about,” said Ramaswamy. “And I think it makes it, in the national context, an even more fitting asset to fill our national Strategic Reserve.”

Matthew Pines: The World Is Paying Attention To Bitcoin After SBR EO

Matthew Pines, Executive Director of BPI, pointed out that bitcoin is beginning to take center stage in the eyes of world leaders for two reasons.

The first, he claimed, is because U.S. debt markets have become increasingly fragile, prompting global leaders to start looking to invest in a global reserve asset aside from U.S. Treasuries.

The second reason is that President Trump’s SBR EO clearly stated that the United States sees bitcoin as “digital gold,” and that it will only be a matter of time before other leaders view it as the same.

“Last Thursday’s executive order landed on the desk of every major president, central bank [chair] and finance minister in the world,” said Pines.

“There are now discussions happening about how to interpret that. What does that mean for their own country’s relationship to bitcoin? Governments don’t move too fast, but when they do, they move in size, they move in scale and they can deploy trillions of dollars in capital that can have geopolitical effects,” he added.

“And I think we’re at this inflection point where the geopolitical aspects of bitcoin start to become extremely important, and can shape the next several years of Bitcoin’s future. The Bitcoin race is now on, and the ball is in our court to maintain our advantage.”

Congressman Nick Begich Reintroduces The Bitcoin Act

After Pines concluded his talk, he introduced Rep. Nick Begich (R-AK) to the stage, where the Congressman made a major announcement.

“Today, I will be announcing the Bitcoin Act of 2025 in the United States House,” said Rep. Begich.

The bill, which is an updated version of the bill Sen. Lummis proposed last year, proposes that the U.S. acquire 1 million bitcoin (at no expense to taxpayers) and protects U.S. citizens’ right to self-custody to their bitcoin.

“[The bill] explicitly protects the rights of individuals to own, hold and transact with bitcoin freely,” said Rep. Begich. “It recognizes self-custody as a fundamental right.”

Congressman Ro Khanna: Democrats Should Support Bitcoin

After a brief talk from Zack Shapiro, Head of Policy at BPI, on why U.S. states should hold bitcoin in their reserves, Rep. Ro Khanna (D-CA) made the case for why Democrats should embrace Bitcoin.

“Bitcoin should be bipartisan,” said Rep. Khanna, the only Democratic politician to speak at the event.

“Now, people are going to be able to get bitcoin. That is transformational for so many people around the world, and that is why the Democratic Party should be embracing this as something that can create financial empowerment for people not just in the United States, but around the world,” he added.

Jack Mallers: Bitcoin Is A Return To American Values

After a handful of talks and panels including the likes of Casa CEO Nick Neuman, Newmarket Capital CEO Andrew Hohns and Lightspark CSO Christian Catalini, Strike CEO Jack Mallers took the stage as the final speaker of the summit.

In his talk, entitled “Strategic Bitcoin Reserve: The American Monetary Revolution”, Mallers made the case that the establishment of the SBR was “a return to American values — including life, liberty and property.”

“The Strategic Bitcoin Reserve executive order and the Bitcoin Act proposed by Senator Lummis is the most significant economic shift and announcement and the only positive economic announcement that’s come out of this nation’s capitol in the last 100 years,” said Mallers.

He went on to say that American economic policy has been working against the principles the country was founded on and cited Executive Order 6102 (gold confiscation under President Franklin D. Roosevelt in 1933), the Nixon Shock (President Nixon’s depegging the U.S. dollar from gold in 1971) and the 2008 bank bailouts as evidence.

However, he ended on a high note.

“[This is a] pivotal moment in American history and a turning point in economic policy for this country,” said Mallers. “The story of humanity is [people] engineering a better world — that’s America, that’s Bitcoin.”

Source link

Bitcoin

Cantor Fitzgerald To Expand Bitcoin Financing Amid U.S. Policy Shift

Published

6 days agoon

March 11, 2025By

admin

Reflecting the United States’ growing embrace of Bitcoin, investment bank Cantor Fitzgerald has announced partnerships with Anchorage Digital and Copper.co to support its expanding global Bitcoin financing business.

Anchorage Digital and Copper.co will serve as collateral managers and custodians for Cantor Fitzgerald, providing leverage to institutional investors holding Bitcoin. Anchorage Digital and Copper will use their industry-leading security solutions to custody and safeguard client assets.

“We are thrilled to partner with Anchorage Digital and Copper, whose industry-leading security solutions will help us deliver best-in-class digital asset custody services to our clients,” said Michael Cunningham, Head of Bitcoin Financing at Cantor Fitzgerald. “We are launching with $2 billion in initial financing and expect to substantially grow the operation over time.”

With Cantor Fitzgerald’s $2 billion initial investment in Bitcoin financing, this partnership signals a major step in mainstream financial institutions embracing Bitcoin as a legitimate investment class.

Nathan McCauley, CEO and Co-Founder of Anchorage Digital, added: “Our partnership marks a major step forward for the Bitcoin financing ecosystem—built on the safety and security of federally regulated digital asset custody. By combining the best of traditional finance with the best of crypto, we are expanding the horizon of what is possible for institutions in Bitcoin.”

This partnership comes as President Donald Trump’s administration continues to advance pro-Bitcoin policies, including the creation of a strategic Bitcoin reserve and reversing previous regulatory hostility under Joe Biden’s administration.

The U.S. Securities and Exchange Commission (SEC) recently rescinded Staff Accounting Bulletin 121, which had previously blocked banks from offering Bitcoin custody services. Following this, the Office of the Comptroller of the Currency (OCC) clarified that banks are now permitted to engage in Bitcoin and crypto services, including asset custody. This shift helped paved the way for major financial institutions like Cantor Fitzgerald to expand into Bitcoin services.

Cantor Fitzgerald President Howard Lutnick, who now serves as the United States Secretary of Commerce, has been instrumental in this shift. Lutnick has been working closely with President Trump on initiatives such as the Strategic Bitcoin Reserve, a key component of the administration’s crypto strategy.

“Institutional investors are increasingly looking to diversify their portfolios and identify secure routes into the digital asset market,” said Amar Kuchinad, CEO of Copper. “This significant partnership with Cantor Fitzgerald will meet the growing demand for sophisticated financing solutions, with Copper.co’s lending and collateral management platform providing a complete toolkit for secure and strategic asset handling.”

Source link

Bitcoin Price Eyes $200,000 Breakout If This History Aligns

Gold-Backed Tokens Outperform as ‘Bond King’ Gundlach Sees Precious Metal Hit $4,000

Ethena Labs, Securitize launch blockchain for DeFi and tokenized assets

Shiba Inu Gains Momentum: SHIB Price Breaks Above 100-Day Moving Average, What’s Next?

A Saint Patrick’s Day Price History

Memecoin Insider Creates Wolf of Wall Street-Inspired Coin Despite Potential Interpol Warrant: Report

Bitfarms stock dips despite $110m acquisition

Police Arrest Four Teens Over Amouranth Home Invasion, Attempted Bitcoin Theft

MUBARAK Coin Price Soars 22% Amid This Binance Announcement, What’s Next?

Michael Saylor’s MSTR Purchases 130 Additional BTC

Michael Saylor’s Strategy makes smallest Bitcoin purchase on record

Bitcoin To $10 Million? Experts Predict Explosive Growth By 2035

Dormant whale sends 300 BTC to FalconX as Bitcoin nears $84k CME gap

Bitcoin Flashing Bullish Reversal Signal Amid Waning Sell-Pressure, According to Crypto Strategist

Bitcoin Price Mirrors Gold’s 1970 Rally – A Six-Figure BTC Target of $250k Next?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x