Bitcoin Magazine Pro

The Truth About Bitcoin Price Models: Stock-to-Flow, Power Law, and Beyond

Published

5 months agoon

By

admin

Predicting Bitcoin’s price has always been a hot topic for investors. Matt Crosby, lead market analyst at Bitcoin Magazine Pro, explores this topic in his recent video, “Truth About Bitcoin Stock To Flow, Power Law & Price Models“. Here, we break down Crosby’s key insights to help investors enhance their Bitcoin strategies.

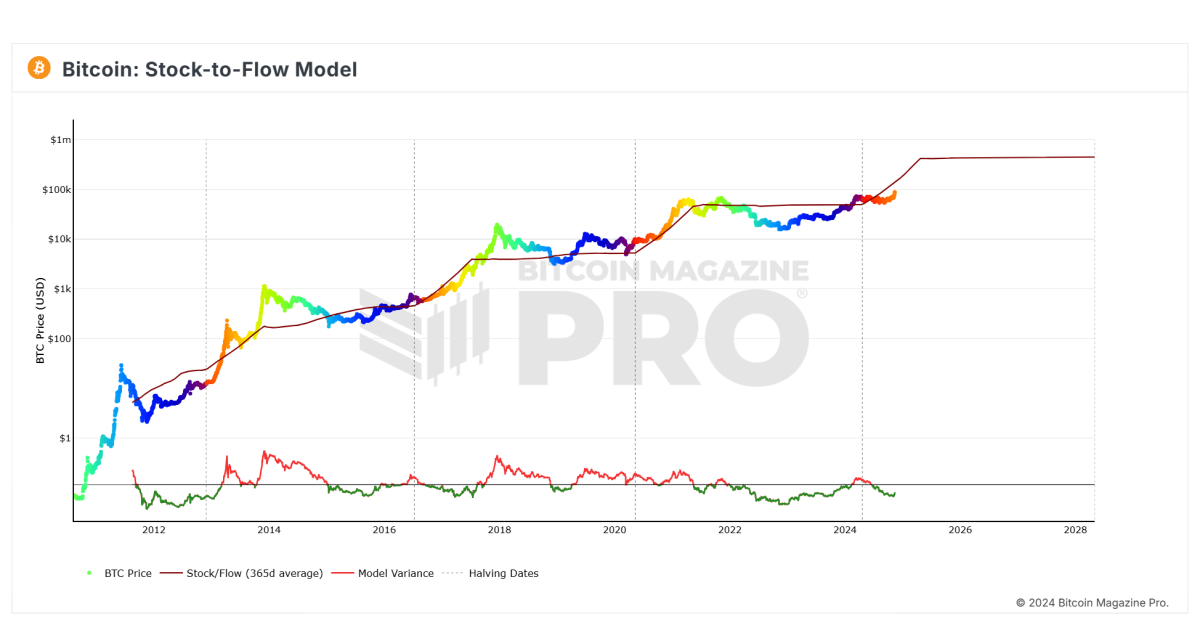

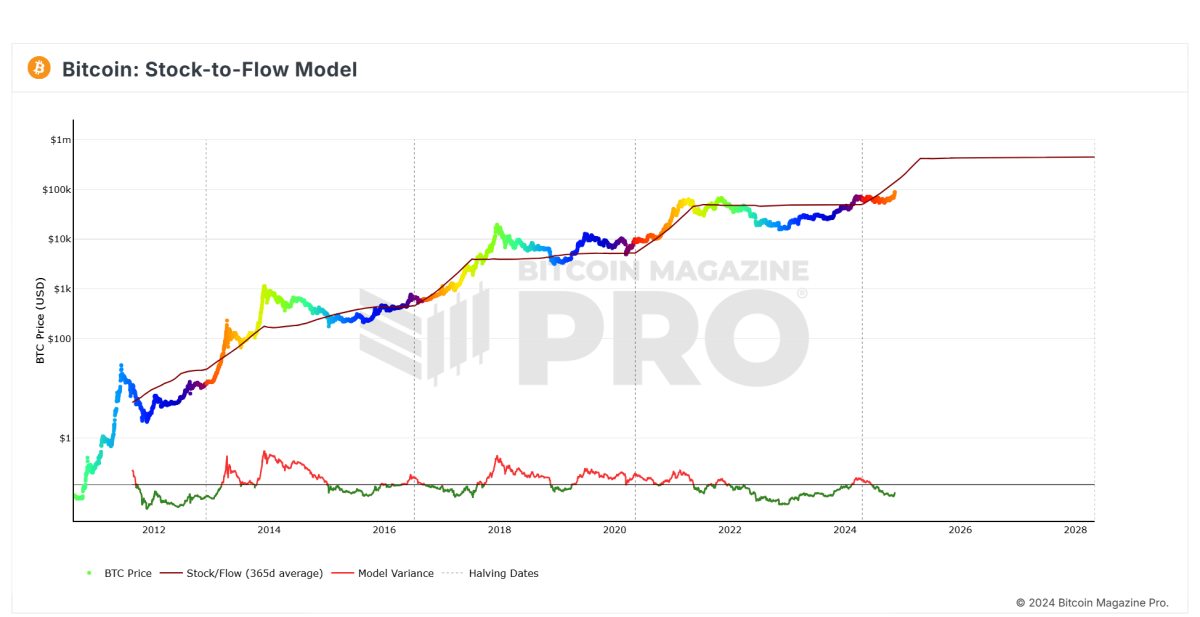

Stock-to-Flow (S2F): A Useful Tool, Not a Crystal Ball

The Stock-to-Flow (S2F) model is one of the most popular ways to predict Bitcoin prices, and Crosby explains its benefits and drawbacks clearly.

Key Takeaways:

- What Is S2F? S2F assesses Bitcoin’s scarcity by comparing the “stock” (current supply) to the “flow” (newly mined coins), similar to how rare commodities like gold are evaluated.

- Updated Predictions: The Cross-Asset S2F model initially forecasted Bitcoin hitting $288,000 between 2020 and 2024. More recently, it suggested a possible valuation of $420,000 by April 2025.

- Limitations: S2F works until unexpected events—like global economic changes—disrupt Bitcoin’s usual patterns. Crosby aptly points out, “S2F works until it doesn’t.”

While S2F is a helpful guide, it’s essential for investors to consider broader market conditions and macroeconomic influences alongside it.

Bitcoin Power Law: The Long-Term View

Crosby also explores the Bitcoin Power Law, a model that uses a log-log chart to illustrate Bitcoin’s historical price patterns.

Why It Matters:

- Logarithmic Scaling: By using logarithmic scaling, the Power Law highlights Bitcoin’s long-term trend of reduced volatility and moderated growth.

- Limitations: This model offers insights for the long haul but is less helpful for short-term predictions or market surprises.

For investors aiming to diversify their portfolios and strategically time their investments, the Power Law provides context but should be used with other, more dynamic tools.

Real-Time Metrics: The Key to Adaptability

Crosby emphasizes the limits of static models like S2F and the Power Law, advocating for real-time, data-driven approaches instead.

Tools Investors Should Use:

- MVRV Z-Score: Measures market cap against realized cap, identifying when Bitcoin is overvalued or undervalued.

- SOPR (Spent Output Profit Ratio): Provides insights into market sentiment by tracking profit-taking behavior.

- On-Chain Metrics: Metrics like Bitcoin’s realized price and value-days-destroyed help detect market turning points.

These metrics give investors the tools to adapt their strategies to the market’s behavior in real-time rather than relying solely on predictions.

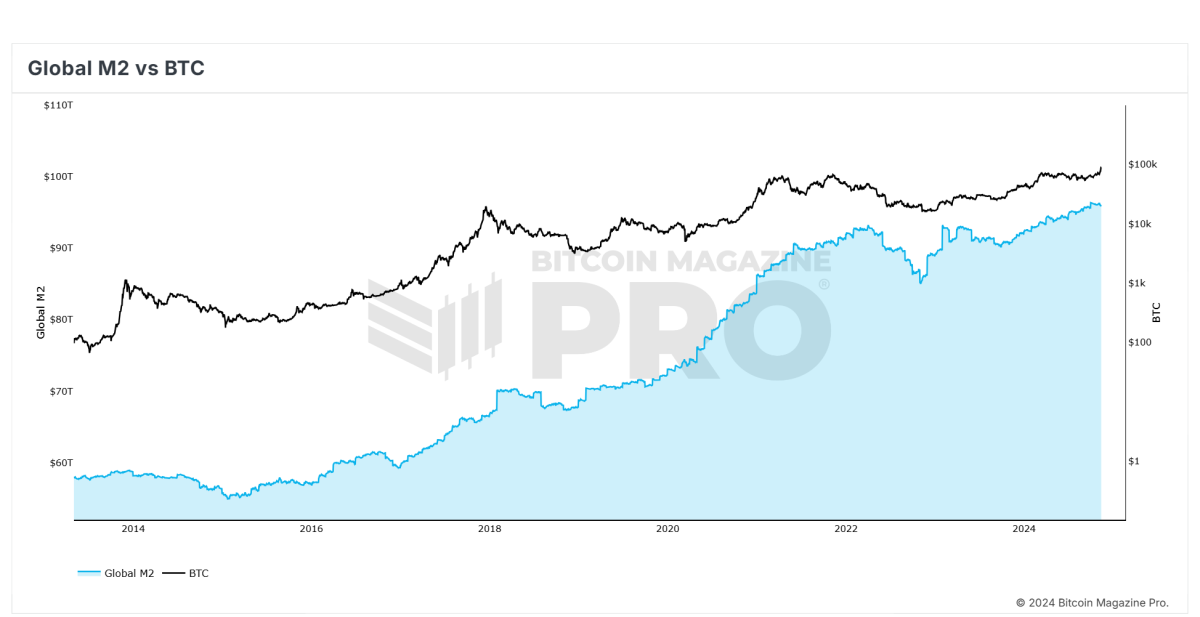

Why External Factors Matter

Crosby cautions against relying only on Bitcoin-specific data, emphasizing the importance of external factors:

- Global Liquidity: Bitcoin’s price often moves with global liquidity cycles, making macroeconomic awareness crucial.

- Institutional Adoption: Actions by major players such as sovereign wealth funds, corporate treasuries, or institutional asset managers can greatly influence Bitcoin’s price.

- Regulatory Changes: Government decisions to regulate or adopt Bitcoin can significantly affect its valuation.

Incorporating both macroeconomic factors and Bitcoin-specific metrics is key for a well-rounded analysis.

Final Thoughts: Stay Pragmatic

Crosby concludes by reminding investors that no single model can predict Bitcoin’s price with certainty. Instead, these tools should be used to provide structure and insight into an unpredictable asset.

Practical Tips for Investors:

- Use Multiple Models: Cross-check predictions using different models to gain a clearer understanding of the market.

- Embrace Real-Time Data: Rely on metrics like MVRV Z-score and SOPR for timely, actionable insights.

- Adapt to Change: Be ready to adjust strategies based on both internal data and external influences.

Bitcoin Magazine Pro offers advanced analytics and real-time data to help investors navigate this fast-paced market. To dive deeper into Crosby’s insights, watch the full video here: Truth About Bitcoin Stock To Flow, Power Law & Price Models.

Source link

You may like

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

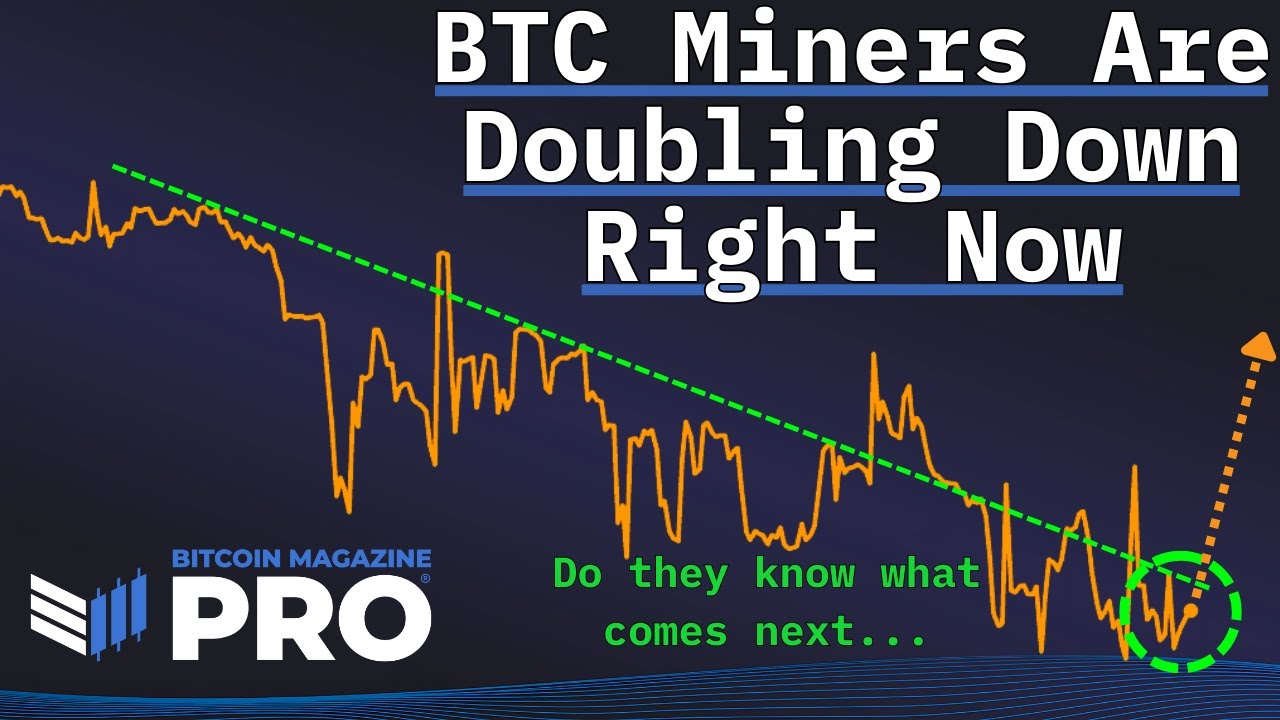

With all the current bearish sentiment and macroeconomic uncertainty swirling around both Bitcoin and the broader global economy, it might come as a surprise to see miners as bullish as ever. In this article, we’ll unpack the data that suggests Bitcoin miners are not just staying the course, they’re accelerating, doubling down at a time when many are pulling back. What exactly do they know that the broader market might be missing?

For a more in-depth look into this topic, check out a recent YouTube video here:

Why Bitcoin Miners Are Doubling Down Right Now

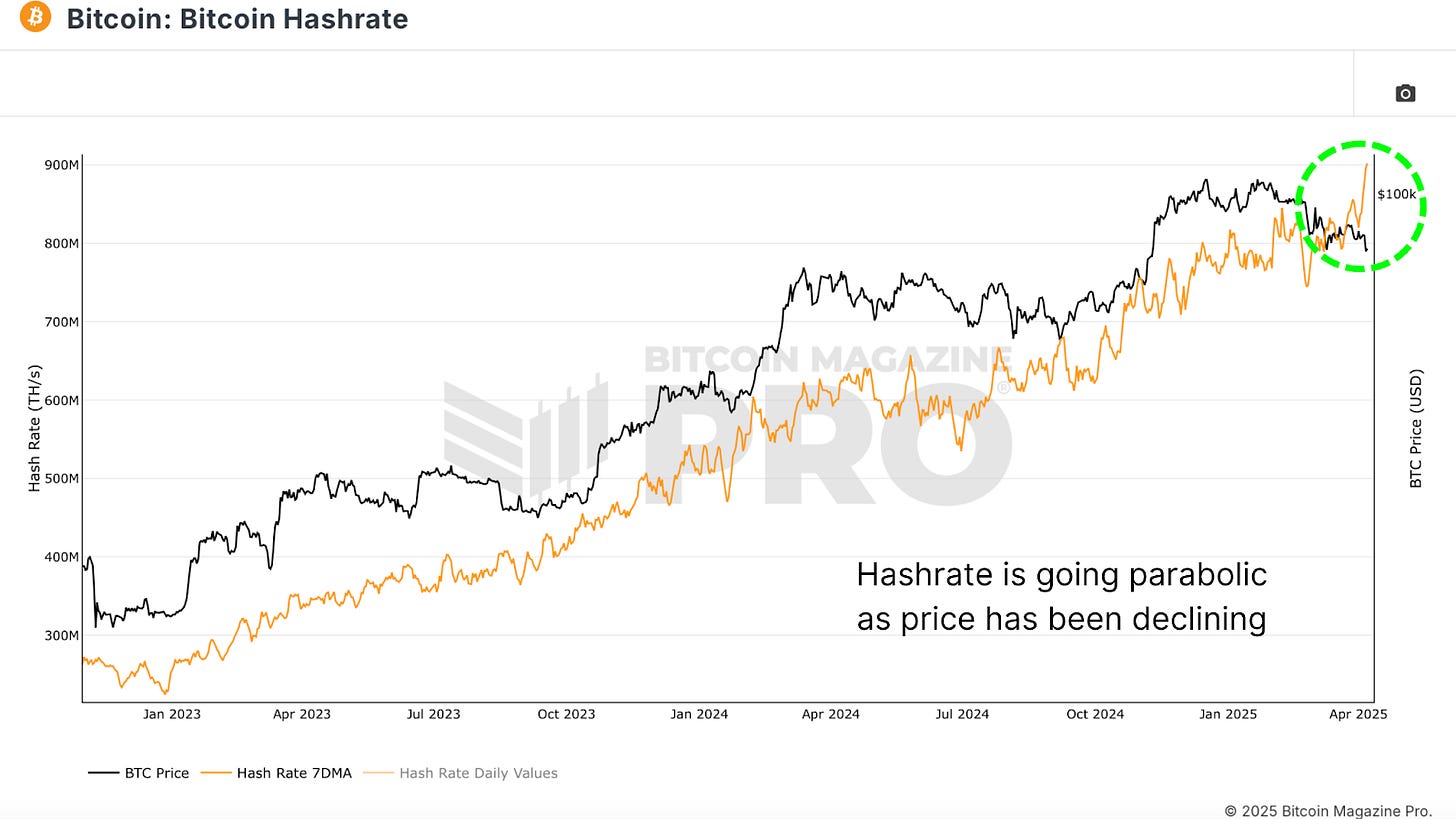

Bitcoin Hash Rate Going Parabolic

Despite Bitcoin’s recent price underperformance, the Bitcoin Hashrate has been going absolutely vertical, breaking all-time highs with seemingly no regard for macro headwinds or sluggish price action. Typically, hash rate is tightly correlated with BTC price; when price drops sharply or remains stagnant, hash rate tends to plateau or decline due to economic pressure on miners.

Yet now, in the face of heightened global tariffs, economic slowdown, and a consolidating BTC price, hash rate is accelerating. Historically, this level of divergence between hash rate and price has been rare and often significant.

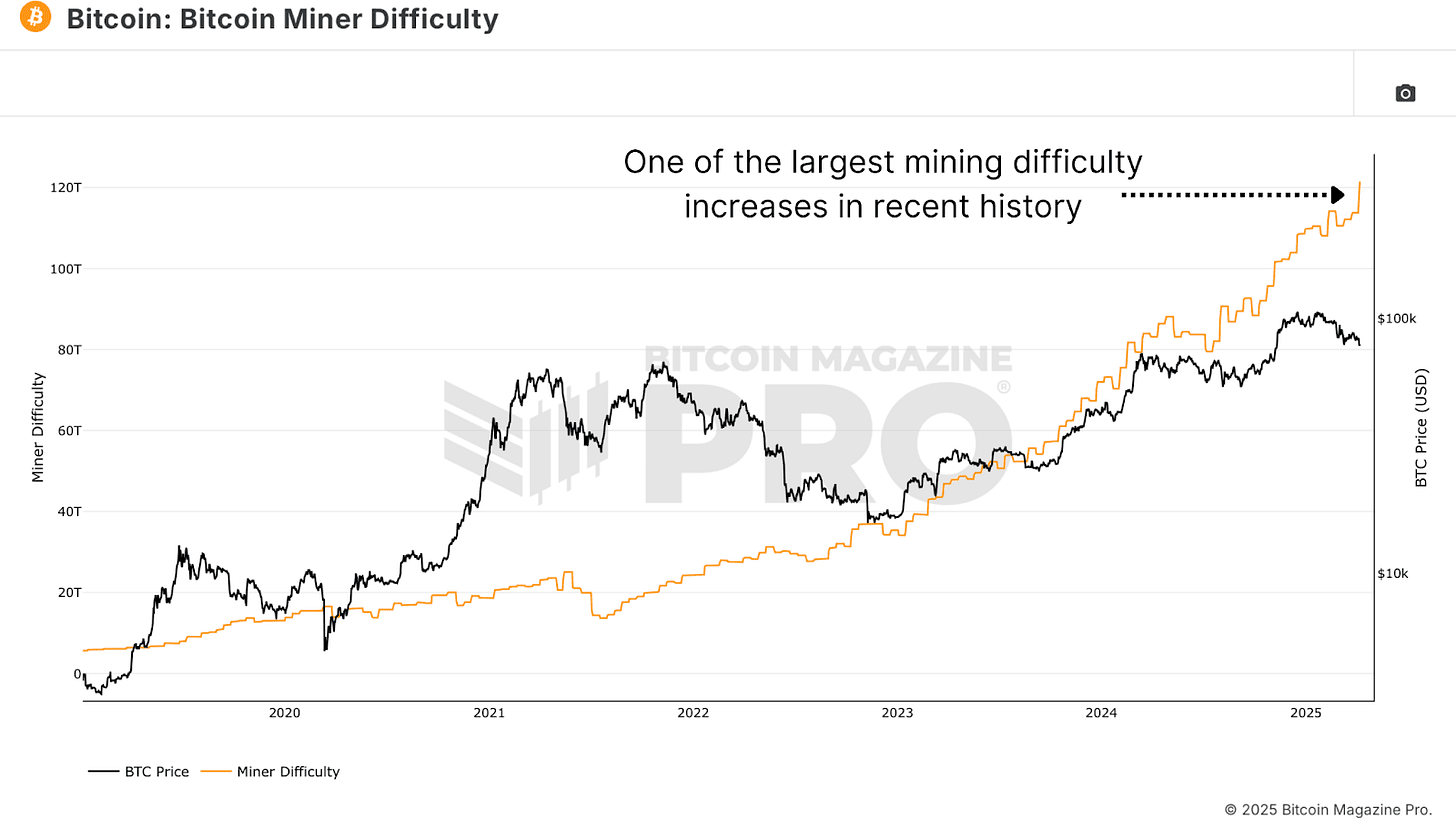

Bitcoin Miner Difficulty, a close cousin to hash rate, just saw one of its largest single adjustments upward in history. This metric, which auto-adjusts to keep Bitcoin’s block timing consistent, only increases when more computational power floods the network. A difficulty spike of this magnitude, especially when paired with poor price performance, is nearly unprecedented.

Again, this suggests that miners are investing heavily in infrastructure and resources, even when BTC price does not appear to support the decision in the short term.

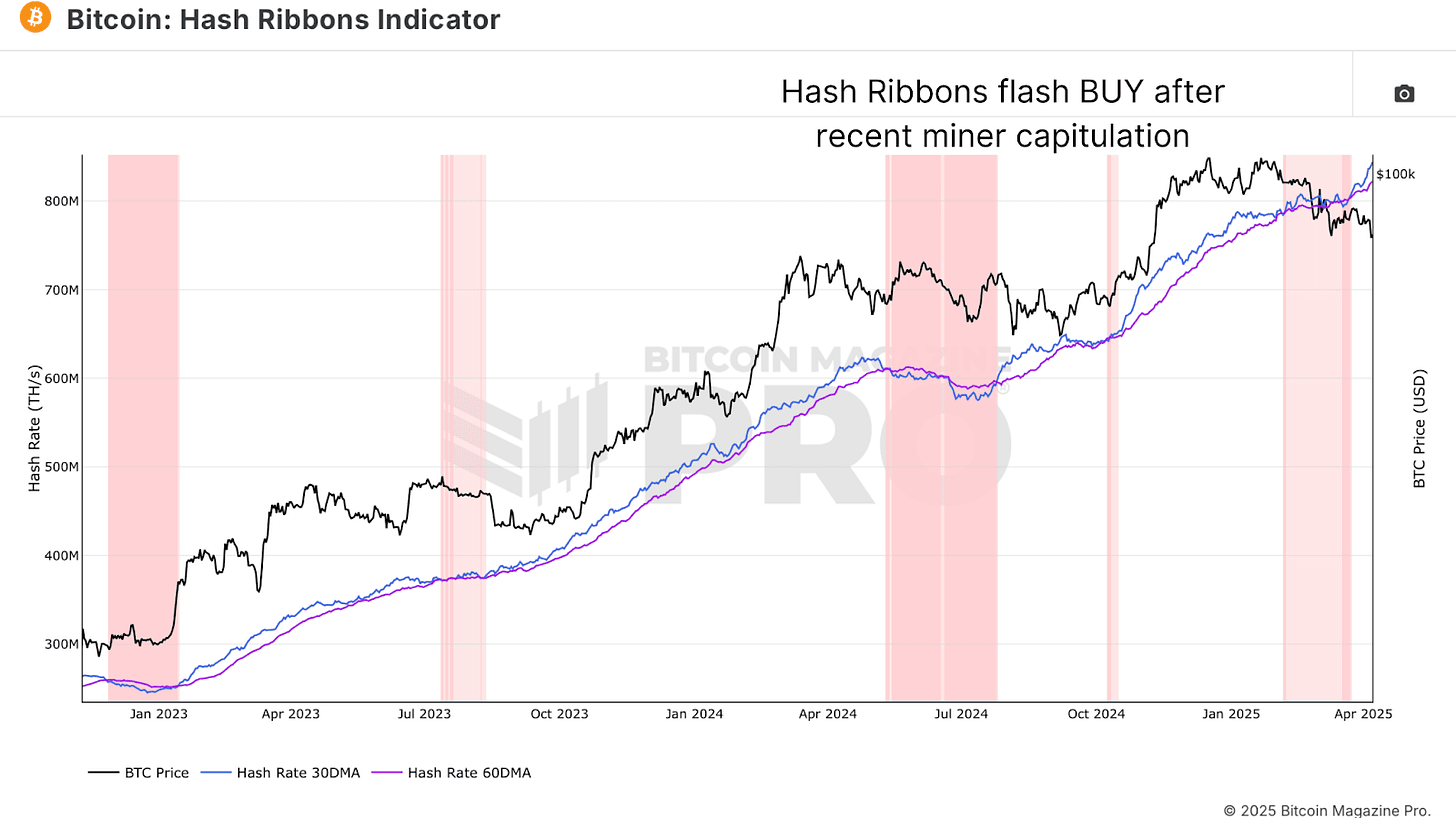

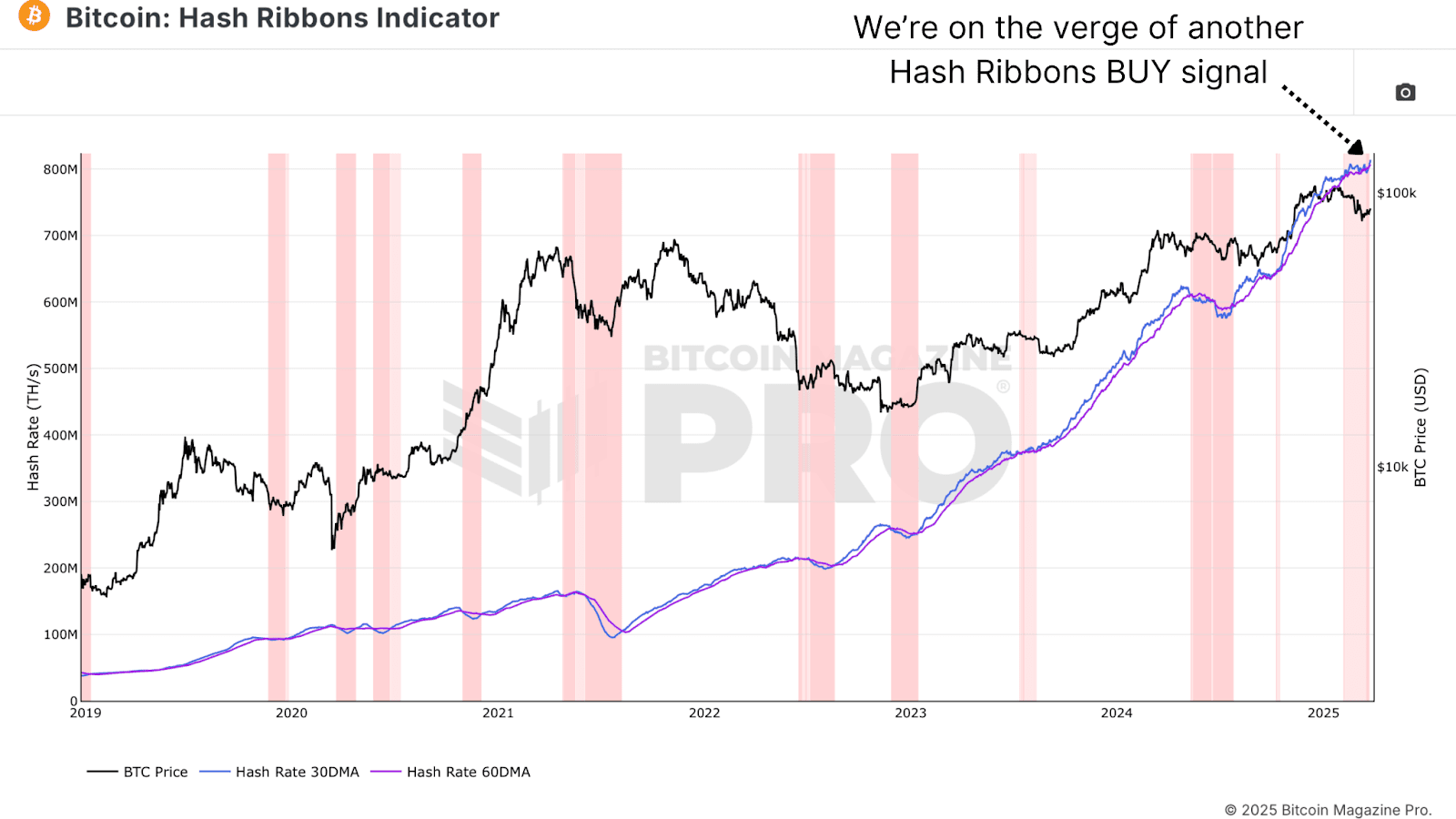

Adding further intrigue, the Hash Ribbons Indicator, a blend of short and long-term hash rate moving averages, recently flashed a classic Bitcoin buy signal.

When the 30-day moving average (blue line) crosses back above the 60-day (purple line), it signals the end of miner capitulation and the beginning of renewed miner strength. Visually, the background of the chart shifts from red to white when this crossover occurs. This has often marked powerful inflection points for BTC price.

What’s striking this time around is how aggressively the 30-day moving average is surging away from the 60-day. This is not just a modest recovery, it’s a statement from miners that they are betting heavily on the future.

The Tariff Factor

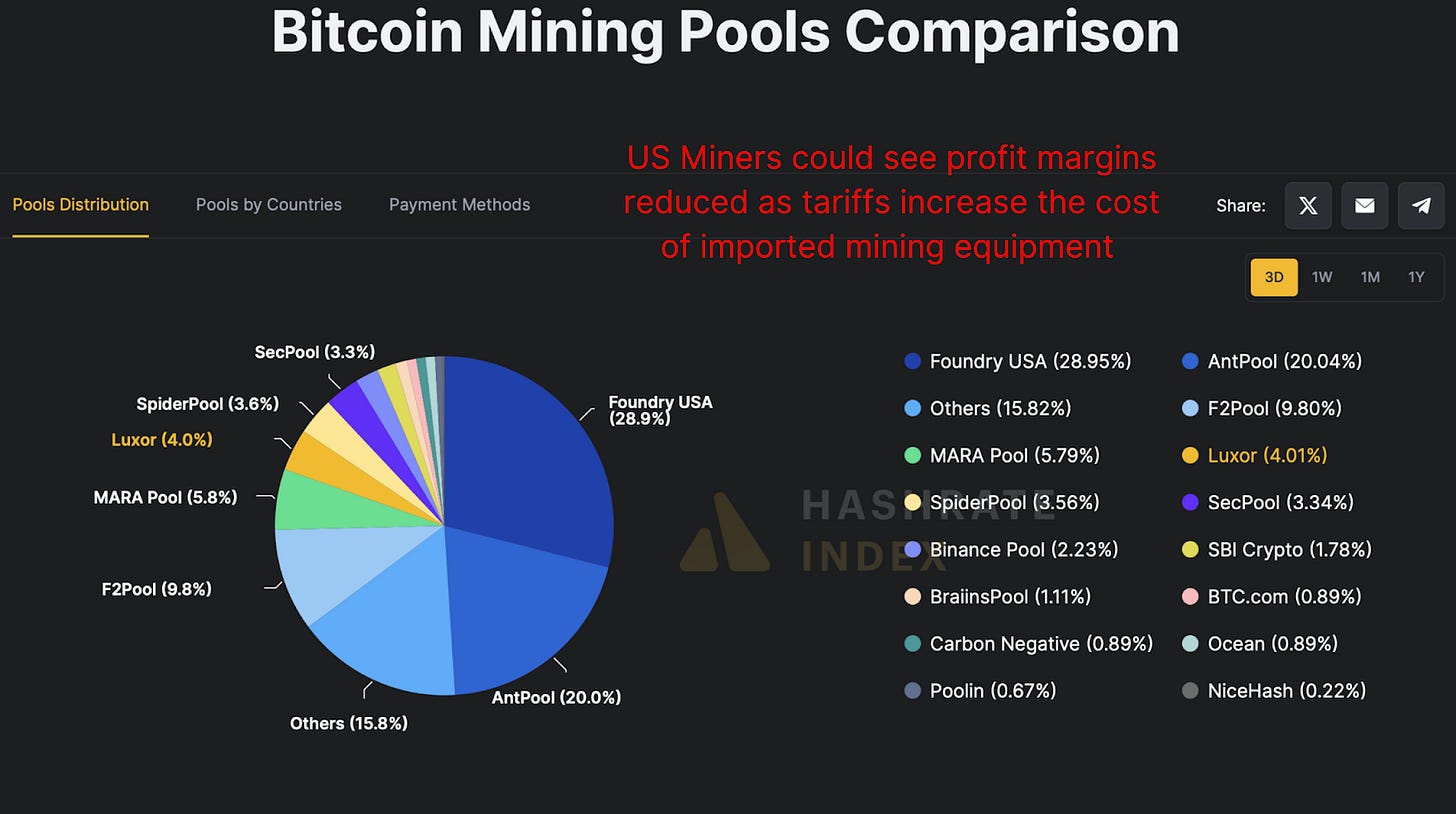

So, what’s fueling this miner frenzy? One plausible explanation is that miners, especially U.S.-based ones, are trying to front-run the impact of looming tariffs. Bitmain, the dominant producer of mining equipment, is now in the crosshairs of trade policies that could see equipment prices surge by 30–50%, potentially to even over 100%!

Given that over 40% of Bitcoin’s hash rate is controlled by U.S.-based pools like Foundry USA, Mara Pool, and Luxor, any cost increase would drastically reduce profit margins. Miners may be aggressively scaling now while hardware is still (relatively) cheap and available.

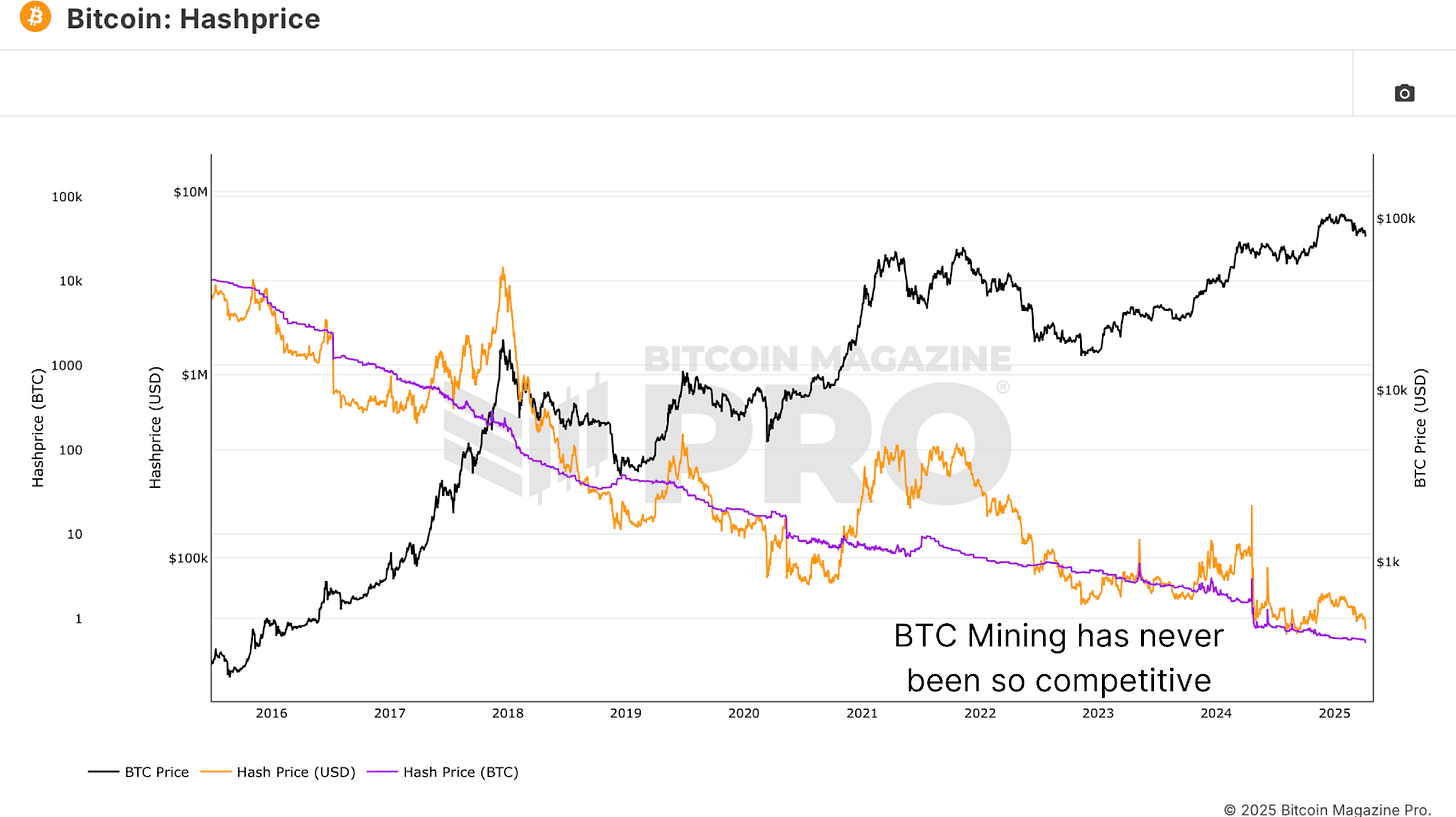

Bitcoin Miners Keep Mining

Hashprice, the BTC-denominated revenue per terahash of computational power, is at historical lows. In other words, it’s never been less profitable in BTC terms to operate a Bitcoin miner on a per-terahash basis. Typically, we see hash price increase toward the tail-end of bear markets, as competition fades and weaker players exit the space.

But that’s not happening here. Despite terrible profitability, miners are not only staying online, they’re deploying more hash power. This could imply one of two things; either miners are racing against deteriorating margins to front-load BTC accumulation, or, more optimistically, they have strong conviction in Bitcoin’s future profitability and are buying the dip aggressively.

Bitcoin Miners Conclusion

So, what’s really happening? Either miners are desperately front-running hardware costs, or, more likely, they’re signaling one of the strongest collective votes of confidence in the future of Bitcoin we’ve seen in recent memory. We’ll continue tracking these metrics in future updates to see whether this miner conviction is proven right.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Bitcoin

This Easy Bitcoin ETF Flow Strategy Beats Buy And Hold By 40%

Published

2 weeks agoon

April 5, 2025By

admin

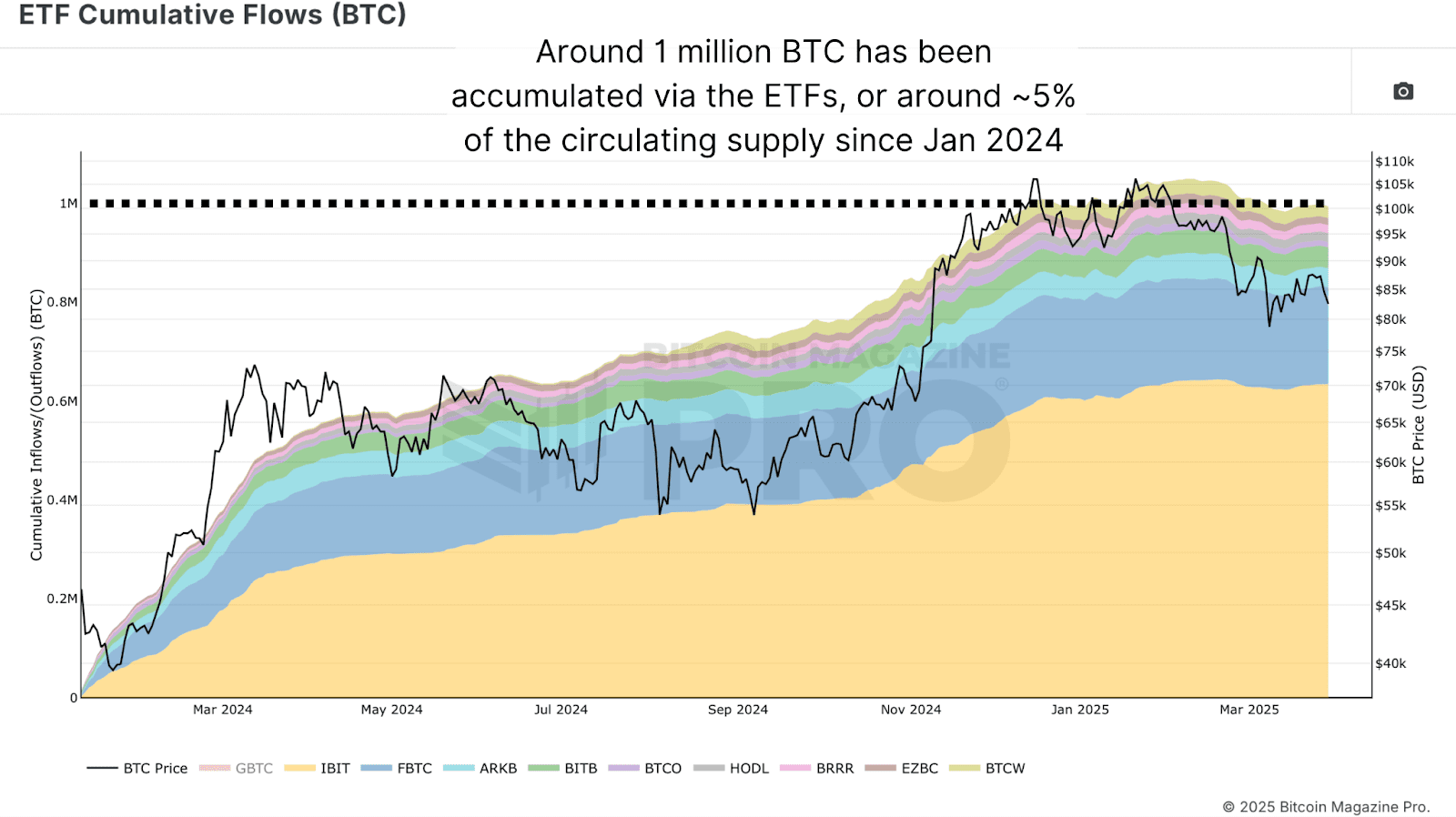

Bitcoin has seen an institutional capital influx on a scale previously unfathomable. Billions of dollars are flowing into Bitcoin ETFs, reshaping the liquidity landscape, inflow-outflow dynamics, and investor psychology. While many interpret this movement as smart money executing complex strategies backed by proprietary analytics, a surprising reality surfaces: outperforming the institutions might not be as difficult as it seems.

For a more in-depth look into this topic, check out a recent YouTube video here:

Outperforming Bitcoin – Invest Like Institutions

Canary In The Bitcoin Coal Mine

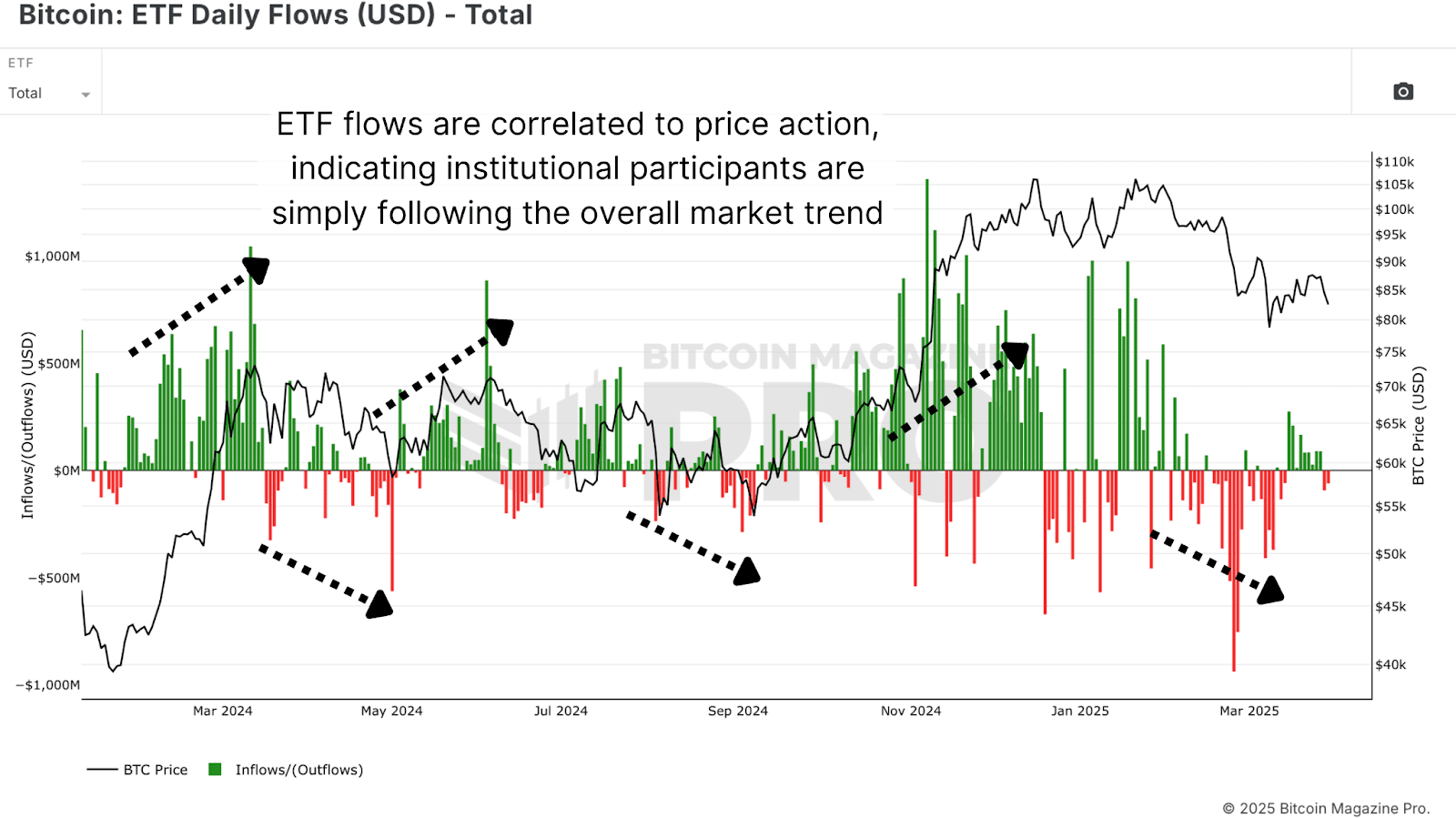

One of the most revealing datasets available today is daily Bitcoin ETF flow data. These flows, denoted in USD, offer direct insight into how much capital is entering or exiting the Bitcoin ETF ecosystem on any given day. This data has a startlingly consistent relationship with short to mid-term price action.

Importantly, while these flows do impact price, they are not the primary movers of a multi-trillion-dollar market. Instead, ETF activity functions more like a mirror for broad market sentiment, especially as retail traders dominate volume during trend inflections.

Surprisingly Simple

The average retail investor often feels outmatched, overwhelmed by the data, and disconnected from the tactical finesse institutions supposedly wield. But institutional strategies are often simple trend-following mechanisms that can be emulated and even surpassed with disciplined execution and proper risk framing:

Strategy Rules:

- Buy when ETF flows are positive for the day.

- Sell when ETF flows turn negative.

- Execute each trade at daily close, using 100% portfolio allocation for clarity.

- No complex TA, no trendlines, just follow the flows.

This system was tested using Bitcoin Magazine Pro’s ETF data starting from January 2024. The base assumption was a first entry on Jan 11, 2024, at ~$46,434 with subsequent trades dictated by flow changes.

Performance vs. Buy-and-Hold

Backtesting this basic ruleset yielded a return of 118.5% as of the end of March 2025. By contrast, a pure buy-and-hold position over the same period yielded 81.7%, a respectable return, but a near 40% underperformance relative to this proposed Bitcoin ETF strategy.

Importantly, this strategy limits drawdowns by reducing exposure during downtrends, days marked by institutional exits. The compounding benefit of avoiding steep losses, more than catching absolute tops or bottoms, is what drives outperformance.

Institutional Behavior

The prevailing myth is that institutional players operate on superior insight. In reality, the majority of Bitcoin ETF inflows and outflows are trend-confirming, not predictive. Institutions are risk-managed, highly regulated entities; they’re often the last to enter and the first to exit based on trend and compliance cycles.

What this means is that institutional trades tend to reinforce existing price momentum, not lead it. This reinforces the validity of using ETF flows as a proxy signal. When ETFs buy, they’re confirming a directional shift that is already unfolding, allowing the retail investor to “surf the wave” of their capital inflow.

Conclusion

The past year has proven that beating Bitcoin’s buy-and-hold strategy, one of the toughest benchmarks in financial history, is not impossible. It requires neither leverage nor complex modeling. Instead, by aligning oneself with institutional positioning, retail investors can benefit from market structure shifts without the burden of prediction.

This doesn’t mean the strategy will work forever. But as long as institutions continue to influence price through these large, visible flow mechanics, there is an edge to be gained in simply following the money.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

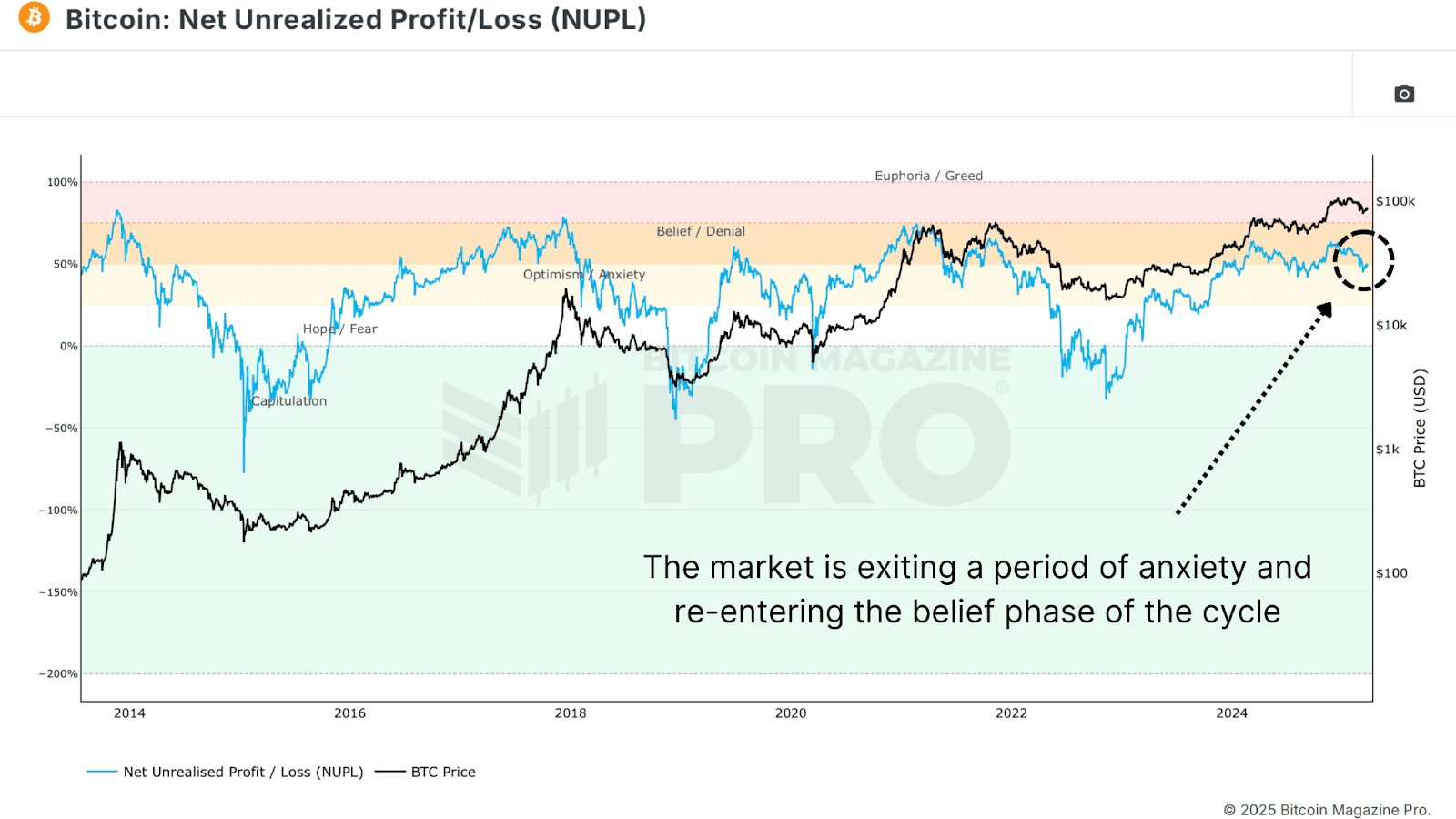

Following a sharp multi-week selloff that dragged Bitcoin from above $100,000 to below $80,000, the recent price bounce has traders debating whether the Bitcoin bull market is truly back on track or if this is merely a bear market rally before the next macro leg higher.

Bitcoin’s Local Bottom or Bull Market Pause?

Bitcoin’s latest correction was deep enough to rattle confidence, but shallow enough to maintain macro trend structure. Price seems to have set a local bottom between $76K–$77K, and several reliable metrics are beginning to solidify the local lows and point towards further upside.

The Net Unrealized Profit and Loss (NUPL) is one of the most reliable sentiment gauges across Bitcoin cycles. As price fell, NUPL dropped into “Anxiety” territory, but following the rebound, NUPL has now reclaimed the “Belief” zone, a critical sentiment transition historically seen at macro higher lows.

The Value Days Destroyed (VDD) Multiple weighs BTC spending by both coin age and transaction size, and compares the data to a previous yearly average, giving insight into long term holder behavior. Current readings have reset to low levels, suggesting that large, aged coins are not being moved. This is a clear signal of conviction from smart money. Similar dynamics preceded major price rallies in both the 2016/17 and 2020/21 bull cycles.

Bitcoin Long-Term Holders Boost Bull Market

We’re also now seeing the Long Term Holder Supply beginning to climb. After profit-taking above $100K, long-term participants are now re-accumulating at lower levels. Historically, these phases of accumulation have set the foundation for supply squeezes and subsequent parabolic price action.

Bitcoin Hash Ribbons Signal Bull Market Cross

The Hash Ribbons Indicator has just completed a bullish crossover, where the short-term hash rate trend moves above the longer-term average. This signal has historically aligned with bottoms and trend reversals. Given that miner behavior tends to reflect profitability expectations, this cross suggests miners are now confident in higher prices ahead.

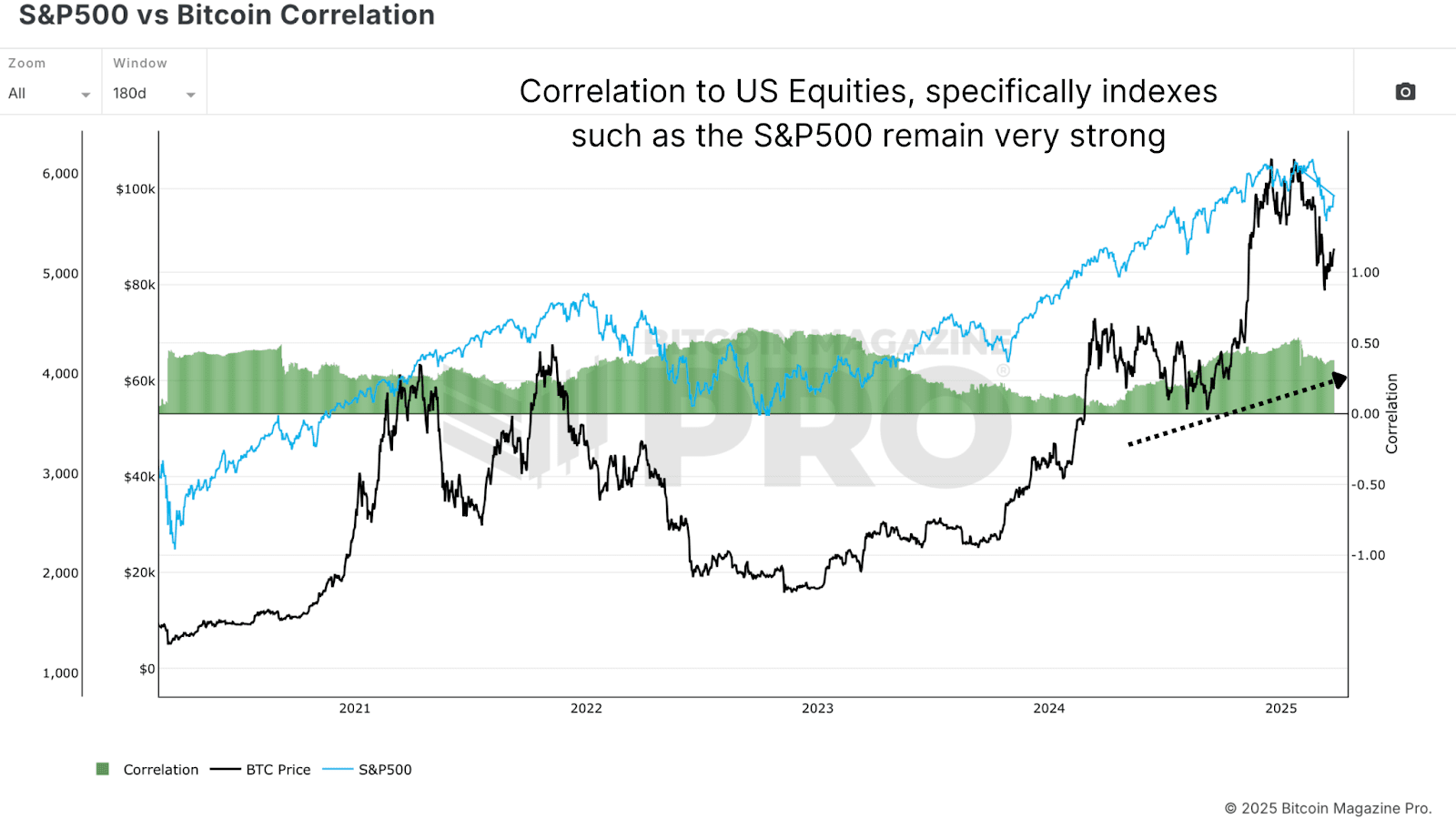

Bitcoin Bull Market Tied to Stocks

Despite bullish on-chain data, Bitcoin remains closely tied to macro liquidity trends and equity markets, particularly the S&P 500. As long as that correlation holds, BTC will be partially at the mercy of global monetary policy, risk sentiment, and liquidity flows. While rate cut expectations have helped risk assets bounce, any sharp reversal could cause renewed choppiness for Bitcoin.

Bitcoin Bull Market Outlook

From a data-driven perspective, Bitcoin looks increasingly well-positioned for a sustained continuation of its bull cycle. On-chain metrics paint a compelling picture of resilience for the Bitcoin bull market. The Net Unrealized Profit and Loss (NUPL) has shifted from “Anxiety” during the dip to the “Belief” zone after the rebound—a transition often seen at macro higher lows. Similarly, the Value Days Destroyed (VDD) Multiple has reset to levels signaling conviction among long-term holders, echoing patterns before Bitcoin’s rallies in 2016/17 and 2020/21. These metrics point to structural strength, bolstered by long-term holders aggressively accumulating supply below $80,000.

Further supporting this, the Hash Ribbons indicator’s recent bullish crossover reflects growing miner confidence in Bitcoin’s profitability, a reliable sign of trend reversals historically. This accumulation phase suggests the Bitcoin bull market may be gearing up for a supply squeeze, a dynamic that has fueled parabolic moves before. The data collectively highlights resilience, not weakness, as long-term holders seize the dip as an opportunity. Yet, this strength hinges on more than just on-chain signals—external factors will play a critical role in what comes next.

However, macro conditions still warrant caution, as the Bitcoin bull market doesn’t operate in isolation. Bull markets take time to build momentum, often needing steady accumulation and favorable conditions to ignite the next leg higher. While the local bottom between $76K–$77K seems to hold, the path forward won’t likely feature vertical candles of peak euphoria yet. Bitcoin’s tie to the S&P 500 and global liquidity trends means volatility could emerge from shifts in monetary policy or risk sentiment.

For example, while rate cut expectations have lifted risk assets, an abrupt reversal—perhaps from inflation spikes or geopolitical shocks—could test Bitcoin’s stability. Thus, even with on-chain data signaling a robust setup, the next phase of the Bitcoin bull market will likely unfold in measured steps. Traders anticipating a return to six-figure prices will need patience as the market builds its foundation.

If you’re interested in more in-depth analysis and real-time data, consider checking out Bitcoin Magazine Pro for valuable insights into the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before making any investment decisions.

Source link

Apple Delists 14 Crypto Apps in South Korea Including KuCoin and MEXC Exchanges Amid Regulatory Crackdown

Athens Exchange Group eyes first onchain order book via Sui

Futureverse Acquires Candy Digital, Taps DC Comics and Netflix IP to Boost Metaverse Strategy

Court Grants Ripple And SEC’s Joint Motion To Suspend Appeal

AVAX Falls 2.1% as Nearly All Assets Trade Lower

What is a VTuber, and how do you become one in 2025?

Top Expert’s Update Sets $10 Target

How Academia Interacts With The Bitcoin Ecosystem

AB DAO and Bitget Launch Dual Reward Campaign, Distributing $2.6M Worth of $AB Globally

AI crypto tokens at risk as Nvidia faces restrictions on China exports

Coinbase Urges Australia to Vote for Crypto Progress in May

How High Would Pi Network Price Go If Pi Coin Adopts Transparency to Avoid Mantra Pitfalls

XRP’s ‘Rising Wedge’ Breakdown Puts Focus on $1.6 Price Support

China selling seized crypto to top up coffers as economy slows: Report

Ethereum Price Dips Again—Time to Panic or Opportunity to Buy?

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Altcoins3 months ago

Altcoins3 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x