Eric Trump

They Didn't Take The Orange Pill, They Threw It Out

Published

1 month agoon

By

admin

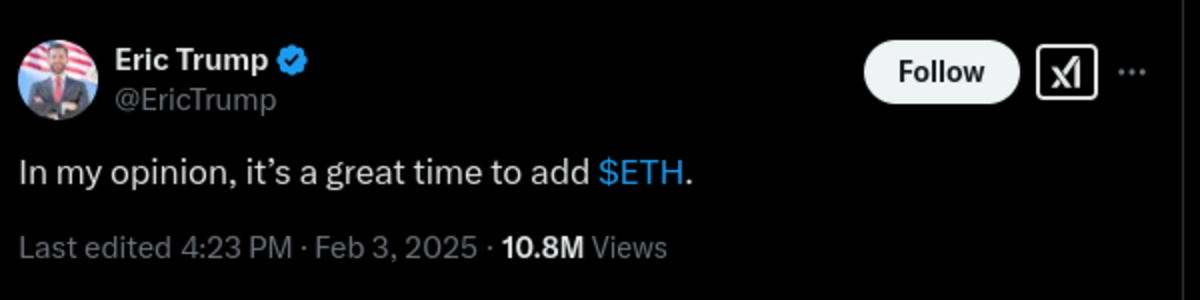

The son of the current President two days ago on Twitter told people it’s time to add Ethereum to their balance sheets. It is mind blowing to see this, given what this cycle represents for Ethereum.

For years people have been predicting the outcome we are seeing play out this cycle. Ethereum’s dominant use case has been as a platform for issuing other assets, and building applications focused on assets other than ether itself. This becoming the dominant use of the network has obvious implications for the necessity of the Ethereum network itself to operate these other applications and assets.

Bitcoiners have consistently pointed this out, and predicted that other cheaper and more centralized networks with the same functionality would eventually obsolete Ethereum, as the chief value proposition of the network in the market has proven not to be Ethereum or ether itself. That is exactly what we see playing out right now with Solana absorbing activity from Ethereum, for everything from memecoins to DEXes now.

This isn’t a new thesis, this isn’t some novel niche idea hidden from the light of day, it is something loudly predicted for half a decade or more. Yet the “orange pilled” son of the President is here publicly stating it’s time to add ETH.

I think this should in a very crystal clear manner demonstrate that none of the Trump family or new administration are “orange pilled” at all. All they have been shown is the opportunity to make money, and they will follow their incentives. That realistically leads to shitcoining.

Shitcoining is the most profitable short-term thing in this space. They will follow the path to easy money. I think this is the cold hard reality that some Bitcoiners don’t want to accept, people are in most cases not better than their incentives. We are not going to have some kind of grand spiritual “Bitcoin awakening” in government. We are just going to see the incentives we’ve watched play out in multiple cycles play out at a larger scale than we ever have before.

What’s amazing to me is how so many Bitcoiners thought sticking our nose into the government would go any other way. We opened the door, and the shit got dragged in behind us.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Polymarket is Over 90% Accurate in Predicting World Events: Research

Bad news Bitcoin bulls, the long-hoped-for retail is already here: CryptoQuant

Leaders In Adoption And Innovation

Trader Issues Urgent XRP Alert, Says the Top-Five Altcoin at Risk of Sharp Correction – Here’s His Target

This coin could see a $10b market cap and double-digit price before SHIB gains its 2021 mojo

Can a Meme Coin Fund the Future of Scientific Research?

Altcoins

Eric Trump’s Ethereum Endorsement Fuels Crypto Buzz

Published

1 month agoon

February 4, 2025By

admin

After momentarily sliding below important support levels, Ethereum (ETH) is once again on the climb. After a significant change in market mood, the second-largest digital asset by market capitalization passed $2,900.

Related Reading

Interestingly, Eric Trump, the son of US President Donald Trump, weighed in on the situation, remarking that it is a strategic opportunity to acquire ETH.

Tariff Pause Sparks Market Rebound

Concerns over possible tariffs on Canada and Mexico rattled the crypto market earlier this week. Both Bitcoin and Ethereum fell significantly; Ethereum dropped momentarily to around $2,360. Still, the temporary suspension of the tariffs by Trump offered a breather, which raised investor confidence in risk assets including cryptocurrency.

In the wake of the announcement, Ethereum experienced a robust recovery, with a nearly 20% increase. Traders interpreted this as an invitation to re-enter the market, and ETH promptly reclaimed the $2,900 mark.

In my opinion, it’s a great time to add $ETH.

— Eric Trump (@EricTrump) February 3, 2025

Eric Trump’s Crypto Endorsement Raises Eyebrows

Eric Trump posted his optimistic view on Ethereum on social media. He first said, “In my opinion, it’s a great time to add $ETH. You can thank me later.” Although the subsequent section of his remarks was deleted, crypto investors saw resonance in his endorsement of Ethereum’s future development.

The Trump family has been progressively involved in the digital asset sector, particularly through their World Liberty Financial platform. This most recent statement serves to emphasize their involvement and potential long-term dedication to blockchain technology.

World Liberty Financial’s Significant Ethereum Transaction

World Liberty Financial recently made a substantial move in the crypto space, which has served to further fuel speculation. The firm transferred over $300 million in assets to Coinbase’s custody platform, according to blockchain analytics firm Spot On Chain. Furthermore, they acquired an additional 1,826 ETH for approximately $5 million and converted nearly 20,000 Lido Staked Ether (stETH) into ETH.

World Liberty Financial (@worldlibertyfi) moved $307.41M in 8 assets to #CoinbasePrime 6 hours ago—as part of treasury management and business operations.

Shortly after, the project unstaked 19,423 $stETH to $ETH and further spent 5M $USDC to buy 1,826 $ETH at $2,738.… https://t.co/Rp9NAFUs5N pic.twitter.com/5bfIvJma7U

— Spot On Chain (@spotonchain) February 4, 2025

These transactions indicate that the company is making preparations for the introduction of its “Earn and Borrow” lending protocol. Although the protocol is still in the process of being developed, the substantial transfers suggest that the platform could soon play a significant role in decentralized finance (DeFi).

Related Reading

Ethereum’s Prospects Still Remain Positive

As institutional interest is rising and the price of the top altcoin has recaptured higher levels, Ether remains a central focus in the crypto market. Macroeconomic changes, strategic investments, and political influence taken together provide an interesting dynamic for ETH’s future course.

Featured image from Gemini Imagen, chart from TradingView

Source link

24/7 Cryptocurrency News

Eric Trump Breaks Silence On $TRUMP Memecoin Amid Criticism and Dumps

Published

2 months agoon

January 19, 2025By

admin

Eric Trump has addressed the ongoing debate surrounding the $TRUMP memecoin, a cryptocurrency launched by President-elect Donald Trump. This follows reports of a whale trader profiting nearly $12 million from trading the token shortly after its release. The launch, which has triggered significant controversy, has drawn responses from financial experts, crypto enthusiasts, and ethics watchdogs.

Eric Trump’s Take on $TRUMP Memecoin

Eric Trump, the son of President-elect Donald Trump, commented on the $TRUMP memecoin’s rapid rise, calling it the “hottest digital meme on earth.” The $TRUMP token, launched late Friday, surged in value within hours, becoming a top trending topic in the cryptocurrency space.

According to CoinGecko, its market capitalization exceeded $5 billion by Saturday afternoon, with trading volumes surpassing $11 billion. The token’s price more than doubled, reaching over $27 within 24 hours of its launch.

The memecoin is owned primarily by CIC Digital LLC, a company tied to Donald Trump, which holds 80% of the token’s supply. With an estimated $20 billion in assets on paper under the current market price, the launch has raised questions about the intersection of Trump’s financial interests and his upcoming presidency.

Peter Schiff, an economist and Bitcoin skeptic, weighed in on the rapid rise of the $TRUMP token. “It took Bitcoin four years to reach a $5 billion market cap. $TRUMP did it in one day,” he wrote on X. Schiff sarcastically suggested creating a strategic reserve for the memecoin and requiring its inclusion in retirement accounts. However, the comments drew mixed reactions, with some dismissing the comparison between Bitcoin and a newly launched meme-based cryptocurrency.

Whale Trader Profits $11.8 Million Amid Market Activity

A significant transaction involving the $TRUMP memecoin occurred hours after its launch, catching the attention of blockchain analysts. A whale trader, who reportedly spent $12 million purchasing 860,895 tokens at $13.94, sold the holdings at $27.67. The transaction resulted in an $11.8 million profit, showcasing the high volatility of the token in its early trading hours.

This development has sparked concerns over the stability of the memecoin and the potential for market manipulation. Critics argue that speculative trading could harm smaller investors entering the market at inflated prices.

Prominent figures, including former White House communications director Anthony Scaramucci, criticized the event. Scaramucci called the launch “an alarming level of corruption,” suggesting it reflects poorly on the broader cryptocurrency industry.

Ethical Concerns Over Presidential Financial Ties

The timing of the $TRUMP memecoin launch has led to ethical questions, as it occurred just days before Donald Trump’s inauguration as president. Historically, presidents-elect have made efforts to distance themselves from business ventures to avoid perceived conflicts of interest. The Trump administration’s direct ties to the cryptocurrency have drawn scrutiny from ethics watchdogs.

Jordan Libowitz of Citizens for Responsibility and Ethics in Washington commented on the situation, stating, “This is a president-elect launching businesses alongside promises to deregulate industries where he stands to profit.” Trump has also faced criticism for promoting cryptocurrency-friendly policies during his campaign, including proposals to overhaul crypto regulations and have the federal government stockpile Bitcoin.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

America

Michael Saylor's Trump Meeting Is Turbo Bullish for Bitcoin

Published

3 months agoon

January 3, 2025By

admin

Last night, President-elect Donald Trump’s son, Eric Trump, posted a photo of himself at Mar-a-Lago with MicroStrategy Executive Chairman Michael Saylor with the caption, “Two friends, one passion: Bitcoin.”

This is so unbelievably bullish — let me explain.

For the last four years, under the Biden-Harris administration with total Democrat control, the U.S. government did their best to terrorize this industry and attack us. The overwhelming majority of the Democrat party did not support Bitcoin and followed Elizabeth Warren’s lead on demonizing the industry and its participants. They weaponized the justice system to arrest Bitcoiners, tried to tax our unrealized gains, stopped pro-Bitcoin legislation from being signed into law, de-banked industry participants via Operation Chokepoint 2.0, refused to support Bitcoin in any meaningful way, and so much more.

They were truly anti-Bitcoin. If Kamala Harris had won the presidential election, their reign of terror on Bitcoin would have continued for at least four more years. But now, the Democrats’ war on Bitcoin in America is finally coming to an end. And a new administration is coming in — and they love Bitcoin.

Donald Trump is not even officially in office yet, and his family is already inviting Michael Saylor to his estate in Mar-a-Lago to discuss Bitcoin further. This isn’t the first time he’s done something like this either, like in 2024 when Trump invited American Bitcoin mining giants there to learn more about the industry and what he needs to do to best support them.

It is important to note that just two weeks ago, Saylor said on Bloomberg that he would be open to advising Donald Trump on Bitcoin. And now with him being at Mar-a-Lago, I think it is safe to speculate that something big might be brewing here.

The Trumps understand Bitcoin and continue to show their support for the asset and industry. Eric Trump recently gave a great speech at the Bitcoin MENA Conference in Abu Dhabi, explaining the characteristics that make Bitcoin an invaluable asset while also sharing his family’s personal experience being de-banked, and how Bitcoin protects individuals from being cancelled. Donald Trump Jr. made an appearance at the Bitcoin 2024 Conference in, along with his father, and showed lots of support for this asset and industry.

Donald Trump has committed to releasing Bitcoiners (Ross Ulbricht) from prison, sign pro-Bitcoin legislation into law, work with the industry to help us thrive, end Operation Chokepoint 2.0, appointed an official Crypto Czar, said “Bitcoin and crypto will skyrocket like never before” under his administration, and so much more.

Even if you’re not a fan of Trump, you have to acknowledge and give him and his family credit for the good work they’re doing to make a regulatory friendly environment for this industry to thrive in. Imagine all this industry can accomplish over the next four years being supported by the President, allowing us the room to innovate and build without fear of being harassed and demonized by our own government. I would say the sky is the limit but it’s even better than that.

Four years is a long time, especially in this industry. Lots can happen during that time and I am incredibly bullish on the future of Bitcoin in America under this incoming Trump administration.

Michael Saylor: "Bitcoin is on the menu at Mar-a-Lago."

AMERICA IS EMBRACING #BITCOIN LIKE NEVER BEFORE

pic.twitter.com/7c2NJG7Kzd

— Nikolaus Hoffman (@NikolausHoff) January 3, 2025

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Polymarket is Over 90% Accurate in Predicting World Events: Research

Bad news Bitcoin bulls, the long-hoped-for retail is already here: CryptoQuant

Top 6 Important Fed Decisions To Know After SEC Drops Ripple Lawsuit Appeal

Leaders In Adoption And Innovation

Trader Issues Urgent XRP Alert, Says the Top-Five Altcoin at Risk of Sharp Correction – Here’s His Target

This coin could see a $10b market cap and double-digit price before SHIB gains its 2021 mojo

Can a Meme Coin Fund the Future of Scientific Research?

Analyst Confirms XRP Price Is Still On Path To $130

Proof-of-Work Crypto Mining Doesn’t Trigger Securities Laws, SEC Says

Crypto campaign donations are democracy at work — former Kraken exec

1 Million Bitcoin In New Whale Hands—A Mega BTC Rally On The Horizon?

Argentina’s Senate Hosts First-Ever Conference On Bitcoin Regulation

Justin Sun Stakes $100,000,000 Worth of Ethereum Amid Calls for ‘Tron Meme Season’

Cardano wallet Lace adds Bitcoin support

Donald Trump Vows to Make America the ‘Undisputed Bitcoin Superpower’

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: