Bitcoin

This Altseason Won’t Be What You Expected, According to CryptoQuant CEO – Here’s Why

Published

5 months agoon

By

admin

The chief executive of blockchain intelligence platform CryptoQuant believes a potential incoming altseason will not be like prior ones for one key reason.

On-chain analyst Ki Young Ju tells his 381,200 followers on the social media platform X that, unlike past cycles, liquidity can no longer flow at the same levels from Bitcoin (BTC) into altcoins, sending them soaring.

The analyst says there is now massive traditional finance participation in Bitcoin, including through spot market BTC exchange-traded funds (ETFs) and increased buying by software company MicroStrategy (MSTR).

“This alt season won’t be what you expected. It’s going to be weird and challenging. Only a chosen few will win the game. Market sentiment is good, but there isn’t much fresh liquidity. Bitcoin is drifting away from the crypto ecosystem. Bitcoin has built its own paper-based layer-2 ecosystem through ETFs, MSTR, funds and more. In this paper-based L2 Bitcoin bridging to other altcoins is impossible.”

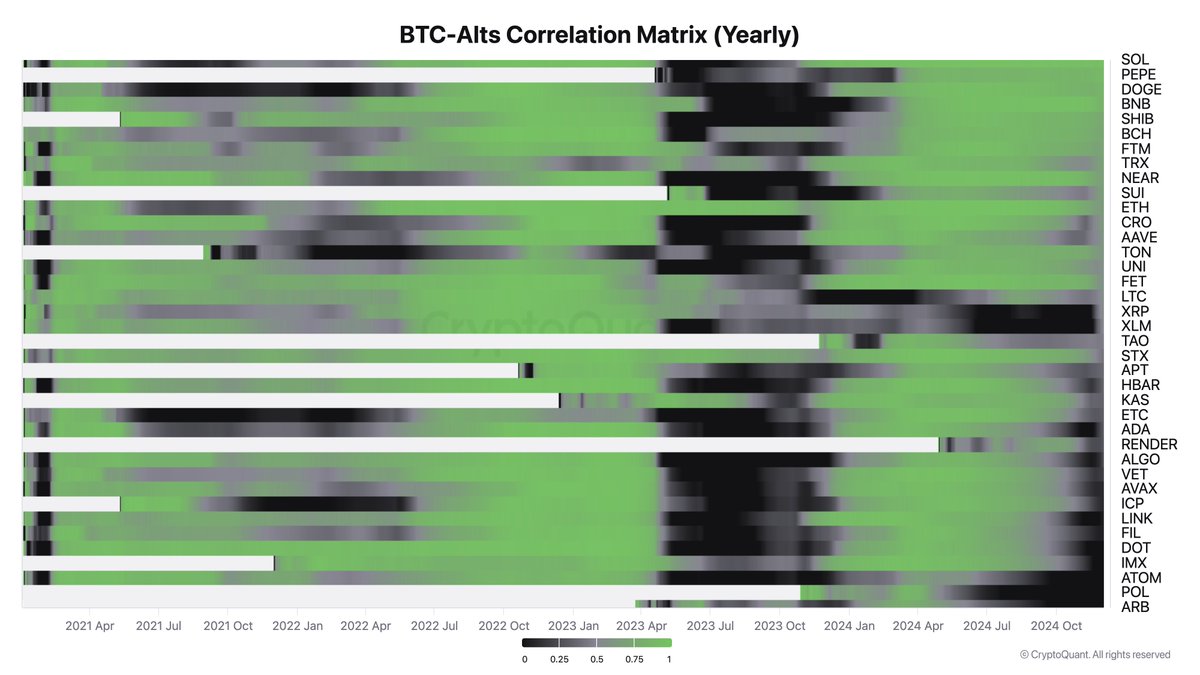

He also shares a chart showing Bitcoin’s price correlation with alts. A score of 1 is the highest correlation, whereas the lowest correlation possible is 0.

“Altcoins used to move together based on their correlation with BTC, but that pattern has now broken. Only a few are starting to show independent trends as they attract new liquidity.”

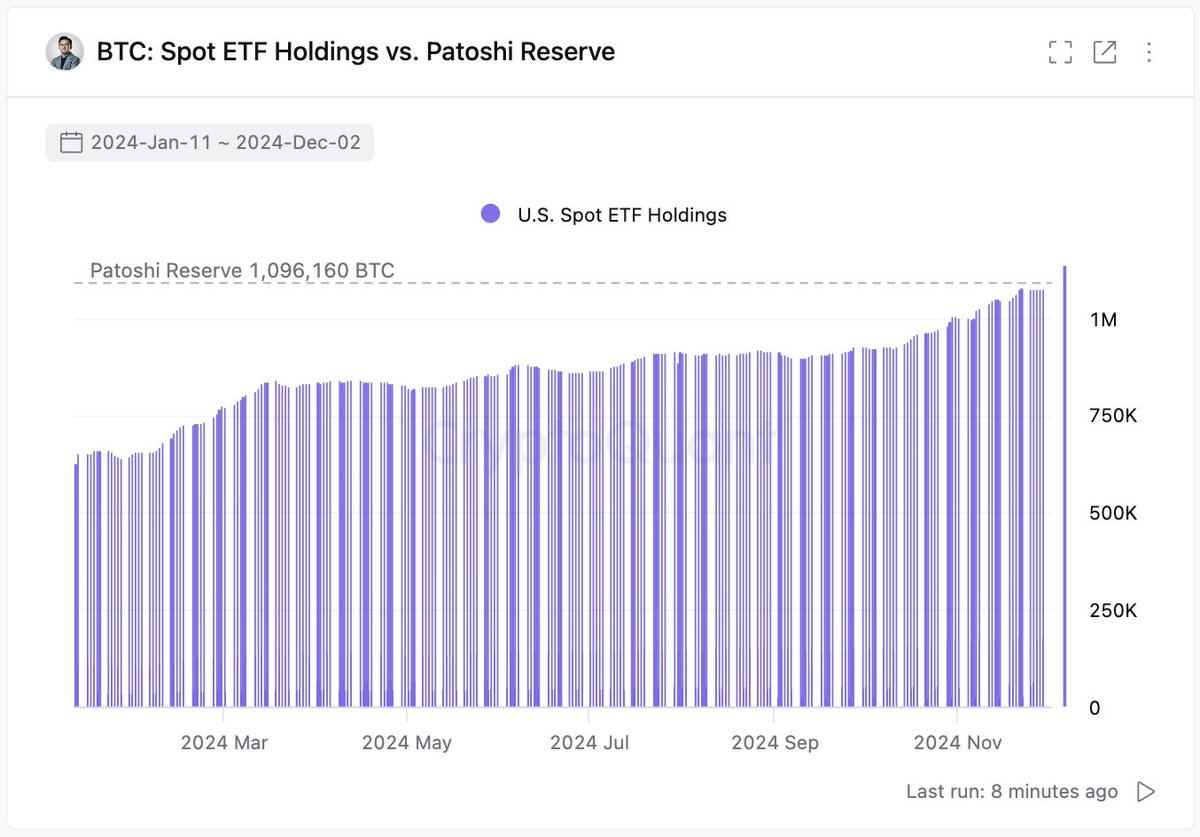

The analyst notes that spot market BTC ETFs have accumulated as much as is believed to have been mined by Bitcoin’s pseudonymous founder Satoshi Nakamoto in the early days of the cryptocurrency’s existence.

“Bitcoin spot ETFs now hold as much BTC as Satoshi Nakamoto (Patoshi).”

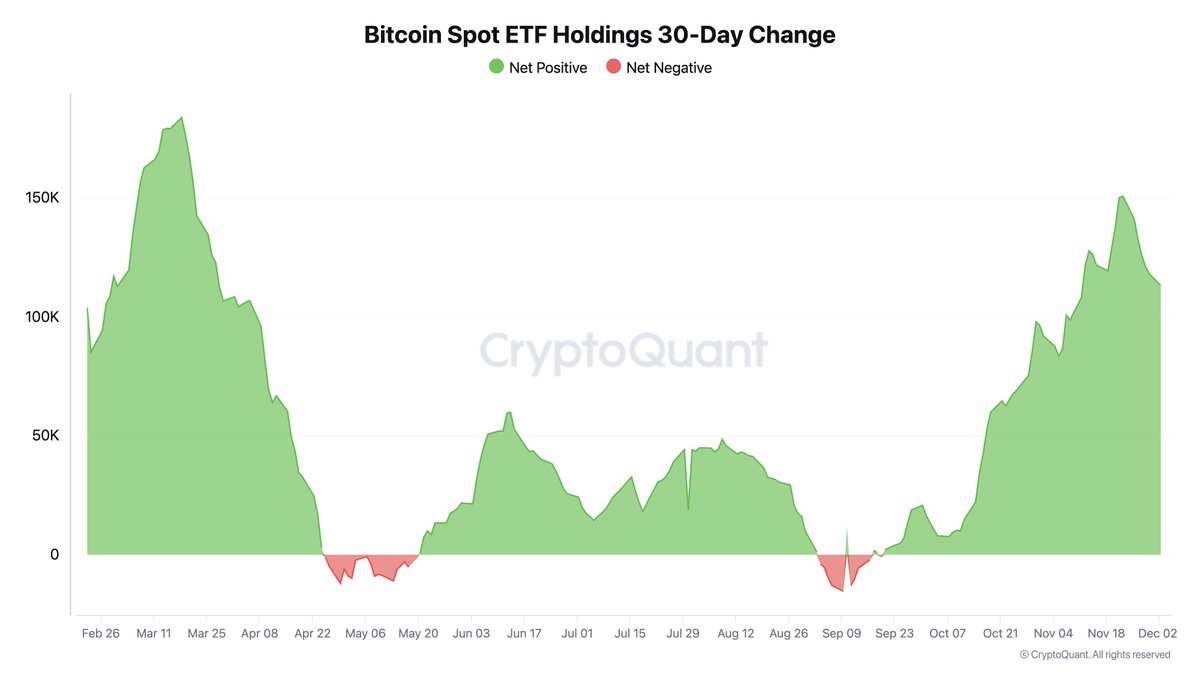

He also says that investor demand for the ETF product is returning to its historical high.

“Bitcoin ETF demand is as strong as at their initial approval this year.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

Bitcoin

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Published

25 minutes agoon

April 28, 2025By

admin

Veteran macro investor Luke Gromen says he likes Bitcoin (BTC) due to its potential to influence demand for US Treasuries.

In a new video update, the founder of the macroeconomic research firm Forest for the Trees (FFTT) says the Trump administration is in a position to boost demand for US bonds after the president signed an executive order creating a Strategic Bitcoin Reserve.

A Bitcoin bull market typically increases demand for dollar-pegged crypto assets, and according to Gromen, could ultimately drive demand for US Treasuries.

“Note that the Trump administration is still talking about putting T-bills (Treasury bills) into stablecoins, using stablecoins as a means to drive demand for T-bills. And obviously, they’ve talked about the Strategic Bitcoin Reserve.

Left unsaid in all of that is that the higher the Bitcoin price, the more stablecoin demand, the more T-bill demand there is…

I think the underlying theme of [the] US government desperately needs balance sheet and stablecoins and therefore Bitcoin can help the US government find balance sheet. I think that is absolutely still in play.

It’s one of the reasons why we still like Bitcoin over the intermediate longer term.”

Stablecoin issuers such as Tether and Circle predominantly rely on Treasury bills to back their coins on a 1:1 basis. As of December 2024, Tether has invested over $94.47 billion in T-bills to back USDT. Meanwhile, Circle owns $22.047 billion worth of T-bills as of February of this year to back USDC.

Additionally, two stablecoin bills that are progressing through Congress, the STABLE Act of 2025 and the GENIUS Act of 2025, require issuers to invest in T-bills and other real-world assets to back their coins.

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Bitcoin

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

Published

4 hours agoon

April 28, 2025By

admin

Shaurya is the Co-Leader of the CoinDesk tokens and data team in Asia with a focus on crypto derivatives, DeFi, market microstructure, and protocol analysis.

Shaurya holds over $1,000 in BTC, ETH, SOL, AVAX, SUSHI, CRV, NEAR, YFI, YFII, SHIB, DOGE, USDT, USDC, BNB, MANA, MLN, LINK, XMR, ALGO, VET, CAKE, AAVE, COMP, ROOK, TRX, SNX, RUNE, FTM, ZIL, KSM, ENJ, CKB, JOE, GHST, PERP, BTRFLY, OHM, BANANA, ROME, BURGER, SPIRIT, and ORCA.

He provides over $1,000 to liquidity pools on Compound, Curve, SushiSwap, PancakeSwap, BurgerSwap, Orca, AnySwap, SpiritSwap, Rook Protocol, Yearn Finance, Synthetix, Harvest, Redacted Cartel, OlympusDAO, Rome, Trader Joe, and SUN.

Source link

24/7 Cryptocurrency News

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Published

7 hours agoon

April 28, 2025By

admin

The Ethereum-to-Bitcoin ratio has fallen to its lowest level in five years after a dismal Ethereum price performance. As investors try to wrap their heads around the grim metric, Taproot Wizards co-founder Eric Wall has explained the reason behind the steep drop.

Eric Wall Highlights Reasons For ETH/BTC Ratio Collapse

Taproot Wizards co-founder Eric Wall has identified a raft of reasons behind the decline of the ETH/BTC ratio in 2025. The cryptocurrency expert revealed the factors behind the falling ETH/BTC ratio in an X post, hinging the bulk of the blame on Ethereum’s recent price performance.

The ETH/BTC ratio slumped to a five-year low after Ethereum bucked the trend of following Bitcoin on a rally after the halving event. While Bitcoin price rose to cross the $100K mark, Ethereum price has tumbled below $2,000 to reach lows of $1,400.

For Wall, one factor affecting the ETH/BTC ratio appears to be Ethereum’s position in a competitive landscape. Since its launch, several blockchains have cropped up to snag market share from the largest altcoin, offering cheaper fees and faster processing times.

The cryptocurrency expert argues that the absence of a Saylor-like buyer for ETH is playing its role in the decline of the ETH/BTC ratio. Michael Saylor’s BTC purchases have contributed to the asset’s performance, but Wall argues that Ethereum does not have a consistent buyer.

Wall adds that Bitcoin and gold have evolved into wartime assets in the current macroeconomic climate, while ETH is considered a “peacetime asset.” Gold has surged to new highs, sparking optimism that Bitcoin will follow in the same path for a similar rally, while the Ethereum price continues its unimpressive run.

The Merge Is Not Responsible For The Ratio Decline

Eric Wall notes that Ethereum’s Merge event is not responsible for the ETH/BTC slump, contrary to popular sentiment. Ethereum migrated from Proof-of-Work to Proof-of-Stake in 2022, with the ETH/BTC ratio tanking since the Merge.

“The ETHBTC ratio did not go down because of The Merge,” said Eric Wall.

However, pseudonymous cryptocurrency analyst Beanie argues that the Merge is the primary reason for the price decline. Rebuffing the speculation, Wall opines that Ethereum’s layer 2 tokens triggered network fragmentation after botching the “asset value capture narrative,” affecting the ETH/BTC ratio.

“Ethereum also stagnated into a depressingly small number of defi primitives relative to what past expectations were,” added Wall.

Ethereum is flashing signs of brilliance after ETH trading volume spiked to $17.5 billion in less than a day. ETH prices are exchanging hands at nearly 1,800 after an impressive 12% rally that saw it outperform SOL and XRP

Aliyu Pokima

Aliyu Pokima is a seasoned cryptocurrency and emerging technologies journalist with a knack for covering needle-moving stories in the space. Aliyu delivers breaking news stories, regulatory updates, and insightful analysis with depth and precision. When he’s not poring over charts or following leads, Aliyu enjoys playing the bass guitar, lifting weights and running marathons.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Here’s How Bitcoin Could Boost Demand for US Treasuries, According to Macro Guru Luke Gromen

Experts Predict US Recession in 2025 if Trump-China Trade War Tariffs Stay

Monero Jumps 51% After ‘Suspicious Transfer’ of $333M in Bitcoin

ZachXBT flags suspicious $330M Bitcoin transfer triggering Monero surge

Monero’s XMR Rockets 40% as XRP Leads Crypto Majors Gains

The 5 top crypto loan platforms of 2025

XRP Price Shows Strength — Breakout Above Key Levels Possible?

Expert Reveals Why The Ethereum-To-Bitcoin Ratio Is Falling

Analyst Says Solana-Based Memecoin Going Much Higher, Sees PENGU Facing ‘True Test’ After April Surge

Nike sued for $5 million over its shutdown of NFT platform RTFKT

Biological Age vs. Chronological Age: Redefining Age in the Digital Era

TRUMP whale regrets sale, pays double to buy back meme coins

Stripe Tests New Stablecoin Project as $3.7T Market Looms

Falling Wedge Pattern Confirms $264 target

Dogecoin Confirms Daily Trend Reversal With Breakout, Retest, And New Uptrend

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Crypto’s Big Trump Gamble Is Risky

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News6 months ago

24/7 Cryptocurrency News6 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Ripple Price1 month ago

Ripple Price1 month ago3 Voting Polls Show Why Ripple’s XRP Price Could Hit $10 Soon

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin6 months ago

Bitcoin6 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Opinion6 months ago

Opinion6 months agoCrypto’s Big Trump Gamble Is Risky

Bitcoin6 months ago

Bitcoin6 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Bitcoin3 months ago

Bitcoin3 months agoThe Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

✓ Share: