Markets

This Week in Bitcoin: Strategy Stalls, But White House Plans to Buy More BTC

Published

1 day agoon

By

admin

One week after U.S. President Trump announced a strategic Bitcoin reserve, the asset is trading down—mostly thanks to wider macroeconomic uncertainties stemming from the new commander in chief’s dramatic and unpredictable policies.

Bitcoin was priced at a little over $84,000 per coin as of late Friday evening after dipping nearly 4% over a seven-day period, CoinGecko shows.

But despite dipping more than 20% from its record high in January, the slump could be brief, analysts told Decrypt.

Thanks to…well, Trump—again.

A White House official told a room of crypto big wigs on Thursday that the new administration wants to acquire as much Bitcoin as possible.

This week had no shortage of Bitcoin news.

ETF action

American crypto investors continued to cash out of Bitcoin ETFs this week, with nearly $900 million leaving the investment vehicles as of Thursday, according to the latest data from Farside Investors.

Now, Bitcoin ETFs are lagging behind their gold counterparts, after having briefly overtaken them back in December.

Still, not to worry: Experts told Decrypt that the products have room to run this year, with Bloomberg’s ETF analyst Eric Balchunas adding that he thought Bitcoin was likely to win the ETF war over the long-term.

Bitwise launches another BTC-related ETF

Speaking of ETFs, asset managers still don’t think the market’s crowded: Bitwise on Tuesday launched a new fund giving investors exposure to publicly traded companies with the biggest Bitcoin stashes.

The new Bitwise Bitcoin Standard Corporations ETF—OWNB—tracks 21 firms that hold 1,000 Bitcoins or more, including Strategy (formerly MicroStrategy), Bitcoin miner MARA, America’s biggest crypto exchange, Coinbase, and even electric car company Tesla.

Today we’re launching the Bitwise Bitcoin Standard Corporations ETF, now trading with ticker OWNB.

Over 70 companies today have adopted MSTR’s playbook of holding bitcoin as a corporate treasury asset. The Bitwise Bitcoin Standard Corporations Index holds the largest, those with… pic.twitter.com/Z7pqLGGx27

— Bitwise (@BitwiseInvest) March 11, 2025

Rumble buys more Bitcoin

YouTube rival Rumble wasn’t included in Bitwise’s index, but the company is a good example of a smaller firm stacking sats: The media firm last year said it would allocate $20 million of its excess cash reserves to Bitcoin.

And on Wednesday, the Nasdaq-listed platform announced it had bought roughly 188 orange coins for its treasury at an average price of $91,000 per token.

Is Strategy done buying?

Bitcoin treasury Strategy, which came up with the blueprint Rumble is now following, has slowed down its BTC buys after a manic shopping spree.

Decrypt spoke to experts who said it was unlikely the company—previously known as MicroStrategy—was giving up its long-term plan, and rather focusing on its new stock offering, STRK.

White House going orange

Perhaps most dramatically for Bitcoiners this week, news dropped that the White House does indeed want to buy more Bitcoin.

Attendees at a closed-door roundtable hosted by the Bitcoin Policy Institute on Tuesday confirmed to Decrypt that the new administration is planning to buy as much of the cryptocurrency as possible. That’s at least what Bo Hines, the executive director of the Presidential Working Group on Digital Assets, reportedly said.

The news comes after President Trump last week followed through with his campaign promise and signed an order to establish a Bitcoin strategic reserve.

Edited by James Rubin

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

What is Milady? The Edgy Ethereum NFT Community With Vitalik Buterin’s Support

Can Pi Network Price Triple if Binance Listing is Approved Before March 2025 Ends?

Gold ETFs Inflow Takes Over BTC ETFs Amid Historic Rally

Toncoin in ‘great entry zone’ as Pavel Durov’s France exit fuels TON price rally

XRP $15 Breakout? Not A Far-Fetched Idea—Analysis

layer 1

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

Published

2 minutes agoon

March 16, 2025By

admin

Cryptocurrency prices rose modestly during the weekend as investors embraced a risk-on sentiment following Friday’s surge in the US stock market.

Bitcoin (BTC) held steady above $84,000, while the market cap of all coins rose to over $2.8 trillion.

The crypto market will have two main catalysts this week: President Donald Trump’s tariffs and the Federal Reserve’s interest rate decisions. A sign of Trump easing his stand on tariffs and a more dovish Fed will be bullish for cryptocurrencies and other risky assets.

The top cryptocurrencies to watch this week will be Binance Coin (BNB), Cronos (CRO), and ZetaChain (ZETA).

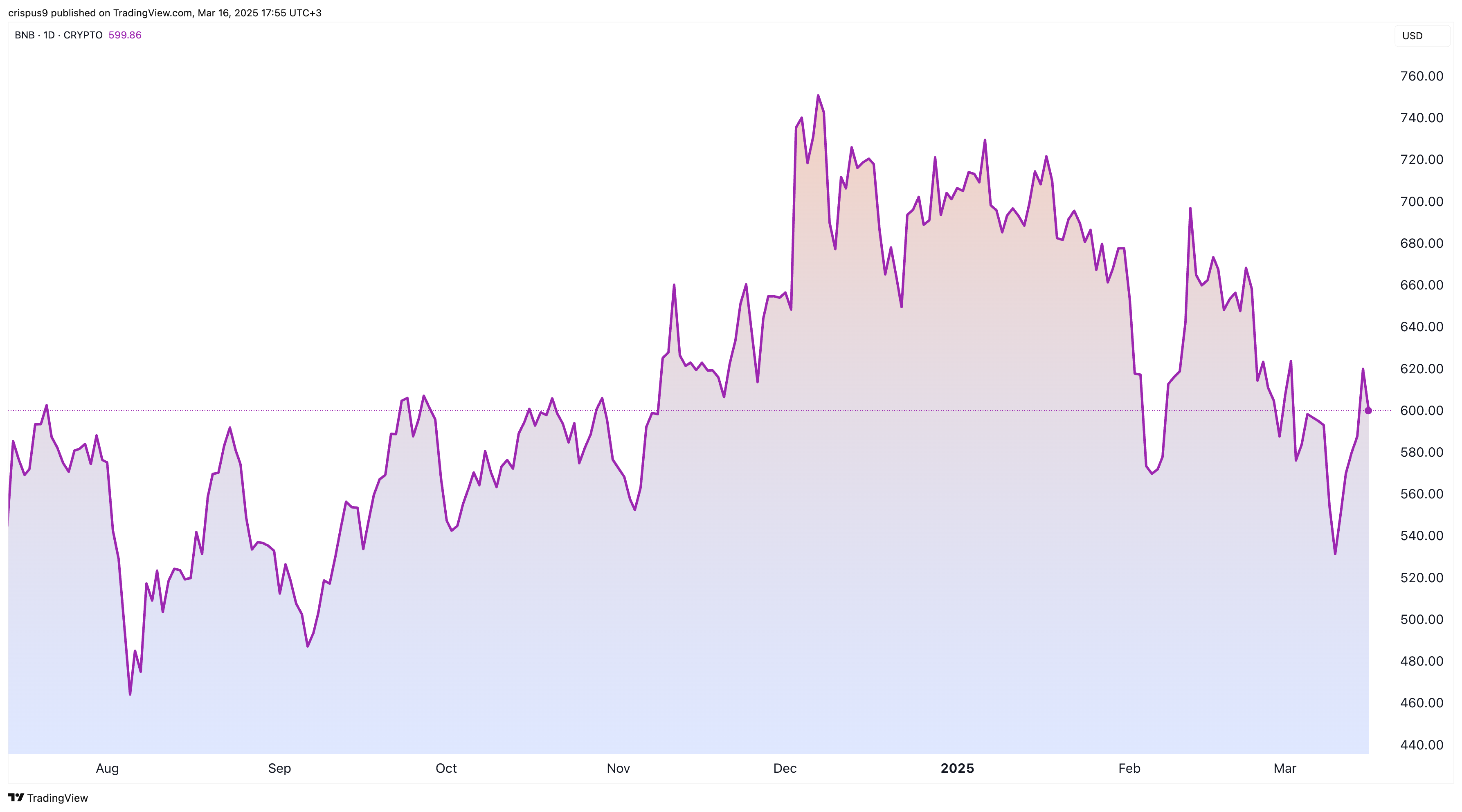

BNB

BNB price will be in the spotlight this week as the developers activate the Pascal hard fork on March 20. This is one of the three upgrades scheduled for the year’s first half. It is set to introduce newer features, including more Ethereum compatibility, native smart contract wallets, and more security.

The other two upgrades will improve BNB Chain’s speed and security. This is happening as the BSC Chain becomes one of the best alternatives to Ethereum (ETH) and Solana (SOL). Ethereum has higher fees and is slow, while the Solana network is highly associated with meme coins.

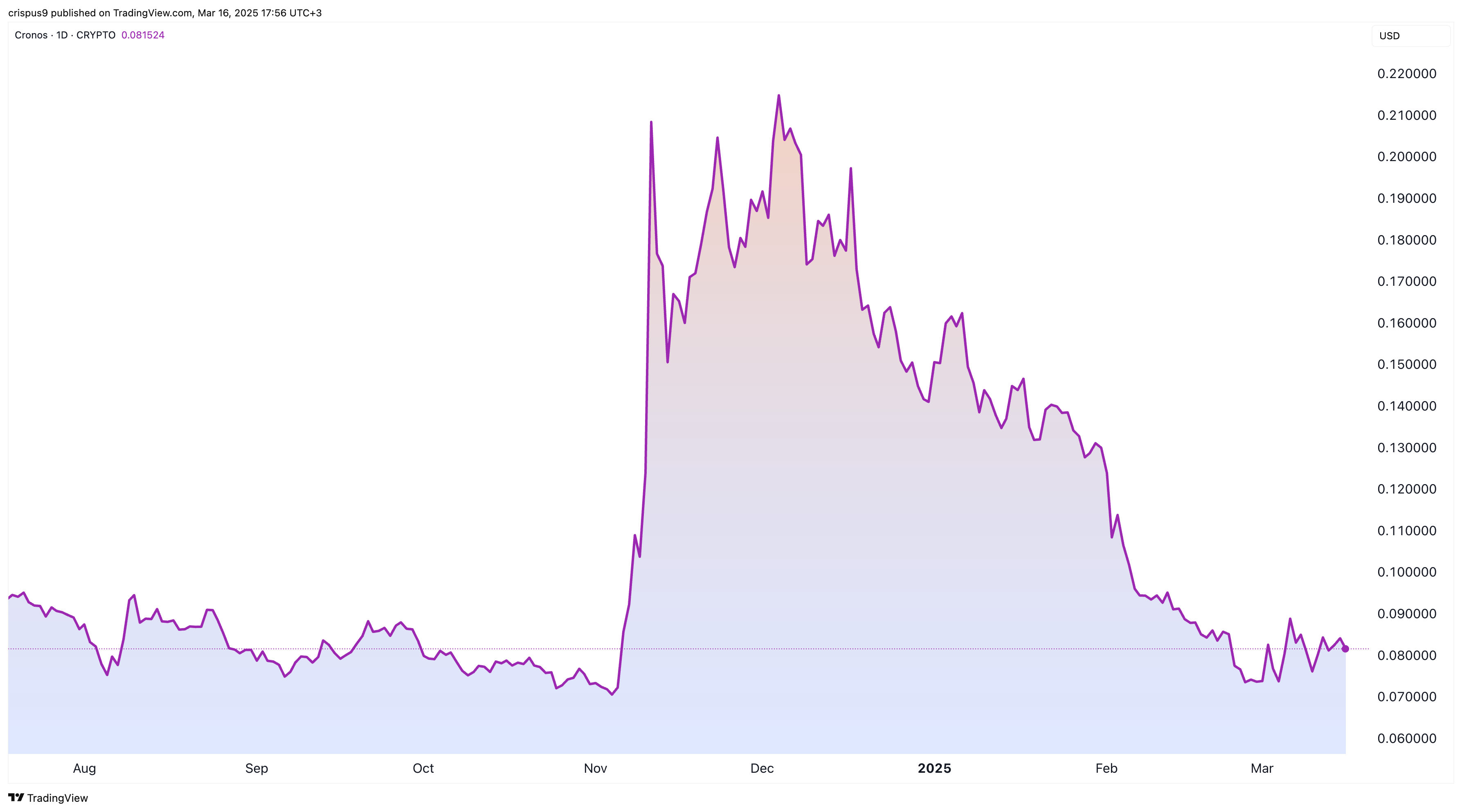

Cronos

A key Cronos vote will conclude on March 17. This crucial vote seeks to determine the creation of the Cronos Strategic Reserve. It aims to do that by undoing a 70 billion token burn that happened in 2021.

If the vote passes, Cronos will create 70 billion tokens and use them to create a reserve that will be used to support the ecosystem. Critics argue that creating these new tokens will dilute existing investors by adding to the supply.

Voting data shows that 45.8% of users have voted in support of the proposal, while 44.4% have rejected it. 9.27% have abstained. If the vote ends like this, the proposal will be rejected as the turnout is less than the quorum.

ZetaChain

ZetaChain is another top cryptocurrency to watch after its price crashed to a record low of $0.2070. It has dropped by over 92% from its all-time high, bringing its market cap to $151 million.

One reason for the ZETA price crash is that the total value locked in its ecosystem has crashed to $13 million from its all-time high of near $20 million.

The other reason is that Zetachain is highly dilutive as it has a circulating supply of 731 million against a total supply of 2.1 billion.

The network will unlock tokens worth over $6.6 million, representing 4.29% of the float this week. Cryptocurrencies are often highly volatile when there is a major unlock.

Source link

Bitcoin ETF

Gold ETFs Inflow Takes Over BTC ETFs Amid Historic Rally

Published

4 hours agoon

March 16, 2025By

admin

Gold exchange-traded funds (ETFs) have overtaken bitcoin ETFs in assets under management as investors shift toward the traditional safe-haven asset as BTC price tumbled more than 19% over the past three months, while the precious metal climbed 12.5%.

Bitcoin ETFs, which saw significant inflows following their U.S. launch in January last year, have experienced major outflows, losing about $3.8 billion since Feb. 24 of this year, according to Farside Investors data. Meanwhile, gold ETFs recorded their highest monthly inflows since March 2022 last month, according to the World Gold Council.

These flows have meant that gold ETFs have now “reclaimed the asset crown over bitcoin ETFs,” as Bloomberg Senior ETF analyst Eric Balchunas said on social media.

The Empire Strikes Back: Gold ETFs have reclaimed the asset crown over bitcoin ETFs thanks to 12% gain this year. https://t.co/ls67z5sIs5

— Eric Balchunas (@EricBalchunas) March 14, 2025

Spot bitcoin ETFs listed in the U.S. first surpassed gold ETFs in assets under management in December 2024 as the cryptocurrency market surged after Donald Trump’s victory in the U.S. presidential elections.

Meanwhile, gold has been seeing a significant run. This Friday, it exceeded the $3,000 per ounce mark for the first time ever, with gold futures for April delivery breaking through the same level earlier in the week.

Market volatility and geopolitical uncertainty have been helping the price of the precious metal rise as demand for a safe haven continues to grow.

Read more: Gold’s Historic Rally Leaves Bitcoin Behind, But the Trend May Reverse

Source link

France

Here’s why the Toncoin price surge may be short-lived

Published

6 hours agoon

March 16, 2025By

admin

Toncoin price has risen by 45% from its lowest level this month after Pavel Durov was allowed to leave France after months.

Toncoin (TON) rose to a high of $3.6240 on Saturday, its highest level since Feb. 24, bringing its market cap to over $8.4 billion.

Pavel Durov leaves France

The surge happened in part because of the ongoing crypto prices rebound and after French authorities gave Durov his passport, allowing him the freedom to leave the country.

https://twitter.com/ton_blockchain/status/1900923518281543959?s=46

Durov was arrested in 2024 in France and was accused of several crimes, including complicity in managing an online platform that enabled illegal transactions. Allegations include refusal to cooperate with authorities, drug trafficking and money laundering.

Following Durov’s arrest, many in the crypto community rallied in his defense.

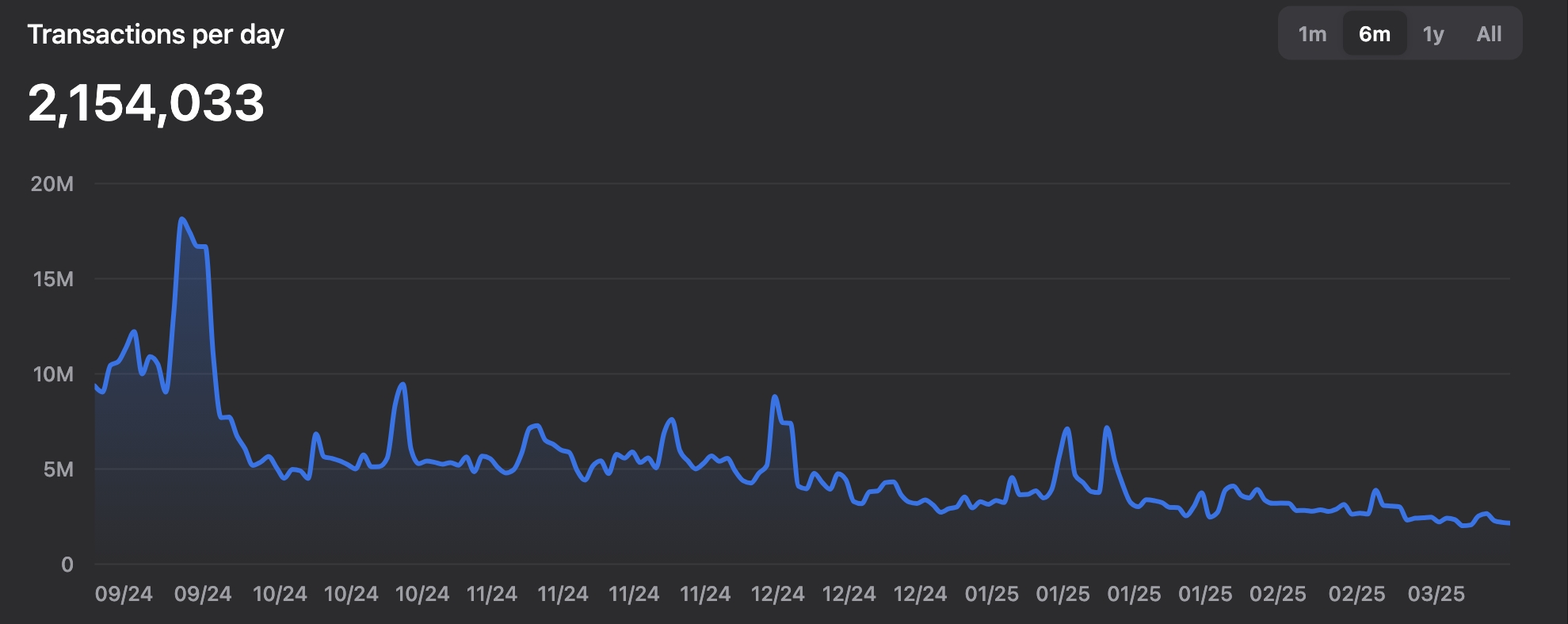

Still, there are risks that the Toncoin price surge may be short-lived because of its fairly weak on-chain metrics. Data compiled by TonStat shows that the TON inflation has continued rising and currently stands at 0.40%, up from 0.33% in October. This inflation has jumped as the total supply has surged to over 5.124 billion.

More data shows that the number of transactions per day crashed to 2.15 million from almost 20 million in September last year.

The number of active wallets in the TON Blockchain has continued to drop. Also, the total value locked in its DeFi ecosystem has dropped to $180 million from almost $800 million a few months ago.

STON.fi, its biggest DEX network, has a small market share, handling $7.1 million in the last 24 hours.

One reason for this performance is that most tokens in the TON Blockchain, like Hamster Kombat (HMSTR), Catizen (CATI) and Tapswap, have crashed — erasing billions of dollars in value.

The Toncoin price may also drop as investors sell the Durov release news. Historically, traders initially overreact to major news and then sell after a while. Recall when Cardano’s price rose after being named one of the tokens included in President Trump’s stockpile (the coin tumbled by double digits a few days later).

Toncoin price analysis

The daily chart shows that the TON price has bounced back after bottoming at $2.3650 this month. It rose to a high of $3.50, which coincided with the 50-day moving average, a sign that it has found substantial resistance.

Toncoin price also found resistance at the weak, stop and reverse point of the Murrey Math Lines. Therefore, the token will likely resume the downtrend and move below $3 as the Durov news starts to fade.

Source link

Cryptocurrencies to watch this week: Binance Coin, Cronos, ZetaChain

What is Milady? The Edgy Ethereum NFT Community With Vitalik Buterin’s Support

Can Pi Network Price Triple if Binance Listing is Approved Before March 2025 Ends?

Gold ETFs Inflow Takes Over BTC ETFs Amid Historic Rally

Toncoin in ‘great entry zone’ as Pavel Durov’s France exit fuels TON price rally

XRP $15 Breakout? Not A Far-Fetched Idea—Analysis

Here’s why the Toncoin price surge may be short-lived

Wells Fargo Sues JPMorgan Chase Over Soured $481,000,000 Loan, Says US Bank Aware Seller Had Inflated Income: Report

BTC Rebounds Ahead of FOMC, Macro Heat Over?

Solana Meme Coin Sent New JellyJelly App Off to a Sweet Start, Founder Says

Toncoin open interest soars 67% after Pavel Durov departs France

Coinbase (COIN) Stock Decline Can’t Stop Highly Leveraged Long ETF Rollouts

Telegram founder Pavel Durov leaves France, Toncoin surges

Ethereum Cost Basis Data Signals Strong Support At $1,886

Solana Cofounder Advocates For Decisive Governance As SIMD-228 Proposal Fails

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x