Altcoins

Trader Predicts Relief Rally for Altcoin Market, Says One Layer-1 Crypto Looking To Move Further Up

Published

1 month agoon

By

admin

An analyst known for calling the November 2021 crypto bull cycle top believes that the altcoin market is about to witness the return of bullish momentum.

Pseudonymous analyst Pentoshi tells his 857,000 followers on the social media platform X that he’s keeping a close watch on the OTHERS chart, an altcoin index that tracks the market cap of all crypto assets excluding Bitcoin (BTC), Ethereum (ETH) and stablecoins.

According to Pentoshi, OTHERS appears to be carving a local bottom at $250 billion and is now threatening to shatter its immediate resistance at $281 billion.

“Alts potential low time frame double bottom forming from $250 billion.

Still think we played this very well overall, and looking for it to go back toward $281 billion once again. Reclaim that and we get a nice move up for some actual relief.”

A double-bottom pattern is a bullish reversal structure indicating that an asset or index has formed a solid demand area and is setting the stage for an upside burst.

Pentoshi predicts that OTHERS can surge by about 15% if it takes out resistance at $281 billion.

“Looking better and better, the market has had numerous opportunities to sell off.

Potential lower high at $320 billion range. Again, that area is likely the most important to watch as well as $250 billion for the next major trend in my opinion.”

At time of writing, OTHERS is trading for $271.63 billion.

One altcoin on the trader’s radar is the native asset of the layer-1 protocol Injective (INJ). According to the analyst, INJ appears to be respecting its high time frame support at $14 and is looking for a bounce toward $17.58.

“Still looking good, hit $16 already, now looking for a move further up.”

At time of writing, INJ is worth $15.26.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

Trump Ally Bill Ackman Calls for 90-Day Pause on US Tariffs as Crypto Sinks

Ethereum price Tags $1,500 As Global Stock Market Crash Triggers Circuit Breakers

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

24/7 Cryptocurrency News

Bitcoin Holds $83K Despite Macro Heat, What’s Happening?

Published

20 hours agoon

April 6, 2025By

admin

The crypto market has closed yet another week, keeping traders and investors cautious with sluggish price performances. Bitcoin (BTC) price held the $83K level with no major gains in the past seven days. Whereas, Ethereum (ETH), Solana (SOL), and XRP prices mimicked a sluggish action.

Notably, the latest announcement by Donald Trump about reciprocal tariffs has rattled global markets, with even risk assets encountering some macro heat. Mentioned below are some of the top market updates reported by CoinGape Media over the past week.

Crypto Market Faces Macroeconomic Pressure

This week saw a couple of concerning macro developments that sparked a cautious sentiment among traders and investors. CoinGape reported that the manufacturing PMI and JOLTS data came in weaker than expected this week.

The March PMI data dropped to 49, below expectations of 49.5 and lower than the 50 recorded in February. Also, the U.S. JOLTS job openings for February stood at 7.568 million, coming short of the expected 7.690 million and lower than the 7.762 million recorded in January. This macro data pointed toward a bearish outlook for the broader market.

In turn, even the crypto market saw a stalled movement, with Bitcoin & Ether prices negating any major gains over the past seven days. In addition, Donald Trump’s Liberation Day, which is the tagline for his proposed reciprocal tariffs on other countries, has added to the pressure on broader markets.

Bitcoin, Ether, & Other Coin Prices Over The Week

BTC price witnessed a marginal 0.5% jump in the past seven days and closed in at the $83K level. In the past 7 days, the flagship crypto stooped as low as $81K whilst also touching a $87K high.

ETH price saw a drop of nearly 2% weekly and exchanged hands at the $1,800 level. Ethereum hit a bottom of $1,700 whilst also nearing a high of $2,000 this week

SOL price fell by roughly 5% over the week to reach $120. The crypto’s weekly high and low was $135 and $112, respectively.

XRP price mimicked the broader crypto market trend, dipping over 2% in seven days to $2.13. Ripple’s coin is consolidating despite speculations of an imminent settlement of the lawsuit against the U.S. SEC.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Altcoin

Ethereum, Solana And Cardano Trend After Crypto Crash

Published

1 day agoon

April 6, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

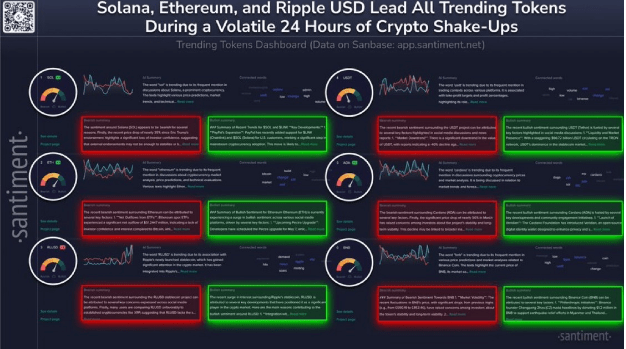

Despite the recent crypto crash that sent most digital assets tumbling, Ethereum (ETH), Solana (SOL) and Cardano (ADA) have managed to hold their ground. According to latest reports, these three cryptocurrencies are now leading the charts as the most trending coins in the market after the crash.

Related Reading

Santiment Unveils Top Trending Cryptos

The crypto market took a significant hit after fears of new tariffs implemented by United States President Donald Trump rattled investors and sent digital assets plunging across the board. However, while US stock markets closed, signs of recovery began to emerge across specific cryptocurrencies, with Ethereum, Solana, and Cardano leading the post-crash chatter.

According to an X (formerly Twitter) post by Santiment, a market intelligence platform, Solana is now back in the headlines as market analysts closely watch its price action following its crash.

The popular meme coin is seeing an increased level of speculative predictions, market trends, and technical chart breakdowns. As a result, SOL is recapturing the attention of retail and institutional investors. There’s also been notable activity within the Solana network as anticipation for a price rebound or breakout keeps spreading.

Ethereum is also trending in the crypto market, not just for its prolonged price slump and reaction to the crypto crash, but its ongoing transition to Ethereum 2.0 — a key upgrade focused on scalability and energy efficiency.

Santiment notes that analysts are highlighting Ethereum’s network performance during the market stress, showcasing an increase in discussions about the cryptocurrency’s market analysis. There have also been increased price predictions, technical evaluations, and talks about the cryptocurrency’s scalability and adoption.

Just like Solana and Ethereum, Cardano is seeing renewed attention as traders assess the cryptocurrency’s position in the broader market. There has been an influx of mentions surrounding Cardano’s market trends, with users speculating on its future price action and potential investments. Forecasts for the ADA price also range widely, with social media buzz and speculative posts fueling the cryptocurrency’s presence on trending charts.

While not as widely discussed as ETH, SOL, and ADA, Binance Coin (BNB) has also been showing up in technical forecasts. Santiment reveals that analysts are tracking BNB’s trading ranges and potential price movements, making it a focal point for investors and traders.

Related Reading

Stablecoins Join List Of Trending Assets

In addition to the altcoins above, Santiment has disclosed that stablecoins have also joined the list of top trending assets. While Ethereum, Solana, and Cardano experienced major declines after the crypto crash, stablecoins, as their names imply, remained stable against the dollar.

Ripple’s newly launched stablecoin RLUSD is trending due to its association with the crypto payments company, which gained significant attention following the completion of its legal battle with the US Securities and Exchange Commission. The stablecoin has been integrated into Ripple’s payment system, improving cross-border transactions and attracting institutional interest.

There has also been a significant increase in adoption and trading volume, with crypto exchange Kraken reporting an 87% surge in the latter and a $10 billion growth in the former.

Featured image from Gemini Imagen, chart from TradingView

Source link

Altcoins

New DeFi Trading Token Definitive (EDGE) Defies Crypto Markets Following Coinbase Listing

Published

3 days agoon

April 3, 2025By

admin

A new decentralized finance (DeFi) trading altcoin is surging after gaining support from the top US-based crypto exchange platform by volume.

In a new thread on the social media platform X, Coinbase says it’s adding the DeFi token Definitive Finance (EDGE) to its suite of digital asset products with an experimental label, causing the altcoin to skyrocket.

Coinbase’s experimental label designates assets as having higher volatility and lower trading volume compared to other products offered by the firm.

News of the addition sent EDGE flying, as the token went from an April 2nd low of $0.0274 to a peak of $0.1157 just a few hours later. The digital asset has since retraced and is trading for $0.086 at time of writing, a staggering gain of nearly 180% during the last 24 hours.

According to its official website, Definitive aims to mimic the experience offered by centralized exchange platforms, such as Coinbase and Binance, despite being decentralized.

“Definitive is the future of onchain trade execution. We deliver a CeFi-like experience on DeFi rails via a fully non-custodial platform and API (application program interface) that is live across Solana, Base and other major EVM (Ethereum virtual machine) chains.

With Definitive, anyone – from a retail user, to a whale, to a liquid fund, or even an AI agent – can trade any asset on any chain with the same institutional-grade execution found in CeFi.”

Follow us on X, Facebook and Telegram

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Trump Ally Bill Ackman Calls for 90-Day Pause on US Tariffs as Crypto Sinks

Ethereum price Tags $1,500 As Global Stock Market Crash Triggers Circuit Breakers

Bitcoin Trades Above $79K as Asia Markets React to Trump Tariffs

Memecoin platform Pump.fun brings livestream feature back to 5% of users

Bitcoin Price On The Verge Of Explosive 15% Breakout As Analyst Spots Triangle Formation

Strategy CEO Makes The Case For Corporate Bitcoin Adoption In MIT Keynote

Hackers Hammer Android and iPhone Users As Bank Account Attacks Surge 258% in One Year: Kaspersky

Cryptocurrencies to watch this week: Aptos, XRP, Solana

This Week in Crypto Games: ‘Off the Grid’ Token Live, Logan Paul ‘CryptoZoo’ Lawsuit Continues

Crypto Liquidations hit $600M as BTC Plunges Below $80K First Time in 25-days

Bitcoin (BTC) Price Posts Worst Q1 in a Decade, Raising Questions About Where the Cycle Stands

Stablecoins are the best way to ensure US dollar dominance — Web3 CEO

Chainlink (LINK) Targets Rebound To $19 — But Only If This Key Support Holds

NFT industry in trouble as activity slows, market collapses

US Tech Sector About To Witness ‘Economic Armageddon’ Amid Trump’s Tariffs, According to Wealth Management Exec

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

Has The Bitcoin Price Already Peaked?

A16z-backed Espresso announces mainnet launch of core product

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

The Future of Bitcoin: Scaling, Institutional Adoption, and Strategic Reserves with Rich Rines

Trump’s Coin Is About As Revolutionary As OneCoin

I’m Grateful for Trump’s Embrace of Bitcoin

Trending

24/7 Cryptocurrency News5 months ago

24/7 Cryptocurrency News5 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin3 months ago

Bitcoin3 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin5 months ago

Bitcoin5 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Altcoins2 months ago

Altcoins2 months agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Bitcoin5 months ago

Bitcoin5 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Opinion5 months ago

Opinion5 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis5 months ago

Price analysis5 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x

✓ Share: