Altcoins

Trader Says Chainlink (LINK) Could Explode by 169%, Updates Outlook on Sui

Published

4 weeks agoon

By

admin

The widely followed trader and analyst Michaël van de Poppe is highlighting one crypto project in the Ethereum (ETH) ecosystem whose token he believes could go up by triple-digit percentage points.

Van de Poppe tells his 773,600 followers on the social media platform X that blockchain oracle Chainlink (LINK) appears bullish against Bitcoin (BTC) and could double in price.

According to the widely followed analyst, the Chainlink/US dollar pair could subsequently appreciate by around 169% from the current level.

“LINK forms a higher low, which indicates that we’re likely into a new uptrend.

My first target is around 2x in BTC value, which should equal around $40 – $50.”

LINK is trading at $18.60 at time of writing.

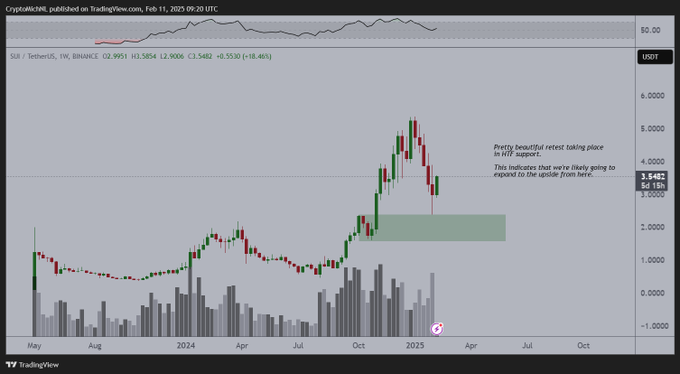

Next up is the native token of the layer-one blockchain project Sui (SUI). The widely followed analyst says Sui could go up by around 61% from the current level after bouncing off a major support zone.

“SUI is an example of what the markets are likely going to do.

It had a high-time frame support test of the order block around $2.50.

Massive interest and price jumped up pretty quickly, to be followed with a strong green weekly candle.

I think that we’ll see a new high on this soon.”

SUI is trading at $3.32 at time of writing, down by approximately 38% from the all-time high of $5.35.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

You may like

This Week in Bitcoin: Strategy Stalls, But White House Plans to Buy More BTC

Layer3 (L3) Price Prediction March 2025, 2026, 2030, 2040

Ripple Token Zooms 5% Higher as Bitcoin Grapples With $84K Level

Bitcoin’s megaphone pattern, explained: How to trade it

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

There’s a Good Chance the Bull Cycle’s Over if Bitcoin Plunges to This Level, Warns Analyst Benjamin Cowen

Altcoin

Is XRP About to Shock the Market? Analyst Says $110 Is Possible

Published

2 days agoon

March 14, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ripple’s XRP, one of the top-performing cryptos last year, is trading between $2.15 and $2.30. The token’s current price is a far cry from its 52-week high of $3.38 last January 17th, which was spurred by the industry’s excitement over US President Donald Trump’s reelection.

Related Reading

Although XRP joins the downtrend of the broader crypto market, a few commentators and analysts expect that Ripple is due for a major rally. According to crypto analyst Egrag Crypto, Ripple’s XRP is set for another price run after it compares the asset’s current Elliot Wave structure with its 2017 fractals.

XRP Continues To Weather The Storm

Egrag Crypto’s latest price analysis and projection for XRP come as the altcoin and the broader crypto market slump. The Ripple’s coin is holding steady above the critical $2 price support, which suggests it follows the broad five-wave Elliott Wave chart. Traditionally, assets replicating the Elliott Wave structure often incur significant price action.

#XRP = Thread (1/7) #XRP: Double Digits This Cycle, Triple Digits Next!

The thread below about #XRP was shared in the Subscribers section on February 12, 2025.

We’ve built together the Full Elliot Wave Count to assess our next Targets:

Take an in-depth look at it!

… pic.twitter.com/NKv00Y5MZD

— EGRAG CRYPTO (@egragcrypto) March 12, 2025

Based on Egrag’s assessment, XRP is currently in the second wave of the Elliot Wave structure, which is traditionally defined by high price volatility and corrections.

Traders And Investors Must Watch Out For The Larger Wave Structure

In a Twitter/X post, Egrag explained that XRP is in its corrective wave two and is primed for a price run to double digits or even over $100.

The analysts elaborated that a Wave 2 often retraces a part of Wave 1, usually matching 50%, 76% or even 85.4% of the initial movement. Ripple’s XRP, he shares, is solidifying its hold in the correction phase.

The asset faces bearish pressure, and the market can expect a double bottom soon before it moves into its Wave 3. EGRAG warns that Wave 3 is the most aggressive part of the cycle, with more volatility.

Can XRP Hit $100 Or More?

Previously, XRP’s Wave 1 pattern submitted a huge 733% increase in price. And by using the Elliot Wave extension formula, the popular analyst projects that XRP’s Wave 3 can extend by 1.618x the gain of the first wave. Using this calculation, Egrag offers a potential surge of 1,185x, translating to XRP’s price range between $22 to $24.

Once XRP hits the peak of Wave 3, the fourth wave and a price correction follows. For this wage, the retracement level ranges between 14% to 38.2% of Wave 3. If this happens, Egrag predicts that XRP’s price can drop to $8.

Related Reading

Wave 5 of the Elliot Wave follows, where price can be predicted using three methods. First, if XRP’s price grows between 1.236% and 1.618%, the asset’s price can hit between $32 and $48. Second, if Wave 5 replicates Wave 1, the price can be between $60 and $70. Third, if there’s a 61.8% extension of the movements of Waves 1 and 3, then there’s a chance that XRP’s price can hit $100.

Featured image from Medium, chart from TradingView

Source link

Altcoin

Dogecoin Price Primed for a 320% Rally—Can DOGE Deliver?

Published

2 days agoon

March 13, 2025By

admin

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A popular meme coin has shown signs of recovery as it entered bullish territory with analysts showing optimism for the future of the crypto in the upcoming months. Analysts predict that Dogecoin’s current momentum will push it to a possible 318% rally, giving their insights on what is driving this move upward.

Related Reading

Price Rally Around The Corner?

An analyst said in a post that Dogecoin could be heading for a 318% increase, which is possible since the breakout experienced by the meme coin aligns with its historical price movements.

“With the breakout target at $0.6533, another +318% increase to reach it can be in the works and prices may only be preparing here to do so,” JavonTM1 said.

Prices of $DOGE (Dogecoin) are still up nearly +129% since breaking out of the pictured resisting trend and with prices still broken out and in a position to confirm another set of Higher Lows, even more upside can be coming!

With the breakout target at $0.6533, another +318%… https://t.co/nhmMIkJgqv pic.twitter.com/Qum16794Li

— JAVON

MARKS (@JavonTM1) March 11, 2025

JavonTM1 made the prediction after the meme coin soared by 129% following a breach of a critical resistance trendline. “Prices of $DOGE (Dogecoin) are still up nearly +129% since breaking out of the pictured resisting trend, and with prices still broken out and, in a position to confirm another set of Higher Lows, even more upside can be coming!”

The Bullish Impulse Wave

Analysts used the Elliott Wave Theory to explain the future of DOGE. According to the charts, Dogecoin’s price might be “in the middle of a bullish impulse wave.” They argued that the coin’s volume spikes showed that there was an increase in market participation, supporting the possibility of sustained upward movement.

Meanwhile, a curved trendline on the chart indicates that the meme coin has shifted from a prolonged correction phase into a breakout phase.

Last month, JavonTM1 noted that Dogecoin, hitting $0.6533, is just around the corner. “It’s only a matter of time here with such a major breakout response and climb thus far but a move above is looking more and more likely!”

Potential Rebound

Another analyst believes that DOGE is heading towards a potential price rebound, reinforcing the coin’s bullish outlook.

Ali Martinez used the TD Sequential indicator to explain the likely surge, saying that the indicator has flashed a buy signal on the daily chart, a cue used by investors to identify trend reversals.

Martinez added that this usually happens after a bearish phase, indicating that the meme coin could be moving toward the recovery phase.

Related Reading

Data showed that DOGE remains in a strong position following the price breakout, indicating possible further gains.

At press time, Dogecoin is traded at $0.1720 per coin with a market cap of more than $25 billion.

Featured image from Pexels, chart from TradingView

Source link

Altcoins

Analyst Unveils Catalysts That Could Trigger ‘Crazy Pump’ for Solana, Says SOL Could Become the Hardest Layer-1

Published

2 days agoon

March 13, 2025By

admin

A widely followed analyst is leaning bullish on Solana (SOL) over the long term amid an upcoming upgrade.

In a new video, the analyst pseudonymously known as InvestAnswers tells his 563,000 YouTube subscribers that a proposal to reduce Solana’s inflation rate by around 80% at the end of Epoch 755 heightens Solana’s bullish prospects.

An Epoch is a fixed period during which certain network activities such as governance matters, protocol upgrades, and other related matters are decided and executed.

At the same time, InvestAnswers says the bullish thesis for the sixth-largest crypto asset by market cap is further improved if the U.S. Securities and Exchange Commission (SEC) approves a spot Solana exchange-traded fund (ETF).

“…they’re coming up with this vote to reduce inflation on Solana, which currently is not that bad at all. But that will reduce inflation from about 4.8% down to about 0.86% inflation.

If it passes, if it passes and it’s looking possible that it might… the voting ends at the end of Epoch 755… if this does happen, all of a sudden Solana becomes the hardest layer-one asset.

Remember, Bitcoin inflation is 0.85%. Solana’s, if this passes, will be 0.86%.

And my question is, what happens if a Solana ETF comes? I mean, so much is staked. There’s very little on exchanges. We could see a crazy pump.”

On the reduced staking rewards, the proposal to cut Solana’s inflation rate is likely to have, InvestAnswers says,

“People say, ‘well, if inflation goes down, won’t my staking rewards go down?’ Well, the math of it is your price appreciation will far exceed your staking rewards.

So please think price appreciation – do you want an asset to go from $120 to $240 or do you want an asset to stay at $120 and get 6% or 8% per year. The answer is you want it to double. That will impact price appreciation more.”

Solana is trading at $126 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

This Week in Bitcoin: Strategy Stalls, But White House Plans to Buy More BTC

Layer3 (L3) Price Prediction March 2025, 2026, 2030, 2040

Ripple Token Zooms 5% Higher as Bitcoin Grapples With $84K Level

Bitcoin’s megaphone pattern, explained: How to trade it

Is Bitcoin Price Headed For $70,000 Or $300,000? What The Charts Are Saying

This Rare Bitcoin Buy Signal Could Ignite Next BTC Rally

There’s a Good Chance the Bull Cycle’s Over if Bitcoin Plunges to This Level, Warns Analyst Benjamin Cowen

Ethena overtakes PancakeSwap and Jupiter with $3.28m daily revenue

Gold ETFs Winning the Asset Race With Bitcoin Funds–for Now

BTC Regains $84K; ETH, XRP, SOL Pump

Court Approves 3AC’s $1.53B Claim Against FTX, Setting Up Major Creditor Battle

Sacks and his VC firm sold over $200M in crypto and stocks before WH role

Polkadot (DOT) Price Stability Fuels Hopes For Short-Term Recovery

Bitcoin Is A Strategic Asset, Not XRP

Bank of America Insider Helps Criminals and Illicit Businesses Launder Funds in Massive Global Conspiracy: US Department of Justice

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Expert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

Aptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin Could Rally to $80,000 on the Eve of US Elections

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Sonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Crypto’s Big Trump Gamble Is Risky

Ripple-SEC Case Ends, But These 3 Rivals Could Jump 500x

A16z-backed Espresso announces mainnet launch of core product

Has The Bitcoin Price Already Peaked?

Xmas Altcoin Rally Insights by BNM Agent I

Blockchain groups challenge new broker reporting rule

Trump’s Coin Is About As Revolutionary As OneCoin

Ripple Vs. SEC, Shiba Inu, US Elections Steal Spotlight

Is $200,000 a Realistic Bitcoin Price Target for This Cycle?

Trending

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoArthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Bitcoin2 months ago

Bitcoin2 months agoExpert Sees Bitcoin Dipping To $50K While Bullish Signs Persist

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoAptos Leverages Chainlink To Enhance Scalability and Data Access

Bitcoin4 months ago

Bitcoin4 months agoBitcoin Could Rally to $80,000 on the Eve of US Elections

Bitcoin4 months ago

Bitcoin4 months agoInstitutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Altcoins1 month ago

Altcoins1 month agoSonic Now ‘Golden Standard’ of Layer-2s After Scaling Transactions to 16,000+ per Second, Says Andre Cronje

Opinion4 months ago

Opinion4 months agoCrypto’s Big Trump Gamble Is Risky

Price analysis4 months ago

Price analysis4 months agoRipple-SEC Case Ends, But These 3 Rivals Could Jump 500x